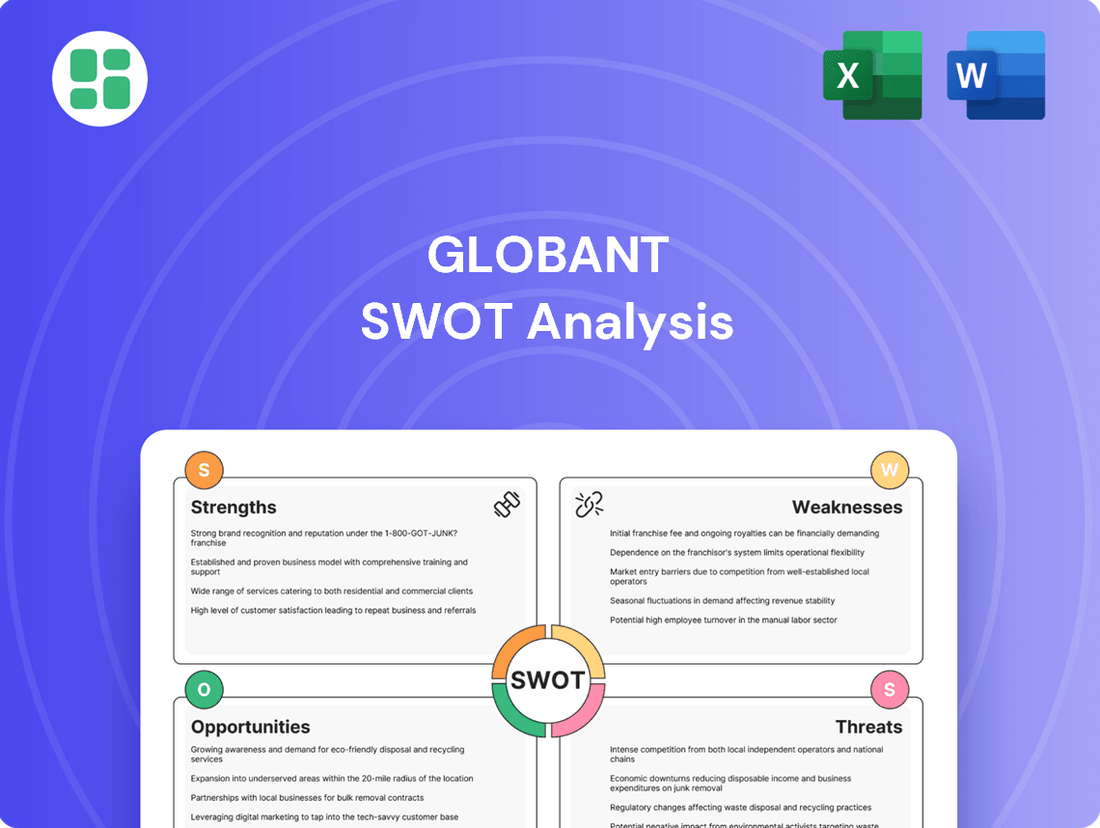

Globant SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Globant Bundle

Globant's strategic positioning is bolstered by its strong brand reputation and agile development capabilities, but it faces challenges in intense market competition and talent retention. Understanding these dynamics is crucial for navigating its future.

Want the full story behind Globant's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Globant's core strength is its 'digitally native' foundation, meaning its operations are inherently built for the digital era. This allows for rapid adaptation to new technologies and market shifts, ensuring clients receive cutting-edge solutions. In 2024, Globant reported revenue growth of 16.5% year-over-year, demonstrating its ability to capitalize on digital transformation trends.

Globant boasts a comprehensive service portfolio encompassing software development, digital strategy, cloud solutions, and cutting-edge technologies such as AI and blockchain. This breadth allows them to cater to a wide array of client needs, offering complete solutions from initial ideation through to deployment and continued maintenance.

The company's capacity to meld various advanced technologies into integrated offerings is a key strength. For instance, in 2023, Globant reported significant growth in its AI and data analytics segment, reflecting strong market demand for these specialized services.

Globant's strength lies in its commitment to business reinvention, a strategy that transcends simple technology adoption. They focus on fundamentally transforming client businesses by using technology to unlock new revenue streams and elevate customer interactions.

This approach, which saw Globant's revenue grow by 19.4% year-over-year to $1.9 billion in the first quarter of 2024, allows them to deliver significant, strategic value by aligning technological solutions with core business objectives.

Strong Client Partnerships

Globant excels at cultivating deep, collaborative relationships with its clients, viewing them as true partners in their digital transformation journeys. This focus on long-term engagement, rather than one-off projects, fosters significant trust and a nuanced understanding of each client's unique business challenges and objectives.

This partnership model directly translates into tangible business benefits. For instance, Globant's emphasis on co-creation and shared success has been a cornerstone of its sustained growth. This approach not only drives repeat business but also generates valuable referrals, contributing to a stable and expanding revenue base.

- Client Retention: Globant's partnership strategy has historically led to high client retention rates, a key indicator of strong relationships.

- Strategic Alignment: By working closely, Globant ensures its digital solutions are tightly aligned with client business goals, maximizing impact and value.

- Deep Domain Expertise: Long-term partnerships allow Globant to develop specialized knowledge within client industries, enhancing service delivery.

Agile and Innovative Approach

Globant's agile and innovative approach is a significant strength, allowing them to adapt quickly to the rapidly changing technology sector. This adaptability is key to developing cutting-edge solutions that meet evolving client needs. For instance, in 2023, Globant reported a revenue of $1.8 billion, demonstrating their ability to scale and deliver value through innovation.

Their methodology emphasizes continuous improvement and the rapid integration of emerging technologies. This ensures their service offerings remain relevant and competitive. Globant's consistent investment in R&D, evidenced by their focus on AI and cloud solutions throughout 2024, further solidifies this strength.

- Agile Methodology: Enables rapid response to market shifts.

- Innovation Focus: Drives development of forward-thinking solutions.

- Technology Integration: Swift adoption of new tech keeps services cutting-edge.

- Client Attraction: Appeals to businesses seeking advanced, adaptable partners.

Globant's financial performance underscores its strengths. In the first quarter of 2024, the company reported a revenue of $1.9 billion, marking a 19.4% increase year-over-year. This robust growth highlights their ability to secure and expand client engagements, particularly in high-demand digital transformation services.

The company's comprehensive service portfolio, spanning AI, cloud, and custom software development, allows them to address diverse client needs. This integrated approach, coupled with a strong focus on business reinvention rather than just technology implementation, positions Globant as a strategic partner capable of delivering significant business value.

Globant's commitment to client partnerships fosters deep understanding and long-term relationships, leading to high retention rates and consistent revenue streams. Their agile and innovative methodologies ensure they remain at the forefront of technological advancements, attracting businesses seeking forward-thinking digital solutions.

| Metric | Q1 2023 | Q1 2024 | Year-over-Year Growth |

|---|---|---|---|

| Revenue | $1.59 billion | $1.9 billion | 19.4% |

| Digital Transformation Focus | High | High | N/A |

| Service Portfolio Breadth | Broad | Broad | N/A |

What is included in the product

Analyzes Globant’s competitive position through key internal and external factors, highlighting its strengths in digital transformation and market opportunities while acknowledging potential weaknesses and threats in a dynamic tech landscape.

Offers a clear, actionable framework to identify and address internal weaknesses and external threats, thereby alleviating strategic uncertainty.

Weaknesses

Globant's reliance on external market conditions is a significant weakness. As a technology services provider, its financial health is tied to global economic trends and corporate IT budgets. For instance, a slowdown in the global economy, as seen in some forecasts for late 2024 and early 2025, could lead clients to reduce spending on consulting and development projects, directly impacting Globant's revenue streams.

This susceptibility to macro-economic shifts means that factors outside of Globant's operational control can heavily influence its performance. A contraction in IT spending by major industries, a common reaction during economic uncertainty, could result in lower project volumes and potentially pressure on pricing, affecting the company's growth trajectory.

Globant operates within a fiercely competitive IT services and digital transformation sector. Major global players and specialized firms alike vie for market share, creating significant pressure on pricing. For instance, the global IT services market was projected to reach over $1.3 trillion in 2024, a testament to its size and the number of participants.

This intense rivalry necessitates constant differentiation and innovation for Globant to maintain its edge. The company must continually invest in cutting-edge technologies and specialized talent to avoid commoditization and secure profitable contracts. Failure to do so risks erosion of market position and profitability in a dynamic industry.

Globant faces significant hurdles in acquiring and keeping skilled tech professionals, particularly in high-demand areas like AI and cloud computing. The intense competition for talent in the IT services sector means that attracting the best often requires higher compensation and more attractive benefits packages, directly impacting labor costs. For instance, in 2024, the average salary for a senior AI engineer in the US tech sector saw an increase of approximately 15-20% compared to the previous year, a trend likely affecting Globant's recruitment expenses.

Potential for Client Concentration

While Globant's growth is impressive, a potential weakness lies in client concentration. Although not explicitly detailed, rapidly expanding service firms can become reliant on a few key clients. Losing a major client or seeing their spending decrease could significantly impact Globant's financial results, as it might disproportionately affect overall revenue.

Mitigating this risk requires a strategic focus on client diversification. By broadening its client base across various industries and geographic regions, Globant can build a more resilient revenue stream. This approach helps to cushion the blow if any single client's business undergoes changes or shifts in demand.

For instance, in the first quarter of 2024, Globant reported that its largest client accounted for approximately 10% of its total revenue. While this indicates a degree of diversification, a concentrated reliance on even a single large client still presents a vulnerability that needs careful management.

Key considerations for addressing client concentration include:

- Proactive client relationship management to foster loyalty and identify potential risks early.

- Targeted business development efforts to attract new clients in diverse sectors.

- Developing service offerings that appeal to a broader range of industries.

- Monitoring client revenue contribution regularly to identify any emerging concentration trends.

Geographic Concentration Risk

Globant's reliance on specific geographic regions for its operations or a significant portion of its revenue presents a notable weakness. For instance, if a substantial percentage of its workforce or client base is concentrated in areas prone to political upheaval or economic downturns, the company's stability could be jeopardized. This concentration risk means that adverse events in a key region, such as regulatory changes or natural disasters, could disproportionately impact Globant's global performance.

To mitigate this, strategic diversification of its operational hubs and client acquisition efforts across a wider range of countries and economic zones is crucial. This would spread the risk and ensure that disruptions in one area have a less severe effect on the company's overall business. For example, while Globant has a strong presence in Latin America, expanding further into Asia or Eastern Europe could offer greater resilience.

Consider the following points regarding geographic concentration:

- Dependency on Key Markets: A significant portion of Globant's revenue or operational capacity might be tied to a limited number of countries, increasing vulnerability to localized economic or political instability.

- Operational Disruptions: Political unrest, changes in trade policies, or natural disasters in core operating regions can directly interrupt service delivery and client relationships.

- Talent Pool Concentration: Over-reliance on specific geographic talent pools can limit access to diverse skills and make the company susceptible to regional labor market fluctuations.

- Regulatory Exposure: Operating heavily in a few jurisdictions exposes Globant to a concentrated set of regulatory frameworks, making it sensitive to changes in those specific legal environments.

Globant's significant reliance on a few major clients represents a key vulnerability. While the company has a diverse client base, losing even one substantial client could disproportionately impact its revenue. For instance, in Q1 2024, its largest client represented approximately 10% of total revenue, highlighting the need for continued client diversification to mitigate this risk.

Preview Before You Purchase

Globant SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of Globant's strategic position.

This is the same SWOT analysis document included in your download. The full content is unlocked after payment, offering detailed insights into Globant's Strengths, Weaknesses, Opportunities, and Threats.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout, allowing you to leverage this professional, structured analysis for your strategic planning.

Opportunities

The global push for digital transformation is a significant tailwind for Globant, with businesses across sectors actively seeking to modernize. This trend is projected to see the global IT services market, encompassing digital transformation, reach an estimated $1.5 trillion by 2027, a substantial increase from previous years.

Globant's expertise in cloud solutions, data analytics, and custom software development directly addresses this escalating demand. The company is well-positioned to capitalize on the increasing corporate spending on digital initiatives, which saw significant growth in 2023 and is expected to continue its upward trajectory through 2025.

Globant can capitalize on emerging markets with high digital adoption rates, such as Southeast Asia and parts of Africa, to establish new delivery centers and sales offices. This strategic move allows them to tap into a fresh client base and diversify their revenue, reducing reliance on existing markets. For instance, by Q3 2024, many tech firms reported significant growth in emerging economies, indicating a strong potential for Globant's expansion.

The accelerating integration of AI, Machine Learning, and blockchain presents a substantial opportunity for growth. Globant's strategic focus on these advanced technologies allows for the development of specialized, proprietary solutions, positioning them as leaders in intelligent automation and data-driven services.

For instance, the global AI market is projected to reach $1.81 trillion by 2030, growing at a CAGR of 37.3% from 2023 to 2030, according to Grand View Research. By deepening its expertise and offering unique frameworks in these domains, Globant can effectively capitalize on this expanding market, securing a larger market share.

Strategic Acquisitions and Partnerships

Globant has significant opportunities to bolster its service offerings and market presence through strategic acquisitions. The company can target smaller, specialized firms that possess niche expertise in emerging technologies like AI-driven automation or advanced cybersecurity, thereby enhancing its existing capabilities. For instance, an acquisition in the generative AI space could significantly boost its value proposition in 2024-2025.

Forming strategic alliances with leading cloud providers or specialized software vendors presents another avenue for growth. These partnerships can unlock new market segments and provide access to cutting-edge solutions that complement Globant's digital transformation services. Such collaborations can also lead to co-selling opportunities and broader client engagement.

- Acquire specialized AI/ML firms: To integrate advanced automation and data analytics capabilities, crucial for 2024-2025 digital transformation projects.

- Partner with cloud infrastructure leaders: To expand service offerings in cloud migration and management, a growing market segment.

- Form joint ventures in emerging tech sectors: Such as quantum computing or advanced biotech software, to secure future growth drivers.

- Invest in or acquire companies with strong B2B SaaS platforms: To enhance its productized service offerings and recurring revenue streams.

Industry-Specific Solutions and Verticals

By honing its expertise in specific sectors like finance, healthcare, and retail, Globant can forge deeper connections and offer more impactful solutions. This focus allows for the development of specialized products that directly tackle industry-specific hurdles and regulatory demands, thereby boosting their appeal to clients needing precise knowledge.

This strategic verticalization can foster more robust client partnerships and unlock opportunities for higher-profit projects. For instance, in 2023, Globant reported significant revenue growth in its financial services and digital transformations segments, indicating a strong market reception for its tailored offerings.

- Deepened Vertical Penetration: Globant's focus on industry-specific solutions allows for a more profound impact within key markets such as finance and healthcare.

- Enhanced Value Proposition: Creating specialized offerings that address unique sector challenges and compliance needs strengthens Globant's appeal to clients.

- Higher-Margin Projects: This verticalization strategy is expected to lead to stronger client relationships and more profitable engagements.

Globant is well-positioned to leverage the ongoing global digital transformation, with the IT services market, including digital transformation, projected to reach $1.5 trillion by 2027. The company's proficiency in cloud, data analytics, and custom software directly addresses this demand, with corporate spending on digital initiatives showing robust growth through 2025.

Expanding into emerging markets with high digital adoption rates offers a significant growth avenue, tapping into new client bases and diversifying revenue streams. Furthermore, the increasing integration of AI, Machine Learning, and blockchain presents a substantial opportunity, with the global AI market alone expected to reach $1.81 trillion by 2030.

Strategic acquisitions of specialized firms, particularly in AI-driven automation or generative AI, can enhance Globant's capabilities and value proposition in the 2024-2025 period. Similarly, forming alliances with cloud providers and software vendors can unlock new market segments and co-selling opportunities.

Deepening sector-specific expertise, such as in finance and healthcare, allows Globant to offer more impactful, tailored solutions and foster stronger client partnerships, leading to potentially higher-margin projects. This verticalization strategy has already shown positive results, with significant revenue growth reported in these segments during 2023.

Threats

The digital services market's maturation intensifies price competition, especially for standardized offerings. Globant faces the risk of clients prioritizing lower costs, which could squeeze profit margins. For instance, in 2024, many IT service providers reported increased pressure on pricing for routine cloud migration and application maintenance tasks.

This trend towards commoditization in areas like basic software development and testing necessitates continuous innovation. Globant must actively differentiate its services through specialized expertise or unique delivery models to command premium pricing and avoid becoming just another cost-effective option.

The tech world moves at lightning speed, with new tools and methods popping up constantly. This means Globant's current services or tech skills could quickly become outdated if they don't keep pace.

For instance, the rise of generative AI in 2024 and 2025 presents a significant shift, requiring companies like Globant to integrate these new capabilities or risk falling behind competitors who do. Globant's reported investment in AI and cloud technologies in their 2024 investor updates highlights their awareness of this threat and their efforts to stay relevant.

To counter this, ongoing investment in research, development, and crucially, employee upskilling is vital. Failing to adapt means losing out on new market opportunities and potentially seeing existing client demand diminish.

As a digital solutions provider, Globant's handling of sensitive client data and intellectual property makes it a prime target for cyberattacks. A significant cybersecurity incident, such as a data breach, could severely tarnish its reputation and result in substantial financial penalties, directly impacting client trust. For instance, the global average cost of a data breach reached $4.45 million in 2024, a figure that underscores the potential financial fallout.

Talent Shortages and Wage Inflation

The intense global demand for tech talent, particularly in cutting-edge fields like artificial intelligence and cloud computing, frequently surpasses the available skilled workforce. This scarcity directly fuels wage inflation, potentially increasing Globant's operating expenses and squeezing profit margins. For instance, in 2024, the average salary for senior AI engineers in major tech hubs saw increases of 15-20% year-over-year, a trend likely to continue.

A persistent deficit in specialized expertise can also hinder Globant's ability to secure new business opportunities or ensure the timely completion of ongoing projects. This bottleneck can impact client satisfaction and revenue generation. Reports from late 2024 indicated that over 60% of IT decision-makers cited a lack of skilled personnel as a primary impediment to project execution.

- Global demand for AI and cloud specialists consistently outpaces supply, driving up labor costs.

- Wage inflation in the tech sector, potentially 15-20% for specialized roles in 2024, directly impacts operational expenses.

- Shortages of skilled professionals can limit project capacity and affect delivery timelines, impacting revenue and client relations.

Economic Downturns and Reduced IT Spending

Economic downturns pose a significant threat to Globant, as they directly impact corporate IT spending. During periods of economic contraction, businesses often tighten their belts, leading to reduced budgets for digital transformation initiatives, which are core to Globant's service offerings. This can result in clients delaying or even canceling projects, thereby impacting Globant's revenue streams and overall growth trajectory. For instance, if a major client industry like financial services or retail experiences a sharp decline, Globant's demand from that sector will likely follow suit.

The company's financial performance is intrinsically linked to the economic vitality of its key markets and client industries. With a substantial portion of its revenue derived from North America and Europe, any slowdown in these regions, or in sectors like technology, media, and financial services, could have a material adverse effect. For example, a recessionary environment in 2024 or 2025 could lead to a decrease in IT investment across the board, directly challenging Globant's ability to secure new business and retain existing contracts.

- Reduced IT Budgets: Economic slowdowns typically lead to cuts in corporate IT expenditures, impacting demand for digital transformation services.

- Project Deferrals/Cancellations: Clients may postpone or cancel ongoing or planned projects, directly affecting Globant's revenue and project pipeline.

- Industry Sensitivity: Globant's reliance on specific industries means its performance is vulnerable to economic headwinds affecting those sectors.

The increasing commoditization of digital services intensifies price competition, forcing Globant to focus on differentiation through specialized expertise or unique delivery models to maintain premium pricing. The rapid pace of technological evolution, exemplified by the rise of generative AI in 2024-2025, necessitates continuous investment in R&D and employee upskilling to prevent service obsolescence.

Globant's exposure to cyber threats remains a significant concern, with the global average cost of a data breach reaching $4.45 million in 2024, highlighting the potential financial and reputational damage from security incidents. Furthermore, the intense global demand for tech talent, particularly in AI and cloud, is driving wage inflation, with senior AI engineer salaries in major hubs increasing by 15-20% year-over-year in 2024, directly impacting operating expenses and project execution capacity.

Economic downturns pose a substantial threat by reducing corporate IT spending, leading to project delays or cancellations and impacting Globant's revenue streams, especially given its reliance on key markets like North America and Europe. For instance, a recessionary environment in 2024-2025 could significantly decrease IT investment across various sectors, challenging Globant's ability to secure new business.

The competitive landscape is also intensifying, with established players and emerging niche providers vying for market share. Globant must continually innovate and adapt its service portfolio to stay ahead. For example, the increasing demand for specialized cybersecurity and data analytics services in 2024-2025 means companies that do not offer these cutting-edge solutions risk losing clients to competitors who do.

| Threat Category | Specific Threat | Impact on Globant | Supporting Data/Trend (2024-2025) |

| Market Dynamics | Intensifying Price Competition | Margin pressure, need for service differentiation | Maturing digital services market, increased client focus on cost-effectiveness for standardized offerings. |

| Technological Obsolescence | Rapidly Evolving Technologies | Risk of outdated services/skills, loss of competitive edge | Rise of generative AI requiring integration, continuous investment in R&D and upskilling is critical. |

| Cybersecurity Risks | Data Breaches and Cyberattacks | Reputational damage, financial penalties, loss of client trust | Global average cost of data breach reached $4.45 million in 2024. |

| Talent Scarcity & Inflation | Shortage of Skilled Tech Talent | Increased operating expenses, project delays, reduced capacity | 15-20% year-over-year salary increase for senior AI engineers in major hubs (2024); over 60% of IT decision-makers cited lack of skilled personnel as a project impediment (late 2024). |

| Economic Conditions | Economic Downturns | Reduced IT spending, project deferrals/cancellations, revenue impact | Vulnerability to slowdowns in key markets (North America, Europe) and client industries (tech, media, financial services). |

SWOT Analysis Data Sources

This Globant SWOT analysis is built upon a robust foundation of data, drawing from publicly available financial reports, comprehensive market research, and industry expert opinions to provide a well-rounded strategic perspective.