Gina Tricot Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gina Tricot Bundle

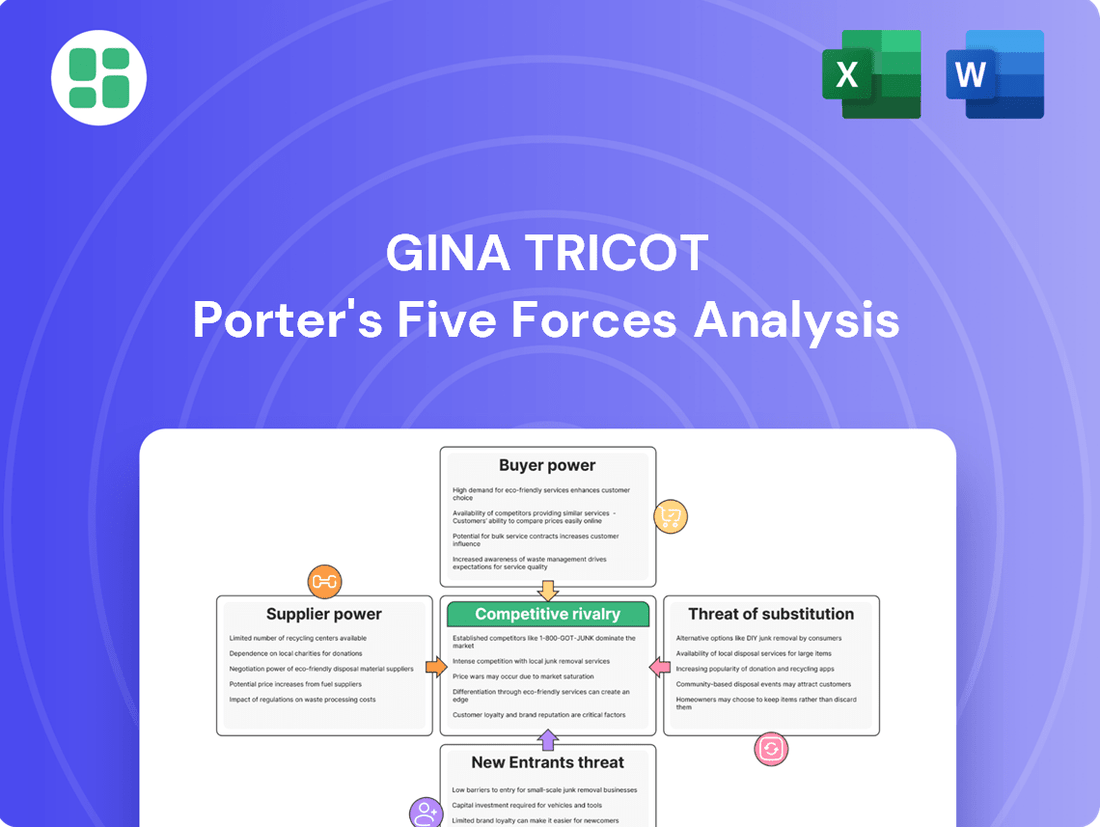

Gina Tricot navigates a dynamic fashion landscape where intense rivalry and the threat of new entrants significantly shape its competitive environment. Understanding the bargaining power of buyers and the availability of substitutes is crucial for their strategic positioning. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Gina Tricot’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Gina Tricot's supplier base is largely fragmented, with many manufacturers located in countries known for lower production costs. This wide distribution of suppliers means that no single supplier holds significant sway over Gina Tricot, as the company can readily shift its business elsewhere.

However, this dynamic can shift if Gina Tricot requires specialized materials or adheres to stringent ethical sourcing standards. In such cases, the number of qualified suppliers shrinks, potentially granting those remaining a stronger bargaining position. For instance, in 2024, the global textile industry faced disruptions, with some niche fabric suppliers experiencing lead time increases of up to 15% due to raw material shortages, impacting pricing power.

For basic garments, Gina Tricot faces low switching costs because numerous factories can produce similar items. This means suppliers of these standard products have limited power. However, the landscape shifts when considering established supplier relationships.

Developing and maintaining partnerships with suppliers that consistently deliver good quality control, meet timely delivery schedules, and adhere to ethical production standards involves considerable effort and investment. The expense and time required to find, vet, and onboard new suppliers for these critical aspects can be substantial, thereby increasing the bargaining power of existing, reliable suppliers.

While many fashion inputs are readily available, Gina Tricot might face suppliers with significant bargaining power if they rely on unique or proprietary designs, specialized sustainable materials, or distinctive prints. For instance, a supplier offering a novel, eco-friendly fabric that is crucial to Gina Tricot's latest collection could command higher prices, as readily available substitutes are scarce.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers for Gina Tricot is generally low. Garment manufacturers typically don't possess the established brand equity, extensive retail networks, or sophisticated direct-to-consumer marketing expertise needed to successfully compete in the fashion retail space. Their strength lies in efficient, large-scale production for numerous clients rather than attempting to replicate a retailer's business model.

This dynamic significantly curtails the bargaining power of suppliers. By focusing on manufacturing and avoiding direct retail competition, suppliers maintain stable, high-volume orders from retailers like Gina Tricot, rather than risking market entry challenges. For instance, in 2024, the global apparel manufacturing sector continued to be fragmented, with many smaller players prioritizing B2B relationships over direct B2C ventures.

- Low Brand Recognition: Most garment manufacturers lack the consumer-facing brand appeal essential for retail success.

- Lack of Retail Infrastructure: Building and managing a retail presence requires significant investment in stores, logistics, and customer service, which is outside the core competency of most manufacturers.

- Marketing and Distribution Expertise: Successfully marketing and distributing fashion directly to consumers demands specialized skills and channels that suppliers often do not possess.

- Focus on Core Competency: Suppliers find greater profitability and stability in mass production for multiple fashion brands rather than engaging in direct retail competition.

Importance of Gina Tricot to Suppliers

Gina Tricot's position as a significant player in the fashion retail sector means it likely accounts for a considerable volume of orders for many of its garment suppliers. This scale of business grants Gina Tricot considerable bargaining power.

For smaller or mid-sized manufacturers, Gina Tricot can be a crucial client, potentially representing a substantial percentage of their total revenue. This reliance allows Gina Tricot to negotiate favorable terms on pricing, product quality standards, and delivery schedules. For instance, if a supplier's business is heavily concentrated on Gina Tricot, they may be more amenable to accommodating the retailer's demands to secure continued orders.

- Supplier Dependence: Smaller or mid-sized garment manufacturers may depend heavily on Gina Tricot for a significant portion of their sales.

- Negotiating Leverage: This dependence gives Gina Tricot leverage to influence pricing, quality specifications, and delivery timelines.

- Market Share Impact: Gina Tricot's substantial order volumes can be a critical factor for suppliers' production planning and financial stability.

Gina Tricot generally experiences low bargaining power from its suppliers. This is primarily due to a fragmented supplier base and the company's significant order volumes, which often make Gina Tricot a key client for many manufacturers.

However, this power can increase for suppliers who provide specialized materials or meet stringent ethical sourcing demands, as qualified alternatives become limited. For instance, in 2024, certain niche fabric suppliers saw lead times extend by up to 15% due to raw material scarcity, influencing their pricing power.

The threat of suppliers integrating forward into retail is minimal, as manufacturers typically lack the brand recognition and infrastructure necessary for direct consumer sales. This focus on production for brands like Gina Tricot reinforces the retailer's advantageous position.

Gina Tricot's substantial purchasing power means it can negotiate favorable terms, especially with smaller manufacturers who rely heavily on its business for revenue and production planning.

| Factor | Impact on Supplier Bargaining Power | Gina Tricot's Position (2024 Context) |

|---|---|---|

| Supplier Fragmentation | Low | Wide distribution of manufacturers limits individual supplier influence. |

| Switching Costs (Basic Garments) | Low | Numerous factories can produce standard items, reducing supplier leverage. |

| Specialized Materials/Ethical Sourcing | Potentially High | Limited qualified suppliers for unique fabrics or ethical standards can increase their power. |

| Supplier Dependence on Gina Tricot | Low | Gina Tricot's large order volumes make it a critical client for many suppliers. |

| Forward Integration Threat | Low | Manufacturers typically lack retail infrastructure and brand equity to compete directly. |

What is included in the product

This Porter's Five Forces analysis for Gina Tricot meticulously examines the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the potential for substitute products within the fashion retail industry.

Visualize competitive intensity with a dynamic Porter's Five Forces chart, instantly highlighting areas of strategic vulnerability for Gina Tricot.

Customers Bargaining Power

Gina Tricot's target market of fashion-conscious shoppers looking for affordable apparel means customers are highly sensitive to price. This sensitivity is evident as consumers readily compare prices for similar trendy items across various fashion retailers. For instance, in 2024, the average consumer spent approximately $1,800 on apparel, with a significant portion allocated to fast fashion, highlighting the importance of competitive pricing.

This intense price sensitivity directly impacts Gina Tricot's ability to maintain its customer base. The company must consistently offer competitive pricing to avoid losing customers to rivals who might offer similar styles at lower costs. In a market where trends change rapidly, price becomes a crucial differentiator for attracting and retaining shoppers.

Customers today have an unprecedented amount of information at their fingertips. Online platforms, social media, and dedicated price comparison websites allow them to easily research and compare fashion retailers, including Gina Tricot. This transparency means they can quickly assess styles, pricing, and read reviews from other shoppers, directly impacting their choices.

This readily available information empowers customers, significantly boosting their bargaining power. They can readily identify if Gina Tricot's offerings are competitive in terms of both price and quality compared to rivals. For instance, during 2024, online fashion searches and price comparisons saw a continued surge, with platforms like Google Shopping and dedicated fashion blogs becoming go-to resources for consumers seeking the best deals and styles.

For customers of Gina Tricot, the ease of switching to a competitor is remarkably high. The financial and psychological costs associated with changing fashion retailers are minimal, allowing consumers to readily explore other options. This low barrier to entry means that if a customer isn't satisfied with Gina Tricot's offerings, they can easily find similar trendy clothing elsewhere.

The fashion market is saturated with numerous alternatives, both online and in brick-and-mortar stores, all vying for consumer attention with comparable styles and price points. This abundance of choice directly contributes to the low switching costs for Gina Tricot's customers. For instance, in 2024, the global online fashion retail market was valued at over $700 billion, indicating a vast competitive landscape where customers have ample opportunities to compare and switch.

Customer Base Fragmentation

Gina Tricot's customer base is largely fragmented, consisting of numerous individual consumers. This fragmentation means that no single customer, or even a small group, accounts for a significant portion of sales, thereby limiting their individual bargaining power.

While individual customers have minimal direct influence, their collective purchasing decisions and evolving preferences significantly shape market trends and demand. Gina Tricot must remain attuned to these broader consumer sentiments to maintain its market position.

- Customer Volume: No single customer or small group represents a substantial percentage of Gina Tricot's overall sales volume, diminishing individual customer leverage.

- Market Influence: Collectively, consumer preferences and purchasing patterns dictate demand and market direction, forcing Gina Tricot to adapt.

- Brand Loyalty: While individual power is low, building strong brand loyalty across the fragmented base can mitigate the overall impact of customer power.

- Price Sensitivity: The fragmented nature can sometimes amplify price sensitivity if competitors offer similar products, though brand appeal can counteract this.

Availability of Substitute Products

The availability of numerous substitute products significantly bolsters customer bargaining power for fashion retailers like Gina Tricot. Beyond direct competitors offering similar apparel, customers can increasingly turn to the growing second-hand clothing market, clothing rental services, or simply choose to extend the lifespan of their current wardrobe. This broad spectrum of alternatives means if Gina Tricot's pricing, quality, or style doesn't meet customer expectations, they have readily accessible options to fulfill their needs without purchasing new items from the brand.

For instance, the global secondhand apparel market was projected to reach $350 billion by 2027, demonstrating a substantial shift in consumer behavior and a clear alternative to new purchases.

- Extensive Substitute Options: Customers can choose from thrift stores, online resale platforms, and clothing rental services.

- Reduced Switching Costs: It is often easy and inexpensive for customers to switch to a substitute product.

- Impact on Pricing Power: The threat of substitutes limits Gina Tricot's ability to raise prices without losing customers.

Gina Tricot faces significant customer bargaining power due to a highly price-sensitive market and readily available information. Consumers in 2024 spent an average of $1,800 on apparel, with fast fashion being a major component, underscoring the need for competitive pricing. This means Gina Tricot must constantly align its prices with market expectations to retain its customer base.

The ease with which customers can compare prices and styles online, amplified by the vastness of the global online fashion retail market valued at over $700 billion in 2024, further empowers them. Low switching costs, coupled with a fragmented customer base, mean that individual customers have little direct leverage, but their collective demand and preferences heavily influence the company's strategy.

The proliferation of substitutes, including the booming secondhand apparel market projected to reach $350 billion by 2027, significantly limits Gina Tricot's pricing power. Customers can easily opt for alternatives, forcing the company to maintain competitive pricing and quality to avoid losing market share.

| Factor | Impact on Gina Tricot | Supporting Data (2024/2025 Estimates) |

|---|---|---|

| Price Sensitivity | High | Average apparel spend: ~$1,800. Fast fashion segment significant. |

| Information Availability | High | Online fashion retail market: >$700 billion. Increased use of comparison sites. |

| Switching Costs | Low | Minimal financial/psychological barriers to changing retailers. |

| Availability of Substitutes | High | Secondhand apparel market: Projected $350 billion by 2027. Rental services growing. |

| Customer Volume | Fragmented | No single customer represents a substantial sales percentage. |

Same Document Delivered

Gina Tricot Porter's Five Forces Analysis

This preview showcases the complete Gina Tricot Porter's Five Forces Analysis you will receive immediately after purchase, offering a comprehensive examination of the competitive landscape. You're looking at the actual document, meaning the depth of analysis regarding the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitute products, and the intensity of rivalry within the fashion retail sector is precisely what you'll gain access to. This professionally formatted report is ready for your immediate use, providing actionable insights into Gina Tricot's strategic positioning.

Rivalry Among Competitors

The fashion retail landscape, particularly for trendy women's apparel, is incredibly crowded. Gina Tricot contends with a vast array of competitors, from massive global brands like H&M and Zara to numerous online-only stores and local boutiques. This intense competition means Gina Tricot must continuously adapt to capture and retain its customer base.

Gina Tricot operates in a highly competitive fashion landscape where numerous brands offer very similar trendy clothing. This means customers can easily find comparable styles and fashion items from rivals, often at similar price points, intensifying the rivalry for market share.

While Gina Tricot strives for unique fashion pieces, the inherently trend-driven nature of the industry means that product differentiation is often short-lived and susceptible to quick imitation by competitors. This dynamic forces companies to constantly innovate and adapt.

Consequently, the competition within this segment is fierce, primarily revolving around how quickly brands can bring new styles to market, their pricing strategies, and the effectiveness of their marketing campaigns. For instance, the fast-fashion sector, where Gina Tricot is a player, saw global revenues reach approximately $1.7 trillion in 2023, highlighting the sheer scale of competition.

Customers can easily switch between fashion retailers with minimal cost or effort. This low switching cost intensifies competition, forcing brands like Gina Tricot to continuously innovate with pricing, product offerings, and marketing to capture and keep shopper loyalty. For instance, the global online fashion market, valued at approximately $750 billion in 2023, showcases this dynamic, with brands vying for market share through frequent sales and new arrivals.

High Fixed Costs and Perishable Inventory

Fashion retail, including players like Gina Tricot, contends with substantial fixed costs. These stem from maintaining a physical store presence, extensive supply chain networks, and ongoing marketing campaigns. For instance, in 2024, the average cost to lease prime retail space in major European cities can range from €50 to €200 per square meter annually, a significant overhead.

Compounding this pressure is the highly perishable nature of fashion inventory. Trends shift rapidly, rendering unsold stock obsolete almost overnight. This necessitates aggressive strategies to move merchandise quickly. In 2024, fashion retailers often resort to frequent sales and promotions to clear inventory, a trend that impacts profit margins but is crucial for managing cash flow and avoiding write-offs.

- High Fixed Costs: Retailers like Gina Tricot invest heavily in physical stores and supply chains, leading to substantial ongoing expenses.

- Perishable Inventory: Fast fashion items quickly lose value as trends change, creating urgency to sell.

- Pressure for Sales Volume: The combination of high costs and perishable goods forces retailers to prioritize high sales throughput, often through competitive pricing.

- Impact on Pricing: This environment often leads to aggressive discounting and promotional activities to clear stock and cover operational expenses.

Diverse Competitive Strategies

Competitors in the fashion industry, including those vying with Gina Tricot, are employing a broad spectrum of strategies. This ranges from the rapid adoption and replication of current trends, often seen in fast fashion models, to a focus on ethically sourced materials and sustainable practices. Furthermore, many players are investing heavily in creating unique brand experiences and aggressively expanding their digital presence and online sales channels.

Gina Tricot faces the challenge of differentiating itself within this dynamic environment. It needs to clearly articulate its specific niche and the unique value it offers to customers amidst such varied competitive approaches. This strategic clarity is crucial for effective positioning and to stand out in a crowded marketplace.

- Fast Fashion Replication: Many competitors focus on quickly bringing runway trends to market at lower price points.

- Sustainability Focus: A growing segment prioritizes eco-friendly materials and ethical production, appealing to environmentally conscious consumers.

- Brand Experience: Companies are investing in creating memorable in-store and online customer journeys to foster loyalty.

- Digital Expansion: Aggressive online marketing, e-commerce optimization, and social media engagement are key growth drivers.

The sheer diversity of these strategies makes it difficult to anticipate and effectively counter the moves of rivals. For instance, while Gina Tricot might focus on its core offerings, a competitor could suddenly launch a highly successful sustainable capsule collection or dominate a new social media marketing trend, requiring constant market monitoring and agile strategic adjustments.

Competitive rivalry is a defining characteristic for Gina Tricot, operating within a saturated fashion market. The industry's low switching costs mean customers can easily move between brands, intensifying the need for Gina Tricot to maintain customer loyalty through compelling offerings and pricing. This constant pressure to attract and retain shoppers fuels intense competition, with brands vying for market share through innovation and aggressive marketing. For example, the global online fashion market, valued at approximately $750 billion in 2023, highlights this intensely competitive environment.

SSubstitutes Threaten

The burgeoning second-hand and resale market presents a substantial threat to new apparel sales. Growing consumer interest in sustainability, coupled with economic pressures, is driving a significant shift towards pre-owned fashion. For instance, the global second-hand apparel market was valued at approximately $177 billion in 2023 and is projected to reach $351 billion by 2027, indicating a robust growth trajectory that directly competes with new item purchases.

Clothing rental services are emerging as a significant substitute, especially for specific needs like special events or trying out high-fashion pieces. This trend, gaining traction in 2024, reflects a growing consumer preference for access over outright ownership, potentially impacting traditional retail models.

While not a direct replacement for everyday wear for many, the increasing popularity of rental platforms signifies a broader shift in consumer behavior. Gina Tricot needs to monitor how this evolving mindset influences purchasing habits for both occasional and potentially more frequent clothing needs.

The growing consumer emphasis on sustainability and product longevity presents a significant threat of substitutes for fast fashion retailers like Gina Tricot. A notable trend is the rise of the second-hand market and rental services, which offer consumers more environmentally friendly and budget-conscious ways to access fashion. For instance, the global second-hand apparel market was projected to reach $350 billion by 2027, indicating a substantial shift away from new purchases.

This cultural pivot encourages repairing, upcycling, and extending the lifespan of existing garments, directly diminishing the demand for new fast fashion items. As consumers increasingly prioritize ethical consumption and reducing their environmental footprint, these practices become viable alternatives to frequent new clothing purchases. Gina Tricot must actively adapt to these evolving consumer values to remain competitive.

DIY and Customization Trends

The growing embrace of do-it-yourself (DIY) fashion, personalization, and handcrafted apparel presents consumers with viable alternatives to conventionally manufactured clothing. This movement, though currently a smaller segment, offers a substitute for individuals prioritizing distinctive fashion choices beyond what mass-market brands typically provide. For example, platforms like Etsy saw a significant increase in sales of handmade goods, with revenue growing by approximately 15% in 2023 compared to the previous year, demonstrating consumer appetite for unique items.

This trend highlights a fundamental consumer desire for individuality that large-scale retailers might find challenging to fully address. The appeal of owning something truly unique, perhaps even co-created, can divert spending from traditional fashion channels. In 2024, the custom apparel market is projected to reach over $2.5 billion globally, underscoring the increasing significance of this substitute threat.

- DIY & Customization as Substitutes: Consumers are increasingly turning to personalized and handmade fashion as an alternative to mass-produced items.

- Niche Market Growth: While not mainstream, the DIY and custom fashion sector is expanding, attracting consumers seeking unique styles.

- Individuality Drive: This trend taps into a consumer desire for self-expression that traditional retailers may not fully satisfy.

- Market Value: The custom apparel market is a growing segment, indicating a tangible shift in consumer preferences and spending.

Spending on Non-Apparel Categories

Consumers have a vast array of choices for their discretionary income, extending far beyond apparel. In 2024, with inflation impacting household budgets, a significant portion of consumer spending is being diverted to essentials and other categories. For instance, spending on experiences like travel and dining, as well as technology and home improvement, often competes directly with fashion purchases.

When economic conditions become challenging, as seen with persistent inflation in 2024, consumers are more likely to prioritize essential spending or alternative discretionary items. This means Gina Tricot isn't just competing with other clothing brands; it's vying for consumer dollars against everything from new smartphones to home renovations, and even travel budgets. The ability of consumers to easily switch their spending to these alternatives represents a significant threat.

- Consumer Discretionary Income Allocation: In 2024, a substantial portion of consumer discretionary income is being allocated to non-apparel categories such as technology, travel, and home goods, directly impacting the fashion sector.

- Economic Tightening Impact: Economic pressures in 2024, including inflation, encourage consumers to substitute fashion purchases with more pressing needs or alternative leisure activities.

- Broad Competitive Landscape: Gina Tricot faces competition not only from other fashion retailers but also from a wide spectrum of industries that capture consumer spending, highlighting the broad threat of substitutes.

The growing popularity of the second-hand and rental markets poses a significant threat to Gina Tricot's new apparel sales. Consumers are increasingly opting for pre-owned or rented clothing due to sustainability concerns and economic prudence. The global second-hand apparel market was valued at approximately $177 billion in 2023 and is projected to grow substantially, directly impacting demand for new garments.

DIY fashion and customization offer consumers unique alternatives to mass-produced clothing, tapping into a desire for individuality. While a niche segment, this trend is growing, as evidenced by the custom apparel market's projected reach of over $2.5 billion globally in 2024, indicating a tangible shift in consumer preferences.

Consumers also divert discretionary spending to non-apparel categories like technology, travel, and home goods, especially amid economic pressures in 2024. This broad competitive landscape means Gina Tricot competes not just with other fashion brands but with a wide array of industries for consumer dollars.

| Substitute Category | Market Value/Growth (Approximate) | Impact on Gina Tricot |

|---|---|---|

| Second-hand Apparel | $177 billion (2023), projected $351 billion (2027) | Directly reduces demand for new apparel. |

| Clothing Rental | Growing trend in 2024 | Offers access over ownership, impacting frequent purchases. |

| DIY & Customization | Custom apparel market > $2.5 billion (2024 projection) | Appeals to individuality, diverting spending from mass-market. |

| Non-Apparel Discretionary Spending | Significant allocation in 2024 due to economic factors | Broad competition for consumer wallets beyond fashion. |

Entrants Threaten

The surge in e-commerce has dramatically reduced the capital needed for new fashion brands to launch, particularly those bypassing physical retail. Online-only entrants can set up shop with considerably lower operational costs, presenting an ongoing challenge to established players like Gina Tricot.

This accessibility means new competitors can emerge quickly, often with innovative marketing and direct-to-consumer models, increasing the overall threat of new entrants. For instance, in 2024, the global e-commerce fashion market continued its robust growth, with many direct-to-consumer brands leveraging social media marketing with minimal upfront investment.

New companies can readily tap into the same global supply chains and manufacturing networks as established fashion retailers like Gina Tricot. This means that the cost and complexity of sourcing materials and producing goods are no longer exclusive advantages for incumbents. For instance, in 2024, the global apparel market's reliance on efficient logistics and manufacturing hubs means that new entrants can leverage these existing infrastructures to launch quickly.

The ease of accessing third-party logistics providers and drop-shipping services further diminishes the traditional barriers associated with inventory management and distribution. This democratized access allows emerging brands to scale their operations with significantly less upfront investment in physical infrastructure, directly impacting the threat of new entrants in the fashion retail sector.

Social media platforms have dramatically lowered the barrier to entry for new fashion brands. In 2024, influencer marketing spend is projected to reach over $21 billion globally, demonstrating its significant impact on brand building. A well-executed social media strategy, leveraging viral content or strategic influencer collaborations, can quickly establish brand awareness and a loyal following, directly challenging established players like Gina Tricot.

Economies of Scale for Incumbents

Established players like Gina Tricot leverage significant economies of scale, particularly in purchasing power. For instance, in 2024, major fashion retailers often negotiate discounts of 10-20% on raw materials due to their bulk orders, a feat difficult for new entrants to replicate immediately. This cost advantage extends to marketing and distribution, where existing infrastructure and brand recognition allow for more efficient customer acquisition and product delivery.

Newcomers face a substantial cost disadvantage as they build their operational volume. Until a new entrant can achieve a similar scale to Gina Tricot, their per-unit costs for production, marketing, and logistics will likely remain higher. This can translate to less competitive pricing or lower profit margins, hindering their ability to gain market share rapidly.

- Purchasing Power: Gina Tricot's large order volumes in 2024 likely secured preferential pricing on textiles and manufacturing, potentially 5-15% lower than a startup could achieve.

- Marketing Efficiency: Established brands can spread marketing costs over a larger customer base, reducing the cost per customer acquired compared to new entrants.

- Distribution Networks: Existing logistics infrastructure provides Gina Tricot with more efficient and cost-effective delivery channels, a significant barrier for new fashion businesses.

- Brand Recognition: The established brand equity of Gina Tricot reduces the marketing investment needed to attract customers compared to an unknown entity.

Customer Loyalty and Brand Recognition

Gina Tricot benefits from significant customer loyalty and strong brand recognition within its core Swedish and Nordic markets. This established presence makes it challenging for new entrants to gain traction. For instance, in 2023, Gina Tricot reported a net sales of SEK 4,971 million, indicating a substantial and loyal customer base.

Newcomers must overcome the hurdle of building trust and familiarity with consumers who are already accustomed to Gina Tricot's offerings. This requires substantial marketing investment and a compelling value proposition to sway existing customer preferences.

The threat of new entrants is thus moderated by the difficulty in replicating Gina Tricot's established brand equity and the associated customer loyalty.

- Established Brand Equity: Gina Tricot's long-standing presence has cultivated a strong brand image.

- Customer Loyalty: A significant portion of its revenue is driven by repeat customers.

- Market Penetration Challenge: New entrants need considerable resources to penetrate the existing customer base.

- Brand Trust: Building consumer trust comparable to Gina Tricot takes time and consistent positive experiences.

The threat of new entrants for Gina Tricot is relatively moderate due to high brand loyalty and established economies of scale, though the digital landscape offers lower entry barriers. While online platforms reduce initial capital needs for new fashion brands, Gina Tricot's purchasing power and marketing efficiency in 2024, potentially securing 10-20% discounts on raw materials, create a significant cost advantage. Replicating Gina Tricot's brand recognition and customer trust, evidenced by SEK 4,971 million in net sales in 2023, requires substantial investment from newcomers.

| Factor | Impact on New Entrants | Gina Tricot's Advantage (2024 Data) |

|---|---|---|

| Digital Accessibility | Lowers barrier to entry | Leverages existing online presence |

| Economies of Scale | High cost disadvantage | 10-20% potential material discounts |

| Brand Recognition & Loyalty | Difficult to replicate | Strong customer base (SEK 4,971M net sales 2023) |

| Marketing Efficiency | Higher cost per acquisition | Lower cost per acquired customer |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Gina Tricot is built upon a foundation of publicly available data, including the company's annual reports, investor presentations, and press releases. We also incorporate insights from reputable fashion industry trade publications and market research reports to understand the competitive landscape.