GE Vernova Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GE Vernova Bundle

GE Vernova operates in a dynamic energy sector, facing significant pressures from powerful suppliers and intense rivalry. Understanding the threat of substitutes and the bargaining power of buyers is crucial for navigating this complex landscape.

The complete report reveals the real forces shaping GE Vernova’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The energy sector, particularly for critical components like advanced gas turbine parts and rare earth magnets for wind turbines, often sees a limited number of highly qualified suppliers. This concentration means these specialized suppliers hold considerable bargaining power over companies like GE Vernova. For instance, in 2024, the global market for wind turbine components, especially those requiring advanced materials and manufacturing processes, is dominated by a handful of key players, making it difficult and costly for GE Vernova to find alternative sources or switch suppliers without significant disruption.

GE Vernova's reliance on suppliers for highly specialized components, like the advanced materials for its H-class gas turbines or unique composite structures for offshore wind blades, significantly influences supplier bargaining power. For instance, a single supplier mastering a critical, proprietary manufacturing technique for a turbine component can command higher prices if GE Vernova has limited alternatives. This uniqueness is a key driver of supplier leverage.

The bargaining power of suppliers for GE Vernova is significantly influenced by switching costs. For instance, if GE Vernova needs to change a supplier for a critical component in its wind turbines or power generation equipment, the process can be extremely costly and time-consuming. This involves rigorous testing and certification of new suppliers, potential modifications to manufacturing processes, and retraining of its workforce to handle new parts or systems.

These substantial switching costs effectively lock in GE Vernova with its current suppliers, limiting its ability to negotiate more favorable pricing or terms. For example, a supplier providing specialized control systems for gas turbines might command higher prices because replacing such a complex, integrated system would require extensive engineering work, validation, and potentially impact warranty agreements for GE Vernova's own products.

In 2024, the energy infrastructure sector, where GE Vernova operates, continued to see supply chain disruptions and increased raw material costs. This environment further amplifies the bargaining power of suppliers who can demonstrate reliability and consistent quality. For GE Vernova, the inability to easily switch suppliers for key technologies means they are more susceptible to price increases dictated by these suppliers, directly impacting their cost of goods sold and profit margins.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers is a nuanced factor for GE Vernova. While some suppliers of highly specialized or patented technologies could theoretically enter GE Vernova's power generation or grid solutions markets, this risk is generally considered low. The substantial capital investment and deep technical expertise required to compete in these complex industries act as significant barriers to entry for most suppliers.

However, this potential, however small, can still influence supplier negotiations. For instance, if a supplier possesses a critical, proprietary component essential for a GE Vernova product, they might leverage this position. The bargaining power of such a supplier is amplified by the difficulty GE Vernova would face in finding or developing an alternative.

- Supplier Specialization: Suppliers with unique, patented technologies essential for GE Vernova's offerings hold more leverage.

- Market Entry Barriers: The high capital and expertise needed to enter GE Vernova's core markets limit the practical threat of supplier forward integration.

- Negotiation Influence: Even a low probability of forward integration can empower suppliers in price and contract discussions.

Importance of GE Vernova to Supplier's Business

The significance of GE Vernova as a customer can heavily influence a supplier's leverage. If GE Vernova constitutes a substantial portion of a supplier's total sales, the supplier is likely more motivated to preserve this relationship, thereby reducing their bargaining power. This is because a disruption in business with GE Vernova could have a considerable impact on the supplier's financial health.

Conversely, if GE Vernova is a relatively minor client for a large, diversified supplier, that supplier may possess greater bargaining power. In such scenarios, the supplier has less dependence on GE Vernova's business and can afford to be more assertive in negotiations regarding pricing, terms, or other contractual elements.

For instance, consider a specialized component manufacturer that derives 30% of its annual revenue from GE Vernova. This supplier would likely prioritize maintaining favorable terms with GE Vernova to secure that significant revenue stream. In contrast, a broad-based industrial materials supplier that only sees 1% of its revenue from GE Vernova would have less incentive to concede on price or terms, as the loss of GE Vernova's business would be less impactful.

- Customer Concentration: Suppliers heavily reliant on GE Vernova may have reduced bargaining power due to the incentive to maintain the relationship.

- Supplier Diversification: Suppliers with a broad customer base and minimal reliance on GE Vernova are likely to wield more influence in negotiations.

- Revenue Impact: The percentage of a supplier's revenue generated by GE Vernova directly correlates with the supplier's dependence and, consequently, their bargaining leverage.

The bargaining power of suppliers is a critical factor for GE Vernova, especially given the specialized nature of components in the energy sector. In 2024, the increasing demand for advanced materials in renewable energy, like those for high-performance wind turbine blades, has concentrated supply among a few key manufacturers. This limited supplier base means these entities can exert significant influence over pricing and terms, as finding alternatives is often impractical or prohibitively expensive for GE Vernova.

The cost and complexity associated with switching suppliers for critical technologies, such as specialized turbine components or advanced grid control systems, significantly strengthen supplier leverage. For example, the extensive re-engineering, testing, and certification required to onboard a new supplier for a proprietary gas turbine part can take years and millions of dollars. This inertia effectively locks GE Vernova into existing supplier relationships, reducing its negotiating flexibility.

The financial impact of supplier power is evident in GE Vernova's cost of goods sold. In 2024, supply chain volatility and inflation in raw materials have further empowered suppliers who can guarantee consistent quality and delivery. For GE Vernova, this translates to higher input costs and potentially squeezed profit margins, particularly when sourcing unique or patented components where few alternatives exist.

| Factor | Impact on GE Vernova | 2024 Context |

|---|---|---|

| Supplier Concentration | High leverage for few specialized suppliers | Increased demand for advanced renewables components |

| Switching Costs | High costs limit flexibility, locking in suppliers | Complex integration of new technologies |

| Customer Importance | GE Vernova's size can reduce supplier power if it's a major client | Mixed, depending on the specific component and supplier |

What is included in the product

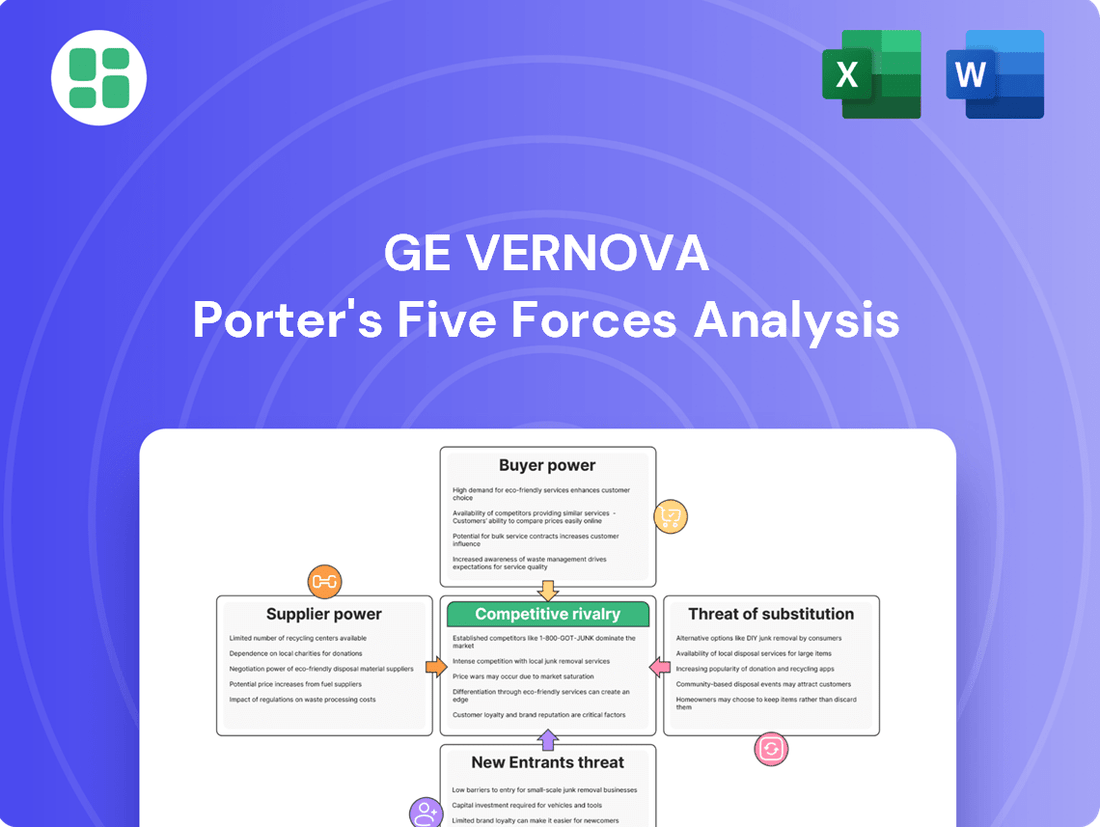

This GE Vernova Porter's Five Forces analysis delves into the competitive intensity within the energy sector, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the rivalry among existing players. It provides a strategic framework for understanding GE Vernova's market position and identifying opportunities for sustained competitive advantage.

Effortlessly identify and address competitive threats by visualizing GE Vernova's Porter's Five Forces with an intuitive, interactive dashboard.

Customers Bargaining Power

GE Vernova's customer base is largely composed of major utility companies and large industrial enterprises. These clients are typically concentrated, meaning a few significant buyers represent a substantial portion of GE Vernova's revenue. This concentration grants these customers considerable bargaining power. For instance, in 2023, GE Vernova's Gas Power segment, which serves many of these large clients, reported revenues of $10.1 billion, highlighting the scale of these relationships.

GE Vernova's customers face significant hurdles when considering a switch from its installed base of energy infrastructure, such as gas turbines or wind turbines. The sheer scale of investment required for these foundational assets means that once a system is in place, the cost and complexity of replacing it are often prohibitive. This inherent stickiness in the customer relationship, particularly for long-term energy projects, can effectively lock in customers, thereby diminishing their bargaining power.

The high switching costs are further amplified by the ongoing service and maintenance agreements that are crucial for the operational efficiency of GE Vernova's equipment. These recurring revenue streams represent a substantial portion of the company's backlog, indicating that customers are reliant on GE Vernova for continued support. In 2023, GE Vernova reported a backlog of $78.6 billion, a significant portion of which is tied to these long-term service contracts, underscoring the customer dependence and reduced ability to switch.

Utilities and industrial clients, the core customer base for GE Vernova, often operate within strict regulatory frameworks and face significant cost pressures. This environment makes them exceptionally sensitive to the pricing of power generation equipment, grid modernization solutions, and ongoing services. For instance, in 2024, many utilities are grappling with rising capital costs for new infrastructure projects, making price a paramount consideration for their procurement decisions.

This heightened price sensitivity directly impacts GE Vernova's profitability. Customers are constantly evaluating bids and seeking the most cost-effective, yet dependable, energy solutions. The need to offer competitive pricing can put downward pressure on GE Vernova's profit margins, especially when dealing with large-scale, long-term contracts where price is a primary deciding factor.

Availability of Alternative Suppliers

The availability of alternative suppliers significantly influences GE Vernova's customer bargaining power. Customers can readily source power generation equipment and grid solutions from global competitors such as Siemens Energy, Mitsubishi Power, and ABB. This competitive landscape provides customers with choices, thereby amplifying their ability to negotiate terms and pricing, compelling GE Vernova to maintain competitive offerings.

This abundance of alternatives means customers aren't locked into a single provider. For instance, in the gas turbine market, Siemens Energy has been actively expanding its portfolio, offering comparable technologies. In 2024, the global power generation equipment market is projected to reach hundreds of billions of dollars, with numerous players vying for market share, underscoring the competitive pressure on incumbents like GE Vernova.

- Customer Choice: GE Vernova's customers have multiple global competitors, including Siemens Energy, Mitsubishi Power, and ABB, offering similar products and services.

- Increased Bargaining Power: The presence of these alternatives empowers customers to negotiate more favorable pricing and contract terms.

- Competitive Pressure: GE Vernova must continuously innovate and offer competitive value propositions to retain its customer base in this environment.

- Market Dynamics: In 2024, the competitive intensity in the power generation and grid solutions sector remains high, with suppliers actively seeking to gain market share through technological advancements and pricing strategies.

Customer's Ability to Backward Integrate

Customer's ability to backward integrate, while generally uncommon for large-scale power generation equipment due to immense capital and technical requirements, can manifest in specific ways. For instance, a very large utility or industrial client might explore developing in-house capabilities for routine maintenance or smaller, localized power solutions. This could potentially reduce their reliance on external service providers for these specific functions.

However, for the core, complex manufacturing of large-scale power generation assets like turbines or grid solutions, backward integration by customers is typically not a significant threat for a company like GE Vernova. The sheer scale, specialized knowledge, and ongoing investment needed to produce such equipment make it prohibitively difficult for most customers to replicate internally. For example, the advanced materials and intricate engineering involved in manufacturing a gas turbine represent a substantial barrier to entry.

- Limited Scope of Backward Integration: Customers are more likely to consider in-house maintenance or smaller-scale solutions rather than full-scale equipment manufacturing.

- High Capital and Technical Barriers: The complexity and cost of producing large power generation equipment make it impractical for most customers to backward integrate.

- Focus on Core Competencies: Customers generally prefer to focus on their core business operations, leaving specialized manufacturing to experts like GE Vernova.

GE Vernova's customers, primarily large utilities and industrial firms, wield significant bargaining power due to their concentrated nature and the substantial revenue they represent. For instance, GE Vernova's Gas Power segment, serving many of these clients, generated $10.1 billion in revenue in 2023, underscoring the importance of these relationships.

Customers often face high switching costs due to the massive investment in GE Vernova's installed base of energy infrastructure, making it difficult and expensive to change providers. This reliance is further solidified by crucial ongoing service and maintenance agreements. In 2023, GE Vernova's backlog stood at $78.6 billion, a significant portion of which is tied to these long-term service contracts, highlighting customer dependence.

The availability of strong global competitors such as Siemens Energy, Mitsubishi Power, and ABB means customers have ample choices, empowering them to negotiate better terms and pricing. The global power generation equipment market, projected to reach hundreds of billions in 2024, is highly competitive, forcing GE Vernova to remain competitive.

| Key Factor | Impact on GE Vernova | Supporting Data (2023/2024) |

| Customer Concentration | High bargaining power for major clients | Gas Power segment revenue: $10.1 billion |

| Switching Costs | Customer stickiness, reduced power | Backlog: $78.6 billion (significant portion from services) |

| Availability of Alternatives | Increased negotiation leverage for customers | Competitive market with Siemens Energy, Mitsubishi Power, ABB |

| Price Sensitivity | Downward pressure on profit margins | Utilities facing rising capital costs in 2024 |

Same Document Delivered

GE Vernova Porter's Five Forces Analysis

This preview showcases the comprehensive GE Vernova Porter's Five Forces Analysis, providing a detailed examination of the competitive landscape within the energy sector. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy, offering actionable insights into industry structure and profitability drivers. You'll gain a thorough understanding of the forces shaping GE Vernova's strategic positioning, including buyer and supplier power, threat of new entrants and substitutes, and the intensity of rivalry. This is the complete, ready-to-use analysis file; what you're previewing is what you get—professionally formatted and ready for your needs.

Rivalry Among Competitors

GE Vernova operates in a highly competitive global energy landscape. Major players like Siemens Energy, Mitsubishi Power, Schneider Electric, and ABB vie for market share across GE Vernova's core segments: gas power, wind power, and grid solutions. This broad and diverse competitor base, each with unique strengths and strategic approaches, fuels aggressive market dynamics.

The energy transition market is poised for substantial, multi-decade growth, fueled by global decarbonization mandates and rising electricity consumption, particularly from burgeoning sectors like data centers. For instance, the International Energy Agency (IEA) projected in 2024 that clean energy investment would surpass $2 trillion annually by 2025, highlighting this robust expansion.

This overall upward trajectory can temper intense competition by expanding the market's capacity to absorb new entrants and increased output. However, the growth isn't uniform across all segments; mature sub-sectors or those facing oversupply can still witness heightened competitive rivalry as companies vie for market share within more constrained opportunities.

GE Vernova distinguishes itself through significant investment in technological innovation, focusing on the efficiency and reliability of its energy generation and grid solutions. For instance, its advanced HA gas turbines are designed for higher power output and lower emissions, a key differentiator in a market increasingly focused on sustainability.

The company's digital offerings, such as the GridOS Distributed Energy Resource Management System (DERMS) software, further enhance its competitive edge by enabling smarter grid management. This ability to provide superior performance and advanced digital capabilities helps GE Vernova avoid direct price competition and maintain its market position.

High Fixed Costs and Exit Barriers

GE Vernova operates in sectors characterized by substantial capital outlays. The power generation and grid solutions industries demand significant investments in advanced manufacturing, ongoing research and development, and extensive global service infrastructure. For instance, the construction of a new gas turbine manufacturing facility can easily run into hundreds of millions of dollars.

These high fixed costs, combined with highly specialized assets and long-term customer commitments, erect formidable exit barriers. Companies find it economically challenging to divest or cease operations, forcing them to persist in competitive markets even when facing economic headwinds. This commitment to staying in the market intensifies rivalry among existing players.

- Capital Intensity: Significant upfront investment required for manufacturing plants and R&D in power generation and grid solutions.

- Specialized Assets: Equipment and facilities are often highly specific to the industry, limiting resale value.

- Long-Term Contracts: Customer agreements often span many years, creating ongoing obligations and dependencies.

- High Exit Barriers: The combination of these factors makes it difficult and costly for companies to leave the market, thus sustaining competitive pressure.

Strategic Stakes

The global energy transition represents a monumental shift, creating immense strategic stakes for companies like GE Vernova and its competitors. Nations and economies are prioritizing this transition, compelling players in the sector to make substantial investments as they battle for leadership in defining the future of energy. This heightened strategic importance directly fuels intensified competition, as businesses jockey for enduring positions in this evolving landscape.

The sheer scale of the energy transition means that market share gains today translate into significant long-term revenue streams and technological dominance. For instance, the global renewable energy market was valued at approximately $1.3 trillion in 2023 and is projected to reach over $2.1 trillion by 2030, according to various market analyses. This growth trajectory underscores the critical nature of securing early advantages.

Consequently, the competitive rivalry is fierce, with established players and emerging innovators alike pouring resources into research, development, and manufacturing capabilities. Companies are not just competing on current product offerings but on their ability to shape industry standards and capture future demand. This dynamic leads to aggressive pricing strategies, strategic partnerships, and a relentless pursuit of innovation to outmaneuver rivals.

- High Investment Requirements: The energy transition necessitates massive capital expenditure in areas like offshore wind, hydrogen production, and grid modernization, creating high barriers to entry and intensifying competition among those with the financial capacity to invest.

- Technological Advancement Race: Companies are locked in a race to develop and deploy more efficient, cost-effective, and sustainable energy technologies, with early movers gaining significant market advantages.

- Government Policy Influence: National energy policies and incentives play a crucial role, driving competition as companies align their strategies to benefit from supportive regulatory environments and secure government contracts.

Competitive rivalry within GE Vernova's operating segments is intense, driven by a mix of established global giants and specialized players. Companies like Siemens Energy, Mitsubishi Power, and Hitachi Energy are significant competitors across gas power, wind, and grid solutions, each leveraging their own technological advancements and market presence.

The sheer scale of investment required in the energy sector, with billions poured into new technologies and manufacturing, naturally concentrates market power among a few well-capitalized firms, intensifying direct competition for market share and technological leadership. For example, the global power generation equipment market is highly concentrated, with the top five players often holding a substantial portion of the market share.

This dynamic is further amplified by the global energy transition, where companies are aggressively pursuing dominance in burgeoning renewable and grid modernization markets. The pursuit of market share in these high-growth areas, such as offshore wind and grid-scale battery storage, leads to aggressive strategies including pricing, innovation, and strategic alliances.

| Competitor | Key Segments | Notable 2024/2025 Focus Areas |

|---|---|---|

| Siemens Energy | Gas Power, Wind Power, Grid Technologies | Hydrogen-ready turbines, grid stability solutions, digital services |

| Mitsubishi Power | Gas Power, Renewable Energy Solutions | Advanced gas turbines, decarbonization technologies, battery storage |

| Hitachi Energy | Grid Solutions, Renewable Energy Integration | Grid modernization, HVDC technology, digital substation solutions |

| Schneider Electric | Grid Solutions, Energy Management | Smart grid technologies, energy efficiency software, distributed energy resource management |

SSubstitutes Threaten

GE Vernova's gas and wind power solutions contend with increasingly cost-competitive alternatives such as utility-scale solar, hydropower, and geothermal energy. For instance, the levelized cost of electricity for utility-scale solar PV in the US averaged around $28 per megawatt-hour in 2023, making it a strong competitor.

These evolving renewable energy technologies, bolstered by supportive government policies and incentives, can redirect crucial investment away from GE Vernova's established gas and wind power segments. The global renewable energy market is projected to reach $1.97 trillion by 2030, indicating significant growth potential for these substitutes.

The threat of substitutes for traditional power generation, which GE Vernova operates within, is intensifying due to advancements in energy storage. Technologies like advanced battery storage and other emerging solutions are increasingly capable of providing grid stability and dispatchable power, functions previously dominated by conventional power plants.

As the cost of energy storage continues to fall, with lithium-ion battery prices dropping by over 80% in the last decade, and their performance improving, their viability as substitutes grows. For instance, by 2024, grid-scale battery storage capacity is projected to reach hundreds of gigawatts globally, directly challenging the need for continuous generation from sources like natural gas or even renewable energy curtailment.

The increasing emphasis on energy efficiency and demand-side management presents a significant threat of substitutes for GE Vernova's traditional power generation equipment. As consumers and utilities adopt smarter grid technologies and localized microgrids, the need for large-scale, centralized power plants diminishes. For instance, the U.S. Department of Energy reported that energy efficiency measures alone saved Americans an estimated 2.5 quadrillion British thermal units (Btu) of energy in 2022, equivalent to reducing primary energy consumption by 20%.

While GE Vernova does offer solutions in grid modernization and distributed energy resources, a substantial market shift towards these alternatives could directly impact sales of its core power generation hardware. The growth of distributed generation, often paired with advanced energy management systems, means customers might opt for a mosaic of smaller, more flexible energy sources rather than investing in large, singular generation units. This trend suggests a potential reduction in the addressable market for GE Vernova's legacy product lines.

Nuclear Power Resurgence

The threat of substitutes for GE Vernova's energy generation business is evolving with the resurgence of nuclear power. This renewed interest, especially in small modular reactors (SMRs), presents a potential long-term alternative to traditional large-scale fossil fuel plants and even some renewable sources.

While GE Vernova is involved in the nuclear sector, a substantial move towards SMRs could reshape the broader energy generation landscape, impacting the demand for other technologies.

- Nuclear Power's Growing Role: Global investment in nuclear energy is on the rise, with projections indicating significant growth in the coming decade. For instance, the World Nuclear Association reported in early 2024 that over 50 new nuclear reactors were under construction worldwide.

- SMR Development: Small Modular Reactors are gaining traction due to their potentially lower upfront costs and faster construction times compared to traditional large-scale plants. Several countries are actively funding SMR development and pilot projects.

- Impact on Energy Mix: A widespread adoption of nuclear power, particularly SMRs, could displace a portion of the market share currently held by gas-fired power plants and potentially impact the deployment of other renewable energy solutions.

Decentralized Energy Systems

The increasing adoption of decentralized energy systems presents a significant threat of substitutes for GE Vernova. As more consumers and communities invest in distributed generation, like rooftop solar panels and battery storage, the demand for traditional, large-scale power generation equipment from utilities may diminish. For instance, in 2023, solar power capacity additions globally reached record levels, with distributed solar playing a crucial role.

This trend directly impacts GE Vernova's core business, particularly its sales of large turbines and grid infrastructure components to centralized power providers. The economic viability of these distributed solutions is improving, driven by falling technology costs and supportive government policies, making them increasingly competitive alternatives.

- Threat of Substitutes: Decentralized Energy Systems

- The rise of rooftop solar and community wind projects offers direct alternatives to traditional utility-scale power plants.

- This shift can reduce the demand for GE Vernova's large-scale generation equipment.

- Global distributed solar capacity saw substantial growth in 2023, highlighting the increasing appeal of these substitutes.

The threat of substitutes for GE Vernova is significant, driven by the increasing cost-effectiveness and technological advancements of alternative energy sources. Utility-scale solar, hydropower, and geothermal energy are becoming more competitive, with solar PV in the US averaging around $28 per megawatt-hour in 2023. These evolving renewables, supported by government policies, are drawing investment away from GE Vernova's established gas and wind power segments. The global renewable energy market is projected to reach $1.97 trillion by 2030, underscoring the growth of these alternatives.

Advancements in energy storage, such as battery technology, also pose a substantial threat by providing grid stability and dispatchable power, functions traditionally held by fossil fuel plants. Lithium-ion battery prices have fallen by over 80% in the past decade, with grid-scale battery storage capacity expected to reach hundreds of gigawatts globally by 2024. Furthermore, energy efficiency and demand-side management are diminishing the need for large, centralized power plants, with U.S. energy efficiency measures saving an estimated 2.5 quadrillion Btu in 2022.

| Substitute Technology | Key Characteristic | 2023/2024 Data Point | Impact on GE Vernova |

|---|---|---|---|

| Utility-Scale Solar | Falling LCOE | ~$28/MWh (US average 2023) | Direct competition for gas/wind projects |

| Energy Storage (Batteries) | Improved performance, lower cost | >80% price drop (last decade), hundreds of GW projected capacity (2024) | Displaces need for continuous generation |

| Energy Efficiency | Reduced demand | 2.5 quadrillion Btu saved (US 2022) | Decreases reliance on new generation capacity |

Entrants Threaten

The power generation equipment and grid solutions sector demands colossal upfront investment. Companies need billions for advanced research and development, state-of-the-art manufacturing plants, and establishing a robust global supply network. For instance, building a new advanced gas turbine manufacturing facility alone can easily cost upwards of $1 billion.

These substantial capital requirements act as a formidable barrier, effectively discouraging potential new entrants from challenging established players like GE Vernova. The sheer scale of investment needed makes it incredibly difficult for smaller or less capitalized firms to even consider entering the market and competing on equal footing.

GE Vernova's position in the energy sector is significantly influenced by the threat of new entrants, particularly concerning technological complexity and the expertise required. Developing and manufacturing advanced gas turbines, large-scale wind turbines, and intricate grid software necessitates profound engineering knowledge, proprietary technologies, and substantial investment in research and development. For instance, the intricate design and manufacturing processes for high-efficiency gas turbines involve specialized materials science and aerodynamic engineering that are not easily replicated.

New players face considerable hurdles in quickly acquiring this specialized knowledge and the intellectual property that underpins GE Vernova's product lines. The capital expenditure for establishing advanced manufacturing facilities for components like turbine blades or advanced power electronics is immense, often running into hundreds of millions or even billions of dollars. This high barrier to entry, stemming from the need for deep technical expertise and significant upfront investment, effectively limits the number of potential new competitors capable of challenging established players like GE Vernova in the near term.

The energy sector, including GE Vernova's markets, faces substantial regulatory hurdles. Stringent environmental standards, such as emissions limits and waste disposal regulations, require significant upfront investment in compliance technology. For example, in 2024, many jurisdictions continued to tighten regulations on carbon emissions from power generation, increasing the cost of entry for new fossil fuel-based power plants.

Navigating complex permitting processes for constructing new power plants or expanding grid infrastructure is another significant barrier. These processes can be lengthy, costly, and unpredictable, often involving multiple government agencies at federal, state, and local levels. The time and resources needed to secure necessary approvals deter many potential new entrants who may lack the expertise or financial capacity to manage such complexities.

Established Customer Relationships and Brand Loyalty

GE Vernova benefits from deeply entrenched customer relationships with global utilities and industrial clients, forged over decades of demonstrated reliability and comprehensive service. New entrants face a significant hurdle in replicating this trust and brand loyalty within a sector that prioritizes proven performance and long-term partnerships.

Breaking into these established networks requires substantial investment in building credibility and demonstrating equivalent service capabilities, which is a time-consuming and capital-intensive endeavor. For instance, in the power generation sector, a significant portion of contracts are awarded through long-term frameworks and existing supplier relationships, making it difficult for newcomers to gain initial traction.

- Long-standing partnerships with major global utilities provide GE Vernova with a stable customer base.

- High switching costs for clients in critical infrastructure sectors deter a move to new, unproven suppliers.

- Brand reputation built on decades of reliable performance is a significant barrier to entry for new competitors.

Economies of Scale and Experience Curve

Existing players like GE Vernova leverage substantial economies of scale across manufacturing, procurement, and global service networks. This scale allows them to spread fixed costs over a larger production volume, leading to lower per-unit costs. For instance, in 2023, GE Vernova reported significant operational efficiencies contributing to their revenue of $21.1 billion, a testament to their established scale.

New entrants would confront a considerable cost disadvantage. Building comparable manufacturing capacity, establishing robust supply chains, and developing a global service infrastructure requires immense capital investment. Until they achieve similar output levels, they would struggle to match the per-unit pricing and operational efficiency of incumbents, posing a significant barrier to entry.

- Economies of Scale: GE Vernova's established global footprint and high production volumes in areas like wind turbines and power generation equipment create significant cost advantages.

- Experience Curve: Decades of operational experience allow GE Vernova to refine manufacturing processes, optimize supply chains, and improve product reliability, further reducing costs and enhancing efficiency.

- Capital Investment: New entrants would need to invest billions of dollars to replicate the scale and technological sophistication of GE Vernova's operations, making market entry financially prohibitive.

- Competitive Pricing: The cost savings derived from scale and experience enable GE Vernova to offer competitive pricing, which new, smaller-scale competitors would find difficult to match.

The threat of new entrants for GE Vernova is generally low due to significant barriers. High capital requirements, often in the billions for advanced manufacturing and R&D, deter new players. Furthermore, the sector demands deep technical expertise and proprietary technology, which are difficult for newcomers to acquire quickly. Established customer relationships and brand loyalty built over decades also present a formidable challenge for any new competitor seeking to gain market share.

| Barrier | Description | Impact on New Entrants | Example for GE Vernova |

|---|---|---|---|

| Capital Requirements | Extremely high investment needed for R&D, advanced manufacturing, and global supply chains. | Prohibitive for most potential entrants. | Building a new advanced gas turbine facility can exceed $1 billion. |

| Technical Expertise & IP | Requires specialized engineering knowledge, proprietary technologies, and extensive R&D. | Difficult and time-consuming to replicate GE Vernova's technological edge. | Complex design and manufacturing of high-efficiency gas turbines. |

| Customer Relationships & Brand Loyalty | Decades-long trust and established partnerships with global utilities. | New entrants struggle to build credibility and displace incumbents. | Long-term contracts with major utilities are common in power generation. |

| Regulatory Hurdles | Stringent environmental standards and complex permitting processes. | Increases costs and time-to-market, deterring new ventures. | Tighter carbon emission regulations in 2024 impact new fossil fuel power plant entries. |

Porter's Five Forces Analysis Data Sources

Our GE Vernova Porter's Five Forces analysis is built upon a foundation of robust data, including company annual reports, SEC filings, and industry-specific market research from reputable firms like IHS Markit and Wood Mackenzie.

We leverage data from financial databases such as Bloomberg and S&P Capital IQ, alongside trade publications and government energy reports, to thoroughly assess the competitive landscape for GE Vernova.