Giant Eagle Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Giant Eagle Bundle

Giant Eagle navigates a complex grocery landscape, facing intense rivalry from established players and the growing threat of online retailers. Understanding the bargaining power of both suppliers and buyers is crucial for their sustained success.

The complete report reveals the real forces shaping Giant Eagle’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The concentration of suppliers significantly impacts Giant Eagle's bargaining power. If a key product is sourced from only a few dominant suppliers, those suppliers gain considerable leverage. For instance, in 2024, the dairy industry, a crucial component of grocery retail, saw consolidation with major players controlling larger market shares, potentially increasing their pricing power over retailers like Giant Eagle.

Suppliers who offer unique or proprietary products, like specialized regional produce or exclusive brand agreements, naturally hold more sway in negotiations. Think about pharmaceutical companies with patented drugs; they have significant control over pricing and terms because there are no readily available alternatives. This uniqueness directly translates to higher bargaining power.

For a company like Giant Eagle, dealing with common grocery items means the uniqueness of most supplier offerings is generally low. This lack of distinctiveness is advantageous for Giant Eagle, as it provides considerable leverage when negotiating prices and terms with a wider pool of potential suppliers for everyday goods.

Giant Eagle faces varying switching costs depending on the product category. For everyday grocery items, the cost of changing suppliers is generally manageable, primarily involving logistical coordination.

However, for more specialized areas like pharmacy supplies, the expense and complexity of switching can be significantly higher. This is often due to existing contractual obligations, the need for intricate system integrations, and the potential impact on customer trust and brand perception if a change is perceived negatively.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into retail is generally low for Giant Eagle's core grocery and pharmacy operations. This is primarily due to the substantial capital outlay and intricate operational demands required to manage a large-scale retail chain.

While some major food manufacturers or pharmaceutical companies might explore direct-to-consumer sales, these efforts typically don't pose a significant challenge to established physical retail distribution networks. For instance, while direct-to-consumer e-commerce sales for CPG brands have grown, they still represent a fraction of overall retail sales. In 2023, CPG e-commerce penetration was around 15-20% in many developed markets, indicating that the bulk of sales still occur through traditional retail channels.

Therefore, this specific threat remains limited in the immediate future for Giant Eagle's primary business model. The complexity and cost associated with replicating Giant Eagle's extensive store footprint and supply chain infrastructure act as a significant deterrent for most suppliers.

- Low Capital Barrier for Suppliers: The capital required to establish and operate a grocery or pharmacy retail chain is substantial, making forward integration by suppliers a high-risk, high-reward strategy.

- Operational Complexity: Managing inventory, logistics, customer service, and regulatory compliance across numerous stores presents significant operational hurdles for companies not already in the retail sector.

- Direct-to-Consumer Channels: While some suppliers are experimenting with D2C models, these are often supplementary and do not aim to replace the broad reach of major retailers. For example, a 2024 report indicated that while D2C sales for some niche food brands increased, they still accounted for less than 5% of their total revenue.

- Limited Immediate Impact: The immediate threat of widespread forward integration by suppliers that could significantly disrupt Giant Eagle's market position is minimal.

Importance of Giant Eagle to Suppliers

Giant Eagle's substantial market presence, especially in its core regions, makes it a crucial distribution channel for many suppliers. This is particularly true for regional food producers and smaller brands that rely heavily on Giant Eagle for market access, thereby limiting their bargaining power. For instance, a regional dairy supplier might see a significant portion of its sales volume tied to Giant Eagle stores, making it more susceptible to the retailer's pricing demands.

However, the power dynamic shifts for larger, national suppliers. For these companies, Giant Eagle is just one of many retail partners, meaning they have more leverage to negotiate favorable terms due to their broader market reach and established brand recognition. This balanced power means Giant Eagle must actively compete for shelf space and product placement with these larger entities.

Giant Eagle is actively seeking to exert more influence over supplier terms, notably in its pharmacy segment. The company's 2023 partnership with Mark Cuban's Cost Plus Drugs is a prime example. This initiative aims to offer prescription drugs at significantly lower prices, which implies Giant Eagle is leveraging its scale to negotiate aggressively with pharmaceutical suppliers and wholesalers. This move could set a precedent for how Giant Eagle approaches supplier negotiations in other product categories, potentially signaling a trend towards greater cost control and supplier pressure.

- Distribution Channel Reliance: Many regional and smaller suppliers depend on Giant Eagle for a substantial portion of their sales, reducing their bargaining power.

- National Supplier Dynamics: Large, national suppliers possess greater leverage as Giant Eagle represents only one of many retail outlets for them.

- Pharmacy Cost Control: The 2023 partnership with Mark Cuban Cost Plus Drugs demonstrates Giant Eagle's intent to influence supplier terms and reduce costs in the pharmacy sector, showcasing its growing leverage.

The bargaining power of suppliers for Giant Eagle is influenced by several factors. When suppliers offer unique or proprietary products, their leverage increases significantly, as seen with specialized regional produce or exclusive brand agreements. Conversely, for common grocery items, Giant Eagle benefits from a broad supplier base, giving it negotiation advantages due to low product differentiation and manageable switching costs for everyday goods.

| Factor | Impact on Giant Eagle | 2024 Data/Trend Example |

|---|---|---|

| Supplier Concentration | High concentration increases supplier power. | Dairy industry consolidation in 2024 gave major players more pricing leverage. |

| Product Uniqueness | Unique offerings grant suppliers more sway. | Most grocery items lack uniqueness, favoring Giant Eagle. |

| Switching Costs | Low for common goods, high for specialized items (e.g., pharmacy). | Logistical costs are manageable for grocery; pharmacy has higher integration costs. |

| Forward Integration Threat | Generally low due to high capital and operational complexity. | D2C sales for CPG brands in 2023 were around 15-20% penetration, not replacing retail. |

| Distribution Channel Reliance | Regional suppliers rely on Giant Eagle, reducing their power. | Regional dairy suppliers tied to Giant Eagle sales are more susceptible to pricing demands. |

| National Supplier Leverage | National suppliers have more power as Giant Eagle is one of many partners. | Giant Eagle competes for shelf space with large, established brands. |

| Cost Control Initiatives | Giant Eagle uses scale to negotiate aggressively, especially in pharmacy. | The 2023 Mark Cuban Cost Plus Drugs partnership signals intent to influence supplier terms. |

What is included in the product

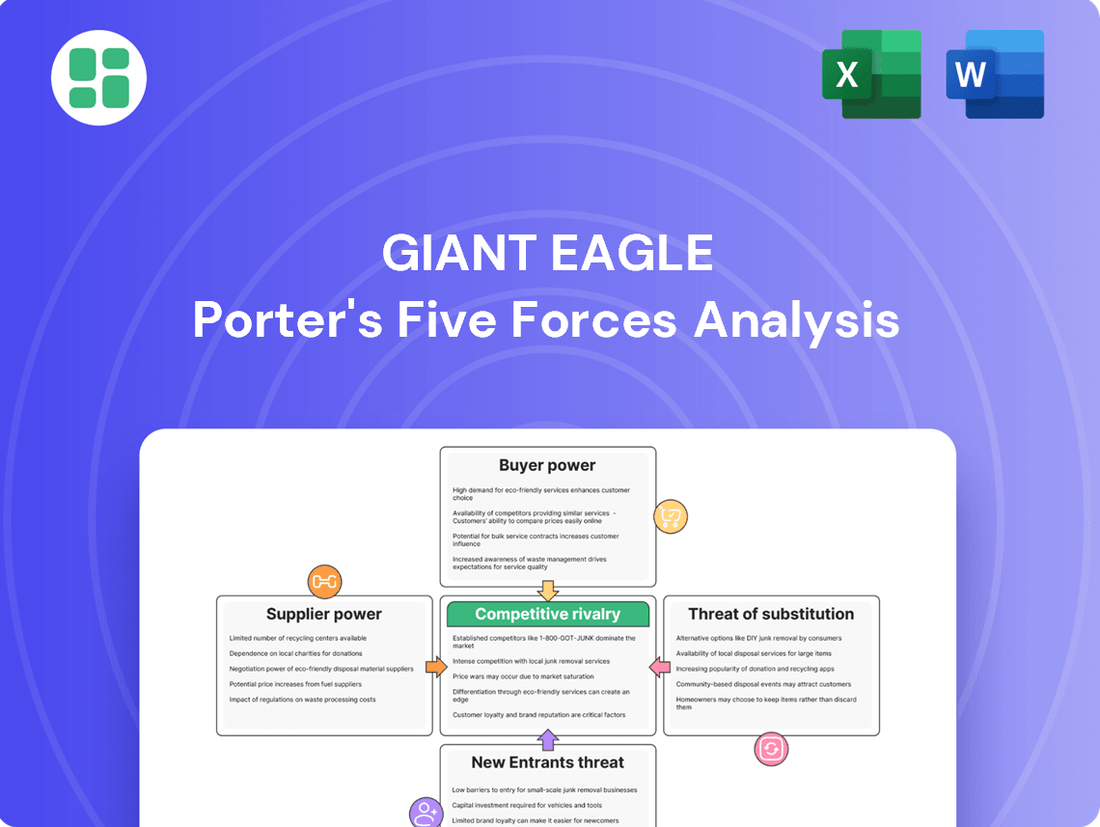

This analysis dissects the competitive forces impacting Giant Eagle, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry among existing competitors.

Instantly understand strategic pressure with a powerful spider/radar chart visualizing Giant Eagle's competitive landscape.

Duplicate tabs for different market conditions (pre/post regulation, new entrant, etc.) allow for agile strategy adjustments.

Customers Bargaining Power

Customers of Giant Eagle, especially within the fiercely competitive grocery market, exhibit significant price sensitivity. This is further intensified by ongoing inflation impacting food costs. For instance, in early 2024, the U.S. Bureau of Labor Statistics reported that food prices, particularly for groceries, continued to show upward trends, though at a slower pace than in previous periods.

This heightened price awareness means many shoppers are actively hunting for discounts, meticulously comparing prices across different retailers, and readily switching to more affordable options like private label brands or discount grocers to stretch their budgets. This behavior directly pressures Giant Eagle to maintain competitive pricing strategies.

Giant Eagle's response to this customer behavior is evident in its strategic decisions. The company has made notable investments aimed at reducing prices, such as its initiative to lower prices on a wide range of produce items. This move directly addresses the consumer's demand for value and aims to retain market share in a price-driven environment.

Giant Eagle customers face significant bargaining power due to the sheer abundance of grocery and pharmacy alternatives. Major competitors like Walmart and Kroger, alongside specialized options such as Trader Joe's and Aldi, offer diverse price points and product selections. In 2023, the US grocery market saw continued growth, with online sales accounting for a notable portion, further empowering consumers with convenient access to a wider array of choices beyond traditional brick-and-mortar stores.

The bargaining power of customers for Giant Eagle is significantly influenced by low switching costs in the grocery and convenience store segments. Consumers can readily switch between various supermarkets, online grocery services, and convenience stores based on factors like price, location, or the specific products offered. For instance, a 2024 study indicated that over 60% of grocery shoppers compare prices across at least three different retailers before making a purchase.

Customer Information and Transparency

Customers today possess unprecedented access to information. Tools for price comparison, online reviews, and readily available promotional offers significantly amplify their bargaining power. This heightened awareness means customers can easily identify alternatives and demand better value from retailers like Giant Eagle.

The increasing transparency in pricing, exemplified by initiatives like Mark Cuban Cost Plus Drug Company, further empowers consumers. This trend forces retailers to be more competitive, as customers can directly compare costs and seek out the most economical options, especially in sensitive areas like pharmaceuticals.

- In 2024, the average consumer spent approximately $6,500 annually on groceries, a figure influenced by price transparency and competitive pressures.

- Online reviews significantly impact purchasing decisions; studies show over 90% of consumers read online reviews before buying.

- Price comparison apps are used by an estimated 70% of online shoppers, allowing for real-time cost evaluation.

Customer Loyalty and Differentiation

Giant Eagle's myPerks program is designed to cultivate customer loyalty, but the broader grocery landscape in 2024 suggests a shift towards value-seeking behavior over strict brand allegiance. Many shoppers are actively comparing prices and promotions across different retailers, making deep, unwavering loyalty a challenge to maintain.

The strategic sale of GetGo locations, while retaining the myPerks integration, signals an intention to concentrate resources on the core supermarket and pharmacy operations. This move could potentially bolster loyalty within these segments by allowing for enhanced product assortments and more competitive pricing, thereby increasing perceived value for shoppers.

- Value-Driven Consumers: In 2024, consumer spending habits show a heightened sensitivity to price, with many shoppers prioritizing discounts and loyalty rewards that offer tangible savings.

- Program Integration: The myPerks program's continued presence across former GetGo locations aims to preserve customer engagement and data, offering a unified loyalty experience.

- Ease of Switching: The low barriers to entry for grocery shopping mean customers can easily switch between competitors based on immediate offers, limiting the depth of their commitment to any single brand.

Giant Eagle customers possess substantial bargaining power due to the highly competitive grocery sector and the ease with which consumers can switch between retailers. In 2024, with inflation continuing to impact household budgets, shoppers are more inclined than ever to seek out the best value, often comparing prices across multiple stores and readily opting for private label brands or discount grocers. This price sensitivity is amplified by the widespread availability of information through price comparison apps and online reviews, empowering consumers to make informed decisions and demand more competitive pricing from all retailers, including Giant Eagle.

| Factor | Impact on Giant Eagle | Supporting Data (2024 Estimates/Trends) |

|---|---|---|

| Price Sensitivity | High pressure to maintain competitive pricing. | Consumers actively compare prices; inflation drives value-seeking. |

| Availability of Alternatives | Weakens customer loyalty; encourages switching. | Numerous competitors (Walmart, Kroger, Aldi, Trader Joe's) offer diverse options. |

| Low Switching Costs | Customers can easily move between retailers. | Over 60% of shoppers compare prices across 3+ retailers. |

| Information Access | Empowers customers with knowledge of best deals. | Price comparison apps used by ~70% of online shoppers; 90%+ read reviews. |

Preview the Actual Deliverable

Giant Eagle Porter's Five Forces Analysis

This preview showcases the complete Giant Eagle Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the grocery industry. The document you see here is precisely what you'll receive immediately after purchase, fully formatted and ready for your strategic insights. This comprehensive analysis will equip you with a deep understanding of Giant Eagle's competitive landscape, enabling informed decision-making.

Rivalry Among Competitors

Giant Eagle faces a crowded marketplace, with rivals spanning national powerhouses like Walmart and Kroger, who command substantial market share and operational scale. The competitive set also includes formidable regional players, value-oriented discounters such as Aldi, and niche specialty grocers like Trader Joe's, all vying for consumer attention across its grocery, pharmacy, and convenience store operations.

The grocery retail sector is seeing steady growth, with online sales surging. In 2024, the U.S. online grocery market was estimated to reach $160 billion, a significant jump from previous years, while physical store traffic is up but with customers spending less time inside. This dynamic creates a competitive landscape where grocery chains are investing heavily in omnichannel strategies to capture market share.

Product and service differentiation in the grocery industry is a constant battle, often won through superior fresh produce, robust private label selections, and a compelling in-store atmosphere. Giant Eagle distinguishes itself by offering a wide array of products and services, from fresh groceries and premium meats to a full-service pharmacy. Their myPerks loyalty program also plays a key role in customer retention and perceived value.

The strategic sale of their GetGo convenience store chain in 2023 provided Giant Eagle with capital to reinvest in core grocery operations. This allows for store remodels and an expanded pharmacy footprint, both critical for enhancing differentiation. For instance, by focusing on pharmacy services, Giant Eagle can offer more than just prescriptions, potentially including health screenings and personalized consultations.

A significant differentiator for Giant Eagle's pharmacy segment is its partnership with Mark Cuban Cost Plus Drug Company. This collaboration aims to provide transparent and significantly lower prices on prescription medications, directly addressing a major consumer pain point. This unique value proposition sets them apart from competitors who may not offer such a direct approach to cost savings on pharmaceuticals.

Exit Barriers for Competitors

Exit barriers in the grocery and pharmacy sectors are considerable, often involving substantial fixed assets like stores and distribution centers, alongside large workforces and long-term leases. These factors make it challenging for companies to leave the market swiftly, potentially prolonging price wars and intensifying competition.

For instance, the grocery industry's capital intensity is evident. In 2024, major grocery chains continued to invest heavily in store renovations and technology upgrades. A report from the Food Marketing Institute indicated that capital expenditures for supermarket chains averaged around 2.5% of sales in 2023, a figure expected to remain consistent through 2024, underscoring the significant investment required to maintain competitive operations.

Even strategic moves, such as Giant Eagle's divestment of its GetGo convenience store chain in 2024, highlight the persistent high barriers to exiting the core grocery and pharmacy businesses. The company retained its extensive network of supermarkets and pharmacies, demonstrating that a complete withdrawal from these capital-intensive segments remains a complex and costly undertaking.

- High Fixed Asset Investment: Grocery and pharmacy businesses require significant capital for physical locations, equipment, and supply chain infrastructure.

- Labor Commitments: Large workforces in retail operations create substantial exit costs related to severance and benefits.

- Lease Obligations: Long-term lease agreements for store locations can lock companies into payments, even if operations cease.

- Brand and Reputation: Exiting a market can damage a company's overall brand and reputation, impacting other business units.

Strategic Commitments of Rivals

Major rivals are making substantial strategic moves that intensify competition for Giant Eagle. For instance, Walmart, a dominant player, continues its aggressive expansion of private label brands, aiming to capture more market share with value-driven offerings. In 2024, Walmart reported significant investments in its e-commerce and omnichannel capabilities, striving to seamlessly integrate online and in-store shopping experiences.

Kroger, another key competitor, is also actively pursuing strategic initiatives. This includes a focus on enhancing its digital presence and expanding its supply chain efficiencies. Furthermore, the grocery sector has seen ongoing consolidation, with strategic mergers and acquisitions becoming a common tactic to gain scale and market penetration, putting pressure on all players to adapt.

The rapid expansion of discounters like Aldi is a prime example of these strategic commitments. Aldi announced plans to open approximately 125 new stores in 2024, further increasing its physical footprint and challenging established grocers on price. These aggressive strategies from competitors necessitate continuous innovation and investment from Giant Eagle to maintain its customer base and competitive edge.

These ongoing commitments from rivals mean that Giant Eagle faces sustained pressure to innovate across its operations. This includes investing heavily in both its physical store network and its digital infrastructure. Offering competitive pricing and delivering superior value are critical for Giant Eagle to retain its loyal customers in this dynamic market landscape.

Giant Eagle operates in a highly competitive grocery and pharmacy market, facing pressure from national giants like Walmart and Kroger, alongside aggressive discounters such as Aldi. These rivals are continuously investing in omnichannel capabilities, private label expansion, and store growth, as evidenced by Aldi's 2024 plan to open 125 new locations.

The competitive intensity is further fueled by ongoing industry consolidation through mergers and acquisitions, forcing players like Giant Eagle to innovate and invest in both physical and digital realms. Maintaining competitive pricing and delivering superior value are paramount for customer retention in this dynamic environment.

Giant Eagle's strategic partnerships, like the one with Mark Cuban Cost Plus Drug Company for prescription pricing, aim to differentiate its pharmacy segment. However, the high fixed asset investment, labor commitments, and lease obligations characteristic of the grocery and pharmacy sectors create significant exit barriers, potentially prolonging price wars and intensifying rivalry.

| Competitor Action | Impact on Giant Eagle | 2024 Data/Trend |

|---|---|---|

| Walmart: Private label expansion & e-commerce investment | Increased price pressure, need for digital parity | Significant investment in omnichannel capabilities |

| Kroger: Digital presence enhancement & supply chain efficiency | Need for operational agility and digital engagement | Focus on supply chain efficiencies |

| Aldi: Aggressive store expansion | Direct competition on price and convenience | Planned ~125 new stores in 2024 |

| Industry Consolidation (M&A) | Pressure to gain scale or find niche advantages | Ongoing trend impacting market structure |

SSubstitutes Threaten

The threat of substitutes is a considerable challenge for Giant Eagle across its various business areas. For its core grocery operations, consumers have increasingly accessible alternatives like meal kit delivery services, which saw significant growth in recent years, and the convenience of restaurant dining. Local farmers' markets also offer a direct substitute for traditional supermarket produce, appealing to consumers seeking freshness and local sourcing.

In the pharmacy segment, Giant Eagle faces competition from mail-order pharmacies and direct-to-consumer drug providers. These alternatives often emphasize convenience and potentially lower prices, drawing customers away from traditional brick-and-mortar pharmacies. For instance, the U.S. mail-order pharmacy market was valued at over $100 billion in 2023, highlighting the scale of this competitive threat.

Substitutes in the grocery sector often vie for customer loyalty through either competitive pricing or enhanced convenience. Online grocery delivery platforms, despite potential delivery fees, can offer substantial time savings for busy shoppers, making them a compelling alternative.

Discount grocers continue to attract a significant portion of the market by offering consistently lower prices, appealing directly to consumers who prioritize budget management. For instance, in 2024, discount grocers like Aldi and Lidl have continued their expansion, capturing market share from traditional supermarkets by emphasizing value.

The threat extends to specialized services as well; the Mark Cuban Cost Plus Drug model, which Giant Eagle has partnered with, directly addresses the competitive pressure from price-focused substitutes within the healthcare sector by aiming for significantly lower prescription costs.

Customer propensity to substitute is quite high for grocery retailers like Giant Eagle. This is largely due to convenience, price sensitivity, and evolving consumer lifestyles. For instance, in 2024, the average US household spent approximately $5,700 annually on groceries, and consumers are actively seeking the best value and easiest shopping experience.

The growing popularity of omnichannel shopping, where customers blend physical store visits with online ordering and delivery or curbside pickup, directly increases the threat of substitutes. Retailers offering seamless digital integration and convenient fulfillment options can easily attract customers away from those with less robust online presences.

Furthermore, the increasing demand for meal solutions and prepared foods presents another significant substitute threat. Many consumers are opting for ready-to-eat meals or meal kits, reducing their reliance on traditional grocery shopping for raw ingredients. This trend highlights a shift away from extensive home cooking, forcing companies like Giant Eagle to adapt their offerings to meet these changing consumer habits.

Switching Costs for Customers to Substitutes

Switching costs for customers considering alternatives to Giant Eagle are generally quite low, making it easier for them to explore other options. For instance, trying a new meal kit service or opting for online grocery delivery from a different retailer requires minimal effort and commitment.

This ease of transition is amplified by external factors. The ongoing trend of pharmacy closures, a notable issue in the retail landscape throughout 2024, has actively driven patients to seek out and transfer their prescriptions to new providers, further lowering the perceived barrier to switching.

Consequently, customers are more inclined to explore alternatives if they believe they can find better value, superior convenience, or a more appealing product offering elsewhere. This dynamic puts pressure on Giant Eagle to continually demonstrate its competitive advantages.

Key considerations regarding low switching costs include:

- Minimal Effort: Trying new meal kit services or alternative grocery providers requires little upfront investment of time or resources.

- Pharmacy Transfers: Increased pharmacy closures in 2024 have normalized and even encouraged customers to switch their prescription services.

- Value and Convenience Focus: Customers are empowered to shop around for better deals and more convenient shopping experiences.

- Digital Accessibility: Online platforms for competing services often streamline the onboarding process for new customers.

Quality and Performance of Substitutes

Substitutes for traditional grocery shopping are rapidly evolving, presenting a significant threat to established players like Giant Eagle. Online grocery platforms, for instance, are not just offering convenience but also increasingly sophisticated user experiences and an expansive product selection that rivals brick-and-mortar stores. In 2024, the online grocery market continued its robust growth, with projections indicating further expansion as technology and logistics improve.

Meal kit services have also emerged as strong contenders, directly addressing consumer demand for convenience and quality. These services deliver pre-portioned, high-quality ingredients along with easy-to-follow recipes, effectively removing the planning and preparation burden from shoppers. This segment saw sustained consumer interest throughout 2024, driven by busy lifestyles and a desire for culinary exploration at home.

Furthermore, traditional convenience stores are no longer just quick stops for snacks and drinks. Many are significantly enhancing their foodservice offerings, transforming into destinations for prepared meals and ready-to-eat options. This strategic shift means that even quick errands that might have previously led to a larger grocery trip can now be fulfilled at these upgraded convenience formats, directly competing for share of stomach.

The cumulative effect of these improvements in substitute quality and convenience necessitates that Giant Eagle continuously re-evaluates and enhances its own value proposition. To remain competitive in 2024 and beyond, the company must focus on differentiating its offerings through superior product quality, unique in-store experiences, and seamless integration of digital and physical shopping channels. For example, investing in personalized shopping experiences and expanding private label brands with a focus on quality and value could be key strategies.

- Evolving Online Platforms: Online grocery sales in the U.S. were estimated to reach over $150 billion in 2024, a testament to their growing appeal and sophistication.

- Meal Kit Market Growth: The global meal kit delivery service market was projected to continue its upward trajectory, with consumers valuing the convenience and quality of ingredients provided.

- Convenience Store Foodservice: Many convenience chains reported double-digit growth in their prepared foods category in 2024, indicating a successful shift towards becoming meal destinations.

- Giant Eagle's Response: To counter these threats, Giant Eagle has been investing in its own e-commerce capabilities and exploring innovative store formats that emphasize fresh offerings and prepared foods, aiming to retain customer loyalty.

Giant Eagle faces a significant threat from substitutes across its operations, particularly in groceries and pharmacy services. Consumers increasingly turn to meal kit delivery, restaurant dining, and online grocery platforms for convenience and value. The ease with which customers can switch to these alternatives, often with minimal effort or cost, puts continuous pressure on Giant Eagle to innovate and maintain its competitive edge.

| Substitute Category | Key Offerings | Impact on Giant Eagle |

|---|---|---|

| Meal Kits | Pre-portioned ingredients, recipes | Reduces need for raw grocery items |

| Online Grocery | Convenience, delivery, wider selection | Offers alternative shopping channels |

| Discount Grocers | Lower prices, value focus | Attracts price-sensitive customers |

| Convenience Stores | Prepared foods, grab-and-go | Competes for quick meal occasions |

| Mail-Order Pharmacies | Convenience, potential cost savings | Diverts prescription business |

Entrants Threaten

The capital requirements for entering the grocery and pharmacy retail sectors are substantial. Companies need to invest heavily in prime real estate, building and equipping stores, managing vast inventory, and establishing efficient supply chains. For instance, opening a single large-format supermarket can easily cost millions of dollars before generating any revenue.

While online-only grocery models might seem less capital-intensive due to reduced physical store needs, they necessitate significant upfront investment in sophisticated technology platforms and robust last-mile delivery networks. These digital infrastructure costs, coupled with marketing to build brand awareness in a competitive online space, still present a considerable financial hurdle for new entrants aiming to challenge established players like Giant Eagle.

Giant Eagle, like other major grocery retailers, benefits immensely from economies of scale. In 2024, its extensive network of stores and substantial purchasing power allows it to secure favorable terms from suppliers, a significant barrier for any new competitor attempting to enter the market. This scale also enables efficient distribution and marketing, further solidifying its cost advantage.

New entrants would find it incredibly difficult to match the cost efficiencies that Giant Eagle has cultivated over years of operation. Achieving comparable purchasing power and spreading fixed costs across a similar sales volume would require substantial upfront investment and time, placing them at an immediate disadvantage in terms of pricing and operational agility.

While actual monetary switching costs for grocery shoppers are generally low, Giant Eagle has cultivated strong brand loyalty over many years. This ingrained customer habit means new competitors face a significant hurdle, requiring substantial marketing budgets and highly attractive offers to lure shoppers away from familiar routines and trusted brands.

To counter this, Giant Eagle has historically relied on programs like myPerks to foster loyalty. Even with recent strategic shifts, like the sale of GetGo, retaining this established customer base remains a key objective, underscoring the importance of brand recognition in mitigating the threat of new entrants.

Access to Distribution Channels

New entrants often struggle to secure access to established distribution channels, a critical hurdle for grocery retailers. Giant Eagle benefits from its existing, well-developed supply chain infrastructure that efficiently serves its extensive network of supermarkets and pharmacies across its operating regions.

Establishing a comparable distribution network requires substantial upfront investment in logistics, warehousing, and transportation, making it a significant barrier. For instance, the U.S. grocery industry's logistics costs can represent a considerable portion of revenue, with some estimates placing it between 5% and 10% of sales, further deterring new players without existing infrastructure.

- Limited Shelf Space: New entrants face difficulties in securing prime shelf space in established retail locations, which are often dominated by incumbent players like Giant Eagle.

- Supplier Relationships: Building strong relationships with suppliers, especially for fresh and perishable goods, is time-consuming and capital-intensive, posing a challenge for newcomers.

- Logistical Hurdles: The complexity and cost of managing a cold chain and ensuring timely delivery across a wide geographic area are significant deterrents for new entrants.

Regulatory and Legal Barriers

The pharmacy sector, a significant component of Giant Eagle's operations, presents substantial regulatory and legal barriers to entry. These include stringent licensing requirements for pharmacists and pharmacies, complex drug dispensing regulations, and evolving healthcare compliance mandates like HIPAA, all of which demand considerable investment and expertise to navigate. For instance, in 2024, obtaining a pharmacy license in many US states can take several months and involve fees ranging from hundreds to thousands of dollars, alongside rigorous inspections.

While the broader grocery retail segment faces fewer direct pharmaceutical regulations, it is not without its own set of hurdles. Zoning laws can restrict where new stores can be built, food safety standards require significant operational investment, and labor laws necessitate compliance with wage, hour, and safety regulations. These factors collectively increase the complexity and cost for any new entrant looking to establish a foothold in the market.

These combined regulatory complexities significantly raise the barrier to entry for new players. New grocery retailers must not only contend with established players like Giant Eagle but also invest heavily in legal counsel, compliance officers, and operational adjustments to meet diverse federal, state, and local requirements, making market entry a challenging and capital-intensive endeavor.

Key regulatory and legal barriers impacting new entrants include:

- Pharmacy Licensing: Obtaining and maintaining pharmacy licenses is a complex and often lengthy process, requiring adherence to strict operational and personnel standards.

- Drug Dispensing Regulations: Compliance with federal and state laws governing prescription drugs, controlled substances, and patient safety adds significant operational overhead.

- Healthcare Compliance: Adherence to privacy laws (like HIPAA) and other healthcare regulations necessitates robust data security and patient data management systems.

- Food Safety and Zoning: Grocery retail operations are subject to food safety regulations and local zoning laws, which can impact store location, design, and operational costs.

The threat of new entrants for Giant Eagle is moderate. While the grocery and pharmacy sectors demand significant capital for real estate, inventory, and supply chains, and economies of scale create cost advantages, established brand loyalty and distribution networks act as substantial deterrents. Regulatory hurdles, particularly in the pharmacy segment, further complicate market entry.

New entrants face considerable capital requirements, with single supermarket openings costing millions. Even online models require substantial investment in technology and delivery networks. Giant Eagle's 2024 purchasing power and established distribution channels provide a significant cost advantage, making it difficult for newcomers to compete on price or efficiency.

Brand loyalty, fostered by programs like myPerks, presents a hurdle for new entrants seeking to attract Giant Eagle's customer base. Furthermore, securing prime shelf space and building robust supplier relationships are challenging and time-consuming, adding to the barriers to entry.

The pharmacy sector's stringent licensing and dispensing regulations, along with general grocery retail compliance like food safety and zoning laws, create a complex and costly environment for new players. These regulatory complexities significantly raise the barrier to entry, demanding substantial investment in legal and operational compliance.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High costs for real estate, inventory, and supply chains. | Significant hurdle, requiring substantial upfront investment. |

| Economies of Scale | Giant Eagle's purchasing power and distribution efficiency. | Creates cost advantages that are difficult for new entrants to match. |

| Brand Loyalty | Established customer habits and loyalty programs. | Requires significant marketing investment to attract customers. |

| Distribution Channels | Existing, efficient supply chain infrastructure. | New entrants must invest heavily to build comparable logistics. |

| Regulatory Compliance | Pharmacy licensing, drug dispensing, food safety, zoning. | Adds complexity and cost, demanding expertise and investment. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Giant Eagle leverages data from industry-specific market research reports, publicly available financial statements, and news archives to understand competitive dynamics.