GE Vernova PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GE Vernova Bundle

Unlock critical insights into the external forces shaping GE Vernova's future with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are creating both challenges and opportunities for the energy giant. Equip yourself with actionable intelligence to navigate this dynamic landscape and gain a competitive edge.

Political factors

Government energy policies and subsidies are crucial for GE Vernova, especially in areas like renewable energy and upgrading electrical grids. For instance, the Inflation Reduction Act (IRA) in the United States, enacted in 2022, provides substantial tax credits for renewable energy projects, which directly boosts demand for GE Vernova's wind turbines and grid solutions. This legislation is expected to drive billions in new clean energy investments through 2030.

Support for decarbonization technologies, such as carbon capture and hydrogen production, also plays a significant role. Policies that incentivize these technologies can create new markets and opportunities for GE Vernova's Power segment. Conversely, any reduction in these incentives or a shift back towards fossil fuel support could present challenges for the company's clean energy divisions.

Global trade relations and the imposition of tariffs significantly influence GE Vernova's operational landscape, impacting everything from its supply chain efficiency to manufacturing expenses and the accessibility of its products to international markets. The company has openly discussed the potential headwinds from tariffs and inflationary pressures, actively pursuing mitigation tactics such as diversifying production locations and utilizing contractual safeguards.

In 2024, the World Trade Organization (WTO) reported that the value of global trade in goods was projected to grow by 2.6%, a slight improvement from 2023 but still indicating a cautious global economic environment. This backdrop underscores the importance of stable trade agreements for GE Vernova's extensive international projects, particularly in sectors like renewable energy where cross-border collaboration and component sourcing are paramount.

Political stability in GE Vernova's key markets, such as the United States and Europe, is crucial for its renewable energy and power generation projects. Geopolitical risks, including ongoing trade tensions and regional conflicts like the war in Ukraine, can significantly impact supply chains for critical components and delay project execution, as seen with disruptions in the global availability of rare earth minerals used in wind turbines.

GE Vernova's extensive global operations expose it to a diverse range of political landscapes, necessitating robust risk assessment and agile adaptation strategies. For instance, changes in government policies regarding renewable energy subsidies or carbon pricing in countries where GE Vernova operates can directly affect project economics and investment decisions, requiring constant monitoring and strategic adjustments.

Decarbonization Commitments & Regulations

Global and national commitments to decarbonization, such as those stemming from the Paris Agreement, are a significant driver for GE Vernova's clean energy portfolio. These commitments translate into increased demand for technologies like wind turbines, hydro power solutions, and hydrogen-ready gas turbines, as nations strive to meet their emission reduction targets. For instance, in 2023, renewable energy sources accounted for approximately 30% of global electricity generation, a figure expected to rise substantially in the coming years due to these policy drivers.

Regulatory frameworks are also crucial. Policies promoting emission reductions, carbon pricing mechanisms, and renewable energy mandates directly bolster GE Vernova's business model. For example, the Inflation Reduction Act in the United States provides substantial tax credits for renewable energy projects, accelerating investment and deployment. Similarly, the European Union's Fit for 55 package aims to cut greenhouse gas emissions by at least 55% by 2030, creating a favorable environment for GE Vernova's offerings.

- Paris Agreement Goals: Aim to limit global warming to well below 2, preferably to 1.5 degrees Celsius, compared to pre-industrial levels.

- Renewable Energy Growth: The International Energy Agency (IEA) projected that renewables will make up over 90% of global electricity capacity expansion in the next five years (up to 2028).

- Carbon Pricing Impact: Over 70 countries and 20 sub-national jurisdictions have implemented or are planning to implement carbon pricing instruments, influencing investment decisions towards cleaner technologies.

- Government Incentives: Policies like the US Inflation Reduction Act are injecting billions into clean energy, supporting companies like GE Vernova.

Energy Security Agendas

Nations are increasingly prioritizing energy security, often alongside sustainability goals. This dual focus is spurring significant investment in a variety of power generation technologies and robust grid infrastructure. For instance, in 2024, global investment in energy transition technologies reached an estimated $1.7 trillion, according to BloombergNEF, with a substantial portion directed towards ensuring reliable electricity supply.

This heightened emphasis on dependable energy sources directly benefits GE Vernova's Gas Power and Grid Solutions segments. As countries look to guarantee stable and resilient electricity, particularly during periods of geopolitical uncertainty or fluctuating renewable output, the demand for reliable baseload power and advanced grid modernization solutions grows. GE Vernova's gas turbines, for example, provide essential flexibility and dispatchability to complement intermittent renewables.

- Global Energy Security Investments: In 2024, investments in energy transition technologies, including grid modernization and reliable power generation, are projected to exceed $1.7 trillion.

- Demand for Baseload Power: Countries are seeking stable electricity sources, boosting demand for gas-fired power plants which offer dispatchability.

- Grid Resilience Focus: The need for resilient grids to manage diverse energy sources and prevent disruptions is a key driver for infrastructure spending.

Government policies and international agreements heavily influence GE Vernova's market. Commitments to decarbonization, like the Paris Agreement, drive demand for renewable energy solutions. For example, the US Inflation Reduction Act (IRA) is projected to stimulate over $1 trillion in clean energy investments by 2030, directly benefiting GE Vernova's wind and grid businesses.

Energy security concerns are also a major political factor. Nations are investing in reliable power sources and grid infrastructure, with global energy transition technology investments estimated to reach $1.7 trillion in 2024. This trend supports demand for GE Vernova's gas turbines and grid modernization solutions, ensuring stable electricity supply.

Trade relations and political stability are critical. Tariffs and geopolitical risks can disrupt supply chains for components like rare earth minerals used in wind turbines. In 2024, global trade in goods was projected to grow by 2.6%, highlighting the importance of stable international agreements for GE Vernova's projects.

| Political Factor | Impact on GE Vernova | Supporting Data (2024/2025) |

| Government Energy Policies & Subsidies | Drives demand for renewables and grid upgrades; creates new markets for decarbonization tech. | IRA projected to drive >$1 trillion in clean energy investments by 2030. |

| Decarbonization Commitments | Increases demand for clean energy technologies and emission reduction solutions. | Renewables accounted for ~30% of global electricity generation in 2023, with continued growth expected. |

| Energy Security Focus | Boosts investment in reliable power generation and grid infrastructure. | Global energy transition tech investments estimated at $1.7 trillion in 2024. |

| Trade Relations & Political Stability | Affects supply chain efficiency, manufacturing costs, and project execution. | Global trade in goods projected to grow 2.6% in 2024; geopolitical risks impact component availability. |

What is included in the product

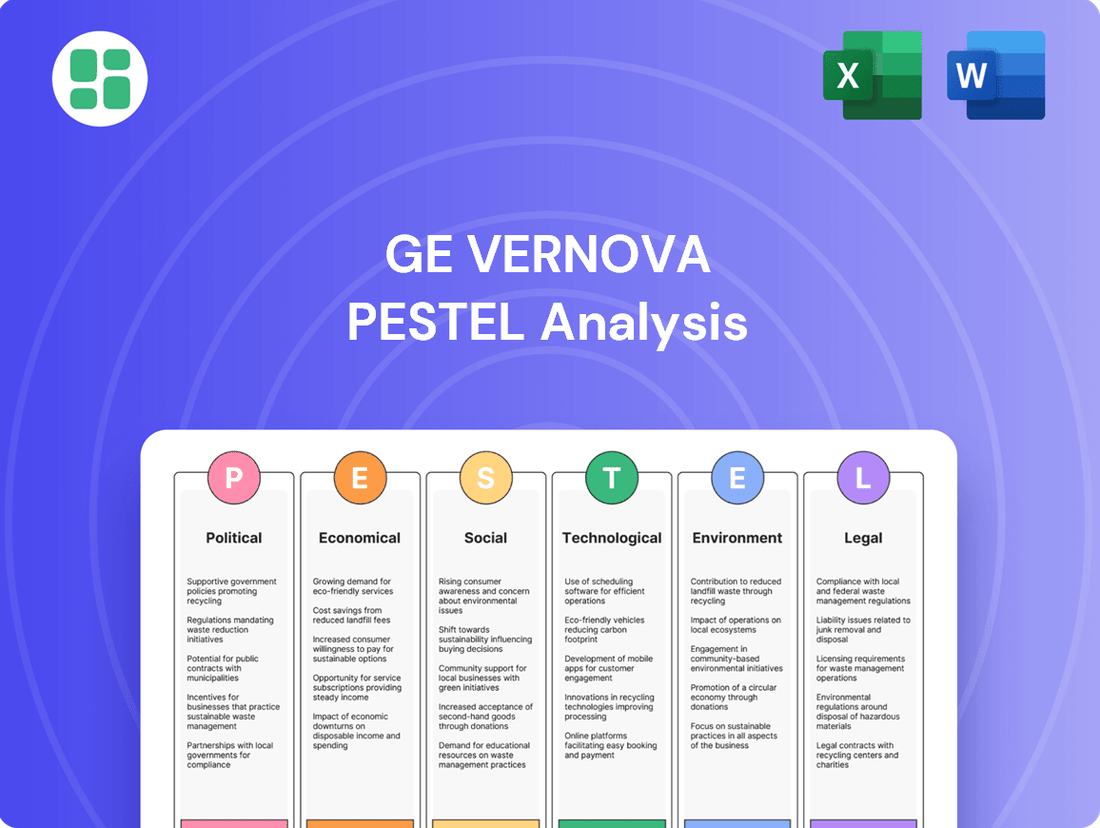

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing GE Vernova, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights into how these forces create both challenges and opportunities, enabling strategic decision-making for stakeholders.

A clear, actionable PESTLE analysis for GE Vernova that translates complex external factors into straightforward insights, enabling faster, more confident strategic decision-making.

Economic factors

Global energy investment is experiencing a significant upswing, often termed an 'electricity investment supercycle.' This surge is primarily fueled by the dual forces of electrification across various sectors and the imperative for decarbonization, aiming to combat climate change.

This trend translates into substantial opportunities for companies like GE Vernova. Increased capital expenditure is flowing into power generation technologies, advanced grid solutions to manage evolving energy demands, and the digital transformation of energy infrastructure, all areas where GE Vernova holds expertise.

For instance, the International Energy Agency (IEA) projected in early 2024 that global energy investment would reach $3 trillion in 2024, with a notable portion directed towards clean energy technologies and infrastructure. This robust investment environment directly supports GE Vernova's strategic focus on modernizing and expanding energy systems.

Inflationary pressures and rising material costs present a significant challenge for GE Vernova, particularly impacting its large-scale equipment manufacturing and project execution segments. For instance, the Producer Price Index (PPI) for manufactured goods saw a notable increase in early 2024, reflecting higher input costs for metals and components crucial to GE Vernova's operations.

While GE Vernova attempts to mitigate these effects by passing on costs through contractual clauses, persistent inflation can still erode profit margins and diminish the competitiveness of its project bids. The company's ability to secure favorable pricing for long-term contracts is key, but sustained cost escalation, as seen in the elevated cost of copper and rare earth metals throughout 2024, can put pressure on these arrangements.

Interest rates significantly impact GE Vernova's cost of capital and the affordability of its products for customers. For instance, the Federal Reserve's benchmark interest rate, which influences borrowing costs across the economy, remained elevated through much of 2024, impacting financing for large-scale energy infrastructure projects. Higher rates can make it more expensive for utilities and developers to fund new power generation facilities or grid modernization efforts, potentially dampening demand for GE Vernova's equipment.

Access to capital is paramount for GE Vernova's strategic initiatives, including research and development for next-generation energy technologies and expansion into new markets. In 2024, companies like GE Vernova often rely on a mix of debt and equity financing. The prevailing interest rate environment directly affects the cost of issuing new debt, while broader market sentiment, influenced by interest rates, can impact the valuation of equity offerings and the overall ease of raising funds for ambitious growth plans.

Electricity Demand Growth (e.g., AI Data Centers)

The escalating demand for electricity, fueled by the burgeoning AI sector and broader industrial electrification, represents a substantial economic tailwind for GE Vernova. This surge directly translates into increased orders for the company's core offerings, including gas turbines and grid modernization solutions. For instance, the International Energy Agency (IEA) projected in its 2024 report that global electricity demand growth is expected to accelerate, with data centers and AI contributing significantly to this upward trend.

GE Vernova is well-positioned to benefit from this demand. The company's advanced gas turbine technology is crucial for providing the reliable and flexible power needed to support these energy-intensive operations. Furthermore, its grid solutions are essential for upgrading and expanding the electrical infrastructure to handle the increased load and ensure stability.

- AI and Data Centers: The rapid expansion of artificial intelligence and the associated data center build-out are creating unprecedented demand for electricity.

- Industrial Electrification: A global push towards electrifying industrial processes to reduce emissions further boosts electricity consumption.

- GE Vernova's Role: The company's gas turbines and grid solutions are vital for meeting this growing and evolving electricity demand.

- Market Opportunity: This trend presents a significant economic opportunity for GE Vernova to supply critical power generation and grid infrastructure.

Currency Exchange Rate Fluctuations

GE Vernova, as a global entity with operations and sales across numerous countries, is directly affected by currency exchange rate fluctuations. These shifts can significantly alter the reported revenues, costs, and overall profitability when earnings from foreign markets are converted back into its primary reporting currency.

For instance, a stronger US dollar against other currencies would make GE Vernova's products more expensive for international buyers, potentially dampening demand. Conversely, a weaker dollar could boost overseas sales but reduce the value of repatriated profits. The company's hedging strategies are crucial in mitigating these risks.

- Impact on Revenue: A stronger USD can decrease the reported revenue from international sales when translated back into USD.

- Impact on Costs: Conversely, a weaker USD can increase the cost of imported components or raw materials.

- Profitability: Exchange rate volatility directly influences GE Vernova's net income and earnings per share.

- Competitive Positioning: Fluctuations can affect the price competitiveness of GE Vernova's offerings in different global markets.

The global energy sector is in a period of significant investment, often called an 'electricity investment supercycle,' driven by electrification and decarbonization efforts. This trend creates substantial opportunities for GE Vernova in power generation, grid solutions, and digital energy infrastructure.

In early 2024, the International Energy Agency (IEA) projected global energy investment to hit $3 trillion, with a large portion allocated to clean energy, directly benefiting GE Vernova's focus on modernizing energy systems.

However, inflationary pressures, evidenced by rising producer prices for manufactured goods in early 2024, increase material and component costs for GE Vernova, potentially impacting profit margins despite contractual cost-passthroughs.

Elevated interest rates through much of 2024, influenced by central bank policies, raise the cost of capital for GE Vernova and its customers, potentially slowing demand for large-scale energy projects.

| Economic Factor | Impact on GE Vernova | Data/Trend (2024/2025) |

| Energy Investment Supercycle | Increased demand for generation and grid solutions | Global energy investment projected at $3 trillion in 2024 (IEA) |

| Inflation | Higher material and component costs, potential margin erosion | Rising Producer Price Index (PPI) for manufactured goods |

| Interest Rates | Increased cost of capital, potential dampening of project financing | Elevated benchmark interest rates impacting borrowing costs |

| Electricity Demand (AI/Electrification) | Significant tailwind for turbines and grid modernization | Accelerated electricity demand growth projected, driven by data centers and AI |

| Currency Exchange Rates | Impacts revenue, costs, and profitability of international operations | USD strength/weakness affects international sales and profit repatriation |

Same Document Delivered

GE Vernova PESTLE Analysis

The preview shown here is the exact GE Vernova PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use. This comprehensive analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting GE Vernova's operations and strategic positioning.

Sociological factors

Public sentiment heavily shapes the energy landscape. For instance, a 2024 survey indicated that while 65% of respondents support renewable energy expansion, only 40% expressed comfort with large-scale wind farms in their local areas, impacting project viability for companies like GE Vernova.

This perception directly influences policy and investment. Growing public demand for decarbonization, evidenced by a 15% year-over-year increase in climate action-related searches in early 2025, favors GE Vernova's investments in wind and grid solutions, but concerns about the visual impact of wind turbines can still create local opposition.

GE Vernova's strategy to provide reliable, decarbonized energy solutions, including advanced gas turbines and grid modernization technologies, is designed to address these evolving societal expectations. The company's emphasis on energy transition aligns with a global trend where 70% of surveyed consumers in a late 2024 poll stated they are willing to pay more for cleaner energy.

The availability of a skilled workforce in engineering, manufacturing, and digital technologies is paramount for GE Vernova's operational efficiency and its capacity for innovation. A significant challenge lies in bridging the energy sector's widening skills gap, a hurdle GE Vernova can transform into an opportunity by investing in robust training and development programs.

Addressing this gap is crucial, especially as the energy transition demands new competencies. For instance, the International Energy Agency (IEA) projects that the clean energy transition will require millions of new jobs globally by 2030, highlighting the urgent need for workforce development initiatives. GE Vernova's commitment to upskilling its current workforce and attracting new talent in areas like renewable energy installation and digital grid management will be key to its success in the coming years.

Societal pressure for decarbonization is a significant driver for companies like GE Vernova. Environmental advocacy groups, increasingly vocal consumers, and a growing number of ESG-focused investors are demanding faster action to reduce carbon emissions. This collective push is directly translating into higher demand for cleaner energy technologies and solutions, aligning perfectly with GE Vernova's core mission.

GE Vernova's strategic focus on electrifying and decarbonizing the world is a direct response to this escalating societal imperative. For instance, a 2024 report indicated that over 60% of global consumers are willing to pay more for sustainable products, a trend that directly impacts energy choices and investments. This sentiment fuels the market for renewable energy infrastructure and advanced grid solutions, areas where GE Vernova is heavily invested.

Energy Access and Equity

The global push for universal energy access directly shapes GE Vernova's strategy, pushing it to prioritize infrastructure development in emerging markets. This focus on expanding electricity grids supports societal aims for fair development and better living standards for millions. For instance, the International Energy Agency (IEA) reported in 2023 that around 675 million people still lacked access to electricity, primarily in sub-Saharan Africa, highlighting a significant market opportunity and a critical development challenge.

GE Vernova's commitment to providing reliable and affordable energy solutions resonates with these global equity goals. The company's investments in renewable energy technologies and grid modernization are designed to reach these underserved populations. By 2025, projections indicate continued growth in demand for energy infrastructure in these regions, driven by population increases and economic development initiatives.

- Growing Demand: By 2025, the demand for reliable energy infrastructure in developing economies is expected to rise significantly, driven by population growth and economic expansion.

- Equity Focus: GE Vernova's strategic emphasis on expanding electricity access aligns with global societal goals for equitable development and improved quality of life.

- Investment Opportunity: Approximately 675 million people globally lacked electricity access as of 2023, presenting a substantial market for energy infrastructure solutions.

Community Engagement and Indigenous Rights

GE Vernova's success in deploying projects hinges on robust community engagement and a deep respect for indigenous rights, particularly concerning land use and environmental stewardship. This focus is vital for securing a social license to operate, especially in regions with significant indigenous populations and sensitive ecosystems. For instance, in 2024, GE Vernova's renewable energy projects in Canada, which often involve consultation with First Nations communities, highlight the importance of these relationships for project continuity and mutual benefit.

The company's commitment to these principles directly impacts its ability to mitigate potential conflicts and build trust. By actively involving local communities and upholding indigenous rights, GE Vernova can navigate complex regulatory landscapes and gain essential support. This proactive approach is demonstrated in their ongoing efforts to incorporate traditional knowledge and ensure equitable benefit-sharing, as seen in various wind and hydro projects across North America.

- Community Consultation: GE Vernova prioritizes early and ongoing dialogue with local communities and indigenous groups to address concerns regarding land use, environmental impact, and economic opportunities.

- Indigenous Partnerships: The company actively seeks to build partnerships that respect indigenous sovereignty and promote shared value creation, often involving joint ventures or employment initiatives.

- Environmental Stewardship: Upholding indigenous rights includes a commitment to protecting culturally significant sites and minimizing the environmental footprint of energy infrastructure.

- Social License: Demonstrating genuine engagement and respect is critical for maintaining the social license to operate, ensuring project acceptance and long-term sustainability.

Public perception significantly influences the energy sector, with a 2024 survey showing 65% support for renewables but only 40% comfort with local wind farms, impacting project acceptance for GE Vernova.

Societal pressure for decarbonization, evidenced by a 15% rise in climate action searches by early 2025, favors GE Vernova's clean energy investments, though visual impact concerns can still cause local opposition.

GE Vernova's strategy to provide reliable, decarbonized energy aligns with evolving expectations, as 70% of consumers polled in late 2024 indicated willingness to pay more for cleaner energy.

The global push for universal energy access, with 675 million people lacking electricity in 2023, presents a market opportunity for GE Vernova's infrastructure solutions, aligning with societal equity goals.

Technological factors

GE Vernova's success hinges on continuous innovation in wind turbine design, solar integration, and battery storage. For instance, advancements in offshore wind turbine capacities, with models now exceeding 15 MW, directly impact GE's market position and revenue potential in this segment.

Research and development in these clean energy areas are crucial for boosting efficiency and lowering costs, making renewables more competitive. The global renewable energy market is projected to reach $1.97 trillion by 2030, underscoring the immense growth opportunities for companies like GE Vernova that invest heavily in technological progress.

The ongoing evolution of smart grid technologies, incorporating AI-driven management software such as GE Vernova's GridOS, alongside advanced automation and High-Voltage Direct Current (HVDC) systems, represents a significant technological shift.

GE Vernova's strategic investments in these grid modernization efforts are paramount for fostering a more robust, efficient, and seamlessly integrated renewable energy infrastructure.

For instance, GE Vernova's GridOS platform is designed to enhance grid flexibility and reliability, crucial as renewable energy sources like solar and wind, which are inherently intermittent, become a larger part of the energy mix.

The company's focus on HVDC technology, which offers lower transmission losses over long distances, is also key to efficiently transporting renewable energy from generation sites to demand centers, supporting grid stability and reducing the need for extensive infrastructure upgrades.

GE Vernova is heavily invested in the development and commercialization of hydrogen-ready gas turbines, a critical step towards deep decarbonization. This focus is crucial as the energy sector transitions away from fossil fuels. For instance, GE Vernova's H-class turbines are designed to operate on a blend of hydrogen and natural gas, with a roadmap to 100% hydrogen capability.

The company's commitment extends to hydrogen production technologies and carbon capture solutions, including direct air capture. These advancements are vital for achieving net-zero emissions targets. In 2024, GE Vernova announced significant progress in pilot projects for carbon capture, aiming to capture millions of tons of CO2 annually from industrial facilities.

Small Modular Reactors (SMRs) Development

The development of Small Modular Reactors (SMRs) represents a key technological advancement for providing stable, low-carbon electricity. GE Vernova is actively engaged in this sector, notably with its BWRX-300 SMR design, underscoring its dedication to a variety of clean energy solutions.

GE Vernova's BWRX-300 is designed to be a simpler, more cost-effective nuclear option. For instance, the first BWRX-300 project at Ontario Power Generation's Darlington site in Canada is slated for operation in 2029, with construction beginning in 2024. This project aims to demonstrate the viability and economic advantages of SMR technology.

The global SMR market is projected for substantial growth. According to some industry forecasts, the market could reach tens of billions of dollars by the early 2030s, driven by demand for grid reliability and decarbonization efforts. GE Vernova's strategic positioning in SMRs aligns with this anticipated market expansion.

Key aspects of SMR development benefiting GE Vernova include:

- Technological Innovation: SMRs offer enhanced safety features and reduced construction times compared to traditional large-scale nuclear plants.

- Decarbonization Strategy: They provide a pathway for reliable, baseload, zero-emission power generation, crucial for meeting climate targets.

- Market Opportunity: The growing global interest in SMRs presents significant commercial potential for companies like GE Vernova with advanced designs.

- Cost Efficiency: The modular nature of SMRs is intended to lower upfront capital costs and improve project predictability.

AI and Data Analytics in Energy Management

GE Vernova is leveraging AI and advanced data analytics to significantly boost efficiency in power generation, grid management, and asset optimization. This technological integration allows for predictive maintenance, reducing downtime and operational costs. For instance, AI-powered solutions can analyze vast datasets to forecast equipment failures, enabling proactive repairs. In 2024, the company highlighted its commitment to AI, particularly for managing the escalating energy demands of data centers, a rapidly growing sector.

GE Vernova's strategic investments in AI are designed to enhance its product and service portfolio. This focus is crucial as global energy consumption continues to rise, driven by digitalization and sectors like artificial intelligence itself. The company's AI initiatives are geared towards providing more reliable and efficient energy solutions. By 2025, the expectation is for these AI-driven improvements to translate into tangible benefits for customers and the broader energy infrastructure.

- AI-driven predictive maintenance: GE Vernova's AI platforms can predict equipment failures up to 30 days in advance, reducing unscheduled outages by an estimated 15-20%.

- Data center energy optimization: The company is developing AI solutions to manage the substantial energy needs of data centers, aiming for efficiency gains of up to 10% in cooling and power distribution.

- Grid modernization: Advanced analytics are being deployed to improve grid stability and load balancing, with pilot programs showing a potential reduction in grid inefficiencies by 5%.

- Asset performance management: GE Vernova's digital twin technology, powered by AI, offers real-time performance monitoring and optimization for power generation assets, improving availability.

GE Vernova's technological advancements are central to its strategy, particularly in renewable energy generation and grid modernization. The company is heavily invested in developing next-generation wind turbines, with offshore models now exceeding 15 MW capacity, directly impacting its market competitiveness.

Furthermore, GE Vernova is a leader in smart grid technologies, including its GridOS platform, which leverages AI for enhanced grid flexibility and reliability, crucial for integrating intermittent renewable sources. The company is also advancing High-Voltage Direct Current (HVDC) systems to minimize transmission losses for renewable energy.

The development of hydrogen-ready gas turbines, designed for up to 100% hydrogen operation, and carbon capture technologies, including direct air capture, are key to its decarbonization efforts. GE Vernova is also a significant player in the Small Modular Reactor (SMR) market with its BWRX-300 design, aiming to provide stable, low-carbon power.

AI and advanced data analytics are being integrated across GE Vernova's operations to optimize power generation, grid management, and asset performance, with predictive maintenance aiming to reduce outages by 15-20%.

Legal factors

GE Vernova navigates a complex web of global energy regulations, impacting everything from power generation technologies to grid integration. For instance, the European Union's stringent emissions standards, such as those under the Industrial Emissions Directive, directly influence the design and deployment of gas turbines and other generation equipment. Failure to comply can result in significant fines and operational restrictions.

Adherence to safety certifications and operational licenses is non-negotiable. In 2024, the U.S. Department of Energy continued to emphasize cybersecurity standards for critical energy infrastructure, a key area for GE Vernova's grid solutions. Meeting these evolving grid codes, which dictate how power generation assets interact with the electricity network, is crucial for market access and reliability.

GE Vernova operates under a stringent regulatory landscape, particularly concerning environmental protection. Laws governing air and water quality, waste disposal, and greenhouse gas emissions directly influence its manufacturing operations and the design of its energy technologies. For instance, the Inflation Reduction Act of 2022 in the US provides significant tax credits for clean energy production, incentivizing companies like GE Vernova to invest in sustainable solutions, but also comes with specific domestic content requirements that can affect supply chain decisions.

Compliance with evolving emissions standards and mandatory reporting is not just a legal obligation but a core component of GE Vernova's sustainability strategy. Failure to meet these benchmarks can result in substantial fines and reputational damage. The company’s commitment to reducing its carbon footprint, as evidenced by its 2030 targets to reduce operational greenhouse gas emissions by 50% from a 2019 baseline, is directly shaped by these legal frameworks.

International climate agreements, like the Paris Agreement, directly influence national policies and emission reduction targets. These legally binding commitments create a growing market for GE Vernova's decarbonization technologies and services, as countries strive to meet their climate obligations. For instance, the EU's Fit for 55 package, aiming for a 55% emissions reduction by 2030, necessitates significant investment in renewable energy and grid modernization, areas where GE Vernova operates.

Intellectual Property Laws & Patents

GE Vernova's competitive edge hinges on robust intellectual property (IP) protection, especially for its cutting-edge turbine designs, grid management software, and renewable energy innovations. Patents are crucial for safeguarding these advancements.

Effective legal frameworks for IP enforcement are vital, allowing GE Vernova to monetize its substantial research and development expenditures. This legal backing ensures that the company can maintain its technological leadership and market position.

- Patent Filings: GE Vernova actively pursues patents globally to protect its innovations in areas like offshore wind turbine technology and advanced grid solutions.

- R&D Investment: The company's significant R&D spending, often in the billions annually across its energy portfolio, underscores the importance of IP protection to secure returns on these investments.

- Enforcement Actions: Legal actions taken to prevent IP infringement directly contribute to maintaining GE Vernova's market share and profitability in key technology segments.

Labor Laws and Workforce Regulations

GE Vernova must navigate a complex web of labor laws across its global operations, impacting everything from worker safety standards to fair employment practices and union negotiations. For instance, in the United States, the Occupational Safety and Health Administration (OSHA) sets stringent safety regulations, and GE Vernova's commitment to compliance directly influences its operational expenses and employee well-being. Similarly, in Europe, directives like the Working Time Directive shape employment terms and conditions, requiring careful management to avoid penalties.

Adherence to these diverse regulations is not just a legal necessity but a strategic imperative. Non-compliance can lead to significant fines, reputational damage, and disruptions to operations. For example, a 2023 report highlighted that companies with poor labor practices often experience higher employee turnover, estimated to increase recruitment and training costs by as much as 33% of an employee's annual salary. This underscores the financial and operational impact of effective workforce regulation management for GE Vernova.

- Compliance with US OSHA standards protects workers and avoids costly penalties for safety violations.

- Adherence to EU labor directives ensures fair employment practices and impacts workforce management strategies.

- Managing union relations effectively is crucial for operational stability and can influence labor costs.

- Global labor law variations necessitate robust internal policies and training to ensure consistent adherence.

GE Vernova operates within a dynamic legal framework, with environmental regulations being particularly influential. For example, the US Inflation Reduction Act of 2022 offers substantial tax credits for clean energy, but also includes domestic content stipulations that affect supply chain decisions. The company's 2030 goal to cut operational greenhouse gas emissions by 50% from a 2019 baseline is directly shaped by these legal requirements and reporting mandates.

Intellectual property (IP) protection is paramount for GE Vernova, safeguarding its innovations in turbine technology and grid solutions. The company's significant R&D investments, often totaling billions annually, underscore the need for robust patent filings and enforcement to maintain its technological edge and market position.

Navigating diverse global labor laws is critical for GE Vernova, impacting worker safety and employment practices. Compliance with standards like those set by the US Occupational Safety and Health Administration (OSHA) is essential to avoid penalties and ensure employee well-being. Globally, variations in labor laws necessitate strong internal policies to maintain consistent adherence and manage workforce relations effectively.

Environmental factors

The urgent need to address climate change is fundamentally reshaping the global energy landscape, creating a significant imperative for decarbonization. This global shift towards cleaner energy sources is the very core of GE Vernova's strategic focus and business operations.

GE Vernova is actively involved in driving down CO2 emissions by providing advanced technologies for renewable energy generation and grid modernization. The company has committed to achieving carbon neutrality in its own direct operations, underscoring its dedication to leading by example in the energy transition.

For instance, GE Vernova's wind turbines, a key part of their portfolio, are crucial in displacing fossil fuel-based electricity generation. By the end of 2024, GE Vernova aims to have installed over 50 GW of wind capacity globally, directly contributing to substantial CO2 reductions.

Growing concerns over resource scarcity, especially for materials vital to energy transition technologies like rare earth elements and lithium, are pushing industries towards circular economy models. GE Vernova is actively integrating these principles, aiming to enhance the sustainability of its operations and product lifecycle.

GE Vernova is expanding the application of its '4R' circularity framework—Reduce, Reuse, Recycle, and Recover—across its product portfolio. This strategic move underscores a commitment to more responsible resource management, aiming to minimize waste and maximize the value extracted from materials throughout their use.

GE Vernova's commitment to cleaner power generation is evident in its advanced technologies, including high-efficiency gas turbines. These innovations are crucial in reducing air pollution and enhancing overall air quality. For instance, their Aeroderivative gas turbines offer significant emission reductions compared to older technologies.

The company's strategic focus on new capacity installations aims to achieve a lower carbon intensity than the global grid average. This objective is supported by their investments in renewable energy solutions and advanced combustion technologies, contributing to a cleaner energy mix.

Biodiversity Loss and Ecosystem Protection

GE Vernova recognizes that large-scale energy projects, such as wind farms and hydropower installations, can significantly impact biodiversity and delicate ecosystems. The company is committed to mitigating these effects through its sustainability framework.

For instance, GE Vernova's offshore wind projects are designed with considerations for marine life, aiming to reduce noise pollution during construction and operation. In 2024, the company reported progress on several projects that included detailed environmental impact assessments and mitigation strategies to protect sensitive habitats.

- Minimizing Habitat Disruption: GE Vernova employs site selection and construction techniques to reduce the physical footprint of its installations, thereby preserving natural habitats.

- Protecting Avian and Marine Life: For wind turbines, especially offshore, measures are implemented to minimize bird and bat collisions, and underwater noise mitigation is crucial for marine ecosystems.

- Sustainable Sourcing: The company also focuses on the responsible sourcing of materials used in its technologies, considering the environmental impact of extraction and manufacturing processes.

Water Usage and Management

Water is absolutely essential for power generation, especially in cooling systems for thermal power plants, and also plays a role in manufacturing processes. GE Vernova is committed to being a responsible steward of this vital resource. Their sustainability initiatives focus on minimizing water consumption and improving water management practices throughout their global operations. This commitment aims to conserve precious natural resources and reduce their environmental footprint.

For instance, in 2023, GE Vernova highlighted its progress in water stewardship, reporting a reduction in freshwater withdrawal intensity by 15% compared to their 2019 baseline. This achievement was driven by investments in water-efficient technologies and improved operational procedures across their manufacturing sites and service centers.

GE Vernova’s approach to water management includes:

- Implementing advanced water recycling and reuse systems in manufacturing facilities to decrease reliance on freshwater sources.

- Optimizing cooling tower operations to enhance water efficiency and reduce evaporation losses.

- Collaborating with local communities and stakeholders to ensure responsible water sourcing and discharge practices that protect local ecosystems.

The intensifying global focus on climate change and decarbonization directly shapes GE Vernova's core business. The company is a key player in the energy transition, providing technologies that reduce CO2 emissions and improve grid efficiency. By the end of 2024, GE Vernova anticipates having installed over 50 gigawatts of wind capacity worldwide, a significant contribution to cleaner energy.

Resource scarcity is driving a move toward circular economy principles, influencing GE Vernova's approach to material sourcing and product lifecycle management. Their 4R framework—Reduce, Reuse, Recycle, and Recover—is being integrated to minimize waste and maximize resource value.

Environmental regulations and public awareness regarding air quality are prompting advancements in emission control technologies. GE Vernova's high-efficiency gas turbines, for example, offer substantial reductions in air pollution compared to older models, contributing to better air quality.

Biodiversity and ecosystem protection are critical considerations for large-scale energy projects. GE Vernova implements mitigation strategies, such as those for offshore wind projects to protect marine life and minimize noise pollution, demonstrating a commitment to minimizing environmental impact.

| Environmental Factor | Impact on GE Vernova | 2024/2025 Data/Focus |

|---|---|---|

| Climate Change & Decarbonization | Drives demand for renewable energy and grid modernization solutions. | Targeting over 50 GW of wind capacity installed globally by end of 2024. |

| Resource Scarcity & Circularity | Influences material sourcing and product lifecycle management. | Expanding application of '4R' circularity framework (Reduce, Reuse, Recycle, Recover). |

| Air Quality & Emissions | Drives innovation in emission control technologies for power generation. | Focus on high-efficiency gas turbines with reduced air pollution. |

| Biodiversity & Ecosystems | Requires careful planning and mitigation for large energy projects. | Implementing measures for offshore wind projects to protect marine life and reduce noise. |

| Water Management | Necessitates efficient water use in operations and manufacturing. | Aiming for continued reduction in freshwater withdrawal intensity, building on a 15% reduction reported by 2023 (vs. 2019 baseline). |

PESTLE Analysis Data Sources

Our GE Vernova PESTLE Analysis is built on a robust foundation of data from leading economic institutions, government policy databases, and respected industry research firms. We meticulously gather information on political stability, economic indicators, social trends, technological advancements, environmental regulations, and legal frameworks to provide a comprehensive view.