GFT Technologies Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GFT Technologies Bundle

GFT Technologies operates in a dynamic IT services landscape, where the threat of new entrants and the bargaining power of buyers significantly shape its competitive environment. Understanding these forces is crucial for navigating the market effectively.

The complete report reveals the real forces shaping GFT Technologies’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

GFT Technologies, much like its peers in the IT services sector, depends significantly on its specialized workforce. The scarcity of talent in high-demand fields such as artificial intelligence, cloud infrastructure, and cybersecurity grants considerable bargaining power to these skilled IT professionals. This global deficit in expertise, particularly in programming, automation, and cybersecurity, amplifies the influence of individual experts and specialized talent groups.

GFT recognizes this dynamic, actively investing in talent development through programs like 'Grow tech talent worldwide.' This focus on internal skill enhancement underscores the crucial role of human capital as a key supplier to the business, directly impacting operational capacity and service delivery.

Suppliers of core technologies, like major cloud platforms such as Microsoft Azure and AWS, wield considerable power. This stems from the unique nature of their services and the substantial costs involved in switching to a different provider for complex IT systems. GFT's strategic alliances with these entities highlight this dependency, granting them leverage in negotiations over pricing and contract terms.

GFT's reliance on these foundational technologies is evident in their product strategy. For instance, their generative AI solution, Wynxx/AI Impact, is readily accessible through both Microsoft and AWS global marketplaces. This strategic placement not only broadens market reach but also underscores the deep integration and ongoing partnerships with these key technology suppliers, reinforcing their bargaining position.

In the niche software market for financial services, especially for critical systems like core banking or regulatory compliance, there are often only a few providers. This scarcity means these specialized software vendors hold significant sway, dictating terms and pricing. GFT Technologies frequently works with these kinds of specialized software, so the cost and access to these licenses directly impact their operations and profitability.

GFT's business model, which includes implementing and integrating these specialized third-party software solutions, makes the bargaining power of these limited vendors a key consideration. For instance, GFT's strategic acquisitions often target companies proficient in implementing software from major players such as Salesforce, SAP, or Guidewire, underscoring the critical nature of these vendor relationships and their associated licensing agreements.

Increasing Costs of Talent Acquisition and Retention

The escalating costs associated with acquiring and retaining skilled IT professionals significantly bolster the bargaining power of suppliers, particularly employees. This competitive talent market means companies like GFT Technologies face upward pressure on wages and benefits to attract and keep top performers. Recent financial disclosures highlight this trend; for instance, increased personnel expenses have demonstrably impacted operating earnings.

GFT's strategic growth is evident in its workforce expansion. By the close of 2024, the company employed over 11,500 full-time individuals, marking a substantial 26% increase from the previous year. This rapid growth underscores a significant investment in human capital, further intensifying the competition for talent and, consequently, strengthening the negotiating position of both current and prospective employees.

- Rising Personnel Costs: The competitive IT talent landscape directly inflates personnel expenses, impacting GFT's profitability.

- Workforce Growth: GFT's workforce expanded by 26% to over 11,500 full-time employees by the end of 2024, reflecting increased investment in talent.

- Employee Bargaining Power: The continuous demand for skilled IT professionals strengthens the bargaining position of employees in attracting and retaining talent.

Dependence on Strategic Partnerships for Market Access

GFT Technologies' capacity to offer complete digital transformation services is frequently built upon its robust network of collaborators, encompassing both established technology firms and emerging startups. These alliances are crucial for GFT to maintain its position at the cutting edge of technological advancement.

However, this reliance means that partners, who supply innovative solutions or provide essential market access, possess a degree of bargaining power. This is especially true when their contributions are distinctive or indispensable for fulfilling particular client requirements.

For example, GFT's engagement with NVIDIA to provide sophisticated AI solutions exemplifies these interdependencies. In 2023, NVIDIA reported a substantial revenue increase, underscoring the significant market demand and value of its advanced technologies, which GFT leverages.

- GFT's digital transformation capabilities are augmented by strategic alliances with technology providers and startups.

- Partners supplying unique or critical solutions and market access can exert bargaining power over GFT.

- Collaborations, such as with NVIDIA for AI solutions, highlight GFT's dependence on key technology partners.

The bargaining power of suppliers for GFT Technologies is notably high, primarily driven by the scarcity of specialized IT talent and the critical nature of core technology platforms. Skilled IT professionals, particularly in areas like AI and cybersecurity, command significant leverage due to global talent deficits, directly impacting GFT's personnel costs. Major cloud providers such as Microsoft Azure and AWS also hold substantial power due to the high switching costs associated with their integrated services.

Furthermore, niche software vendors for financial services, offering essential systems like core banking solutions, exert considerable influence due to their limited market presence. GFT's reliance on these specialized software licenses and the need for strategic partnerships with technology firms like NVIDIA for advanced AI solutions further amplify supplier bargaining power, influencing pricing and contract terms across the board.

| Supplier Type | Bargaining Power Drivers | Impact on GFT Technologies |

|---|---|---|

| Skilled IT Professionals | Global talent scarcity, high demand in AI/cybersecurity | Increased personnel costs, retention challenges |

| Cloud Platform Providers (e.g., AWS, Azure) | High switching costs, essential infrastructure | Leverage in pricing and contract negotiations |

| Niche Software Vendors (Financial Services) | Limited providers, critical system dependency | Dictates licensing terms and costs |

| Technology Partners (e.g., NVIDIA) | Unique/indispensable solutions, market access | Influences collaboration terms and technology adoption |

What is included in the product

This analysis uncovers key drivers of competition, customer influence, and market entry risks tailored to GFT Technologies' position in the IT services sector.

GFT Technologies' Porter's Five Forces Analysis provides a dynamic, interactive dashboard to visualize and manage competitive pressures, allowing for proactive strategy adjustments.

Customers Bargaining Power

GFT Technologies' customer base is largely composed of major financial institutions, such as banks and insurance companies. These clients wield considerable purchasing power due to their sheer size and the significant volume of services they require from GFT.

The concentration of GFT's revenue among a few key clients amplifies this bargaining power. For instance, Deutsche Bank alone accounted for 14% of GFT's revenues in 2024, highlighting the influence a single large customer can exert when negotiating terms.

This dependence on a concentrated customer base means that these major clients are in a strong position to negotiate for more favorable pricing and contract conditions, which can directly affect GFT's profit margins.

While customers possess considerable influence, the intricate nature of IT service projects, such as core banking modernization, cloud migration, or AI integration, presents substantial switching costs for financial institutions. These costs encompass not only direct financial outlays but also the risks associated with operational disruption and the potential for integration failures.

For GFT Technologies, this translates into a degree of customer lock-in. Once a financial institution has invested heavily in integrating GFT's solutions and expertise into its complex systems, the inertia to switch providers becomes a significant deterrent. This embedded relationship naturally tempers the immediate bargaining power of these clients.

In 2024, the financial services sector continued to see significant investment in digital transformation, with many institutions undertaking multi-year projects. The average cost of a major core banking system replacement, for example, can range from tens of millions to hundreds of millions of dollars, underscoring the substantial commitment and thus, the high switching costs involved.

The financial services industry's rapid push towards digital transformation, including the widespread adoption of cloud technologies and artificial intelligence, significantly amplifies customer bargaining power. Customers, particularly large enterprises, now expect highly efficient, innovative, and cost-optimized solutions, putting pressure on providers like GFT to deliver. For instance, a 2024 report indicated that 70% of financial institutions planned to increase their AI investments, highlighting this demand.

Financial institutions are increasingly reliant on AI to enhance operational efficiency, personalize customer experiences, and bolster risk management capabilities. This strategic imperative means they can demand more sophisticated and value-driven offerings from their technology partners, such as GFT. In 2024, the global AI in financial services market was projected to reach over $20 billion, underscoring the scale of this customer-driven innovation.

Price Sensitivity and Budget Constraints

Even with strong demand for IT services, customers, especially during periods of economic uncertainty like those seen in 2024 with elevated interest rates, can become more price-sensitive. This means they are more likely to scrutinize costs and seek out the most budget-friendly options available.

GFT Technologies' own financial performance reflects this customer behavior. For instance, the company revised its guidance downwards in 2024, citing market challenges. These included a notable slowdown in the UK market and adverse currency exchange rate movements, both of which directly impact customer spending power and their willingness to invest in IT solutions.

- Price Sensitivity: Customers are increasingly evaluating the cost-effectiveness of IT services, particularly in the face of economic headwinds.

- Budget Constraints: Higher interest rates and economic uncertainty in 2024 have led many businesses to tighten their IT budgets.

- Market Challenges: GFT's revised 2024 guidance highlights the impact of these customer sensitivities on the IT services sector.

- Cost-Efficient Solutions: The demand is shifting towards providers offering demonstrable value and cost savings.

Availability of Alternative IT Service Providers

The bargaining power of customers is significantly influenced by the availability of alternative IT service providers. GFT Technologies operates in a market where clients can choose from a vast ecosystem of competitors, including major global players like Accenture and Capgemini, as well as specialized fintech firms and in-house IT departments. This wide selection of options naturally empowers customers, allowing them to negotiate more favorable terms and pressuring GFT to clearly articulate its unique value proposition.

To counter this, GFT must emphasize its specialized expertise, profound industry insights, and pioneering AI-driven solutions. For instance, in 2024, the IT services market saw continued growth, with global IT spending projected to reach over $1.5 trillion, indicating a robust demand but also intense competition. GFT's ability to carve out a niche and deliver superior, differentiated services is crucial for retaining and attracting clients in this dynamic environment.

- Broad Market Options: Customers can select from global consultancies, niche providers, and internal IT teams.

- Increased Negotiation Leverage: A competitive landscape grants customers greater power to dictate terms.

- GFT's Differentiation Imperative: The company must highlight specialized skills, industry knowledge, and AI innovation.

- Market Context (2024): Over $1.5 trillion in global IT spending underscores both opportunity and intense rivalry.

GFT Technologies' customers, primarily large financial institutions, possess significant bargaining power due to their substantial business volume and the critical nature of IT services. This power is amplified by the increasing demand for advanced solutions like AI, where clients expect cutting-edge and cost-effective offerings. For example, the global AI in financial services market was projected to exceed $20 billion in 2024, reflecting this customer-driven innovation and demand for sophisticated capabilities.

| Factor | Impact on GFT Technologies | 2024 Data/Context |

|---|---|---|

| Customer Size and Volume | Large clients can negotiate better pricing due to significant service uptake. | Deutsche Bank accounted for 14% of GFT's revenues in 2024. |

| Switching Costs | High costs associated with integrating complex IT projects create customer lock-in. | Core banking system replacements can cost tens to hundreds of millions of dollars. |

| Demand for Innovation (AI) | Clients push for advanced, value-driven AI solutions. | 70% of financial institutions planned AI investment increases in 2024. |

| Economic Sensitivity | Price sensitivity increases during economic downturns, impacting IT budgets. | GFT revised its 2024 guidance downwards due to market challenges and customer spending. |

| Availability of Alternatives | A competitive market with numerous providers enhances customer negotiation leverage. | Global IT spending exceeded $1.5 trillion in 2024, indicating intense competition. |

Preview the Actual Deliverable

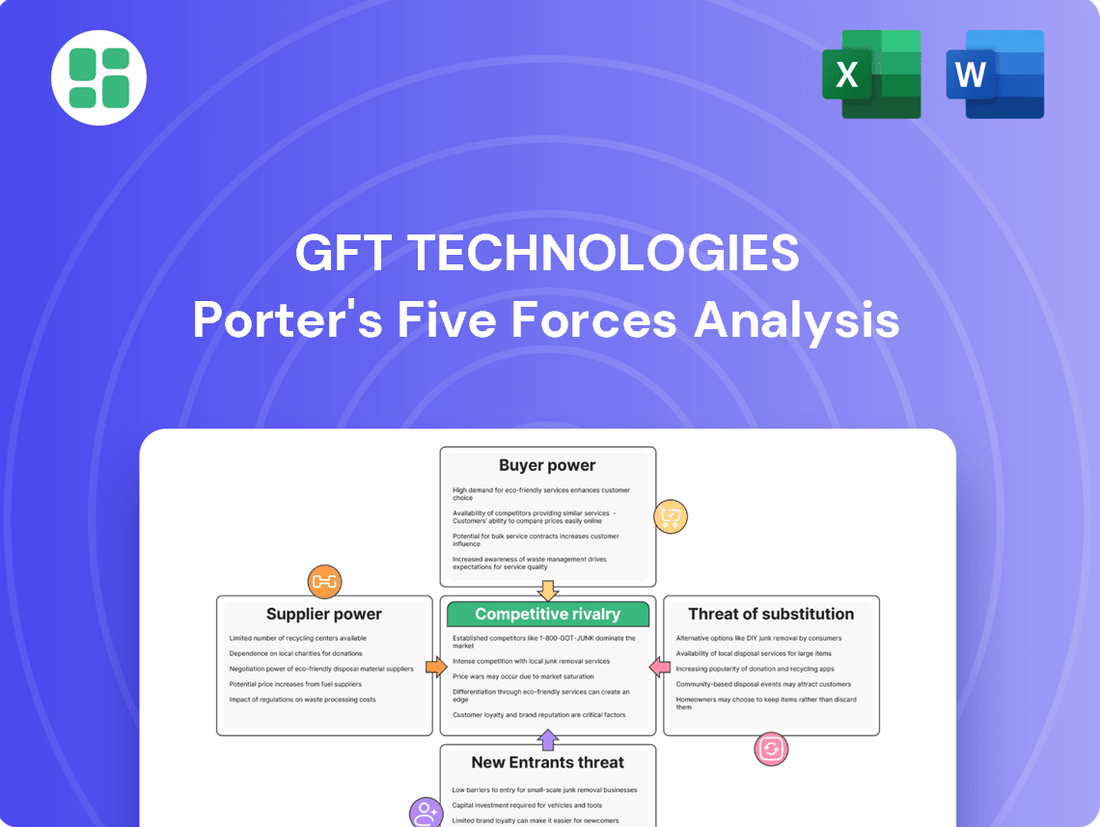

GFT Technologies Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces Analysis for GFT Technologies, providing a detailed examination of competitive rivalry, the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, and the threat of substitute products. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy. You can confidently use this analysis to understand the industry landscape and inform your strategic decisions.

Rivalry Among Competitors

The IT services and software engineering landscape, particularly for financial institutions, is densely populated. This includes giants like Accenture and Capgemini, alongside many smaller, specialized firms, creating a highly fragmented market.

This intense competition for both clients and skilled professionals is a significant factor. For instance, the global IT services market was projected to reach over $1.5 trillion in 2024, with a substantial portion dedicated to financial services, highlighting the sheer volume of players vying for market share.

The push for financial institutions to embrace digital transformation and artificial intelligence is intensifying, creating a fierce competitive landscape for IT service providers. This isn't just about offering services; it's about leading the charge in a market that's rapidly evolving.

GFT's ambitious goal to be fully AI-centric by 2029, evidenced by its development of offerings like Wynxx and AI Impact, directly positions it against rivals also targeting the burgeoning AI as a Service (AIaaS) market. This market is projected to reach a significant $105 billion, making it a crucial area of competition for IT firms.

The market is seeing a lot of companies joining forces, and GFT is right in the middle of it, making strategic purchases to get bigger and better. This means more competition as firms combine to offer a wider range of services and grab more customers.

GFT's moves, like acquiring Sophos Solutions in 2024 and Megawork in 2025, are perfect examples of this consolidation trend. These acquisitions are not just about growing; they're about becoming a more formidable player in the industry, directly impacting how rivals compete.

Differentiation through Specialization and Innovation

Competitive rivalry in the IT services sector, particularly for companies like GFT Technologies, is intense. Differentiation is key, and it's often achieved through deep industry expertise and a commitment to cutting-edge technology. GFT's strategic focus on the financial services sector allows them to cultivate specialized knowledge that sets them apart.

Innovation is another critical driver of competition. GFT is actively investing in proprietary AI products, such as Wynxx. This AI solution is designed to significantly boost software development productivity, with reported increases of up to 90%. Such advancements are crucial for maintaining a competitive edge in a rapidly evolving technological landscape.

The company's specialized capabilities are frequently recognized through industry accolades. For instance, GFT's award as Google Cloud Country Partner of the Year for Germany in 2024 underscores its strong technical proficiency and market position within a specific geographic and technological domain.

- Industry Expertise: GFT's specialization in financial services fosters deep domain knowledge.

- Technological Innovation: Investment in AI, like Wynxx, enhances software development efficiency.

- Productivity Gains: Wynxx aims to improve software development productivity by up to 90%.

- Industry Recognition: Awards such as Google Cloud Country Partner of the Year for Germany in 2024 validate specialized capabilities.

Pressure on Pricing and Margins

Intense competition within the IT services sector often forces companies like GFT Technologies to lower prices, squeezing their profit margins. This dynamic is evident in GFT's experience in markets such as the UK, where competitive pressures have necessitated adjustments to its strategic focus.

To counteract this margin pressure, GFT is actively working to rebalance its service portfolio towards higher-margin offerings. This strategic shift is crucial for maintaining profitability in a highly competitive landscape.

Furthermore, GFT's expansion of its smartshore delivery model is a direct response to these competitive pricing challenges. By leveraging offshore resources, the company aims to improve its cost structure and, by extension, enhance its profit margins.

- Competitive pressure directly impacts pricing strategies and profitability.

- GFT has experienced market-specific challenges, such as in the UK, affecting financial performance.

- Strategic adjustments include shifting to higher-margin services and expanding smartshore delivery.

- These actions are aimed at improving overall profitability in a competitive environment.

The IT services market is incredibly crowded, with GFT Technologies facing stiff competition from both large, established players and smaller, niche firms. This intense rivalry is driven by the digital transformation needs of financial institutions, pushing companies to innovate rapidly and secure market share.

GFT's strategic acquisitions, like Sophos Solutions in 2024, demonstrate a proactive approach to consolidating its position and expanding its service offerings to directly challenge competitors. The company's focus on AI, with products like Wynxx aiming for up to 90% productivity gains, is a clear differentiator in this battle for technological leadership.

Competitive pressures also force GFT to manage pricing carefully, as seen in markets like the UK, and to strategically shift towards higher-margin services and optimize its delivery models, such as smartshoring, to maintain profitability.

| Competitor Type | Examples | Impact on GFT |

|---|---|---|

| Large IT Consultancies | Accenture, Capgemini | Intense competition for large financial services contracts; pressure on pricing. |

| Specialized IT Firms | Numerous niche players | Competition for specific technology solutions and expertise; potential for partnerships or acquisitions. |

| In-house IT Departments | Financial institutions' own IT teams | Competition for talent and project control; GFT aims to offer superior efficiency and innovation. |

SSubstitutes Threaten

Financial institutions, especially larger ones with significant IT budgets, might opt for in-house development of technology solutions. This trend is amplified by the increasing accessibility of advanced internal AI tools and the rise of low-code/no-code platforms, enabling faster internal development cycles. For instance, in 2023, global IT spending by financial services firms reached an estimated $220 billion, a portion of which could be redirected to internal capabilities rather than external providers like GFT.

The rise of readily available, off-the-shelf software and SaaS solutions presents a significant threat of substitutes for GFT Technologies. For many common business functions, clients can bypass the need for GFT's custom development by directly adopting these standardized products. For instance, the global SaaS market was projected to reach $270 billion in 2024, indicating a vast array of readily available alternatives.

Generic consulting firms present a notable threat to GFT Technologies. These firms, while lacking GFT's specialized financial services IT expertise, can still offer broad strategic IT advisory services. This can lead clients to consider alternative technology paths recommended by these generalists.

These broader consulting services can pose a substitution threat by suggesting solutions that bypass GFT's core competencies. For instance, a generic firm might advise a bank to adopt a more off-the-shelf cloud solution rather than GFT's tailored digital transformation services. The global IT consulting market was valued at approximately $350 billion in 2023, indicating a substantial competitive landscape where generic players can indeed capture market share.

Emergence of Low-Code/No-Code Platforms

The rise of low-code/no-code (LCNC) platforms presents a significant threat of substitutes for GFT Technologies. These platforms enable financial institutions to develop applications and automate workflows with minimal or no traditional coding expertise. This accessibility allows clients to build solutions faster and often at a reduced cost, directly competing with GFT's custom software engineering services.

LCNC platforms are rapidly maturing, with major players like Microsoft Power Apps, OutSystems, and Mendix gaining substantial market traction. For instance, Gartner projected the low-code development software market to reach $26.9 billion in 2023, an increase of 19.6% from 2022, indicating strong adoption and a growing alternative for businesses that might otherwise engage custom development firms like GFT.

- Increased Accessibility: LCNC platforms democratize software development, allowing business users to create applications without deep technical knowledge.

- Faster Time-to-Market: Businesses can deploy solutions significantly quicker compared to traditional development cycles, a key advantage over custom-built software.

- Cost Reduction: By reducing the reliance on highly skilled, expensive developers, LCNC can offer a more budget-friendly alternative for certain projects.

- Growing Market Adoption: The expanding market share and investment in LCNC technologies signal a clear shift in how software solutions are being procured and built within the financial sector.

Shifting Client Priorities to Managed Services

Clients may increasingly favor managed services over large transformation projects, shifting their IT spend. This trend could see some customers opting for direct AI-as-a-Service (AIaaS) solutions from hyperscalers or niche AI providers, potentially bypassing GFT's comprehensive integration services.

While GFT does offer managed services and AIaaS, the threat lies in clients choosing alternative, bundled offerings that might appear more cost-effective or streamlined. For instance, a significant portion of the IT services market is moving towards managed services; in 2024, the global managed services market was valued at approximately $327.8 billion, with projections indicating continued growth.

- Shift to Managed Services: Clients may prioritize ongoing operational support over large, upfront transformation initiatives.

- AIaaS Adoption: Direct procurement of AI capabilities from hyperscalers or specialized AI vendors presents an alternative to GFT's integration-heavy approach.

- Bundled Offerings: Competitors offering integrated managed services and AIaaS packages could attract clients seeking simpler solutions.

- Market Dynamics: The growing managed services market in 2024, valued at over $327 billion, highlights the increasing client preference for outsourced IT operations.

The threat of substitutes for GFT Technologies is substantial, driven by the increasing availability of off-the-shelf software, low-code/no-code platforms, and generic consulting services. Clients can bypass specialized financial IT services by opting for standardized solutions or internal development, especially as IT spending continues to grow. For instance, the global SaaS market was projected to reach $270 billion in 2024, offering a wide array of alternatives.

Low-code/no-code platforms are a direct substitute, enabling faster and cheaper application development. Gartner projected the low-code market to reach $26.9 billion in 2023, highlighting its growing appeal. Similarly, generic consulting firms can offer broad IT advice, potentially steering clients away from GFT's niche expertise by suggesting alternative, less specialized solutions.

The shift towards managed services and AI-as-a-Service (AIaaS) also presents a substitution threat. Clients might opt for direct AI capabilities from hyperscalers or choose bundled managed services that appear more cost-effective than GFT's transformation projects. The global managed services market, valued at approximately $327.8 billion in 2024, underscores this trend.

| Substitute Type | Description | Market Size/Growth Indicator (2023-2024) | Impact on GFT |

|---|---|---|---|

| Off-the-Shelf Software/SaaS | Standardized, readily available software solutions for common business functions. | Global SaaS market projected at $270 billion (2024). | Reduces demand for custom development. |

| Low-Code/No-Code (LCNC) Platforms | Tools enabling faster, less technical application development. | LCNC market reached $26.9 billion (2023), up 19.6% YoY. | Directly competes with custom software engineering. |

| Generic IT Consulting Firms | Firms offering broad IT strategy advice without deep financial sector specialization. | Global IT consulting market ~$350 billion (2023). | Can steer clients to alternative technology paths. |

| Managed Services & AIaaS | Outsourced IT operations and direct AI capabilities from providers. | Managed services market ~$327.8 billion (2024). | Shifts IT spend from transformation to operational support. |

Entrants Threaten

The specialized IT and software engineering sector for financial services presents a formidable barrier to entry due to immense capital and expertise demands. New companies must invest heavily in acquiring top-tier talent, building robust technology infrastructure, and conducting continuous research and development, particularly in cutting-edge fields like artificial intelligence and cloud computing.

GFT Technologies, for instance, employs over 12,000 technology experts across more than 20 countries, illustrating the sheer scale and global reach necessary to compete effectively. This extensive talent pool and international presence represent a significant hurdle for any aspiring entrant seeking to establish a foothold in this competitive landscape.

The financial services sector, where GFT Technologies operates, is characterized by formidable regulatory and compliance barriers. These include intricate requirements for data security, privacy protection, and anti-money laundering protocols, demanding significant investment and expertise. For instance, the General Data Protection Regulation (GDPR) in Europe, which came into full effect in 2018 and continues to evolve, imposes strict rules on data handling, with penalties for non-compliance that can reach up to 4% of annual global turnover or €20 million, whichever is higher.

Newcomers must navigate these complex, often country-specific, regulatory landscapes and obtain necessary certifications. This process is not only costly but also time-consuming, effectively creating high entry hurdles. GFT, having operated for decades, has cultivated deep-seated knowledge and built established trust, along with the requisite certifications, which are difficult and expensive for new entrants to replicate quickly.

Established client relationships and trust are significant barriers for new entrants in the IT services sector, particularly for companies like GFT Technologies serving major financial institutions. These incumbent players have cultivated deep, long-standing partnerships based on a proven track record of reliable delivery and an intimate understanding of each client's unique operational and regulatory requirements. For instance, in 2024, the financial services industry continued to prioritize stability and security, making it difficult for newcomers to displace trusted providers.

Brand Reputation and Track Record

A strong brand reputation and a proven track record in digital transformation are crucial for winning business with major financial players. GFT's established history as a digital transformation pioneer, dating back to 1987, coupled with recent accolades and client successes, creates a powerful reputation that newcomers struggle to match.

New entrants face significant hurdles in establishing the trust and credibility required to compete with established firms like GFT. Building a reputation takes years, and without a history of successful, large-scale digital transformation projects, new companies find it difficult to attract the attention of risk-averse financial institutions.

- Established Trust: GFT's long-standing presence and consistent delivery foster deep trust with clients, a difficult asset for new entrants to replicate quickly.

- Proven Success: A history of successful digital transformation projects, evidenced by client testimonials and case studies, provides new entrants with a benchmark they must meet.

- Industry Recognition: Awards and industry recognition, such as those GFT has received, serve as external validation of expertise, which is a significant barrier for emerging competitors.

Access to Specialized Ecosystems and Partnerships

GFT Technologies thrives by leveraging a robust ecosystem of partners, encompassing major cloud providers and cutting-edge fintech firms. This network is indispensable for GFT to offer its clients complete, integrated solutions. For any new player to compete, replicating this extensive web of alliances and collaborations would require substantial time and significant financial investment, acting as a considerable deterrent.

Building such specialized ecosystems and forging strategic partnerships presents a formidable hurdle for potential new entrants. For instance, in 2023, the digital transformation services market, where GFT operates, saw continued consolidation and deepening strategic alliances. Companies that can quickly establish and nurture these relationships, like GFT has with key players such as Microsoft Azure and AWS, gain a distinct advantage. Newcomers would face lengthy onboarding processes and the challenge of proving their value to established technology giants and innovative startups alike, making market penetration exceptionally difficult.

- Ecosystem Advantage: GFT's established relationships with cloud giants and fintech innovators provide a significant competitive edge.

- Partnership Barrier: New entrants must invest heavily in time and resources to build comparable partner networks.

- Market Penetration Difficulty: The complexity and cost of replicating GFT's ecosystem create a substantial barrier to entry.

The threat of new entrants for GFT Technologies is considerably low due to high capital requirements, specialized expertise, and stringent regulatory compliance in the financial IT services sector. Building the necessary infrastructure and talent pool, as exemplified by GFT's global team of over 12,000 experts, demands substantial upfront investment. Furthermore, navigating complex regulations like GDPR, which can impose penalties up to 4% of global turnover, requires significant legal and compliance resources that are difficult for newcomers to acquire quickly.

Established trust and long-standing client relationships are critical deterrents, as financial institutions prioritize stability and proven track records. GFT's history since 1987 and its success in digital transformation projects create a reputation that new firms struggle to match. Additionally, GFT's robust partner ecosystem, including collaborations with major cloud providers like Microsoft Azure and AWS, presents another significant barrier, requiring considerable time and investment for new entrants to replicate.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Intensity | High investment in talent, technology, and R&D. | Significant financial hurdle. |

| Regulatory Compliance | Strict data security, privacy, and financial regulations (e.g., GDPR). | Costly and time-consuming to achieve. |

| Established Relationships | Deep client trust built over years of reliable service. | Difficult for new firms to displace incumbents. |

| Ecosystem & Partnerships | Extensive network with cloud providers and fintechs. | Requires substantial time and investment to build comparable alliances. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for GFT Technologies is built upon a robust foundation of publicly available information, including GFT's annual reports and investor presentations. We also leverage industry-specific market research reports and analyses from reputable financial news outlets to capture a comprehensive view of the competitive landscape.