Globant Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Globant Bundle

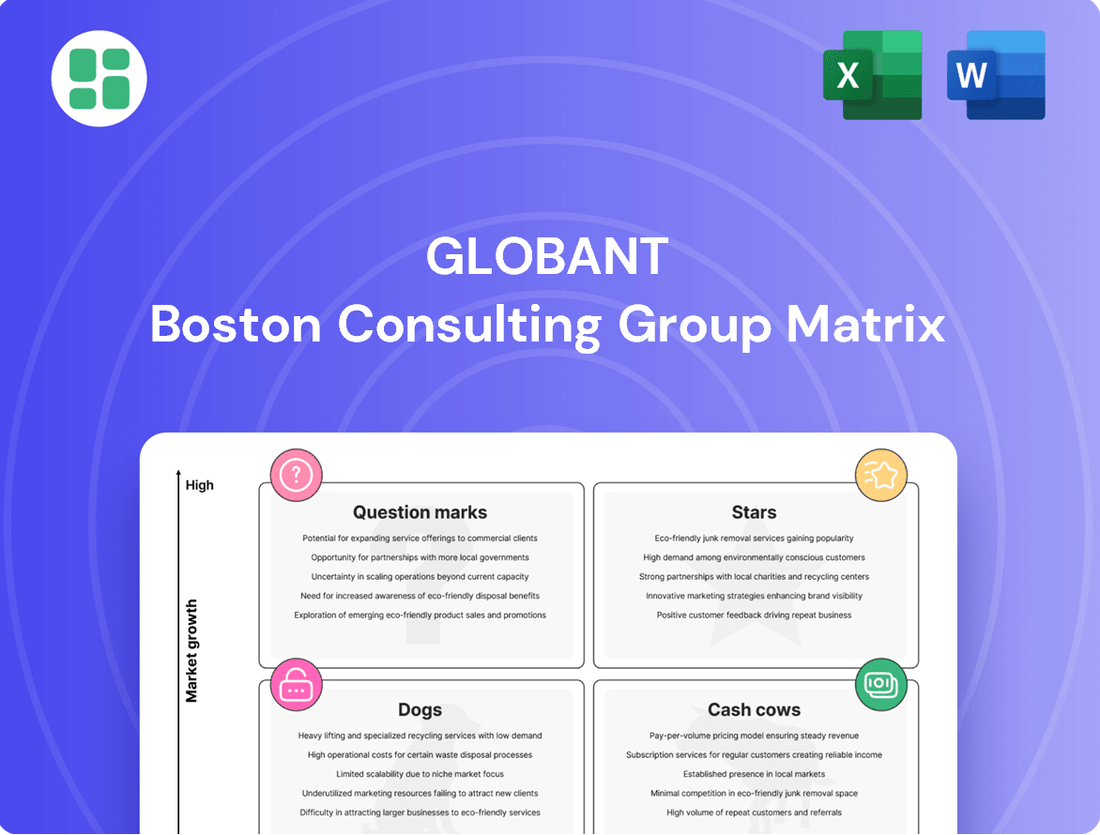

Curious about Globant's strategic product positioning? This glimpse into their BCG Matrix reveals how their offerings stack up as Stars, Cash Cows, Dogs, or Question Marks. Don't miss out on the complete picture; purchase the full BCG Matrix for a detailed breakdown and actionable insights to guide your investment decisions.

Stars

Globant's AI and Data Transformation Services are firmly in the Star quadrant of the BCG matrix. This is driven by the booming demand for AI solutions, with businesses increasingly leveraging data for competitive advantage. Globant's expertise in AI strategy, implementation, and MLOps directly addresses this market need, positioning them for continued growth.

Globant's Cloud Digital Transformation services are firmly positioned as a Star in the BCG Matrix. As businesses accelerate their cloud adoption and optimization, Globant's end-to-end offerings, from initial migration to sophisticated cloud-native development, capture a significant and expanding market share. This segment is critical for enabling scalable and efficient digital operations, a paramount need across industries.

Globant's Reinforce Customer Experience (CX) Solutions are a significant driver of their growth, focusing on innovative digital platforms and personalized interactions. This area is experiencing strong demand as businesses prioritize customer loyalty and engagement, a trend clearly visible in the increasing market share of CX-focused companies. Globant's expertise in delivering impactful CX transformations directly contributes to their strong performance, with the CX market projected to grow substantially.

Digital Product Engineering

Globant's Digital Product Engineering services are a clear Star in the BCG matrix, driven by the persistent market need for innovative digital solutions. This includes everything from custom mobile apps to sophisticated enterprise-level software, showcasing their ability to deliver across the spectrum.

Their strength lies in agile development practices and profound technical knowledge, enabling them to collaborate with clients on creating advanced digital products. This segment is fueled by continuous digital transformation trends, making it a substantial contributor to their overall project portfolio.

- High Market Demand: The global market for digital product development continues to expand, with businesses investing heavily in digital transformation initiatives.

- Globant's Expertise: Globant's proven track record in delivering complex digital solutions across various sectors reinforces its Star status.

- Revenue Contribution: Digital Product Engineering is a significant revenue driver for Globant, reflecting its strong market position and client trust.

- Future Growth Potential: The ongoing evolution of technology and increasing digital adoption by businesses suggest sustained high growth for this segment.

Cybersecurity Integration Services

As digital transformation accelerates, cybersecurity integration services are crucial. Globant's offerings in this space are seeing significant demand driven by rising cyber threats and stricter compliance needs. Their expertise in safeguarding digital assets positions this as a high-growth, high-market-share area for the company.

Globant's cybersecurity integration services are a key component of their strategy in the current digital landscape. The company actively addresses the growing need for secure digital infrastructure, a trend amplified by the increasing sophistication of cyberattacks. For instance, the global cybersecurity market was projected to reach over $345 billion in 2024, highlighting the immense opportunity.

- High Demand: Driven by escalating cyber threats and regulatory mandates.

- Strategic Importance: Essential for securing clients' digital transformation initiatives.

- Market Position: Reflects a strong market share in a rapidly expanding sector.

- Growth Driver: Contributes significantly to Globant's overall revenue growth.

Globant's AI and Data Transformation Services are a clear Star, capitalizing on the immense demand for AI-driven insights and solutions. This segment benefits from businesses increasingly relying on data for a competitive edge, with AI market growth projections remaining robust. Globant's strategic focus on AI implementation and MLOps directly aligns with these market needs, ensuring continued expansion.

What is included in the product

Globant's BCG Matrix analysis categorizes its business units by market share and growth potential.

Globant's BCG Matrix provides a clear, visual roadmap, alleviating the pain of uncertainty about where to invest strategic resources.

Cash Cows

Globant's legacy application modernization services act as a significant cash cow. While the market for this area might not be experiencing explosive growth, its consistent demand from large enterprises seeking to update aging systems provides a stable, high-market-share revenue source. These projects, often complex and foundational, are critical for clients to maintain their competitive edge.

The long-term nature of these modernization efforts, coupled with Globant's established expertise, translates into predictable and profitable cash flow. For instance, in 2024, Globant continued to secure substantial contracts in this space, reinforcing its position as a reliable provider for essential business infrastructure upgrades.

Globant's core IT consulting and strategic advisory services are its cash cows. These offerings, which help companies navigate digital transformations, are mature but incredibly profitable. Their long-standing client relationships and deep expertise ensure stable revenue streams, meaning they don't need heavy investment to grow.

These foundational services are essential for bringing new clients on board and building lasting strategic partnerships. In 2023, Globant reported a significant portion of its revenue coming from these established service lines, demonstrating their consistent cash-generating power and importance to the company's financial stability.

Globant's Enterprise Application Services, focusing on ERP and CRM implementations, represent a stable pillar within their business. These services are crucial for large enterprises needing to integrate complex systems, offering a dependable source of revenue. In 2024, the demand for such specialized integration services continued to be strong, with many companies undertaking digital transformation initiatives that necessitate these core system upgrades.

While not experiencing hyper-growth, these projects are typically high-margin due to the specialized skills and project management required. Globant's established client relationships often lead to long-term contracts for these implementations, providing predictable cash flow. This consistent revenue generation is vital for funding other, more growth-oriented areas of the business.

Managed Services and Support

Managed Services and Support represent a significant Cash Cow for Globant, generating stable, recurring revenue. This segment thrives on providing ongoing maintenance, updates, and operational assistance for digital solutions previously implemented by the company. Clients often enter long-term contracts for these services, ensuring a predictable income stream.

The recurring nature of managed services leads to high client retention, a hallmark of a Cash Cow. Globant's ability to consistently deliver value post-implementation fosters these enduring relationships. This stability is crucial for funding other areas of the business.

For instance, Globant's focus on digital transformation often extends into long-term support agreements. While specific revenue figures for this segment are often aggregated, the company's consistent growth in its consulting and technology services, which heavily include managed services, points to its strength. In 2023, Globant reported a total revenue of $1.79 billion, with a significant portion attributable to these ongoing client engagements.

- Stable Recurring Revenue: Managed services provide a predictable income stream through ongoing support and maintenance contracts.

- High Client Retention: Long-term relationships are fostered by consistent value delivery post-implementation.

- Predictable Cash Flow: The recurring nature of these services ensures a reliable financial foundation for Globant.

- Supports Business Growth: Cash generated from this segment can be reinvested into Stars or Question Marks.

Quality Assurance and Testing Services

Quality Assurance and Testing Services represent a foundational element within Globant's business, acting as a stable Cash Cow. These services are integral to every software development project, ensuring reliability and client satisfaction, thereby generating consistent revenue. Globant's strong brand recognition in delivering dependable solutions fuels ongoing demand for these essential offerings.

While not experiencing rapid expansion, these services are critical for maintaining Globant's operational integrity and financial predictability. Their role as a reliable income source underpins the company's overall stability. For instance, in 2023, Globant reported that its digital and emerging technologies segment, which includes QA and testing, continued to be a significant contributor to its revenue, though specific figures for the QA segment alone are not separately disclosed.

- Consistent Revenue Stream: QA and testing services provide a predictable and steady income for Globant.

- Essential Project Component: They are a non-negotiable part of software development, ensuring demand.

- Brand Reputation Support: Globant's commitment to quality in these services reinforces its overall market standing.

- Financial Stability: These services contribute significantly to the company's financial health and predictability.

Globant's legacy application modernization services are a prime example of a cash cow. These services, while in a mature market, consistently generate revenue due to the ongoing need for enterprises to update their aging systems. Globant's established expertise in this area ensures a high market share and predictable income.

These long-term projects, critical for clients' operational efficiency, translate into stable, high-margin cash flows. In 2024, Globant continued to secure substantial contracts in this domain, demonstrating the enduring demand for essential infrastructure upgrades and reinforcing its position as a reliable provider.

Globant's core IT consulting and strategic advisory services are also significant cash cows. These mature offerings, vital for guiding clients through digital transformations, are highly profitable due to established client relationships and deep expertise. They require minimal investment to maintain their steady revenue streams.

These foundational services are crucial for client acquisition and building long-term partnerships. In 2023, a substantial portion of Globant's revenue, which totaled $1.79 billion, was attributed to these established service lines, highlighting their consistent cash-generating power and contribution to financial stability.

Enterprise Application Services, particularly ERP and CRM implementations, form a stable pillar for Globant, acting as a cash cow. These services are essential for large enterprises integrating complex systems, providing a dependable revenue source. In 2024, demand for specialized integration services remained robust as many companies pursued digital transformations requiring core system upgrades.

Although not experiencing hyper-growth, these high-margin projects, due to specialized skills and project management, provide predictable cash flow through long-term contracts stemming from established client relationships. This consistent revenue is vital for funding growth-oriented business areas.

Managed Services and Support are a significant cash cow for Globant, delivering stable, recurring revenue through ongoing maintenance and operational assistance for implemented digital solutions. Clients often commit to long-term contracts, ensuring a predictable income stream and high retention rates, which are hallmarks of a cash cow.

Globant's focus on digital transformation often extends into long-term support agreements. While specific segment figures aren't always disclosed, the company's overall growth in consulting and technology services, which heavily include managed services, indicates its strength. In 2023, Globant's total revenue of $1.79 billion included significant contributions from these ongoing client engagements.

Quality Assurance and Testing Services serve as a foundational cash cow for Globant, generating consistent revenue by ensuring the reliability and client satisfaction of every software development project. Globant's reputation for delivering dependable solutions fuels continuous demand for these essential services.

While not a high-growth area, these services are critical for maintaining Globant's operational integrity and financial predictability, contributing significantly to its overall stability. In 2023, Globant's digital and emerging technologies segment, which encompasses QA and testing, was a substantial revenue contributor, underscoring the importance of these services.

| Service Area | BCG Matrix Category | Revenue Contribution (Indicative) | Growth Outlook | Investment Need |

| Legacy Application Modernization | Cash Cow | High, Stable | Low to Moderate | Low |

| Core IT Consulting & Strategic Advisory | Cash Cow | High, Stable | Low to Moderate | Low |

| Enterprise Application Services (ERP/CRM) | Cash Cow | High, Stable | Moderate | Low to Moderate |

| Managed Services & Support | Cash Cow | High, Recurring | Moderate | Low |

| Quality Assurance & Testing | Cash Cow | Moderate to High, Consistent | Moderate | Low |

Delivered as Shown

Globant BCG Matrix

The Globant BCG Matrix preview you are examining is the complete, finalized document you will receive immediately after your purchase. This means you're seeing the exact analysis, formatting, and actionable insights that will be yours to leverage for strategic decision-making, with no alterations or missing sections. Rest assured, this is not a demo or a sample; it's the professional-grade report ready for immediate application within your organization.

Dogs

Basic web development, often seen in simple brochure websites, represents a low-growth, low-market-share segment. Companies like Globant, focused on digital transformation, typically de-emphasize this area. In 2024, the market for purely static websites continued to mature, with pricing pressures increasing as more developers and smaller agencies offer these services.

Globant's commoditized IT staff augmentation for generic roles, absent strategic consulting or specialized expertise, operates in a low-margin segment. This area contends with fierce competition and minimal differentiation, making it less appealing for a firm focused on premium digital transformation.

In 2024, the global IT staff augmentation market was valued at approximately $14.5 billion, but this segment within Globant is less strategic. Globant prioritizes outcome-based engagements, moving beyond simple "body shopping" to deliver tangible business results.

Developing custom software exclusively for on-premise deployment, without cloud-native considerations or modern architectural patterns, places Globant in a shrinking market segment. This approach is characterized by low growth potential, as the industry increasingly shifts towards cloud and hybrid solutions. For instance, in 2024, the global market for on-premise software is projected to see a CAGR of only 3.2%, a stark contrast to the cloud market's expected 15.7% growth.

Legacy System Maintenance (without Modernization Scope)

Maintaining very old, niche legacy systems without any modernization plans can place an engagement firmly in the 'Dog' category of the BCG Matrix. These projects often demand significant resources but deliver minimal strategic advantage to the client, limiting their long-term value. For Globant, such work typically represents low-margin, reactive maintenance that diverts focus from their core strategy of digital transformation.

These 'Dog' engagements are characterized by their low growth potential and limited strategic impact. They often involve high operational costs relative to the value generated. In 2024, companies are increasingly looking to shed these maintenance burdens rather than invest further in them.

- Low Strategic Value: Engagements focused solely on maintaining outdated systems offer little to no strategic benefit for clients, hindering their competitive edge.

- Limited Growth Potential: The market for purely legacy system maintenance is shrinking as businesses prioritize modernization.

- High Effort, Low Return: These tasks are often labor-intensive but yield low margins, impacting overall profitability.

- Misalignment with Digital Reinvention: Such work contradicts Globant's strategic focus on driving digital innovation and transformation for its clients.

Generic Hardware Procurement Services

If Globant were to offer generic hardware procurement as a standalone service, it would likely be placed in the Dogs quadrant of the BCG matrix. This market is characterized by low growth and low market share, offering little strategic advantage to a company focused on digital transformation.

The hardware procurement market is highly commoditized, with razor-thin margins. For a company like Globant, whose core strength lies in software and digital services, this segment offers no strategic differentiation and would not significantly contribute to their overall objectives or profitability.

- Low Growth Market: The market for generic hardware procurement is mature and experiences minimal growth.

- Low Profitability: Margins in this sector are typically very low, often in the single digits, making it unattractive.

- Lack of Differentiation: There is little to distinguish one provider from another in terms of service or product, leading to price-based competition.

- Non-Core Business: It does not align with Globant's core competencies in digital engineering and transformation services.

Globant's 'Dogs' represent services with low market share and low growth potential, offering minimal strategic value. These often include maintaining outdated legacy systems or providing generic IT staff augmentation without specialized expertise.

These segments are characterized by low margins and high competition, diverting resources from Globant's core focus on digital transformation. In 2024, the trend is for businesses to divest from or minimize such low-return activities.

For instance, the market for maintaining very old, niche legacy systems without modernization plans offers little upside. Similarly, generic hardware procurement is a commoditized, low-margin business that does not align with Globant's strategic objectives.

These 'Dog' services are essentially drains on resources, offering little in return and hindering the company's ability to invest in higher-growth, more profitable areas.

| Service Area | Market Growth | Market Share | Strategic Fit | Profitability |

|---|---|---|---|---|

| Legacy System Maintenance (unmodernized) | Low | Low | Poor | Low |

| Generic IT Staff Augmentation | Moderate | Low | Poor | Low |

| On-Premise Software Development (non-cloud) | Low (3.2% CAGR in 2024) | Low | Poor | Low |

| Basic Web Development (static sites) | Low | Low | Poor | Low |

Question Marks

Quantum computing, though still in its early stages, promises to revolutionize problem-solving across various industries by tackling complexities far beyond classical computers. Globant's strategic investment in exploring and developing niche quantum applications or proofs-of-concept positions this as a nascent but high-potential area.

This aligns with the Question Mark quadrant of the BCG matrix, characterized by high market growth potential but currently minimal market share. Significant research and development funding is essential for Globant to mature these quantum initiatives into commercially viable offerings.

Globant's investments in Metaverse and Web3 enterprise solutions currently position them as a Question Mark in the BCG Matrix. While these technologies are nascent for broad business adoption, they represent a significant future growth opportunity. For instance, the global metaverse market is projected to reach $524.8 billion by 2028, indicating substantial untapped potential.

The challenge lies in the early stage of market development and the need for substantial client education and investment in building scalable solutions. This means current market share is likely low, requiring strategic focus and resource allocation to cultivate these offerings into future stars.

Globant's exploration into advanced robotics, extending beyond Robotic Process Automation (RPA) to encompass physical robotics in industrial and service sectors, positions it as a potential Question Mark on the BCG matrix. This segment offers significant growth prospects as businesses increasingly demand sophisticated automation for enhanced efficiency and operational capabilities.

While the market for advanced robotics is expanding, with global spending on industrial robots projected to reach $73.2 billion by 2024, Globant's current market share and enterprise adoption in this specific advanced physical robotics domain might still be developing. This necessitates considerable investment in research and development, alongside the cultivation of specialized technical expertise to effectively compete and scale.

Biotechnology and Health-tech Niche Platforms

Globant's potential specialized offerings in biotechnology and advanced health-tech platforms, powered by AI and data analytics, represent a strategic move into high-growth, innovation-driven sectors. These niches demand deep domain expertise and significant investment, particularly within highly regulated environments, to capture substantial market share. These initiatives are viewed as crucial strategic bets for Globant's future market expansion and revenue diversification.

The biotechnology and health-tech sectors are experiencing rapid advancement. For instance, the global digital health market was valued at approximately USD 211 billion in 2023 and is projected to reach over USD 800 billion by 2030, demonstrating a compound annual growth rate (CAGR) of over 20%. This robust growth underscores the potential for specialized players. Globant's focus could leverage AI for drug discovery acceleration, personalized medicine platforms, or advanced diagnostic tools.

- AI-driven Drug Discovery: Developing platforms that use AI to identify potential drug candidates and predict their efficacy, potentially reducing R&D timelines and costs.

- Personalized Medicine Solutions: Creating integrated platforms for analyzing genomic data, patient health records, and lifestyle factors to deliver tailored treatment plans.

- Advanced Health-tech Platforms: Building solutions for remote patient monitoring, AI-powered medical imaging analysis, or blockchain-based health data management for enhanced security and interoperability.

- Regulatory Compliance & Data Security: Offering specialized services to navigate the complex regulatory landscape (e.g., FDA, EMA) and ensure robust data privacy and security for sensitive health information.

Sustainable Technology Consulting

Globant's Sustainable Technology Consulting, while tapping into a significant growth trend, likely falls into the Question Mark category of the BCG Matrix. The demand for specialized services like optimizing IT for energy efficiency or developing carbon tracking software is rapidly expanding, with the global green IT market projected to reach over $40 billion by 2025, according to some industry estimates. However, the market share Globant holds in this specific, nascent niche may still be building, necessitating strategic investment to solidify its position and capitalize on future growth.

The consulting segment focused purely on sustainable technology implementation presents a high-growth opportunity, driven by increasing corporate environmental, social, and governance (ESG) mandates and a growing awareness of climate change impacts. For instance, the market for sustainability consulting services overall saw substantial growth in 2023, with many firms reporting double-digit percentage increases in revenue from these offerings. Globant's potential in this area lies in its ability to integrate technology solutions that demonstrably reduce a client's environmental footprint.

- High Growth Potential: The global push for sustainability and digitalization creates a strong demand for technology solutions that reduce environmental impact.

- Developing Market Share: While the trend is strong, dedicated consulting services for sustainable tech implementation are still maturing, meaning Globant's market share in this specific niche might be in its early stages.

- Strategic Investment Needed: To become a leader, Globant will likely need to invest in specialized talent, develop proprietary tools, and build a strong track record in this area.

- Competitive Landscape: As sustainability becomes more mainstream, competition from both established consulting firms and specialized tech providers is increasing.

Globant's ventures into emerging technologies like quantum computing, Metaverse, Web3, and advanced robotics are strategically positioned as Question Marks. These areas exhibit high growth potential but currently represent nascent markets with limited established market share for Globant. Significant investment in research, development, and client education is crucial for these initiatives to mature into future market leaders.

The company's focus on specialized areas such as AI-driven drug discovery and personalized medicine within biotechnology also falls into the Question Mark category. While these sectors are experiencing robust growth, with the digital health market projected to exceed $800 billion by 2030, Globant's market penetration in these highly specialized niches is likely still developing. Successfully navigating complex regulatory environments and building deep domain expertise are key challenges.

Globant's sustainable technology consulting is another example of a Question Mark. The demand for green IT solutions is escalating, with the market expected to surpass $40 billion by 2025, yet Globant's specific market share in this specialized consulting area requires further development. Strategic investment in talent and proprietary tools will be vital to capitalize on this growing trend.

| Initiative | Market Growth Potential | Current Market Share (Est.) | Strategic Focus | Investment Needs |

|---|---|---|---|---|

| Quantum Computing | Very High | Low | Niche applications, R&D | Significant R&D funding |

| Metaverse & Web3 | High | Low | Enterprise solutions, client education | Scalable solution development |

| Advanced Robotics | High | Developing | Physical robotics, specialized expertise | R&D, talent acquisition |

| Biotechnology & Health-tech | Very High | Low | AI drug discovery, personalized medicine | Domain expertise, regulatory navigation |

| Sustainable Technology Consulting | High | Developing | Green IT, ESG integration | Talent, proprietary tools |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.