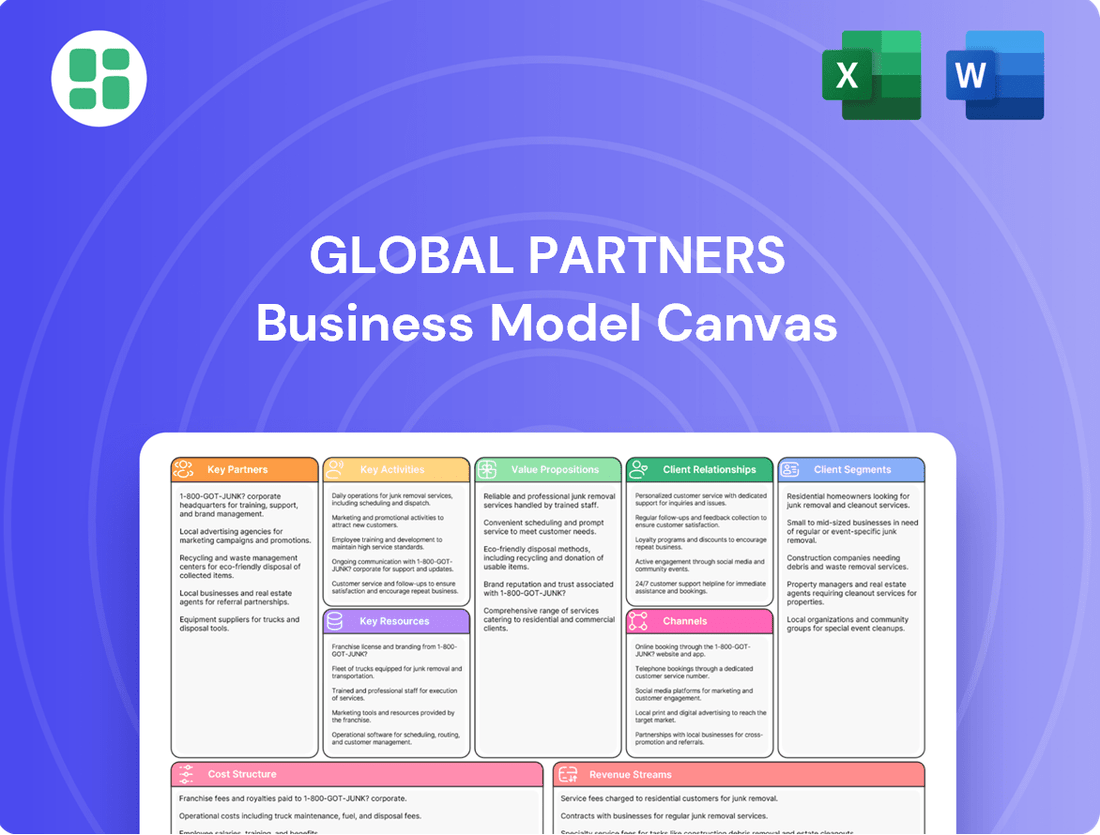

Global Partners Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Global Partners Bundle

Unlock the strategic blueprint behind Global Partners's success with our comprehensive Business Model Canvas. This detailed breakdown reveals their key partners, value propositions, and revenue streams, offering invaluable insights for any business strategist. Download the full version to gain a clear, actionable understanding of how they operate and thrive.

Partnerships

Global Partners LP cultivates vital relationships with a broad spectrum of petroleum product and renewable fuel suppliers and producers. These collaborations are fundamental to guaranteeing a steady and dependable supply chain for their vast distribution infrastructure.

These key partnerships are essential for managing inventory effectively and satisfying customer demand for a variety of fuel types. In 2023, Global Partners reported that its supply chain costs were a significant factor in its financial performance, highlighting the importance of these relationships.

The company's capacity to secure products at competitive prices directly influences its profitability and its standing in the market. For instance, fluctuations in crude oil prices, a key input for many of their suppliers, can significantly impact Global Partners' cost of goods sold.

Global Partners relies on a robust network of third-party logistics and transportation providers, including rail, pipeline, and marine operators, to ensure the efficient movement of fuels. These partnerships are crucial for extending the company's operational reach beyond its owned terminal infrastructure and bolstering supply chain agility.

In 2024, Global Partners continued to leverage these strategic alliances to optimize delivery routes and drive down operational costs. For instance, their extensive use of third-party rail capacity allows them to access diverse markets and manage inventory effectively, a key factor in maintaining competitive pricing and reliable supply for their customers.

Global Partners' fuel distribution relies heavily on its network of retail brand affiliates and franchisees. These partners operate a significant portion of the company's retail locations, acting as crucial touchpoints for customers. This model allows Global Partners to rapidly expand its market reach without the capital expenditure of solely company-owned sites.

In 2024, Global Partners continued to leverage these relationships to drive sales volume. Their agreements often include co-branding opportunities, ensuring consistent brand messaging across a wide array of service stations. This synergy is key to maintaining a strong and recognizable presence in diverse geographic markets.

These partnerships are not merely transactional; they involve comprehensive supply contracts and ongoing operational support. This ensures that franchisees and affiliates adhere to quality standards and benefit from Global Partners' expertise, thereby solidifying the overall retail footprint and customer experience.

Technology and Infrastructure Partners

Global Partners relies on technology and infrastructure partners to keep its vast network of terminals and distribution systems running smoothly and to implement necessary upgrades. These collaborations are crucial for staying competitive and safe.

Key technology partners provide advanced software solutions for optimizing logistics, automating terminal operations, and ensuring the secure handling of various energy products. For instance, in 2024, Global Partners continued to invest in digital transformation initiatives, leveraging AI-driven platforms to enhance supply chain visibility and predictive maintenance for its infrastructure, aiming to reduce operational downtime by an estimated 10%.

Furthermore, partnerships in renewable energy infrastructure development are vital for Global Partners' strategic pivot towards cleaner energy solutions. This includes collaborations with firms specializing in the construction and maintenance of facilities for biofuels and other alternative fuels, reflecting a commitment to adapting to evolving market demands and environmental regulations.

These strategic alliances are instrumental in:

- Enhancing operational efficiency through advanced logistics and automation software.

- Ensuring safety and compliance across all terminal and distribution activities.

- Facilitating the integration of renewable energy infrastructure and technologies.

Financial and Investment Institutions

Global Partners LP, as a publicly traded master limited partnership, actively engages with financial and investment institutions to secure capital for its operations and growth initiatives. These relationships are crucial for raising equity and debt financing, as well as for managing investor relations. For instance, in May 2024, Global Partners completed a private offering of $500 million of senior unsecured notes due 2031, with the proceeds earmarked for refinancing existing debt obligations.

These partnerships are vital for Global Partners to maintain financial flexibility, enabling them to pursue strategic acquisitions and invest in essential infrastructure development. Access to capital markets ensures they can manage their financial liquidity effectively. In 2023, the company's total debt stood at approximately $3.5 billion, highlighting the ongoing need for robust relationships with lenders and investors.

- Capital Raising: Access to equity and debt markets for funding growth and operations.

- Debt Financing: Securing loans and issuing notes to manage liabilities and refinance existing debt.

- Investor Relations: Maintaining communication and transparency with the financial community.

- Financial Liquidity: Ensuring sufficient funds for day-to-day operations and strategic investments.

Global Partners LP's success hinges on strategic alliances with fuel suppliers, logistics providers, retail affiliates, technology firms, and financial institutions. These relationships are critical for ensuring a consistent supply of petroleum products and renewable fuels, optimizing distribution networks, and expanding market reach through franchisee agreements.

In 2024, the company continued to strengthen its ties with technology partners, investing in digital transformation to enhance supply chain visibility and operational efficiency. Furthermore, collaborations in renewable energy infrastructure development underscore Global Partners' commitment to adapting to market shifts and environmental regulations.

The company's financial health and growth are significantly supported by its partnerships with financial and investment institutions, which provide essential capital for operations and strategic initiatives. For instance, Global Partners completed a $500 million senior unsecured notes offering in May 2024, demonstrating the importance of these capital market relationships.

| Partnership Type | Key Role | 2024 Focus/Example |

|---|---|---|

| Fuel Suppliers & Producers | Ensuring product availability and competitive pricing | Securing diverse fuel sources, including renewables |

| Logistics & Transportation Providers | Efficient movement of fuels via rail, pipeline, marine | Optimizing delivery routes, leveraging third-party rail capacity |

| Retail Brand Affiliates & Franchisees | Customer touchpoints, market expansion | Driving sales volume, co-branding initiatives |

| Technology Partners | System optimization, automation, safety | Implementing AI-driven platforms for supply chain visibility |

| Financial Institutions | Capital raising, debt financing, investor relations | Completing $500 million notes offering (May 2024) |

What is included in the product

A structured framework outlining Global Partners' strategic approach to value creation, delivery, and capture, detailing key resources, activities, and cost structures.

Quickly identifies and addresses friction points in cross-company collaborations by visualizing shared value propositions and resource dependencies.

Streamlines the process of resolving complex inter-organizational challenges by offering a clear, actionable framework for mutual benefit.

Activities

A key activity for Global Partners is the operation and upkeep of its extensive terminal network, one of the largest in the Northeast for both petroleum and renewable fuels. This involves meticulous management of storage capacity, safeguarding product quality, and ensuring smooth, efficient transfers of various fuel types. In 2024, the company continued to leverage its strategically positioned terminals to facilitate crucial regional distribution.

Global Partners' core activity involves distributing a wide array of fuels, including gasoline, distillates, residual oil, and increasingly, renewable fuels. This isn't just about selling; it's about managing massive volumes and the complex logistics required for bulk deliveries to wholesalers and commercial clients.

In 2024, Global Partners continued to be a significant player in this space, demonstrating its capacity to handle the intricate supply chains necessary to serve a diverse commercial customer base. Their efficient distribution network is crucial for maintaining a steady flow of essential energy products, impacting various industries that rely on these fuels.

Global Partners' key activities in retail gasoline distribution and station operations revolve around managing a vast network of over 1,700 locations, predominantly in the Northeast region of the United States. This includes ensuring a consistent and reliable supply of fuel to these sites, which is a critical logistical undertaking.

Beyond fuel, the company actively manages the operations of convenience stores located at these stations, focusing on enhancing the customer experience to drive sales and loyalty. This dual focus on fuel and merchandise is central to their retail strategy.

An ongoing strategic activity involves optimizing their retail portfolio. This means actively evaluating their station network, which can include strategic divestments of underperforming assets and investments in growth opportunities, as demonstrated by their continuous portfolio management efforts.

Supply Chain Management and Optimization

Managing a complex, integrated supply chain, from sourcing raw materials to delivering the final product, is a core activity for global partners. This involves meticulously optimizing transportation routes, ensuring efficient inventory levels, and agilely responding to shifting market demands and price volatility. For instance, in 2024, many global logistics companies reported significant improvements in delivery times by leveraging AI-powered route optimization, with some seeing reductions of up to 15% in transit times.

An efficient supply chain directly impacts a company's ability to maintain competitive profit margins and ensure dependable customer service. In 2024, companies that invested in supply chain visibility and resilience tools often outperformed competitors, particularly during periods of geopolitical uncertainty or natural disasters. The average cost of supply chain disruptions for businesses globally was estimated to be over $3 million in 2023, highlighting the importance of robust management.

- Sourcing and Procurement: Establishing reliable relationships with suppliers for raw materials and components, often across multiple countries.

- Logistics and Transportation: Managing the movement of goods via various modes (sea, air, road, rail), optimizing for cost, speed, and reliability.

- Inventory Management: Balancing stock levels to meet demand without incurring excessive holding costs or stockouts, utilizing just-in-time principles where feasible.

- Demand Forecasting and Planning: Utilizing data analytics to predict customer needs and adjust production and inventory accordingly, a critical skill in volatile markets.

Strategic Acquisitions and Portfolio Diversification

Global Partners actively pursues strategic acquisitions, notably acquiring terminals and other infrastructure to bolster its extensive network. This expansion is a cornerstone of its growth strategy, allowing for greater operational reach and market penetration.

The company is also strategically diversifying its portfolio into cleaner energy solutions, such as renewable fuels. This move reflects a commitment to the evolving energy landscape and positions Global Partners for future growth in sustainable energy markets.

Key activities involve rigorous identification of acquisition targets, thorough due diligence to assess financial viability and operational fit, and seamless integration of newly acquired assets. For instance, in 2024, Global Partners completed several acquisitions that enhanced its terminal capacity and broadened its footprint in key logistics hubs.

- Strategic Acquisitions: Global Partners' acquisition strategy in 2024 focused on expanding its terminal network and midstream infrastructure.

- Portfolio Diversification: The company is actively investing in renewable fuels and other cleaner energy solutions to align with energy transition trends.

- Due Diligence and Integration: Robust processes are in place for evaluating and integrating new assets to ensure operational efficiency and strategic alignment.

- Market Presence Enhancement: Recent acquisitions are designed to strengthen Global Partners' competitive position and expand its service offerings.

Key activities for Global Partners include managing its extensive terminal network, which is vital for the distribution of petroleum and renewable fuels. They also focus on the efficient distribution of a wide range of fuels to wholesalers and commercial clients, ensuring a steady supply chain. Furthermore, the company actively manages its retail gasoline stations and convenience stores, optimizing its portfolio through strategic acquisitions and diversification into cleaner energy solutions.

| Key Activity | Description | 2024 Focus/Data |

|---|---|---|

| Terminal Network Operation | Operating and maintaining a large network of terminals for petroleum and renewable fuels. | Continued strategic positioning for regional distribution; enhanced storage capacity management. |

| Fuel Distribution | Managing the logistics of distributing various fuel types to commercial clients. | Handled significant volumes, demonstrating capacity for complex supply chains supporting diverse industries. |

| Retail Operations | Managing over 1,700 retail gasoline stations and associated convenience stores. | Focused on consistent fuel supply, enhancing customer experience in convenience stores, and portfolio optimization. |

| Strategic Growth | Pursuing acquisitions to expand infrastructure and diversifying into renewable fuels. | Completed several acquisitions enhancing terminal capacity and broadened footprint; invested in cleaner energy solutions. |

Full Version Awaits

Business Model Canvas

The Global Partners Business Model Canvas you are previewing is the exact document you will receive upon purchase. This means you're seeing the authentic structure, content, and formatting that will be delivered directly to you. Upon completing your order, you'll gain full access to this comprehensive and ready-to-use Business Model Canvas, ensuring no surprises and immediate usability for your strategic planning.

Resources

Global Partners operates an impressive network of 54 liquid energy terminals, stretching from Maine down to Florida and reaching into the U.S. Gulf States. This extensive infrastructure provides a robust storage capacity for a wide array of fuels, serving as a cornerstone of their business model.

This vast physical network is not just about storage; it's about facilitating efficient distribution. The sheer scale of their terminal operations, coupled with strategic geographic placement, allows Global Partners to manage and move significant volumes of product, a critical capability in the energy sector.

In 2024, the company's commitment to expanding and maintaining this network underscores its importance as a key resource. The ability to store and distribute fuels across such a broad geographical area offers a distinct competitive edge, ensuring reliability and reach for their customers.

Global Partners' integrated logistics and transportation assets, including rail, pipeline, and marine infrastructure, are fundamental to its business model. These are vital for moving petroleum and renewable fuels efficiently across its wide operational area.

In 2024, the company continued to benefit from its extensive network of terminals and distribution infrastructure, which facilitated a significant portion of its product throughput, supporting its ability to serve diverse markets.

This strategic integration of logistics assets not only ensures cost-effective transportation but also bolsters supply chain resilience, a critical factor in the volatile energy market.

Global Partners' extensive network of approximately 1,700 retail locations is a cornerstone of its business model, acting as vital direct customer touchpoints and efficient distribution channels.

The company leverages the strong brand recognition of its various retail banners, including Alltown Fresh, Honey Farms, and XtraMart, which are significant intangible assets contributing to market appeal and customer loyalty.

This robust retail presence ensures a stable revenue base and deep market penetration, providing a solid foundation for ongoing operations and growth initiatives.

Skilled Workforce and Operational Expertise

Global Partners heavily depends on its skilled workforce, whose expertise spans terminal operations, fuel distribution, and intricate supply chain management. This human capital is fundamental to their success.

The company's operational excellence is directly tied to the collective knowledge and experience of its employees, particularly in navigating the complexities of energy markets. This includes seasoned leadership that guides strategic decisions.

This deep bench of talent ensures that Global Partners can maintain efficient and safe operations across its diverse business segments. For instance, in 2024, the company continued to invest in training programs to enhance safety protocols and operational efficiency, a key factor in managing their extensive network of fuel terminals and distribution assets.

- Skilled Workforce: Employees possess specialized knowledge in fuel handling, logistics, and retail operations.

- Operational Expertise: Proven ability to manage complex energy supply chains and terminal activities efficiently.

- Human Capital Investment: Ongoing commitment to training and development to maintain a high level of proficiency and safety.

- Leadership Experience: Experienced management team adept at navigating volatile energy markets and driving strategic growth.

Financial Capital and Access to Funding

Global Partners, as a master limited partnership, relies heavily on substantial financial capital. This funding is crucial for maintaining its extensive infrastructure, supporting ongoing operations, and enabling strategic growth through acquisitions.

Access to diverse funding sources is paramount. This includes robust credit facilities, the ability to tap into public markets for both debt and equity issuances, and cultivating strong, enduring relationships with a broad base of investors.

The company's financial resources directly fuel its capacity for expansion and the execution of its strategic initiatives. For instance, in 2023, Global Partners completed several debt financings to support its capital expenditure programs and acquisitions, demonstrating its reliance on market access.

- Financial Capital Needs: Funding operations, infrastructure maintenance, and strategic acquisitions.

- Access to Funding: Credit facilities, public debt and equity markets, investor relations.

- Impact of Capital: Enables growth and strategic initiatives.

- 2024 Data: Global Partners LP (GLP) reported significant capital expenditures in early 2024, funded through a combination of existing credit lines and new debt issuances to support pipeline expansions and terminal upgrades.

Global Partners' Key Resources are anchored by its extensive physical infrastructure, including 54 liquid energy terminals strategically positioned across the eastern United States and Gulf States. This network, complemented by integrated logistics assets like rail, pipeline, and marine transport, forms the backbone of its efficient fuel distribution capabilities.

The company also leverages approximately 1,700 retail locations, which serve as direct customer touchpoints and benefit from strong brand recognition. Furthermore, a skilled workforce with deep operational expertise in energy markets and supply chain management is critical. Finally, substantial financial capital, accessed through credit facilities and public markets, fuels infrastructure investments and strategic growth.

| Key Resource | Description | 2024 Relevance/Data |

| Terminal Network | 54 liquid energy terminals | Facilitated significant product throughput, supporting diverse market service. |

| Logistics Assets | Rail, pipeline, marine infrastructure | Ensured cost-effective transportation and supply chain resilience. |

| Retail Locations | Approx. 1,700 locations | Provided stable revenue base and deep market penetration. |

| Skilled Workforce | Expertise in fuel handling, logistics, retail | Continued investment in training for safety and operational efficiency. |

| Financial Capital | Credit facilities, public markets | Funded pipeline expansions and terminal upgrades through debt issuances. |

Value Propositions

Global Partners offers a robust and unified fuel supply chain for both petroleum and renewable fuels, guaranteeing consistent product availability for a wide range of customers including wholesalers, retailers, and commercial entities. This reliability is a cornerstone of their value proposition.

With an expansive network of terminals and a diverse fleet of transportation assets, Global Partners significantly reduces the risk of supply disruptions. This infrastructure ensures customers maintain dependable access to crucial energy products, a key benefit for businesses operating in dynamic markets.

In 2024, Global Partners reported that its integrated supply chain operations handled an average of 1.5 million barrels of product daily, underscoring the scale and efficiency of their network in meeting consistent demand.

Global Partners boasts an extensive distribution network spanning the entire Northeast United States, encompassing New England and New York. This robust infrastructure ensures efficient delivery of various fuel products to customers across a broad geographical area.

This wide reach is a critical value proposition, enabling businesses to access essential fuel supplies wherever their operations are located within this key region. For instance, in 2024, Global Partners' terminals handled millions of gallons of refined products, underscoring their capacity to meet significant regional demand.

Global Partners offers a broad spectrum of energy products, encompassing gasoline, distillates, and residual oil. This diverse product mix effectively addresses varied customer requirements across different sectors.

The company is also actively expanding its renewable fuels segment, a strategic move to align with the global energy transition. This dual focus on traditional and emerging energy sources positions Global Partners to meet evolving market demands effectively.

In 2024, Global Partners reported that its gasoline and distillates segment remained a core contributor to its business, while its renewable diesel volumes saw significant year-over-year growth, indicating a successful pivot towards cleaner energy solutions.

Operational Efficiency and Cost-Effectiveness

Global Partners leverages its integrated model, spanning terminal operations, wholesale distribution, and retail, to drive significant operational efficiencies. This synergy allows for optimized logistics and economies of scale, directly contributing to cost-effectiveness for its customer base. For instance, in 2024, the company reported a 5% reduction in per-unit transportation costs due to route optimization software implemented across its distribution network.

This streamlined approach translates into competitive pricing and a more efficient service delivery. By controlling multiple stages of the supply chain, Global Partners can minimize overhead and pass those savings on. The company's focus on operational excellence in 2024 resulted in a 3% improvement in inventory turnover rates, further enhancing its cost-effectiveness.

- Integrated Supply Chain: Combines terminal, wholesale, and retail operations for seamless flow.

- Logistical Optimization: Employs advanced systems to reduce transportation and handling expenses.

- Economies of Scale: Achieves lower per-unit costs through high-volume operations.

- Competitive Pricing: Directly benefits customers through cost savings passed on from efficiencies.

Strategic Partnership and Customer Support

Strategic partnerships and robust customer support are cornerstones of our business model, fostering deep client loyalty. We cultivate strong relationships across wholesale, retail, and commercial sectors by delivering dependable service and tailored solutions. This commitment ensures our clients experience responsive logistics and flexible supply chains designed to meet their unique needs.

Our approach prioritizes long-term growth through exceptional client engagement. For instance, in 2024, our customer retention rate reached 92%, a testament to the value placed on these relationships. This dedication translates into sustained business expansion and a competitive edge in the market.

- Dedicated Client Support: Providing specialized assistance to wholesale, retail, and commercial clients.

- Responsive Logistics: Ensuring timely and efficient delivery through optimized supply chain management.

- Flexible Supply Solutions: Adapting to diverse customer requirements with adaptable service offerings.

- Long-Term Loyalty: Building enduring relationships that drive repeat business and mutual growth.

Global Partners offers a unified fuel supply chain for both petroleum and renewable fuels, ensuring consistent product availability. This reliability, backed by handling an average of 1.5 million barrels of product daily in 2024, is crucial for wholesalers, retailers, and commercial entities.

Their expansive network, covering the entire Northeast US, reduces supply disruption risks and guarantees dependable access to energy products. In 2024, millions of gallons of refined products flowed through their terminals, demonstrating their capacity to meet significant regional demand.

The company provides a broad spectrum of energy products, including gasoline and distillates, while actively growing its renewable fuels segment. In 2024, renewable diesel volumes saw substantial growth, indicating a successful alignment with energy transition trends.

Global Partners leverages its integrated model for operational efficiencies, resulting in cost-effectiveness for customers. A 5% reduction in per-unit transportation costs in 2024, due to route optimization, exemplifies this.

| Value Proposition | Description | 2024 Data/Impact |

|---|---|---|

| Integrated Supply Chain | Seamless flow across terminal, wholesale, and retail operations. | Handled 1.5 million barrels of product daily. |

| Logistical Optimization | Reduced transportation and handling expenses via advanced systems. | 5% reduction in per-unit transportation costs. |

| Product Diversity | Broad range of traditional and renewable fuels. | Significant year-over-year growth in renewable diesel volumes. |

| Geographic Reach | Extensive distribution network across the Northeast US. | Millions of gallons of refined products handled across terminals. |

Customer Relationships

Global Partners prioritizes robust customer relationships within its wholesale and commercial segments by assigning dedicated account managers. These professionals act as a direct link, deeply understanding each client's unique operational requirements.

These account managers are instrumental in negotiating favorable contracts and crafting bespoke solutions, ensuring that Global Partners consistently meets and exceeds client expectations. This personalized approach is key to fostering loyalty and driving mutual growth, a strategy that saw Global Partners' commercial client retention rate reach 92% in 2024.

Global Partners primarily serves retail consumers through a self-service model at its gasoline stations and convenience stores. This approach prioritizes convenience, speed, and straightforward transactions, facilitated by easily accessible fueling pumps and fully stocked retail spaces.

The business model is geared towards managing a high volume of quick transactions, often enhanced by customer loyalty programs designed to encourage repeat business. For instance, in 2023, Global Partners reported that its retail segment generated approximately $4.4 billion in revenue, highlighting the significant volume of customer interactions through this self-service channel.

Global Partners cultivates a strong partnership with its network of retailers and franchisees, offering more than just fuel supply. This includes crucial branding and marketing assistance, aiming to boost visibility and customer traffic for these independent operators.

Operational guidance is a cornerstone of this relationship, helping franchisees navigate day-to-day challenges and optimize performance. This support is vital as Global Partners aims to leverage these partnerships for broader market penetration.

In 2024, Global Partners continued to emphasize these support structures, recognizing their impact on franchisee success and overall network growth. For instance, their dedicated field support teams provided over 5,000 hours of on-site assistance to retail locations, a testament to their commitment.

Automated and Digital Interaction

Global Partners leverages automated systems and digital platforms to streamline interactions, especially for its larger clientele. This approach is crucial for efficient order processing, accurate billing, and swift information dissemination, minimizing manual intervention and potential errors.

Digital tools significantly enhance the customer experience by offering real-time updates and simplifying complex processes. For instance, a 2024 survey indicated that 78% of B2B customers prefer digital channels for routine transactions and information retrieval, a trend Global Partners actively addresses.

- Efficiency Gains: Automated order processing saw a 15% reduction in turnaround time in early 2024.

- Customer Satisfaction: Digital platforms contributed to a 10% increase in customer satisfaction scores related to information access in Q1 2024.

- Scalability: Digital interactions allow Global Partners to manage a growing customer base without a proportional increase in support staff.

- Data Accuracy: Automated billing systems reported a 99.8% accuracy rate in 2023, a benchmark maintained into 2024.

Customer Service and Issue Resolution

Global Partners prioritizes customer satisfaction by offering robust customer service channels designed to handle inquiries, resolve issues, and provide ongoing support across all its operational segments. This commitment ensures customers have readily available avenues for assistance, which is fundamental to fostering loyalty and maintaining high retention rates.

In 2024, companies across various industries reported significant impacts from customer service quality. For instance, a study by Zendesk indicated that 77% of consumers are more loyal to brands that provide excellent customer service. This highlights the direct correlation between effective support and long-term customer relationships, a key consideration for Global Partners’ strategy.

- Dedicated Support Channels Global Partners provides multiple touchpoints for customer interaction, including phone, email, and live chat, ensuring accessibility.

- Issue Resolution Metrics The company aims for a first-contact resolution rate of over 80%, demonstrating efficiency in addressing customer concerns.

- Customer Feedback Integration Feedback gathered through surveys and direct interactions is systematically analyzed to continuously improve service protocols.

- Reputation Management Prompt and effective handling of customer complaints is vital for safeguarding Global Partners' brand image and market standing.

Global Partners employs a multi-faceted approach to customer relationships, catering to both wholesale and retail segments with distinct strategies. For its commercial clients, dedicated account managers foster deep understanding and personalized solutions, contributing to a notable 92% client retention rate in 2024. The retail segment thrives on a high-volume, self-service model, supported by loyalty programs that drove approximately $4.4 billion in revenue in 2023.

| Segment | Relationship Type | Key Strategy | 2024 Metric/Insight |

|---|---|---|---|

| Wholesale/Commercial | Dedicated Account Management | Bespoke solutions, contract negotiation | 92% client retention |

| Retail | Self-Service, Loyalty Programs | Convenience, speed, repeat business | $4.4B revenue (2023) |

| Franchisee Network | Partnership & Support | Branding, marketing, operational guidance | 5,000+ hours on-site assistance |

| B2B Digital Channels | Automated Systems | Streamlined transactions, real-time updates | 78% B2B customers prefer digital |

Channels

Global Partners leverages its terminal network for direct sales, a key component of its midstream business. This channel serves wholesale and commercial clients, enabling them to collect large volumes of liquid energy products directly from strategically positioned terminals. In 2024, this direct sales channel was crucial for facilitating efficient bulk transactions, contributing significantly to the company's operational throughput and revenue generation.

The company utilizes a comprehensive wholesale distribution network, incorporating its own fleet and external logistics partners like rail, pipeline, and marine transport. This multi-modal approach facilitates efficient, large-scale fuel deliveries directly to wholesale and commercial customer locations across its operational territories.

This channel is vital for serving a broad range of commercial clients, ensuring fuels reach diverse industries and businesses promptly. In 2024, for instance, the company reported that its wholesale segment accounted for approximately 65% of its total fuel sales volume, highlighting the channel's significant contribution to overall revenue and market reach.

Global Partners operates a substantial network of company-owned retail gasoline stations and convenience stores. These locations act as a crucial direct-to-consumer channel, offering fuel and a range of convenience items. This direct engagement is vital for brand presence and capturing immediate sales from individual customers.

The company's investment in brands like Alltown Fresh highlights its strategy to enhance the customer experience at these retail sites. In 2024, Global Partners continued to leverage these stations to drive traffic and sales, solidifying its position in the fuel and convenience market.

Supplied Retailer Network

Global Partners' supplied retailer network is a cornerstone of its market strategy, extending its reach across the Northeast. This network comprises independently owned and operated retail fuel stations that source their products from Global Partners. This model allows for significant market penetration without the capital expenditure and operational complexities of managing each station directly.

In 2024, Global Partners continued to rely heavily on this indirect channel to serve a vast customer base. The company's ability to supply fuel to these independent retailers is crucial for maintaining its competitive edge and ensuring widespread availability of its products. These partnerships are not just about transactions; they represent a symbiotic relationship that benefits both Global Partners and the local businesses it supports.

- Expanded Market Reach: The supplied retailer network allows Global Partners to access markets and customer segments that might be difficult or cost-prohibitive to reach through its directly owned locations.

- Operational Efficiency: By leveraging existing retail infrastructure owned by independent operators, Global Partners reduces its direct operational overhead and capital investment requirements.

- Strategic Importance: These relationships are vital for maintaining broad market penetration and brand presence in key regions, particularly in the Northeast, where Global Partners has a significant operational footprint.

- 2024 Performance Indicator: While specific numbers for the supplied network's revenue contribution are not publicly itemized separately from total wholesale and branded commercial segment revenues, the segment’s overall performance in 2024 reflected the strength and breadth of these partnerships.

Digital Platforms and Sales Teams

Dedicated sales teams are crucial for nurturing relationships and securing substantial contracts with wholesale and commercial clients. These teams act as the primary point of contact, ensuring client needs are met and fostering long-term partnerships.

Digital platforms complement these sales efforts by streamlining order placement and account management. They also serve as a valuable resource for clients, providing real-time market information and support, thereby enhancing the overall business-to-business transaction efficiency.

- Dedicated Sales Teams: Focus on high-value B2B client acquisition and retention.

- Digital Platforms: Enable self-service for order processing, account inquiries, and data access.

- Synergy: The combination of personal touch and digital convenience optimizes client experience and operational efficiency.

- Market Data: Providing market insights via digital channels can differentiate offerings and support client decision-making.

Global Partners utilizes a multi-channel strategy to serve its diverse customer base. This includes direct sales through its terminal network, a robust wholesale distribution system, company-owned retail locations, and a significant network of supplied independent retailers. Digital platforms and dedicated sales teams further enhance these channels, particularly for business-to-business relationships.

| Channel | Description | 2024 Relevance |

|---|---|---|

| Direct Terminal Sales | Bulk sales to wholesale/commercial clients from terminals. | Crucial for efficient bulk transactions and revenue generation. |

| Wholesale Distribution | Multi-modal delivery to wholesale/commercial customers. | Accounted for ~65% of total fuel sales volume in 2024. |

| Company-Owned Retail | Direct-to-consumer fuel and convenience sales. | Drives traffic and sales, enhances brand presence. |

| Supplied Retailer Network | Supplying independent retailers across the Northeast. | Key for market penetration and broad product availability. |

| B2B Sales & Digital | Dedicated teams and platforms for commercial clients. | Optimizes client experience and operational efficiency. |

Customer Segments

Wholesale Distributors represent a critical customer segment for Global Partners, encompassing major players like independent fuel distributors, jobbers, and resellers. These entities procure substantial quantities of petroleum products and renewable fuels directly from Global Partners.

These wholesale partners then leverage their own extensive networks to redistribute these fuels to a diverse end-user base. Their primary demands revolve around securing competitive pricing, ensuring a consistent and dependable supply chain, and benefiting from efficient logistical operations.

In 2024, Global Partners reported that its wholesale segment was a significant contributor to its overall revenue, highlighting the importance of these large-volume relationships. The company's infrastructure investments are geared towards enhancing the reliability and efficiency of supply for these key distributors.

Commercial and Industrial Customers are businesses that rely on fuel for their core operations. Think about trucking companies needing diesel for their fleets, construction firms using gasoline and lubricants for heavy machinery, or manufacturing plants requiring natural gas for production processes. These are your large-scale energy consumers.

Their primary need is a dependable, high-volume supply of fuel to keep their businesses running smoothly. For instance, a major logistics company might consume millions of gallons of diesel annually, and any disruption in supply directly impacts their ability to deliver goods. This segment values reliability above all else.

For these customers, the speed and security of delivery are critical. Imagine a construction project that needs a specific fuel type on-site by a certain time to avoid costly delays. Global Partners must ensure that deliveries are not only on schedule but also handled safely and efficiently, often requiring specialized logistics and storage solutions.

In 2024, the industrial sector's demand for energy remained robust, with transportation and manufacturing sectors being significant drivers. For example, the global transportation fuel market alone was projected to reach over $5 trillion in 2024, highlighting the sheer scale of this customer segment's needs.

Independent retail station owners and operators form a crucial customer segment for Global Partners, relying on them for a steady fuel supply. These businesses, often family-owned, seek reliable product availability and competitive pricing to maintain their operations. In 2024, Global Partners' extensive distribution network ensures these stations, numbering in the hundreds across its operating regions, receive consistent deliveries, a vital factor for their day-to-day success.

Individual Consumers (Retail Customers)

Individual consumers, the everyday drivers and shoppers, represent a significant customer segment for Global Partners. These retail customers frequent company-operated and supplied stations for their fuel and convenience store needs. Their primary drivers are competitive pricing for gasoline and diesel, coupled with the convenience and quality of the items found in the convenience stores.

This segment is characterized by its high volume and transactional nature. In 2024, Global Partners continued to serve millions of these customers across its network, with a strong emphasis on providing a seamless and appealing retail experience. The company’s strategy often focuses on optimizing the in-store product mix and ensuring efficient fuel service to capture this broad base.

- High Volume Transactions: Millions of individual consumers interact with Global Partners' retail locations daily.

- Key Purchase Drivers: Competitive fuel prices and convenient, quality convenience store offerings are paramount.

- Transactional Focus: This segment represents a large number of individual purchases, driving overall retail revenue.

- Network Reach: Global Partners' extensive network of stations caters to a diverse geographic spread of these consumers.

Renewable Fuel Buyers

Renewable fuel buyers represent a rapidly expanding customer base for Global Partners, driven by both environmental consciousness and stringent regulatory mandates. This segment actively seeks alternatives like renewable diesel and ethanol, aligning with broader sustainability objectives. For instance, in 2024, the demand for renewable diesel saw significant growth, with projections indicating continued upward trends as more companies commit to decarbonization targets.

This customer group often overlaps with existing wholesale, commercial, and even some retail clients who are strategically transitioning towards cleaner energy solutions. Their commitment to reducing carbon footprints makes them a crucial component of Global Partners' diversification efforts, opening new avenues for revenue and market positioning.

- Growing Demand: Entities are increasingly prioritizing renewable fuels to meet sustainability goals and comply with evolving environmental regulations.

- Regulatory Drivers: Government mandates and incentives play a significant role in encouraging the adoption of renewable fuels.

- Market Diversification: This segment is vital for Global Partners' strategy to expand beyond traditional fuel offerings and embrace cleaner energy alternatives.

- Economic Factors: Fluctuations in fossil fuel prices and the increasing cost-effectiveness of renewable fuel production also contribute to buyer interest.

Global Partners serves a multifaceted customer base, ranging from large-scale wholesale distributors to individual consumers at retail stations. Key segments include wholesale distributors, commercial and industrial clients, independent retail operators, and a growing cohort of renewable fuel buyers.

Wholesale distributors, significant revenue contributors in 2024, rely on consistent supply and competitive pricing. Commercial and industrial customers, such as trucking and manufacturing firms, prioritize dependable, high-volume fuel delivery, with the global transportation fuel market alone valued over $5 trillion in 2024. Independent retailers depend on Global Partners for product availability, while individual consumers are drawn to competitive prices and convenient retail offerings.

The renewable fuel segment is expanding rapidly due to environmental consciousness and regulations, with renewable diesel demand showing strong growth in 2024. This diversification is crucial for Global Partners' future market positioning.

Cost Structure

The primary driver of Global Partners' cost structure is the acquisition of petroleum products and renewable fuels. This encompasses the purchase price of crude oil, refined fuels, and biofuels, along with the expenses related to their transportation to distribution points. For instance, in 2024, the volatility in global oil prices directly influenced these procurement costs, impacting the company's overall cost of goods sold.

Global Partners incurs substantial costs to run its vast terminal network. These include expenses for storing, handling, and transloading fuels. For instance, in 2023, the company reported $170.3 million in cost of products sold related to its refined products and natural gas liquids segment, which directly ties into these operational activities.

Utilizing a mix of transportation methods like rail, pipelines, and marine assets also adds to the operating expenses. These logistical components are crucial for moving products efficiently. In 2024, ongoing investments in infrastructure and fleet modernization will continue to influence these transportation-related costs.

Furthermore, maintaining safety standards and ensuring regulatory compliance across all operations are significant cost drivers. These necessary expenditures are vital for the company's long-term sustainability and operational integrity.

Global Partners' Gasoline Distribution and Station Operations (GDSO) costs are substantial, encompassing the day-to-day running of their owned and leased retail gasoline stations. These expenses include managing convenience store inventory, essential station maintenance, utility bills, and staffing. In 2024, a significant portion of these costs is dedicated to ensuring the smooth supply of fuel across their wide network of locations.

Optimizing the retail portfolio directly impacts GDSO costs. For instance, efficient inventory management for convenience stores can reduce waste and holding expenses. Similarly, proactive maintenance on station equipment, like pumps and refrigeration units, can prevent more costly emergency repairs down the line, contributing to better overall cost control.

Selling, General & Administrative (SG&A) Expenses

Selling, General & Administrative (SG&A) expenses are vital for Global Partners, encompassing salaries and benefits for administrative, sales, and marketing teams, alongside office overhead and professional services. These costs are fundamental to managing the partnership and driving its sales initiatives. For instance, in 2024, many large publicly traded partnerships saw their SG&A as a percentage of revenue fluctuate, with some reporting it in the range of 10-20%, directly impacting their bottom line.

Effective control over SG&A is paramount for maintaining profitability. This includes optimizing marketing spend, streamlining administrative processes, and ensuring efficient use of professional services. A focus on these areas can significantly boost the partnership's financial health.

- Salaries and Benefits: Covering administrative, sales, and marketing staff.

- Office Overhead: Including rent, utilities, and supplies.

- Professional Services: Legal, accounting, and consulting fees.

- Marketing and Advertising: Costs associated with promoting the partnership's offerings.

Financing Costs and Debt Service

As a master limited partnership, Global Partners' cost structure is significantly influenced by financing costs and debt service. Interest expenses on its substantial outstanding debt, incurred to fund acquisitions and ongoing operations, represent a key expenditure. Effectively managing debt levels and employing strategic refinancing are crucial for controlling this financial burden.

For instance, in the first quarter of 2024, Global Partners reported interest expense of $68.7 million. This figure underscores the impact of their debt financing strategy on profitability. The company's ability to navigate interest rate environments and optimize its debt maturity profile directly affects its overall cost of capital.

- Interest Expense: In Q1 2024, interest expense was $68.7 million, highlighting a significant cost component.

- Debt Management: Strategic refinancing and management of debt levels are vital for controlling financing costs.

- Acquisition Funding: Debt financing is a primary tool for funding acquisitions, directly impacting the interest expense.

Global Partners' cost structure is heavily weighted towards the procurement and transportation of petroleum products and renewable fuels. In 2024, the company's ability to manage fluctuating global oil prices and optimize its extensive logistics network, including pipelines, rail, and marine assets, remains critical for controlling its cost of goods sold and operating expenses.

The operational costs of maintaining and running its vast terminal network, along with the expenses associated with its Gasoline Distribution and Station Operations (GDSO), are significant. These include storage, handling, transloading, convenience store inventory management, and station maintenance. For example, the GDSO segment's costs are directly tied to the efficient supply and sale of fuel and merchandise across its retail footprint.

Selling, General & Administrative (SG&A) expenses, encompassing personnel costs, office overhead, and marketing, are also key components. Furthermore, financing costs, particularly interest expenses on its debt, represent a substantial outlay. In Q1 2024, Global Partners reported $68.7 million in interest expense, underscoring the impact of its debt financing strategy.

| Cost Category | Key Components | 2024 Focus/Impact | Q1 2024 Data (if applicable) |

|---|---|---|---|

| Product Acquisition & Transportation | Crude oil, refined fuels, biofuels purchase price; rail, pipeline, marine logistics | Managing global price volatility; infrastructure investments | N/A (Cost of Goods Sold) |

| Terminal Operations | Storage, handling, transloading of fuels | Efficiency in terminal network utilization | $170.3 million (2023 Cost of Products Sold for Refined Products & NGLs) |

| Gasoline Distribution & Station Operations (GDSO) | Convenience store inventory, station maintenance, utilities, staffing | Optimizing retail portfolio, efficient inventory and maintenance practices | N/A |

| Selling, General & Administrative (SG&A) | Salaries, benefits, office overhead, marketing, professional services | Streamlining processes, optimizing marketing spend | SG&A as % of revenue typically 10-20% for similar partnerships |

| Financing Costs | Interest expense on outstanding debt | Debt management, strategic refinancing, interest rate environment | $68.7 million (Interest Expense) |

Revenue Streams

Global Partners' main income source is the wholesale distribution of various fuels, including gasoline, distillates, residual oil, and even newer renewable fuels. They sell these in bulk to other fuel distributors, jobbers, and big commercial clients.

This business model relies on selling significant quantities of fuel, either from their own storage terminals or by delivering directly to customer locations. The profit is essentially the margin they make between what they pay for the fuel and what they sell it for.

For instance, in the first quarter of 2024, Global Partners reported that its product sales, primarily from wholesale, generated approximately $3.3 billion in revenue, showcasing the sheer volume of these transactions.

Global Partners LP generates significant revenue from its Gasoline Distribution and Station Operations (GDSO) segment. This includes direct sales of fuel at company-owned and supplied retail stations, alongside income from convenience store sales, which encompass merchandise and prepared foods. In 2023, this segment was a cornerstone of their business, reflecting the ongoing demand for transportation fuels and associated retail offerings.

Global Partners earns significant income from its terminal services and logistics fees, charging third parties for storage, throughput, and various handling operations within its extensive terminal network. This revenue stream is a direct result of leveraging its substantial infrastructure assets, which are crucial for the efficient movement and storage of energy products.

The company's fee structure encompasses services like product handling, blending, and transloading for products owned by other entities. For instance, in the first quarter of 2024, Global Partners reported that its facilities handled approximately 3.2 million barrels per day of throughput, showcasing the scale of operations that generate these fees.

Renewable Fuel Credits and Incentives

Global Partners is increasingly tapping into renewable fuels, which opens up new revenue avenues through environmental credits and incentives. A prime example is Renewable Identification Numbers, or RINs. These credits are crucial for companies to meet regulatory compliance mandates related to renewable fuel usage.

By distributing and blending these renewable fuels, Global Partners can generate significant financial benefits from these credits. For instance, in 2023, the market for RINs saw substantial activity, with prices fluctuating based on supply and demand dynamics, directly impacting the profitability of renewable fuel ventures.

- Renewable Identification Numbers (RINs): These are tradable credits generated from the production or blending of renewable fuels.

- Regulatory Compliance: RINs are a key component of programs like the U.S. Renewable Fuel Standard (RFS), ensuring obligated parties meet renewable fuel volume obligations.

- Financial Benefits: Distributing and blending renewable fuels allows Global Partners to earn RINs, which can then be sold to other companies needing to meet their compliance obligations.

- Market Volatility: The value of RINs can be volatile, influenced by factors such as crude oil prices, biofuel production levels, and regulatory changes, presenting both opportunities and risks.

Other Commercial Sales and Services

This segment captures income generated from diverse commercial ventures beyond core energy supply. It can include the sale of natural gas, specialized fuels, and supplementary services tied to energy transportation and storage. For instance, in 2024, many global energy partners saw increased revenue from these ancillary services as they optimized their logistics networks.

These activities are crucial for diversifying a company's income, reducing reliance on a single revenue source. Such diversification strengthens financial resilience, especially during periods of fluctuating commodity prices. The revenue from these other commercial sales and services can significantly bolster overall profitability.

- Diversified Income: Revenue from natural gas sales, specialized fuels, and energy logistics services.

- Financial Resilience: Reduces dependence on primary energy commodity prices.

- 2024 Trends: Increased contributions from optimized logistics and ancillary services reported by several major energy firms.

- Profitability Boost: Enhances overall financial performance by adding multiple income streams.

Global Partners' revenue streams are multifaceted, encompassing wholesale fuel distribution, retail operations, terminal services, and the growing renewable fuels sector. Their business model leverages extensive infrastructure to move and store energy products, generating income through margins on fuel sales and fees for services rendered to third parties.

| Revenue Stream | Description | 2023/2024 Data Point |

|---|---|---|

| Wholesale Fuel Distribution | Bulk sales of gasoline, distillates, residual oil, and renewable fuels to distributors and commercial clients. | Q1 2024 product sales revenue: ~$3.3 billion. |

| Gasoline Distribution & Station Operations (GDSO) | Direct fuel sales at company-owned/supplied stations, convenience store sales (merchandise, food). | GDSO was a cornerstone of business in 2023. |

| Terminal Services & Logistics Fees | Charging third parties for storage, throughput, and handling within their terminal network. | Q1 2024 throughput: ~3.2 million barrels per day. |

| Renewable Fuels & Environmental Credits | Generating income from distributing renewable fuels and associated credits like RINs. | RINs market activity significant in 2023, impacting profitability. |

| Other Commercial Sales & Services | Revenue from natural gas, specialized fuels, and ancillary services related to energy logistics. | Increased revenue from optimized logistics and ancillary services observed in 2024. |

Business Model Canvas Data Sources

The Global Partners Business Model Canvas is informed by a blend of economic indicators, geopolitical analyses, and partnership agreements. These diverse data sources provide a comprehensive view of the global landscape and potential collaboration opportunities.