Giant Eagle Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Giant Eagle Bundle

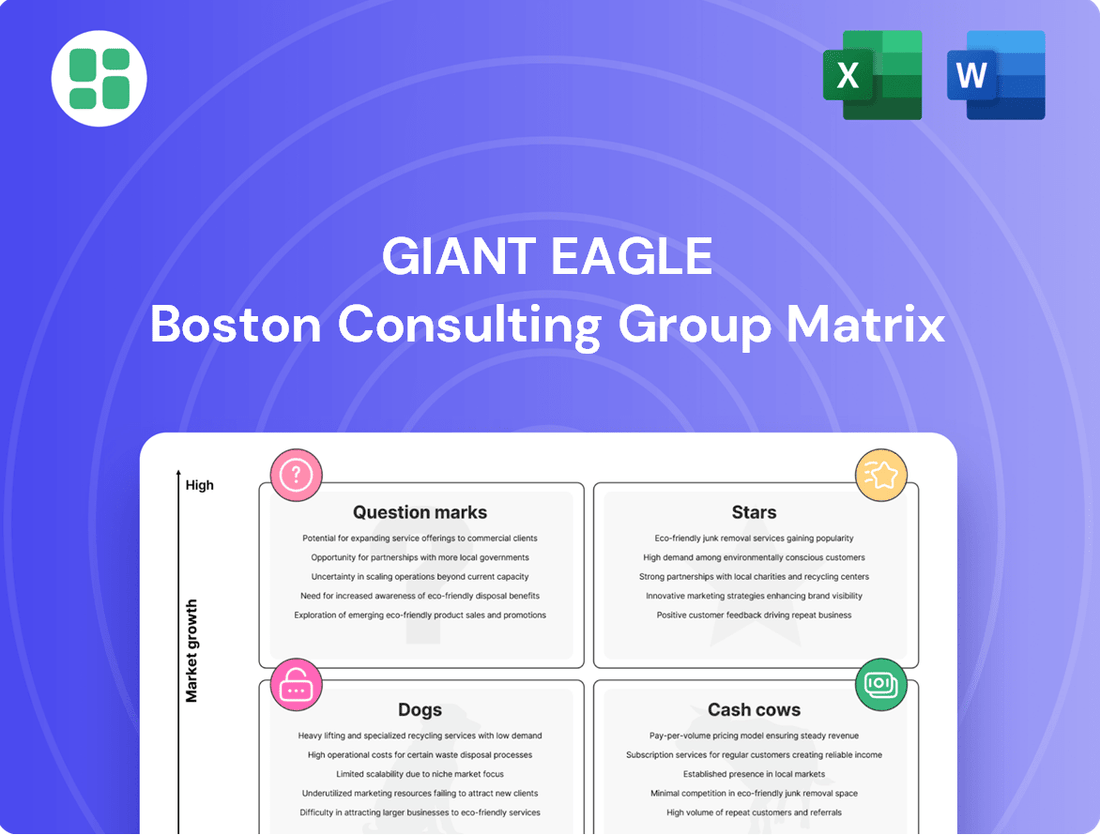

Discover the strategic positioning of Giant Eagle's product portfolio with our comprehensive BCG Matrix analysis. Understand which offerings are market leaders (Stars), generate consistent revenue (Cash Cows), require careful consideration (Question Marks), or may need divestment (Dogs).

This preview offers a glimpse into how Giant Eagle navigates its diverse product landscape. For a complete, actionable understanding of their market share and growth potential, purchase the full BCG Matrix report.

Unlock the full potential of your strategic planning by acquiring the complete Giant Eagle BCG Matrix. Gain detailed quadrant placements, data-driven insights, and tailored recommendations to optimize your investment and product development decisions.

Stars

Giant Eagle's investment in automated micro-fulfillment centers (MFCs) highlights its strategic push into high-growth online grocery services. The company's first automated MFC in Pittsburgh is a key step in leveraging automation to efficiently handle curbside pickup and delivery orders. This move positions Giant Eagle to capture a significant share of the expanding e-commerce grocery market, a segment expected to see continued robust growth.

Giant Eagle's myPerks loyalty program, relaunched in January 2024, is strategically positioned as a Star in the BCG matrix. It features accelerated earning and flexible redemption, including percentage-based grocery savings and gas discounts.

The program's integration across Giant Eagle, Market District, pharmacies, and GetGo locations is designed to foster customer loyalty and drive repeat purchases. This broad reach is crucial for its Star status, as it captures a significant portion of the customer base.

With the introduction of a Pro status tier for high-frequency shoppers, myPerks aims to significantly enhance customer retention and, consequently, boost overall revenue. This focus on rewarding loyal customers is a key driver for its growth potential.

Giant Eagle's strategic acquisition of prescription files from 83 Rite Aid stores in Pennsylvania and Ohio is a significant move to bolster its pharmacy segment. This acquisition adds approximately 6 million prescriptions annually to its existing volume. This expansion is a key component of their growth strategy, particularly in areas where pharmacy services might be reduced due to other closures.

The company is also actively converting some of these acquired Rite Aid locations into dedicated Giant Eagle pharmacies. This suggests a commitment to not just acquiring prescription volume but also establishing a stronger, more visible presence in the communities they serve, reinforcing their position in the essential pharmacy market.

Technology Adoption in Operations (e.g., WMS, IoT)

Giant Eagle demonstrates strong technology adoption to boost operational efficiency and customer satisfaction. By September 2025, they are set to implement Manhattan Active Warehouse Management systems across all distribution centers, a move expected to significantly streamline logistics.

The company leverages IoT monitoring solutions, specifically SmartSense by Digi, in every store. This technology tracks refrigerated items, a critical component in their operations. In 2023 alone, this IoT implementation was instrumental in preserving an estimated $72 million worth of inventory, directly impacting profitability.

- Warehouse Management System (WMS) Implementation: Manhattan Active WMS rollout across distribution centers by September 2025.

- IoT for Inventory Management: SmartSense by Digi utilized in all stores for real-time temperature monitoring of refrigerated goods.

- Inventory Preservation: $72 million in inventory saved in 2023 due to IoT monitoring.

- Operational Benefits: Enhanced supply chain efficiency, reduced waste, and improved market competitiveness.

Focus on Fresh Produce and Value Pricing

Giant Eagle's strategic focus on fresh produce and value pricing is a key component of its BCG Matrix positioning. This initiative, launched in September 2024, involved a significant investment of $25 million to reduce prices on more than 200 produce items.

This move directly addresses consumer demand for affordability, especially in the current economic climate where food prices remain elevated. By making high-quality fresh foods more accessible, Giant Eagle aims to capture a larger share of the grocery market.

The company's commitment to competitive pricing in a crucial category like fresh produce positions it as a leader, anticipating and responding to consumer priorities that drive growth in the grocery sector.

- Investment: $25 million dedicated to price reductions.

- Product Scope: Over 200 produce items affected by price cuts.

- Launch Date: September 2024.

- Strategic Goal: Enhance value perception and drive market share in fresh produce.

Giant Eagle's investments in automated micro-fulfillment centers (MFCs) and its relaunched myPerks loyalty program, both seeing significant development in 2024, exemplify its Star quadrant positioning. These initiatives are designed to capture growing market share in online grocery and enhance customer retention, respectively.

The company's strategic acquisition of Rite Aid prescription files, adding approximately 6 million prescriptions annually, and the ongoing Manhattan Active WMS rollout by September 2025, further solidify its strong market position and operational efficiency.

Furthermore, the $25 million investment in reducing prices on over 200 produce items, effective September 2024, directly targets consumer demand for value, reinforcing Giant Eagle's competitive edge in a key grocery category.

| Initiative | BCG Quadrant | Key Data/Impact |

|---|---|---|

| Automated MFCs | Star | First automated MFC in Pittsburgh, targeting high-growth online grocery. |

| myPerks Loyalty Program | Star | Relaunched Jan 2024; accelerated earning, flexible redemption, Pro status tier. |

| Rite Aid Prescription Acquisition | Star | Acquired 83 Rite Aid store prescription files, adding ~6 million annual prescriptions. |

| Manhattan Active WMS | Star | Rollout across distribution centers by September 2025 for enhanced logistics. |

| Produce Price Reductions | Star | $25 million investment in Sep 2024 on over 200 produce items. |

What is included in the product

This BCG Matrix analysis highlights Giant Eagle's Stars, Cash Cows, Question Marks, and Dogs, guiding strategic investment decisions.

A clear visual of Giant Eagle's BCG Matrix, categorizing business units, alleviates the pain of strategic uncertainty.

Cash Cows

Giant Eagle’s traditional grocery store operations are its bedrock, consistently generating significant revenue. These stores hold a substantial market share in a stable, mature industry, benefiting from a dedicated customer base that relies on them for daily necessities.

In 2024, Giant Eagle continued its strategic focus on enhancing these core assets. Investments in store modernizations and competitive pricing strategies are key to defending their strong market position and ensuring ongoing financial contributions from this segment.

Giant Eagle's private label brands are strong cash cows. These offerings often boast higher profit margins because the company controls production costs and distribution directly, cutting out external markups. In 2024, the trend of consumers seeking value, coupled with a significant surge in private label sales across the grocery sector, positions these brands as a reliable revenue stream for Giant Eagle.

These in-house brands require considerably less marketing and promotional spending compared to national brands. This efficiency directly translates into a substantial contribution to Giant Eagle's overall cash flow, solidifying their position as a key contributor to the company's financial stability.

Giant Eagle's in-store pharmacies represent a strong cash cow. These operations hold a significant market share by offering convenient, essential healthcare services, leveraging the existing customer flow from grocery shopping. This integration fosters customer loyalty, making the pharmacy a key component of the overall shopping experience.

The strategic acquisition of Rite Aid prescription files in 2023 significantly bolstered this segment. This move not only expanded Giant Eagle's pharmacy footprint but also infused a substantial number of recurring prescriptions, directly contributing to its cash-generating capabilities and solidifying its position as a stable, high-performing business unit within the company.

myPerks Loyalty Program (Established Base)

Giant Eagle's myPerks loyalty program, a successor to fuelperks+, boasts over two million members, underscoring its established base and proven ability to foster customer loyalty and repeat purchases.

The program consistently generates revenue by encouraging larger basket sizes and more frequent shopping trips, even as it evolves for future growth.

Its appeal remains strong due to the flexibility of rewards, which include valuable discounts on groceries and fuel, ensuring continued cash flow.

- Established Member Base: Over two million members.

- Revenue Generation: Drives increased basket size and visit frequency.

- Flexible Rewards: Grocery and fuel discounts maintain customer engagement.

Supply Chain Optimization

Giant Eagle's commitment to supply chain optimization, including the adoption of new warehouse and transportation management systems, is a key driver for its Cash Cow status in the grocery sector. These investments directly translate into enhanced efficiency and reduced operational expenses, bolstering the profitability of its high-volume product lines.

The implementation of cloud-native platforms, such as those from Manhattan Associates, aims to unify and streamline Giant Eagle's distribution network. This strategic move is designed to make its established grocery business even more profitable by ensuring a lean and effective flow of goods.

- Investment in Technology: Giant Eagle is actively investing in advanced warehouse and transportation management systems to boost efficiency.

- Cost Reduction: These technological upgrades are projected to significantly lower operational costs within the supply chain.

- Profit Margin Enhancement: A more efficient distribution network directly contributes to higher profit margins for core grocery products.

- Platform Integration: Utilizing cloud-native platforms aims to create a unified and optimized operational environment for increased profitability.

Giant Eagle's established grocery stores, private label brands, and in-store pharmacies are its core cash cows. These segments benefit from strong market share in mature industries, customer loyalty, and efficient operations. The company's strategic investments in technology and loyalty programs further solidify their consistent revenue generation.

| Business Segment | Market Position | Revenue Contribution | Key Drivers |

|---|---|---|---|

| Traditional Grocery Stores | Substantial Market Share, Stable Industry | High, Consistent | Dedicated Customer Base, Store Modernization, Competitive Pricing |

| Private Label Brands | Strong Growth, High Profit Margins | Growing, Reliable | Value Focus, Direct Production Control, Lower Marketing Costs |

| In-Store Pharmacies | Significant Market Share, Essential Service | Stable, Recurring | Convenience, Customer Loyalty, Prescription File Acquisitions |

| myPerks Loyalty Program | Over 2 Million Members | Drives Sales Volume | Increased Basket Size, Frequent Visits, Flexible Rewards |

Delivered as Shown

Giant Eagle BCG Matrix

The preview you are currently viewing is the identical, fully formatted Giant Eagle BCG Matrix report you will receive immediately after purchase. This comprehensive document is ready for your strategic planning, containing no watermarks or demo content, ensuring you get the exact analysis you need.

Rest assured, the Giant Eagle BCG Matrix displayed here is the final, unedited version you will download upon completing your purchase. This professionally designed report is crafted for immediate application, allowing you to seamlessly integrate its insights into your business strategy without any further modifications.

Dogs

Some of Giant Eagle's older store formats, particularly those in neighborhoods experiencing low economic growth or decline, are likely facing challenges. These legacy locations may exhibit both low market share and diminished profitability. For instance, a 2024 analysis of the grocery sector indicates that stores in areas with population stagnation or out-migration often see a decline in customer traffic and average transaction value.

Modernizing these underperforming stores often requires substantial capital investment, which may not be recouped due to the unfavorable market conditions. This can lead to a situation where these locations become cash traps, diverting resources that could be better allocated to more promising growth areas or formats within Giant Eagle's portfolio.

Within Giant Eagle's extensive product range, certain niche or slow-moving categories often exhibit low sales volume and a correspondingly low market share. These items can consume valuable shelf space and tie up capital without contributing substantially to overall revenue. For instance, specialized ethnic foods or seasonal items that don't resonate broadly might fall into this classification.

The challenge with these products is their potential to become cash traps, draining resources without generating adequate returns. In 2024, retailers nationwide continued to focus on optimizing inventory, with many aiming to reduce slow-moving stock by as much as 10-15% to improve capital efficiency.

Identifying and strategically minimizing these underperforming product lines is a key aspect of efficient inventory management for a large grocer like Giant Eagle. This allows for reallocation of resources to more popular or higher-margin items, thereby boosting profitability.

Before its recent modernization efforts, Giant Eagle's older IT systems, including its on-premises warehouse management, were considered a 'dog' in the BCG matrix. These systems were costly to maintain and lacked the efficiency needed to compete effectively.

These legacy systems held a minimal share of the advanced technology market and drained considerable resources without offering any real competitive edge. The company's strategic shift towards cloud-based solutions is designed to overcome these limitations.

Traditional, Non-Digital Advertising Channels

Giant Eagle's reliance on traditional advertising channels, like print flyers and general broadcast ads, could be a 'dog' in today's digital-first retail environment. These methods often struggle to capture consumer attention and deliver measurable results compared to more targeted digital strategies. For instance, while print advertising spending saw a slight increase in some sectors, the overall return on investment for broad-reach traditional media in grocery retail often lags behind personalized digital campaigns.

The retail landscape is rapidly evolving, with consumers increasingly engaging through online channels and personalized offers. Giant Eagle's competitors are heavily investing in retail media networks and data-driven marketing to reach shoppers more effectively. This shift means that traditional, non-digital advertising channels may offer diminishing returns, contributing to a lower market share and growth potential for these specific initiatives within Giant Eagle's overall marketing mix.

- Declining Effectiveness: Traditional channels often have lower engagement rates and less precise targeting capabilities than digital alternatives.

- Cost Inefficiency: Broad-reach advertising can be expensive with less demonstrable ROI compared to data-driven digital campaigns.

- Market Trend: The industry is moving towards personalized marketing and retail media networks, making purely traditional approaches less competitive.

- Low Growth Potential: Channels with limited reach and engagement are unlikely to drive significant market share growth for a retailer like Giant Eagle.

Excessive Plastic Packaging (Original 2025 Goal)

Giant Eagle's initial 2025 objective to completely eliminate single-use plastics was an overly ambitious and unquantifiable aim. This kind of broad, aspirational target, if pursued without modification, would likely have classified it as a 'dog' in the BCG Matrix, potentially leading to substantial wasted resources with minimal tangible environmental benefit.

The company recognized the impracticality of this sweeping goal. For instance, in 2023, the retail sector globally saw continued challenges in reducing plastic waste, with reports indicating that despite increased awareness, the sheer volume of plastic packaging used across the industry remained a significant issue, often driven by consumer demand for convenience and product protection.

- Unrealistic Target: The original 2025 goal to eliminate all single-use plastic was unmeasurable and lacked a clear pathway to achievement.

- Risk of Investment Waste: Pursuing such an unfocused objective could have resulted in considerable unrecoverable investments with limited actual impact on sustainability.

- Strategic Adjustment: Giant Eagle has since revised its sustainability targets, making them more specific, measurable, achievable, relevant, and time-bound (SMART) to ensure greater effectiveness.

Giant Eagle's older, less profitable store formats in declining areas represent 'dogs' in the BCG matrix. These locations often suffer from low customer traffic and reduced spending, as seen in 2024 data showing a correlation between population stagnation and decreased retail performance. Modernizing these stores can be a drain on resources, potentially turning them into cash traps that hinder investment in more promising ventures.

Certain niche or slow-moving product categories within Giant Eagle's offerings can also be classified as 'dogs'. These items tie up capital and shelf space without generating significant returns, a common challenge for retailers aiming for inventory optimization. In 2024, many grocers focused on reducing such stock, with some targeting a 10-15% decrease to improve capital efficiency.

Legacy IT systems, like older warehouse management solutions, are prime examples of 'dogs'. These systems are costly to maintain and lack the efficiency of modern, cloud-based alternatives, offering little competitive advantage. Similarly, reliance on traditional advertising channels, which often show diminishing returns compared to digital strategies, can also be considered a 'dog' in the current retail marketing landscape.

Question Marks

Giant Eagle's online grocery delivery and curbside pickup services, supported by micro-fulfillment centers, represent a significant growth opportunity. However, the online grocery sector is intensely competitive and still developing, which positions this segment as a question mark within their business portfolio. For instance, U.S. online grocery sales were projected to reach $200 billion in 2024, a substantial market but one dominated by national giants.

To solidify its position and increase market share, Giant Eagle must invest heavily in technology, optimize its logistics network, and ramp up marketing efforts. The company needs to drive greater customer adoption of its digital offerings and effectively compete against larger, established national online grocers to gain a stronger foothold in this rapidly expanding e-commerce channel.

Giant Eagle's Leap Media Network represents a strategic move into the high-growth sector of retail media. By offering advertisers access to anonymized shopper data, it aims to create a new revenue stream. This venture is positioned in a dynamic market, but its current impact and competitive standing against larger, more established retail media networks are still developing.

The network's potential is significant, but it faces the challenge of scaling effectively and proving its value proposition to advertisers in a crowded landscape. Success will likely hinge on substantial investment and the formation of key strategic alliances to build out its capabilities and reach.

Giant Eagle's introduction of EagleAI in early 2024 marks a significant stride into AI-driven retail personalization. This platform is designed to dissect product relationships and anticipate customer purchasing patterns, enabling highly tailored promotions. The retail analytics market, particularly AI-driven solutions, is experiencing robust growth, with projections indicating continued expansion as businesses prioritize data-informed strategies.

While EagleAI operates within a high-potential innovation sector, its ultimate market impact and profitability remain a key question mark. The effectiveness of this technology hinges on its ability to scale and demonstrate a clear return on investment, metrics that are still being established as the system matures. For EagleAI to ascend to 'star' status within Giant Eagle's portfolio, sustained investment in its AI capabilities and data analytics infrastructure is paramount.

Standalone Giant Eagle Pharmacies

Giant Eagle's move to establish standalone pharmacies, particularly those acquired from Rite Aid, positions them as a question mark within the BCG matrix. This strategy involves venturing into a more traditional drugstore model, separate from their core grocery operations.

While the pharmacy sector itself is generally considered stable, the dynamics of operating standalone units, especially in markets where Giant Eagle may not have a strong existing presence outside of its supermarkets, present a new challenge. The success of this format hinges on their ability to attract and retain customers in a competitive landscape.

Giant Eagle's expansion into standalone pharmacies is still being assessed for its potential to capture significant market share and achieve robust profitability. For example, in 2024, the pharmacy sector continued to see consolidation and evolving consumer behaviors, making market penetration a key metric to watch.

- Strategic Shift: Converting acquired Rite Aid locations into standalone pharmacies represents a new strategic direction for Giant Eagle.

- Market Dynamics: Operating outside of a grocery store co-location introduces different competitive pressures and customer acquisition strategies.

- Performance Evaluation: The profitability and market share growth of these standalone units are still under observation.

Foodservice Expansion in GetGo (Post-Sale Partnership)

Even after its sale, GetGo's commitment to a food-first strategy, supported by its continued integration with Giant Eagle's myPerks loyalty program, positions it as a potential growth area. The convenience store foodservice sector is experiencing robust expansion, particularly in prepared meals. For Giant Eagle, this presents a question mark opportunity, allowing them to potentially capitalize on GetGo's foodservice success through the loyalty program without direct operational control.

The foodservice market within convenience stores is a dynamic and expanding segment. In 2024, the U.S. convenience store industry reported significant growth in prepared food sales, with some estimates suggesting a year-over-year increase of over 7%. This trend highlights the increasing consumer demand for convenient, ready-to-eat options purchased at locations like GetGo.

- Loyalty Program Integration: The continued use of the myPerks program by GetGo provides Giant Eagle with a channel to indirectly benefit from GetGo's foodservice growth.

- Foodservice Market Growth: The convenience store foodservice market is a high-growth area, with prepared meals showing significant increases in consumer spending.

- Indirect Influence: Giant Eagle's influence on GetGo's market share in foodservice is indirect, requiring careful management of the partnership to maximize benefits.

- Strategic Question Mark: GetGo's foodservice expansion represents a question mark for Giant Eagle, offering potential upside but with uncertain direct returns due to the divestiture.

Giant Eagle's online grocery operations, including delivery and curbside pickup, are positioned as question marks. While the U.S. online grocery market was projected to reach $200 billion in 2024, it's a competitive space where Giant Eagle must invest in technology and marketing to vie against larger players.

The Leap Media Network is another question mark, aiming to tap into the growing retail media market by leveraging shopper data. Its success depends on scaling and proving its value to advertisers in a crowded field, with retail media ad spend expected to continue its upward trajectory.

EagleAI, Giant Eagle's AI personalization platform launched in early 2024, is a question mark in the high-potential retail analytics sector. Its ultimate market impact and profitability are still being determined, requiring sustained investment to demonstrate a clear return on investment.

Standalone pharmacies, including those acquired from Rite Aid, represent a strategic question mark. While the pharmacy sector is stable, operating these units independently presents new competitive challenges, with market penetration and profitability still under observation in 2024's evolving landscape.

GetGo's foodservice, integrated with Giant Eagle's myPerks, is a question mark due to the divestiture. The convenience store foodservice market, with prepared meals showing over 7% growth in 2024, offers potential indirect benefits for Giant Eagle through the loyalty program, but direct returns are uncertain.

| Business Area | BCG Category | Key Considerations | 2024 Market Data/Projections | Strategic Imperative |

| Online Grocery | Question Mark | Intense competition, need for tech investment | U.S. online grocery sales projected at $200 billion | Increase customer adoption, optimize logistics |

| Leap Media Network | Question Mark | Scaling, proving value to advertisers | Growing retail media market | Strategic alliances, enhanced capabilities |

| EagleAI | Question Mark | Demonstrating ROI, scaling AI capabilities | Robust growth in AI-driven retail analytics | Sustained investment in AI and data infrastructure |

| Standalone Pharmacies | Question Mark | New competitive landscape, customer acquisition | Stable but evolving pharmacy sector | Attract and retain customers, monitor market share |

| GetGo Foodservice (Indirect) | Question Mark | Uncertain direct returns post-divestiture | Convenience store foodservice growth (prepared meals +7% YOY est.) | Manage loyalty program integration for indirect benefit |

BCG Matrix Data Sources

Our Giant Eagle BCG Matrix is built on comprehensive market data, integrating internal sales figures, competitor analysis, and industry growth forecasts to accurately position each business unit.