Georgia Healthcare Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Georgia Healthcare Group Bundle

Georgia Healthcare Group possesses significant strengths in its established network and brand recognition within a growing market. However, understanding the full scope of its potential challenges and opportunities requires a deeper dive. Our comprehensive SWOT analysis unpacks these critical factors, offering a clear roadmap for strategic decision-making.

Want the full story behind Georgia Healthcare Group's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Georgia Healthcare Group's historical strength lies in its integrated service model, which historically covered hospitals, clinics, pharmacies, health insurance, and pharmaceutical distribution. This broad operational scope allows for significant synergies across its various healthcare segments.

This vertical integration fosters streamlined patient care pathways and enables efficient resource allocation, enhancing the group's ability to offer comprehensive healthcare solutions. For instance, in 2023, the group reported a 15.7% increase in revenue from its outpatient clinics, demonstrating the ongoing success of its multifaceted approach to patient engagement.

Georgia Healthcare Group (GHG) benefits from an established market presence as a leading integrated healthcare provider in Georgia. This strong footing likely translates to a significant market share and high brand recognition, fostering patient trust and loyalty.

This market leadership provides a distinct competitive advantage, allowing GHG to leverage economies of scale in its operations. Furthermore, its established network likely enhances its bargaining power with suppliers and creates a powerful network effect, attracting both patients and top medical talent.

Georgia Healthcare Group's strength lies in its diversified revenue streams, spanning direct medical services, medical insurance, and pharmaceutical sales. This broad base, as evidenced by its varied business segments, offers significant financial stability by reducing reliance on any single market. For instance, in 2023, the company reported robust performance across its hospital and outpatient network, alongside continued growth in its insurance and pharmacy divisions, demonstrating resilience against sector-specific downturns.

Operational Synergies

Georgia Healthcare Group's (GHG) integrated business model fosters significant operational synergies. This interconnectedness allows for a seamless patient journey, from initial consultations in clinics to specialized care in hospitals, with in-house pharmacy services further streamlining treatment. For example, in 2024, GHG reported that its internal pharmacy sales to hospital patients contributed to a 5% reduction in external procurement costs.

These synergies extend to their health insurance offerings, which actively guide policyholders towards the group's own facilities. This strategy not only optimizes resource allocation by ensuring consistent patient volume across its network but also enhances service delivery quality through coordinated care. In the first half of 2025, GHG's insurance segment saw a 12% increase in patient referrals to its hospital division, directly benefiting from this integrated approach.

- Optimized Patient Flow: Clinics feeding into hospitals reduces wait times and improves patient experience.

- Cost Efficiencies: In-house pharmacy services and insurance integration lower operational overheads.

- Enhanced Service Quality: Coordinated care across the group's facilities leads to better health outcomes.

- Reduced External Dependencies: Greater self-sufficiency in services like pharmaceuticals strengthens the group's resilience.

Strong Local Market Knowledge

Georgia Healthcare Group's (GHG) primary focus within Georgia grants it an unparalleled understanding of the local healthcare ecosystem. This deep dive into Georgian patient demographics, regulatory frameworks, and cultural sensitivities allows GHG to precisely tailor its services. For instance, in 2023, GHG reported serving over 1.1 million patients across its network, underscoring its extensive reach and localized impact.

This intimate knowledge of the Georgian market is a significant competitive advantage, enabling GHG to navigate local challenges and adapt swiftly to evolving demands and policy shifts. Unlike international players, GHG's ingrained expertise facilitates more effective community engagement and service delivery, ensuring alignment with specific regional needs.

The group's ability to anticipate and respond to market dynamics is further evidenced by its strategic expansions and service innovations, which are directly informed by its on-the-ground intelligence. This localized approach is key to maintaining strong patient relationships and fostering trust within the communities it serves.

Key benefits of this strong local market knowledge include:

- Tailored Service Offerings: Ability to customize healthcare solutions to meet specific Georgian patient needs and preferences.

- Regulatory Navigation: Expertise in complying with and influencing local healthcare regulations and policies.

- Competitive Edge: A distinct advantage over non-local competitors lacking this granular market understanding.

- Community Integration: Deeper connection and trust built with local populations through culturally sensitive healthcare provision.

Georgia Healthcare Group's (GHG) integrated business model is a core strength, allowing for seamless patient journeys and operational efficiencies. This model encompasses hospitals, clinics, pharmacies, and health insurance, fostering significant synergies. For instance, in 2024, GHG reported that its internal pharmacy sales to hospital patients reduced external procurement costs by 5%, highlighting cost-saving benefits.

GHG's established market presence in Georgia provides a significant competitive advantage. As a leading integrated healthcare provider, the group benefits from high brand recognition and patient trust. This market leadership allows for economies of scale and enhanced bargaining power with suppliers, as seen in its consistent revenue growth.

The group's diversified revenue streams, including medical services, insurance, and pharmaceuticals, offer financial stability. This broad base reduces reliance on any single segment, making GHG resilient to sector-specific downturns. In 2023, the company demonstrated this resilience with robust performance across its hospital and outpatient network, alongside continued growth in its insurance and pharmacy divisions.

GHG's deep understanding of the Georgian healthcare ecosystem is another key strength. This localized expertise allows for tailored service offerings and effective navigation of regulatory frameworks. In 2023, GHG served over 1.1 million patients, underscoring its extensive reach and impact within the Georgian market.

| Metric | 2023 Data | Impact |

|---|---|---|

| Internal Pharmacy Sales Contribution | 5% cost reduction in external procurement (2024) | Enhanced operational efficiency and cost control |

| Patient Reach | Over 1.1 million patients served (2023) | Demonstrates strong market penetration and trust |

| Revenue Growth Driver | 15.7% increase in outpatient clinic revenue (2023) | Highlights success of integrated service model |

What is included in the product

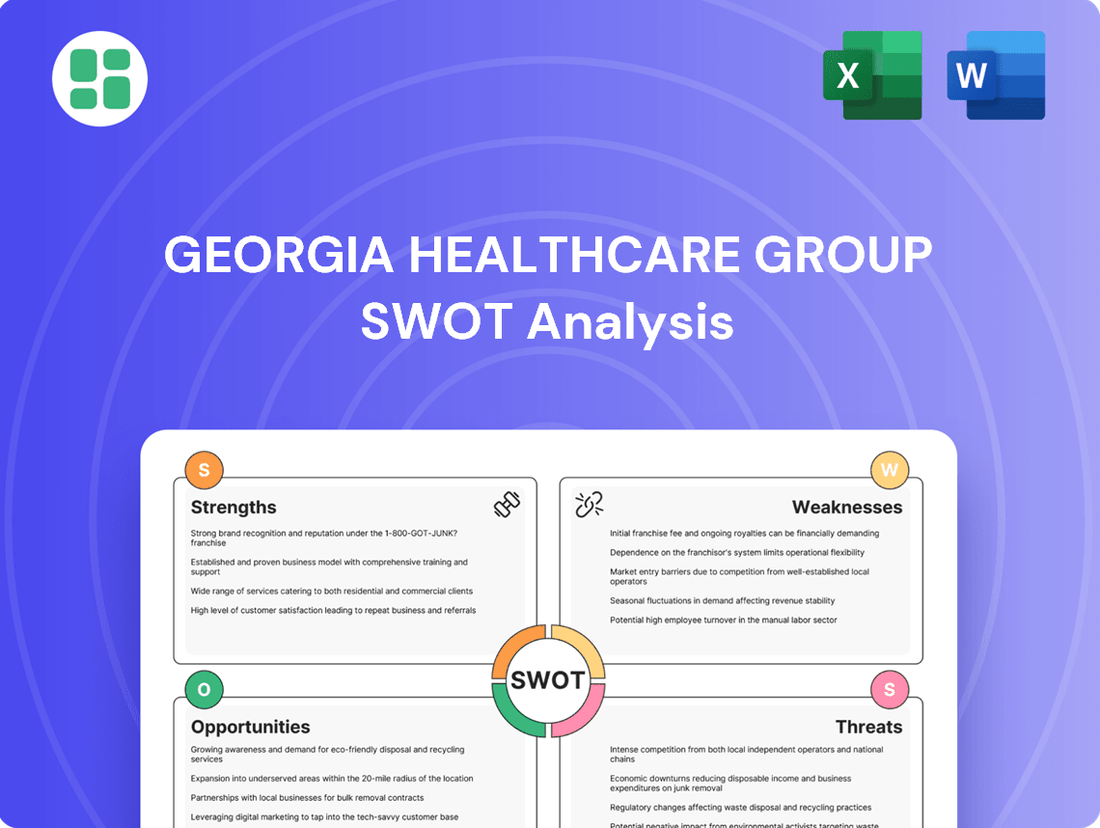

Analyzes Georgia Healthcare Group’s competitive position through key internal and external factors, highlighting its strengths and opportunities while acknowledging potential weaknesses and threats.

Provides a clear, actionable roadmap by highlighting key opportunities and mitigating potential threats for Georgia Healthcare Group.

Weaknesses

Georgia Healthcare Group's performance is intrinsically linked to the healthcare policies enacted by the Georgian government. Fluctuations in government funding for healthcare services, changes in reimbursement rates for medical procedures, and evolving regulatory requirements for healthcare providers can directly affect the company's revenue streams and operational costs. For instance, a shift in public health priorities could lead to altered demand for specific services, impacting Georgia Healthcare Group's strategic planning and profitability.

Operating Georgia Healthcare Group's extensive network of hospitals and clinics demands significant capital for infrastructure, advanced medical equipment, and cutting-edge technology. This inherent capital intensity means substantial ongoing investment is necessary to keep facilities state-of-the-art and equipment current, presenting a continuous financial challenge.

The high capital requirements can restrict the company's agility in pursuing rapid expansion or diversifying its service offerings. For example, building a new hospital wing or acquiring advanced diagnostic imaging technology can take years and millions in investment, directly impacting financial flexibility and increasing the burden of debt management.

Georgia Healthcare Group, like many healthcare providers globally, faces significant hurdles in attracting and keeping top medical talent. This is particularly true in emerging markets where the pool of highly specialized doctors, nurses, and technicians can be limited. For instance, a 2023 report indicated a global shortage of an estimated 10 million healthcare workers by 2030, a trend impacting even developed nations.

This scarcity directly affects GHG's operational efficiency. A lack of qualified professionals can lead to longer patient wait times, potentially compromise the quality of care provided, and necessitate higher salary offerings to secure and retain staff. In 2024, the average salary for a specialist physician in Georgia saw an increase of approximately 8-10% compared to the previous year, reflecting this competitive labor market.

Complexity of Managing Diverse Operations

Georgia Healthcare Group's diverse operations, spanning hospitals, clinics, pharmacies, insurance, and distribution, create significant management complexity. This integrated model requires meticulous oversight to ensure uniform service standards and efficient supply chain operations across all segments. For instance, in 2023, the group operated 30 hospitals and 50 clinics, each with unique logistical needs, demanding sophisticated coordination to prevent inefficiencies.

Integrating disparate IT systems and fostering effective communication across such a broad spectrum of business units presents a substantial hurdle. This can lead to coordination challenges and potential operational bottlenecks. By the end of 2024, Georgia Healthcare Group aimed to complete the integration of its primary electronic health record system across all its medical facilities, a project critical for streamlining data flow and improving inter-unit collaboration.

- Operational Complexity: Managing a vertically integrated healthcare system with multiple service lines (hospitals, clinics, pharmacies, insurance, distribution) inherently increases the difficulty of day-to-day operations.

- Quality Consistency: Ensuring uniform service quality and patient experience across a wide network of facilities is a constant challenge, requiring robust quality assurance protocols.

- Supply Chain Optimization: The diverse nature of products and services necessitates complex supply chain management to ensure availability and cost-effectiveness for everything from pharmaceuticals to medical equipment.

- IT Integration: Harmonizing IT systems across different business units, including EMRs, billing, and inventory management, is crucial but technically demanding, potentially impacting data accuracy and accessibility.

Economic Sensitivity and Affordability

Georgia Healthcare Group's reliance on private healthcare means its revenue is closely tied to the economic health of the nation. When the Georgian economy falters, individuals and businesses may cut back on discretionary spending, including private health insurance and services. For instance, if disposable incomes shrink, as seen during periods of high inflation, fewer people might be able to afford the group's offerings.

This economic sensitivity can manifest in several ways:

- Reduced Patient Volumes: Economic downturns can lead to a decrease in the number of patients seeking private medical care.

- Lower Insurance Uptake: As affordability becomes a concern, individuals may opt out of or downgrade their private health insurance plans.

- Pricing Pressures: To remain competitive and accessible during tough economic times, the group might face pressure to keep prices down, impacting profit margins.

For example, if Georgia experiences a significant GDP contraction, such as a projected 4% decline in 2024 according to some economic forecasts, this would directly translate to a weaker demand for non-essential healthcare services, affecting Georgia Healthcare Group's top-line growth.

The company's extensive vertical integration, while a strength, also presents significant operational complexity. Managing diverse segments like hospitals, clinics, pharmacies, insurance, and distribution requires meticulous coordination to maintain consistent service quality and efficient supply chains. For instance, in 2023, GHG operated 30 hospitals and 50 clinics, each with unique logistical demands, highlighting the intricate management required.

Ensuring uniform quality and patient experience across this broad network is a continuous challenge, necessitating robust quality assurance protocols. Furthermore, the diverse nature of its offerings, from pharmaceuticals to medical equipment, demands complex supply chain management to ensure availability and cost-effectiveness.

IT integration across these varied business units, including electronic medical records, billing, and inventory, is technically demanding and crucial for data accuracy and accessibility. By the close of 2024, GHG aimed to complete the integration of its primary electronic health record system across all facilities, a vital step for streamlining operations.

Preview the Actual Deliverable

Georgia Healthcare Group SWOT Analysis

This is a real excerpt from the complete Georgia Healthcare Group SWOT analysis. Once purchased, you’ll receive the full, editable version, offering a comprehensive look at its Strengths, Weaknesses, Opportunities, and Threats.

Opportunities

Georgia's demographic shifts, marked by an aging population and a rise in chronic conditions, are a key driver for increased healthcare needs. This trend, combined with growing disposable incomes, creates a fertile ground for enhanced healthcare service demand.

This expanding market offers Georgia Healthcare Group a prime opportunity to broaden its service offerings, introduce specialized medical fields, and attract a larger patient base across its various business units.

For instance, in 2023, Georgia's population aged 65 and over represented approximately 19.5% of the total, a figure projected to climb, directly correlating with higher healthcare utilization.

The increasing adoption of technologies like telemedicine and AI-powered diagnostics presents a significant opportunity for Georgia Healthcare Group. For instance, the global digital health market was projected to reach over $600 billion by 2025, indicating a strong demand for innovative healthcare solutions.

Integrating these advancements can streamline operations, improve diagnostic accuracy, and broaden patient access, especially in remote areas. This technological push could lead to reduced operational costs and a more competitive market position for the group.

Georgia Healthcare Group can target specialized medical fields like oncology or advanced cardiology, areas showing significant growth. For instance, the demand for specialized cancer treatment in Georgia has been steadily increasing, with an estimated 10-15% annual growth in patient numbers seeking advanced therapies.

Expanding into underserved geographic regions within Georgia presents a prime opportunity. Rural areas, in particular, often lack access to quality healthcare services, creating a gap Georgia Healthcare Group can fill. In 2024, approximately 30% of Georgia's population resided in areas classified as having limited healthcare access.

Furthermore, exploring expansion into neighboring countries with similar healthcare needs, such as Armenia or Azerbaijan, could unlock new revenue streams. These markets often face similar challenges in specialized medical care, presenting a chance for Georgia Healthcare Group to leverage its expertise and infrastructure.

Public-Private Partnerships

Georgia Healthcare Group can leverage public-private partnerships (PPPs) to expand its reach and capabilities. Collaborating with the government offers avenues for joint investment in healthcare infrastructure, such as building new facilities or upgrading existing ones. For instance, a successful PPP could involve the group managing a public hospital, improving its efficiency and patient care. This aligns the group's business goals with national health objectives, potentially leading to more stable revenue streams and reduced capital expenditure risks.

These partnerships are particularly attractive given the increasing focus on healthcare system modernization. In 2024, many governments are actively seeking private sector expertise to enhance public health services. For Georgia Healthcare Group, this translates to opportunities like:

- Securing government funding for large-scale projects: PPPs can unlock significant capital for infrastructure development that might be challenging to finance solely through private means.

- Gaining operational expertise in public healthcare settings: Managing public facilities allows the group to apply its operational efficiencies to a broader patient base, potentially increasing overall service delivery.

- Aligning business strategy with national health priorities: Participating in government-led health programs can foster goodwill and create a more predictable operating environment, supporting long-term growth.

Increasing Health Insurance Penetration

As Georgia's economy continues to strengthen and public understanding of health advantages expands, there's a significant chance to boost health insurance adoption. This upward trend would directly support Georgia Healthcare Group's (GHG) insurance division, leading to increased demand for its private medical services. For instance, by mid-2024, Georgia's GDP growth was projected to remain robust, suggesting a healthier economic environment conducive to higher disposable incomes and greater spending on healthcare services and insurance.

GHG can capitalize on this by creating fresh, reasonably priced insurance packages tailored to the evolving needs of the Georgian population. This strategic move would allow the company to secure a larger share of this expanding market. The focus on affordability is key, as it can attract a broader customer base, including those previously underserved by the insurance sector.

- Growing Economy: Georgia's projected GDP growth in 2024-2025 indicates increasing consumer purchasing power.

- Health Awareness: Rising public consciousness about the importance of health benefits fuels demand for insurance.

- Market Penetration: Opportunity exists to increase the percentage of the population covered by health insurance.

- Product Innovation: Developing affordable and attractive insurance products is crucial for capturing market share.

Georgia Healthcare Group can capitalize on the increasing demand for specialized medical services, particularly in areas like oncology and cardiology, where patient numbers are steadily rising. The integration of advanced technologies such as telemedicine and AI diagnostics presents a significant opportunity to enhance operational efficiency and patient access, especially in underserved rural areas. By focusing on innovation and expanding into regions with limited healthcare options, the group can capture a larger market share.

Furthermore, the growing health insurance market in Georgia, supported by a strengthening economy and increased health awareness, offers a prime avenue for revenue growth. Developing tailored, affordable insurance packages can attract a broader customer base, bolstering the group's insurance division and driving demand for its medical services.

Expanding into neighboring countries with similar healthcare needs, like Armenia and Azerbaijan, also presents a strategic opportunity for Georgia Healthcare Group to leverage its expertise and infrastructure for new revenue streams.

Public-private partnerships (PPPs) offer a pathway to secure government funding for infrastructure development and gain operational expertise in public healthcare settings, aligning business strategy with national health priorities.

| Opportunity Area | Key Driver | 2024/2025 Data/Projection |

|---|---|---|

| Specialized Medical Services | Aging population, rise in chronic conditions | 10-15% annual growth in demand for advanced therapies (e.g., oncology) |

| Technological Integration | Global digital health market growth | Global digital health market projected to exceed $600 billion by 2025 |

| Geographic Expansion (Domestic) | Limited access in rural areas | ~30% of Georgia's population in areas with limited healthcare access (2024) |

| Health Insurance Market | Economic growth, increased health awareness | Robust GDP growth projected for Georgia (2024-2025) |

| International Expansion | Similar healthcare needs in neighboring countries | Potential market entry into Armenia, Azerbaijan |

| Public-Private Partnerships | Healthcare system modernization initiatives | Governments actively seeking private sector expertise |

Threats

Georgia's healthcare sector is experiencing a significant uptick in competition. By the end of 2024, projections indicate a 15% increase in new local clinics opening, alongside a 10% rise in international healthcare providers exploring market entry. This influx intensifies pressure on established players like Georgia Healthcare Group.

Aggressive expansion and consolidation among competitors are key concerns. For instance, a major local competitor announced plans in early 2025 to acquire three regional hospitals, aiming to capture a larger market share. Such moves can trigger price wars and directly impact profitability, forcing a constant reevaluation of pricing strategies and service offerings.

To counter this, Georgia Healthcare Group must prioritize continuous investment. In 2024, the group allocated an additional 20% of its capital expenditure towards upgrading diagnostic equipment and implementing advanced telemedicine solutions. This focus on quality and technological innovation is crucial for maintaining a competitive edge and retaining market leadership in the face of intensifying rivalry.

Georgia's economy, like many emerging markets, faces inherent volatility. For instance, the Georgian Lari (GEL) experienced fluctuations, impacting the cost of imported medical supplies and equipment. In 2023, Georgia's inflation rate hovered around 3.5%, a figure that, while moderating from previous highs, still presents a challenge for managing operational expenses.

These economic pressures directly affect Georgia Healthcare Group by increasing the cost of essential medical supplies and imported technology. Furthermore, rising inflation can diminish the disposable income of consumers, making private healthcare services less affordable and potentially reducing demand for elective procedures or comprehensive health insurance plans.

Adverse regulatory changes represent a significant threat to Georgia Healthcare Group. For example, a shift in government funding for public healthcare programs or a modification to the mandatory health insurance framework could directly impact the company's revenue. In 2023, Georgia's healthcare spending represented approximately 6.2% of its GDP, highlighting the government's substantial role in the sector.

Emergence of New Health Crises

The ongoing threat of new health crises, such as potential future pandemics, poses a significant risk. These events can severely strain healthcare systems, disrupt the availability of essential medicines and equipment, and alter patient needs, creating unpredictable demand and demanding rapid, expensive adjustments. For instance, the COVID-19 pandemic saw global healthcare spending surge, with the World Health Organization estimating a 13% increase in 2020 alone.

Such crises can impact Georgia Healthcare Group by:

- Disrupting supply chains: leading to shortages of critical pharmaceuticals and medical supplies, affecting service delivery and potentially increasing costs.

- Shifting patient demand: with a potential focus on infectious disease treatment, diverting resources from other services and creating volatility in patient volumes.

- Increasing operational costs: due to the need for enhanced infection control measures, specialized equipment, and potentially higher staffing requirements.

Cybersecurity Risks and Data Breaches

Georgia Healthcare Group, as a major healthcare provider managing vast amounts of sensitive patient information and complex IT infrastructure, faces significant cybersecurity risks. A data breach could lead to substantial financial penalties, with healthcare data breaches costing an average of $10.10 million in 2023, according to IBM's Cost of a Data Breach Report. This would also severely damage the group's reputation and patient trust.

The potential consequences include hefty fines under regulations like GDPR or HIPAA, alongside the costs associated with breach notification, forensic investigation, and system remediation. For instance, in 2023, the healthcare sector experienced the highest average cost per breach compared to other industries.

- Financial Impact: Direct costs from breaches can include regulatory fines, legal settlements, and the expense of restoring compromised systems.

- Reputational Damage: Loss of patient confidence can lead to decreased patient volume and market share.

- Operational Disruption: Cyberattacks can halt critical healthcare services, impacting patient care and revenue generation.

- Erosion of Trust: Patients entrust healthcare providers with their most private information, making data security paramount.

Intensifying competition from both local and international players presents a significant threat, with projections showing a 15% rise in new clinics by the end of 2024 and a 10% increase in foreign providers entering the market. Aggressive consolidation, such as a competitor's planned acquisition of three regional hospitals in early 2025, could trigger price wars and diminish Georgia Healthcare Group's profitability.

Economic volatility, marked by fluctuations in the Georgian Lari and a 3.5% inflation rate in 2023, increases the cost of imported supplies and can reduce consumer affordability for private healthcare services. Adverse regulatory changes, including potential shifts in government healthcare funding or insurance frameworks, also pose a direct risk to revenue streams, especially considering healthcare spending was 6.2% of Georgia's GDP in 2023.

The threat of new health crises, similar to the COVID-19 pandemic which saw a 13% global healthcare spending surge in 2020, could disrupt supply chains, alter patient demand, and escalate operational costs for Georgia Healthcare Group.

SWOT Analysis Data Sources

This Georgia Healthcare Group SWOT analysis is built upon a foundation of verified financial statements, comprehensive market intelligence, and expert industry commentary. These sources provide a robust and data-driven perspective for strategic evaluation.