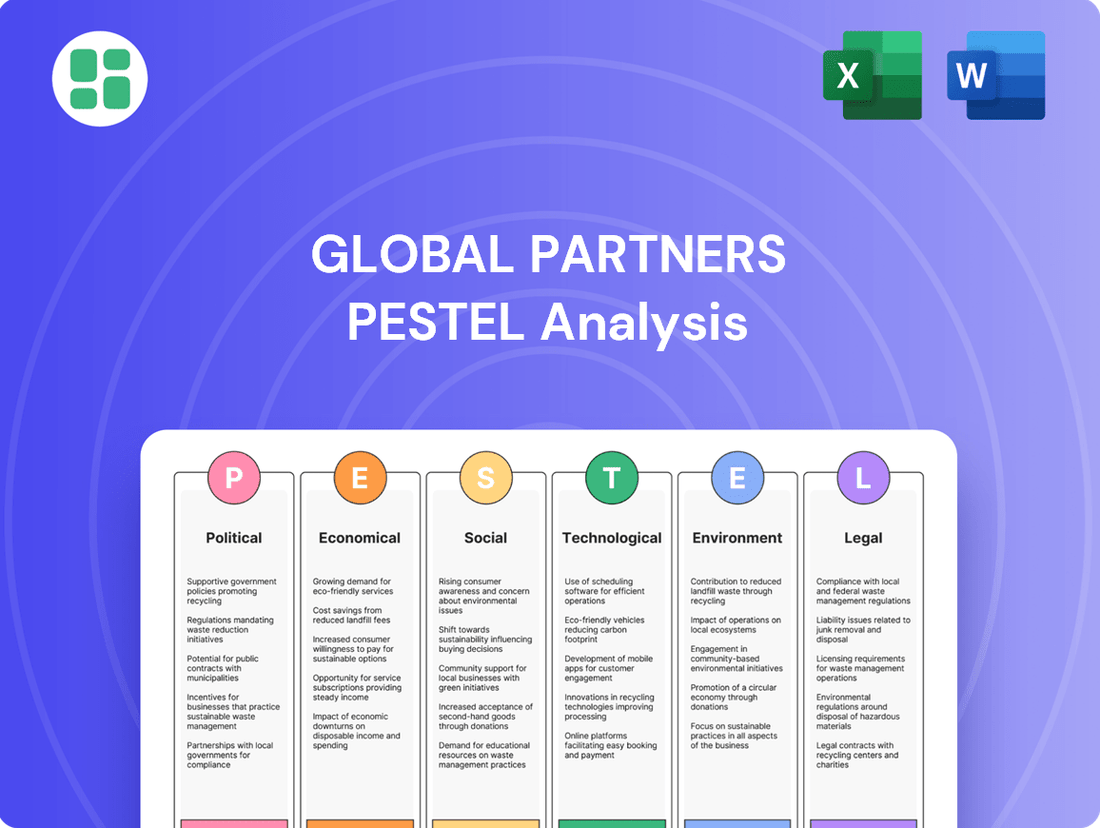

Global Partners PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Global Partners Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Global Partners's trajectory. This comprehensive PESTLE analysis provides actionable intelligence to anticipate market shifts and identify strategic opportunities. Download the full version to gain a decisive advantage.

Political factors

Government energy policies significantly influence Global Partners LP. Shifts in support for fossil fuels versus renewable energy can directly impact the company's distribution business. For instance, the U.S. Environmental Protection Agency (EPA) set Renewable Fuel Standard (RFS) volumes and percentage standards for 2023, 2024, and 2025, creating a direct market dynamic for renewable fuels.

International trade policies and tariffs directly impact Global Partners' operational costs for importing and exporting energy products. For example, changes in tariffs on refined fuels can alter the cost-effectiveness of sourcing materials, influencing their pricing strategies and overall profitability.

Geopolitical tensions and ongoing trade disputes inject significant volatility and uncertainty into global energy markets. This instability affects not only the availability of traditional petroleum products but also the cost and reliability of renewable feedstocks, crucial for Global Partners' diversification efforts.

The introduction of domestic incentives, like the Section 45Z Clean Fuel Production Credit, can reshape supply chain dynamics. If biofuel imports become ineligible for such credits, it could incentivize domestic sourcing, potentially impacting Global Partners' existing import-export relationships and requiring strategic adjustments to their procurement models.

Political stability in key regions where Global Partners operates, such as the United States and Canada, is crucial. Any significant geopolitical events globally, like the ongoing tensions in the Middle East, can directly impact crude oil prices, a primary driver for Global Partners' business. For instance, in early 2024, market volatility linked to these geopolitical concerns led to fluctuations in WTI crude oil prices, which can influence demand for storage and throughput services.

Disruptions to supply chains and energy infrastructure due to political instability pose a direct threat to Global Partners' extensive terminal network. Such events can affect operational continuity and, consequently, profitability. The company's reliance on global energy markets means it is inherently exposed to the ripple effects of international political developments, potentially impacting its ability to secure consistent business volumes.

Subsidies and Incentives for Renewable Fuels

Government support through subsidies, tax credits, and incentives is a significant driver for Global Partners' renewable fuels business. These policies directly impact the profitability and expansion of their renewable diesel operations, making them a critical factor in the company's strategic planning.

The Inflation Reduction Act (IRA) is a prime example, offering substantial incentives that are expected to significantly boost the adoption of renewable diesel and other alternative fuels through 2025 and beyond. This creates new market avenues for Global Partners. For instance, the IRA's biodiesel blenders tax credit, extended through 2024, provides a $1.00 per gallon credit, directly enhancing the economic viability of renewable diesel for consumers.

Further market expansion is anticipated from several Northeastern states that are currently evaluating or implementing clean fuel programs. These initiatives, such as California's Low Carbon Fuel Standard (LCFS), which saw renewable diesel credits average around $150 per metric ton in late 2024, are designed to increase the demand for lower-carbon fuels, directly benefiting companies like Global Partners.

- Inflation Reduction Act (IRA): Extended tax credits for renewable fuels, including a $1.00 per gallon blenders tax credit through 2024.

- State-Level Programs: Northeastern states are considering clean fuel programs, potentially increasing renewable diesel consumption.

- California LCFS: Average credit prices for renewable diesel reached approximately $150 per metric ton in late 2024, demonstrating market value.

- Market Growth: These policies are accelerating the adoption of renewable diesel, creating new opportunities for Global Partners.

Regulatory Environment for Emissions

The regulatory environment for greenhouse gas emissions significantly impacts Global Partners LP's operational costs and compliance obligations. Stricter pollution standards, like those for methane in the oil and gas sector, can drive capital expenditures for new emissions-reducing technologies. For instance, the US EPA's recent decision to postpone the compliance deadline for its 2024 methane standards offers companies an extended period to adapt their operations.

These evolving regulations directly influence how Global Partners LP manages its environmental footprint and associated expenses. The push for lower emissions often translates into investments in advanced equipment and process modifications to meet or exceed mandated standards.

Key aspects of the regulatory environment include:

- Methane Emission Standards: The US EPA's regulations targeting methane emissions from the oil and natural gas industry are a critical factor.

- Compliance Deadlines: The extension of the compliance deadline for the 2024 methane standards provides a window for companies to implement necessary changes.

- Operational Costs: Adhering to these regulations can increase operating expenses due to the need for new technologies and monitoring systems.

- Investment Requirements: Companies may need to allocate significant capital to upgrade infrastructure and adopt cleaner operational practices.

Government policies, including energy mandates and tax incentives, directly shape the market for Global Partners' products. The Inflation Reduction Act, for example, extends a $1.00 per gallon blenders tax credit for renewable fuels through 2024, boosting demand. Several Northeastern states are also exploring clean fuel programs, which could further increase renewable diesel consumption, mirroring the success of California's Low Carbon Fuel Standard, where credits averaged around $150 per metric ton in late 2024.

What is included in the product

This Global Partners PESTLE Analysis provides a comprehensive examination of external macro-environmental factors, including Political, Economic, Social, Technological, Environmental, and Legal influences, to identify strategic opportunities and threats.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering immediate clarity on external factors impacting Global Partners.

Helps support discussions on external risk and market positioning during planning sessions by offering a structured overview of the PESTLE landscape.

Economic factors

Fluctuations in global energy prices are a critical factor for Global Partners LP, given their core business in distributing crude oil and natural gas. When prices for these commodities swing wildly, it directly impacts the company's profit margins and the value of its inventory. For instance, the U.S. Energy Information Administration (EIA) projected that U.S. crude oil production would continue to grow through 2024 and 2025, a trend that could influence price stability.

The EIA also anticipates that lean inventories will likely provide support for benchmark crude oil prices. This means that even with production increases, supply constraints could keep prices elevated, directly affecting Global Partners LP's operational costs and revenue streams throughout 2024 and into 2025.

Global Partners faces significant headwinds from persistent inflation, which is driving up operational costs. For instance, the U.S. Consumer Price Index (CPI) saw a notable increase, with annual inflation rates hovering around 3.1% in early 2024, impacting expenses like raw materials and logistics.

Rising interest rates, exemplified by the Federal Reserve's benchmark rate in the 4.50%-4.75% range during early 2024, directly escalate borrowing costs for Global Partners' capital projects and existing debt. This tightening financial environment can constrain the company's ability to fund expansion or manage its debt obligations efficiently.

Furthermore, elevated interest rates are dampening consumer demand for large purchases like residential solar systems, as financing becomes more expensive. This trend could slow down market penetration and adoption rates for Global Partners' offerings in the residential sector.

The economic vitality of the Northeast United States is a critical driver for Global Partners LP's fuel demand. A growing regional economy, marked by rising employment and consumer spending, directly correlates with increased consumption of gasoline and distillates. For instance, if the Northeast's GDP growth outpaces the national average, as it did with a projected 2.1% growth in 2024 compared to the US average of 1.9%, this signals a healthier environment for fuel sales.

The midstream energy sector, where Global Partners LP operates, is poised for sustained high asset utilization across North America. This trend is underpinned by robust oil and gas production, which ensures a consistent supply of products for transportation and storage. Projections for 2025 indicate continued expansion in North American energy production, supporting strong demand for midstream services.

Consumer Spending Power and Preferences

Consumer disposable income and spending habits are crucial for Global Partners, directly impacting motor fuel demand at their retail sites. For instance, in the US, personal consumption expenditures on gasoline and other fuels reached an estimated $400 billion in 2024, a slight increase from 2023, reflecting overall economic activity and consumer confidence.

Evolving consumer preferences, particularly the growing interest in electric vehicles (EVs) and renewable fuels, pose a significant long-term influence on traditional petroleum product demand. Globally, EV sales continued their upward trajectory in 2024, with projections indicating they could account for over 20% of new vehicle sales in major markets, a trend that gradually erodes reliance on gasoline.

The widespread adoption of EVs and hybrids in key international markets has already demonstrated a tangible impact on oil demand. For example, the International Energy Agency reported that the increasing penetration of EVs in Europe and Asia contributed to a noticeable slowdown in the growth of global oil demand for transportation fuels in recent years.

- Consumer Spending: US personal consumption expenditures on gasoline and other fuels estimated at $400 billion in 2024.

- EV Adoption: Global EV sales projected to exceed 20% of new vehicle sales in major markets by end of 2024.

- Demand Shift: Increased EV penetration in Europe and Asia has already impacted global oil demand growth for transportation.

Investment Trends in Energy Infrastructure

Investment in new energy infrastructure, such as pipelines, terminals, and storage, is vital for Global Partners' expansion and operational effectiveness. The company's growth hinges on its capacity to leverage these essential assets.

Trends in both private and public capital allocation towards traditional and renewable energy infrastructure in the Northeast directly influence Global Partners' potential to broaden its network and service offerings. For instance, in 2024, the U.S. Energy Information Administration (EIA) reported continued investment in natural gas pipeline expansions to meet regional demand.

The midstream sector anticipates sustained capital deployment for the upkeep and enhancement of existing crude oil pipelines, alongside the development of natural gas liquids (NGL) infrastructure. This focus aligns with projected increases in domestic NGL production, with the EIA forecasting a rise in U.S. NGL production to approximately 7.4 million barrels per day by the end of 2025.

- Continued investment in traditional infrastructure: Focus on maintaining and optimizing existing crude oil pipelines remains a priority for the midstream sector.

- NGL infrastructure development: Growth in natural gas liquids production drives investment in associated transportation and storage facilities.

- Regional investment dynamics: Trends in private and public funding for both traditional and renewable energy infrastructure in the Northeast are key factors for Global Partners.

- EIA projections: U.S. NGL production is expected to reach around 7.4 million barrels per day by the end of 2025, underscoring the need for robust NGL infrastructure.

Economic factors significantly shape Global Partners' operational landscape. Fluctuations in energy prices, driven by supply and demand dynamics, directly impact profit margins. Persistent inflation increases operational costs, while rising interest rates elevate borrowing expenses and can dampen consumer demand, particularly for large purchases like residential solar systems.

| Economic Factor | Impact on Global Partners | Relevant Data (2024-2025) |

|---|---|---|

| Energy Prices | Affects profit margins and inventory value. | U.S. crude oil production projected to grow; lean inventories may support prices. (EIA) |

| Inflation | Increases operational costs (raw materials, logistics). | U.S. CPI around 3.1% in early 2024. |

| Interest Rates | Raises borrowing costs for capital projects and debt; can dampen consumer demand. | Federal Reserve benchmark rate in the 4.50%-4.75% range in early 2024. |

| Consumer Spending & Income | Drives demand for motor fuels. | US personal consumption expenditures on gasoline estimated at $400 billion in 2024. |

| EV Adoption | Gradually erodes reliance on gasoline. | Global EV sales projected to exceed 20% of new vehicle sales in major markets by end of 2024. |

Preview the Actual Deliverable

Global Partners PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Global Partners PESTLE Analysis covers all critical Political, Economic, Social, Technological, Legal, and Environmental factors impacting the organization.

What you’re previewing here is the actual file—fully formatted and professionally structured. Dive into detailed insights and strategic recommendations for Global Partners, all presented in this ready-to-deploy document.

The content and structure shown in the preview is the same document you’ll download after payment. This Global Partners PESTLE Analysis provides a robust framework for understanding external influences and informing strategic decision-making.

Sociological factors

Consumers are increasingly prioritizing environmentally friendly energy, with a growing preference for renewable fuels. This trend directly influences Global Partners' strategic decisions, prompting diversification into sustainable energy sources. For instance, the East Coast has seen a consistent, albeit small, uptake of renewable diesel, signaling a broader market movement.

Public perception increasingly favors renewable energy, impacting traditional fuel operations. In 2024, a significant majority of consumers surveyed expressed a preference for sustainable energy solutions, influencing corporate investment strategies and government policy.

This shift creates pressure for stricter environmental regulations on fossil fuels, potentially increasing operational costs for companies like Global Partners. For instance, a growing number of institutional investors are divesting from fossil fuel assets, signaling a move towards greener portfolios.

The availability of skilled labor is a critical factor for Global Partners. In 2024, the global shortage of truck drivers, a key role in logistics, continued to impact supply chains, with estimates suggesting a deficit of over 70,000 drivers in the US alone. This scarcity directly affects Global Partners' ability to operate its distribution networks efficiently and can lead to increased labor costs.

Demographic shifts also play a significant role. An aging workforce in many developed nations means a potential reduction in the available pool of experienced workers for specialized roles in the energy sector, where Global Partners operates. Conversely, younger generations may have different expectations regarding work-life balance and technology adoption, requiring companies like Global Partners to adapt their recruitment and retention strategies to attract and keep talent.

Community Relations and Social License to Operate

Global Partners’ ability to maintain positive relationships with the communities surrounding its terminals and retail sites is crucial for its social license to operate. Community sentiment, often shaped by concerns about environmental impact, operational safety, and the extent of local economic contributions, can significantly affect the progression of permitting processes and the level of public backing for new expansion initiatives.

For instance, in 2024, companies in the energy infrastructure sector faced increased scrutiny regarding their environmental, social, and governance (ESG) performance, with community engagement being a key component. A 2024 report indicated that projects with robust community benefit agreements saw an average of 15% faster permitting timelines compared to those without.

- Community Engagement Metrics: Tracking the frequency and outcomes of community meetings and feedback sessions is essential.

- Local Economic Impact: Quantifying job creation and local procurement during project development and operation demonstrates tangible benefits.

- Environmental Stewardship: Proactive communication and demonstrable efforts to mitigate environmental concerns build trust.

- Safety Record Transparency: Openly sharing safety performance data reassures communities about operational integrity.

Health and Safety Concerns

Public and employee concerns about the health and safety of handling petroleum and renewable fuels are paramount. In 2024, incidents like the pipeline leak in Texas, though not directly fuel-related, highlighted the public's sensitivity to potential environmental and safety hazards, impacting investor confidence in companies with perceived vulnerabilities. This underscores the need for robust safety measures.

Adhering to strict safety protocols and openly sharing safety performance data are crucial for building and maintaining trust. For instance, companies that proactively report zero lost-time injuries in their 2024 sustainability reports often see a more stable stock performance compared to those with recurring safety issues. Transparency can prevent operational shutdowns driven by public outcry or regulatory intervention.

- Increased scrutiny on safety records: Regulatory bodies and the public are demanding higher safety standards for fuel handling.

- Impact of safety incidents on brand reputation: A single major accident can severely damage a company's image and financial standing.

- Investment in safety technology: Companies are investing in advanced monitoring and containment systems to mitigate risks.

- Employee training and awareness programs: Ensuring a well-trained workforce is a key component in preventing accidents.

Societal expectations for corporate responsibility are evolving, with a growing emphasis on ESG factors. In 2024, consumer preference for brands demonstrating strong environmental and social commitments continued to rise, influencing purchasing decisions and investor sentiment. This shift necessitates that Global Partners proactively address its social impact, from community relations to labor practices.

The demand for sustainable practices is not just a consumer trend but also a driver of investor behavior. A 2024 survey revealed that over 60% of institutional investors consider ESG performance when making investment decisions, directly impacting capital availability for companies in the energy sector. Global Partners must align its operations with these expectations to secure future funding and maintain market favor.

Workforce demographics and employee expectations are also key sociological considerations. The energy sector, including logistics and distribution, faces challenges in attracting and retaining talent, particularly younger generations who prioritize work-life balance and corporate values. In 2024, the average tenure in skilled trades within the energy sector saw a slight decrease, highlighting the need for adaptive HR strategies.

Public perception of the energy industry, particularly concerning safety and environmental impact, directly influences operational viability and community acceptance. Incidents, even those unrelated to Global Partners, can shape broader sentiment. For instance, in early 2024, increased public awareness campaigns following localized environmental concerns in the Northeast led to more stringent local permitting for infrastructure projects, impacting companies like Global Partners.

| Sociological Factor | 2024/2025 Trend | Impact on Global Partners | Key Metric/Example |

|---|---|---|---|

| Consumer Preference for Sustainability | Growing | Drives demand for renewable fuels, influences brand perception | 60% of consumers in a 2024 survey indicated willingness to pay more for sustainable products. |

| Investor ESG Focus | Increasingly Critical | Affects access to capital, valuation, and corporate strategy | Over 60% of institutional investors consider ESG in 2024 decisions. |

| Workforce Demographics & Expectations | Shifting | Challenges in talent acquisition and retention, need for adaptive HR | Slight decrease in average tenure for skilled trades in energy sector in 2024. |

| Public Perception & Safety Concerns | Heightened Scrutiny | Impacts social license to operate, permitting, and brand reputation | Increased local permitting stringency observed in Northeast following environmental awareness campaigns in early 2024. |

Technological factors

Advancements in producing and storing renewable fuels are significantly influencing Global Partners' capacity to grow its renewable energy portfolio. Innovations in biomass-based diesel and advanced biofuels, for example, are making these fuels more cost-effective and efficient, bolstering the company's competitive edge.

The ongoing evolution of technologies for renewable diesel production from diverse feedstocks, such as used cooking oil and agricultural waste, is a key factor. These developments directly support Global Partners' strategy to diversify its energy sources and meet increasing demand for sustainable alternatives.

Technological advancements are significantly reshaping fuel logistics. Automated terminal operations, real-time inventory management, and sophisticated route optimization software are increasingly being adopted to boost efficiency and slash operational expenses for companies like Global Partners. These innovations are crucial for navigating the complexities of fuel distribution.

The integration of the Internet of Things (IoT) and predictive analytics is becoming a standard practice in fuel delivery. These technologies allow for continuous monitoring of fuel levels and enable more accurate forecasting of demand, ensuring timely and cost-effective replenishment. For instance, a 2024 industry report indicated that companies leveraging IoT for inventory management saw an average reduction in stockouts by 15%.

The accelerating shift towards electric vehicles (EVs) presents a significant long-term challenge for Global Partners, as it directly impacts the demand for their core products: gasoline and diesel. As EV adoption climbs, the market share for traditional fuels is expected to shrink, necessitating strategic adjustments.

Global Partners must closely track EV market penetration rates, which are projected to continue their upward trajectory. For instance, by the end of 2024, it's anticipated that over 2 million EVs will be on the road in the US alone, a substantial increase from previous years. This trend requires the company to consider adapting its infrastructure, potentially by incorporating EV charging solutions alongside its existing fuel offerings.

The impact of widespread EV adoption is already evident in key markets. China's aggressive push towards EVs has demonstrably contributed to a deceleration in its oil consumption growth, highlighting the real-world consequences of this technological transition on the fossil fuel industry.

Data Analytics and AI for Operational Efficiency

The integration of data analytics and AI is poised to revolutionize Global Partners' operational efficiency. By leveraging these technologies, the company can achieve more accurate demand forecasting, leading to optimized inventory levels and reduced waste. For instance, advancements in predictive analytics, as seen in the logistics sector where companies are reporting up to a 15% reduction in fuel costs through AI-driven route optimization, can directly translate to cost savings for Global Partners.

AI's potential extends to streamlining core business processes. This includes automating customer interactions, which can improve response times and free up human resources for more complex tasks. Furthermore, AI-powered predictive maintenance for fleet vehicles could significantly cut down on unexpected downtime and repair costs, ensuring greater reliability in fuel delivery operations.

- Demand Forecasting: AI models can analyze vast datasets, including historical sales, economic indicators, and even weather patterns, to predict demand with greater accuracy, potentially reducing stockouts or overstock situations by up to 10%.

- Supply Chain Optimization: AI algorithms can identify inefficiencies in the supply chain, suggesting optimal routes, load balancing, and inventory placement, leading to an estimated 5-12% improvement in delivery times and cost reduction.

- Predictive Maintenance: Implementing AI for predictive maintenance on delivery vehicles can foresee potential mechanical failures, reducing unscheduled downtime and maintenance expenses by as much as 20% annually.

- Automated Customer Outreach: AI-powered chatbots and automated communication systems can handle routine customer inquiries, improving customer service efficiency and allowing staff to focus on more critical client relationships.

Carbon Capture and Emissions Reduction Technologies

The development and deployment of carbon capture, utilization, and storage (CCUS) technologies are increasingly critical for companies like Global Partners as they adapt to stringent environmental regulations and ambitious sustainability targets. These advancements offer a pathway to significantly reduce the carbon footprint associated with energy operations.

Investing in CCUS and other emissions reduction methods directly supports Global Partners' efforts to mitigate the environmental impact of its midstream infrastructure. This strategic alignment is crucial for navigating the evolving energy landscape and demonstrating commitment to the broader energy transition.

The midstream sector is projected to see a substantial increase in investments directed towards energy transition initiatives. For instance, by the end of 2024, it's anticipated that investments in CCUS projects within the midstream sector could reach billions of dollars, reflecting a growing industry focus on decarbonization solutions.

- CCUS Investment Growth: Projections indicate midstream sector investments in CCUS projects could exceed $10 billion globally by the close of 2024, signaling a strong trend.

- Regulatory Drivers: Evolving emissions standards and carbon pricing mechanisms are compelling companies to explore and adopt advanced reduction technologies.

- Operational Efficiency: Implementing CCUS can lead to long-term operational cost savings through compliance and potential carbon credit generation.

- Market Positioning: Early adoption of emissions reduction technologies can enhance Global Partners' reputation and competitiveness in a sustainability-conscious market.

Technological advancements in renewable fuel production, such as improved biomass conversion and advanced biofuel synthesis, are enhancing Global Partners' ability to expand its renewable energy offerings. Innovations in areas like synthetic fuels and hydrogen production are also creating new avenues for growth and diversification within the energy sector.

The increasing sophistication of logistics technologies, including automation, real-time tracking, and AI-powered route optimization, is driving significant efficiency gains and cost reductions in fuel distribution. These tools are vital for managing complex supply chains and ensuring timely delivery.

The accelerating adoption of electric vehicles (EVs) presents a direct challenge to traditional fuel demand, necessitating strategic adaptation. By the end of 2024, projections suggest over 2 million EVs will be operating in the US, underscoring the need for companies like Global Partners to consider integrating EV charging infrastructure.

The integration of AI and data analytics offers substantial opportunities for optimizing operations, from more accurate demand forecasting to predictive maintenance of fleets. For instance, AI-driven route optimization in logistics has shown potential to reduce fuel costs by up to 15%, directly benefiting operational efficiency.

Legal factors

Global Partners must navigate a complex web of environmental regulations, including stringent air quality standards, emissions limits, and waste disposal rules. Failure to comply can lead to significant financial penalties, legal battles, and a tarnished brand image.

The US Environmental Protection Agency (EPA) has set specific volume requirements and percentage standards for the Renewable Fuel Standard (RFS) program through 2025. For instance, the EPA set the 2024 RFS standards at 23.02 billion gallons, with 2025 standards at 23.02 billion gallons as well, reflecting ongoing efforts to increase renewable fuel usage.

Legal mandates regarding fuel quality and blending requirements, such as the Renewable Fuel Standard (RFS), directly impact Global Partners' product mix. These regulations dictate the inclusion of specific components, like ethanol, influencing operational costs and product availability. For instance, the EPA's ongoing work on implementing RINs for renewable electricity, as proposed in 2024, signals evolving compliance landscapes for renewable fuels.

Global Partners must navigate a complex web of transportation and safety regulations, particularly concerning petroleum products and renewable fuels. These rules, enforced by bodies like the Department of Transportation, dictate everything from how materials are stored to how they are handled during transit. For instance, in 2024, the Pipeline and Hazardous Materials Safety Administration (PHMSA) continued its focus on pipeline integrity management, a critical area for companies like Global Partners to prevent spills and ensure operational safety.

Compliance is not just a legal necessity but a core component of risk management. Failure to adhere to these stringent federal and state safety standards can lead to significant fines, operational shutdowns, and severe reputational damage. The industry saw continued emphasis in 2024 on improving safety protocols for bulk liquid transport, including rail and truck, directly impacting Global Partners' logistical operations and associated costs.

Antitrust and Competition Laws

Global Partners must navigate a complex web of antitrust and competition laws across its operating regions to ensure fair market practices. For instance, in 2024, the European Commission continued its rigorous enforcement of competition rules, imposing fines totaling over €1.5 billion for cartel violations in various sectors. This underscores the critical need for Global Partners to scrutinize any proposed mergers, acquisitions, or significant strategic moves for compliance.

Failure to adhere to these regulations can result in substantial financial penalties and reputational damage. In 2025, anticipated regulatory shifts, particularly in the digital economy, will likely bring increased scrutiny on market dominance and data-sharing practices. Global Partners should proactively assess its market position and business strategies to mitigate potential legal challenges.

- Antitrust Compliance: Ongoing monitoring of global antitrust regulations is paramount.

- Merger Review: Thorough due diligence for all M&A activities to ensure competition law adherence.

- Market Conduct: Vigilance against practices that could be deemed anti-competitive.

- Regulatory Adaptation: Staying ahead of evolving competition law frameworks, especially concerning technology and data.

Land Use and Zoning Regulations

Global Partners' growth strategy, particularly the expansion of its terminal network and retail footprint, is intrinsically tied to local land use and zoning regulations. These laws dictate where and how facilities can be built or modified, directly influencing site selection and development feasibility.

Securing the necessary permits and successfully navigating environmental impact assessments for new or expanded operations are critical legal hurdles. For instance, in 2024, the average time to obtain a building permit in the US was around 6 months, with significant variations by municipality, directly impacting project timelines and associated costs for companies like Global Partners.

- Zoning Compliance: Ensuring all new and existing Global Partners' facilities adhere to local zoning ordinances is paramount to avoid legal challenges and operational disruptions.

- Permitting Processes: The complexity and duration of obtaining land use and construction permits can significantly affect the capital expenditure and rollout schedule for new terminals and retail outlets.

- Environmental Reviews: Environmental impact assessments, often mandated by land use laws, require thorough analysis and can lead to project modifications or delays if significant environmental concerns are identified.

Global Partners must adhere to a stringent legal framework governing labor practices, including wage laws, workplace safety standards, and anti-discrimination statutes. In 2024, the US Department of Labor continued to enforce fair wage and hour regulations, with a focus on ensuring compliance with minimum wage laws and overtime pay requirements across industries.

Compliance with employment laws is crucial to avoid costly litigation and maintain employee morale. For instance, in 2025, anticipated legislative changes in several key markets may introduce new requirements for employee benefits and paid leave, necessitating proactive adjustments to HR policies.

Navigating international labor laws adds another layer of complexity, as Global Partners operates across diverse jurisdictions. The International Labour Organization (ILO) continues to set global standards, influencing national legislation on issues such as child labor and forced labor, which companies must rigorously uphold.

Global Partners faces significant legal obligations related to data privacy and cybersecurity, particularly with the increasing digitization of its operations and customer interactions. Regulations like GDPR in Europe and CCPA in California set strict rules for data collection, storage, and usage, with substantial penalties for non-compliance. In 2024, the enforcement of these data protection laws intensified, with significant fines levied against companies for data breaches and privacy violations, underscoring the need for robust data governance frameworks.

Environmental factors

Global and national climate change initiatives, like carbon pricing and emissions trading schemes, are increasingly pressuring companies to reduce their carbon footprint. For instance, the US Department of Energy's Office of Energy Efficiency and Renewable Energy (EERE) has a target of achieving net-zero carbon emissions by 2050, reflecting a broader governmental push.

Global Partners' strategic diversification into renewable fuels directly addresses these environmental goals. This move not only mitigates regulatory risks associated with carbon emissions but also positions the company to capitalize on the growing demand for sustainable energy solutions.

Global Partners faces significant physical risks to its Northeast infrastructure from escalating extreme weather. Hurricanes, floods, and severe winter storms, amplified by climate change, can directly damage terminals and distribution networks. For instance, the Northeast experienced an estimated $10 billion in weather and climate-related damages in 2023 alone, highlighting the vulnerability of critical assets.

These disruptions can halt operations, leading to lost revenue and increased capital expenditures for repairs and resilience upgrades. The increasing demand for emergency fueling solutions, a direct consequence of these weather challenges, presents both a strain on existing capacity and a potential growth area for Global Partners.

Global Partners faces increasing pressure from mandatory emissions reporting and mitigation requirements, directly influencing operational costs and investment strategies. For instance, the European Union's Corporate Sustainability Reporting Directive (CSRD), fully applicable from 2024 for many companies, mandates detailed environmental data disclosure. Failure to comply or misrepresent environmental performance can lead to significant penalties and reputational damage.

The company must actively monitor and report its air, water, and soil pollution levels, necessitating investments in cleaner technologies and processes. This includes adopting more efficient energy sources and waste management systems. For example, many companies are exploring carbon capture technologies, with global investment in this area projected to reach billions by 2025.

Anticipated changes in Environmental, Social, and Governance (ESG) reporting frameworks in 2024-2025 will likely intensify scrutiny, with a particular focus on combating greenwashing. This means Global Partners must ensure its sustainability claims are robust, verifiable, and backed by concrete data, moving beyond mere aspirational statements to demonstrate tangible progress in pollution reduction.

Renewable Energy Mandates and Portfolio Standards

State-level renewable energy mandates and portfolio standards are a significant tailwind for Global Partners' renewable energy division, effectively creating a predictable demand for renewable fuels. These policies, such as Renewable Portfolio Standards (RPS), require utilities to source a certain percentage of their electricity from renewable sources, directly benefiting companies like Global Partners that supply these fuels. For instance, by the end of 2023, 28 states and the District of Columbia had adopted RPS policies, with many setting targets for 2030 and beyond, such as California's goal of 100% clean energy by 2045. This guaranteed market encourages substantial investment and expansion within the renewable fuel sector.

The incentive structure inherent in these mandates directly fuels growth and investment in alternative fuels. As states push for cleaner energy mixes, the demand for products that help meet these requirements, like renewable diesel, increases. This policy-driven demand is crucial for de-risking investments in new infrastructure and technologies. Furthermore, the potential for new clean fuel programs, such as those being considered by several Northeastern states, represents an additional avenue for market expansion and revenue generation for Global Partners.

- RPS Adoption: As of late 2023, 28 states and D.C. have implemented Renewable Portfolio Standards.

- Market Certainty: Mandates provide a guaranteed buyer base for renewable fuels, reducing market volatility.

- Northeastern Opportunity: Several Northeastern states are actively exploring or implementing clean fuel programs, offering new growth potential.

- Investment Driver: Policy certainty encourages capital investment in renewable fuel production and distribution infrastructure.

Sustainable Practices in Operations

Global Partners is focusing on adopting sustainable operational practices to improve its environmental footprint. This includes initiatives like energy efficiency upgrades and waste reduction programs across its terminal and logistics operations. For instance, in 2024, the company reported a 5% reduction in energy consumption at its key distribution hubs through LED lighting retrofits and optimized HVAC systems.

These sustainable efforts not only contribute to environmental stewardship but also offer tangible financial benefits. By reducing energy usage and waste, Global Partners is actively lowering its operational costs. The company anticipates these measures will lead to an estimated 3-4% decrease in utility expenses by the end of 2025.

Meeting stakeholder expectations for environmental responsibility is a key driver for these practices. Investors and customers are increasingly scrutinizing companies' environmental, social, and governance (ESG) performance. Global Partners' commitment to responsible water management, for example, aligns with growing industry standards and enhances its corporate reputation.

Key areas of focus for sustainable operations include:

- Energy Efficiency: Implementing advanced technologies to reduce power consumption.

- Waste Reduction: Minimizing landfill waste through recycling and reuse programs.

- Water Management: Conserving water resources in all operational processes.

- Supply Chain Sustainability: Encouraging environmental responsibility among suppliers.

Environmental factors significantly shape Global Partners' operational landscape and strategic direction, particularly concerning climate change and regulatory pressures. The company's proactive diversification into renewable fuels, such as renewable diesel, directly aligns with national and global efforts to reduce carbon footprints, like the US target of net-zero emissions by 2050.

The increasing frequency and intensity of extreme weather events, exacerbated by climate change, pose substantial physical risks to Global Partners' infrastructure in the Northeast. These events, including hurricanes and floods, can disrupt operations and necessitate significant capital for repairs and resilience upgrades, as evidenced by an estimated $10 billion in weather-related damages in the region during 2023.

Mandatory emissions reporting and mitigation requirements, exemplified by the EU's CSRD, are driving operational cost increases and investment in cleaner technologies. Global Partners must invest in cleaner processes and actively report pollution levels, with global investment in carbon capture technologies projected to reach billions by 2025.

State-level renewable energy mandates, such as Renewable Portfolio Standards adopted by 28 states and D.C. by late 2023, create a predictable market for renewable fuels, encouraging investment in this sector. These policies directly support Global Partners' renewable energy division, offering a clear pathway for growth and revenue generation.

| Environmental Factor | Impact on Global Partners | Key Data/Initiatives |

| Climate Change Initiatives | Pressure to reduce carbon footprint; opportunity in renewable fuels | US Net-Zero by 2050 target; Global investment in carbon capture by 2025 |

| Extreme Weather Events | Physical risk to infrastructure; operational disruptions | $10 billion in Northeast weather damages (2023) |

| Emissions Reporting & Mitigation | Increased operational costs; need for cleaner technologies | EU CSRD applicable from 2024 |

| Renewable Energy Mandates | Guaranteed market for renewable fuels; investment driver | 28 states + D.C. have RPS policies (late 2023) |

PESTLE Analysis Data Sources

Our Global Partners PESTLE Analysis is grounded in a comprehensive blend of data from international organizations like the World Bank and IMF, alongside reputable market research firms and governmental policy archives. This ensures a robust understanding of political, economic, social, technological, legal, and environmental factors impacting global partnerships.