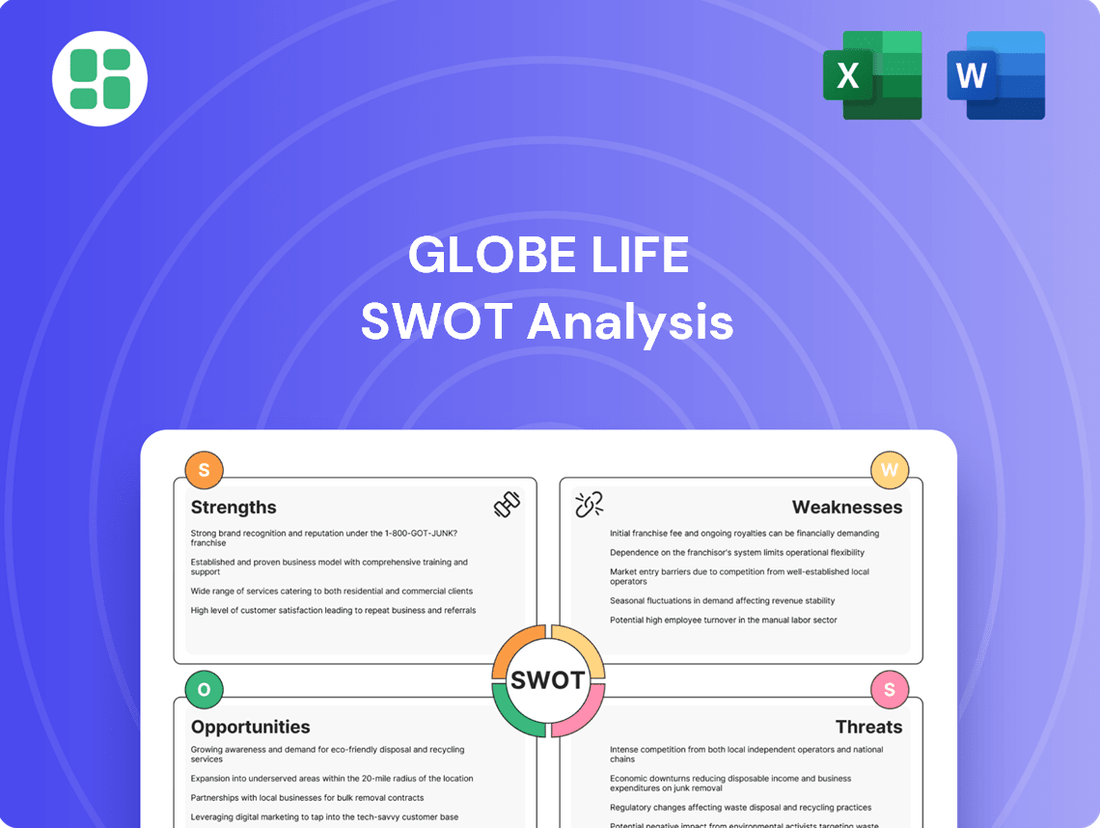

Globe Life SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Globe Life Bundle

Globe Life leverages a strong brand reputation and a vast distribution network, but faces increasing competition and regulatory scrutiny. Our comprehensive SWOT analysis delves into these critical factors, providing a clear roadmap for strategic advantage.

Want the full story behind Globe Life's competitive edge, potential vulnerabilities, and future opportunities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Globe Life Inc. has carved out a strong market niche by focusing on providing life and supplemental health insurance to middle and lower-middle-income Americans. This strategic concentration allows them to deeply understand and cater to the specific needs of this demographic, which is often overlooked by larger, more generalized insurers. Their approach fosters strong customer loyalty.

The company's deep roots, tracing back to 1900, have cultivated significant brand recognition and instilled a sense of trust within its core customer base. This long-standing presence is a key differentiator, enabling Globe Life to resonate with consumers seeking reliable insurance solutions.

Globe Life's diverse distribution channels, including direct response, independent agents, and captive agencies, are a significant strength, allowing it to reach a broad customer base and adapt to various market conditions. This multi-pronged strategy ensures efficient customer acquisition across different segments.

The company's American Income Life Division, for instance, effectively targets labor unions and affinity groups, while other divisions focus on direct-to-consumer sales. This broad reach is a key driver for consistent premium growth and an expanding agent count.

Globe Life consistently delivers robust financial results, showcasing impressive earnings and a strong return on equity. For the fiscal year ending December 31, 2024, the company reported a notable 10% increase in net income, reaching $1.07 billion, and an 8% rise in net operating income to $1.11 billion.

This sustained profitability is underpinned by steady premium income growth and a healthy balance sheet. Furthermore, favorable investment income contributes significantly to Globe Life's overall financial strength and stability.

High Credit Ratings and Capital Adequacy

Globe Life benefits from robust financial strength, evidenced by AM Best affirming its key subsidiaries with an A (Excellent) Financial Strength Rating and “a+” (Excellent) Long-Term Issuer Credit Ratings. This strong rating, maintained with a stable outlook, underscores the company's solid balance sheet and very strong operating performance. Globe Life's commitment to prudent risk management further bolsters its financial stability, positioning it favorably within the insurance sector.

The company's capital adequacy is a significant strength, with its risk-based capital assessed in the strong category. This indicates a substantial financial cushion, enabling Globe Life to navigate market volatility and meet its obligations effectively. Such financial resilience is crucial for maintaining investor confidence and supporting long-term growth initiatives.

- Financial Strength: AM Best's A (Excellent) FSR and “a+” (Excellent) Long-Term ICR for Globe Life subsidiaries.

- Stable Outlook: Reflects confidence in Globe Life's ongoing financial health and operational performance.

- Capital Adequacy: Risk-based capital is categorized as strong, demonstrating significant financial resilience.

- Risk Management: Appropriate enterprise risk management practices contribute to the company's strong credit ratings.

Strategic Share Repurchase Programs

Globe Life's strategic share repurchase programs are a significant strength, demonstrating a commitment to returning capital to shareholders and boosting per-share metrics. This practice can signal management's belief in the company's undervaluation and its robust financial health.

The company’s aggressive buyback activity is evident in its financial reports. In the first quarter of 2025 alone, Globe Life repurchased 1.5 million shares for $177 million. This follows a substantial buyback program in 2024, where 10.1 million shares were repurchased for a total of $946 million.

These consistent repurchases directly impact shareholder value by reducing the number of outstanding shares, thereby increasing earnings per share (EPS) and potentially driving up the stock price. This capital allocation strategy underscores Globe Life's confidence in its future earnings potential and operational stability.

- Enhanced Shareholder Value: Share repurchases reduce the number of outstanding shares, increasing ownership percentage for remaining shareholders and potentially boosting EPS.

- Confidence Signal: Active buybacks signal management's belief that the company's stock is undervalued, reflecting confidence in future performance.

- Capital Return: Globe Life's commitment to returning capital through buybacks demonstrates financial strength and a focus on rewarding investors.

- Q1 2025 Activity: Repurchased 1.5 million shares for $177 million in the first quarter of 2025.

- Full Year 2024 Activity: Repurchased 10.1 million shares for $946 million throughout 2024.

Globe Life's established market position in serving middle and lower-middle-income Americans is a significant strength, fostering deep customer understanding and loyalty. This focused approach, combined with a long history dating back to 1900, has built considerable brand recognition and trust.

The company's diversified distribution network, encompassing direct response, independent agents, and captive agencies, ensures broad market reach and adaptability. For instance, the American Income Life Division's success in targeting labor unions highlights this strategic advantage.

Financially, Globe Life demonstrates robust performance, with net income reaching $1.07 billion in 2024, a 10% increase year-over-year. This profitability is supported by consistent premium growth and strong investment income.

Furthermore, Globe Life's financial strength is validated by AM Best's A (Excellent) Financial Strength Rating for its subsidiaries, reflecting a stable outlook and strong operating performance. Their capital adequacy, assessed in the strong category, provides a solid financial cushion.

Globe Life actively returns capital to shareholders through share repurchases, signaling confidence in its valuation. In Q1 2025, the company bought back 1.5 million shares for $177 million, following $946 million in repurchases during 2024.

| Metric | 2024 (FY) | Q1 2025 |

|---|---|---|

| Net Income | $1.07 billion | N/A |

| Net Operating Income | $1.11 billion | N/A |

| Share Repurchases | $946 million (10.1M shares) | $177 million (1.5M shares) |

| AM Best Rating (Subsidiaries) | A (Excellent) FSR, “a+” (Excellent) ICR | A (Excellent) FSR, “a+” (Excellent) ICR |

What is included in the product

Analyzes Globe Life’s competitive position through key internal and external factors, highlighting its strong market presence and growth opportunities alongside potential regulatory challenges and competitive pressures.

Offers a clear, actionable framework for identifying and addressing Globe Life's strategic challenges and opportunities.

Weaknesses

Globe Life's reliance on traditional distribution methods, such as direct response and captive agencies, presents a notable weakness. While these channels have served the company well, they may struggle to keep pace in an increasingly digital landscape.

These established methods can be less cost-effective and scalable when compared to modern digital-first strategies. This could hinder Globe Life's ability to reach younger, more tech-savvy consumer segments effectively.

The impact of this was seen in 2024, where the Direct to Consumer Division experienced a dip in net sales. This decline was partly attributed to increased costs associated with managing both direct mail and online advertising efforts.

Globe Life's profitability is sensitive to interest rate changes, impacting its investment income. While higher rates in 2023 and early 2024 boosted insurer portfolios, a return to lower interest rate environments, potentially seen later in 2024 or into 2025, could reduce investment yields and pressure earnings.

The insurance sector is seeing a significant shift with the rise of Insurtech firms. These companies are using cutting-edge tech like AI and advanced data analytics to provide slicker, more customized, and often cheaper insurance options. This agility poses a direct challenge to established players like Globe Life.

Insurtechs are disrupting traditional sales channels and could chip away at Globe Life's customer base if the company doesn't keep pace with technological advancements and improve its digital customer experience. For instance, by mid-2024, Insurtech funding continued to be robust, with several startups announcing significant funding rounds aimed at enhancing digital underwriting and customer onboarding processes.

Perceived Cost and Product Complexity by Consumers

A significant hurdle for Globe Life, and the life insurance industry broadly, is the perception of high costs among many Americans, particularly those in middle and lower-income groups. This perception, coupled with confusion over different policy types, can deter potential customers. For instance, a 2024 survey indicated that over 40% of uninsured adults cite cost as the primary reason they don't have life insurance.

While Globe Life emphasizes affordability, these widespread industry-wide perceptions can still limit its ability to reach and convert a larger segment of the population, especially those who are currently underinsured. Effectively communicating the actual value and cost-effectiveness of its products is an ongoing challenge.

- Consumer Perception: Many Americans, especially those in middle and lower-income brackets, perceive life insurance as expensive.

- Market Penetration: General industry perceptions of high costs and policy complexity can hinder Globe Life's sales growth among underinsured populations.

- Educational Gap: A persistent challenge lies in educating consumers about the true affordability of life insurance and simplifying product choices.

Legal and Regulatory Scrutiny

Globe Life has encountered significant legal challenges, including securities class action lawsuits alleging violations, which can erode investor trust and lead to substantial legal expenses. For instance, in late 2023, the company was reportedly involved in a class action lawsuit concerning allegations of misleading statements made to investors regarding its business practices.

While investigations by the SEC and DOJ into past practices have concluded, these past legal entanglements underscore a potential weakness in its sales methodologies or adherence to compliance standards. Such scrutiny can create an ongoing perception of risk for stakeholders.

Furthermore, the dynamic nature of regulatory landscapes, especially concerning data privacy and consumer protection, presents a persistent compliance challenge for Globe Life. For example, evolving state-level data privacy laws, such as those in California, require continuous adaptation and investment in compliance infrastructure to avoid penalties and maintain operational integrity.

- Securities Class Action Lawsuits: Globe Life has faced litigation from investors alleging misrepresentations, impacting its reputation and financial stability.

- Past Regulatory Investigations: Though concluded, prior SEC and DOJ probes into sales practices signal potential areas of ongoing compliance focus.

- Evolving Data Privacy Regulations: Compliance with new data protection laws, like those enacted in various US states, necessitates ongoing investment and vigilance.

- Consumer Protection Scrutiny: Heightened attention to consumer protection practices can lead to increased compliance costs and potential reputational damage if not managed effectively.

Globe Life's reliance on traditional distribution channels, like direct mail and captive agents, is a significant weakness in a digital-first world. These methods can be less cost-effective and scalable, potentially limiting reach to younger, tech-savvy consumers. For instance, the company's Direct to Consumer Division saw a dip in net sales in 2024, partly due to rising costs in managing both direct mail and online advertising.

The company's profitability is also vulnerable to interest rate fluctuations, which affect investment income. While higher rates in 2023 and early 2024 were beneficial, a return to lower rates, anticipated by some analysts for late 2024 or 2025, could compress earnings.

Furthermore, widespread consumer perception of life insurance as expensive, with over 40% of uninsured adults citing cost as a barrier in a 2024 survey, presents a challenge. This perception, even with Globe Life's focus on affordability, can hinder market penetration among underinsured populations.

Globe Life has also faced legal headwinds, including securities class action lawsuits alleging misrepresentations, which can damage investor confidence and incur significant legal costs. Although past regulatory investigations by the SEC and DOJ have concluded, these events highlight potential ongoing compliance needs, especially with evolving data privacy laws across different US states.

What You See Is What You Get

Globe Life SWOT Analysis

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

Opportunities

Globe Life has a substantial opportunity to grow by tapping into the large segment of underinsured Americans, where over 102 million people currently lack sufficient life insurance. This presents a significant market for expansion.

The company's established focus on the middle and lower-middle-income demographic perfectly positions it to address this unmet need. By extending its reach and actively educating these potential customers about the benefits of affordable life insurance, Globe Life can unlock considerable growth potential.

Globe Life can significantly boost its efficiency and competitiveness by adopting advanced technologies like AI and machine learning. These tools can streamline underwriting, making it faster and more accurate, while also improving how claims are handled.

By personalizing product offerings through data analytics, Globe Life can better meet individual customer needs, a key differentiator against nimble Insurtech competitors. This digital transformation is projected to reduce operational costs, with the insurance industry seeing AI adoption potentially saving billions in the coming years.

Globe Life can expand its product line beyond core life and supplemental health insurance. This diversification could include specialized health products addressing emerging consumer needs or highly customized life insurance solutions. For instance, offering policies with riders for critical illnesses or long-term care, or creating flexible premium structures based on life stage, could attract a wider customer base.

Strategic Partnerships and Acquisitions

Globe Life can pursue strategic partnerships or acquisitions to enhance its technological capabilities and market reach. Collaborating with or acquiring smaller insurtech firms or businesses with complementary offerings allows for the rapid integration of new technologies and expansion into untapped market segments or distribution channels.

The insurance industry is anticipated to maintain its pace of mergers and acquisitions activity through 2024 and into 2025. This trend presents significant opportunities for Globe Life to achieve strategic growth and participate in market consolidation. For instance, in 2023, the insurance sector saw a notable number of M&A deals, indicating a robust environment for such strategic moves.

- Technology Integration: Acquire insurtechs to quickly adopt AI-driven underwriting or customer service platforms.

- Market Expansion: Target companies with strong presences in niche markets or emerging demographics.

- Distribution Channel Growth: Partner with or acquire entities that offer unique distribution networks, such as digital-first platforms or specialized brokers.

- Industry Consolidation: Leverage the ongoing M&A trend to gain market share and operational efficiencies.

Adapting to Evolving Regulatory Landscapes

Globe Life can seize opportunities by proactively adapting to evolving regulatory landscapes. For instance, anticipating and integrating new data privacy laws, like potential updates to GDPR or CCPA-like regulations in other jurisdictions, can position Globe Life as a leader in consumer protection. This forward-thinking approach not only mitigates risks but also fosters trust, a critical asset in the insurance sector.

By embracing upcoming climate risk disclosure requirements, which are becoming increasingly prevalent, Globe Life can demonstrate its commitment to sustainability and responsible business practices. This can differentiate the company from competitors who may be slower to adapt, potentially attracting environmentally conscious investors and customers. For example, in 2023, the SEC proposed new rules for climate-related disclosures, and companies that are well-prepared can leverage this for a competitive edge.

Globe Life's proactive stance on compliance can translate into tangible benefits:

- Enhanced Reputation: Demonstrating leadership in regulatory adherence builds a strong, trustworthy brand image.

- Increased Consumer Trust: Robust data privacy and disclosure practices can significantly boost customer confidence.

- Competitive Advantage: Early adoption of new standards can outpace rivals, securing market share and favorable positioning.

Globe Life has a significant opportunity to expand by reaching the more than 102 million Americans who are currently underinsured, a substantial market for growth. The company's established focus on the middle and lower-middle-income segments positions it well to address this need, with potential to grow by educating these customers on affordable life insurance options.

Leveraging advanced technologies like AI and machine learning can streamline underwriting and claims processing, enhancing efficiency and accuracy. This digital transformation, projected to save the insurance industry billions, also allows for personalized product offerings, a key differentiator against Insurtech competitors.

Diversifying its product line beyond core life and supplemental health insurance, perhaps with critical illness riders or flexible premium structures, can attract a broader customer base. Strategic partnerships or acquisitions of insurtech firms can accelerate technological integration and market reach, capitalizing on the anticipated ongoing M&A activity in the insurance sector through 2024 and 2025.

Proactively adapting to evolving regulations, such as data privacy laws and upcoming climate risk disclosure requirements, can enhance Globe Life's reputation and consumer trust. Early adoption of these standards can provide a competitive advantage, positioning the company as a leader in consumer protection and sustainability.

Threats

The insurance sector is a crowded marketplace, with established giants and nimble Insurtech firms constantly battling for customers. This intense rivalry, exemplified by major players like Sun Life Financial and Principal Financial Group, can put pressure on pricing and escalate the costs associated with attracting new policyholders for Globe Life.

Economic instability, marked by slowing GDP growth and persistent inflation, poses a significant threat to Globe Life. This environment can dampen consumer spending on essential insurance products and simultaneously drive up the cost of claims. For instance, if inflation continues to outpace wage growth, consumers may cut back on discretionary spending, which could include life and health insurance premiums.

While higher interest rates can boost investment income for insurers, the ongoing inflationary pressures can squeeze underwriting margins. This is particularly true for supplemental health products where benefit costs can rise with inflation. Furthermore, reduced consumer affordability due to inflation might hinder Globe Life's ability to attract new policyholders, impacting future premium growth.

Globe Life, like all insurers, navigates a complex web of state and federal regulations. Recent years have seen increased scrutiny and new mandates concerning data privacy, such as evolving state-level breach notification laws, and a growing emphasis on consumer protection, which can impact product design and sales practices.

Adapting to these changes is not without cost. For instance, investments in cybersecurity infrastructure to meet new data security standards and compliance training for personnel represent significant operational expenditures. Failure to comply can result in substantial penalties, as evidenced by the millions in fines levied against other insurance companies for data breaches or regulatory violations in recent years, directly impacting profitability.

Technological Disruption and Cybersecurity Risks

The insurance sector, including players like Globe Life, faces significant threats from rapid technological advancements, particularly in Insurtech and artificial intelligence. These innovations can quickly make established business models less competitive, forcing companies to adapt or risk becoming obsolete. For instance, AI-powered underwriting and claims processing could offer faster and more accurate services, potentially attracting customers away from traditional insurers.

Globe Life's increasing reliance on digital platforms and extensive data management also heightens its exposure to cybersecurity risks. A successful cyberattack, such as a data breach or ransomware incident, could result in substantial financial losses, regulatory penalties, and severe damage to its reputation. The financial services industry, in general, saw a notable increase in cyber threats in 2024, with reports indicating a rise in sophisticated attacks targeting sensitive customer information.

- Insurtech Disruption: New Insurtech startups leveraging AI and big data can offer more personalized and efficient insurance products, challenging incumbents.

- Cybersecurity Vulnerabilities: Increased digital operations expose Globe Life to risks like data breaches, ransomware, and system failures, potentially leading to significant financial and reputational damage.

- AI Integration Costs: While AI offers opportunities, the investment required for its development and integration, alongside the ongoing need for cybersecurity defenses, presents a financial challenge.

- Regulatory Scrutiny: As technology evolves, so do regulations surrounding data privacy and AI use, creating compliance challenges and potential costs for companies like Globe Life.

Changing Consumer Preferences and Demographics

Globe Life's focus on specific income segments might be challenged by evolving consumer preferences, especially among younger demographics. These consumers increasingly favor digital-first experiences, highly personalized insurance products, and a greater degree of transparency, which could present a hurdle if Globe Life's offerings and engagement methods don't keep pace.

Demographic shifts, coupled with a growing preference for online interactions, could also disrupt Globe Life's established sales channels. For instance, a Pew Research Center study in 2024 indicated that over 70% of Gen Z adults prefer digital communication for most inquiries, a trend that could impact traditional in-person or phone-based sales approaches.

- Digital Preference: Younger consumers, particularly Gen Z and Millennials, increasingly expect seamless digital interactions for all aspects of their financial lives, including insurance.

- Personalization Demand: A growing segment of the market desires insurance policies tailored to their specific needs and life stages, rather than standardized offerings.

- Transparency Expectations: Consumers are demanding clearer explanations of policy terms, pricing, and company practices, pushing for greater openness in the insurance industry.

- Channel Disruption: Traditional sales models may face challenges as consumers gravitate towards online research, comparison tools, and direct-to-consumer platforms.

Intense competition from both established insurers and agile Insurtech firms could pressure Globe Life's pricing and increase customer acquisition costs. Economic headwinds, including inflation and potential GDP slowdowns, may reduce consumer spending on insurance and inflate claim expenses, impacting affordability and profitability. Furthermore, evolving consumer preferences towards digital engagement and personalized products require significant adaptation in sales channels and product design, potentially disrupting traditional models.

SWOT Analysis Data Sources

This Globe Life SWOT analysis is built upon a foundation of verified financial statements, comprehensive market research reports, and expert industry commentary. These diverse sources provide a robust and data-driven perspective on the company's strategic position.