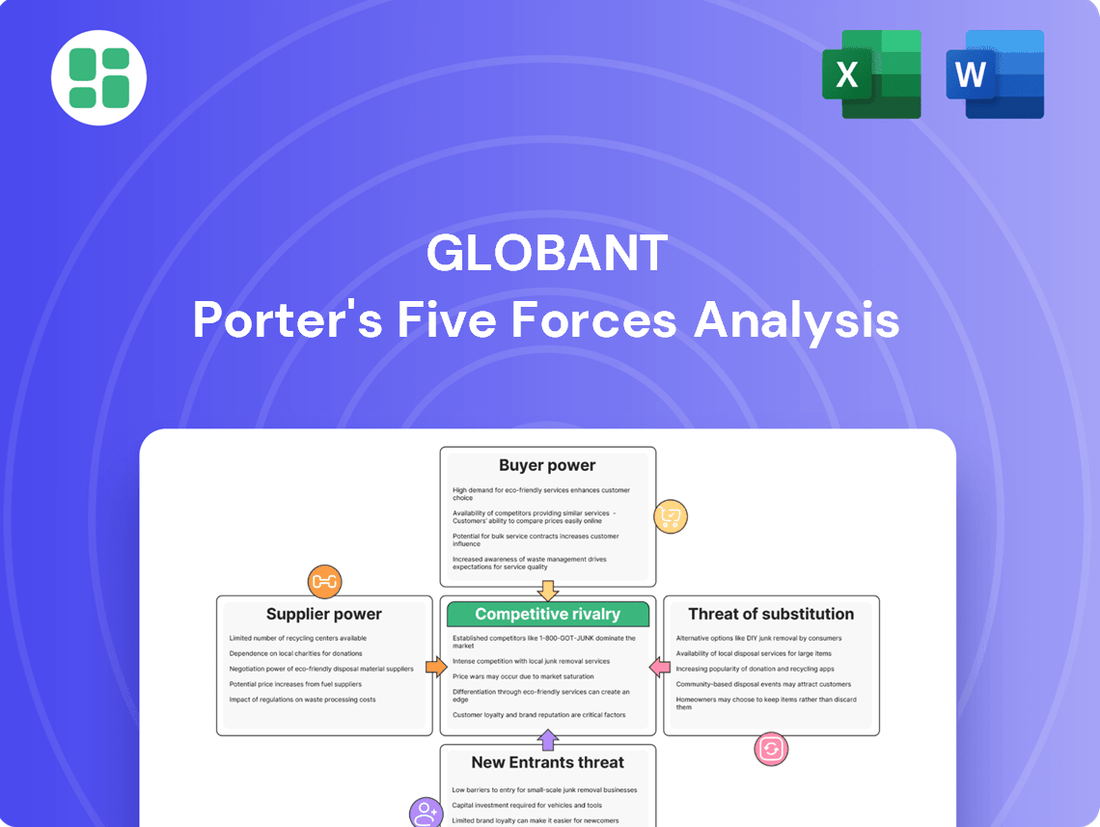

Globant Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Globant Bundle

Globant navigates intense competition, with buyer power and the threat of substitutes significantly shaping its market. Understanding these dynamics is crucial for any stakeholder.

The complete report reveals the real forces shaping Globant’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Globant's reliance on highly specialized talent, such as AI/ML engineers and digital strategists, means that a scarcity of these professionals significantly impacts supplier power. The intense global demand for these skills, often exceeding available talent pools, grants individual experts and niche recruitment firms considerable leverage.

This talent scarcity directly translates into higher compensation demands and increased recruitment expenses for Globant. For instance, reports from early 2024 indicated that the average salary for senior AI engineers in major tech hubs could exceed $200,000 annually, a significant cost pressure. Such conditions make it challenging for Globant to scale its teams rapidly to meet client project needs, directly impacting its operational flexibility and project delivery timelines.

Globant's reliance on specific technology platforms, such as cloud providers like AWS, Azure, or Google Cloud, can grant suppliers significant bargaining power. If a particular platform is crucial for delivering client solutions and few alternatives exist, these suppliers can dictate terms, impacting pricing and availability. For instance, in 2024, the demand for specialized cloud services continued to grow, potentially increasing the leverage of major providers.

However, Globant actively works to reduce this dependency. Their multi-cloud strategy and increasing adoption of agnostic tools help them avoid being locked into a single vendor. Recent strategic alliances, such as those with Google Cloud and OpenAI in late 2023 and early 2024, demonstrate a commitment to leveraging diverse, cutting-edge technologies, thereby diffusing supplier power.

Globant relies on specialized software for development and project management. Vendors offering unique or industry-essential tools can exert influence, particularly if Globant faces significant costs or operational disruptions when switching, perhaps due to deeply integrated workflows or specific client mandates.

For instance, in 2024, the global market for software development tools was valued at over $15 billion, highlighting the importance of these suppliers. While many open-source and commercial alternatives exist, limiting supplier leverage, the integration of specific proprietary platforms can still create dependencies.

Infrastructure and connectivity providers

Infrastructure and connectivity providers hold moderate bargaining power over Globant. As a digitally native company, reliable, high-speed internet and data center services are critical to operations. While the market for these services is generally competitive, specific geographic needs or specialized requirements can empower certain providers.

Globant's global presence, with significant revenue streams from North America, Europe, and Latin America, helps mitigate the risk of over-reliance on a single provider. This distributed model allows for diversification of infrastructure partners, thereby reducing the leverage of any individual supplier.

- Critical Dependency: High-speed internet and data center services are fundamental for Globant's digitally native operations.

- Market Dynamics: While generally competitive, niche geographical or technical demands can increase supplier leverage.

- Diversification Strategy: Globant's global revenue distribution (North America, Europe, Latin America) allows for varied infrastructure sourcing.

Limited forward integration by suppliers

Suppliers of talent and technology to companies like Globant generally lack the capacity or inclination to move into offering complete digital transformation services themselves. This means they can't directly challenge Globant's core business. Their power is therefore mostly confined to negotiating prices and ensuring the supply of their specialized inputs, rather than posing a broader competitive threat.

This limited forward integration means these suppliers remain focused on their niche, typically providing skilled professionals or specific technological components. They are unlikely to develop the broad capabilities needed to compete as end-to-end service providers against established digital transformation firms.

- Limited Scope of Power: Suppliers' influence is primarily on input costs and availability, not on directly competing with Globant's service offerings.

- Specialization Focus: Talent and technology providers tend to concentrate on their core competencies rather than expanding into full-service integration.

- Reduced Competitive Threat: The absence of forward integration significantly lowers the direct competitive pressure from these suppliers.

Globant's suppliers, particularly those providing specialized tech talent and cloud infrastructure, possess significant bargaining power due to high demand and limited alternatives. This leverage translates into increased costs for Globant, impacting recruitment expenses and service pricing. For instance, in early 2024, the demand for AI/ML specialists drove average salaries in key markets above $200,000 annually.

While Globant mitigates this by diversifying its tech stack and talent sourcing, the inherent scarcity of niche skills and the critical nature of certain platforms like major cloud providers (AWS, Azure, Google Cloud) continue to empower these suppliers. The global software development tools market, valued at over $15 billion in 2024, also illustrates the potential influence of key vendors whose proprietary platforms are deeply integrated.

| Supplier Type | Bargaining Power Factor | Impact on Globant | Mitigation Strategy |

|---|---|---|---|

| Specialized Tech Talent | High demand, scarcity of skills | Increased compensation, recruitment costs | Global talent sourcing, strategic partnerships |

| Cloud Infrastructure Providers | Criticality of platforms, limited alternatives | Potential for price increases, service terms | Multi-cloud strategy, agnostic tools |

| Software/Tool Vendors | Proprietary platforms, integration costs | Dependency, potential switching costs | Adoption of open-source, vendor diversification |

What is included in the product

This analysis dissects the competitive landscape for Globant, examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and ultimately, Globant's strategic positioning within these forces.

Globant's Porter's Five Forces Analysis provides a clear, one-sheet summary of all five forces, perfect for quick decision-making and understanding competitive pressures.

Customers Bargaining Power

Globant's customer base is heavily weighted towards large enterprise clients and multinational corporations. These clients are typically undertaking significant digital transformation projects, which means they often have substantial budgets and a deep understanding of the services they require. This scale gives them considerable leverage in negotiations.

The bargaining power of these large enterprise clients is significant because they can influence pricing, contract terms, and service level agreements. For instance, a client initiating a multi-million dollar digital transformation project can demand competitive pricing and flexible payment schedules, directly impacting Globant's profit margins. In 2023, Globant reported that its top 10 clients accounted for approximately 30% of its total revenue, highlighting the concentrated purchasing power of its major customers.

These clients often have robust procurement departments and established processes for vendor selection and negotiation. They can also switch providers if they are not satisfied with the terms or performance, although the complexity and cost of switching in large-scale digital transformation can be a deterrent. Nevertheless, their ability to negotiate favorable terms, demand high service levels, and potentially walk away if needs aren't met underscores their strong bargaining power.

The bargaining power of customers is significantly influenced by the availability of alternative service providers. Globant's clients face a landscape brimming with choices, from other large global IT service firms to niche digital transformation agencies and even management consultancies that have built out their technology capabilities. In 2024, the IT services market continued to be highly competitive, with numerous players vying for market share, further amplifying customer leverage.

This broad competitive spectrum empowers clients. If a customer finds Globant's offerings lacking in performance, pricing, or the pace of innovation, they can readily explore and switch to a competitor. For instance, the rise of specialized AI and cloud migration firms in 2024 offered clients highly focused alternatives, increasing the ease with which they could find a better fit or more competitive terms.

While Globant's clients might have numerous options for IT services, the reality of large-scale digital transformation projects introduces substantial switching barriers. For instance, initiating a new provider mid-way through a complex implementation can mean incurring costs related to data migration, retraining personnel, and the inherent risk of project delays. This effectively anchors clients to their current provider, like Globant, especially in long-term, deeply integrated partnerships.

Customer's strategic importance of services

Globant's services are frequently integral to their clients' fundamental business operations and future expansion plans, such as improving customer engagement or launching novel income streams. This strategic importance enhances the perceived worth of Globant's solutions, potentially diverting clients' attention from a singular focus on cost to a greater appreciation for high-quality, innovative outcomes.

The deeply embedded and strategic nature of Globant's engagements can significantly influence the bargaining power dynamic. When clients rely on Globant for mission-critical functions or competitive differentiation, their willingness to negotiate aggressively on price may diminish, as the risk of disrupting vital operations or hindering growth becomes a primary concern.

- Strategic Integration: Globant's solutions often become deeply woven into client operations, making switching costs high and reducing customer price sensitivity.

- Value-Driven Relationships: Clients prioritize the strategic value and innovation Globant provides, rather than solely focusing on the lowest bid.

- Client Dependence: For many clients, Globant's expertise is crucial for digital transformation and maintaining a competitive edge, thereby limiting their bargaining leverage.

Price sensitivity and project scope control

Clients, especially those with sophisticated procurement departments, are keenly aware of pricing and actively work to reduce project expenses. This price sensitivity is a significant lever for customers.

They can wield their power by requesting granular cost breakdowns, insisting on fixed-price agreements, or by trimming the scope of projects to manage their budgets more effectively. For instance, in 2024, many large enterprises continued to scrutinize IT service provider contracts, with some renegotiating terms to achieve cost savings of up to 10% on existing projects.

- Price Sensitivity: Clients often prioritize cost optimization, particularly for large-scale or ongoing projects.

- Scope Control: The ability to adjust project scope directly impacts the revenue and resource allocation for service providers like Globant.

- ROI Justification: In competitive bidding, demonstrating a clear return on investment is crucial for Globant to secure and maintain client relationships.

Globant's large enterprise clients possess significant bargaining power due to their substantial project budgets and the critical nature of digital transformation initiatives. These clients can influence pricing and contract terms, as evidenced by Globant's top 10 clients representing approximately 30% of its 2023 revenue, underscoring their concentrated purchasing influence.

The competitive IT services market in 2024, with numerous global and niche providers, further amplifies customer leverage, allowing clients to easily switch if dissatisfied with pricing or performance. For example, specialized AI and cloud migration firms offered clients more attractive alternatives in 2024.

While switching costs for complex digital transformation projects can be high, clients actively manage project expenses by scrutinizing contracts and negotiating terms, with some achieving cost savings of up to 10% on existing projects in 2024.

| Factor | Impact on Globant | Client Leverage Example |

|---|---|---|

| Client Size & Concentration | High dependence on key accounts | Top 10 clients = ~30% of 2023 revenue |

| Market Competition | Increased pressure on pricing and service | Availability of niche AI/cloud providers in 2024 |

| Cost Sensitivity | Demand for price optimization | Potential for 10% cost savings via renegotiation (2024) |

Full Version Awaits

Globant Porter's Five Forces Analysis

This preview showcases the complete Globant Porter's Five Forces Analysis, offering a thorough examination of the competitive landscape within the IT consulting and digital transformation sector. The document you see here is the exact, professionally formatted analysis you will receive immediately upon purchase, ensuring full transparency and immediate utility for your strategic planning.

Rivalry Among Competitors

Globant operates in a highly fragmented digital transformation and IT services market, facing intense rivalry from a multitude of global and regional competitors. Major players such as Accenture, Deloitte, Capgemini, and PwC, along with numerous specialized niche firms, create a crowded landscape. This fierce competition puts constant pressure on pricing and necessitates continuous differentiation of Globant's service portfolio to stand out and capture market share.

The digital transformation market is booming, with IT spending and digital business services projected for robust growth through 2027-2028. This expansion acts like a magnet, drawing in new companies and pushing current players to beef up their offerings. Consequently, the competition is heating up.

With cutting-edge technologies like AI and blockchain constantly reshaping the landscape, companies must pour resources into staying current. This continuous investment cycle fuels a dynamic and intensely competitive arena where firms are actively battling for dominance in these rapidly developing tech sectors.

Competitive rivalry in the IT services sector, while intense, is somewhat softened by a firm's ability to stand out through specialized knowledge and innovation. Globant, for instance, differentiates itself with its deep industry insights and proprietary approaches, particularly evident in its AI Industry Reinvention Studio Network. Their significant investments in AI are designed to create unique value propositions.

Globant's strategic focus on reinventing businesses via AI is a clear differentiator, aiming to provide specialized solutions. However, this advantage is constantly being challenged as major competitors are also pouring resources into AI, cloud computing, and data analytics. This broad industry investment means that maintaining a unique edge requires continuous innovation and adaptation, making sustained differentiation a significant hurdle.

Client loyalty and relationship-based business

Globant benefits from robust client loyalty, fostered by long-term relationships built on trust, consistent delivery, and a deep understanding of client needs. This creates significant switching barriers, effectively dampening direct competitive rivalry. For instance, as of the first quarter of 2024, Globant reported that a substantial portion of its revenue, approximately 80%, comes from its existing client base, underscoring the strength of these enduring partnerships.

These strong relationships are further evidenced by the company's significant number of large clients. In 2023, Globant served over 250 customers each generating more than $1 million in annual revenue, a testament to the depth and value of its client engagements.

- Client Retention: Globant's high revenue from existing customers (around 80% in early 2024) highlights strong loyalty and reduces the impact of new entrants.

- Large Client Base: Over 250 clients exceeded $1 million in annual revenue in 2023, indicating deep, valuable relationships that are hard to replicate.

- Market Trend: Despite strong loyalty, clients are increasingly adopting best-of-breed strategies, leading them to work with multiple vendors for specialized digital transformation needs.

- Rivalry Mitigation: The established trust and proven delivery in these long-term relationships act as a natural defense against competitors seeking to poach clients.

Aggressive pricing and talent acquisition wars

Globant faces intense competition, often leading to aggressive pricing as companies vie for contracts and client loyalty, which can squeeze profit margins. This pricing pressure is particularly evident in the digital transformation services sector.

The struggle to secure and keep top talent is another major battleground. Companies are locked in fierce competition to attract skilled professionals, especially those with expertise in burgeoning fields like artificial intelligence and cybersecurity. For instance, in 2024, the demand for AI specialists remained exceptionally high, with average salaries for experienced AI engineers often exceeding $150,000 annually in major tech hubs.

- Aggressive Pricing: Companies may lower prices to win bids, impacting overall profitability.

- Talent Acquisition Wars: Intense competition to hire and retain skilled employees, especially in AI and cybersecurity.

- Increased Labor Costs: The war for talent drives up wages and benefits, affecting operational expenses.

- Impact on Operational Efficiency: High demand for specific skills can create bottlenecks and strain resources.

Globant operates in a crowded digital transformation market with intense rivalry from global giants and niche specialists, leading to pricing pressures and a constant need for differentiation. The sector's growth attracts new entrants, intensifying competition, especially as companies invest heavily in emerging technologies like AI to maintain a competitive edge.

While Globant benefits from strong client loyalty, with approximately 80% of revenue coming from existing clients in early 2024, clients are increasingly adopting multi-vendor strategies. This trend, coupled with the ongoing "war for talent" in areas like AI, where experienced specialists can earn over $150,000 annually in 2024, means sustained differentiation and talent acquisition remain critical challenges.

| Metric | Globant (Early 2024) | Industry Trend |

|---|---|---|

| Revenue from Existing Clients | ~80% | High loyalty, but clients diversify vendors |

| Number of $1M+ Clients (2023) | >250 | Indicates deep, valuable relationships |

| AI Specialist Salaries (2024) | >$150,000 (Major Tech Hubs) | Intense competition for top talent |

SSubstitutes Threaten

Many large enterprises possess substantial internal IT departments, capable of developing solutions independently. This presents a direct substitute for outsourcing, especially for projects deemed non-core or requiring high levels of data security.

The choice between in-house development and external providers often boils down to a careful consideration of cost-effectiveness, the desire for direct control over the project, and the availability of specialized internal expertise. As these internal capabilities mature, the threat of substitution naturally escalates.

For instance, in 2024, many Fortune 500 companies continued to invest heavily in their IT infrastructure, with some reporting IT spending exceeding billions of dollars annually. This internal investment directly competes with the market for IT outsourcing services, potentially diverting projects that might otherwise have gone to firms like Globant.

Off-the-shelf software and SaaS solutions present a significant threat to Globant's custom development services. For many common business functions like customer relationship management (CRM) or enterprise resource planning (ERP), readily available platforms can fulfill needs without the cost and complexity of bespoke development. The global SaaS market was valued at over $300 billion in 2023 and is projected to continue its strong growth, indicating a broad and accessible market for these alternatives.

While Globant excels in tailored digital transformation, the increasing sophistication and feature richness of SaaS offerings mean they can now address a wider array of business challenges. This broader applicability makes them a more viable substitute, potentially reducing client demand for highly customized solutions, especially for less unique business processes. For instance, the adoption rate of cloud-based business applications continues to rise across industries.

The proliferation of low-code and no-code platforms presents a significant threat of substitutes for traditional software development services. These platforms enable businesses to build applications with minimal or no coding expertise, thereby reducing their need to outsource or hire specialized development teams for simpler projects. For instance, by 2025, the low-code development platform market is projected to reach $187 billion, according to Gartner, indicating a substantial shift towards these alternatives.

Generic consulting services without implementation

Clients might opt for strategic advice from traditional consulting firms, then handle implementation internally or with a different vendor. This bifurcated approach, while not a perfect substitute for Globant's integrated digital transformation services, can limit the scope of Globant's involvement by separating strategy from execution. For instance, in 2024, many companies focused on cost optimization, potentially leading them to seek cheaper strategic planning without committing to full-scale implementation partnerships.

This trend pressures Globant to clearly articulate and prove its end-to-end value proposition, demonstrating how its integrated approach delivers superior outcomes compared to piecemeal solutions. The ability to showcase tangible ROI from strategy through to implementation becomes critical in retaining larger, more comprehensive engagements.

- Separation of Strategy and Execution: Clients can engage separate firms for digital strategy and implementation, reducing the need for a single, end-to-end provider like Globant.

- Cost Optimization Focus: In 2024, many businesses prioritized cost-saving measures, making them more inclined to split services to manage budgets more granularly.

- Value Demonstration: Globant must clearly showcase the benefits of its integrated, full-stack digital transformation services to justify its comprehensive engagement model.

- Reduced Engagement Scope: This threat can lead to smaller project scopes for Globant if clients choose to manage parts of the digital transformation journey independently.

Automation tools reducing the need for custom solutions

Automation tools, like Robotic Process Automation (RPA) and AI-driven platforms, are increasingly capable of handling tasks previously requiring custom software. This trend directly impacts the demand for bespoke development services, as businesses can achieve similar efficiencies through off-the-shelf or configurable automation solutions. For instance, Gartner predicted that by 2025, 70% of new enterprise applications would be developed using low-code or no-code approaches, a significant shift away from traditional custom coding.

Companies are actively adopting these tools to boost productivity and cut operational costs. This strategic focus on automation means that the need for highly specialized, custom-built software for many routine functions is diminishing. The market for automation software itself is growing rapidly, with IDC forecasting worldwide spending on AI software to reach $200 billion in 2024, indicating a strong preference for these solutions over custom alternatives.

The increasing sophistication and accessibility of automation technologies present a significant threat of substitutes for traditional custom software development. Businesses can leverage these tools for:

- Streamlined Operations: Automating repetitive tasks like data entry, report generation, and customer service queries.

- Cost Reduction: Lowering expenses associated with custom development, maintenance, and specialized IT personnel.

- Faster Implementation: Deploying automated solutions more quickly compared to the longer development cycles of custom software.

- Scalability: Easily scaling automation capabilities up or down as business needs change.

The availability of sophisticated off-the-shelf software and Software-as-a-Service (SaaS) platforms directly competes with Globant's custom development. For many standard business needs, these readily available solutions offer a more cost-effective and quicker alternative to bespoke software. The global SaaS market's continued expansion, projected to exceed $300 billion in 2023, underscores the significant market share these substitutes command.

Furthermore, the rise of low-code and no-code development platforms is democratizing application creation, allowing businesses to build solutions with minimal technical expertise. This trend is projected to see the low-code market reach $187 billion by 2025, presenting a substantial threat by reducing the need for external development partners for many projects.

Automation tools, including Robotic Process Automation (RPA) and AI-driven platforms, are also increasingly capable of performing tasks that would typically require custom software development. With worldwide spending on AI software predicted to reach $200 billion in 2024, businesses are opting for these efficient, often pre-built, solutions to streamline operations and cut costs, thereby diminishing the demand for custom-built alternatives.

| Substitute Category | Key Characteristics | Impact on Globant | Market Data/Projections |

|---|---|---|---|

| In-house IT Development | Direct control, data security focus | Reduces outsourcing demand for non-core projects | Fortune 500 IT spending exceeding billions annually (2024) |

| Off-the-Shelf Software & SaaS | Cost-effectiveness, faster deployment for standard functions | Limits demand for custom solutions for common business processes | Global SaaS market >$300 billion (2023) |

| Low-Code/No-Code Platforms | Accessibility, reduced need for coding expertise | Threatens custom development for simpler applications | Low-code market projected at $187 billion by 2025 |

| Automation Tools (RPA, AI) | Efficiency, cost reduction for repetitive tasks | Decreases need for custom software for routine functions | Worldwide AI software spending $200 billion (2024) |

Entrants Threaten

Establishing a global digital transformation company like Globant demands significant capital. Think about the costs involved in building out infrastructure, investing in cutting-edge technology, and, crucially, attracting and keeping a diverse, highly skilled workforce across many countries. These substantial upfront expenses create a real hurdle for many aspiring new players.

Beyond infrastructure and talent, building a strong brand and a solid client base also necessitates considerable financial outlay. For instance, in 2023, Globant's revenue reached $1.9 billion, showcasing the scale of operations that new entrants would need to match to compete effectively, requiring immense capital to even approach such a level.

In the competitive IT services landscape, reputation and client trust are critical barriers to entry. Newcomers struggle to match the established credibility and long-standing relationships that firms like Globant have built. Globant, recognized for its AI leadership and rapid growth, has cultivated deep client loyalty through consistent, successful project deliveries.

A significant barrier for new entrants into the IT services sector, like Globant, is the challenge of accessing and retaining a specialized talent pool. This is particularly true for in-demand fields such as artificial intelligence, cloud computing, and cybersecurity, where skilled professionals are scarce.

Globant, for instance, has cultivated strong recruitment pipelines and robust talent development initiatives, even being recognized as a Google Cloud Talent Development Partner of the Year for Latin America. This existing infrastructure and employer reputation make it considerably harder for newcomers to attract and keep the highly sought-after talent needed for complex projects.

Economies of scale and scope

Globant, as a large player in the IT services industry, leverages significant economies of scale. This includes efficient resource utilization, optimized global delivery models, and enhanced purchasing power for essential tools and infrastructure. For instance, in 2023, Globant reported total revenue of $1.79 billion, indicating a substantial operational footprint that smaller competitors struggle to match.

Economies of scope also provide Globant with a competitive advantage. By offering a wide array of integrated services, they can cater to the diverse and complex needs of large enterprise clients. New entrants often begin with a more specialized service portfolio, making it challenging to compete on cost-effectiveness or the ability to deliver comprehensive solutions required by major corporations.

The scale achieved by established firms like Globant translates directly into more efficient operations. This efficiency can lead to lower per-unit costs, enabling them to offer more competitive pricing, particularly to clients demanding extensive and multifaceted IT solutions.

The threat of new entrants is therefore moderated by these scale-related advantages:

- Economies of Scale: Globant's large operational size allows for cost efficiencies in resource deployment and procurement, making it difficult for smaller new entrants to match pricing.

- Economies of Scope: The ability to offer a broad spectrum of integrated IT services positions Globant favorably against new firms with narrower specializations.

- Capital Requirements: Establishing the infrastructure and global reach necessary to compete effectively requires substantial upfront investment, acting as a barrier for nascent companies.

- Brand Reputation and Client Relationships: Established firms benefit from existing trust and long-term relationships with large clients, which new entrants must work hard to build.

Regulatory and compliance hurdles

Regulatory and compliance hurdles significantly deter new entrants in the IT services sector, especially for global players like Globant. Operating across various industries and geographies means grappling with a complex web of regulations. For instance, data privacy laws like GDPR in Europe and CCPA in California, alongside industry-specific mandates such as HIPAA for healthcare or SOX for financial services, demand substantial investment in compliance infrastructure.

Established companies have already built robust legal and compliance frameworks, giving them a distinct advantage. Newcomers face considerable costs and complexities in establishing similar systems, making market entry and expansion more challenging. This regulatory burden acts as a substantial barrier, increasing the risk and capital requirements for potential competitors seeking to enter Globant's operating space.

- GDPR fines can reach up to 4% of annual global revenue or €20 million, whichever is higher.

- CCPA grants consumers rights regarding their personal data, requiring businesses to adapt data handling practices.

- SOX compliance costs for public companies can range from hundreds of thousands to millions of dollars annually.

- Navigating these diverse regulations requires specialized legal expertise and ongoing investment in compliance technology.

The threat of new entrants for Globant is moderate, primarily due to substantial capital requirements and the need for specialized talent. Building global infrastructure and attracting top-tier AI and cloud experts demands significant investment, a hurdle for many newcomers.

Globant's established brand reputation and deep client relationships further solidify its position, making it difficult for new players to gain trust and market share. For instance, in 2023, Globant's revenue of $1.9 billion highlights the scale required to compete effectively.

Economies of scale and scope also present barriers, allowing Globant to offer integrated services and competitive pricing that smaller entrants struggle to match. Navigating complex regulations across different regions also adds to the cost and difficulty of market entry.

Porter's Five Forces Analysis Data Sources

Our Globant Porter's Five Forces analysis is built on a foundation of robust data, including industry-specific market research reports, financial disclosures from publicly traded companies, and insights from reputable business news outlets.