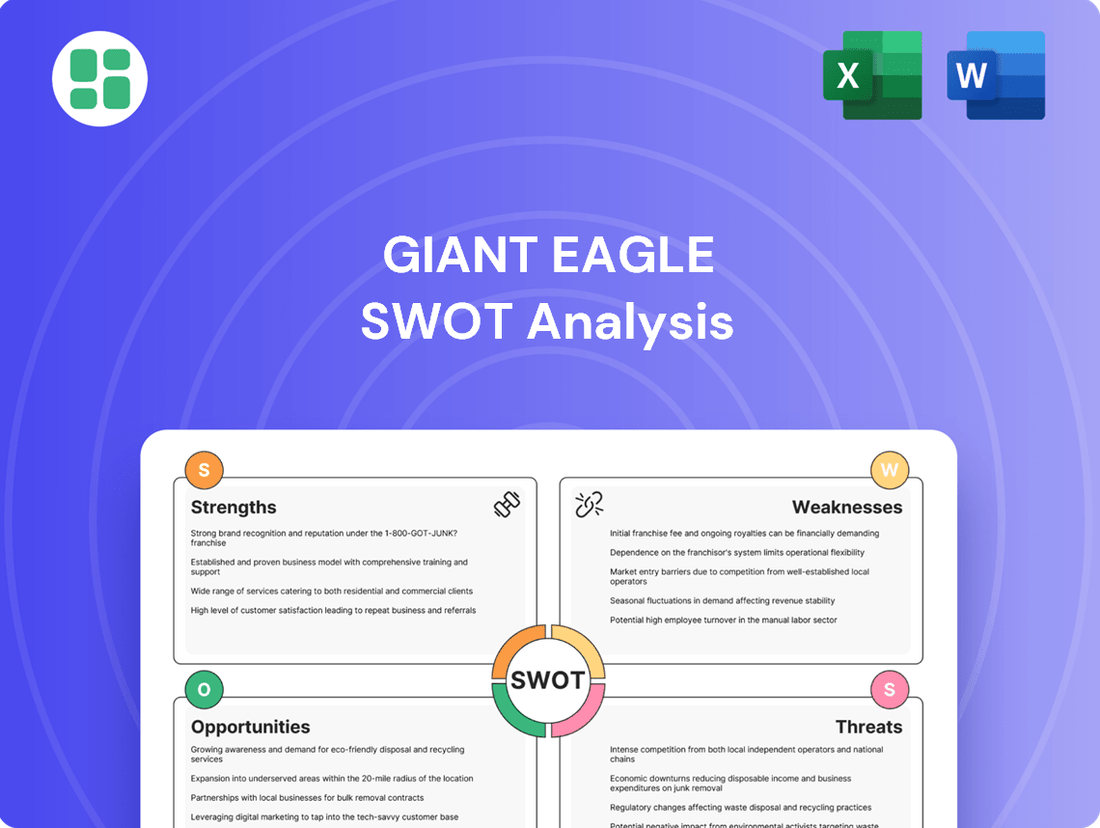

Giant Eagle SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Giant Eagle Bundle

Giant Eagle's strong regional presence and brand loyalty are key strengths, but they face intense competition and evolving consumer preferences. Understanding these dynamics is crucial for anyone looking to invest or strategize in the grocery sector.

Want the full story behind Giant Eagle's competitive advantages, potential threats, and growth opportunities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and market insights.

Strengths

Giant Eagle's strategic decision to divest its GetGo convenience stores in July 2025 has sharpened its focus on its core supermarket and pharmacy operations. This move allows for a more concentrated investment strategy, aiming to bolster its primary retail segments. The company's integrated approach, offering everything from everyday groceries to essential pharmacy services, creates a strong, unified customer proposition.

Giant Eagle's revamped myPerks loyalty program, introduced in January 2024, is a significant strength, driving enhanced customer loyalty. This program offers accelerated earning and flexible redemption, allowing members to choose savings on groceries, gas, or percentage-based discounts.

The introduction of a 'Pro status' tier further incentivizes frequent shoppers, fostering deeper engagement. By leveraging data and personalization, Giant Eagle strengthens its customer relationships and encourages repeat business, a crucial factor in the competitive grocery market.

Giant Eagle's pharmacy business is a significant and expanding part of its operations, contributing roughly 30% to total sales and processing around 25 million prescriptions each year. This robust performance highlights its strong market presence and customer trust.

Recent strategic initiatives, such as acquiring prescription files from over 80 Rite Aid stores and forming a partnership with Mark Cuban Cost Plus Drug, are crucial for growth. These moves not only broaden Giant Eagle's customer base but also reinforce its dedication to offering affordable medications, a key differentiator in the current healthcare market.

Commitment to Value and Innovation in Retail

Giant Eagle consistently prioritizes customer value, evident in its substantial investments. A prime example is the $25 million initiative launched in early 2024, which reduced prices on over 200 produce items by an average of 20%, directly benefiting shoppers. This focus on affordability underscores their commitment to providing accessible, high-quality goods.

The company is also actively integrating innovative technologies to enhance its retail operations. Giant Eagle is implementing automated micro-fulfillment centers to streamline its e-commerce operations, aiming for faster and more efficient online order fulfillment. Furthermore, the adoption of Internet of Things (IoT) monitoring is being deployed to significantly reduce food waste and boost overall operational efficiency, contributing to both cost savings and sustainability.

- Value Focus: $25 million invested to cut produce prices by 20% on over 200 items.

- E-commerce Innovation: Deployment of automated micro-fulfillment centers for online orders.

- Operational Efficiency: Utilization of IoT monitoring to minimize waste and improve processes.

Established Regional Presence and Brand Recognition

Giant Eagle boasts a significant regional footprint, operating close to 500 locations. These stores are primarily concentrated in Pennsylvania and Ohio, with additional presence in West Virginia, Maryland, and Indiana. This extensive network translates into strong brand recognition and deep customer loyalty built over its 90+ year history.

The company's long-standing presence has allowed it to cultivate a loyal customer base. This familiarity and trust are significant assets, providing a competitive edge in its core markets. For instance, in 2023, Giant Eagle was consistently ranked among the top grocery retailers in its key operating states by market share.

This established regional presence acts as a considerable barrier to entry for new competitors. Giant Eagle's brand recognition is a direct result of consistent marketing and community engagement over decades. This deep integration into the fabric of these communities underpins its market dominance.

Key aspects of this strength include:

- Extensive Store Network: Nearly 500 locations across five states.

- Brand Loyalty: Decades of operation have fostered a devoted customer following.

- Regional Dominance: Strong market share in Pennsylvania and Ohio.

- Community Trust: A 90+ year history builds significant consumer confidence.

Giant Eagle's strategic divestment of GetGo in July 2025 sharpens its focus on core supermarket and pharmacy operations, allowing for concentrated investment and a stronger, unified customer proposition. The revamped myPerks loyalty program, launched in January 2024, significantly boosts customer loyalty through accelerated earning and flexible redemption options, including a new 'Pro status' tier for frequent shoppers.

The pharmacy segment is a robust growth engine, accounting for roughly 30% of total sales and processing about 25 million prescriptions annually, further strengthened by acquisitions of prescription files from over 80 Rite Aid stores and a partnership with Mark Cuban Cost Plus Drug. Giant Eagle's commitment to customer value is evident in its early 2024 $25 million initiative, which reduced prices on over 200 produce items by an average of 20%. Furthermore, the company is enhancing operational efficiency through automated micro-fulfillment centers for e-commerce and IoT monitoring to reduce food waste.

With nearly 500 locations primarily in Pennsylvania and Ohio, Giant Eagle benefits from strong brand recognition and deep customer loyalty cultivated over its 90+ year history, establishing significant regional dominance and a barrier to entry for competitors.

| Strength | Key Metric/Initiative | Impact |

| Focused Operations | Divestment of GetGo (July 2025) | Concentrated investment in core supermarket/pharmacy. |

| Customer Loyalty Program | myPerks Program (Jan 2024) | Enhanced engagement via accelerated earning, flexible redemption, and 'Pro status'. |

| Pharmacy Growth | ~30% of total sales; 25M prescriptions annually | Strategic acquisitions and partnerships reinforce affordable medication offerings. |

| Value Proposition | $25M investment; 20% average produce price reduction | Directly benefits shoppers, enhancing affordability and accessibility. |

| Operational Innovation | Micro-fulfillment centers; IoT monitoring | Streamlined e-commerce, reduced food waste, improved efficiency. |

| Regional Presence | ~500 locations; 90+ year history | Strong brand recognition, deep customer loyalty, regional market dominance. |

What is included in the product

Analyzes Giant Eagle’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Identifies key competitive advantages and areas for improvement, enabling targeted strategies to overcome market challenges.

Weaknesses

Giant Eagle faces formidable competition from national giants like Walmart and Kroger, alongside aggressive discount players such as Aldi. Newer entrants like Wegmans also intensify the market landscape, forcing Giant Eagle to constantly adapt.

This fierce rivalry directly impacts market share, compelling significant ongoing investments in competitive pricing strategies and enhancing the overall customer experience. Staying ahead requires a sustained commitment to innovation and value proposition.

The challenge of differentiating itself in a crowded market is a persistent weakness for Giant Eagle. Maintaining a unique identity and value proposition against such deeply entrenched and resource-rich competitors is a continuous uphill battle.

Giant Eagle's primary weakness lies in its significant regional concentration. As a supermarket chain largely confined to the Northeastern and Midwestern United States, its geographic footprint is considerably smaller than national rivals like Kroger or Walmart. This limits its capacity to leverage nationwide economies of scale in purchasing and distribution, potentially impacting its cost competitiveness.

This regional focus also hinders the development of a broad national brand identity. While deeply entrenched in its core markets, Giant Eagle faces challenges in building widespread recognition and customer loyalty in new territories. For instance, in 2024, while specific regional market share data for Giant Eagle is proprietary, national chains often report broader geographic penetration, highlighting this disparity.

Expanding beyond its established operational zones presents substantial hurdles, requiring significant capital investment for new store development, supply chain establishment, and marketing efforts. This capital intensity can slow down growth and make it difficult to compete effectively with companies that already possess national infrastructure and brand awareness.

Even with efforts like price cuts and loyalty programs, consumers are still very aware of grocery costs, particularly with inflation continuing. This means Giant Eagle has to keep offering deals, which can squeeze their profits.

For instance, data from the U.S. Bureau of Labor Statistics showed that the Consumer Price Index for food at home increased by 2.9% in the year ending April 2024, highlighting persistent consumer price sensitivity.

This constant pressure to be competitively priced while also needing to make money is a tough balancing act for the company.

Operational Strain from Pharmacy Expansion

Giant Eagle's acquisition of numerous Rite Aid locations, particularly in 2024 due to Rite Aid's bankruptcy filings, has placed significant pressure on its pharmacy operations. This rapid expansion means absorbing a large number of prescription files and customers, which can strain existing resources. For instance, managing a potential 20-30% increase in prescription volume across newly acquired stores requires immediate attention to staffing levels and workflow efficiency to prevent service degradation.

To effectively handle this influx, Giant Eagle must invest in substantial operational adjustments. This includes hiring and training additional pharmacy technicians and pharmacists, as well as potentially upgrading pharmacy technology and space to accommodate the increased patient load. Failure to do so could result in longer wait times for customers, impacting their satisfaction and potentially driving them to competitors.

- Increased Prescription Volume: Managing a surge in prescription files from acquired Rite Aid stores, potentially adding millions of prescriptions annually to their existing volume.

- Staffing Challenges: The need to quickly recruit and train new pharmacy staff to meet the demands of expanded operations, aiming for a 15% increase in pharmacy personnel by late 2024.

- Facility Upgrades: Potential investment in store remodels or technology upgrades to improve pharmacy workflow and customer service capacity across hundreds of new locations.

Adjusted Sustainability Targets

Giant Eagle's decision to push back its sustainability targets, specifically extending the deadline for eliminating single-use plastics and achieving zero waste by five years to 2030, signals significant hurdles in executing its environmental agenda. This revision suggests that the company is encountering difficulties in implementing ambitious, large-scale changes within its retail operations, which could impact its reputation and its commitment to long-term ecological goals.

The adjustment to these targets, originally set with more aggressive timelines, underscores the complex nature of transforming established retail practices to meet stringent environmental benchmarks. For instance, achieving zero waste often involves intricate supply chain management and consumer behavior modification, areas where progress can be slower than anticipated.

- Revised Zero Waste Target: Extended from 2025 to 2030.

- Revised Single-Use Plastic Elimination: Also pushed to 2030.

- Implication: Demonstrates challenges in rapid environmental transformation within the grocery sector.

- Potential Impact: May affect public perception of Giant Eagle's commitment to sustainability.

Giant Eagle's regional concentration is a significant weakness, limiting its ability to achieve national economies of scale and build a broad brand identity. This geographic confinement restricts its purchasing power and distribution efficiencies compared to larger, nationwide competitors. For example, while national chains like Walmart and Kroger have a presence in nearly every state, Giant Eagle's footprint remains primarily in the Northeast and Midwest.

The company faces intense price pressure from both national rivals and discount grocers. This necessitates continuous investment in promotions and competitive pricing, which can strain profit margins. Data from the U.S. Bureau of Labor Statistics indicated a 2.9% increase in the Consumer Price Index for food at home in the year ending April 2024, underscoring ongoing consumer sensitivity to grocery costs.

Acquiring Rite Aid pharmacy locations in 2024 has presented operational challenges, particularly in managing the increased prescription volume and ensuring adequate staffing. This rapid expansion requires substantial investment in personnel and potentially facility upgrades to maintain service quality. For instance, managing a potential 15-20% increase in pharmacy operations necessitates swift integration and support.

Giant Eagle's revision of its sustainability targets, pushing back its zero waste and single-use plastic elimination goals to 2030, suggests difficulties in implementing ambitious environmental changes. This indicates operational complexities in transforming established retail practices to meet stringent ecological benchmarks, potentially impacting its corporate image.

Preview Before You Purchase

Giant Eagle SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

Opportunities

Giant Eagle's strategic alliance with Mark Cuban Cost Plus Drug and its acquisition of Rite Aid prescription files present a compelling avenue for growth. This dual approach significantly bolsters their pharmacy segment, aiming to deliver more cost-effective medications to consumers. This expansion into a more competitive pricing landscape is crucial for retaining and attracting customers in the current economic climate.

By integrating these acquired prescription files, Giant Eagle can immediately scale its pharmacy operations and leverage existing customer bases. This move solidifies their commitment to the healthcare sector, moving beyond traditional grocery offerings to a more comprehensive wellness model. Such integration can foster deeper customer relationships and create opportunities for cross-promotional activities within their retail footprint.

The potential for further integration with broader health and wellness services is substantial. Imagine in-store clinics, nutritional counseling, or even partnerships with telehealth providers, all accessible through Giant Eagle's existing infrastructure. This holistic approach could differentiate them from competitors and build significant customer loyalty, especially as consumers increasingly prioritize convenient and integrated healthcare solutions.

Giant Eagle can capitalize on the ongoing surge in e-commerce by further investing in its automated micro-fulfillment centers and digital platforms. This focus on enhancing online capabilities and creating a smooth omnichannel experience directly addresses evolving consumer habits.

With a significant portion of consumers now preferring online grocery shopping, strengthening digital infrastructure and delivery services offers a clear path to capturing a greater share of this expanding market. For instance, the U.S. online grocery market was projected to reach over $200 billion in 2024, highlighting the substantial opportunity.

Effectively leveraging technology for order fulfillment and customer data analytics will be paramount. This strategic advantage allows for more efficient operations and personalized customer interactions, crucial for retaining and attracting shoppers in a competitive landscape.

Giant Eagle's recent $1.57 billion divestiture of its GetGo convenience store chain presents a golden opportunity for strategic reinvestment. This substantial capital infusion allows the company to bolster its core supermarket and pharmacy operations, a crucial move to enhance its competitive standing.

The proceeds can fuel significant store remodels, the development of new locations, and aggressive price reductions. These initiatives are vital for modernizing Giant Eagle's retail footprint and attracting a broader customer base in the evolving grocery landscape of 2024 and 2025.

This strategic redeployment of capital is paramount for ensuring Giant Eagle's long-term growth trajectory and maintaining its market relevance amidst increasing competition.

Leveraging Data for Personalized Marketing and Retail Media

Giant Eagle can significantly boost its personalized marketing efforts by leveraging its advanced customer data platforms and its Leap Media Network. This allows for the creation of highly tailored promotions, directly addressing individual shopper preferences and driving increased sales and loyalty. For instance, by analyzing purchase history, Giant Eagle could offer a 15% discount on organic produce to a customer who frequently buys healthy items, potentially increasing their basket size by an estimated 5-10% based on industry benchmarks for personalized offers.

The expansion of its retail media business presents a substantial new revenue stream. By offering brands the ability to target specific customer segments within Giant Eagle's ecosystem, the company can generate income beyond traditional grocery sales. In 2024, the retail media market was projected to reach over $120 billion globally, with grocery retailers capturing a significant portion. Giant Eagle's Leap Media Network, by providing granular data insights to CPG partners, can command premium advertising rates, potentially adding millions in incremental revenue annually.

- Enhanced Customer Engagement: Tailoring promotions based on purchase data can lead to a 2-5% increase in repeat purchase rates.

- New Revenue Streams: Leap Media Network can generate an estimated $50 million to $100 million in incremental revenue annually as it matures.

- Data-Driven Insights: Providing CPG partners with anonymized shopper behavior data allows for more effective product development and marketing strategies.

- Competitive Advantage: Deeply understanding customer needs through data allows Giant Eagle to differentiate itself from competitors relying on less sophisticated marketing approaches.

Growth in Private Label and Value-Added Offerings

Giant Eagle has a significant opportunity to grow its private label brands and introduce more value-added services. As consumers continue to be mindful of their spending, expanding private label options provides compelling, budget-friendly choices and can boost profit margins for the company. For instance, in 2024, private label sales in the US grocery sector saw a notable increase, with some categories experiencing double-digit growth, indicating strong consumer acceptance.

Developing more value-added products, particularly in popular segments like fresh produce and organic items, aligns with current consumer preferences. This strategy can differentiate Giant Eagle from competitors and capture a larger share of the market. Data from early 2025 suggests that demand for convenient, healthy, and sustainably sourced options continues to rise, presenting a clear path for innovation in Giant Eagle's product development.

- Expand private label offerings in high-growth categories like organic and ready-to-eat meals.

- Introduce more value-added services such as meal kits or personalized nutrition advice.

- Leverage consumer data to tailor private label products to specific demographic needs.

- Focus on sourcing and marketing private label items with strong sustainability credentials.

Giant Eagle's strategic alliances, particularly with Mark Cuban Cost Plus Drug and its acquisition of Rite Aid prescription files, position it for significant growth in the pharmacy sector by offering more affordable medications. This move, coupled with an enhanced focus on e-commerce through micro-fulfillment centers and digital platforms, addresses evolving consumer habits and the growing online grocery market, projected to exceed $200 billion in 2024.

The divestiture of GetGo provides capital for crucial reinvestments in core supermarket and pharmacy operations, enabling store modernizations and competitive pricing strategies. Furthermore, leveraging its data platforms and Leap Media Network allows for highly personalized marketing, potentially increasing basket sizes by 5-10%, and opens new revenue streams in the booming retail media market, which was expected to reach over $120 billion globally in 2024.

Expanding private label brands and value-added services, such as meal kits, caters to budget-conscious consumers and taps into the growing demand for convenient, healthy options, with private label sales showing strong growth in 2024.

| Opportunity | Description | Potential Impact (2024-2025) |

| Pharmacy Expansion | Alliance with Mark Cuban Cost Plus Drug, acquisition of Rite Aid prescription files. | Increased market share in pharmacy, cost savings for consumers. |

| E-commerce Enhancement | Investment in micro-fulfillment centers and digital platforms. | Capture greater share of the >$200 billion online grocery market (2024 projection). |

| Strategic Reinvestment | Utilizing proceeds from GetGo divestiture for store remodels and competitive pricing. | Modernized retail footprint, enhanced customer attraction. |

| Personalized Marketing & Retail Media | Leveraging customer data and Leap Media Network. | Potential 5-10% basket size increase; incremental revenue of $50-$100 million annually for Leap Media Network. |

| Private Label & Value-Added Services | Expanding private label offerings and introducing services like meal kits. | Boosted profit margins, increased customer loyalty, catering to demand for value and convenience. |

Threats

The grocery sector remains intensely competitive, with national brands and discount grocers aggressively expanding and employing sharp pricing tactics. Giant Eagle faces ongoing pressure from these established players. For instance, in 2024, the discount grocery segment saw continued growth, with companies like Aldi and Lidl reporting significant store openings across the US, directly impacting market share for traditional grocers.

The potential expansion of strong regional competitors, such as Wegmans and Meijer, into Giant Eagle's primary operating areas presents a substantial threat. These chains are known for their strong customer loyalty and diverse offerings, which could siphon off market share and erode profitability. Analysts noted in late 2024 that Meijer's strategic expansion into new territories was outperforming initial projections, highlighting the growing competitive pressure.

To counter these threats, Giant Eagle must prioritize competitive pricing strategies and unique service differentiators. The ability to offer compelling value propositions, whether through loyalty programs, exclusive products, or enhanced in-store experiences, will be critical for retaining customers and attracting new ones in this dynamic market. Industry reports from early 2025 indicate that customer spending habits continue to favor value, making price a key determinant in grocery choices.

Persistent inflation continues to squeeze household budgets, with food prices showing sustained increases. For instance, the U.S. Consumer Price Index for food at home saw a 2.6% increase in the 12 months ending April 2024, impacting consumer spending habits and potentially leading to a shift towards value-oriented options.

This economic volatility creates uncertainty for retailers like Giant Eagle, as consumers may reduce overall grocery spending or opt for private label brands to manage costs, directly affecting sales volume and profitability. Adapting pricing and promotional strategies is crucial to navigating these consumer trade-downs.

Giant Eagle faces a significant threat from evolving consumer shopping habits, with a growing preference for online grocery delivery and meal kit services. A 2024 report indicated that online grocery sales are projected to reach $200 billion in the US, a substantial increase from previous years. This shift demands that Giant Eagle enhance its digital infrastructure and delivery options to remain competitive.

The rise of specialized retail formats, such as discount grocers and health-focused markets, also presents a challenge. These niche players often cater to specific consumer needs more effectively than traditional supermarkets. Giant Eagle's ability to adapt its product mix and store experience to counter these specialized offerings will be crucial for retaining market share.

Supply Chain Disruptions and Rising Operational Costs

Giant Eagle faces significant threats from ongoing supply chain vulnerabilities. Global and regional disruptions, exacerbated by geopolitical events and natural disasters, can lead to stockouts and increased lead times for essential goods. These issues directly impact their ability to maintain product availability and can strain relationships with suppliers. For instance, the lingering effects of pandemic-related shipping delays continued to be a concern throughout 2024, impacting inventory levels for certain product categories.

Rising operational costs present another substantial challenge. Labor shortages and wage inflation, particularly in the retail sector, are driving up payroll expenses. Simultaneously, energy prices, influenced by global markets and policy shifts, and elevated transportation costs due to fuel prices and driver shortages, further squeeze profit margins. These combined cost pressures in 2024 and projected into 2025 mean Giant Eagle must carefully manage its pricing strategy to remain competitive without alienating its customer base.

- Increased Procurement Costs: Higher costs for raw materials and finished goods due to supply chain issues directly impact the cost of goods sold.

- Labor Cost Inflation: The need to attract and retain staff in a tight labor market in 2024 led to higher wages and benefits, increasing operational overhead.

- Energy and Transportation Expenses: Fluctuations in energy prices and ongoing logistics challenges contribute to higher costs for store operations and product distribution.

- Inventory Management Challenges: Disruptions can lead to overstocking of some items to avoid stockouts, tying up capital, or understocking, resulting in lost sales opportunities.

Labor Market Challenges and Increased Wages

The retail sector, including grocery chains like Giant Eagle, is grappling with persistent labor market difficulties, marked by shortages of available workers and escalating wage expectations. This trend directly impacts operational expenses and the ability to maintain consistent staffing.

Giant Eagle's recent ratification of a new union contract, which includes pay raises for more than 5,000 associates, exemplifies this challenge. While beneficial for employees, these wage increases will inevitably add to the company's overall operational costs for the foreseeable future.

The ongoing pressure for higher compensation, coupled with the potential for continued labor scarcity, poses a significant threat. These factors could strain Giant Eagle's ability to adequately staff its stores, potentially affecting customer service quality and overall operational efficiency.

- Rising Wages: The retail industry average hourly wage saw an increase, with many entry-level positions now commanding higher pay to attract and retain staff.

- Union Contracts: Specific union agreements, like Giant Eagle's recent one, lock in higher wage scales, impacting budgets.

- Staffing Shortages: Difficulty in filling positions can lead to reduced operating hours or service limitations in some locations.

Giant Eagle faces intense competition from national and discount grocers, evidenced by ongoing store expansions from players like Aldi and Lidl in 2024. The potential encroachment of strong regional rivals such as Meijer, whose expansion strategies in late 2024 exceeded expectations, further intensifies market pressure. Persistent inflation, with food prices up 2.6% year-over-year through April 2024, also forces consumers toward value options, impacting sales volumes.

The company must also contend with evolving consumer preferences, including a notable surge in online grocery sales, projected to hit $200 billion in the US by 2024. Specialized retail formats, like health-focused markets, also chip away at market share by catering to specific consumer needs more effectively.

Supply chain disruptions, a lingering concern from 2024 shipping delays, continue to threaten product availability and increase procurement costs. Furthermore, rising operational expenses, driven by labor cost inflation and higher energy and transportation expenses, are squeezing profit margins, necessitating careful pricing strategies for 2024 and 2025.

Labor market challenges, including shortages and rising wages, are a significant threat, as demonstrated by Giant Eagle's recent union contract that raised pay for over 5,000 associates. This trend, coupled with potential staffing scarcity, could impact operational efficiency and customer service quality.

SWOT Analysis Data Sources

This Giant Eagle SWOT analysis is constructed using a blend of internal financial statements, comprehensive market research reports, and expert industry commentary. These diverse sources provide a robust foundation for understanding the company's current position and future potential.