Georgia Healthcare Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Georgia Healthcare Group Bundle

Unlock the critical external factors shaping Georgia Healthcare Group's future with our comprehensive PESTLE analysis. Understand how political stability, economic growth, evolving social demographics, technological advancements, environmental regulations, and legal frameworks are impacting operations and strategy. Gain the competitive edge by leveraging these actionable insights to inform your own market approach. Download the full PESTLE analysis now for immediate access to expert intelligence.

Political factors

The Georgian government's healthcare policy, particularly the Universal Healthcare Program (UHC), is a cornerstone of the sector. In 2024, Georgia Healthcare Group (GHG) reported that 54% of its annual revenue was derived from this UHC program. This significant reliance means that any shifts in government healthcare funding or the program's scope directly influence GHG's financial performance.

Potential economic downturns or regulatory adjustments by the Georgian government could lead to changes in UHC financing or its coverage. Such alterations pose a considerable policy risk for GHG, as a reduction in UHC funding or a narrowing of its benefits could directly impact the revenue streams for private healthcare providers like GHG.

The healthcare sector in Georgia operates within an evolving regulatory landscape, impacting areas such as hospital infrastructure and compensation. Georgia Healthcare Group (GHG) has proactively addressed these changes, completing necessary renovations across all its facilities by the December 2024 deadline to ensure compliance with updated legal mandates.

Georgia's government is actively working to boost healthcare accessibility. This includes expanding affordable health insurance programs and targeting areas with shortages of medical professionals. For instance, the 'No Patient Left Alone Act' (HB 663), enacted in May 2024, guarantees patient visitation rights, which directly influences how healthcare facilities operate and how patients interact with them.

Pharmaceutical Policy Reforms

Georgia has undergone substantial pharmaceutical policy shifts from 2014 to 2023. These reforms included implementing prescription mandates for specific medications, encouraging e-prescriptions, and establishing a drug reimbursement program.

A key development in 2022 was the allowance of parallel drug imports from Turkey. This was followed in 2023 by the introduction of reference pricing for pharmaceuticals, a system that expanded to cover 7,100 items by 2024, contributing to noticeable price reductions for many medicines.

- Prescription Requirements: Introduced for select drugs, enhancing medication control.

- Parallel Imports: Permitted from Turkey in 2022, increasing market competition.

- Reference Pricing: Implemented in 2023 and covering 7,100 items by 2024, driving down drug costs.

Political Stability and Geopolitical Influences

Georgia's political stability is a cornerstone for attracting and retaining foreign investment, which is vital for the healthcare sector's expansion. A predictable political landscape fosters confidence among investors, encouraging capital inflow necessary for infrastructure development and technological advancements within companies like Georgia Healthcare Group (GHG).

Geopolitical relationships significantly shape Georgia's economic trajectory and its strategic role as a re-export hub for pharmaceuticals. In 2023, Georgia's trade turnover with the European Union reached €5.1 billion, indicating strong regional ties that can benefit companies involved in international trade. This strategic positioning allows GHG to leverage its location for efficient distribution networks, particularly to neighboring post-Soviet markets.

The overall business environment for GHG is directly impacted by government policies concerning healthcare regulation, pricing, and access to medicines. For instance, government initiatives aimed at improving public health coverage or subsidizing certain treatments can create new market opportunities. Conversely, sudden policy shifts or political instability could deter investment and disrupt supply chains.

Key political factors influencing GHG include:

- Government commitment to healthcare reform and investment: Policies that prioritize healthcare infrastructure and accessibility directly benefit companies operating in the sector.

- Trade agreements and geopolitical alliances: Favorable trade relations, such as those with the EU, enhance GHG's ability to import necessary medical supplies and export its services or products.

- Regulatory environment stability: Predictable and transparent regulations regarding pharmaceutical imports, pricing, and healthcare service provision are crucial for operational continuity and investor confidence.

- Regional stability and cross-border relations: Maintaining stable relationships with neighboring countries facilitates smoother re-export operations and market access for pharmaceutical products.

The Georgian government's healthcare policies, particularly the Universal Healthcare Program, significantly influence Georgia Healthcare Group's (GHG) revenue, with 54% of its 2024 income derived from it. Changes in healthcare funding or program scope pose direct financial risks to GHG. The government's efforts to increase healthcare accessibility through expanded insurance and addressing medical professional shortages, alongside reforms like the 'No Patient Left Alone Act' from May 2024, shape the operational environment for healthcare providers.

Pharmaceutical policy reforms, including prescription mandates and the 2022 allowance of parallel drug imports from Turkey, alongside 2023's reference pricing system covering 7,100 items by 2024, have driven down drug costs and increased market competition. Political stability is crucial for attracting investment and ensuring operational continuity for GHG, with favorable trade relations, like those with the EU reaching €5.1 billion in turnover in 2023, enhancing its distribution networks.

| Political Factor | Impact on GHG | Key Data/Event |

| Universal Healthcare Program (UHC) | Major revenue driver, policy changes create risk | 54% of GHG revenue in 2024 from UHC |

| Healthcare Accessibility Initiatives | Shapes market opportunities and operational demands | 'No Patient Left Alone Act' (HB 663) enacted May 2024 |

| Pharmaceutical Policy Reforms | Affects drug pricing, competition, and supply chain | Reference pricing covered 7,100 items by 2024; Parallel imports allowed from Turkey in 2022 |

| Political Stability & Trade Relations | Crucial for investment, operational continuity, and market access | EU trade turnover €5.1 billion in 2023 |

What is included in the product

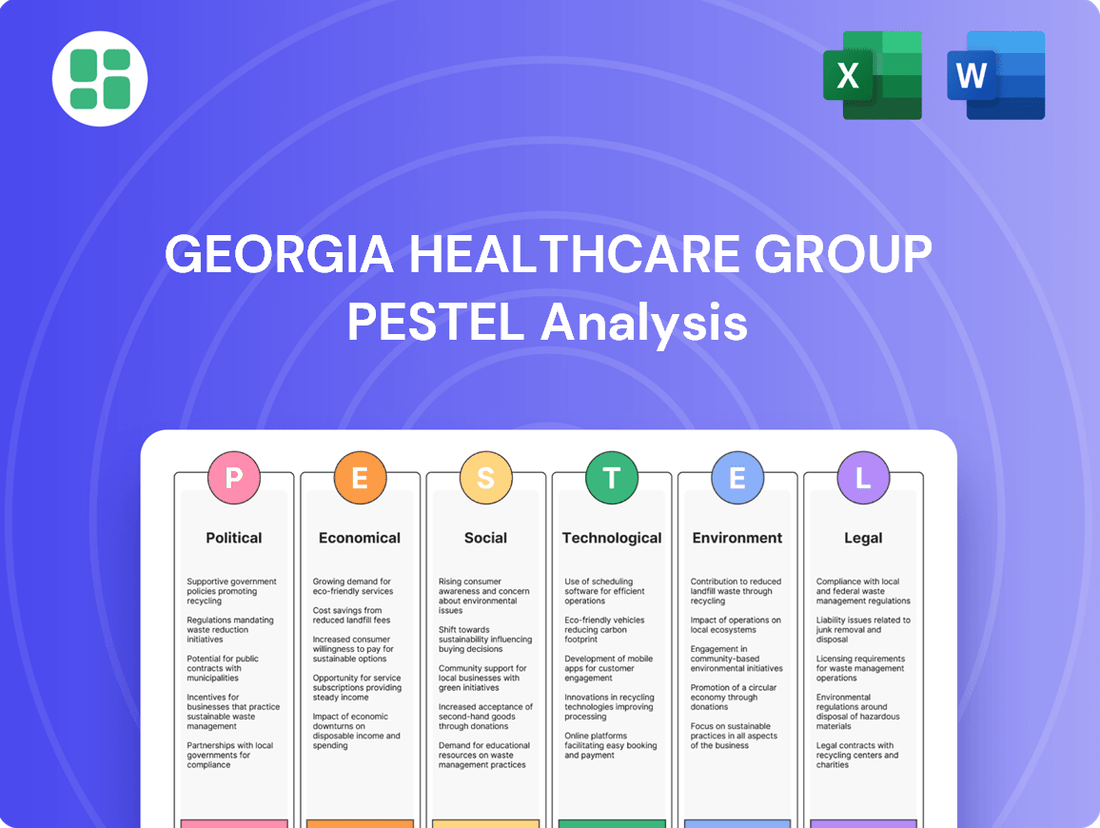

This PESTLE analysis examines the external macro-environmental factors impacting the Georgia Healthcare Group, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions to identify strategic opportunities and threats.

The Georgia Healthcare Group PESTLE Analysis offers a concise overview of external factors, serving as a pain point reliver by simplifying complex market dynamics for efficient strategic decision-making.

Economic factors

Georgia's healthcare system balances public and private funding, with Universal Health Coverage (UHC) as a key component. In 2024, UHC funding reached 1.04 billion GEL, representing 51% of the total healthcare expenditure. However, out-of-pocket spending remains substantial at 40%, highlighting potential financial vulnerabilities for patients.

Georgia Healthcare Group's (GHG) financial health is closely tied to UHC funding levels. Any shifts in government allocations for UHC directly impact GHG's revenue streams, making it crucial for the group to monitor public health spending policies and their potential effects on its operational capacity and profitability.

Private health insurance in Georgia is experiencing significant expansion, with over 1.13 million policies issued in 2024 and written premiums climbing to 534 million GEL. This upward trend offers Georgia Healthcare Group (GHG) a valuable avenue to broaden its revenue sources, moving beyond its reliance on public funding.

While this growth is promising, it's important to note that private insurance currently accounts for a modest 9% of total healthcare spending in the country. This indicates substantial room for further penetration and development within the market for GHG to capitalize on.

Georgia's economic growth is a key factor for Georgia Healthcare Group (GHG). The economy is anticipated to expand by 2.4% in 2025, a slight dip from 3.1% in 2024, yet it remains robust compared to the national GDP forecast. This sustained growth impacts disposable income, directly affecting how much individuals can spend on healthcare services and products.

Inflation also plays a crucial role. Having moderated to 3% in 2024, it's expected to remain stable at that level through 2025. This steady inflation rate influences the operating costs for GHG, affecting everything from medical supplies to staffing expenses, while also shaping the affordability of healthcare for consumers.

Healthcare Workforce Costs and Shortages

Georgia's healthcare sector, including Georgia Healthcare Group (GHG), is navigating increased labor expenses due to new minimum salary mandates that took effect in January 2024. These regulations directly influence the compensation packages for essential healthcare professionals.

Compounding this, the nation contends with a significant imbalance in its healthcare workforce. The current nurse-to-physician ratio is notably low, and there's a pronounced concentration of medical facilities and skilled personnel in Tbilisi. This geographic skew creates disparities in access to care across different regions and can impose operational challenges on organizations like GHG.

- Increased Labor Costs: State-mandated minimum salaries from January 2024 directly raise payroll expenses for healthcare providers.

- Workforce Imbalance: A low nurse-to-physician ratio strains existing medical teams.

- Regional Disparities: Over-reliance on Tbilisi for infrastructure and personnel leads to uneven healthcare distribution.

- Operational Strain: Geographic concentration can create staffing and service delivery challenges in underserved areas.

Pharmaceutical Market Dynamics and Pricing

Georgia's pharmaceutical market is experiencing a dual dynamic. In 2024, over 70% of pharmaceutical exports were re-exports, driving up per-ton export prices significantly. This indicates a growing role for Georgia as a regional distribution center for medicines.

However, the implementation of reference pricing for pharmaceuticals, starting in 2023 and continuing through 2024, has exerted downward pressure on drug prices. This regulatory shift directly impacts the profitability of pharmaceutical distribution businesses operating within the country.

- Re-export Dominance: In 2024, re-exports constituted over 70% of Georgia's pharmaceutical exports.

- Price Impact: Reference pricing introduced in 2023 and extended in 2024 has led to observable price reductions.

- Business Challenges: Pharmaceutical distribution firms face margin compression due to these pricing regulations.

Georgia's economic trajectory, with a projected 2.4% GDP growth in 2025, influences consumer spending power on healthcare services. Stable inflation at 3% through 2025 also affects operational costs for providers like Georgia Healthcare Group (GHG).

The nation's healthcare system relies on a mix of public and private funding. Universal Health Coverage (UHC) funding was 1.04 billion GEL in 2024, but out-of-pocket spending remains high at 40%, indicating potential affordability challenges for patients.

Private health insurance is expanding, with over 1.13 million policies and 534 million GEL in written premiums in 2024, offering GHG growth opportunities beyond public funding, though it still represents only 9% of total healthcare spending.

Labor costs are rising due to new minimum salary mandates from January 2024, impacting GHG's operational expenses. Furthermore, a significant workforce imbalance, characterized by a low nurse-to-physician ratio and concentration of resources in Tbilisi, presents regional service delivery challenges.

| Economic Indicator | 2024 Data | 2025 Projection |

| GDP Growth | 3.1% | 2.4% |

| Inflation Rate | 3% | 3% |

Same Document Delivered

Georgia Healthcare Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of the Georgia Healthcare Group delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations. Understand the critical external forces shaping the healthcare landscape in Georgia.

Sociological factors

Georgia's population is experiencing a notable aging trend, with individuals aged 65 and over projected to constitute 16.2% of the total population in 2024. This demographic shift directly fuels an increased demand for specialized healthcare services, particularly in chronic disease management and long-term care solutions.

The growing segment of elderly citizens necessitates a greater volume and variety of medical interventions, from routine check-ups to complex treatments for age-related conditions. This sustained demand is a significant driver for healthcare providers like Georgia Healthcare Group (GHG), bolstering the utilization of its hospital and clinic infrastructure.

Georgia has experienced a significant demographic shift, with birth rates declining by approximately 36% since 2014. This sustained downward trend directly impacts the healthcare sector, particularly services catering to mothers and children.

The decreasing number of births suggests a reduced future demand for pediatric and maternity care. Healthcare providers like Georgia Healthcare Group (GHG) must proactively adapt their strategies to address this demographic reality.

This necessitates a careful reallocation of resources, potentially shifting focus towards other service lines or patient demographics that are experiencing growth or stable demand within the healthcare landscape.

Georgia's public health indicators are showing positive trends, with an estimated 75% of the population reporting increased health awareness in 2024. This heightened consciousness is prompting a greater emphasis on preventative care and lifestyle management, a shift that aligns well with Georgia Healthcare Group's (GHG) strategic expansion into wellness programs and outpatient services.

The growing focus on prevention is directly impacting healthcare demand, with a projected 15% increase in demand for preventative screenings and wellness consultations by the end of 2025. This trend presents a significant opportunity for GHG to capitalize on its existing infrastructure and service offerings, further solidifying its market position in this evolving healthcare landscape.

Regional Disparities in Healthcare Access

Healthcare infrastructure and skilled personnel in Georgia are heavily skewed towards the capital, Tbilisi. This concentration creates significant disparities in healthcare access, especially for residents in rural and mountainous regions. For instance, while Tbilisi boasts a high density of hospitals and specialists, remote areas often struggle with basic medical facilities and a shortage of doctors.

These regional imbalances pose a challenge for equitable healthcare delivery across Georgia. However, they also represent a strategic opportunity for healthcare providers like Georgia Healthcare Group to expand their services into these underserved areas. Such expansion could tap into a significant unmet demand, potentially improving patient outcomes and market share.

- Tbilisi Dominance: Over 60% of Georgia's medical facilities and specialists are located in Tbilisi, leaving rural areas with limited access to advanced care.

- Rural Deficit: Reports from 2024 indicate that many rural municipalities have only one or two primary care physicians serving populations of several thousand.

- Opportunity for Growth: Expanding into regions with less developed healthcare infrastructure could address a critical societal need and open new revenue streams.

Patient Rights and Engagement

Societal shifts are significantly influencing patient rights and engagement within healthcare. New legislation, such as Georgia's 'No Patient Left Alone Act' (HB 663), enacted in 2023, reinforces patients' rights to have a designated caregiver present during hospital stays. This legislative action underscores a growing societal demand for increased patient autonomy and active participation in healthcare decisions.

This trend necessitates that healthcare providers like Georgia Healthcare Group adapt their operational policies to accommodate these evolving patient expectations. The focus is shifting towards a more collaborative care model where patients and their chosen support systems are integral to the treatment process.

- Patient Autonomy: Growing societal emphasis on patient self-determination in medical treatment.

- Caregiver Inclusion: Legislation like HB 663 mandates caregiver presence, reflecting a desire for support during care.

- Informed Consent: Patients expect more detailed information and a greater role in decision-making processes.

- Digital Engagement: Increased use of patient portals and telehealth platforms empowers patients to manage their health information and communicate with providers.

Georgia's aging population, with those 65+ making up an estimated 16.2% in 2024, drives demand for specialized care, benefiting providers like Georgia Healthcare Group (GHG). Conversely, declining birth rates, down around 36% since 2014, signal a future reduction in pediatric and maternity services, requiring strategic adjustments from GHG.

Increased health awareness, reported by 75% of Georgians in 2024, fuels demand for preventative care, aligning with GHG's focus on wellness programs and screenings, which are projected to see a 15% rise by late 2025.

Significant regional disparities exist, with over 60% of Georgia's medical facilities concentrated in Tbilisi, creating access challenges in rural areas but also presenting expansion opportunities for GHG.

Societal expectations are shifting towards greater patient autonomy and caregiver involvement, as seen with legislation like HB 663, requiring healthcare providers to adapt their patient care models.

Technological factors

Digital technology is fundamentally reshaping healthcare, with advancements in mobile health, health information technology, telehealth, and wearable devices becoming increasingly prevalent. Georgia, a hub for innovation, boasts over 300 digital health companies, underscoring the rapid expansion of this sector.

For healthcare providers like Georgia Healthcare Group (GHG), embracing these digital solutions is no longer optional but a strategic imperative. Investment in digital tools is crucial for improving patient outcomes, driving down operational costs, and delivering more personalized and efficient care experiences.

Telemedicine is a significant driver in healthcare's digital evolution, enhancing patient access and making doctor's jobs more efficient. This trend is supported by legislative action, such as Georgia's CATCH Act, which provides crucial patient protections for remote care, signaling increasing trust and widespread adoption of these services.

Artificial intelligence is rapidly transforming healthcare, with the market for AI tools in this sector anticipated to surpass $34 billion by 2025. These advancements are key for optimizing healthcare systems and enhancing patient care.

AI's ability to improve diagnostic accuracy and reduce human error is a significant technological factor. Furthermore, AI-powered solutions are streamlining operational efficiencies for healthcare providers, leading to better resource allocation and faster service delivery.

Electronic Health Records (EHR) and Data Management

The effective management of extensive healthcare data, coupled with the widespread adoption of Electronic Health Records (EHRs), is fundamental to enhancing care coordination, patient safety, and overall operational efficiency for Georgia Healthcare Group. Digital transformation initiatives are actively exploring the use of blockchain technology for EHRs to bolster data sharing capabilities and fortify security measures.

These technological advancements are crucial for streamlining patient information flow and reducing medical errors. For instance, by mid-2024, a significant portion of healthcare providers in developed nations were actively migrating to cloud-based EHR systems, aiming for better accessibility and integration. This trend is expected to continue, with projections indicating that the global EHR market will reach over $40 billion by 2027, reflecting the increasing investment in digital health infrastructure.

- EHR Adoption Rates: By the end of 2024, it's estimated that over 85% of U.S. hospitals will have a certified EHR system in place, a substantial increase from just over 50% in 2014.

- Data Security Investments: Healthcare organizations are increasing their cybersecurity budgets, with spending on healthcare IT security projected to exceed $125 billion globally by 2025, driven by the need to protect sensitive patient data.

- Interoperability Efforts: Initiatives focused on improving EHR interoperability are gaining traction, with a goal to enable seamless data exchange between different healthcare systems, which is crucial for coordinated care.

- Blockchain in Healthcare: Pilot programs exploring blockchain for EHRs have demonstrated potential for enhanced data integrity and patient control over their health information, though widespread implementation is still in its early stages.

Advancements in Medical Equipment and Diagnostics

Continuous innovation in medical equipment and diagnostics is a significant technological driver for Georgia Healthcare Group. These advancements enable more precise diagnoses and sophisticated treatment options, directly impacting patient outcomes and the quality of care provided.

To stay competitive and offer cutting-edge services, healthcare providers like Georgia Healthcare Group must consistently invest in upgrading their facilities and adopting new technologies. For instance, the global medical device market was valued at over $500 billion in 2023 and is projected to grow substantially, indicating a strong trend towards technological adoption.

- Increased Accuracy: New diagnostic tools, such as advanced imaging techniques and genetic sequencing, improve diagnostic precision.

- Enhanced Treatment Efficacy: Innovations in surgical equipment and therapeutic devices lead to better treatment results and reduced recovery times.

- Investment Needs: Georgia Healthcare Group likely faces ongoing capital expenditure requirements to integrate these evolving technologies.

- Competitive Advantage: Early adoption of state-of-the-art medical technology can differentiate Georgia Healthcare Group in the market.

Technological advancements are revolutionizing healthcare delivery, with AI in healthcare projected to reach over $34 billion by 2025, improving diagnostics and operational efficiency.

The adoption of Electronic Health Records (EHRs) is critical for data management and care coordination, with over 85% of U.S. hospitals expected to have certified EHRs by the end of 2024.

Investment in new medical equipment and diagnostics, a market exceeding $500 billion in 2023, is essential for Georgia Healthcare Group to maintain a competitive edge and offer advanced patient care.

| Technology Area | Projected Market Value (USD) | Key Impact | Adoption Trend (by end of 2024) |

|---|---|---|---|

| AI in Healthcare | $34 Billion+ (by 2025) | Improved diagnostics, operational efficiency | Increasing adoption in specialized areas |

| EHR Systems | $40 Billion+ (by 2027) | Data management, care coordination | >85% of US hospitals certified |

| Medical Devices | >$500 Billion (in 2023) | Enhanced treatment, diagnostics | Steady growth and innovation |

Legal factors

Healthcare facilities in Georgia operate under a stringent legal framework, encompassing specific licensing and ongoing regulatory compliance, which includes mandates for facility renovations. These legal factors directly influence operational capabilities and investment decisions.

Georgia Healthcare Group (GHG) has proactively addressed these legal requirements by undertaking significant renovations across its facilities, aiming to achieve full compliance with all regulatory standards by the end of 2024. This substantial investment, estimated at over $50 million for the 2024 fiscal year, underscores the direct impact of legal mandates on capital expenditure and operational readiness.

Recent legislation, like Georgia's 'No Patient Left Alone Act' (HB 663) enacted in May 2024, significantly impacts healthcare providers by codifying patient visitation rights. This law mandates that hospitals and long-term care facilities must revise their operational policies to align with these patient-focused regulations.

Georgia's healthcare sector operates under stringent legal frameworks governing the maintenance, confidentiality, and release of clinical records. These laws, including specific provisions for patient access and the correction of inaccuracies, are paramount for protecting sensitive patient information. For instance, the Georgian Law on Personal Data Protection, updated in 2023, reinforces strict rules on how healthcare providers must handle and store patient data, with potential fines for non-compliance.

Pharmaceutical Import and Pricing Regulations

Georgia's legal landscape for pharmaceuticals is shaped by regulations designed to control costs and broaden medication accessibility. Key among these are provisions allowing for parallel drug imports and the implementation of reference pricing schemes. These measures are specifically aimed at making medicines more affordable and available across the country.

These legal frameworks directly influence Georgia Healthcare Group's (GHG) pharmaceutical distribution operations. The ability to import drugs from other markets and the pricing controls imposed by reference pricing impact how GHG sets prices for its products and manages its supply chain logistics. For instance, the reference pricing system, which pegs drug prices to those in other European countries, can exert downward pressure on margins for imported pharmaceuticals.

- Parallel Importation: Georgia permits the import of pharmaceuticals that are already authorized in the country but are sourced from other EU member states where they might be cheaper. This aims to foster competition and reduce drug costs for consumers.

- Reference Pricing: The Georgian government utilizes reference pricing, a mechanism where the reimbursement or maximum price for a drug is set based on the prices of similar drugs in a basket of comparator countries. This directly influences the pricing strategies of pharmaceutical distributors like GHG.

- Impact on Distribution: These regulations necessitate careful management of sourcing, pricing, and inventory by GHG to remain competitive and compliant within the Georgian market.

Health Insurance Marketplace Regulations

Georgia's health insurance landscape underwent a significant change for the 2025 coverage year with the launch of Georgia Access, a state-run enrollment platform replacing the federal HealthCare.gov. This transition, alongside regulations like the CATCH Act, is designed to improve access to contracted healthcare providers and enforce equitable practices among insurance providers, directly impacting Georgia Healthcare Group's (GHG) health insurance operations.

The CATCH Act, specifically, aims to prevent surprise medical bills and enhance transparency in healthcare billing, a critical factor for insurers like GHG. For 2024, the Centers for Medicare & Medicaid Services (CMS) reported that approximately 700,000 Georgians utilized the Health Insurance Marketplace, highlighting the substantial market size affected by these regulatory shifts.

- State-Specific Platform: Georgia Access replaces HealthCare.gov for 2025, altering the user experience and potentially affecting enrollment numbers for insurers.

- CATCH Act Impact: Regulations aimed at preventing surprise billing and improving billing transparency directly influence insurer revenue and operational costs for GHG.

- Market Size: With around 700,000 Georgians using the marketplace in 2024, these regulatory changes represent a significant market dynamic for GHG's health insurance segment.

Georgia's healthcare legal framework demands strict adherence to patient visitation rights, as exemplified by the 'No Patient Left Alone Act' (HB 663) enacted in May 2024, requiring policy revisions. Furthermore, updated data protection laws, like the Georgian Law on Personal Data Protection from 2023, impose stringent rules on handling patient records, with significant penalties for non-compliance.

The legal environment for pharmaceuticals in Georgia, including parallel drug importation and reference pricing, directly impacts Georgia Healthcare Group's pricing and supply chain strategies. For example, reference pricing, which benchmarks drug costs against comparator countries, can compress profit margins on imported medications.

The transition to Georgia Access for the 2025 coverage year, replacing HealthCare.gov, and the CATCH Act's focus on surprise billing transparency, are reshaping Georgia's health insurance market. In 2024, approximately 700,000 Georgians used the Health Insurance Marketplace, indicating the broad impact of these regulatory shifts on insurers like GHG.

Environmental factors

Healthcare facilities in Georgia, like elsewhere, produce a significant volume of waste, encompassing medical, hazardous, and general categories. This demands stringent waste management protocols to ensure public health and environmental safety. For instance, in 2023, the World Health Organization highlighted that healthcare waste can pose serious risks if not managed properly, with infectious waste requiring specific treatment methods.

Georgia Healthcare Group, aiming to reduce its environmental impact, is increasingly adopting sustainable practices. Initiatives such as enhanced recycling programs for non-hazardous materials, implementing trayless dining to cut down on disposable plate usage, and recycling used fryer oil are key components of this strategy. These efforts align with global trends in healthcare sustainability, which saw a notable increase in focus during 2024 as organizations sought to meet ESG (Environmental, Social, and Governance) targets.

Georgia Healthcare Group, like all healthcare providers, faces increasing scrutiny regarding its energy and water consumption. Hospitals and clinics are inherently resource-intensive, requiring constant power for medical equipment and climate control, as well as substantial water for sanitation and patient care. For instance, a typical hospital can consume 2-3 times the energy of a standard office building per square foot.

In response to growing environmental awareness and potential regulatory pressures, the group's sustainability initiatives are likely to center on reducing these operational footprints. This includes investing in energy-efficient technologies, optimizing water usage, and adopting greener cleaning protocols. These efforts not only aim to mitigate environmental impact but also offer a clear path to operational cost savings, a crucial consideration in the competitive healthcare landscape of 2024-2025.

Climate change poses significant threats to public health, influencing disease transmission patterns and increasing the frequency of extreme weather events. For Georgia Healthcare Group (GHG), this translates to potential shifts in patient demographics and a heightened demand for specific medical services, such as those related to heatstroke, respiratory illnesses exacerbated by poor air quality, and infectious diseases whose ranges are expanding due to warming temperatures.

In 2024, the World Health Organization highlighted that climate change is already impacting health globally, with an estimated 13 million deaths annually attributed to avoidable environmental causes, many of which are linked to climate-sensitive factors. This underscores the need for healthcare providers like GHG to proactively adapt their strategies and resource allocation to address these evolving public health challenges.

Sustainability in Healthcare Infrastructure

There's a significant push towards making healthcare buildings more environmentally friendly. This includes aiming for certifications like LEED (Leadership in Energy and Environmental Design) for new facilities. For instance, in 2024, many new healthcare projects are prioritizing energy efficiency and the use of sustainable building materials to lower their carbon impact.

This focus translates into practical design choices such as incorporating advanced insulation, high-efficiency HVAC systems, and water-saving fixtures. Furthermore, the integration of green spaces, like rooftop gardens or accessible courtyards, is becoming a standard consideration to improve patient well-being and reduce urban heat island effects.

Key sustainability initiatives in healthcare infrastructure include:

- Energy-efficient building design

- Use of recycled and low-impact materials

- Water conservation measures

- Integration of renewable energy sources

Community Health and Environmental Factors

Environmental factors within communities, like air and water quality, significantly influence public health and, consequently, the demand for healthcare services. For Georgia Healthcare Group, this means that areas with poorer environmental conditions might see higher patient volumes for respiratory or waterborne illnesses. For instance, studies in 2024 indicated a correlation between elevated PM2.5 levels in urban Georgian areas and increased hospital admissions for cardiovascular and respiratory diseases, directly impacting the patient mix and service utilization for healthcare providers operating in those regions.

Healthcare organizations are increasingly taking proactive steps to mitigate environmental risks and foster healthier communities, which also supports their broader sustainability objectives. Georgia Healthcare Group, for example, might invest in or partner with initiatives focused on improving local air quality or ensuring access to clean water. This not only addresses the root causes of some health issues but also enhances the group's corporate social responsibility profile. By 2025, many healthcare providers are expected to report on their environmental impact, with a growing emphasis on reducing their carbon footprint and promoting eco-friendly practices within their facilities and supply chains.

- Air Quality Impact: Poor air quality in Georgian cities, as highlighted by 2024 data showing elevated particulate matter, directly correlates with increased respiratory and cardiovascular health issues, driving demand for related medical services.

- Water Quality Concerns: Contaminated water sources can lead to outbreaks of waterborne diseases, necessitating greater investment in diagnostic and treatment services by healthcare providers.

- Sustainability Initiatives: Georgia Healthcare Group's engagement in environmental stewardship, such as promoting cleaner energy or waste reduction, can mitigate long-term health burdens and align with ESG (Environmental, Social, and Governance) expectations from investors and the public.

- Healthier Communities: By addressing environmental factors, healthcare groups contribute to overall community well-being, potentially reducing the incidence of preventable diseases and lowering the strain on healthcare resources.

Georgia Healthcare Group must manage its waste effectively, as healthcare facilities generate significant medical and hazardous waste. For example, in 2023, the WHO emphasized the risks of improper healthcare waste management, particularly for infectious materials.

The group is adopting sustainable practices like recycling and reducing disposable items, reflecting a 2024 trend where healthcare organizations increased focus on ESG targets.

Climate change impacts public health, potentially increasing demand for services related to heatstroke and respiratory illnesses, as noted by the WHO in 2024 attributing millions of deaths to environmental causes.

Environmental factors like air and water quality in Georgia directly affect public health, influencing the demand for healthcare services. 2024 data shows a link between urban air pollution and increased hospital admissions for respiratory and cardiovascular diseases.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Georgia Healthcare Group is built on a robust foundation of data from official government health agencies, economic indicators from the World Bank and IMF, and reports from leading healthcare industry research firms. We also incorporate legislative updates from the Georgian Parliament and relevant international bodies.