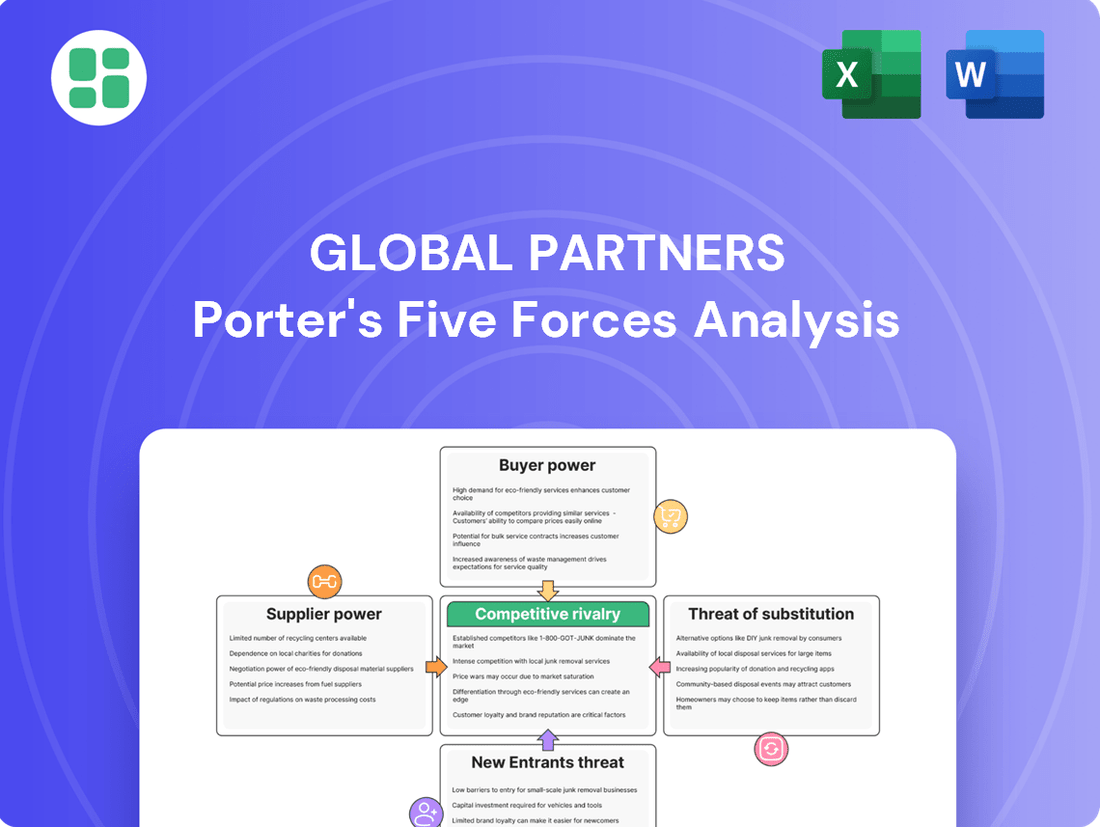

Global Partners Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Global Partners Bundle

Global Partners faces a dynamic competitive landscape, with moderate bargaining power from buyers and suppliers influencing its market position. The threat of new entrants is present, though potentially mitigated by existing infrastructure and brand recognition.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Global Partners’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The concentration of suppliers in the petroleum and renewable fuels market is a critical factor for Global Partners. If a small number of companies dominate the production of crude oil, refined products, or renewable feedstocks, these suppliers gain considerable power to influence pricing and supply agreements. For instance, in 2023, the top five oil-producing countries accounted for approximately 50% of global crude oil production, highlighting a degree of supplier concentration.

Global Partners can lessen the impact of supplier concentration by cultivating relationships with a broad base of suppliers. Diversifying sourcing across various geographic regions and exploring different types of fuels, including a wider array of renewable feedstocks, can create more negotiation flexibility and reduce reliance on any single supplier or group of suppliers.

The costs Global Partners incurs when switching suppliers significantly impact supplier leverage. High switching costs, such as those involving substantial investments in new terminal infrastructure or complex renegotiations of existing long-term agreements, grant incumbent suppliers greater bargaining power. For instance, if reconfiguring a port facility to accommodate a new supplier's fuel type requires millions in upgrades, the current supplier can command higher prices.

The uniqueness of Global Partners' suppliers' offerings significantly impacts their bargaining power. If suppliers provide highly specialized, refined products or critical transportation services that are difficult for Global Partners to source elsewhere, their leverage grows. For instance, if a supplier offers a unique blend of renewable fuel components, essential for Global Partners' operations and not readily available from other sources, that supplier can command higher prices or more favorable terms. In 2023, the global renewable fuels market saw significant growth, with specialized components becoming increasingly vital.

Threat of Forward Integration by Suppliers

Suppliers' potential to integrate forward into Global Partners' midstream and marketing operations presents a significant threat. If crude oil producers or renewable fuel manufacturers possess the capital and capability to establish their own terminal networks or distribution channels, they could effectively bypass intermediaries like Global Partners. This would not only enhance the suppliers' bargaining power but also create substantial disruption within Global Partners' established supply chain.

For instance, in 2023, the energy sector saw increased investment in downstream infrastructure by major oil producers looking to capture more value. While specific data for Global Partners' suppliers is proprietary, the broader trend suggests a heightened risk. If suppliers were to pursue this strategy, it could directly impact Global Partners' revenue streams and market position.

- Forward Integration Risk: Suppliers could invest in terminals and distribution, cutting out Global Partners.

- Increased Supplier Power: Bypassing Global Partners would give suppliers more leverage.

- Supply Chain Disruption: This move could destabilize Global Partners' operations.

- Sector Trend: Increased producer investment in downstream assets is a notable trend.

Importance of Global Partners to Suppliers

The significance of Global Partners as a customer directly influences its suppliers' bargaining power. When Global Partners constitutes a substantial part of a supplier's revenue, that supplier is more likely to offer competitive pricing and favorable terms to secure continued business. For instance, in 2024, if a key component supplier derived over 20% of its annual revenue from Global Partners, its ability to dictate terms would be considerably reduced.

Conversely, if Global Partners represents a minor portion of a supplier's overall sales, its leverage in negotiations naturally diminishes. This asymmetry means suppliers catering to a broad client base might have less incentive to accommodate Global Partners' specific demands, especially if those demands are costly to implement.

- Supplier Dependence: If Global Partners accounts for a large percentage of a supplier's sales, the supplier's bargaining power weakens.

- Client Size Impact: A smaller client relationship grants Global Partners less influence over supplier pricing and terms.

- Market Concentration: Suppliers with many clients are less susceptible to the demands of any single customer like Global Partners.

The bargaining power of suppliers is a key element in Global Partners' operational landscape. When suppliers have unique or differentiated offerings, like specialized renewable fuel components, their ability to command higher prices increases. For example, the global renewable fuels market saw significant advancements and demand for specific blends in 2023, potentially empowering suppliers of these niche products.

Switching costs also play a crucial role; if Global Partners faces substantial expenses to change suppliers, existing suppliers gain leverage. The potential for suppliers to integrate forward into Global Partners' business, such as by developing their own distribution networks, poses a direct threat by increasing supplier control and potentially disrupting Global Partners' market position. In 2023, major energy producers showed increased investment in downstream infrastructure, a trend that could heighten this risk.

| Factor | Impact on Supplier Bargaining Power | Relevance to Global Partners (2023-2024 Trend) |

|---|---|---|

| Supplier Concentration | High concentration increases power | Top 5 oil producers accounted for ~50% of 2023 global crude output. |

| Switching Costs | High costs empower suppliers | Infrastructure upgrades for new fuels can be millions, increasing incumbent leverage. |

| Supplier Differentiation | Unique offerings increase power | Specialized renewable fuel components are vital, giving suppliers pricing advantage. |

| Forward Integration Threat | Suppliers entering Global Partners' space increases their power | Energy sector saw increased producer investment in downstream assets in 2023. |

| Global Partners' Customer Significance | Low significance empowers suppliers | If Global Partners is <20% of a supplier's revenue, supplier leverage is high. |

What is included in the product

This analysis dissects the competitive forces impacting Global Partners, revealing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the influence of substitutes.

Effortlessly identify and mitigate competitive threats with a dynamic, interactive analysis that visualizes each of Porter's Five Forces.

Customers Bargaining Power

The bargaining power of Global Partners' customers is heavily influenced by their concentration and the volume of fuel they purchase. Large wholesalers and commercial entities, for instance, can exert significant pressure for lower prices or preferential terms due to their substantial order sizes.

In 2024, a few key wholesale accounts represented a notable portion of Global Partners' revenue, underscoring the importance of these relationships. This concentration means that losing even one major customer could have a material impact on profitability, giving those customers considerable leverage.

While Global Partners serves a broad spectrum of customers, including smaller retailers and individual commercial clients, the sheer volume purchased by a few dominant players shapes the overall customer bargaining power dynamic, compelling the company to remain competitive on pricing and service.

The bargaining power of customers for Global Partners is significantly influenced by switching costs. If customers can easily find and transition to other fuel distributors with minimal operational disruption or financial penalty, their ability to demand lower prices increases. For instance, if a customer can switch suppliers with just a few phone calls and no significant changes to their fueling infrastructure, their leverage is high.

Global Partners' strategy to mitigate this involves its expansive terminal network and integrated logistics. This infrastructure aims to make it more inconvenient and costly for customers to switch. For example, a customer relying on Global Partners' strategically located terminals for their supply chain efficiency would face higher switching costs if they had to reconfigure their sourcing and transportation routes to a new distributor.

The number of alternative suppliers available to Global Partners' customers directly influences their negotiating strength. When customers can easily switch to another fuel distributor or terminal operator, their ability to demand better terms, such as lower prices or more favorable contract conditions, increases significantly. This is a common dynamic in competitive markets.

Global Partners operates within the Northeast U.S. market, which is characterized by a considerable number of competing fuel distributors and terminal operators. For instance, in 2024, the U.S. energy sector saw continued activity in mergers and acquisitions, consolidating some players but still leaving a fragmented landscape in many regional markets, including the Northeast. This means customers often have several viable options for their fuel supply needs.

This competitive environment empowers customers. They can leverage the presence of these alternatives to negotiate more effectively with Global Partners. If Global Partners' pricing or service levels are not competitive, customers are more likely to explore and switch to a different supplier, thereby limiting Global Partners' pricing power and potentially impacting its profit margins.

Price Sensitivity of Customers

The price sensitivity of Global Partners' customers is a significant driver of their bargaining power. Factors such as the customers' own profit margins, the commodity nature of fuels, and intense competitive pressures compel them to seek the lowest possible prices. This, in turn, exerts considerable downward pressure on Global Partners' own profit margins.

For instance, in 2024, the global average profit margin for fuel retailers hovered around 1-3%. When customers operate within such tight margins, even small price fluctuations become critical. This heightened sensitivity means customers are more likely to switch suppliers if a competitor offers a slightly better deal, directly impacting Global Partners' ability to maintain pricing power.

- High Price Sensitivity: Customers, often operating on thin profit margins, are acutely aware of fuel costs.

- Commodity Nature: Fuels are largely undifferentiated products, making price the primary purchasing criterion.

- Competitive Landscape: Intense competition among fuel suppliers forces customers to demand lower prices to remain competitive themselves.

- Margin Squeeze: In 2024, with average fuel retail margins around 1-3%, customers are less able to absorb price increases, amplifying their bargaining power.

Threat of Backward Integration by Customers

Customers' ability to integrate backward into fuel distribution or terminal operations significantly boosts their bargaining power. For instance, major retail chains or large commercial fleets could invest in their own storage and logistics infrastructure, diminishing their dependence on third-party providers like Global Partners. This strategic move allows them to control costs and ensure supply chain reliability.

The threat of backward integration is particularly pronounced for very large customers who possess the financial resources and operational scale to undertake such ventures. In 2024, the increasing volatility in fuel prices and supply chain disruptions have incentivized some major consumers to explore captive distribution solutions. For example, a large trucking company with a substantial fuel consumption might find it economically viable to own and operate its own fuel terminals, bypassing intermediaries.

- Increased Customer Leverage: Customers can negotiate more favorable terms or switch to alternative suppliers if they have the capability to self-distribute.

- Reduced Reliance on Global Partners: Backward integration by key clients directly erodes the revenue streams derived from distribution and terminal services.

- Capital Investment Threshold: The feasibility of backward integration depends on the significant capital outlay required for storage, transportation, and regulatory compliance.

- Market Dynamics: Fluctuations in commodity prices and the competitive landscape influence the attractiveness of customers pursuing self-sufficiency in fuel logistics.

The bargaining power of Global Partners' customers is substantial, driven by several key factors. Their ability to switch suppliers is a primary lever, especially when switching costs are low and alternative fuel distributors are readily available. This is particularly true in the competitive Northeast U.S. market. Customers are also highly price-sensitive, often operating on thin profit margins, which amplifies their demand for lower prices.

The threat of backward integration, where large customers might invest in their own distribution infrastructure, also significantly increases their leverage. In 2024, this was a growing consideration for major fuel consumers due to market volatility. A table illustrating these factors can provide a clearer picture of customer influence.

| Factor | Impact on Customer Bargaining Power | 2024 Context/Data |

|---|---|---|

| Customer Concentration & Volume | High leverage for large buyers | Key wholesale accounts represented a notable portion of revenue. |

| Switching Costs | Low costs increase power | Minimal disruption for customers switching distributors. |

| Availability of Alternatives | More options mean more power | Fragmented Northeast market with multiple distributors. |

| Price Sensitivity | High sensitivity drives price demands | Average fuel retail margins around 1-3% in 2024. |

| Threat of Backward Integration | Potential to bypass suppliers | Volatility incentivized some large consumers to explore captive solutions. |

Full Version Awaits

Global Partners Porter's Five Forces Analysis

This preview showcases the complete Global Partners Porter's Five Forces Analysis, providing a detailed examination of competitive forces within the industry. The document you see here is precisely the same professionally formatted and insightful analysis you will receive immediately after purchase, ensuring no surprises. You can confidently expect to download this exact, ready-to-use document upon completing your transaction.

Rivalry Among Competitors

The competitive landscape for Global Partners in the Northeast U.S. midstream logistics and fuel distribution sector is quite dynamic. The number and size of competitors directly shape the intensity of rivalry. Global Partners faces competition from a mix of large, integrated energy companies with substantial resources and smaller, more agile regional players, all vying for market share.

In 2024, the Northeast U.S. market for midstream logistics and fuel distribution is characterized by a moderate to high number of participants. While specific market share data for all private entities is not publicly disclosed, publicly traded companies like Global Partners (NYSE: GLP) are key players. For instance, in 2023, Global Partners reported revenues of approximately $3.7 billion, indicating its significant scale within this competitive environment.

The industry growth rate significantly shapes competitive rivalry in the Northeast U.S. petroleum and renewable fuels distribution sector. A mature or slow-growth market typically sees intensified competition as companies vie for existing market share, a dynamic that can be exacerbated by stagnant demand for traditional fuels, even with potential growth in renewables.

Global Partners faces intense competition, especially since its core fuel products are largely seen as commodities. When products are undifferentiated, the battle often shifts to who can offer the lowest price, squeezing profit margins for everyone involved.

The company attempts to stand out through its vast terminal network, which ensures reliable supply, and its integrated logistics capabilities, offering efficiency to customers. Furthermore, a focus on customer service aims to build loyalty in a market where the fuel itself is hard to make unique.

While these efforts provide some distinction, the inherent nature of refined petroleum products means significant differentiation in the fuel's quality or performance is inherently limited. This makes price a persistent and powerful competitive lever in the industry.

Exit Barriers

High exit barriers in the midstream and fuel distribution sectors significantly fuel competitive rivalry. Companies facing substantial costs to leave the market, such as those tied to specialized terminals and extensive infrastructure, often opt to continue operations even at reduced profitability rather than absorb these exit expenses. This dynamic can lead to prolonged periods of intense competition as firms remain entrenched.

The significant capital investments required for terminals, pipelines, and distribution networks represent major exit barriers. For instance, the U.S. midstream sector alone saw capital expenditures exceeding $100 billion annually in recent years, underscoring the sunk costs involved. Companies are therefore incentivized to keep these assets operational, even if returns diminish, to avoid realizing substantial losses upon divestment.

- High Capital Investment: The midstream and fuel distribution sectors demand enormous upfront capital for infrastructure like pipelines, storage tanks, and terminals, creating substantial sunk costs that deter exit.

- Specialized Assets: Much of this infrastructure is highly specialized, with limited alternative uses, making it difficult and costly to repurpose or sell upon exiting the market.

- Contractual Obligations: Long-term contracts with suppliers and customers can also create exit barriers, as breaking these agreements may involve significant penalties or legal liabilities.

- Regulatory Hurdles: Environmental regulations and permitting processes associated with asset decommissioning can add further complexity and cost to exiting the industry.

Switching Costs for Customers Among Competitors

Low switching costs for customers among fuel distributors significantly intensify competitive rivalry. When it's straightforward for buyers, whether wholesalers, retailers, or large commercial operations, to change suppliers, distributors face continuous pressure. This often translates into price wars and aggressive service offerings to keep existing clients and attract new ones.

In 2024, the global fuel distribution market saw intense competition, with many regional players vying for market share. For instance, in the U.S. market, the average customer retention rate for fuel distributors can be significantly impacted by even minor price discrepancies. A study indicated that over 60% of commercial fuel buyers would consider switching providers for a saving of just 2% on their monthly fuel bill, highlighting the sensitivity to switching costs.

- Low Switching Costs: Customers can easily change fuel suppliers without incurring significant financial penalties or operational disruptions.

- Price Sensitivity: A small price advantage from a competitor can lead to rapid customer defection.

- Service Differentiation: Distributors must continually innovate in service delivery, such as logistics efficiency or payment terms, to retain customers.

- Market Pressure: This ease of switching forces all players to maintain competitive pricing and service levels, increasing the intensity of rivalry.

The competitive rivalry for Global Partners in the Northeast U.S. midstream sector is heightened by a substantial number of players, including large integrated companies and smaller regional operators. This intense competition is further fueled by the commoditized nature of refined petroleum products, making price a primary differentiator. High exit barriers, such as significant capital investments in specialized infrastructure, keep companies entrenched, while low customer switching costs compel distributors to constantly compete on price and service to retain market share.

| Factor | Impact on Rivalry | 2024 Data/Observation |

|---|---|---|

| Number of Competitors | Moderate to High | Presence of major integrated energy firms and numerous regional distributors in the Northeast U.S. |

| Industry Growth Rate | Mature/Slow Growth | Stagnant demand for traditional fuels, with growth potential in renewables, intensifying competition for existing market share. |

| Product Differentiation | Low (Commoditized) | Refined petroleum products are largely undifferentiated, leading to price-based competition. |

| Exit Barriers | High | Significant capital investment in specialized infrastructure (terminals, pipelines) creates substantial sunk costs, discouraging exit. |

| Switching Costs for Customers | Low | Customers can easily switch suppliers for minor price advantages, increasing pressure on distributors. Over 60% of commercial buyers consider switching for a 2% saving. |

SSubstitutes Threaten

The increasing availability and adoption of alternative energy sources represent a significant threat of substitution for Global Partners' traditional petroleum products. For instance, the burgeoning electric vehicle (EV) market directly erodes demand for gasoline. By the end of 2023, global EV sales surpassed 13 million units, a substantial increase from previous years, indicating a clear shift away from internal combustion engines.

Furthermore, the growing adoption of natural gas and other renewable sources for heating purposes directly impacts the demand for heating oil. In 2023, natural gas continued its strong penetration in residential and commercial heating sectors, with its share in global primary energy consumption rising steadily. This diversification of energy options presents a clear challenge to the long-term market dominance of fossil fuels.

The threat of substitutes for Global Partners' traditional petroleum products is heavily influenced by the price and performance of alternatives. For instance, the increasing affordability and improving range of electric vehicles (EVs) present a growing substitution threat to gasoline distribution. In 2024, the average cost of operating an EV per mile continued to decline, making it more competitive with internal combustion engine vehicles.

Similarly, the sustained low price of natural gas directly impacts the demand for heating oil. If natural gas remains significantly cheaper than heating oil, consumers and businesses will continue to switch, eroding Global Partners' market share in that segment. This dynamic is crucial as many households and industrial facilities have the flexibility to choose between these energy sources.

The willingness of Global Partners' diverse customer base, from large wholesalers to individual commercial entities, to switch to alternative energy sources or distribution methods is a significant threat. Factors such as growing environmental consciousness and government mandates promoting cleaner fuels directly influence this propensity. For instance, in 2024, the global demand for renewable energy sources continued its upward trajectory, with solar and wind power installations seeing substantial growth, indicating a potential shift away from traditional fossil fuels for many end-users.

Investment in Renewable Fuels Infrastructure

Global Partners' strategic investments in renewable fuels infrastructure, such as biodiesel and renewable diesel, directly address the threat of substitution. By expanding into these cleaner alternatives, the company positions itself to benefit from the ongoing energy transition, rather than being solely reliant on traditional fossil fuels.

This diversification is crucial as other clean energy sources and technologies continue to emerge. For instance, advancements in electric vehicle technology and battery storage present a growing alternative to internal combustion engines, which are powered by fuels that Global Partners distributes.

- Renewable Fuel Investments: Global Partners has been actively investing in and expanding its capabilities for distributing renewable fuels, including biodiesel and renewable diesel.

- Market Share Capture: These investments are designed to capture a growing share of the market as demand shifts towards lower-carbon energy solutions.

- Mitigation Strategy: By diversifying its product offering, Global Partners mitigates the risk of its core business being displaced by substitute energy sources.

- Energy Transition Alignment: The company's focus on renewables aligns with broader governmental and societal pushes for decarbonization, making it a proactive rather than reactive player in the evolving energy landscape.

Regulatory and Policy Support for Substitutes

Government regulations and policy support can significantly bolster the threat of substitutes for Global Partners. For instance, in 2024, many nations continued to implement ambitious clean energy targets, often backed by substantial subsidies and tax credits for renewable energy adoption. This creates a more favorable economic landscape for substitute products and services, making them more competitive against Global Partners' offerings.

Mandates for energy efficiency and emissions reduction directly pressure industries reliant on traditional fuels, a core area for Global Partners. For example, by the end of 2024, the European Union's stringent CO2 emission standards for new vehicles were set to further incentivize the shift towards electric mobility, directly impacting the demand for internal combustion engine components and related services that Global Partners might provide.

The accelerating adoption of electric vehicles (EVs) and the growth of renewable heating solutions are prime examples of how policy can amplify substitution threats. By early 2025, projections indicated that global EV sales would surpass 15 million units for 2024, a testament to supportive policies like purchase incentives and charging infrastructure development. Similarly, government support for solar and heat pump installations directly erodes the market share of fossil fuel-based heating systems.

- Regulatory Push: Policies favoring electric vehicles and renewable energy, such as subsidies and tax credits, are intensifying the threat of substitutes.

- Emissions Standards: Stricter emissions regulations for traditional fuels directly diminish the market for conventional products used by companies like Global Partners.

- Market Shift: The projected 15 million+ global EV sales in 2024, driven by policy, highlights a significant substitution trend impacting established automotive sectors.

- Energy Efficiency Mandates: Government mandates promoting energy efficiency accelerate the adoption of alternative solutions in heating and transportation.

The growing availability and improving economics of electric vehicles (EVs) present a substantial threat to Global Partners' gasoline sales. By the end of 2024, the global EV market was projected to see sales exceeding 15 million units, a significant increase driven by government incentives and expanding charging infrastructure.

Similarly, the increasing adoption of natural gas and renewable sources for heating directly impacts demand for heating oil. In 2023, natural gas continued its strong penetration in the heating sector, with its share in global primary energy consumption rising steadily, indicating a diversification away from fossil fuels.

The competitive pricing and enhanced performance of these alternatives are key drivers of substitution. For instance, the declining cost per mile of EV operation in 2024 made them increasingly attractive compared to traditional internal combustion engine vehicles.

| Substitute | Impact on Global Partners | Key Driver (2024 Data) |

|---|---|---|

| Electric Vehicles (EVs) | Reduced gasoline demand | Projected 15M+ global sales; declining operating costs |

| Natural Gas (Heating) | Reduced heating oil demand | Rising share in global primary energy consumption |

| Renewable Heating (Solar, Heat Pumps) | Reduced heating oil demand | Government subsidies and efficiency mandates |

Entrants Threaten

The midstream and fuel distribution sector, where Global Partners operates, demands massive upfront investment. Building or acquiring terminal networks, storage facilities, and transportation infrastructure requires substantial capital, effectively deterring new players from entering the market. For instance, the cost of developing a single modern terminal can run into hundreds of millions of dollars, making it a high hurdle for any aspiring competitor.

Global Partners leverages significant economies of scale in its operations, particularly in fuel purchasing and distribution networks. For instance, in 2024, the company's vast network of fueling stations and logistics infrastructure allows for bulk purchasing discounts that new entrants simply cannot match. This scale translates into a substantial cost advantage, making it challenging for newcomers to achieve price competitiveness.

Furthermore, Global Partners' decades of experience in managing complex supply chains and navigating diverse regulatory landscapes across its operating regions is a formidable barrier. This accumulated knowledge, gained through years of practical application, enables more efficient operations and risk mitigation, which are difficult and costly for new companies to replicate quickly.

New companies entering the energy distribution market face significant challenges in securing access to essential infrastructure like pipelines and marine terminals. Global Partners has cultivated an extensive network, making it difficult for newcomers to replicate their reach to a broad customer base of wholesalers and retailers.

Regulatory and Permitting Hurdles

The fuel distribution and midstream sectors face significant barriers to entry due to stringent regulatory and permitting requirements. These are especially pronounced in areas like the Northeast U.S., where environmental standards are high.

Navigating this complex web of regulations, including environmental impact assessments and safety certifications, can be a lengthy and expensive undertaking. For instance, obtaining a new pipeline permit can take several years and involve substantial legal and consulting fees, effectively deterring many potential new players.

- Extensive Environmental Regulations: Compliance with EPA standards and state-specific rules adds considerable cost and time.

- Safety Standards: Adherence to PHMSA regulations for pipeline integrity and operations requires significant investment.

- Permitting Processes: Securing rights-of-way and construction permits can be a multi-year endeavor, often involving public hearings and environmental reviews.

- Cost of Compliance: The combined expenses for legal counsel, environmental consultants, and compliance staff can run into millions of dollars for new entrants.

Brand Loyalty and Switching Costs for Customers

While fuel itself is often seen as a commodity, the established relationships and dependable service provided by existing players can cultivate a significant level of customer loyalty. This makes it challenging for newcomers to break in. For instance, in the competitive US retail gasoline market, where major brands like ExxonMobil and Shell have deeply entrenched customer bases, a new entrant would likely face substantial hurdles in attracting and retaining customers. They would need to offer compelling incentives, such as aggressive pricing or superior loyalty programs, to overcome these existing bonds, thereby increasing their initial customer acquisition costs.

- Brand loyalty in the fuel sector, while not as pronounced as in some other consumer goods, still presents a barrier.

- Established relationships and perceived reliability of service contribute to customer retention for incumbent firms.

- New entrants must invest heavily in marketing and incentives to overcome existing customer loyalty and switching costs, potentially impacting initial profitability.

The threat of new entrants for Global Partners is significantly mitigated by the immense capital required to establish infrastructure, such as terminals and pipelines. For example, the cost to build a new fuel terminal can easily exceed $100 million. Additionally, the sector is burdened by extensive and costly regulatory compliance, particularly in environmentally sensitive regions like the Northeast, where obtaining permits can take years and cost millions in legal and consulting fees.

| Barrier Category | Specific Example | Estimated Cost/Timeframe for New Entrant |

|---|---|---|

| Capital Requirements | Terminal Construction | $100M+ per terminal |

| Regulatory Compliance | Pipeline Permitting (Northeast US) | Several years, millions in legal/consulting fees |

| Economies of Scale | Bulk Purchasing & Distribution | New entrants lack Global Partners' 2024 purchasing power |

| Customer Loyalty/Relationships | Securing wholesale/retail contracts | High initial marketing and incentive costs |

Porter's Five Forces Analysis Data Sources

Our Global Partners Porter's Five Forces analysis is built upon a robust foundation of data, including publicly available financial reports from key industry players, comprehensive market research from leading firms, and insights from global trade associations. This blend ensures a thorough understanding of competitive dynamics.