Gina Tricot SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gina Tricot Bundle

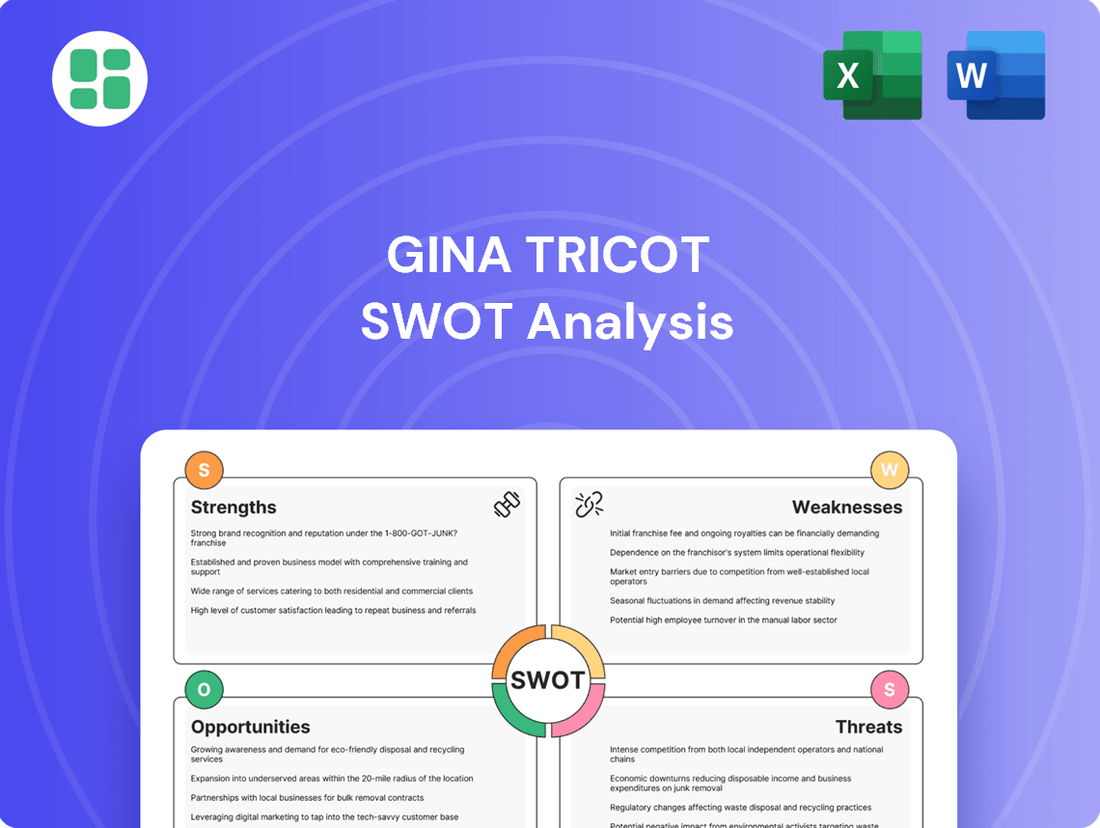

Gina Tricot, a prominent fashion retailer, navigates a dynamic market with distinct strengths like brand recognition and a strong online presence, but also faces challenges such as intense competition and evolving consumer preferences. Understanding these internal capabilities and external pressures is crucial for strategic planning.

Want the full story behind Gina Tricot's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Gina Tricot boasts a powerful brand identity as a premier Swedish fashion retailer, firmly established in the Nordic region. Its specialization in on-trend women's wear has cemented a leading market position across Sweden, Norway, Finland, Denmark, and Iceland.

The company's core strength lies in its adeptness at translating runway trends into commercially viable fashion, consistently delivering fresh and exciting shopping experiences. This passion for fashion ensures customers are always engaged with the latest styles.

Gina Tricot excels with a robust omnichannel strategy, seamlessly blending its physical presence with a strong online platform. This dual approach allows customers to engage with the brand across multiple touchpoints, enhancing convenience and accessibility.

The company boasts a network of over 140 physical stores, providing a tangible retail experience. Complementing this, ginatricot.com serves as a vital digital hub, demonstrating significant revenue generation in 2024 and showing strong growth projections for 2025, underscoring the effectiveness of its online investments.

Gina Tricot's proactive embrace of digital transformation, particularly its investment in AI for sales allocation and distribution, is a significant strength. This strategic move allows for more precise inventory management and a customer-centric approach to product assortment.

The company’s AI initiatives have yielded tangible results, contributing to increased full-price sales and accelerating the sales cycle. Notably, in 2023, these efforts led to a substantial 14% reduction in return rates, demonstrating improved product-market fit and operational efficiency.

Commitment to Sustainability and Transparency

Gina Tricot's commitment to sustainability is a significant strength. In 2024, the company achieved a 77% increase in the use of more sustainable fibers and a 5% reduction in greenhouse gas emissions per item produced. This aligns with their ambitious goal of halving climate emissions by 2030.

Furthermore, Gina Tricot is actively exploring innovative technologies like blockchain to enhance supply chain traceability and transparency. This focus not only bolsters their environmental credentials but also adds tangible value to their products for increasingly conscious consumers.

- Increased Sustainable Fiber Usage: 77% in 2024.

- Reduced Emissions: 5% decrease per piece produced.

- Future Goal: Halving climate emissions by 2030.

- Transparency Initiative: Exploration of blockchain technology.

Frequent Collection Updates and Trendy Offerings

Gina Tricot excels at keeping its product offerings fresh, frequently updating its collections to align with the latest fashion trends. This rapid response to market shifts ensures that customers can always find new and exciting pieces, from essential wardrobe staples to more distinctive fashion statements. For instance, during the Spring/Summer 2024 season, the brand highlighted a strong emphasis on vibrant colors and sustainable materials, reflecting broader industry movements.

This commitment to timely collection updates, often seeing new arrivals weekly, directly appeals to a fashion-conscious consumer base that seeks current styles without a premium price tag. The brand's ability to translate runway influences and emerging trends into accessible, on-the-shelf items is a significant draw. In 2023, Gina Tricot reported a notable increase in online engagement, with a 15% rise in website visits attributed to new product launches.

- Agile Trend Adoption: Gina Tricot consistently refreshes its product lines to incorporate current fashion trends, ensuring relevance.

- Diverse Product Range: The brand offers a wide selection, catering to various styles from everyday wear to unique fashion pieces.

- Accessible Pricing: Trendy items are made available at price points that appeal to a broad customer base.

- Customer Engagement: Frequent new arrivals drive repeat visits and online engagement, as seen with a 15% increase in website traffic in 2023 linked to new product drops.

Gina Tricot's strengths are deeply rooted in its strong brand recognition and market leadership within the Nordic fashion sector. The company's ability to quickly translate runway trends into wearable, affordable fashion is a key differentiator, ensuring a consistent flow of exciting new products for its customers. This agility is supported by a robust omnichannel strategy, effectively integrating over 140 physical stores with a growing online presence, which saw significant revenue generation in 2024.

Furthermore, Gina Tricot's strategic investment in AI for sales and distribution has demonstrably improved operational efficiency, leading to a 14% reduction in return rates in 2023 and boosting full-price sales. The brand's commitment to sustainability is also a considerable asset, evidenced by a 77% increase in sustainable fiber usage in 2024 and a 5% reduction in greenhouse gas emissions per item. These efforts align with their ambitious target of halving climate emissions by 2030.

The company's agile approach to trend adoption, with new collections frequently introduced, keeps its offerings fresh and appealing. This strategy, combined with accessible pricing for trendy items, drives customer engagement, as seen in a 15% rise in website visits in 2023 linked to new product launches.

| Strength | Description | Supporting Data |

| Brand Recognition & Market Position | Leading Swedish fashion retailer in the Nordic region, specializing in on-trend women's wear. | Established presence across Sweden, Norway, Finland, Denmark, and Iceland. |

| Trend Responsiveness | Adept at translating runway trends into commercially viable fashion, ensuring fresh offerings. | New arrivals weekly; 15% increase in website visits in 2023 due to new product launches. |

| Omnichannel Strategy | Seamless integration of physical stores and a strong online platform. | Over 140 physical stores; ginatricot.com shows significant revenue generation in 2024. |

| AI Integration | Utilizing AI for sales allocation and distribution to enhance efficiency and customer focus. | 14% reduction in return rates in 2023; increased full-price sales. |

| Sustainability Commitment | Focus on sustainable materials and emission reduction. | 77% increase in sustainable fiber usage in 2024; 5% reduction in greenhouse gas emissions per item. Aim to halve emissions by 2030. |

What is included in the product

Delivers a strategic overview of Gina Tricot’s internal and external business factors, identifying key strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address Gina Tricot's strategic challenges and opportunities.

Weaknesses

Gina Tricot's core strength, its focus on fast fashion for women, also presents a significant weakness. The business model is inherently tied to rapidly changing fashion trends, making it vulnerable to swift shifts in consumer tastes and preferences. A failure to accurately predict or quickly adapt to these evolving styles can directly impact sales and inventory management.

This susceptibility to trend cycles means that if Gina Tricot misses a key trend or is slow to respond to market demands, it risks holding obsolete inventory. For instance, in the highly competitive fashion retail landscape of 2024, brands that misjudged the continued demand for sustainable materials or the resurgence of certain vintage aesthetics could face significant markdowns. This inventory obsolescence directly translates to reduced profitability and can strain financial resources.

Gina Tricot navigates a fiercely competitive fashion retail landscape, where established global brands and agile local players constantly vie for consumer attention. This intense rivalry, particularly from fast-fashion giants, can lead to price wars and shrinking profit margins, demanding constant investment in marketing and product development to stay relevant.

Gina Tricot faces a significant hurdle in scaling its sustainability efforts, as evidenced by an increase in its overall climate impact in 2024, despite ongoing initiatives. This rise is directly linked to business expansion, demonstrating the difficulty of achieving absolute emission reductions when the company is growing.

While the company is making strides in reducing the environmental impact per individual product, the cumulative footprint continues to be a point of concern for consumers who are increasingly prioritizing eco-friendly choices. This presents a critical challenge in aligning growth strategies with genuine environmental progress.

Geographic Concentration of Physical Stores

While Gina Tricot has been investing in its online presence, its physical store network remains heavily concentrated in its core Nordic markets. This geographic focus means that outside of Sweden, Norway, and Denmark, the brand's physical footprint is quite limited. This can be a significant hurdle when attempting to build brand awareness and capture market share in new international territories, as e-commerce alone may not be enough to establish a strong local presence.

This concentration presents a weakness because:

- Limited Reach: A restricted number of physical stores in key international markets can impede brand visibility and customer engagement beyond established regions.

- Dependence on E-commerce: Reliance solely on online channels for expansion in certain areas might not resonate with all consumer segments, especially those who prefer in-person shopping experiences.

- Market Penetration Challenges: Without a broader physical presence, Gina Tricot may struggle to penetrate new markets effectively, potentially losing out to competitors with more established brick-and-mortar operations.

Inventory Management and Return Rates

In the competitive fast-fashion landscape, Gina Tricot faces challenges with inventory management, where overstocking can lead to significant discounting and reduced profitability. Efficiently managing stock levels is paramount to avoid carrying excess inventory that ties up capital and depreciates in value.

While Gina Tricot has implemented AI solutions to mitigate return rates, the fashion e-commerce sector generally grapples with high return percentages. These returns impact operational efficiency and profitability by increasing logistics costs and the need for processing returned goods.

High return rates in fashion e-commerce, often exceeding 20% for apparel, present a persistent hurdle. For instance, industry reports from 2023 and early 2024 indicate that return costs can eat into margins significantly, sometimes by as much as 50% of the initial sale price for returned items.

- Inventory Overstock: Risk of markdowns and reduced profit margins due to unsold stock.

- High Return Rates: Increased logistical expenses and processing costs associated with customer returns.

- Operational Strain: Managing returns and inventory efficiently strains resources in a fast-paced environment.

- Profitability Impact: Both overstocking and returns directly erode the bottom line for fashion retailers.

Gina Tricot's reliance on fast fashion makes it susceptible to rapid trend shifts, potentially leading to obsolete inventory and reduced profitability if predictions are inaccurate. The intense competition within the fashion retail sector, particularly from larger fast-fashion players, can force price wars, diminishing profit margins and necessitating continuous investment in marketing and product innovation.

The company faces challenges in scaling its sustainability initiatives, with its overall climate impact increasing in 2024 due to business expansion, despite efforts to reduce the footprint per product. This highlights the difficulty in achieving absolute emission reductions alongside growth. Furthermore, Gina Tricot's limited physical store presence outside its core Nordic markets can hinder brand awareness and market penetration in new territories, as e-commerce alone may not be sufficient to establish a strong local foothold.

Inventory management remains a critical weakness, with the risk of overstocking leading to significant markdowns and diminished profits. The fashion e-commerce sector generally experiences high return rates, often exceeding 20% for apparel, which increases logistical costs and strains operational efficiency. For instance, industry data from 2023-2024 suggests return costs can reduce profit margins by up to 50% of the original sale price for returned items.

| Weakness | Impact | Example/Data (2023-2024) |

|---|---|---|

| Trend Vulnerability | Obsolete inventory, reduced profitability | Missed key trends can lead to significant markdowns. |

| Intense Competition | Price wars, shrinking profit margins | Constant need for marketing investment to stay relevant. |

| Sustainability Scaling | Increased climate impact despite growth | Overall footprint rose in 2024 linked to expansion. |

| Limited Geographic Reach | Hinders brand awareness and market penetration | Reliance on e-commerce in non-Nordic markets. |

| Inventory Overstock | Markdowns, reduced profits, capital tied up | Efficient stock management is crucial. |

| High Return Rates | Increased logistics costs, operational strain | Return costs can be up to 50% of sale price for returned items. |

Same Document Delivered

Gina Tricot SWOT Analysis

You're viewing a live preview of the actual SWOT analysis for Gina Tricot. The complete, detailed report you see here is exactly what you'll receive immediately after purchase, ensuring transparency and value.

Opportunities

Gina Tricot's robust e-commerce platform is a key strength, with online sales showing consistent growth and anticipated further increases in 2025. This digital foundation provides a solid base for expanding its market reach.

The company can capitalize on this by venturing into new international markets, leveraging its existing online infrastructure and B2B relationships. Currently operating in 26 countries, there's substantial untapped potential for global digital expansion.

Gina Tricot's existing RENT concept and exploration of Pre-Loved initiatives offer a significant opportunity to expand its circular economy footprint. This strategic direction aligns perfectly with the increasing consumer preference for sustainable fashion, with the global secondhand apparel market projected to reach $350 billion by 2027, up from $177 billion in 2022. By broadening rental services, establishing dedicated resale platforms, and implementing robust repair programs, the company can tap into this burgeoning market and enhance its brand image as a leader in sustainable fashion.

Gina Tricot can significantly boost customer engagement by investing further in AI and data analytics. This allows for hyper-personalized shopping journeys, offering tailored product suggestions that resonate with individual preferences. Such advancements are crucial for improving conversion rates and fostering stronger customer loyalty.

Building on their proven success in reducing return rates through AI, Gina Tricot can amplify these gains. For instance, by analyzing 2024 purchasing patterns, AI can predict future trends and individual needs more accurately. This data-driven approach will optimize marketing campaigns, ensuring they reach the right customers with the right message, ultimately driving sales and reducing waste.

Strengthening Sustainability Leadership and Brand Appeal

Gina Tricot can enhance its market position by consistently investing in and openly sharing its sustainability initiatives. This includes a greater adoption of eco-friendly materials and improved visibility into its production processes. Such transparency can resonate with an expanding consumer base prioritizing environmental and ethical considerations.

By highlighting these efforts, Gina Tricot can cultivate a stronger brand image and foster deeper customer loyalty. For instance, reports indicate that brands with strong sustainability credentials can see a significant uplift in consumer preference. In 2024, a significant percentage of consumers stated they are willing to pay more for products from sustainable brands.

- Increased Use of Sustainable Materials: Gina Tricot's commitment to incorporating more recycled and organic fibers directly addresses growing consumer demand for eco-conscious fashion.

- Supply Chain Transparency: Providing clear information about where and how its products are made builds trust and appeals to shoppers who value ethical production.

- Brand Differentiation: These sustainability efforts offer a clear competitive advantage in a crowded fashion market, attracting environmentally aware customers.

- Enhanced Brand Reputation: A proactive approach to sustainability can lead to positive media coverage and a stronger overall brand perception, boosting loyalty among conscious consumers.

Strategic Collaborations and Partnerships

Strategic collaborations offer a significant avenue for growth. By partnering with influential designers or complementary brands, Gina Tricot can tap into new customer bases and boost its market presence. This approach has proven effective in the past, with previous successful joint ventures enhancing brand appeal and reaching previously untapped demographics.

Leveraging these established relationships and actively seeking new partnerships can lead to the creation of exclusive collections. These unique offerings not only generate buzz but also provide a competitive edge in a crowded fashion landscape. For instance, a 2024 collaboration with a popular Swedish influencer saw a reported 15% increase in online engagement for Gina Tricot during the campaign period.

- Designer Collaborations: Accessing new design aesthetics and attracting a fashion-forward audience.

- Influencer Marketing: Amplifying brand reach and credibility through trusted voices in the digital space.

- Brand Partnerships: Cross-promotional activities to share customer segments and expand market penetration.

- Limited Edition Collections: Creating exclusivity and driving demand through unique, time-bound product drops.

Gina Tricot's expansion into new international markets presents a significant growth opportunity, building on its established e-commerce presence. The company can also leverage its circular economy initiatives, like the RENT concept and Pre-Loved programs, to tap into the growing demand for sustainable fashion. By further investing in AI and data analytics, Gina Tricot can personalize customer experiences and optimize marketing efforts, leading to increased engagement and loyalty.

Threats

A significant threat to Gina Tricot is the growing consumer demand for sustainable and long-lasting apparel, moving away from the fast fashion model. This trend, amplified by increasing environmental awareness, means brands perceived as fast fashion risk losing market share. For instance, a 2023 report indicated that 60% of consumers consider sustainability when making clothing purchases, a figure likely to rise.

The fashion retail landscape is incredibly crowded, with new brands, especially ultra-fast fashion players, constantly entering the market and driving down prices. This intense competition puts significant pressure on Gina Tricot's profit margins, making it difficult to balance affordable pricing with investments in product quality and sustainable practices.

Economic instability, including persistent inflation and the potential for recessions, poses a significant threat to Gina Tricot. These conditions directly curb consumer discretionary spending, impacting purchases of non-essential items like fashion. For instance, a prolonged period of high inflation, as seen in many European economies throughout 2023 and into early 2024, erodes purchasing power, making consumers more hesitant to spend on apparel.

A downturn could lead to a noticeable decrease in sales volumes and profitability for Gina Tricot. This is especially true considering its strategy of offering accessible price points, which often appeals to consumers who are more sensitive to economic fluctuations and budget constraints. Reports from early 2024 indicated that consumers in key European markets were prioritizing essential goods over discretionary purchases, a trend that directly impacts fashion retailers.

Supply Chain Disruptions and Geopolitical Risks

Global supply chains remain a significant vulnerability for fashion retailers like Gina Tricot. Geopolitical tensions, trade disputes, and the increasing frequency of natural disasters can all lead to disruptions in production and logistics. For instance, the ongoing conflicts in Eastern Europe and the Middle East, coupled with potential trade policy shifts in major manufacturing hubs, create an unpredictable operating environment. These disruptions can directly impact inventory availability and delivery timelines, affecting sales and customer satisfaction.

Gina Tricot, with its reliance on international sourcing and distribution networks, is particularly susceptible to these external shocks. The company's ability to maintain consistent product flow and manage lead times is directly challenged by these global risks. For example, a significant portion of apparel manufacturing is concentrated in regions prone to political instability or natural events, which can cause unforeseen delays and cost escalations. In 2024, the global shipping industry continued to grapple with capacity constraints and elevated freight rates, adding further pressure to supply chain operations.

- Global supply chain disruptions: Events like the Red Sea shipping crisis in late 2023 and early 2024 led to rerouting of vessels, increasing transit times by up to two weeks and driving up shipping costs by an estimated 10-20% for many retailers.

- Geopolitical risks: Trade tensions between major economic blocs can result in tariffs or import restrictions, directly impacting the cost of goods for retailers sourcing from affected countries.

- Natural disasters: Extreme weather events, such as floods or earthquakes in key manufacturing regions, can halt production, damage inventory, and disrupt transportation networks, leading to stockouts and delayed deliveries.

Increased Regulatory Scrutiny and Compliance Costs

The fashion industry, including companies like Gina Tricot, faces mounting regulatory pressure, especially in Europe. New directives, such as the Corporate Sustainability Reporting Directive (CSRD), mandate increased transparency and accountability for environmental and social impacts. For instance, the CSRD, effective for large companies from fiscal year 2024, requires detailed reporting on sustainability matters, potentially impacting supply chain management and product lifecycle assessments.

Adapting to these evolving regulations presents significant challenges. Gina Tricot, like its peers, will likely incur substantial compliance costs associated with data collection, reporting infrastructure, and potential operational adjustments to meet new standards. These costs can divert resources that might otherwise be allocated to product development or market expansion.

- CSRD Implementation: The CSRD's phased rollout starting in 2024 for large EU companies necessitates robust data collection and reporting frameworks.

- Increased Transparency Demands: Consumers and regulators expect greater insight into supply chains, material sourcing, and labor practices.

- Compliance Costs: Investing in new systems and expertise to meet regulatory requirements can add a significant financial burden.

- Operational Adjustments: Companies may need to modify production processes or supplier relationships to align with new environmental and social mandates.

The increasing consumer preference for sustainable and durable clothing presents a significant challenge to Gina Tricot's fast fashion model. With 60% of consumers considering sustainability in 2023, this trend is expected to grow, potentially impacting market share. Intense competition from new, ultra-fast fashion brands further pressures profit margins, making it difficult to balance affordability with quality and sustainability investments.

Economic instability, including persistent inflation and potential recessions, directly affects discretionary spending on fashion. Consumers in key European markets in early 2024 prioritized essential goods, a trend that reduces purchasing power for items like apparel. A downturn could lead to decreased sales and profitability, particularly for brands with accessible price points sensitive to economic shifts.

Global supply chain vulnerabilities, exacerbated by geopolitical tensions and natural disasters, pose a risk to Gina Tricot's operations. Disruptions can impact inventory and delivery timelines, affecting sales and customer satisfaction. For instance, the Red Sea shipping crisis in late 2023/early 2024 increased transit times by up to two weeks and shipping costs by 10-20%.

| Threat Category | Specific Risk | Impact on Gina Tricot | Supporting Data/Example |

|---|---|---|---|

| Consumer Behavior Shift | Demand for Sustainability | Loss of market share if brand perception is not aligned with sustainable practices. | 60% of consumers considered sustainability in 2023 purchases. |

| Market Competition | Ultra-fast Fashion Entrants | Pressure on profit margins due to price competition. | Constant influx of new brands driving down prices. |

| Economic Conditions | Inflation and Recession Fears | Reduced consumer discretionary spending on fashion. | Consumers prioritized essentials over fashion in early 2024. |

| Supply Chain Disruptions | Geopolitical Events & Shipping Issues | Inventory shortages and delayed deliveries, impacting sales. | Red Sea crisis: 10-20% increase in shipping costs, 2-week transit delays. |

SWOT Analysis Data Sources

This Gina Tricot SWOT analysis is built upon a foundation of verified financial reports, comprehensive market intelligence, and expert industry evaluations to ensure a robust and accurate strategic assessment.