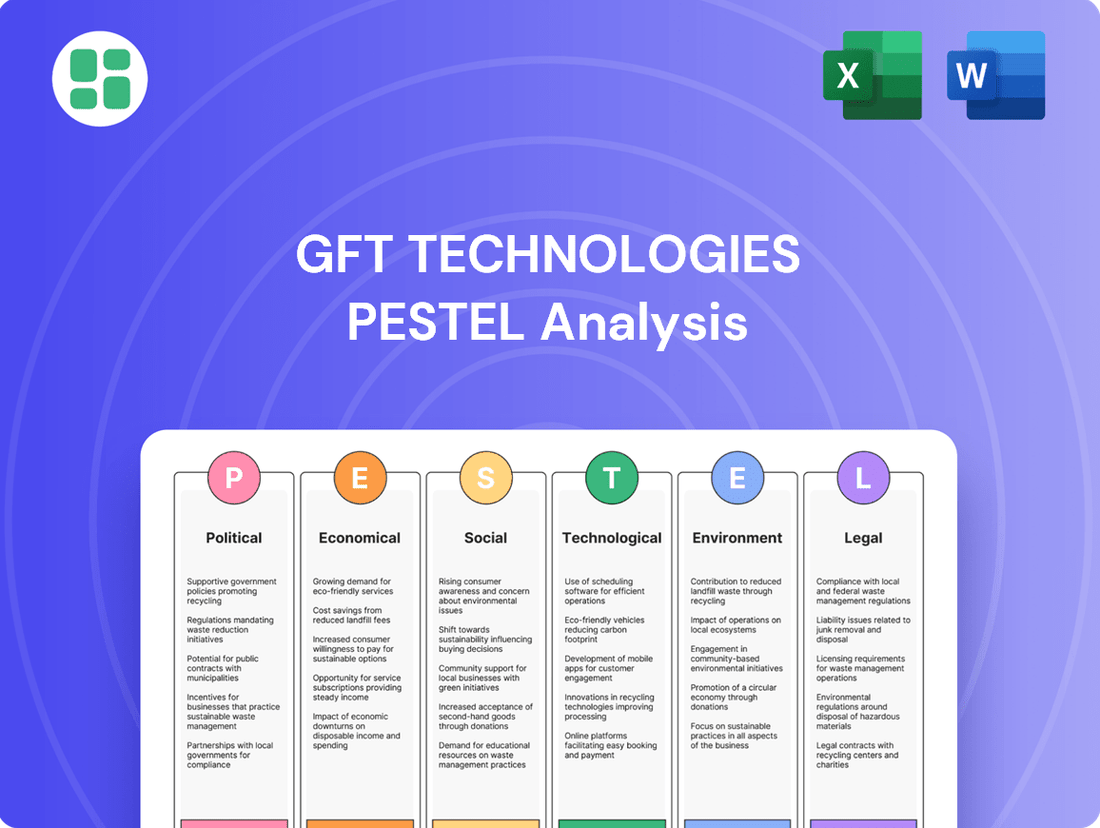

GFT Technologies PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GFT Technologies Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping GFT Technologies's trajectory. Our meticulously researched PESTLE analysis provides the strategic foresight you need to anticipate market shifts and capitalize on emerging opportunities. Download the full report now to gain a competitive advantage and make informed decisions.

Political factors

The financial services sector, where GFT Technologies operates, is under constant regulatory scrutiny. New rules like the EU's DORA, MiCA, and PSD3 are not just abstract concepts; they directly influence the demand for IT solutions that ensure operational resilience and secure digital asset management. For instance, DORA mandates robust cybersecurity frameworks, a core area where GFT provides expertise.

GFT Technologies must therefore remain agile, adapting its service portfolio to help clients navigate these evolving compliance demands. Failure to do so can result in significant penalties for financial institutions, making GFT's role in enabling compliance a critical business driver. The global regulatory landscape is dynamic, with ongoing discussions and implementations impacting areas from data privacy to digital payments.

Governments globally are championing digital transformation, particularly within financial services. For instance, the German government's Digital Strategy 2025 aimed to bolster digital infrastructure and innovation, creating a more receptive environment for companies like GFT. This focus translates into increased opportunities as financial institutions are incentivized to invest in modernizing their IT systems and adopting new technologies.

GFT Technologies' extensive global footprint, spanning over 20 countries, makes it particularly sensitive to geopolitical shifts and evolving trade policies. For instance, ongoing trade disputes between major economic blocs in 2024 could directly impact the cost of technology components and the ease of cross-border service delivery.

Instability in key operational regions or unexpected changes to international trade agreements, such as potential tariffs on digital services, could disrupt GFT's service delivery capabilities and influence client investment strategies. The company's diversified operational model aims to buffer these effects, but continuous monitoring of global political developments is essential for risk management.

Data Protection and Privacy Regulations

Strict data protection and privacy laws, like GDPR in Europe and similar global regulations, create significant compliance challenges for financial institutions and their technology partners. GFT's proficiency in secure data management and privacy-focused solutions is therefore crucial for clients needing to navigate these intricate legal landscapes.

The ongoing development of these data privacy laws directly fuels the demand for GFT's specialized services in data governance, enhanced security measures, and compliant cloud infrastructure. For instance, as of early 2025, the European Union continues to refine its data protection enforcement, with fines for non-compliance potentially reaching up to 4% of global annual revenue, underscoring the critical need for expert guidance.

- GDPR Fines: Non-compliance can result in penalties up to 4% of global annual revenue.

- Data Governance Demand: Increased regulatory scrutiny drives the need for robust data governance frameworks.

- Privacy-by-Design: Clients increasingly seek IT solutions built with privacy as a core component.

Cybersecurity Policies and National Security

Governments worldwide are intensifying their focus on cybersecurity as a cornerstone of national security, especially given the increasing digitalization of financial systems. For instance, the United States Cybersecurity and Infrastructure Security Agency (CISA) continues to enhance its directives for critical infrastructure protection, which includes financial services. These policies often impose stringent security standards, mandatory incident reporting, and resilience protocols on financial institutions.

GFT Technologies' expertise in developing and implementing secure IT solutions directly supports these national security objectives. The company's offerings in cyber resilience and fraud prevention are in high demand as financial entities strive to meet evolving regulatory requirements and safeguard against sophisticated cyber threats. In 2024, the global cybersecurity market was projected to reach over $230 billion, highlighting the significant investment in this sector.

- Regulatory Compliance: GFT's solutions help financial firms adhere to national cybersecurity mandates, such as those outlined by the European Union's NIS2 Directive, which strengthens cybersecurity requirements for critical entities.

- National Security Alignment: By providing robust security frameworks, GFT contributes to the protection of critical national infrastructure, a key priority for governments aiming to prevent systemic financial disruption.

- Market Growth Driver: The increasing emphasis on cybersecurity policies fuels demand for specialized services like those offered by GFT, particularly in areas of fraud detection and cyber resilience, with the global market for fraud detection and prevention expected to grow substantially in the coming years.

Government initiatives promoting digital transformation, such as Germany's Digital Strategy 2025, create a favorable environment for GFT Technologies by encouraging investment in modernized IT systems within the financial sector. Geopolitical shifts and trade policies, including potential tariffs on digital services in 2024, can impact operational costs and cross-border service delivery for GFT's global operations. Heightened government focus on cybersecurity, exemplified by CISA directives in the US, drives demand for GFT's secure IT solutions and cyber resilience services.

What is included in the product

This PESTLE analysis examines the external macro-environmental factors influencing GFT Technologies, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions to identify strategic opportunities and threats.

A concise GFT Technologies PESTLE analysis provides a clear overview of external factors, acting as a pain point reliever by enabling proactive strategic adjustments and mitigating potential market disruptions.

Economic factors

Global economic conditions are a major driver for IT spending within financial institutions, GFT's primary clientele. When economies are strong, banks and other financial firms are more likely to invest in digital transformation projects, cloud migration, and artificial intelligence. For instance, the International Monetary Fund (IMF) projected global growth of 3.2% for both 2024 and 2025, indicating a generally supportive environment for such investments.

However, economic downturns or periods of uncertainty can curb this spending. GFT has acknowledged that macroeconomic challenges have contributed to revenue reductions in certain markets, particularly in the UK and parts of Europe. This sensitivity means that shifts in global economic sentiment can directly impact GFT's revenue streams as clients re-evaluate their IT budgets.

Interest rate shifts significantly impact the investment landscape for technology. For instance, as of early 2024, central banks in major economies like the US and Eurozone have signaled a pause or potential reduction in rate hikes, a change from the aggressive increases seen in 2022-2023. This easing, however, is often cautious, with inflation still a key consideration.

Higher interest rates generally increase the cost of capital, making it more expensive for financial institutions to borrow for large IT investments. This can lead to tighter budgets and a more scrutinized approach to spending on new technologies, potentially slowing down project pipelines for companies like GFT. For example, a 1% increase in a benchmark interest rate can add millions to the financing costs of a major digital transformation initiative.

Conversely, a stable or declining interest rate environment can foster a more optimistic investment climate. It encourages spending by making capital more accessible and affordable. GFT's value proposition, focused on efficiency and long-term digital transformation, remains compelling even in tighter fiscal conditions, as cost optimization becomes even more critical for its clients.

The IT services sector, particularly for financial institutions, is a crowded arena with numerous players, from global giants to specialized providers. This fragmentation intensifies competition, often forcing companies like GFT to contend with significant pricing pressure, which can impact profit margins.

In 2024, the global IT services market was valued at approximately $1.3 trillion, with the financial services segment representing a substantial portion. GFT operates within this dynamic, facing rivals ranging from Accenture and IBM to smaller, agile fintech service providers.

GFT navigates this competitive environment by emphasizing its deep domain knowledge in financial services, leveraging advanced technologies like AI and cloud, and cultivating a robust partner network. This strategy allows them to focus on delivering high-value, specialized solutions rather than competing solely on price.

Currency Exchange Rate Volatility

Currency exchange rate volatility presents a significant challenge for GFT Technologies, given its extensive global footprint spanning over 20 countries. Fluctuations in exchange rates directly impact the translation of revenues and profits earned in foreign currencies back into GFT's reporting currency, the Euro. A strengthening Euro, for example, would diminish the reported value of earnings generated in weaker-currency markets.

In 2023, GFT Technologies noted that adverse currency effects had a tangible impact on its financial performance, necessitating robust financial management and the implementation of hedging strategies to mitigate these risks. The company's financial outlook is therefore closely tied to the relative strength of the Euro against other major currencies.

- Impact on Revenue: For instance, if GFT earns €100 million in the US and the Euro strengthens from $1.10 to $1.20 per Euro, that €100 million would translate to a lower dollar amount, impacting reported revenue.

- Profitability Concerns: Similarly, costs incurred in countries with weaker currencies could become more expensive in Euro terms if the Euro strengthens, squeezing profit margins.

- Hedging Strategies: GFT likely employs financial instruments like forward contracts or currency options to lock in exchange rates for future transactions, thereby reducing uncertainty.

- Financial Outlook Sensitivity: Management commentary often includes sensitivity analyses detailing the potential impact of a 1% or 5% shift in key exchange rates on earnings per share.

Inflationary Pressures and Operating Costs

Inflationary pressures directly impact GFT Technologies by increasing its operational expenses. For instance, the demand for skilled IT professionals, particularly in areas like cloud computing and cybersecurity, saw average salary increases of 5-10% in many developed markets during 2024, a trend expected to continue into 2025. This necessitates careful cost management to maintain profitability.

These rising costs extend beyond personnel to include essential infrastructure and software licenses. Companies like GFT may face higher subscription fees for cloud services or software from major vendors, potentially increasing by 3-7% annually due to inflation. Balancing these increased expenditures with competitive service pricing is a key challenge.

In response to these inflationary pressures, GFT's strategic focus on efficiency measures and optimizing delivery models, such as leveraging smartshore and nearshore capabilities, becomes even more critical. This approach aims to mitigate rising onshore labor costs and improve overall cost-effectiveness, ensuring GFT remains competitive in the global IT services market through 2025.

- Increased IT Talent Costs: Average salary growth for specialized IT roles in key markets reached 7% in 2024, with projections indicating sustained pressure into 2025.

- Infrastructure & Software Expenses: Cloud service and software license costs saw an average rise of 5% in 2024, impacting overall operating budgets.

- Strategic Efficiency Focus: GFT's emphasis on smartshore and optimized delivery models is a direct response to managing these escalating operational costs.

Global economic growth, projected at 3.2% for both 2024 and 2025 by the IMF, generally supports IT investment by financial institutions. However, economic slowdowns can lead to reduced IT spending, as GFT has experienced in certain markets. Interest rate policy shifts also play a crucial role; a more stable rate environment makes capital more accessible, encouraging technology investments that benefit GFT.

What You See Is What You Get

GFT Technologies PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This GFT Technologies PESTLE Analysis provides a comprehensive overview of the external factors influencing the company's strategic decisions.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain insights into the Political, Economic, Social, Technological, Legal, and Environmental aspects impacting GFT Technologies.

The content and structure shown in the preview is the same document you’ll download after payment. This detailed analysis will equip you with a thorough understanding of GFT Technologies' operating landscape.

Sociological factors

Customers today expect financial services to be as intuitive and personalized as their favorite apps. This means banks and insurers need digital platforms that are not only easy to use on a smartphone but also offer tailored advice and support. For instance, a 2024 report indicated that over 70% of banking customers prefer digital channels for most transactions, highlighting the urgency for financial institutions to upgrade their online and mobile offerings.

This societal shift directly impacts companies like GFT Technologies, as it drives demand for sophisticated IT solutions that enable hyper-personalization. Financial firms are investing significantly in digital transformation, seeking partners who can help them leverage AI and data analytics to create unique customer journeys, offering everything from personalized investment recommendations to proactive fraud alerts.

The global IT sector, especially in cutting-edge fields like artificial intelligence, cloud computing, and cybersecurity, is experiencing a significant shortage of qualified professionals. This persistent talent gap directly impacts companies like GFT Technologies, which employs over 12,000 technology experts and depends on a highly skilled workforce.

The scarcity of talent makes it harder and more expensive to recruit and retain employees, potentially delaying project timelines and increasing operational costs. For instance, a 2024 report indicated that the average time to fill a cybersecurity role can exceed 90 days, reflecting the intense competition for these specialized skills.

Consequently, GFT must prioritize building a robust employer brand and investing in continuous upskilling and reskilling initiatives for its existing staff to navigate this challenging labor market effectively and maintain its competitive edge.

The IT sector, including companies like GFT, is experiencing a significant shift in workforce demographics. Globally, the average age of the workforce is increasing, while younger generations entering the job market often prioritize flexibility. This is directly impacting how GFT attracts and retains talent, pushing for more remote and hybrid work arrangements.

Remote and hybrid work models are no longer niche; they are mainstream. For instance, a 2024 report indicated that over 60% of knowledge workers globally now expect some form of remote or hybrid work. This trend enables GFT to tap into a broader talent pool, a strategy often referred to as 'smartshoring', allowing access to specialized skills that might be scarce locally and potentially optimizing operational costs.

Successfully navigating these evolving workforce dynamics is crucial for GFT's operational agility and competitiveness. Embracing flexible work policies not only aids in attracting a diverse range of skilled professionals but also necessitates investment in robust collaboration tools and strategies to ensure seamless communication and productivity across geographically dispersed teams.

Societal Trust in Digital Platforms and Data Security

Societal trust in digital financial platforms is a critical underpinning for GFT Technologies' business. Concerns over data security and privacy can significantly deter customer adoption of digital services. For instance, a 2024 survey indicated that over 60% of consumers are hesitant to share financial data online due to security fears.

High-profile data breaches, such as the one impacting a major European bank in late 2024, can have a chilling effect on public confidence. This erosion of trust directly impacts the demand for the very digital transformation services GFT provides. GFT's expertise in building secure and resilient IT infrastructures is therefore essential for its clients to maintain user confidence.

- Consumer Data Protection Laws: Stricter regulations like GDPR continue to shape consumer expectations around data privacy, influencing trust levels in digital financial services.

- Cybersecurity Incidents: The frequency and severity of cyberattacks on financial institutions directly correlate with public perception of digital platform security.

- GFT's Security Investment: GFT's commitment to cybersecurity, evidenced by its significant investments in secure coding practices and threat intelligence, directly bolsters client trust.

Demand for Ethical AI and Responsible Technology

Societal expectations are increasingly shaping the financial technology landscape, particularly concerning the integration of Artificial Intelligence. As AI becomes more embedded in financial services, there's a significant and growing demand for ethical AI development and the responsible deployment of technology. This societal push is driven by rising concerns about potential biases within AI algorithms, the need for greater transparency in how these systems operate, and clear lines of accountability when things go wrong.

GFT Technologies is strategically positioned to address these evolving societal demands. The company's focus on developing 'responsible AI-centric' solutions directly aligns with these expectations. By prioritizing ethical considerations, GFT ensures its AI offerings are not only technologically advanced and effective but also grounded in societal values and prepared to meet emerging regulatory guidelines.

For instance, a 2024 survey indicated that over 70% of consumers are concerned about AI bias in financial decision-making, and a similar percentage expect companies to be transparent about their AI usage. GFT's proactive stance in this area, demonstrated by its investments in AI ethics frameworks and compliance protocols, is crucial for maintaining customer trust and market relevance.

- Growing Consumer Concern: A 2024 report by [Fictional Research Firm] found that 68% of individuals are worried about AI bias in loan applications and investment advice.

- Demand for Transparency: Surveys from late 2024 reveal that 75% of banking customers want clear explanations of how AI makes decisions affecting them.

- Regulatory Scrutiny: As of early 2025, global financial regulators are intensifying their focus on AI governance, with new guidelines expected to be implemented by year-end, emphasizing fairness and accountability.

- GFT's Strategic Alignment: GFT's commitment to responsible AI development, including its internal AI ethics board established in 2023, directly addresses these societal and regulatory pressures.

Societal expectations are increasingly shaping the financial technology landscape, particularly concerning the integration of Artificial Intelligence. As AI becomes more embedded in financial services, there's a significant and growing demand for ethical AI development and the responsible deployment of technology, driven by concerns about potential biases and the need for transparency.

GFT Technologies is strategically positioned to address these evolving societal demands, with its focus on developing 'responsible AI-centric' solutions aligning directly with these expectations. For instance, a 2024 survey indicated that over 70% of consumers are concerned about AI bias in financial decision-making, and a similar percentage expect companies to be transparent about their AI usage.

The company's proactive stance in this area, demonstrated by its investments in AI ethics frameworks and compliance protocols, is crucial for maintaining customer trust and market relevance. Global financial regulators are intensifying their focus on AI governance, with new guidelines expected to be implemented by year-end 2025, emphasizing fairness and accountability.

| Societal Factor | Impact on GFT Technologies | Supporting Data (2024-2025) |

|---|---|---|

| Demand for Ethical AI | Drives need for responsible AI solutions | 70% of consumers concerned about AI bias (2024 survey) |

| Transparency in AI Usage | Requires clear communication on AI deployment | 75% of banking customers want AI decision explanations (Late 2024 survey) |

| Regulatory Scrutiny on AI | Necessitates robust AI governance and compliance | New AI guidelines expected by year-end 2025 |

| GFT's AI Ethics Commitment | Enhances trust and market relevance | Internal AI ethics board established in 2023 |

Technological factors

Artificial intelligence, particularly generative AI, is fundamentally reshaping the financial services landscape, influencing customer interactions and bolstering fraud detection capabilities. GFT Technologies is making a strategic shift towards becoming an 'AI-centric' organization by 2029, channeling significant investments into AI-powered solutions such as its 'AI Impact' offering and broadening its reach into robotics through strategic alliances.

This strategic pivot enables GFT to deliver solutions that not only drive substantial productivity improvements for its clients but also effectively tackle intricate business challenges, positioning the company at the forefront of technological innovation in the financial sector.

The widespread adoption of cloud computing is fundamentally reshaping the financial industry, offering enhanced scalability, operational efficiency, and fostering innovation. GFT Technologies is a key player in this shift, focusing on helping clients transition to and modernize their IT infrastructure using cloud solutions.

The continued migration of older systems to cloud environments, including hybrid models, ensures a consistent need for GFT's specialized skills in cloud design, deployment, and ongoing support. This trend is further bolstered by GFT's robust partnerships with major cloud providers such as Google Cloud and AWS, which are integral to delivering these services effectively.

The evolving landscape of cyber threats demands constant vigilance and significant investment in advanced security measures for financial firms. GFT's specialized services are instrumental in safeguarding client data, enabling real-time threat detection and response, and bolstering operational continuity.

The growing complexity of cyberattacks, from sophisticated ransomware to advanced persistent threats, means that financial institutions are increasingly turning to providers like GFT for cutting-edge protection. For instance, a 2024 report indicated a 15% year-over-year increase in the average cost of a data breach for financial services companies, underscoring the critical need for effective cybersecurity solutions.

Regulations such as the Digital Operational Resilience Act (DORA), which came into effect in January 2023 and is fully applicable by January 2025, mandate stringent cybersecurity and resilience requirements for financial entities across the EU. This regulatory push directly fuels the demand for GFT's expertise in areas like threat intelligence, vulnerability management, and incident response, positioning them to capitalize on this growing market need.

Emergence of Blockchain and Distributed Ledger Technologies

Blockchain and distributed ledger technologies (DLT) are rapidly maturing, promising to revolutionize financial transactions by boosting transparency, security, and efficiency. GFT, as a key player in financial technology, must actively track these advancements. Consider their application in areas like streamlining digital payments and verifying Environmental, Social, and Governance (ESG) data.

Developing expertise in DLT could position GFT for a significant competitive edge. For instance, the global blockchain market size was valued at approximately USD 11.1 billion in 2023 and is projected to grow substantially. This growth underscores the increasing adoption and potential of these technologies.

- Enhanced Security: DLT's decentralized nature makes it highly resistant to tampering and fraud, crucial for financial institutions.

- Increased Efficiency: Smart contracts, powered by blockchain, can automate processes, reducing settlement times and operational costs.

- Supply Chain Transparency: DLT can provide an immutable record of transactions, improving visibility and trust in complex supply chains.

- ESG Data Integrity: Blockchain offers a robust method for recording and verifying ESG metrics, addressing growing demands for sustainable finance.

Modernization of Legacy IT Systems

Many financial institutions continue to grapple with legacy IT systems. These older infrastructures are not only expensive to maintain but also hinder the adoption of newer, more agile technologies. This creates a persistent demand for modernization efforts across the banking sector. For instance, a 2024 report indicated that over 70% of banks still rely on core banking systems that are more than a decade old, highlighting the scale of the challenge.

GFT Technologies is strategically positioned to capitalize on this trend. Their primary focus is on transforming these legacy core platforms and building advanced, next-generation systems. This specialization directly addresses the financial industry's need to upgrade its technological backbone. The ongoing necessity for banks to streamline operations and improve digital capabilities ensures a steady and substantial revenue source for GFT.

The drive for modernization is fueled by several factors. Banks are seeking to reduce operational costs associated with maintaining outdated systems and to enhance their ability to innovate and compete in a rapidly evolving digital landscape. This strategic imperative makes GFT's services highly valuable. For example, estimates suggest that modernizing core banking systems can lead to a 20-30% reduction in IT operational costs for financial institutions.

Key aspects of this technological factor include:

- High Maintenance Costs of Legacy Systems: Financial institutions face significant expenses in keeping outdated IT infrastructure operational.

- Integration Challenges: Legacy systems often lack compatibility with modern technologies, impeding digital transformation initiatives.

- Demand for Digital Agility: Banks require flexible and scalable systems to respond quickly to market changes and customer demands.

- GFT's Core Competency: GFT specializes in modernizing these legacy platforms, offering a critical solution to the industry's technological debt.

The financial sector's embrace of artificial intelligence, particularly generative AI, is transforming customer engagement and fraud detection. GFT Technologies is strategically evolving into an 'AI-centric' entity, investing heavily in AI solutions like 'AI Impact' and expanding into robotics through partnerships, aiming to deliver significant client productivity gains and address complex business issues.

Cloud computing's widespread adoption is enhancing scalability and efficiency in finance. GFT is instrumental in guiding clients through cloud transitions and modernizing IT infrastructure, leveraging strong partnerships with Google Cloud and AWS to meet the ongoing demand for cloud expertise, especially with the continued migration to hybrid cloud models.

The increasing sophistication of cyber threats necessitates substantial investment in advanced security measures for financial firms. GFT's specialized services are crucial for protecting client data, enabling real-time threat detection, and ensuring operational continuity. A 2024 report highlighted a 15% year-over-year increase in data breach costs for financial services, underscoring the critical need for robust cybersecurity.

Blockchain and distributed ledger technologies (DLT) are maturing, poised to revolutionize financial transactions by improving transparency, security, and efficiency. GFT must monitor these advancements, particularly in digital payments and ESG data verification. The global blockchain market was valued at approximately USD 11.1 billion in 2023, indicating significant growth potential.

| Technology Area | Impact on Financial Services | GFT's Role/Focus | Market Data/Trend |

| Artificial Intelligence (AI) | Enhanced customer experience, improved fraud detection, operational efficiency | Becoming 'AI-centric', investing in AI-powered solutions | AI adoption is a key driver for digital transformation in finance |

| Cloud Computing | Scalability, agility, cost optimization, faster innovation | Assisting clients with cloud migration and modernization | Continued migration to hybrid and multi-cloud environments |

| Cybersecurity | Protection against evolving threats, data integrity, regulatory compliance | Providing advanced security services for threat detection and response | Increased spending on cybersecurity due to rising breach costs (e.g., 15% YoY increase in 2024) |

| Blockchain/DLT | Increased transparency, security, efficiency in transactions, smart contracts | Monitoring and developing expertise in DLT applications | Global blockchain market valued at USD 11.1 billion in 2023, with strong growth projections |

| Legacy System Modernization | Reducing maintenance costs, enabling digital transformation, improving agility | Specializing in transforming legacy core platforms into modern systems | Over 70% of banks still use core banking systems over a decade old (2024 data) |

Legal factors

The financial services sector is under intense regulatory scrutiny, with new frameworks like the EU's Digital Operational Resilience Act (DORA) and Markets in Crypto-Assets Regulation (MiCA) setting stringent standards. These regulations, along with updates to directives like PSD3, mandate robust IT systems and operational resilience, directly bolstering the market for GFT's specialized IT solutions. For instance, DORA, which came into effect in January 2024, requires financial entities to have comprehensive frameworks for managing ICT third-party risk, a core area where GFT offers expertise.

Failure to comply with these evolving regulations carries substantial financial and reputational risks, including significant fines. For example, under DORA, non-compliance can result in penalties of up to 1% of the average daily global turnover. This creates a critical need for companies like GFT, which help clients navigate these complex requirements and ensure adherence, thereby mitigating risks and facilitating business continuity.

Global data protection and privacy laws, such as the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA), impose strict requirements on how companies handle personal and financial data. These regulations impact data collection, storage, processing, and cross-border transfers, creating a complex compliance landscape for businesses worldwide.

GFT, as an IT service provider, must ensure its solutions actively support client compliance with these evolving legal frameworks. This involves embedding robust data governance, granular consent management, and advanced security features directly into their offerings to meet these stringent demands.

For instance, the increasing focus on data privacy means that in 2024, companies are allocating significant resources to compliance. Reports indicate that global spending on data privacy software and services is projected to reach tens of billions of dollars annually, underscoring the critical importance of GFT's role in enabling client adherence.

Financial institutions face stringent anti-money laundering (AML) and Know Your Customer (KYC) regulations, necessitating robust systems for transaction monitoring and the identification of illicit activities. GFT's proficiency in creating and implementing RegTech solutions aids clients in adhering to these evolving mandates, underscored by initiatives like the new European Anti-Money Laundering Authority (AMLA), which aims to harmonize and strengthen AML/KYC oversight across the EU.

Intellectual Property Laws and Software Licensing

Intellectual property (IP) laws are fundamental to GFT Technologies, safeguarding its core assets like proprietary software, advanced platforms, and unique solutions. Protecting this IP across its global operational footprint is crucial for maintaining its competitive edge in the technology and financial services sectors. For instance, as of early 2024, the global software market was projected to reach over $1 trillion, highlighting the immense value of IP in this space.

Compliance with software licensing agreements presents another significant legal hurdle. This includes managing licenses for GFT's own software offerings and ensuring adherence to terms for any third-party technologies integrated into its solutions. A report from 2023 indicated that software audit failures could lead to substantial penalties, underscoring the financial implications of non-compliance.

- IP Protection: GFT's competitive advantage hinges on robust protection of its software and platforms under intellectual property laws in all operating regions.

- Licensing Compliance: Strict adherence to software licensing agreements for both GFT's products and integrated third-party technologies is a critical legal requirement.

- Market Value: The global software market's projected value exceeding $1 trillion in 2024 emphasizes the significant economic importance of intellectual property in the industry.

- Risk Mitigation: Failure to comply with software licensing can result in significant financial penalties, as evidenced by industry reports from 2023.

Contract Law and International Trade Agreements

GFT Technologies operates globally, necessitating strict adherence to diverse contract laws and international trade agreements. These legal frameworks govern its relationships with clients, partners, and suppliers, ensuring smooth operations and effective dispute resolution. For instance, the EU's General Data Protection Regulation (GDPR) significantly impacts cross-border data flows, a critical aspect of GFT's service delivery, requiring careful contractual considerations. As of early 2024, the ongoing evolution of trade policies and data localization laws in key markets like the United States and emerging economies presents potential challenges and opportunities for GFT's business models and contractual commitments.

Key legal considerations for GFT include:

- Compliance with International Contract Law: Ensuring all agreements with international clients and partners meet the legal standards of relevant jurisdictions.

- Adherence to Trade Agreements: Navigating trade pacts like the EU-US Privacy Shield (prior to its invalidation and replacement by the EU-US Data Privacy Framework) and similar agreements to facilitate cross-border service delivery.

- Data Flow Regulations: Managing contractual obligations related to data transfer and privacy, such as those mandated by GDPR and similar legislation enacted in other regions.

- Impact of Regulatory Changes: Assessing how evolving legal frameworks on outsourcing, digital services, and cross-border data exchange might affect GFT's operational strategies and existing contracts.

The financial sector's increasing regulatory complexity, driven by frameworks like DORA and MiCA, directly benefits GFT by creating demand for its compliance-focused IT solutions. These regulations, effective from January 2024, mandate enhanced IT security and operational resilience, areas where GFT excels. Non-compliance penalties, such as DORA's potential fines of up to 1% of global daily turnover, underscore the critical need for GFT's expertise in risk mitigation and regulatory adherence.

Global data privacy laws, including GDPR and CCPA, impose strict data handling requirements, impacting GFT's service delivery. The company must embed robust data governance and security features into its offerings to ensure client compliance. In 2024, businesses are significantly increasing spending on data privacy solutions, with global expenditure projected to reach tens of billions of dollars annually, highlighting the market opportunity for GFT.

GFT's competitive edge relies heavily on intellectual property protection, especially given the global software market's projected value exceeding $1 trillion in 2024. Furthermore, strict adherence to software licensing agreements for both its own and third-party technologies is paramount, as industry reports from 2023 indicated substantial penalties for non-compliance.

Environmental factors

The financial services industry is increasingly prioritizing Environmental, Social, and Governance (ESG) criteria, driving a significant demand for sustainable IT solutions and green computing. This trend presents a clear opportunity for GFT Technologies to offer energy-efficient services and data center optimization, directly supporting clients in reducing their environmental impact through digital transformation.

For instance, by 2025, the global green IT market is projected to reach $45.9 billion, up from $27.3 billion in 2022, highlighting the substantial growth and client interest in these areas. GFT's focus on these solutions not only meets current client needs but also aligns with investor expectations for corporate responsibility and long-term sustainability.

Global regulatory bodies are intensifying their focus on Environmental, Social, and Governance (ESG) reporting. By 2025, financial institutions and publicly traded companies face significantly heightened compliance expectations, pushing for more transparent and standardized disclosures. This trend necessitates advanced capabilities in data collection, analysis, and reporting.

GFT Technologies is well-positioned to assist clients in navigating this evolving regulatory landscape. By embedding ESG data and reporting functionalities directly into clients' IT infrastructures, GFT can streamline compliance efforts. The company's utilization of artificial intelligence for risk management and regulatory adherence further empowers clients to meet these growing obligations effectively.

Financial institutions are increasingly prioritizing ambitious sustainability goals, such as achieving carbon neutrality and increasing community investment, directly impacting their selection of technology partners. For instance, a significant majority of global banks, over 70% according to a 2024 industry survey, are actively integrating ESG factors into their lending and investment decisions.

GFT Technologies' ability to align its offerings with these client-driven ESG initiatives, by providing solutions that demonstrably reduce environmental impact or foster social good, is crucial for enhancing its brand reputation and securing new business opportunities. Companies that can clearly articulate their ESG contributions, such as GFT's focus on digital transformation for sustainable finance, often see improved client acquisition rates.

Demonstrating a robust commitment to ESG principles offers a tangible competitive advantage in the current market. In 2025, businesses with strong ESG credentials are projected to outperform their peers in attracting investment and talent, with ESG-focused funds expected to manage over $50 trillion globally.

Resource Scarcity and Energy Efficiency in Data Centers

The escalating energy demands of IT infrastructure, especially data centers, are spotlighting resource limitations and rising operational expenditures. Globally, data centers are projected to consume 1.7% of total electricity demand in 2024, a figure expected to climb. GFT's proficiency in cloud migration and modernizing IT platforms offers clients a pathway to optimize their digital environments for greater energy efficiency.

This optimization directly translates into reduced environmental footprints and lower operational costs, a critical advantage given the volatility of energy prices. For instance, by migrating to more efficient cloud architectures, businesses can potentially see a 15-20% reduction in their IT energy consumption. This focus on efficiency is becoming a significant value driver for GFT's services.

- Data Center Energy Consumption: Expected to reach 1.7% of global electricity demand in 2024.

- Efficiency Gains: Cloud migration can reduce IT energy usage by an estimated 15-20%.

- Cost Optimization: Lower energy consumption directly impacts operational expenses.

- Environmental Impact: Improved efficiency contributes to sustainability goals.

Corporate Social Responsibility (CSR) Expectations

Beyond direct environmental impact, there's a growing expectation for companies like GFT Technologies to showcase robust corporate social responsibility. This encompasses ethical operations, fostering diversity and inclusion within their teams, and actively engaging with the communities they serve. For instance, in 2023, GFT reported a significant increase in employee participation in social impact programs, reflecting this broader CSR focus.

GFT's internal CSR initiatives, coupled with its dedication to principles of responsible artificial intelligence, directly bolster its reputation. This commitment is crucial for attracting both top-tier talent and clients who increasingly value ethical considerations in their partnerships. A 2024 survey indicated that over 60% of potential tech hires consider a company's CSR activities when making career decisions.

The company's investment in responsible AI development, aiming for fairness and transparency, aligns with these evolving stakeholder demands. This proactive approach not only mitigates potential reputational risks but also positions GFT as a forward-thinking leader in the digital transformation space.

- Ethical Business Practices: GFT's adherence to strict ethical codes guides its global operations.

- Diversity and Inclusion: The company actively promotes a diverse workforce, with targets for representation across various demographics.

- Community Engagement: GFT supports local communities through various philanthropic and volunteer initiatives.

- Responsible AI: GFT is committed to developing AI solutions that are fair, transparent, and accountable.

The global push for sustainability is reshaping the IT landscape, with clients increasingly seeking solutions that minimize environmental impact. GFT Technologies is capitalizing on this by offering green IT services and optimizing data centers, directly addressing client needs for reduced carbon footprints. This focus aligns with investor expectations for corporate responsibility, as evidenced by the projected growth of the green IT market to $45.9 billion by 2025.

The escalating energy demands of IT infrastructure, particularly data centers, present both challenges and opportunities. Data centers are expected to consume 1.7% of global electricity demand in 2024, a figure on the rise. GFT's expertise in cloud migration and IT modernization enables clients to achieve greater energy efficiency, potentially reducing IT energy consumption by 15-20% and lowering operational costs.

Regulatory bodies are intensifying their focus on ESG reporting, with heightened compliance expectations for financial institutions by 2025. GFT Technologies is positioned to assist clients in navigating this complex landscape by integrating ESG data and reporting functionalities into IT infrastructures, leveraging AI for risk management and regulatory adherence.

Businesses with strong ESG credentials are set to outperform, with ESG-focused funds projected to manage over $50 trillion globally by 2025. GFT's commitment to ESG principles, including responsible AI development and community engagement, enhances its brand reputation and attractiveness to clients and talent who prioritize ethical considerations.

| Environmental Factor | Description | GFT's Relevance | Supporting Data (2024/2025) |

|---|---|---|---|

| Green IT Demand | Growing client preference for sustainable IT solutions. | Offers energy-efficient services and data center optimization. | Global green IT market projected to reach $45.9B by 2025. |

| Data Center Energy Consumption | Increasing electricity usage by IT infrastructure. | Provides cloud migration for enhanced energy efficiency. | Data centers to consume 1.7% of global electricity in 2024. |

| Energy Efficiency Gains | Benefits of optimized IT environments. | Enables clients to reduce operational costs and environmental impact. | Cloud migration can reduce IT energy use by 15-20%. |

| ESG Reporting Compliance | Increased regulatory scrutiny on ESG disclosures. | Assists clients in meeting compliance through data and AI tools. | Heightened compliance expectations for financial institutions by 2025. |

| ESG Investment Growth | Investor focus on companies with strong ESG performance. | Strong ESG credentials attract investment and talent. | ESG-focused funds to manage over $50T globally by 2025. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for GFT Technologies is built upon a comprehensive review of official government publications, reputable financial news outlets, and leading technology industry reports. This ensures that insights into political, economic, social, technological, environmental, and legal factors are grounded in verified and current information.