GFT Technologies Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GFT Technologies Bundle

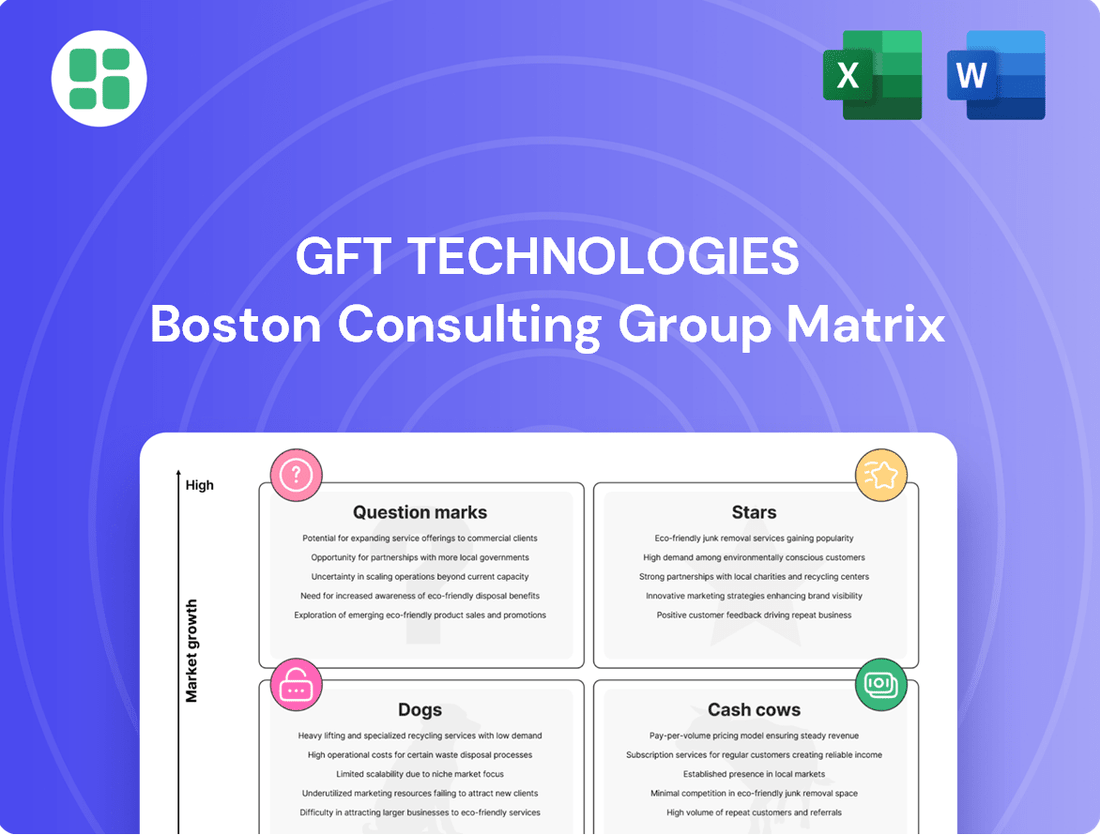

Curious about GFT Technologies' product portfolio performance? This glimpse into their BCG Matrix reveals the strategic positioning of their offerings, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. To truly unlock actionable insights and make informed decisions about resource allocation and future investments, dive into the complete BCG Matrix report.

Gain a comprehensive understanding of GFT Technologies' market share and growth potential by purchasing the full BCG Matrix. This detailed analysis will equip you with the knowledge to identify high-performing products and those requiring strategic attention, paving the way for optimized growth and profitability.

Don't miss out on the complete GFT Technologies BCG Matrix, your essential guide to navigating their product landscape. With detailed quadrant placements and expert commentary, this report is your shortcut to strategic clarity and confident decision-making in a dynamic market.

Stars

GFT is making substantial investments in AI-driven solutions, with Wynxx, a Generative AI product, showing remarkable traction. This strategic focus is evident as GFT aims to be fully AI-centric by 2029.

Wynxx is successfully acquiring new clients and boosting license sales, underscoring its significant growth potential. The solution is delivering impressive productivity gains, ranging from 50% to 90%, which clearly resonates with customers in the fast-growing AI market.

GFT Technologies has strategically entered the robotics and physical AI space with a significant contract with Neura Robotics in Germany. This move places GFT at the vanguard of intelligent machine development, a sector poised for substantial expansion.

The global market for industrial robots alone was valued at approximately $50 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 15% through 2030, indicating the immense potential GFT is tapping into.

By securing this major AI contract, GFT is leveraging an early mover advantage in a field that is rapidly evolving, suggesting a strong potential for future growth and market leadership in physical AI applications.

Cloud Transformation Services represent a significant area for GFT, aligning with the booming global cloud computing market. This sector is projected to reach over $1.3 trillion by 2025, underscoring its rapid expansion. GFT's strategic focus on cloud modernization and its partnerships with industry leaders like AWS and Microsoft, particularly for AI-driven solutions, positions it favorably within this high-growth segment, making it a key player in driving digital transformation across various industries.

Insurance Sector IT Services Growth

The insurance sector represents a significant growth area for GFT Technologies, reflecting the industry's accelerated digital transformation. GFT's IT services for this sector have seen robust expansion, with a notable 24% revenue surge reported in the first quarter of 2025. This impressive performance underscores the increasing demand for advanced technological solutions within insurance.

This upward trajectory is fueled by insurers' commitment to adopting cutting-edge technologies, such as artificial intelligence and cloud computing, to enhance customer experience and operational efficiency. GFT's specialized expertise in these areas positions it advantageously within this high-growth segment of financial services.

- Strong Q1 2025 Revenue Growth: GFT Technologies achieved a 24% revenue increase in the insurance sector during Q1 2025.

- Digital Transformation Driver: The growth is attributed to the insurance industry's ongoing digital transformation initiatives.

- Technology Adoption: Increased adoption of AI and other advanced technologies is a key factor in this expansion.

- Strategic Focus: GFT is capitalizing on this high-growth opportunity within financial services IT.

Digital Transformation for Tier-1 Financial Clients

GFT Technologies strategically targets Tier-1 financial clients for digital transformation, focusing on complex core banking modernizations. This approach aims for high-value, high-growth engagements where their deep industry expertise allows them to secure leading positions. For instance, GFT's successful projects with major institutions like Bancolombia and Banco Actinver highlight their capability in this segment.

- Targeted Expansion: GFT's strategy emphasizes deepening relationships with existing Tier-1 financial clients and expanding its global account footprint.

- Core Banking Modernization: A key focus area involves complex projects to update and transform legacy core banking systems for major financial institutions.

- High-Value Engagements: These initiatives represent significant opportunities for revenue growth and market leadership due to their complexity and strategic importance.

- Proven Success: Engagements with clients such as Bancolombia and Banco Actinver demonstrate GFT's ability to deliver impactful digital transformation outcomes for leading banks.

GFT Technologies' AI-driven solutions, particularly Wynxx, are positioned as Stars in the BCG matrix due to their high market growth and strong competitive position. Wynxx is achieving significant client acquisition and license sales, coupled with impressive productivity gains of 50% to 90%, indicating substantial demand and GFT's leading edge in the generative AI market.

The company's expansion into robotics and physical AI, exemplified by its contract with Neura Robotics, also places it in a high-growth sector. The industrial robot market, valued at approximately $50 billion in 2023 and projected for over 15% CAGR through 2030, highlights the immense potential of this strategic move.

GFT's focus on cloud transformation services, a market expected to exceed $1.3 trillion by 2025, further solidifies its Star status. Its partnerships with AWS and Microsoft for AI-driven cloud solutions position it as a key player in this rapidly expanding digital transformation landscape.

The insurance sector is another Star, with GFT reporting a 24% revenue surge in Q1 2025, driven by the industry's digital transformation and adoption of AI and cloud technologies. GFT's expertise in these areas allows it to capitalize on this high-growth segment.

Similarly, GFT's strategic focus on complex core banking modernizations for Tier-1 financial clients, evidenced by successful projects with Bancolombia and Banco Actinver, places it in a high-growth, high-value segment of financial services IT, reinforcing its Star positioning.

What is included in the product

GFT Technologies' BCG Matrix offers a strategic view of its portfolio, categorizing units into Stars, Cash Cows, Question Marks, and Dogs.

This analysis guides investment decisions, highlighting which GFT units to nurture, harvest, or divest for optimal growth.

GFT Technologies' BCG Matrix offers a clear, visual roadmap, relieving the pain of strategic uncertainty by highlighting which business units need investment and which can be divested.

Cash Cows

GFT Technologies' traditional core banking platform modernization efforts are firmly positioned as a Cash Cow within the BCG matrix. This segment leverages GFT's deep-seated expertise and established relationships within the financial sector, ensuring a steady stream of high-margin revenue from essential upgrade services for legacy systems.

The market for core banking modernization is mature, characterized by consistent demand rather than rapid expansion. GFT's strong market share in this area directly translates to predictable and substantial cash flow, underpinning the company's financial stability. For instance, in 2024, the global banking sector continued to invest billions in digital transformation, with core modernization remaining a critical component of these initiatives.

Managed IT services for financial institutions represent a cornerstone of GFT Technologies' business, acting as a classic cash cow. This segment generates consistent, predictable revenue through long-term contracts focused on maintaining critical IT infrastructure for banks and other financial entities. In 2024, GFT continued to leverage its deep expertise in this mature market, securing significant multi-year agreements that underscore the stability of this revenue source.

GFT Technologies' established regulatory compliance solutions act as a classic cash cow within the BCG framework. These services cater to the persistent and often stringent needs of financial institutions to adhere to evolving regulations, ensuring a stable demand. GFT’s deep expertise and established presence in this mature market segment translate into predictable, recurring revenue streams, a hallmark of cash cow businesses.

Enterprise Application (SAP) Implementation & Support

GFT Technologies' Enterprise Application (SAP) Implementation & Support services are positioned as a Cash Cow within the BCG Matrix. This is largely due to the strategic acquisition of Megawork, which significantly bolstered GFT's capabilities and market presence in SAP migration and implementation, especially in Brazil.

SAP services represent a mature yet indispensable segment of enterprise IT infrastructure. They consistently generate stable, high-margin revenue streams, driven by ongoing client demands for modernization and optimization, further amplified by GFT's expanded expertise.

- Market Maturity: SAP services cater to established enterprise needs, offering predictable demand.

- Revenue Stability: High-margin, recurring revenue from long-term client relationships.

- Competitive Advantage: Megawork acquisition enhances GFT's SAP migration and implementation prowess, particularly in the growing Brazilian market.

- Financial Performance: In 2023, GFT reported revenues of €1.7 billion, with its Digital Solutions segment, which includes SAP services, showing robust performance driven by such strategic offerings.

Legacy System Maintenance and Optimization

GFT Technologies generates substantial revenue by maintaining and optimizing legacy IT systems for its clients. These services are crucial for ensuring the operational stability of mature industries, providing a consistent income stream from existing infrastructure. This often acts as a foundational step before or in conjunction with broader modernization initiatives.

These legacy system maintenance and optimization services represent a significant Cash Cow for GFT. The demand remains robust as many established businesses rely on these systems for core operations. For instance, in 2024, GFT reported continued strong performance in its IT infrastructure services, which heavily includes legacy system support, contributing significantly to its overall revenue stability.

- Stable Revenue Stream: Legacy system maintenance provides predictable and consistent income for GFT.

- Low Investment Requirement: These services generally require less investment in new market development compared to Stars or Question Marks.

- Client Dependency: Many clients depend on GFT for the ongoing upkeep of their critical legacy systems.

- Foundation for Modernization: Optimization efforts can create opportunities for future modernization projects.

GFT Technologies' core banking platform modernization services are a prime example of a Cash Cow. These offerings capitalize on GFT's established expertise and deep relationships within the financial sector, consistently generating high-margin revenue from essential legacy system upgrades. The market for core banking modernization, while mature, exhibits steady demand, with global banking investments in digital transformation continuing to be substantial, as seen in 2024.

Managed IT services for financial institutions also function as a classic cash cow, providing predictable, recurring revenue through long-term contracts for maintaining critical IT infrastructure. GFT's continued success in securing multi-year agreements in 2024 highlights the stability of this revenue source in a mature market.

Furthermore, GFT's regulatory compliance solutions are a dependable cash cow, addressing the ongoing and stringent needs of financial institutions to meet evolving regulations. This mature segment ensures stable demand and predictable, recurring revenue streams, a hallmark of cash cow businesses.

The company's Enterprise Application (SAP) Implementation & Support services, particularly strengthened by the Megawork acquisition, are also firmly in the Cash Cow category. These services benefit from the mature but indispensable nature of SAP in enterprise IT, delivering stable, high-margin revenue, further boosted by GFT's enhanced capabilities. In 2023, GFT's Digital Solutions segment, which includes SAP services, demonstrated robust performance, contributing to the company's overall €1.7 billion revenue.

Finally, GFT's legacy system maintenance and optimization services provide a significant and stable revenue stream. These services are crucial for operational stability in established industries, generating consistent income from existing infrastructure, as demonstrated by GFT's strong performance in IT infrastructure services in 2024.

| Service Area | BCG Category | Key Characteristics | 2024/2023 Data Point |

|---|---|---|---|

| Core Banking Modernization | Cash Cow | Mature market, steady demand, high-margin revenue from upgrades | Continued significant investment in digital transformation by global banks |

| Managed IT Services | Cash Cow | Predictable revenue from long-term contracts, critical infrastructure maintenance | Secured significant multi-year agreements |

| Regulatory Compliance | Cash Cow | Persistent demand for adherence to evolving regulations, stable recurring revenue | Stable demand in a mature market segment |

| SAP Implementation & Support | Cash Cow | Mature enterprise IT need, stable high-margin revenue, enhanced by acquisition | GFT reported €1.7 billion revenue in 2023; Digital Solutions segment showed robust performance |

| Legacy System Maintenance | Cash Cow | Crucial for operational stability, consistent income from existing infrastructure | Strong performance in IT infrastructure services |

Preview = Final Product

GFT Technologies BCG Matrix

The GFT Technologies BCG Matrix preview you are viewing is the exact, final document you will receive upon purchase. This comprehensive report, meticulously crafted for strategic analysis, contains no watermarks or placeholder content, ensuring you get a polished and immediately usable tool for evaluating GFT's business units. You can confidently use this preview as a true representation of the professional-grade BCG Matrix you'll download, ready for immediate integration into your business planning and decision-making processes.

Dogs

GFT Technologies' UK operations appear to be in a challenging phase. The company experienced a notable revenue reduction in 2024, and projections suggest further declines into 2025. This downturn is accompanied by a contraction in Earnings Before Tax (EBT) margins.

These financial indicators point to a shrinking market share for GFT within the UK. The combination of declining revenue and profitability suggests the UK market might be a cash trap, demanding substantial strategic intervention to reverse the trend.

The GFT Software Solutions GmbH segment within GFT Technologies is facing significant challenges. Its profitability has been on a downward trend, requiring substantial capital injections for necessary upgrades and modernization efforts. This situation points to a potential Stars or Question Marks category, depending on future market growth and the effectiveness of turnaround strategies.

Compounding these issues, the segment seems to hold a relatively small market share and is finding it difficult to maintain a competitive edge. This makes it a prime candidate for a thorough strategic evaluation, with divestiture being a real possibility if efforts to revitalize its performance do not yield positive results. For instance, in 2023, GFT Technologies reported that its software development segment faced margin pressures, although specific figures for GFT Software Solutions GmbH are not publicly itemized.

Commoditized Basic IT Consulting represents a segment where GFT Technologies likely faces significant competition from numerous providers offering similar, undifferentiated services. This category typically involves lower profit margins due to intense price sensitivity among clients. For instance, in 2024, the global IT consulting market saw continued pressure on pricing for basic services, with many smaller firms competing aggressively on cost.

Outdated Niche Technology Support

Services GFT might still offer for technologies that are becoming obsolete, without significant modernization investment, would reside in the Dogs quadrant of the BCG Matrix. These services cater to a diminishing market, generating low returns and consuming valuable resources. For instance, maintaining legacy mainframe systems for a handful of aging clients exemplifies this category.

Such offerings typically face declining demand and offer minimal profitability. In 2024, the global market for maintaining outdated enterprise software, a prime example of a dog, was estimated to be significantly smaller than newer cloud-based solutions, with growth rates often in the negative single digits.

- Shrinking Market Share: These services serve a niche and contracting customer base.

- Low Profitability: Returns are minimal, often barely covering costs.

- Resource Drain: Continued support ties up capital and specialized personnel.

- Limited Future Relevance: Demand is expected to continue to decline.

Underperforming Regional Operations (excluding specific strong growth regions)

While GFT Technologies is experiencing robust growth in key markets such as Latin America, North America, and the APAC region, certain European operations outside the UK may be showing signs of underperformance. These specific regional pockets, if not demonstrating recovery or holding significant strategic value, could be consuming resources without yielding commensurate returns. For instance, in 2024, while GFT's overall revenue saw a healthy increase, specific segments within continental Europe might have lagged, potentially impacting profitability in those areas.

These underperforming regional operations can be viewed as question marks or even dogs within the BCG matrix framework if their market share and growth prospects remain consistently low. The challenge lies in identifying these specific areas and making decisive strategic choices.

- Stagnant Growth Pockets: Identifying specific European countries or sub-regions where GFT's market share and revenue growth have been minimal or negative in 2024.

- Resource Drain: Assessing the operational costs and investments allocated to these underperforming areas versus the returns generated, highlighting potential inefficiencies.

- Strategic Re-evaluation: Considering options such as divestment, restructuring, or targeted turnaround strategies for these regions if they do not align with GFT's long-term growth objectives.

- Comparative Performance: Contrasting the performance of these regions with the strong growth observed in Latin America, North America, and APAC to underscore the disparity.

Services GFT offers for technologies becoming obsolete, without significant modernization, would reside in the Dogs quadrant. These cater to a diminishing market, generating low returns and consuming valuable resources. For instance, maintaining legacy mainframe systems for aging clients exemplifies this category, with the global market for such services shrinking significantly by 2024.

These offerings face declining demand and minimal profitability, often barely covering costs. In 2024, the market for maintaining outdated enterprise software, a prime dog example, was considerably smaller than newer cloud solutions, with negative growth rates.

These services serve a contracting customer base, offering minimal returns that often just cover expenses. Continued support for such offerings drains capital and specialized personnel, with limited future relevance as demand continues to fall.

GFT Technologies' UK operations are in a challenging phase, with revenue reduction in 2024 and projected declines into 2025, impacting Earnings Before Tax margins. This suggests a shrinking market share and potential cash trap requiring strategic intervention.

| BCG Quadrant | Market Growth | Relative Market Share | GFT Technologies Example | Strategic Implication |

|---|---|---|---|---|

| Dogs | Low | Low | Legacy system maintenance, commoditized basic IT consulting | Divest, harvest, or minimize investment |

Question Marks

GFT Technologies is actively exploring cutting-edge AI, including agentic and reasoning AI, which show significant future growth potential but currently hold a small market share. These ventures demand considerable research and development funding, with outcomes that are uncertain but could yield substantial future profits.

For instance, in 2024, GFT's commitment to innovation in these advanced AI fields is reflected in their strategic investments, though specific figures for these nascent applications are not yet publicly disclosed. The company's focus on these specialized areas positions them to capitalize on emerging market trends, aiming to disrupt industries with novel AI-driven solutions.

GFT Technologies is strategically expanding into new industry verticals such as healthcare, pharmaceuticals, the public sector, and utilities. This diversification, notably through acquisitions like Mega Work, aims to tap into high-growth markets where GFT's presence is currently minimal. These new ventures are considered question marks within the BCG matrix framework, signifying their potential for high growth but also their current low market share.

Entering these new sectors requires substantial investment to build a competitive presence and achieve scalability. For instance, the digital transformation market in healthcare is projected to reach over $100 billion by 2025, presenting a significant opportunity but also demanding considerable capital outlay for GFT to establish a strong foothold.

Emerging blockchain and DLT solutions outside of finance, while holding significant future potential with a projected CAGR of 43.6% by 2032, currently represent question marks for GFT Technologies. These ventures, such as supply chain management or digital identity platforms, require substantial investment in research, development, and market education to achieve widespread adoption and monetization.

These nascent applications consume considerable cash flow, mirroring the characteristics of question mark assets in a BCG matrix. GFT's strategic allocation of resources to these areas is a bet on future market growth and technological leadership in a sector that is still defining its most lucrative use cases beyond its financial origins.

Niche Cybersecurity Offerings with AI Integration

GFT Technologies might be focusing on niche cybersecurity offerings that leverage artificial intelligence. This positions them in a rapidly expanding market, fueled by the constant evolution of cyber threats. However, given the specialized nature of these AI-integrated solutions, GFT's current market share in these specific segments would likely be modest, necessitating substantial investment in market penetration and customer acquisition.

The global cybersecurity market is projected to reach $345.4 billion by 2026, with AI-driven solutions being a significant growth catalyst. GFT's strategic move into these specialized areas could see them developing offerings such as AI-powered threat detection and response platforms, or advanced analytics for identifying sophisticated cyber-attacks.

- High Growth Potential: The demand for AI-enhanced cybersecurity is soaring, with the AI in cybersecurity market expected to grow from $10.3 billion in 2023 to $35.6 billion by 2028, at a CAGR of 28.1%.

- Low Initial Market Share: As a new entrant or specialist in these cutting-edge areas, GFT's market share would initially be small, requiring significant effort to capture customers.

- Investment Required: To gain traction, GFT will need to invest heavily in research and development, marketing, and sales to build brand awareness and demonstrate the value of their AI-powered solutions.

- Strategic Focus: This niche focus allows GFT to differentiate itself from broader cybersecurity providers and target specific customer needs with advanced capabilities.

Strategic Geographic Market Penetration (New Segments)

GFT Technologies is strategically expanding its reach into new geographic market segments, aiming to replicate its success in established regions. This involves identifying and penetrating underserved or emerging markets where its digital transformation and IT consulting services can address specific business needs. For instance, targeting the burgeoning FinTech sector in Southeast Asia presents a significant opportunity for growth.

Within its existing strongholds, such as the United States, GFT is actively pursuing new client acquisition in key banking and insurance sub-segments. This focused approach means identifying high-potential areas where its current market penetration is relatively low. For example, within the US banking sector, GFT might be focusing on community banks or credit unions that are increasingly looking to adopt advanced digital solutions.

These strategic market penetration efforts require dedicated investment to secure substantial market share. This could involve setting up local offices, building tailored service offerings, and investing in marketing campaigns that resonate with the specific needs of these new segments. The goal is to establish a strong foothold before competitors fully capitalize on these opportunities.

- Targeting new, high-growth sub-markets within existing geographic strongholds, like specific segments of the US banking and insurance industries.

- Expanding into new geographic regions with a high potential for digital transformation services, such as emerging markets in Asia.

- Allocating focused investment to capture significant market share in these newly penetrated segments.

- Developing tailored service offerings and marketing strategies to meet the unique demands of these new client bases.

GFT Technologies' ventures into emerging AI fields like agentic and reasoning AI, alongside new industry verticals such as healthcare and public sector IT, and non-financial blockchain applications, all fit the profile of Question Marks in the BCG matrix. These areas exhibit high growth potential but currently represent a small market share for GFT, necessitating significant investment. The company's strategic allocation of resources to these nascent technologies and markets is a calculated move to capture future market leadership, despite the inherent risks and uncertain outcomes. For example, the global AI in cybersecurity market is projected to grow significantly, and GFT's niche focus aims to capitalize on this trend.

| BCG Category | GFT Technologies' Ventures | Market Characteristics | Strategic Implications |

|---|---|---|---|

| Question Marks | Agentic & Reasoning AI | High Growth Potential, Low Market Share | Requires significant R&D investment; potential for high future returns. |

| Question Marks | Healthcare, Public Sector, Utilities (New Verticals) | High Growth Potential, Low Market Share | Investment in market penetration and scalability needed; diversification strategy. |

| Question Marks | Blockchain/DLT (Non-Financial) | High Growth Potential, Low Market Share | Substantial investment in R&D and market education; bet on future adoption. |

| Question Marks | Niche AI-Powered Cybersecurity | High Growth Potential, Low Market Share | Investment in marketing and sales to build brand awareness; differentiation strategy. |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from GFT's financial reports, internal performance metrics, and market research on technology trends to accurately position business units.