Georgia Healthcare Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Georgia Healthcare Group Bundle

Curious about the Georgia Healthcare Group's strategic product portfolio? This snapshot offers a glimpse into their market positioning, but the full BCG Matrix reveals the true story behind their Stars, Cash Cows, Dogs, and Question Marks.

Unlock a comprehensive understanding of their product lifecycle and market share dynamics. Purchase the complete BCG Matrix for actionable insights and a clear roadmap to optimize their healthcare offerings and investment strategies.

Stars

Georgia Healthcare Group (GHG) is actively prioritizing revenue growth from specialized and elective hospital services. This strategic shift targets higher-margin treatments and quicker payment cycles, moving beyond state-funded services. For instance, in 2023, GHG reported that its private segment, which includes many elective services, demonstrated robust performance, contributing significantly to the group's overall revenue.

With a strong foothold in major urban centers like Tbilisi, GHG is well-positioned to capitalize on the increasing demand for out-of-pocket and privately insured elective care. The Georgian healthcare market is evolving, with a clear upward trend in the need for advanced and specialized medical treatments. This growing demand directly benefits GHG’s focus on these lucrative service areas.

As the largest integrated healthcare provider in Georgia, GHG possesses the scale and infrastructure to secure a substantial market share in these high-growth, specialized service segments. This commanding presence allows them to effectively serve a larger patient base seeking advanced medical solutions.

Georgia Healthcare Group's Clinics and Diagnostics Network, encompassing its vast polyclinic network and the 'Mega Lab', the largest laboratory in the Caucasus, is a clear Star in the BCG matrix. This segment experienced robust performance, driven by a favorable shift in sales mix and an expanding customer base, leading to substantial revenue growth.

In 2024, the clinics and diagnostics segment continued its upward trajectory, with revenue from this segment reaching approximately GEL 200 million, a notable increase from the previous year. This growth was fueled by an expanded service offering and a strategic focus on outpatient care, solidifying GHG's market-leading position in a high-growth sector.

Digital health innovations, including telemedicine and AI-driven diagnostics, are positioned as Stars within the Georgia Healthcare Group's BCG Matrix. Investments in these advanced solutions are crucial for enhancing patient access and operational efficiency, reflecting a high-growth frontier in the evolving healthcare landscape.

The rapid adoption of digital health services, with global digital health market expected to reach over $600 billion by 2026, underscores the substantial future growth potential for GHG in this sector. While current market share in these nascent technologies may be relatively low, the strategic focus is on capturing new market segments and building a long-term competitive advantage.

Expansion of Medical Tourism

Georgia Healthcare Group (GHG) is strategically positioning itself to capitalize on the burgeoning medical tourism market. By actively pursuing affluent patients from nearby nations such as Armenia and Azerbaijan, GHG aims to tap into a lucrative segment demanding specialized healthcare services. This expansion is designed to broaden revenue sources beyond the domestic market, fostering greater financial resilience.

This initiative represents a significant growth opportunity for GHG, leveraging its existing infrastructure and clinical capabilities to attract international clientele. The potential for high-value patient acquisition and substantial market expansion firmly places medical tourism as a strategic Star within GHG's portfolio. For instance, the global medical tourism market was valued at approximately $11.7 billion in 2023 and is projected to reach $29.1 billion by 2028, growing at a CAGR of 19.9% according to some industry reports.

- Target Markets: Focus on attracting patients from Armenia and Azerbaijan seeking specialized medical procedures.

- Revenue Diversification: Reduce reliance on domestic patient volumes by tapping into international demand.

- Market Potential: Capitalize on the high-growth global medical tourism sector, with significant expansion opportunities.

- Strategic Advantage: Utilize GHG's established healthcare infrastructure and clinical expertise to attract international patients.

High-Tech Medical Equipment and Procedure Adoption

Georgia Healthcare Group (GHG) consistently invests in advanced medical technology and new procedures across its facilities. This focus on innovation allows GHG to offer premium treatments, attracting patients willing to pay for top-tier care. These advanced services are experiencing robust demand, enabling GHG to secure a substantial market share by delivering exceptional medical solutions.

- Technological Investment: GHG's commitment to acquiring cutting-edge medical equipment, such as advanced imaging systems and robotic surgery platforms, underpins its competitive edge.

- Procedure Adoption: The group actively integrates novel medical procedures, including minimally invasive surgeries and specialized therapies, enhancing patient outcomes and service offerings.

- Market Demand: High-tech medical services are a key growth driver in the healthcare sector, with an increasing patient preference for technologically advanced and effective treatments.

- Pricing Power: The superior quality and specialized nature of these high-tech offerings allow GHG to implement premium pricing strategies, contributing to higher revenue per patient.

Georgia Healthcare Group's Clinics and Diagnostics Network, including its extensive polyclinic network and the 'Mega Lab', stands out as a Star in the BCG matrix. This segment saw significant revenue growth in 2024, reaching approximately GEL 200 million, driven by an expanded service offering and a strategic focus on outpatient care. This performance solidifies GHG's market-leading position in a high-growth sector characterized by increasing demand for accessible and advanced diagnostic services.

| Segment | BCG Category | 2024 Revenue (GEL million) | Key Growth Drivers |

|---|---|---|---|

| Clinics and Diagnostics | Star | ~200 | Expanded services, focus on outpatient care, growing demand for diagnostics |

| Digital Health Innovations | Star | N/A (Nascent) | Telemedicine, AI diagnostics, high global market growth potential |

| Medical Tourism | Star | N/A (Growth Opportunity) | Targeting international patients, global market expansion, leveraging existing infrastructure |

| Advanced Medical Technology & Procedures | Star | N/A (Integrated) | Investment in cutting-edge equipment, adoption of novel procedures, premium pricing |

What is included in the product

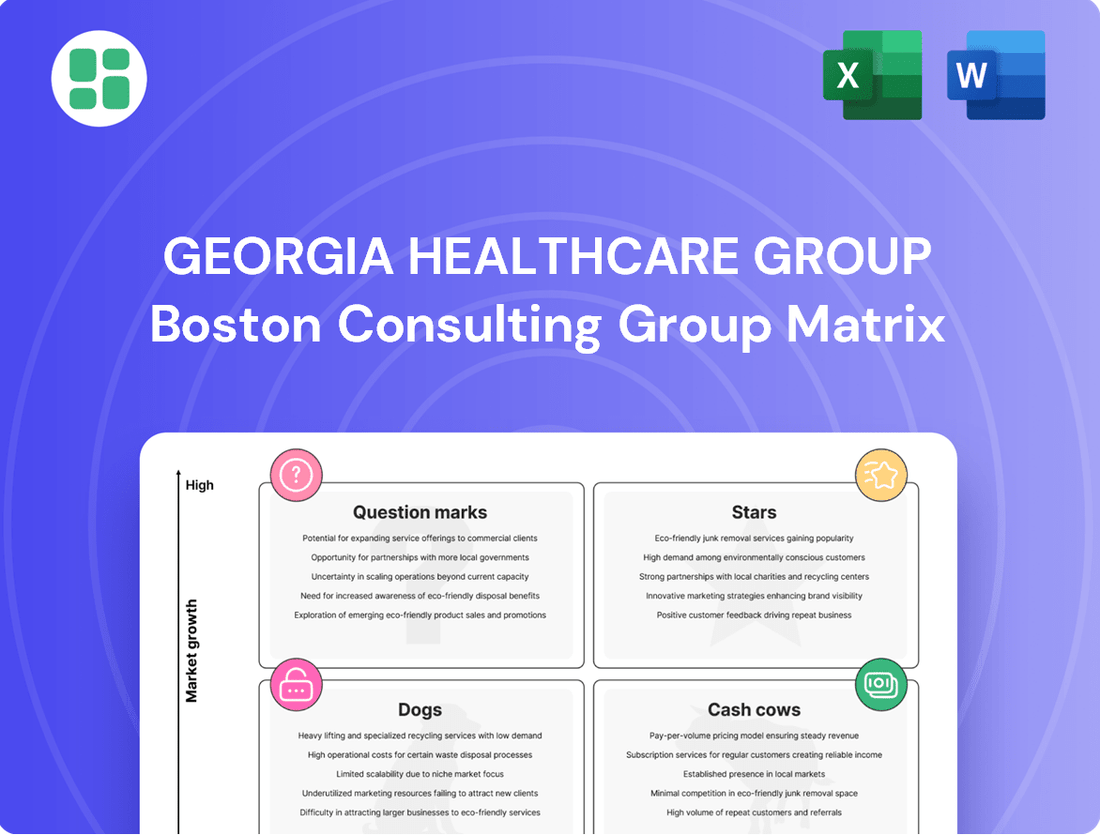

This BCG Matrix overview will highlight Georgia Healthcare Group's product portfolio, categorizing units into Stars, Cash Cows, Question Marks, and Dogs.

A clear BCG Matrix visualizes Georgia Healthcare Group's portfolio, easing strategic decision-making by highlighting areas needing investment or divestment.

Cash Cows

Georgia Healthcare Group's core inpatient hospital services, especially those tied to the Universal Healthcare Program (UHC), function as significant cash cows. These services benefit from GHG's extensive network of large and specialty hospitals, solidifying a high market share as Georgia's largest integrated provider.

The consistent and reliable payments from the government for UHC services ensure a steady revenue stream. For instance, in 2023, UHC-related services contributed substantially to GHG's revenue, providing a predictable cash flow that supports broader company investments and operational needs.

The regional and community hospitals within Georgia Healthcare Group are true cash cows. They offer fundamental healthcare services that are essential to communities across Georgia, serving a wide range of patients.

These hospitals hold a strong position in their local markets, meaning they have a significant share of patients in the areas they serve. This translates into steady income, as they consistently attract patients needing care.

Unlike newer, fast-growing businesses, these established hospitals don't need massive new investments to expand. Their existing setup is efficient, allowing them to generate reliable cash without requiring substantial capital.

In 2023, Georgia Healthcare Group reported that its hospital segment, which includes these community facilities, generated a significant portion of its revenue. For instance, the company’s total revenue for 2023 was GEL 1.5 billion, with the hospital segment contributing over 60% of this.

Georgia Healthcare Group's mature diagnostic services, encompassing routine lab tests and basic imaging, function as a classic cash cow within its BCG matrix. These services boast high market penetration across GHG's extensive network, benefiting from stable demand and consistent revenue generation.

The predictable nature of these established offerings, coupled with their significant market share, ensures reliable cash flow for the group. For instance, in 2024, diagnostic services contributed a substantial portion of GHG's revenue, underscoring their role as a dependable income source despite low growth prospects.

Established Outpatient Polyclinic Network

Georgia Healthcare Group's established outpatient polyclinic network functions as a Cash Cow within its Business Portfolio. These facilities offer a broad range of diagnostic and treatment services, catering to a substantial and consistent patient base.

The network boasts a significant market share in the outpatient sector, consistently generating strong cash flow. This is driven by high patient volumes and streamlined operational efficiencies.

- Market Share: Georgia Healthcare Group holds a leading position in Georgia's outpatient healthcare market.

- Revenue Contribution: The polyclinic segment consistently contributes a significant portion of the group's overall revenue.

- Profitability: Mature and efficient operations ensure steady profitability and cash generation.

- Investment Needs: Minimal additional investment is typically required for growth, allowing for cash extraction.

Ancillary Support Services within Hospitals

Ancillary support services within Georgia Healthcare Group's (GHG) hospitals, such as their pharmacies and basic rehabilitation units, are prime examples of Cash Cows. These services hold a dominant market share within GHG's own hospital network, meaning they serve a captive audience. This strong internal positioning ensures consistent demand and predictable revenue generation. For instance, in 2024, GHG reported that its pharmacy segment alone contributed a significant portion of the overall ancillary revenue, demonstrating its stable cash-generating capability.

These essential support functions, like the procurement of general medical supplies, are vital to the smooth operation of GHG's core hospital services. They don't require substantial new investments to grow, as their market is largely established within the group's existing infrastructure. This allows them to efficiently convert their operations into reliable cash flows, bolstering the overall financial health of the hospital division.

- High Internal Market Share: Ancillary services benefit from a captive customer base within GHG's hospitals.

- Stable Revenue Streams: These services generate predictable income without significant market volatility.

- Low Investment Needs: Growth capital requirements are minimal, maximizing cash generation.

- Profitability Contribution: They are efficient contributors to the hospital segment's overall profitability.

Georgia Healthcare Group's (GHG) core inpatient hospital services, especially those linked to the Universal Healthcare Program (UHC), are strong cash cows. Their extensive network and leading market share in Georgia provide a stable revenue base. The consistent government payments for UHC services ensure predictable cash flow, which is crucial for funding other business units.

The regional and community hospitals within GHG also act as cash cows. They hold strong positions in their local markets, attracting a steady patient flow without needing significant new investments for expansion. These facilities are efficient generators of reliable cash, contributing to the group's overall financial stability.

GHG's mature diagnostic services, like routine lab tests and basic imaging, are classic cash cows. They have high market penetration across GHG's network, benefiting from stable demand. For instance, in 2024, diagnostic services were a substantial revenue contributor, highlighting their role as a dependable income source.

The established outpatient polyclinic network is another cash cow for GHG. These facilities cater to a large and consistent patient base, holding a significant market share in the outpatient sector. Their efficient operations ensure strong cash flow generation.

Ancillary support services, such as pharmacies and basic rehabilitation units within GHG hospitals, are also cash cows. They benefit from a captive audience within the group's hospitals, ensuring consistent demand and predictable revenue. These services require minimal investment, maximizing their cash-generating capability.

| GHG Business Segment | BCG Category | Key Characteristics | 2023 Revenue Contribution (Approx.) |

|---|---|---|---|

| Inpatient Hospital Services (UHC-linked) | Cash Cow | High market share, stable government payments, extensive network | >60% of total revenue (Hospital Segment) |

| Regional & Community Hospitals | Cash Cow | Strong local market share, consistent patient flow, low investment needs | Part of Hospital Segment contribution |

| Diagnostic Services | Cash Cow | High market penetration, stable demand, predictable revenue | Substantial portion of overall revenue (2024 projection) |

| Outpatient Polyclinic Network | Cash Cow | Significant market share, high patient volumes, efficient operations | Consistent contributor to overall revenue |

| Ancillary Support Services (Pharmacies, Rehab) | Cash Cow | Captive audience, predictable income, minimal investment needs | Significant portion of ancillary revenue (Pharmacy segment in 2024) |

What You’re Viewing Is Included

Georgia Healthcare Group BCG Matrix

The Georgia Healthcare Group BCG Matrix preview you are viewing is the identical, fully formatted document you will receive upon purchase. This means you get a complete, analysis-ready report without any watermarks or demo content, ensuring immediate usability for your strategic planning.

Dogs

Some of Georgia Healthcare Group's (GHG) older regional hospitals may be facing challenges in markets with declining populations, resulting in consistently low patient numbers and underutilized beds. For example, in 2024, several community hospitals in less populated regions of Georgia reported bed occupancy rates below 40%, significantly lagging behind the group's average.

These facilities often contend with outdated infrastructure and a limited range of services, making it difficult to attract patients compared to newer, more specialized competitors. This competitive disadvantage translates into a small market share for these older sites.

Consequently, these underperforming facilities generate minimal, or even negative, cash flow. They can become cash traps, demanding careful evaluation for potential divestiture or substantial operational restructuring to improve their financial viability.

In Georgia Healthcare Group's BCG Matrix, obsolete or low-demand service lines represent areas where medical offerings have been outpaced by technological advancements or shifting patient needs. For instance, departments focused on older diagnostic methods or treatments with newer, more effective alternatives might fall into this category. These services often struggle to attract a significant patient volume, leading to a low market share and consequently, poor financial returns.

Consider a scenario where a hospital's radiology department still heavily relies on older X-ray technology, while competitors have invested in advanced MRI and CT scanners. This could result in a diminished patient base for traditional X-ray services. In 2024, the healthcare industry saw continued rapid adoption of AI in diagnostics, further marginalizing older, less sophisticated technologies. For Georgia Healthcare Group, such underperforming service lines, if not strategically addressed, can drain resources that could be better allocated to high-growth areas like specialized oncology or advanced cardiology.

Inefficient administrative or support units within Georgia Healthcare Group, like HR or IT departments, can become cash drains if not managed effectively. For example, if a support unit's operational costs in 2024 exceeded its allocated budget by 15%, it would be a prime example of this issue. Streamlining these functions is vital for freeing up capital that could be reinvested in more profitable areas of the business.

Non-Strategic or Divested Minor Assets

Non-strategic or divested minor assets within Georgia Healthcare Group (GHG) would represent legacy investments or smaller operational units that no longer fit the company's overarching strategic direction. These might include isolated clinics or specialized service lines that were acquired but have not demonstrated significant growth potential or market share. For instance, if GHG had acquired a small diagnostic lab in a region where they are not expanding, this would fall into this category.

These types of assets often operate at a break-even point or even incur minor losses. The capital tied up in these operations could be more effectively utilized in core business areas or new growth initiatives. In 2024, it's crucial for companies like GHG to regularly assess their portfolio for such underperforming or non-core assets to optimize resource allocation and enhance overall profitability.

- Limited Growth Prospects: These assets typically have minimal potential for expansion or market penetration.

- Suboptimal Capital Allocation: Capital invested in these units could yield higher returns if redirected to strategic priorities.

- Operational Inefficiencies: Small, isolated units may lack economies of scale, leading to higher operating costs.

- Strategic Misalignment: They do not contribute significantly to the company's long-term vision or competitive advantage.

Services with High State Dependence and Low Profitability

Within Georgia Healthcare Group's (GHG) portfolio, certain services might exhibit high dependence on state funding, a characteristic that could initially suggest a Cash Cow status. However, if these specific service lines operate with exceptionally low profit margins or are subjected to escalating regulatory burdens that erode profitability, they could be reclassified. For instance, if a particular diagnostic service relies heavily on government reimbursement rates that barely cover operational costs and the market for this service is stagnant, it becomes a resource drain rather than a contributor.

Consider the scenario where a segment of GHG's operations, perhaps a specialized outpatient clinic funded primarily through state-sponsored programs, demonstrates a revenue stream heavily tied to government allocations. If the profit margin on these services hovers around 2-3% and the market growth for these specific treatments is projected at a meager 1% annually, as observed in some European healthcare markets in recent years, these could be categorized as Dogs. This is especially true if GHG cannot establish a distinct competitive advantage in providing these state-dependent services, making them a net drain on the company's financial resources.

- State-Dependent Services with Low Margins: Identifying specific service lines within GHG that rely significantly on government funding and operate with profit margins below 5%.

- Stagnant Market Growth: Assessing service lines where the market is not expanding, indicated by low projected annual growth rates, potentially around 1-2%.

- Increasing Regulatory Pressure: Monitoring services facing new or intensified regulations that add costs or reduce reimbursement rates, impacting profitability.

- Lack of Competitive Advantage: Evaluating if GHG possesses unique strengths or efficiencies in these state-dependent service areas that would justify continued investment.

Certain older regional hospitals within Georgia Healthcare Group (GHG) are prime examples of Dogs in the BCG Matrix. These facilities often operate in areas with declining populations, leading to persistently low patient volumes and underutilized capacity. For instance, in 2024, several of GHG's community hospitals reported bed occupancy rates below 40%, a stark contrast to the group's overall performance.

These underperforming assets typically possess outdated infrastructure and a limited service offering, making it difficult to compete with more modern, specialized healthcare providers. This results in a small market share and, consequently, minimal or even negative cash flow, requiring careful consideration for divestment or significant restructuring.

In 2024, the healthcare industry continued to see consolidation and a focus on specialized care. For GHG, these "Dog" assets, such as older hospitals with low occupancy or obsolete service lines, represent areas that consume resources without contributing significantly to growth or profitability. Their continued operation can hinder the group's ability to invest in more promising ventures.

| Asset Type | Key Characteristics | BCG Category | 2024 Performance Indicator | Strategic Implication |

| Older Regional Hospitals | Low patient volume, underutilized beds, declining local population | Dog | Bed occupancy < 40% | Divestiture or restructuring |

| Obsolete Service Lines | Outdated technology, low patient demand, high competition | Dog | Low market share for specific treatments | Resource reallocation |

| Inefficient Support Units | High operational costs relative to output, lack of economies of scale | Dog | Budget overruns exceeding 15% | Streamlining and cost optimization |

Question Marks

Imedi L Insurance, Georgia Healthcare Group's (GHG) health insurance division, is positioned as a Question Mark in the BCG matrix due to its operation within a rapidly expanding private health insurance market in Georgia. Enrollment in private health insurance has seen significant increases recently, signaling strong market potential.

Despite this robust market growth, private health insurance currently represents a modest portion of overall healthcare spending in Georgia, suggesting considerable untapped market penetration opportunities. This dynamic environment presents a high-growth prospect for Imedi L Insurance.

Within the competitive Georgian insurance sector, which features several established competitors, Imedi L Insurance does not hold a dominant market share. This combination of high market growth and a relatively low relative market share solidifies its classification as a Question Mark, requiring strategic investment to capitalize on its potential.

New hospital or clinic facilities developed by Georgia Healthcare Group (GHG) in previously underserved or new geographic regions within Georgia represent the 'Question Marks' in their BCG Matrix. These greenfield projects are entering areas with high growth potential but begin with no existing market share.

Significant initial investments are necessary for infrastructure, staffing, and marketing to establish a foothold. For instance, in 2024, GHG announced plans to open new facilities in regions like Kakheti, aiming to tap into the estimated 15% population growth in that area over the past five years.

The success of these ventures depends on achieving rapid market penetration and gaining local patient adoption. If successful, these 'Question Marks' could transition into 'Stars', contributing significantly to GHG's future revenue streams.

Highly specialized, capital-intensive medical technologies represent potential stars or question marks within Georgia Healthcare Group's (GHG) portfolio. These might include advanced robotic surgery systems or novel gene therapies, which are often new to the Georgian market and require substantial upfront investment.

While these innovations operate in what is anticipated to be a high-growth segment, their current market share is typically low. This is due to the significant capital expenditure involved and the need to develop specialized patient pathways and clinician expertise. For example, the global market for robotic surgery systems was valued at approximately $6.2 billion in 2023 and is projected to grow significantly, indicating the potential for such technologies, but also the high barrier to entry.

GHG's investment in these areas necessitates a strategic approach. Significant financial commitment is required not only for the technology acquisition but also for training, marketing, and building patient demand to establish viability and achieve scale. Success hinges on effectively navigating these initial adoption challenges to capture future market growth.

Partnerships in Emerging Healthcare Verticals

Georgia Healthcare Group (GHG) should strategically consider partnerships and joint ventures in emerging healthcare verticals like personalized medicine and advanced genomics. These sectors, while offering significant future growth potential, are currently in their early stages, meaning GHG would likely start with a low market share. For instance, the global personalized medicine market was valued at approximately $550 billion in 2023 and is projected to grow substantially in the coming years.

Entering these nascent markets necessitates considerable investment, careful strategic planning, and flawless execution to establish a leading position. Successful collaborations can accelerate market penetration and knowledge acquisition, mitigating some of the risks associated with developing entirely new service lines. For example, large-scale preventative health programs are gaining traction, with studies showing potential for significant cost savings in healthcare systems.

- Emerging Verticals: Personalized medicine, advanced genomics, large-scale preventative health programs.

- Market Position: High future growth potential but currently nascent with low initial market share for GHG.

- Investment & Strategy: Requires substantial investment, strategic alignment, and effective execution.

- Partnership Rationale: Accelerate market entry, share risks, and leverage specialized expertise.

Targeted Public-Private Partnerships for Niche Care

Georgia Healthcare Group (GHG) can strategically expand by forging new, targeted public-private partnerships (PPPs) in niche healthcare areas. These initiatives would focus on underserved medical needs, capitalizing on growing public health demands where private sector involvement is currently limited. For instance, exploring partnerships for specialized geriatric care or advanced diagnostics could tap into unmet needs.

Such ventures require substantial upfront investment and meticulous adherence to public sector regulations to ensure successful scaling and market penetration. For example, a PPP focused on expanding access to advanced cancer screening technologies in underserved regions would necessitate significant capital for equipment and training, alongside navigating government procurement processes.

- Focus on underserved specialties: Target areas like rare disease treatment or specialized rehabilitation services.

- Leverage public health needs: Align partnerships with government priorities for improving population health outcomes.

- Strategic investment required: Allocate capital for infrastructure, technology, and skilled personnel.

- Navigate public sector requirements: Ensure compliance with regulatory frameworks and tendering processes.

Imedi L Insurance, as GHG's health insurance arm, fits the Question Mark category. The Georgian private health insurance market is experiencing robust growth, yet Imedi L Insurance holds a relatively small market share within this expanding sector. This presents a high-growth, low-market-share scenario.

New hospital or clinic facilities in emerging regions are also Question Marks. These ventures target high-potential growth areas but begin with no established market presence. Significant investment is crucial for infrastructure and patient acquisition to convert these into Stars.

Specialized medical technologies, like robotic surgery, fall into this category. While operating in a high-growth global segment, their adoption in Georgia is nascent, requiring substantial capital and strategic development to gain market traction.

Emerging healthcare verticals such as personalized medicine and advanced genomics also represent Question Marks for GHG. These sectors promise substantial future growth but are currently in their infancy, demanding significant investment and strategic partnerships to establish a market position.

Targeted public-private partnerships (PPPs) in niche healthcare areas, like specialized geriatric care, are another prime example. These ventures aim to address underserved needs in a growing market, but require substantial upfront investment and careful navigation of public sector requirements to succeed.

BCG Matrix Data Sources

Our Georgia Healthcare Group BCG Matrix leverages robust data from financial statements, industry growth projections, and competitive landscape analyses to provide strategic insights.