Globe Life Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Globe Life Bundle

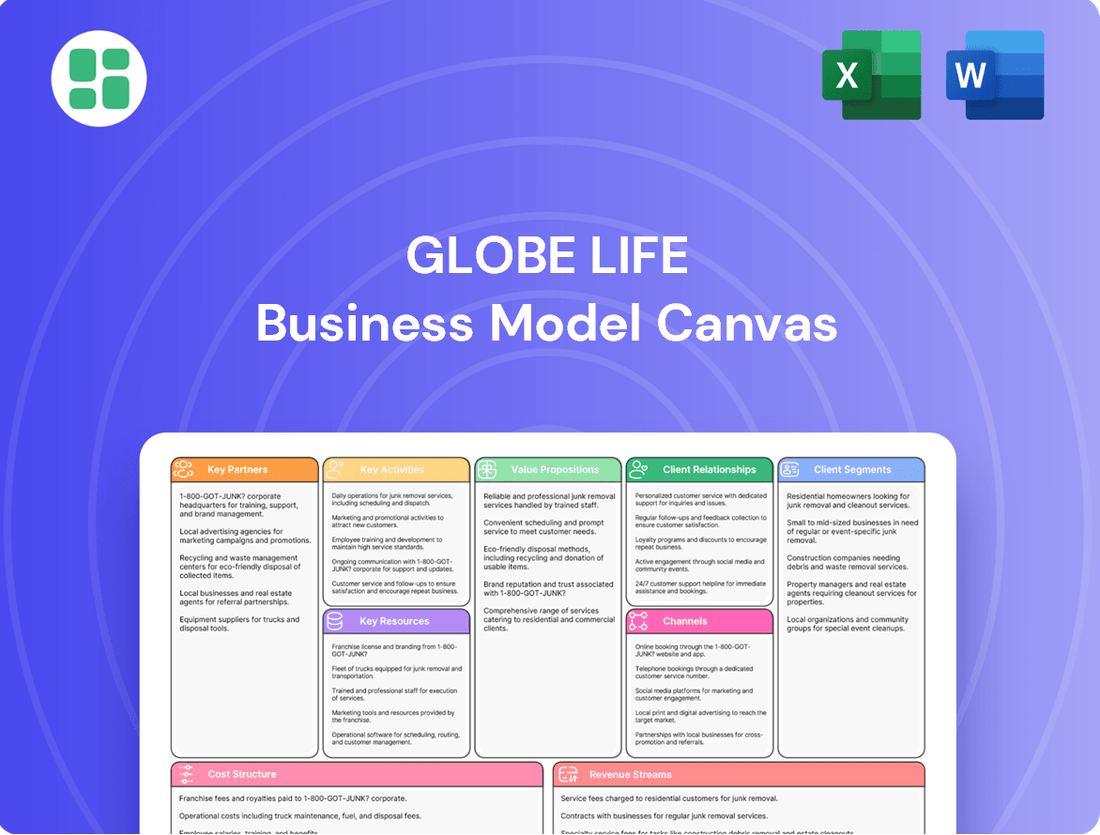

Curious about Globe Life's winning formula? Our Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear view of their operational success. It's a must-have for anyone wanting to understand their competitive edge.

Partnerships

Globe Life collaborates with reinsurance companies to offload a portion of its insurance risk. This strategic move is crucial for managing the financial impact of significant claims and maintaining stable financial results, thereby bolstering long-term solvency and optimizing capital usage.

A prime example of this partnership in action is Globe Life's submission of a business plan to the Bermuda Monetary Authority. This plan outlines the establishment of a reinsurance affiliate designed to absorb a share of both new and existing life insurance policies, with projections indicating potential annual returns of $200 million over the long term.

Independent Marketing Organizations (IMOs) and General Agencies are vital partners for Globe Life, acting as a primary engine for growth within its independent agency distribution network. These entities are instrumental in recruiting, training, and providing ongoing support to a large and dispersed field of independent insurance agents.

Through these strategic alliances, Globe Life effectively extends its market penetration into diverse geographic regions and customer segments. In 2024, the independent agent channel continued to be a significant contributor to Globe Life's sales volume, underscoring the critical role IMOs play in accessing and serving a broad customer base without the overhead of direct employee management.

Globe Life leverages its captive agency networks, including prominent divisions like American Income Life, Liberty National, and Family Heritage, as a cornerstone of its business model. These exclusive networks foster deep collaboration with agents who are dedicated to promoting and selling Globe Life's insurance products.

This strategic partnership ensures a focused and consistent sales approach, reinforcing Globe Life's brand identity across its diverse product lines. In 2023, Globe Life's life insurance in-force policies reached 4.7 million, a testament to the effectiveness of these dedicated sales channels.

Technology and Software Providers

Globe Life's strategic alliances with technology and software providers are crucial for boosting efficiency and customer interaction. These partnerships enable the adoption of advanced customer relationship management (CRM) platforms and sophisticated analytical tools, streamlining operations and enhancing agent effectiveness.

By integrating these technologies, Globe Life can better manage customer data, personalize marketing efforts, and identify new growth opportunities. For instance, in 2023, the insurance sector saw significant investment in AI-driven analytics, with companies reporting an average 15% increase in customer retention through personalized engagement strategies.

- CRM Systems: To manage customer interactions and improve sales processes.

- Data Analytics Platforms: For insights into customer behavior and market trends.

- Digital Transformation Tools: To enhance online customer experience and agent productivity.

Financial Institutions and Investment Managers

Globe Life, as a major insurance holding company, relies heavily on its financial institution and investment manager partnerships to effectively manage its substantial investment operations, which are crucial for backing its policy liabilities. These collaborations are vital for optimizing investment portfolio performance and ensuring adequate liquidity to meet policyholder obligations.

- Banks provide services like cash management, credit facilities, and underwriting support for Globe Life's debt issuances.

- Asset Managers are engaged to manage portions of Globe Life's investment portfolio, seeking to generate competitive returns across various asset classes like fixed income, equities, and alternatives.

- Other Financial Institutions, such as custodians and clearing houses, facilitate the operational aspects of Globe Life's extensive investment activities.

In 2024, Globe Life reported significant investment income, a testament to the effectiveness of its partnerships in managing its vast portfolio. For instance, their investment portfolio, which supports policyholder liabilities, is managed with a focus on stability and yield, often involving partnerships with firms specializing in fixed-income securities. These relationships are key to navigating market volatility and ensuring long-term financial strength.

Globe Life's key partnerships extend to reinsurance companies, crucial for managing risk and ensuring solvency, as demonstrated by their plan to establish a reinsurance affiliate potentially yielding $200 million annually. Independent Marketing Organizations (IMOs) and General Agencies are vital for expanding their independent agent network, a significant sales driver in 2024. Furthermore, captive agency networks like American Income Life, Liberty National, and Family Heritage are foundational, contributing to their 4.7 million in-force policies as of 2023.

| Partner Type | Role | Impact/Example |

|---|---|---|

| Reinsurance Companies | Risk transfer and capital optimization | Planned affiliate to absorb policy risk, projecting $200M annual returns. |

| IMOs & General Agencies | Agent recruitment, training, and distribution network expansion | Key contributors to sales volume in 2024 for broad market access. |

| Captive Agencies (e.g., AIL, Liberty National) | Dedicated sales force and brand reinforcement | Underpinning 4.7 million in-force policies by end of 2023. |

What is included in the product

A detailed breakdown of Globe Life's strategy, outlining its customer segments, value propositions, and distribution channels for insurance products.

Illustrates how Globe Life leverages its direct sales force and affinity marketing to deliver affordable life and health insurance, supported by efficient operations and a focus on long-term customer relationships.

Globe Life's Business Model Canvas provides a clear, structured framework to identify and address the complexities of their insurance operations, acting as a pain point reliever by simplifying strategic understanding.

It allows for the rapid visualization of value propositions and customer segments, effectively easing the pain of navigating intricate market dynamics.

Activities

Globe Life's key activities revolve around underwriting and policy administration, a crucial process for assessing risk and setting appropriate premiums for their insurance products. This involves a deep dive into applicant data to determine insurability and policy terms, ensuring fairness and accuracy.

This core function encompasses the entire policy lifecycle, from the initial application and issuance to ongoing management and, ultimately, claims processing. Globe Life leverages meticulous data analysis to price policies competitively and efficiently manage policyholder interactions, aiming for smooth operations and customer satisfaction.

In 2023, Globe Life maintained robust underwriting and policy administration, contributing to their impressive financial performance. The company reported total revenues of $10.4 billion for the year, with their life insurance segment showing continued strength, underscoring the effectiveness of their operational backbone.

Globe Life's product development focuses on creating and enhancing life and supplemental health insurance offerings to align with changing customer preferences and market dynamics. This includes a diverse portfolio encompassing term life, whole life, and accidental death insurance, alongside various health coverage options.

In 2023, Globe Life's American Income Life segment, a key contributor to its product distribution, reported a significant increase in net income, reaching $1.1 billion. This growth underscores the success of their product strategy in meeting consumer demand for reliable insurance solutions.

Globe Life's sales and distribution management is crucial for its customer acquisition and retention. This involves overseeing a diverse network, including direct response marketing, independent agents, and captive agencies. In 2023, Globe Life's total revenue reached $11.1 billion, a testament to the effectiveness of its sales channels.

A core activity is the recruitment, training, and ongoing support of its vast agent force. This ensures agents are equipped to effectively present Globe Life's products. The company's focus on agent development contributes to its consistent growth, with net income for 2023 reported at $1.3 billion.

Investment Management

Globe Life's investment management is central to its operations, focusing on actively managing a large portfolio to generate income and secure future policy payouts. This includes making smart choices about where to invest money, managing potential risks, and keeping a close eye on market trends to get the best possible returns from bonds and other assets.

In 2024, Globe Life's investment portfolio played a significant role in its financial performance. The company's strategy centers on optimizing returns from its extensive holdings, which are crucial for fulfilling long-term policyholder commitments.

- Strategic Asset Allocation: Globe Life carefully selects investments across various asset classes, with a significant portion in fixed maturities, to balance risk and return.

- Risk Management: Robust risk management practices are employed to safeguard the investment portfolio against market volatility and ensure financial stability.

- Performance Monitoring: Continuous monitoring of market conditions and investment performance is essential for adapting strategies and maximizing returns to support policy obligations.

Customer Service and Claims Processing

Globe Life prioritizes responsive and empathetic customer support, ensuring policyholders feel heard and valued. This commitment is crucial for fostering long-term relationships and building trust.

Efficient and fair claims processing is another cornerstone activity. Globe Life aims to handle claims promptly and equitably, minimizing stress for beneficiaries during difficult times. This operational efficiency directly influences customer satisfaction and retention rates.

In 2023, Globe Life reported a significant number of policies in force, underscoring the importance of robust customer service and claims handling. For instance, their American Income Life division alone had a substantial policy count, highlighting the scale of their customer interactions.

- Customer Support: Providing accessible and compassionate assistance to policyholders.

- Claims Processing: Ensuring timely, accurate, and fair adjudication of claims.

- Customer Retention: Directly linked to the quality of service and claims experience.

- Reputation Management: Maintaining a positive market perception through excellent customer care.

Globe Life's key activities are multifaceted, encompassing core insurance operations, strategic growth initiatives, and robust customer engagement. These activities are designed to ensure efficient policy management, expand market reach, and maintain strong customer relationships.

Underwriting and policy administration form the bedrock, involving meticulous risk assessment and efficient policy lifecycle management. This is complemented by continuous product development to meet evolving consumer needs, ensuring a competitive and relevant offering.

Sales and distribution are driven by a diverse network, including direct response and agent-led channels, supported by extensive agent recruitment and training. Furthermore, strategic investment management is crucial for generating returns and fulfilling long-term policyholder obligations.

Finally, exceptional customer support and streamlined claims processing are paramount for retention and reputation. In 2023, Globe Life achieved total revenues of $11.1 billion, with a net income of $1.3 billion, reflecting the effectiveness of these integrated activities.

Full Version Awaits

Business Model Canvas

This preview offers a genuine glimpse into the Globe Life Business Model Canvas you will receive upon purchase. The structure, content, and layout you see here are identical to the final deliverable, ensuring no surprises. You'll gain immediate access to this complete, professionally formatted document, ready for your strategic planning and analysis.

Resources

Globe Life's substantial financial capital, including significant policy reserves, is a cornerstone resource. As of the first quarter of 2024, the company reported total investments of $28.6 billion, a key asset that underpins its ability to underwrite new policies and meet its obligations to policyholders.

This robust investment portfolio, managed strategically, is crucial for generating investment income, which complements premium revenue. In 2023, Globe Life's net investment income reached $1.15 billion, demonstrating its effectiveness in leveraging its capital to enhance financial strength and support operational growth.

Globe Life's extensive network of independent and captive agents is a cornerstone of its business model, directly driving sales and customer acquisition. In 2023, the company reported a significant number of agents, a testament to its widespread distribution capabilities, which are crucial for reaching diverse customer segments and fueling premium growth.

This robust sales force is the primary engine for distributing Globe Life's insurance products, translating market opportunity into tangible revenue. The effectiveness and sheer scale of these agent networks are key differentiators, allowing the company to maintain a strong market presence and achieve consistent premium income.

Globe Life leverages a vast database of policyholder information, demographic data, and historical claims data. This proprietary information is absolutely crucial for effective underwriting, precise risk assessment, and highly targeted marketing campaigns. For instance, in 2023, Globe Life reported a significant increase in its customer base, underscoring the ongoing value of this data in driving growth and refining their sales strategies.

Brand Reputation and Trust

Globe Life's enduring presence, dating back to 1900, has cultivated a deep-seated brand reputation and trust, a critical asset in the insurance sector. This long history translates into significant brand recognition, making consumers more likely to consider Globe Life for their insurance needs.

In 2023, Globe Life reported a net income of $1.1 billion, underscoring its financial stability and ability to meet policyholder obligations, which directly bolsters its trustworthiness. This consistent financial performance reinforces the confidence customers place in the company.

The insurance industry heavily relies on trust; policyholders need assurance that their provider will be there to pay claims. Globe Life's established reputation and consistent operational history are key differentiators in attracting and retaining a loyal customer base.

- Established Brand Recognition: Globe Life's longevity provides a significant advantage in consumer awareness and recall.

- Financial Stability: Consistent profitability, such as its $1.1 billion net income in 2023, reinforces policyholder confidence.

- Industry Credibility: A strong reputation is paramount for attracting and retaining customers in the insurance market.

- Customer Loyalty: Trust built over decades contributes to higher customer retention rates.

Technology Infrastructure and Digital Platforms

Globe Life relies on modern IT systems and digital platforms to streamline its insurance operations. These include sophisticated customer relationship management (CRM) tools and digital marketing channels, which are critical for managing vast amounts of policyholder data and reaching new customers efficiently.

Investments in digital transformation are a cornerstone of Globe Life's strategy to boost productivity and expand its market reach. For instance, in 2023, the company continued to enhance its digital agent portals, facilitating quicker policy issuance and improved service delivery. This focus on technology infrastructure directly supports their ability to manage a large and growing customer base.

The efficiency gained from these digital platforms is substantial. Globe Life's commitment to a robust CRM system, for example, allows for personalized customer interactions and effective agent support, which are vital in the competitive insurance landscape. This digital backbone is essential for maintaining operational excellence and driving growth.

- Modern IT Systems: Facilitate efficient policy administration and data management.

- Digital Marketing Platforms: Enable targeted customer acquisition and brand building.

- Robust CRM System: Enhances customer and agent engagement and support.

- Digital Transformation Investments: Drive productivity improvements and broader outreach.

Globe Life's substantial financial capital, including significant policy reserves, is a cornerstone resource. As of the first quarter of 2024, the company reported total investments of $28.6 billion, a key asset that underpins its ability to underwrite new policies and meet its obligations to policyholders.

This robust investment portfolio, managed strategically, is crucial for generating investment income, which complements premium revenue. In 2023, Globe Life's net investment income reached $1.15 billion, demonstrating its effectiveness in leveraging its capital to enhance financial strength and support operational growth.

Globe Life's extensive network of independent and captive agents is a cornerstone of its business model, directly driving sales and customer acquisition. In 2023, the company reported a significant number of agents, a testament to its widespread distribution capabilities, which are crucial for reaching diverse customer segments and fueling premium growth.

Globe Life's enduring presence, dating back to 1900, has cultivated a deep-seated brand reputation and trust, a critical asset in the insurance sector. This long history translates into significant brand recognition, making consumers more likely to consider Globe Life for their insurance needs. In 2023, Globe Life reported a net income of $1.1 billion, underscoring its financial stability and ability to meet policyholder obligations, which directly bolsters its trustworthiness.

Globe Life relies on modern IT systems and digital platforms to streamline its insurance operations, including sophisticated customer relationship management (CRM) tools and digital marketing channels. Investments in digital transformation are a cornerstone of Globe Life's strategy to boost productivity and expand its market reach, with enhanced digital agent portals facilitating quicker policy issuance and improved service delivery in 2023.

| Key Resource | Description | 2023/Q1 2024 Data Point |

|---|---|---|

| Financial Capital & Investments | Policy reserves and investment portfolio | Total Investments: $28.6 billion (Q1 2024) |

| Net Investment Income | Income generated from investment portfolio | $1.15 billion (2023) |

| Agent Network | Independent and captive sales force | Significant number of agents reported (2023) |

| Brand Reputation & Trust | Longevity and financial stability | Net Income: $1.1 billion (2023) |

| IT Systems & Digital Platforms | CRM, digital marketing, agent portals | Continued enhancement of digital agent portals (2023) |

Value Propositions

Globe Life's core value proposition centers on providing affordable life and supplemental health insurance solutions designed to meet the needs of middle and lower-middle-income American families. This focus directly addresses a critical gap in the market, offering essential financial protection to a demographic that may find other insurance options out of reach.

In 2024, the median household income in the United States hovered around $75,000, a segment where budget-conscious decisions are paramount. Globe Life's accessible pricing makes it a viable option for these families, ensuring they can secure a safety net without undue financial strain.

This commitment to affordability is a key differentiator, allowing Globe Life to serve a broad customer base that prioritizes value and reliability in their insurance choices. The company's business model is built around making these vital protections attainable.

Globe Life's value proposition centers on simplified application and direct access to insurance products. They streamline the process, allowing individuals to secure coverage with minimal hassle, often through direct-to-consumer channels like online platforms, telemarketing, and mail. This accessibility is a key differentiator in the insurance market.

In 2024, Globe Life continued to emphasize this direct approach. Their business model effectively cuts out intermediaries, which can translate to cost savings for consumers and a more efficient sales cycle for the company. This direct engagement is crucial for their customer acquisition strategy.

Globe Life offers a crucial safety net through its life and supplemental health insurance. These products are designed to provide financial stability for families when facing unexpected events like a death or serious illness, ensuring immediate needs are met without added financial strain.

This protection translates directly into peace of mind for policyholders. Knowing that loved ones will be financially supported during difficult times alleviates the stress associated with potential medical bills or lost income, a value that is increasingly sought after.

In 2024, the insurance industry continued to see strong demand for these foundational products. Globe Life, for instance, reported significant growth in its policy count, underscoring the enduring need for reliable financial protection. This trend highlights how essential these offerings are for everyday Americans.

Diverse Product Portfolio

Globe Life's diverse product portfolio is a cornerstone of its value proposition, offering a wide array of life and supplemental health insurance options. This breadth allows customers to select policies, such as term life, whole life, accidental death, and various health coverages, that precisely match their individual circumstances and financial goals.

This extensive product range effectively caters to a broad spectrum of consumers, from young families seeking affordable term coverage to individuals requiring long-term financial security or protection against unexpected medical expenses.

As of the first quarter of 2024, Globe Life reported a significant increase in premium income, reflecting the strong demand for its diverse insurance products. For instance, the company saw substantial growth in its life insurance segment, with new business premiums rising year-over-year.

- Term Life Insurance: Provides coverage for a specific period, offering affordability for many families.

- Whole Life Insurance: Offers lifelong coverage with a cash value component, appealing to those seeking long-term financial planning.

- Accidental Death Insurance: Delivers a payout if the insured dies as a result of an accident, providing an extra layer of security.

- Supplemental Health Insurance: Includes products like critical illness and accident insurance, designed to complement existing health coverage and mitigate out-of-pocket costs.

Reliability and Established History

Globe Life's reliability is underscored by its extensive history, tracing its origins back to 1900. This century-plus track record demonstrates a consistent ability to navigate economic cycles and fulfill its promises to policyholders, fostering deep trust within the market.

This established presence translates into significant financial stability, a key value proposition for customers seeking long-term security. The company's longevity reassures individuals that Globe Life is well-positioned to meet its financial obligations for decades to come.

- Founded in 1900, Globe Life has over 120 years of operational history.

- Financial Strength Ratings from agencies like AM Best consistently affirm Globe Life's stability.

- Demonstrated ability to pay claims throughout numerous economic downturns reinforces its reliability.

Globe Life offers accessible, affordable life and supplemental health insurance, directly serving middle and lower-middle-income families. This focus addresses a market need for essential financial protection, making coverage attainable for a broad customer base prioritizing value and reliability.

Customer Relationships

Globe Life builds strong customer connections through direct engagement, utilizing telemarketing, direct mail, and online platforms. This approach facilitates personalized communication and streamlines the sales process, especially for consumers who value ease and accessibility.

Globe Life's agent-led personalized service is a cornerstone of its customer relationships. Independent and captive agents act as direct consultants, building trust through tailored advice and detailed policy explanations. This direct interaction is crucial for guiding customers through the application process.

In 2024, this approach continues to resonate. For instance, the insurance industry generally sees higher conversion rates and customer satisfaction when personalized agent interaction is involved, often exceeding 70% in satisfaction scores for those who engage with an agent directly.

Globe Life leverages digital platforms to offer automated policy management, making it easier for policyholders to handle billing and basic inquiries. This self-service approach provides significant convenience, allowing customers to manage their accounts anytime. In 2023, Globe Life reported a 9.4% increase in net income, reaching $1.3 billion, partly driven by the efficiency gains from such digital initiatives.

Claims Support and Assistance

Globe Life maintains and strengthens customer relationships by providing responsive and empathetic support throughout the claims process. This focus on assistance is paramount for policyholders during potentially stressful times.

Efficient and fair claims handling is a cornerstone of demonstrating the value of Globe Life's insurance products. In 2024, the company reported a claims processing efficiency that aims to resolve a significant majority of claims within a target timeframe, reinforcing customer trust.

- Claims Efficiency: Globe Life aims for a high percentage of claims processed within industry-leading timelines, contributing to positive customer experiences.

- Customer Satisfaction: Ongoing surveys indicate that effective claims support significantly impacts overall customer satisfaction and retention rates.

- Trust Building: A transparent and supportive claims experience is crucial for building long-term trust, a key differentiator in the insurance market.

- Value Proposition: Demonstrating prompt and fair payouts validates the policy's promise and strengthens the customer's perception of Globe Life's reliability.

Ongoing Communication and Support

Globe Life prioritizes ongoing communication to keep policyholders informed and engaged. This includes regular updates on policy changes, timely renewal notices, and valuable educational content designed to highlight the benefits of their insurance coverage. For instance, in 2024, Globe Life continued its robust outreach programs, with customer retention rates remaining a key performance indicator.

This proactive strategy ensures customers feel consistently supported throughout their entire policy journey. By maintaining open lines of communication, Globe Life fosters a sense of trust and reinforces the long-term value proposition of its products, contributing to sustained customer loyalty.

- Proactive policy updates and renewal reminders are sent regularly.

- Educational materials are provided to enhance customer understanding and engagement.

- Customer support channels are readily available for inquiries and assistance.

- Feedback mechanisms are in place to continuously improve customer experience.

Globe Life cultivates enduring customer relationships through a multi-faceted approach combining direct engagement and personalized support. Their strategy emphasizes building trust via independent agents and offering convenient digital self-service options, all while ensuring efficient and empathetic claims processing. This commitment to customer care, evident in their sustained growth and customer retention efforts, underscores the value placed on long-term policyholder satisfaction.

| Customer Relationship Aspect | Description | 2024/2023 Data Point |

|---|---|---|

| Direct Engagement | Telemarketing, direct mail, online platforms for personalized communication. | Industry satisfaction scores often exceed 70% for agent-assisted interactions. |

| Agent-Led Service | Independent and captive agents provide tailored advice and policy explanations. | Crucial for guiding customers through the application process, fostering trust. |

| Digital Self-Service | Automated policy management for billing and inquiries. | Globe Life's 2023 net income of $1.3 billion reflects efficiency gains from digital initiatives. |

| Claims Support | Responsive and empathetic assistance during the claims process. | Aims for high claims processing efficiency, reinforcing customer trust and reliability. |

| Ongoing Communication | Regular updates, renewal notices, and educational content. | Customer retention rates remain a key performance indicator in 2024. |

Channels

Direct Response Marketing is a cornerstone for Globe Life, employing a multi-channel approach including direct mail, telemarketing, and online advertising. This strategy is designed to connect with potential customers directly, fostering immediate engagement and lead generation. In 2024, the insurance industry saw continued reliance on these methods, with direct mail still proving effective for reaching older demographics, while digital channels like targeted social media ads and search engine marketing are crucial for acquiring younger policyholders.

Globe Life’s business model heavily relies on its extensive network of independent agents. These agents are crucial for market penetration, acting as the primary sales force for Globe Life’s insurance and financial products. In 2023, Globe Life continued to expand this agent force, a key driver for its sustained growth.

This independent agent channel offers significant flexibility, allowing Globe Life to reach diverse customer segments across various geographical locations. The agents, often selling a portfolio of products including those from other companies, provide a broad market access point that a direct-only model might miss. This multi-product approach by agents enhances their value proposition to customers and, by extension, to Globe Life.

Globe Life leverages captive agencies, its exclusive divisions like American Income Life, Liberty National, and Family Heritage, to drive sales. These dedicated agents focus solely on Globe Life's product portfolio, fostering specialized knowledge and consistent brand messaging.

In 2024, these captive agencies were instrumental in Globe Life's financial performance, contributing significantly to its revenue streams. The focused sales approach allows for efficient customer acquisition and strengthens the company's market penetration in key demographics.

Online Platforms and Digital

Globe Life leverages its corporate website as a primary hub for direct sales, lead generation, and comprehensive customer service. This digital storefront provides a convenient and accessible avenue for potential and existing clients to engage with the company's offerings.

The company also utilizes third-party online aggregators and comparison sites, expanding its reach to a broader audience. These platforms are crucial for capturing leads and allowing customers to easily compare Globe Life's products with those of competitors.

Digital channels are instrumental in catering to a growing segment of tech-savvy consumers who prefer the ease of online transactions and information gathering. In 2024, online insurance sales continued to see robust growth, with a significant portion of policy inquiries originating from digital platforms.

Globe Life's digital strategy focuses on providing a seamless user experience, from initial product exploration to policy management. This commitment to digital accessibility is a cornerstone of their customer engagement model.

- Corporate Website: Serves as a central point for direct sales, lead capture, and customer support.

- Third-Party Aggregators: Expands market reach and facilitates product comparison, driving lead generation.

- Digital Convenience: Caters to the preferences of tech-savvy consumers seeking ease of access and transaction.

- Customer Engagement: Digital platforms are key to providing ongoing support and policy management for existing clients.

Referral Programs

Referral programs are a cornerstone for Globe Life, tapping into the power of their existing customer base. By encouraging satisfied policyholders to recommend Globe Life to friends and family, the company fosters organic growth. This strategy leverages trust and personal relationships, often proving more cost-effective than traditional advertising. In 2023, Globe Life reported a significant portion of its new business originated through such channels, highlighting the effectiveness of this approach.

These programs act as a low-cost acquisition channel, turning happy customers into brand advocates. This organic growth model is particularly valuable in the insurance sector, where trust and reliability are paramount. Globe Life’s success in 2024 continues to be bolstered by these satisfied policyholder referrals.

- Leveraging Existing Policyholders: Globe Life actively incentivizes current customers to refer new clients, often through modest rewards or discounts.

- Community Affiliations: Partnerships with community groups and organizations provide access to potential customers who trust those affiliations.

- Organic Growth Driver: Satisfied customers become powerful advocates, leading to a more sustainable and cost-efficient customer acquisition strategy.

- Cost-Effective Acquisition: Referral programs typically yield a higher return on investment compared to broad-reach marketing campaigns.

Globe Life utilizes a multi-faceted channel strategy, blending direct response marketing with a robust independent agent network. This approach ensures broad market reach, from direct mail targeting older demographics to digital advertising capturing younger consumers. The company’s captive agencies, like American Income Life, provide focused sales expertise, while its corporate website and third-party aggregators enhance online accessibility. Referral programs further amplify growth by leveraging satisfied customers as brand advocates.

| Channel | Description | Key Benefit | 2024 Focus/Impact |

|---|---|---|---|

| Direct Response Marketing | Direct mail, telemarketing, online ads | Immediate engagement, lead generation | Continued effectiveness across demographics, especially digital for younger segments. |

| Independent Agents | Extensive sales force | Market penetration, diverse customer reach | Key driver for sustained growth and broad market access. |

| Captive Agencies | Exclusive divisions (e.g., AIL) | Specialized knowledge, consistent branding | Instrumental in revenue generation and focused customer acquisition. |

| Corporate Website | Digital storefront | Direct sales, lead generation, customer service | Primary hub for customer engagement and online transactions. |

| Third-Party Aggregators | Comparison sites | Expanded reach, lead capture | Crucial for reaching a wider audience and facilitating product comparison. |

| Referral Programs | Customer-driven leads | Organic growth, cost-effective acquisition | Significant contributor to new business, leveraging trust and relationships. |

Customer Segments

Globe Life's core customer base consists of middle to lower-middle income households, a segment often overlooked by major insurance providers. These families, typically earning between $30,000 and $125,000 annually, seek accessible and affordable life and supplemental health insurance solutions to protect their financial futures.

This demographic values straightforward policies and predictable costs, making Globe Life's direct-to-consumer model particularly appealing. In 2024, the median household income in the United States was reported to be around $84,000, placing a significant portion of American families squarely within Globe Life's target market.

Individuals seeking basic protection are primarily concerned with straightforward, affordable life and health insurance. They prioritize essential coverage to safeguard their families against unexpected events, rather than seeking complex investment-linked products. For instance, in 2024, reports indicated a significant portion of the population still relies on term life insurance for its simplicity and cost-effectiveness, highlighting a strong demand for fundamental protection.

Families with dependents, a core customer segment for Globe Life, are primarily concerned with safeguarding their loved ones' financial future. They seek robust insurance solutions to cover potential income loss or unexpected expenses arising from the death or serious illness of a primary earner. This group prioritizes peace of mind, knowing their children or other dependents will be financially secure even in their absence.

In 2024, the importance of this segment is underscored by ongoing economic uncertainties and the persistent need for financial resilience. For instance, data from the U.S. Census Bureau consistently shows a significant portion of households rely on dual incomes, making life insurance a critical component of their financial planning. Globe Life's model effectively addresses this by offering accessible and often affordable coverage options tailored to the needs of these family units.

Small Business Owners and Their Employees

Small business owners often seek ways to offer competitive benefits to attract and retain talent, even if they don't have large HR departments. Globe Life can cater to this by providing accessible, affordable group life and supplemental insurance options that small businesses can offer their employees, often with minimal administrative burden. This approach helps these businesses compete with larger corporations that typically offer more robust benefit packages.

For instance, in 2024, small businesses continue to be a significant engine of economic growth, with millions of new businesses forming annually. Many of these businesses operate on tight margins and may not have the resources to negotiate large group insurance plans. Globe Life's model allows them to provide valuable coverage, enhancing employee loyalty and well-being without significant upfront costs.

- Targeting Businesses: Agencies may actively reach out to small businesses to present tailored group life and supplemental insurance packages.

- Employee Focus: The primary goal is to offer employees affordable coverage options, particularly in sectors where employer-sponsored benefits are less common.

- Affordability & Simplicity: Products are designed to be cost-effective and easy for small businesses to implement and manage.

- Market Gap: Addresses the need for accessible insurance solutions for employees of businesses that may not offer extensive benefits.

Underserved or Uninsured Populations

Globe Life actively pursues customer segments often overlooked by traditional insurers, including those who are uninsured or underinsured. This strategic focus allows them to offer vital financial protection where other providers might deem the market less profitable. Their approach is particularly effective in reaching individuals who may not have access to employer-sponsored benefits or who find other insurance options too expensive or complex.

This commitment extends to geographic expansion, penetrating areas with lower insurance penetration rates. For instance, in 2024, Globe Life continued its expansion efforts, aiming to capture market share in regions where insurance access is historically limited. Their business model is built on providing straightforward, affordable products that meet the needs of these specific populations.

- Focus on accessibility: Globe Life prioritizes making insurance simple and affordable for those often excluded.

- Geographic reach: They actively target less penetrated markets to serve a wider customer base.

- Addressing underinsurance: A key segment includes individuals who have some coverage but not enough to fully protect their families.

- Product simplicity: Their offerings are designed to be easily understood and purchased, reducing barriers to entry.

Globe Life's customer base is predominantly middle to lower-middle income households seeking accessible and affordable life and supplemental health insurance. These individuals and families prioritize straightforward policies and predictable costs, aligning with Globe Life's direct-to-consumer approach. In 2024, with the median household income in the US around $84,000, a substantial portion of the population falls within this target market, valuing essential coverage for financial security.

Cost Structure

Globe Life's cost structure is heavily influenced by agent commissions and acquisition expenses. A substantial part of their outlay goes towards compensating a vast network of independent and captive agents for selling new policies. This is a direct driver of their sales volume.

Beyond commissions, Globe Life invests significantly in marketing and lead generation to attract potential customers. Furthermore, costs associated with training and supporting their agent force are crucial for maintaining sales effectiveness. For instance, in 2023, their selling, general, and administrative expenses were $1.89 billion, reflecting these significant acquisition and operational costs.

The most significant expense for an insurer like Globe Life is the money paid out to policyholders when they file claims. In 2023, Globe Life reported that its benefits and claims paid out amounted to $4.1 billion, a substantial portion of its overall operational costs.

Managing these payouts effectively is paramount. Globe Life's commitment to robust underwriting practices and diligent risk assessment directly impacts its ability to control these core costs, ensuring financial stability and profitability.

Administrative and operational expenses are the backbone of Globe Life's day-to-day functioning, encompassing salaries for its dedicated non-agent workforce, the cost of maintaining office spaces, essential utilities, and other general overhead. These costs are crucial for supporting the sales force and ensuring smooth policy administration.

A key indicator of Globe Life's operational efficiency is the ratio of administrative expenses to premiums collected. For instance, in 2023, Globe Life reported that its ratio of general expenses to life insurance premiums was approximately 12.5%, demonstrating a focus on cost management while supporting its extensive agent network and policyholder services.

Marketing and Advertising Spend

Globe Life invests heavily in direct response marketing, telemarketing, and online advertising to acquire new policyholders. These efforts are crucial for generating leads and driving sales across their insurance products. For instance, in 2023, Globe Life reported marketing and advertising expenses of $503 million, a significant portion of their overall cost structure, underscoring the importance of customer acquisition.

The company's strategy involves continuous campaigns across multiple channels to reach its target demographic effectively. This sustained investment is a key driver of their growth.

- Direct Response Marketing: Campaigns designed to elicit an immediate response from consumers.

- Telemarketing: Direct outreach via phone to potential customers.

- Online Advertising: Digital campaigns on platforms like search engines and social media.

- Customer Acquisition Costs: Significant expenditure aimed at bringing in new policyholders.

Technology and Infrastructure Investments

Globe Life's cost structure significantly involves technology and infrastructure investments. These are crucial for maintaining efficient operations and securing a competitive edge in the insurance market. This includes the ongoing expense of developing, maintaining, and upgrading their IT systems, digital platforms, and robust cybersecurity measures.

These investments extend to customer relationship management (CRM) systems and advanced analytical capabilities, which are vital for understanding customer needs and optimizing business processes. For instance, in 2023, Globe Life reported significant capital expenditures, with a portion allocated to technology enhancements aimed at improving digital customer experiences and operational efficiency.

- IT System Development & Maintenance: Costs associated with software, hardware, and IT personnel.

- Digital Platform Enhancements: Investments in online portals, mobile applications, and digital sales tools.

- Cybersecurity Measures: Spending on data protection, threat detection, and compliance.

- CRM & Analytics Tools: Acquisition and upkeep of systems for customer management and data analysis.

Globe Life's cost structure is dominated by benefits and claims paid, reflecting its core insurance business. In 2023, these payouts reached $4.1 billion, directly impacting profitability. Agent commissions and acquisition expenses are also significant, with selling, general, and administrative expenses totaling $1.89 billion in 2023, highlighting the cost of their sales-driven model.

| Cost Category | 2023 Amount (USD Billions) | Significance |

|---|---|---|

| Benefits and Claims Paid | 4.1 | Core operational cost, directly linked to policyholder payouts. |

| Selling, General & Administrative Expenses | 1.89 | Includes agent commissions, marketing, and operational overhead. |

| Marketing and Advertising | 0.503 | Key investment for customer acquisition and sales generation. |

Revenue Streams

Globe Life's primary revenue driver is the collection of premiums from individuals who purchase their life insurance policies. These premiums are the bedrock of their financial model, providing a predictable and recurring income stream. In 2023, Globe Life reported total revenues of $23.08 billion, with a significant portion stemming from these insurance premiums.

Globe Life also generates revenue through premiums collected for its supplemental health insurance offerings. These products include coverage for accidental death, cancer, critical illness, and Medicare Supplement plans. This broad range of policies diversifies the company's premium income, making it less reliant on a single product line.

Globe Life's net investment income is a powerhouse, fueled by its massive portfolio of fixed maturities and other investments. In 2023, this segment generated a substantial $1.3 billion in net investment income, underscoring its critical role in the company's profitability.

This income stream, derived from interest, dividends, and capital gains, is a cornerstone for insurance companies like Globe Life. It represents earnings on the premiums collected, allowing for reinvestment and further growth of the company's financial base.

Policy Fees and Charges

Globe Life also generates revenue through various policy fees and charges. These can include administrative fees for managing policies and surrender charges applied when a policyholder cancels their coverage before its maturity. While typically smaller contributors than premiums, these fees add to the overall revenue stream.

For instance, in 2023, Globe Life's total revenues reached $11.5 billion, with premiums and annuity considerations forming the vast majority. However, the granular breakdown of smaller fee-based income, while not always explicitly detailed in headline figures, represents a consistent revenue component.

- Policy Administration Fees: These cover the ongoing costs associated with maintaining policyholder records and servicing.

- Surrender Charges: Fees applied when a policy is terminated early, often as a way to recoup initial acquisition costs.

- Other Service Fees: Potentially includes fees for services like policy changes or duplicate document requests.

Reinsurance Ceded Income (if applicable)

Globe Life's reinsurance ceded income, while typically an expense, can manifest as a minor revenue stream through ceding commissions or profit-sharing agreements when business is passed to reinsurers. For instance, in 2023, Globe Life's net premiums earned were substantial, and while the exact figures for ceded income are not separately itemized as revenue, the structure of reinsurance agreements often includes such arrangements.

These arrangements are designed to offset some of the costs associated with transferring risk. While the primary goal of ceding business is risk management and capital optimization, the financial incentives embedded in these contracts can contribute positively to the bottom line, albeit usually on a smaller scale compared to direct premium income.

- Ceding Commissions: Globe Life may receive an upfront payment from the reinsurer, calculated as a percentage of the premiums ceded, to cover administrative and acquisition costs.

- Profit Sharing: In some reinsurance contracts, Globe Life may be entitled to a share of the profits generated by the reinsured business, provided it performs within agreed-upon parameters.

- Net Effect: Despite these potential income streams, the overall impact of reinsurance is generally a net cost, as the premiums paid to reinsurers typically exceed the income generated from these specific arrangements.

Globe Life's revenue is predominantly built upon the consistent collection of insurance premiums for life and supplemental health policies. This core income stream, supplemented by investment gains, forms the financial backbone of the company. In 2023, Globe Life reported total revenues of $11.5 billion, showcasing the significant scale of its premium-driven operations.

The company also benefits from net investment income, which is generated from its substantial portfolio of fixed-maturity securities and other investments. This income is crucial for profitability, as demonstrated by the $1.3 billion in net investment income reported in 2023. Policy fees, though a smaller component, add to the overall revenue mix.

| Revenue Stream | 2023 (in billions) |

| Total Revenues | $11.5 |

| Net Investment Income | $1.3 |

Business Model Canvas Data Sources

The Globe Life Business Model Canvas is built upon extensive market research, internal financial data, and competitive analysis. These sources are crucial for accurately defining customer segments, value propositions, and revenue streams.