GE Vernova Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GE Vernova Bundle

Explore the strategic positioning of GE Vernova's diverse portfolio with our insightful BCG Matrix preview. Understand how their innovations are classified as Stars, Cash Cows, Dogs, or Question Marks, offering a glimpse into their market potential and resource allocation.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for GE Vernova.

Stars

GE Vernova's Electrification Solutions, primarily its Grid Solutions business, is a standout performer. This segment is experiencing robust growth, fueled by the global push for grid modernization and the increasing integration of renewable energy sources. The demand for these solutions is on an upward trajectory, positioning GE Vernova favorably in a rapidly expanding market.

Real-world data underscores this strength. In the first quarter of 2025, Electrification Solutions achieved a notable 14% revenue growth. This momentum continued into the second quarter of 2025, with revenue climbing an impressive 23%. Significant order and backlog increases, particularly in key markets like Europe and North America, further validate the segment's leading position and the strong market appetite for its offerings.

GE Vernova's HA Gas Turbines are positioned in a rapidly expanding market driven by the immense power needs of AI and data centers. The company's 7HA and 9HA models are particularly well-suited for this sector due to their efficient and quick power generation capabilities.

This strategic advantage has led to substantial market penetration, evidenced by significant contract wins and reserved production slots. Notably, a full third of GE Vernova's HA turbine reservation pipeline is specifically allocated to data center projects, underscoring the strong demand and GE's focus on this high-growth area.

GE Vernova is a frontrunner in hydrogen-ready gas turbine technology, with a significant installed base. Over 100 of their units are already operational, accumulating millions of hours running on hydrogen fuel blends.

This capability is crucial as the global push for decarbonization intensifies. The ability to seamlessly integrate hydrogen into power generation places GE Vernova's technology in a market poised for substantial growth and high potential.

Nuclear Small Modular Reactors (SMRs)

GE Vernova's BWRX-300 Small Modular Reactor (SMR) technology is a significant player in the evolving energy landscape. The company is making strides in regulatory approvals, with projects expected to commence construction in 2025. This positions GE Vernova at the forefront of a rapidly expanding market.

The global interest in SMRs is surging due to their potential as a cleaner, more reliable, and adaptable power generation solution. This burgeoning market presents a high-growth opportunity, and GE Vernova's early establishment of a leading position is a key strategic advantage.

- Market Growth: The SMR market is projected to grow significantly, with some estimates suggesting a multi-billion dollar industry by the early 2030s.

- Project Pipeline: GE Vernova's BWRX-300 has secured multiple project agreements, including those in Canada and Poland, signaling tangible progress towards commercial deployment.

- Technological Advancement: The BWRX-300 leverages existing boiling water reactor technology, aiming for cost-effectiveness and faster deployment compared to traditional large-scale nuclear plants.

- Regulatory Progress: GE Vernova is actively engaged with regulatory bodies worldwide to ensure its SMR design meets stringent safety standards, a critical factor for market acceptance and project execution.

Services for Installed Base

GE Vernova's extensive installed base of gas and wind turbines worldwide is a cornerstone of its business, forming a significant services backlog. This backlog, which represents approximately 65% of their total backlog, highlights a dominant market share in a sector experiencing consistent growth.

This strong position translates into a reliable stream of recurring revenue through maintenance, upgrades, and operational support services. The company's focus on its installed base ensures robust cash flow generation, a key indicator of financial health.

- Services Backlog Dominance: Services for the installed base constitute roughly 65% of GE Vernova's total backlog.

- Market Share and Growth: This translates to a high-market-share position in a consistently growing market for turbine services.

- Revenue and Cash Flow: The services segment ensures recurring revenue and strong cash flow through maintenance and operational support.

GE Vernova's Electrification Solutions and HA Gas Turbines are clear Stars. Electrification Solutions saw 23% revenue growth in Q2 2025, driven by grid modernization. HA Gas Turbines, particularly the 7HA and 9HA models, are capitalizing on AI and data center power demands, with a third of their turbine reservation pipeline dedicated to these projects.

| Segment | Growth Driver | Key Data Point |

|---|---|---|

| Electrification Solutions | Grid modernization, renewable integration | 23% revenue growth (Q2 2025) |

| HA Gas Turbines | AI & data center power needs | 33% of HA turbine pipeline for data centers |

What is included in the product

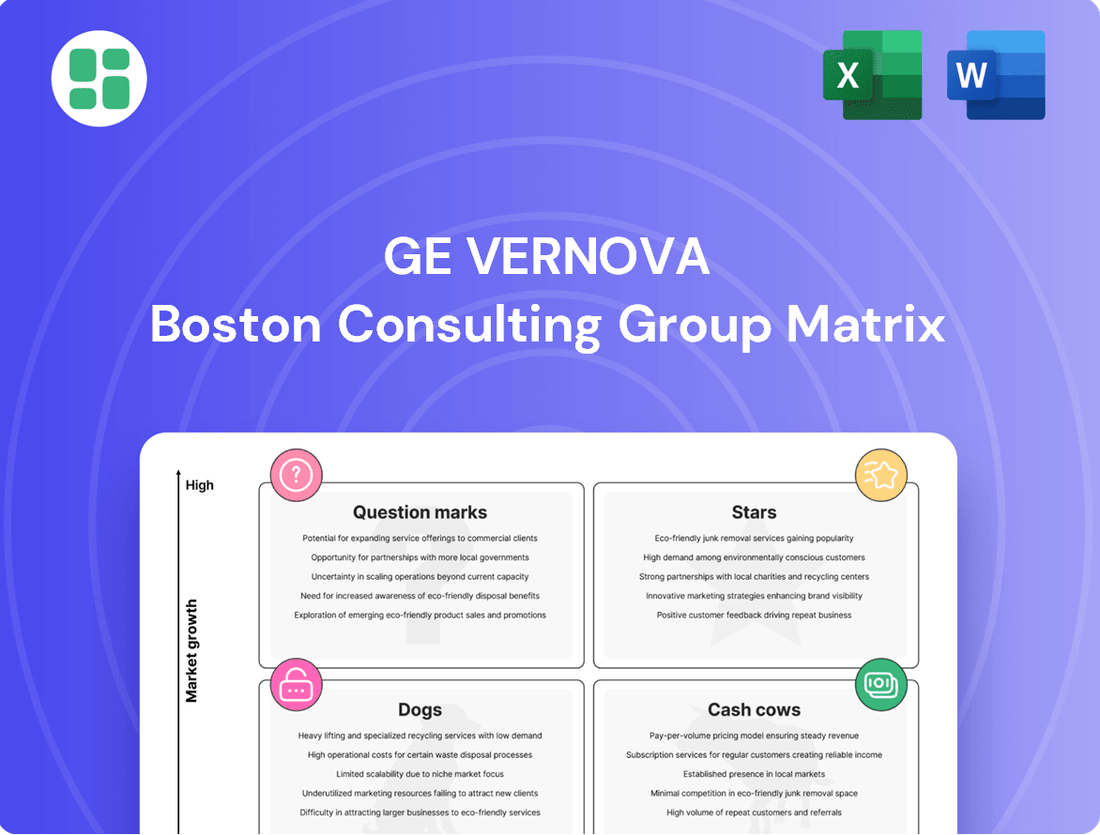

The GE Vernova BCG Matrix offers a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs based on market growth and share.

A clear, actionable GE Vernova BCG Matrix visualizes business unit performance, easing the pain of strategic uncertainty.

Cash Cows

GE Vernova's traditional gas power generation equipment, despite operating in a mature market, stands as a robust Cash Cow. This segment benefits from a substantial market share, consistently generating stable revenue and demonstrating healthy margin expansion. The ongoing need for dispatchable and reliable baseload power globally underpins its continued demand.

The installed fleet of gas turbines is a significant driver of growth, particularly through the expansion of its services business. For instance, in 2023, GE Vernova reported strong performance in its Gas Power segment, with revenue growth driven by both new equipment orders and a robust services backlog.

GE Vernova's power segment boasts a substantial services backlog, driven by Long-Term Service Agreements (LTSAs). These agreements, focused on maintaining and servicing existing gas and steam power plants, are a cornerstone of their cash flow generation.

LTSAs operate within a mature market, but their value lies in the highly predictable and stable revenue streams they provide. This consistency makes them a reliable source of high-margin income for GE Vernova, contributing significantly to their financial stability.

As of the first quarter of 2024, GE Vernova reported a robust backlog, with a significant portion attributed to their Power segment services. This indicates continued demand for their expertise in keeping existing power infrastructure running efficiently, underpinning their Cash Cow status.

GE Vernova's Hydro Power Solutions are firmly positioned as Cash Cows within the BCG Matrix. This segment benefits from a mature market with consistent demand for maintenance and upgrades of existing hydroelectric infrastructure, contributing steady revenue streams.

While the growth rate for new large-scale hydro projects may be moderate, the installed base and the critical need for grid reliability ensure its ongoing profitability. For instance, in 2024, the global hydropower market is expected to continue its steady, albeit not explosive, growth, driven by the need for baseload renewable power and grid stability, providing a reliable foundation for GE Vernova's cash generation.

Steam Power Services

GE Vernova's Steam Power Services represent a classic cash cow within the BCG Matrix. While the market for new steam power generation equipment is contracting, the installed base of these turbines and related systems requires ongoing maintenance, upgrades, and operational support. This creates a predictable and substantial revenue stream for GE Vernova, drawing on existing customer relationships and infrastructure.

The key advantage here is the low need for new capital investment. GE Vernova can leverage its existing service infrastructure and expertise to generate consistent cash flow from these mature assets. For instance, in 2024, the global power generation services market, which includes steam power, was projected to reach over $200 billion, with a significant portion attributable to the lifecycle support of existing fleets.

- Steady Revenue: Maintenance, repairs, and operational support for the existing steam power fleet provide a reliable income source.

- Low Investment Needs: Unlike growth-oriented segments, cash cows require minimal reinvestment, allowing for significant free cash flow generation.

- Market Position: GE Vernova's established presence in the steam power sector ensures a substantial installed base to service.

- Profitability: The mature nature of the services often allows for healthy profit margins due to optimized operations and established pricing.

Grid Components for Established Infrastructure

Certain mature grid components, such as standard transformers and switchgear, function within a stable, lower-growth market. GE Vernova benefits from its established market position and significant share in these segments, translating into reliable profitability and consistent cash flow.

These components are vital for maintaining existing electrical infrastructure, ensuring operational continuity. GE Vernova's strong market presence in these established areas allows for efficient operations and cost management, further bolstering their cash-generating capabilities.

- Mature Market: Standard transformers and switchgear operate in a stable, low-growth environment.

- High Market Share: GE Vernova holds a significant position in these established grid component markets.

- Consistent Profitability: The company generates reliable profits from these mature product lines.

- Cash Generation: These components are key contributors to GE Vernova's overall cash flow.

GE Vernova's Gas Power services, including Long-Term Service Agreements (LTSAs), are prime examples of Cash Cows. These services leverage a large installed base of gas turbines, generating predictable, high-margin revenue from maintenance and upgrades. The global demand for reliable baseload power ensures continued need for these services, as evidenced by GE Vernova's robust backlog in its Power segment, a significant portion of which is service-related, as reported in Q1 2024.

Hydro Power Solutions also function as Cash Cows, benefiting from the ongoing need for maintenance and upgrades of existing hydroelectric infrastructure. While new project growth is moderate, the installed base provides a stable revenue stream, supported by the global demand for reliable renewable baseload power and grid stability throughout 2024.

Steam Power Services are another strong Cash Cow. Despite a contracting market for new equipment, the extensive installed base of steam turbines requires substantial ongoing support. This segment generates consistent cash flow with minimal new capital investment, capitalizing on GE Vernova's established service infrastructure and expertise. The global power generation services market, projected to exceed $200 billion in 2024, highlights the significant revenue potential from lifecycle support of existing fleets.

| Segment | BCG Classification | Key Drivers | 2024 Outlook/Data Point |

| Gas Power Services (LTSAs) | Cash Cow | Installed base, demand for reliable power, service backlog | Robust backlog in Power segment services (Q1 2024) |

| Hydro Power Solutions | Cash Cow | Existing infrastructure maintenance, grid stability | Steady growth in global hydropower market |

| Steam Power Services | Cash Cow | Installed base, ongoing maintenance needs, low investment | Global power generation services market > $200 billion (2024 projection) |

| Standard Transformers & Switchgear | Cash Cow | Existing infrastructure, operational continuity, market share | Stable, lower-growth market with consistent profitability |

Full Transparency, Always

GE Vernova BCG Matrix

The GE Vernova BCG Matrix preview you're viewing is the exact, fully formatted document you will receive upon purchase. This means no watermarks or placeholder content, just a comprehensive strategic analysis ready for immediate use in your business planning. You can confidently use this preview as a direct representation of the professional, actionable report you'll download.

Dogs

Legacy coal-fired power plant technologies are in a declining market as the global push for decarbonization intensifies. These older, less efficient systems face shrinking demand and market share. For example, global coal power generation capacity additions have slowed significantly, with many developed nations actively phasing out coal.

Certain older, less efficient gas turbine models from GE Vernova are positioned as Dogs in the BCG Matrix. These models are experiencing declining demand and market share as the industry shifts towards more efficient and lower-carbon solutions. For instance, as of early 2024, the demand for turbines primarily designed for traditional fossil fuels has seen a noticeable dip compared to the previous year, reflecting this market trend.

While GE Vernova continues to offer services and maintenance for these existing units, new equipment sales for these particular older models are minimal. This makes them potential cash traps, consuming resources without significant future growth potential, unlike more innovative or adaptable product lines.

GE Vernova, in its pursuit of a focused strategy, might classify certain legacy business units as Question Marks or even Dogs if they exhibit low market share and limited growth potential within the energy transition landscape. For instance, any remaining components of GE's historical industrial equipment that don't directly contribute to electrification or decarbonization efforts could fall into this category. These units would likely have minimal investment appeal and could be candidates for divestiture to streamline operations and capital allocation toward core growth areas.

Underperforming Offshore Wind Projects (Specific Geographies)

Underperforming offshore wind projects, particularly in specific geographies, represent a potential drag on GE Vernova's Wind segment. These projects may require substantial capital investment and ongoing operational support, yet yield returns that are insufficient to justify the expenditure. This situation can arise from a combination of factors, including challenging site conditions, supply chain disruptions, and intense competition that limits pricing power.

The broader Wind segment has indeed encountered headwinds. For instance, in 2023, GE Vernova reported a net loss for its Renewable Energy segment, which includes offshore wind. This highlights the systemic challenges within the sector, such as rising costs for raw materials like steel and increased financing expenses. These factors can significantly impact the profitability of even well-managed projects.

GE Vernova's exposure to these underperforming assets could be categorized as a 'Dog' in a BCG matrix framework. This implies that these ventures have low market share and operate in slow-growing or declining market segments, or face intense competition that prevents market share gains. Resources allocated to these projects might be better deployed in areas with higher growth potential and stronger competitive positioning.

- Resource Drain: Specific offshore wind projects with poor performance metrics can divert critical financial and human capital away from more promising ventures.

- Market Position Weakness: In geographies where GE Vernova lacks a strong competitive foothold or faces significant execution hurdles, the risk of underperformance is amplified.

- Segmental Losses: The Wind segment's overall financial performance, including reported losses in previous periods, underscores the challenges of profitability in this capital-intensive industry.

Niche or Obsolete Digital Solutions

GE Vernova's "Niche or Obsolete Digital Solutions" quadrant likely houses digital offerings that haven't achieved widespread adoption or have been outpaced by advancements. These could include legacy software for specific industrial processes or digital platforms with limited user bases. For instance, a digital twin solution tailored for an older generation of turbines with declining operational lifespans would fit here.

These solutions typically exhibit low market share and demand high investment for meager returns. Consider a proprietary data analytics platform for a segment of the grid modernization market that has since been dominated by more integrated, cloud-based systems. The cost to maintain and update such a niche solution, while seeing little revenue growth, makes it a candidate for this category.

GE Vernova might face challenges in these areas, potentially leading to divestiture or significant restructuring. For example, if a digital solution designed for a specific legacy power plant control system is no longer supported by the original hardware, its market relevance diminishes rapidly. In 2024, companies in similar positions often report declining revenue streams for such products, with a focus shifting to newer, more scalable digital architectures.

- Low Market Share: Digital solutions with minimal penetration in their target markets.

- High Investment, Low Return: Requires substantial resources for development and maintenance with negligible profit generation.

- Superseded by Technology: Rendered less competitive or obsolete by newer, more advanced digital alternatives.

Certain legacy industrial equipment and services, particularly those tied to older, less environmentally friendly technologies, can be classified as Dogs. These offerings likely have a low market share and are in a declining market segment, with minimal future growth prospects. For instance, components or services related to outdated manufacturing processes that are being phased out due to efficiency or regulatory reasons would fit this description.

GE Vernova's older, less efficient gas turbine models, especially those primarily designed for traditional fossil fuels, are examples of Dogs. Demand for these specific models has seen a noticeable dip in early 2024 compared to previous years, as the market shifts towards more sustainable and efficient energy solutions. While GE Vernova continues to support these existing units, new sales for these particular older models are minimal.

Underperforming offshore wind projects, especially in challenging geographies or those facing intense competition, can also be categorized as Dogs. These ventures may require significant capital but yield insufficient returns, diverting resources from more promising areas. The Renewable Energy segment, which includes offshore wind, reported a net loss in 2023, underscoring the profitability challenges in this capital-intensive sector, with rising material and financing costs impacting performance.

Niche or obsolete digital solutions, such as legacy software for specific industrial processes with limited user bases, also fall into the Dog category. These solutions often have minimal market penetration and require substantial investment for negligible returns, frequently being superseded by more advanced digital alternatives. For example, a digital twin solution for older turbines with declining operational lifespans would represent such a product.

Question Marks

GE Vernova's offshore wind equipment segment operates in a high-growth market, yet the company's market share is still developing. Despite revenue growth in Q1 2025, a significant decrease in orders signals challenges in securing new projects. This positions the segment as a potential question mark within the BCG matrix, requiring careful strategic consideration.

The offshore wind sector is expanding rapidly, but GE Vernova faces headwinds including order declines and cost pressures. These factors contributed to EBITDA losses in the segment, highlighting the need for strategic adjustments to improve profitability and market standing. The company's developing position in this dynamic market necessitates a focus on strengthening its competitive edge.

Advanced carbon capture technologies represent a high-growth sector essential for global decarbonization efforts. Despite its critical importance, the widespread commercial deployment of these technologies is still in its early stages, with GE Vernova likely holding a modest market share in this emerging field.

The nascent nature of advanced carbon capture means significant capital investment is necessary for GE Vernova to build a competitive advantage. The global carbon capture market is projected to reach over $50 billion by 2030, indicating substantial future growth potential for companies that can establish a strong foothold.

GE Vernova's AI-Optimized Grid Solutions, such as GridOS and GridBeats, are positioned as question marks. These are early-stage products in a rapidly expanding market, fueled by the massive energy demands of AI data centers. The company is making significant investments to establish a foothold, acknowledging that capturing substantial market share will require continued dedication and resources.

New Energy Storage Solutions

The energy storage market, especially for large-scale grid applications, is booming. GE Vernova's involvement in this sector, including integrating solar and storage, represents a strategic bet on future growth. However, its current market share in this rapidly evolving space might still be developing, placing it in the Question Mark category of the BCG matrix.

- Market Growth: The global energy storage market was projected to reach over $300 billion by 2030, with grid-scale storage being a significant driver.

- GE Vernova's Position: GE Vernova aims to be a leader in this transition, offering solutions that combine renewable generation with storage capabilities.

- Investment Focus: The company is investing in advanced battery technologies and hybrid solutions to capture future market share in this dynamic segment.

- Strategic Importance: Success in new energy storage solutions is crucial for GE Vernova's long-term strategy of providing integrated energy systems.

Hydrogen Production Technologies (Electrolyzers)

GE Vernova’s position in the electrolyzer market, crucial for green hydrogen production, represents a potential high-growth area. While the company has a strong foothold in hydrogen-ready turbines, its direct participation in manufacturing electrolyzers is a newer endeavor.

The global electrolyzer market is experiencing rapid expansion, with projections indicating significant growth. For instance, the market was valued at approximately $3.5 billion in 2023 and is expected to reach over $20 billion by 2030, demonstrating a compound annual growth rate of around 25%. GE Vernova's current market share in this segment is likely nascent, positioning it as a challenger rather than an incumbent.

- Market Entry: GE Vernova’s focus on electrolyzers places it in a burgeoning sector with substantial future demand.

- Competitive Landscape: The electrolyzer market is characterized by established players and new entrants, necessitating significant investment for GE Vernova to gain substantial market share.

- Growth Potential: As governments worldwide push for decarbonization, the demand for green hydrogen, and thus electrolyzers, is set to surge, offering a strong growth trajectory.

- Strategic Investment: To compete effectively, GE Vernova will need to allocate considerable capital towards research, development, and manufacturing capacity for its electrolyzer technologies.

GE Vernova's offshore wind equipment segment is in a high-growth market, but its market share is still developing. Despite revenue growth in Q1 2025, a significant decrease in orders signals challenges in securing new projects, positioning it as a potential question mark requiring careful strategic consideration.

The company's position in advanced carbon capture technologies is also a question mark. This sector is critical for decarbonization and experiencing high growth, but widespread commercial deployment is still in early stages, meaning GE Vernova likely holds a modest market share in this emerging field.

AI-Optimized Grid Solutions, like GridOS and GridBeats, are early-stage products in a rapidly expanding market driven by AI data center demands. GE Vernova is investing heavily to establish a foothold, recognizing that capturing substantial market share will require continued dedication and resources.

The energy storage market, particularly for large-scale grid applications, is booming. GE Vernova's involvement, including integrating solar and storage, is a strategic bet on future growth. However, its current market share in this dynamic space is likely still developing, placing it in the Question Mark category.

GE Vernova's electrolyzer market participation, vital for green hydrogen, is another question mark. While strong in hydrogen-ready turbines, its direct electrolyzer manufacturing is a newer endeavor in a rapidly expanding market. The global electrolyzer market was valued at approximately $3.5 billion in 2023 and is projected to exceed $20 billion by 2030, indicating substantial growth potential for GE Vernova if it can gain market share.

BCG Matrix Data Sources

Our GE Vernova BCG Matrix leverages a blend of internal financial disclosures, market growth forecasts, and competitive landscape analysis. This ensures a robust understanding of each business unit's position.