Geospace Technologies PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Geospace Technologies Bundle

Understand how political, economic, and technological forces impact Geospace Technologies's performance. This ready-made PESTEL Analysis delivers expert-level insights—perfect for investors, consultants, and business planners. Buy the full version to get the complete breakdown instantly.

Political factors

Government policies and regulations, especially those affecting oil and gas exploration and production, are a major factor for Geospace Technologies' Energy Solutions. These policies can directly influence the demand for their seismic equipment. For instance, the U.S. Environmental Protection Agency (EPA) introduced new regulations for oil and gas facilities in May 2024 and May 2025. These rules aim to reduce emissions from both new and existing operations, potentially altering how companies operate and their need for advanced monitoring technologies.

Shifts in government priorities, such as a move towards renewable energy sources, could lead to a decrease in demand for traditional seismic equipment. Conversely, policies that encourage or support domestic oil and gas production could boost demand. The U.S. Energy Information Administration (EIA) reported that crude oil production reached an average of 13.2 million barrels per day in 2024, a record high, indicating a currently favorable environment for exploration activities.

Government defense spending is a significant driver for Geospace Technologies, particularly impacting its Intelligent Industrial segment. Increased geopolitical tensions and ongoing military modernization efforts worldwide are fueling a robust demand for advanced electronics and sensor solutions, directly benefiting companies like Geospace.

The global defense electronics market is projected to reach over $300 billion by 2028, with a compound annual growth rate of approximately 4.5% during this period, according to various market research reports from late 2023 and early 2024. This upward trend presents substantial opportunities for Geospace to secure lucrative government contracts for critical applications such as border surveillance systems and sophisticated sensor technologies.

International trade policies, including tariffs and trade disputes, significantly impact Geospace Technologies' supply chain and the cost of importing and exporting critical components and finished goods. For instance, ongoing trade tensions, particularly between the U.S. and China, have disrupted the flow of electronic components. This has driven companies like Geospace to explore reshoring and diversification strategies to build more resilient supply chains, a trend expected to continue through 2024 and 2025.

Geopolitical Stability

Global geopolitical stability significantly impacts Geospace Technologies. For instance, the ongoing conflicts in Eastern Europe in early 2024 have contributed to volatile energy prices, a key market for Geospace's seismic data acquisition technologies. Heightened global security concerns also tend to bolster defense budgets, potentially increasing demand for Geospace's specialized defense sensing solutions.

The company's performance is directly tied to these geopolitical shifts. For example, increased defense spending, a trend observed in many NATO countries throughout 2024, could translate into higher revenues for Geospace's maritime and land-based defense systems. Conversely, instability in major oil-producing regions can disrupt exploration activities, affecting the demand for seismic equipment.

- Increased defense budgets in 2024, driven by geopolitical tensions, could boost Geospace's defense segment.

- Volatile energy prices, a consequence of global instability, directly influence the demand for seismic acquisition equipment.

- Geopolitical events can impact supply chain stability, affecting Geospace's manufacturing and delivery capabilities.

Government Infrastructure Funding

Government infrastructure funding, especially for water management, creates substantial opportunities for Geospace's Smart Water division. Programs like the U.S. Water Infrastructure Finance Act are injecting significant capital into water-related projects, directly increasing the need for Geospace's Hydroconn smart water connectivity solutions and Aquana products. For example, the Bipartisan Infrastructure Law, enacted in 2021, allocated billions towards water infrastructure improvements, with a considerable portion earmarked for modernizing water systems and addressing emerging contaminants through 2026.

These government initiatives are designed to upgrade aging water infrastructure, improve water quality, and enhance the efficiency of water distribution networks. This translates into a more robust market for advanced monitoring and control technologies that Geospace offers. The focus on smart water solutions aligns perfectly with the goals of these funding programs, aiming to reduce water loss, optimize resource allocation, and improve overall system resilience.

Key government funding aspects impacting Geospace include:

- Increased Project Pipeline: Federal and state funding programs directly stimulate the number and scale of water infrastructure projects, creating a larger market for Geospace's technologies.

- Technological Modernization Push: Funding often prioritizes the adoption of new technologies for improved data collection, leak detection, and system management, benefiting Geospace's smart water offerings.

- Long-Term Investment Certainty: These programs provide a more predictable and sustained demand for infrastructure solutions, allowing companies like Geospace to plan and invest with greater confidence.

Government regulations directly influence Geospace Technologies' core markets. For instance, environmental policies impacting oil and gas operations can alter demand for seismic equipment, while defense spending, particularly in 2024 and projected into 2025, significantly boosts the Intelligent Industrial segment. International trade policies also play a crucial role, affecting supply chain costs and driving diversification strategies.

The U.S. EIA reported record crude oil production in 2024, underscoring a favorable environment for exploration. Simultaneously, the global defense electronics market is expected to exceed $300 billion by 2028, indicating strong demand for Geospace's defense solutions. Government infrastructure funding, especially for water systems, is also a key driver for the Smart Water division, with initiatives like the Bipartisan Infrastructure Law continuing to inject capital through 2026.

| Factor | Impact on Geospace Technologies | Data/Trend (2024-2025) |

| Energy Regulations | Influences demand for seismic equipment | New EPA emissions rules in May 2024/2025 |

| Defense Spending | Boosts Intelligent Industrial segment | Global defense electronics market projected >$300B by 2028 |

| Infrastructure Funding | Drives Smart Water division growth | Bipartisan Infrastructure Law funds water projects through 2026 |

| Trade Policies | Affects supply chain costs and strategy | Ongoing trade tensions impacting component availability |

What is included in the product

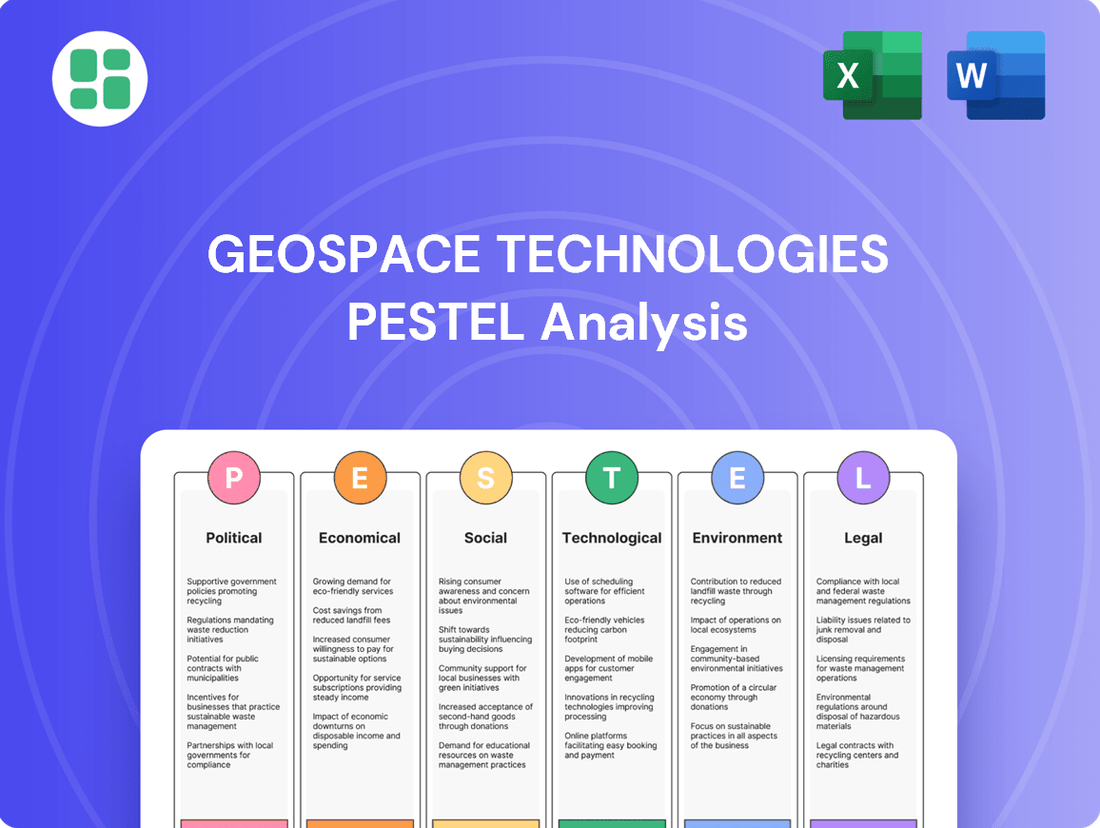

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Geospace Technologies, delving into Political, Economic, Social, Technological, Environmental, and Legal influences.

It offers actionable insights for strategic decision-making by identifying potential threats and opportunities within Geospace Technologies' operating landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, helping to quickly identify and address external factors impacting Geospace Technologies.

Economic factors

Global oil and gas prices are a major driver for Geospace Technologies. When prices are low, energy companies tend to cut back on exploration and production spending. This directly impacts Geospace because it means less demand for their seismic data acquisition equipment and reservoir monitoring solutions. For instance, Geospace reported a dip in revenue in their Q1 and Q2 fiscal year 2025, partly attributed to reduced investment in seismic surveys due to volatile energy markets.

Overall economic growth is a significant driver for Geospace Technologies, directly impacting demand across its industrial and healthcare sectors. When the global economy is expanding, businesses tend to invest more in new manufacturing capabilities, automation technologies, and essential healthcare infrastructure. This increased investment translates into higher demand for Geospace's industrial sensors and specialized electronic components.

The industrial sensors market, in particular, is expected to experience robust expansion through 2029. This growth is largely fueled by the ongoing digitalization of factories and the increasing adoption of edge-ready devices, which require advanced sensing and data processing capabilities. For example, the global industrial sensors market was valued at approximately $17.5 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of around 6.5% in the coming years, reaching an estimated $26 billion by 2029.

Inflationary pressures in 2024 and early 2025 directly impact Geospace Technologies by increasing the cost of essential raw materials, manufacturing processes, and labor. For instance, global supply chain disruptions and energy price volatility, key drivers of inflation, could significantly raise Geospace's operational expenses, potentially squeezing profit margins on its seismic data acquisition and processing equipment.

Rising interest rates, a common counter-inflationary measure, present a dual challenge for Geospace. Higher borrowing costs can make investments in crucial research and development (R&D) for new technologies more expensive. Furthermore, many of Geospace's clients operate in capital-intensive sectors like oil and gas exploration, where increased interest rates can dampen their willingness or ability to undertake large capital expenditures, thus affecting demand for Geospace's products and services.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations present a significant economic factor for Geospace Technologies, a global manufacturer. As a U.S.-based company with international sales, changes in currency values directly impact its reported financial results. For instance, a strengthening U.S. dollar can make Geospace's products more expensive for buyers in other countries, potentially dampening demand and affecting revenue from those regions.

These fluctuations also influence the cost of goods and services sourced internationally. If Geospace procures components or materials from countries with weaker currencies, a stronger dollar would lower those costs in dollar terms, potentially boosting profit margins. Conversely, a weaker dollar would increase the cost of imported inputs.

Recent data highlights the impact of currency on global trade. For example, in early 2024, the U.S. dollar experienced periods of strength against major currencies like the Euro and Japanese Yen. This trend would likely have presented challenges for U.S. exporters like Geospace, making their offerings less competitive in those specific markets.

- Impact on Revenue: A stronger USD can reduce the dollar value of sales made in foreign currencies, impacting reported top-line figures.

- Competitive Pricing: Higher U.S. dollar costs for international customers can make Geospace's products less price-competitive against local or regional manufacturers.

- Cost of Goods Sold: Fluctuations affect the dollar cost of imported raw materials and components, influencing gross margins.

- Profitability: The net effect of these revenue and cost impacts can significantly alter Geospace Technologies' overall profitability from its global operations.

Capital Availability and Investment

Geospace Technologies' ability to secure capital directly fuels its research and development, as well as its expansion plans. This access to funding is paramount for the company's ongoing diversification and its drive for technological innovation. For instance, in the first quarter of fiscal year 2024, Geospace reported a significant increase in its cash position, providing a solid foundation for future investments.

Investor confidence plays a vital role, enabling Geospace to undertake strategic acquisitions and develop cutting-edge products. This financial backing allows the company to target high-growth sectors, such as smart water management and industrial IoT, which offer substantial profit potential.

- Capital Availability: Geospace Technologies relies on consistent access to capital markets to fund its growth strategies.

- R&D Investment: Securing capital is essential for investing in new technologies and product development, particularly in emerging markets.

- Investor Confidence: Positive investor sentiment supports the company's ability to raise funds for strategic initiatives and acquisitions.

- Market Expansion: Availability of capital directly impacts Geospace's capacity to enter and scale operations in high-margin sectors like smart water and industrial IoT.

Economic factors significantly influence Geospace Technologies' performance, particularly through global commodity prices and overall economic growth. Fluctuations in oil and gas prices directly impact demand for seismic equipment, while broader economic expansion boosts sales in industrial and healthcare sectors. Inflationary pressures and rising interest rates, prevalent in 2024-2025, increase operational costs and can deter client capital expenditures, affecting Geospace's profitability and investment capacity.

| Economic Factor | Impact on Geospace Technologies | Supporting Data/Trend (2024-2025) |

|---|---|---|

| Global Oil & Gas Prices | Reduced exploration spending dampens demand for seismic equipment. | Q1/Q2 FY2025 revenue dip linked to volatile energy markets. |

| Economic Growth | Increased investment in industrial and healthcare sectors drives demand for sensors and components. | Industrial sensors market projected to reach $26 billion by 2029 (CAGR ~6.5%). |

| Inflation | Higher costs for raw materials, manufacturing, and labor. | Supply chain disruptions and energy price volatility are key drivers. |

| Interest Rates | Increased R&D costs and dampened client capital expenditure. | Higher borrowing costs affect investment decisions in capital-intensive industries. |

| Currency Exchange Rates | Affects international sales competitiveness and cost of imported goods. | Periods of USD strength in early 2024 impacted U.S. exporters. |

Preview Before You Purchase

Geospace Technologies PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis for Geospace Technologies delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and future growth.

What you’re previewing here is the actual file—fully formatted and professionally structured. It provides an in-depth examination of the external forces shaping Geospace Technologies' strategic landscape, offering valuable insights for informed decision-making.

Sociological factors

Public sentiment towards fossil fuels is increasingly negative, driven by growing awareness of climate change impacts. This shift is a significant factor for companies like Geospace, whose traditional markets are tied to oil and gas exploration. For instance, a 2024 survey indicated that over 60% of respondents believe governments should prioritize renewable energy investments over fossil fuels, directly impacting demand for oilfield services.

This evolving public perception directly pressures the oil and gas industry, making it a less attractive investment area for many. Consequently, Geospace is strategically expanding into sectors less reliant on fossil fuels, such as smart water management and diverse industrial applications. This diversification is crucial for long-term resilience in a world moving towards decarbonization.

The availability of a skilled workforce is paramount for Geospace Technologies, especially in specialized fields like high-tech manufacturing, engineering, and data science. The company's success hinges on access to talent with expertise in advanced sensing technologies, the Internet of Things (IoT), and sophisticated analytical software. For instance, the U.S. Bureau of Labor Statistics projected a 20% growth in software developers and a 10% growth in data scientists between 2022 and 2032, indicating a competitive landscape for these critical roles.

Attracting and retaining such specialized talent presents a significant challenge. Geospace Technologies must compete for individuals who possess the unique combination of hardware and software skills needed to drive innovation in seismic monitoring and data acquisition. Reports from 2024 indicate a persistent skills gap in advanced manufacturing and engineering, with many companies struggling to fill positions requiring cutting-edge technical knowledge, directly impacting their capacity for research and development and operational scaling.

Societal demand for cutting-edge healthcare is booming, creating significant opportunities for companies like Geospace Technologies. As people increasingly seek advanced medical solutions, the market for remote patient monitoring and sophisticated medical devices is expanding rapidly. This trend is directly fueling the need for the specialized sensor products Geospace offers.

The rise of the Internet of Medical Things (IoMT) and the widespread adoption of wearable health technology are powerful drivers of this demand. These innovations rely heavily on accurate, reliable sensors and seamless connectivity solutions, areas where Geospace's expertise is particularly valuable. For instance, the global IoMT market was valued at approximately $77.2 billion in 2023 and is projected to reach $378.9 billion by 2030, showcasing the immense growth potential.

Urbanization and Infrastructure Modernization

The accelerating trend of urbanization, particularly in developing economies, is a significant driver for Geospace Technologies. As more people move into cities, the demand for robust and efficient infrastructure, especially in water management, escalates. This societal shift directly fuels Geospace's Smart Water segment, as urban centers grapple with providing reliable water services to growing populations.

This focus on infrastructure modernization translates into a tangible need for advanced solutions. Geospace's offerings, such as smart water meters and remote shut-off valves, are crucial for utilities aiming to optimize water distribution, reduce leaks, and improve overall management. For instance, smart water meter adoption is projected to grow significantly, with the global smart water meter market expected to reach over $10 billion by 2027, indicating strong market potential for Geospace's segment.

- Urban Population Growth: By 2050, an estimated 68% of the world's population is projected to live in urban areas, creating immense pressure on existing infrastructure.

- Smart City Initiatives: Many cities worldwide are investing heavily in smart city technologies, with water management being a key component, driving demand for IoT solutions.

- Water Utility Efficiency: The need to conserve water and reduce operational costs pushes utilities towards adopting technologies like smart metering, which can reduce non-revenue water by up to 15%.

Corporate Social Responsibility (CSR) Expectations

Societal views on corporate behavior are shifting, with stakeholders increasingly demanding that companies like Geospace Technologies prioritize social and environmental responsibility. This pressure comes from various groups, including investors looking for sustainable investments, consumers preferring ethically sourced products, and employees seeking to work for purpose-driven organizations. For instance, in 2024, a significant portion of global investors, estimated at over 70% by some reports, actively consider Environmental, Social, and Governance (ESG) factors in their investment decisions, directly impacting companies like Geospace.

Geospace's commitment to these principles can translate into tangible benefits. By adopting greener manufacturing processes, such as reducing energy consumption in its facilities or minimizing waste in its product lifecycle, the company can bolster its brand image. This enhanced reputation is crucial for attracting and retaining talent and for appealing to a growing segment of the market that values sustainability. For example, companies with strong ESG ratings often experience lower capital costs and higher valuations, reflecting market confidence in their long-term viability and responsible operations.

- Investor Scrutiny: In 2024, ESG funds saw continued inflows, with many actively engaging with portfolio companies on their sustainability performance.

- Consumer Preference: Surveys consistently show a growing willingness among consumers to pay a premium for products from environmentally and socially responsible companies.

- Employee Attraction: A company's CSR stance is becoming a key factor for job seekers, particularly among younger generations entering the workforce.

- Reputational Capital: Positive CSR initiatives can mitigate reputational risks and build goodwill, which is invaluable during challenging economic periods.

Societal shifts towards environmental consciousness are significantly impacting Geospace Technologies, as public opinion increasingly favors renewable energy over fossil fuels. This trend pressures traditional oil and gas markets, prompting Geospace to diversify into areas like smart water management. The demand for skilled professionals in advanced manufacturing and data science is also high, with projected growth in these sectors creating a competitive talent landscape for Geospace.

Geospace is also benefiting from the growing demand for advanced healthcare solutions, particularly in remote patient monitoring and wearable technology, driven by the expansion of the Internet of Medical Things (IoMT). Furthermore, urbanization is increasing the need for efficient infrastructure, such as smart water management systems, which plays directly into Geospace's strategic focus areas.

Companies like Geospace face growing expectations for corporate social responsibility, with investors and consumers prioritizing ESG factors. Demonstrating strong CSR performance can enhance brand reputation, attract talent, and potentially lower capital costs, as evidenced by the continued inflows into ESG funds in 2024.

| Sociological Factor | Impact on Geospace Technologies | Supporting Data/Trend (2023-2025) |

|---|---|---|

| Environmental Awareness | Decreased demand in traditional fossil fuel markets; increased focus on diversification. | Over 60% of respondents in a 2024 survey favored prioritizing renewable energy investments. |

| Skilled Workforce Demand | Need for specialized talent in advanced manufacturing, engineering, and data science. | Projected 20% growth for software developers and 10% for data scientists (2022-2032) by U.S. BLS; persistent skills gap reported in 2024. |

| Healthcare Advancements | Growth opportunities in IoMT, remote patient monitoring, and wearable tech. | IoMT market valued at ~$77.2 billion in 2023, projected to reach $378.9 billion by 2030. |

| Urbanization | Increased demand for smart infrastructure, especially in water management. | Global smart water meter market expected to exceed $10 billion by 2027. |

| Corporate Social Responsibility | Pressure to adopt ESG principles; potential for enhanced reputation and lower capital costs. | Over 70% of global investors considered ESG factors in 2024; ESG funds saw continued inflows. |

Technological factors

Continuous advancements in seismic imaging, data acquisition, and processing are crucial for Geospace's Energy Solutions business. Innovations like 4D seismic imaging and ocean-bottom nodes (OBNs) are significantly improving the accuracy and efficiency of finding and monitoring oil and gas reserves.

The integration of artificial intelligence (AI) and machine learning into seismic data analysis is a key technological driver. These technologies allow for faster and more precise interpretation of complex geological data, leading to better exploration success rates and optimized reservoir management for Geospace's clients.

The relentless advancement of sensor technology is a significant technological factor for Geospace. Miniaturization, enhanced precision, and the incorporation of artificial intelligence are opening doors for Geospace's expansion beyond its traditional seismic markets into sectors like industrial automation, defense systems, and healthcare.

For instance, the global sensor market was valued at approximately $22.7 billion in 2023 and is projected to reach $44.8 billion by 2030, growing at a compound annual growth rate of 10.2%. This growth is fueled by innovations like AI-powered sensors, which are crucial for applications such as predictive maintenance in manufacturing and advanced diagnostic tools in medicine, directly aligning with Geospace's strategic diversification efforts.

Geospace Technologies is increasingly seeing the impact of Artificial Intelligence (AI) and Machine Learning (ML) across its served markets. These technologies are revolutionizing how data is analyzed and how predictive maintenance is performed, offering significant advantages.

For instance, AI can optimize seismic data processing in the energy sector, leading to more efficient exploration. In national security, AI enhances threat detection and situational awareness. By 2024, the global AI market was projected to reach over $200 billion, highlighting the substantial investment and adoption of these transformative tools.

IoT and Connectivity Solutions

The widespread adoption of the Internet of Things (IoT) and the rollout of advanced connectivity like 5G are vital for Geospace Technologies, particularly for its smart water and industrial sensor offerings. These technologies enable real-time data collection and remote management, directly boosting the market potential for Geospace's connected sensor solutions.

For instance, the global IoT market was projected to reach $1.1 trillion in 2024, with a significant portion driven by industrial applications. This growth underscores the expanding opportunity for companies like Geospace that provide the foundational sensor technology for these connected ecosystems. The ability to offer integrated, data-rich solutions positions Geospace to capitalize on this trend.

- IoT Growth: The global IoT market is expected to grow substantially, creating a larger addressable market for Geospace's smart sensor products.

- 5G Impact: The expansion of 5G networks will enhance the reliability and speed of data transmission for Geospace's connected devices, improving performance and user experience.

- Data-Driven Solutions: IoT integration allows Geospace to offer advanced analytics and remote monitoring capabilities, adding significant value for customers in water management and industrial sectors.

Cybersecurity and Data Transmission Systems

Geospace Technologies' increasing reliance on data acquisition and transmission across its diverse segments, from seismic exploration to healthcare, underscores the critical need for robust cybersecurity. The company must ensure its systems are resilient against threats that could compromise sensitive data. This is particularly vital given the company's involvement in defense and industrial applications where data integrity is paramount.

The technological landscape demands continuous investment in secure data transmission systems to meet stringent compliance requirements. For instance, evolving data privacy regulations like GDPR and CCPA necessitate advanced encryption and access control protocols. Geospace's commitment to these standards directly impacts its ability to operate in regulated markets and maintain client trust.

In 2024, the global cybersecurity market was projected to reach over $200 billion, highlighting the significant resources dedicated to this field. Geospace Technologies is positioned to leverage advancements in areas like AI-driven threat detection and secure cloud infrastructure to safeguard its operations and client data.

- Cybersecurity Investment: Geospace must allocate resources to advanced threat detection and prevention technologies.

- Data Privacy Compliance: Adherence to evolving global data privacy regulations is essential for market access and reputation.

- Secure Transmission Infrastructure: Investing in encrypted and resilient data transmission systems is a non-negotiable requirement.

Technological advancements in seismic data processing, including AI and machine learning, are enhancing Geospace's ability to locate and manage energy resources more effectively. The increasing sophistication of sensor technology is also enabling the company to expand into new markets like industrial automation and healthcare.

The growth of the Internet of Things (IoT) and 5G connectivity provides significant opportunities for Geospace's smart water and industrial sensor solutions by enabling real-time data collection and remote management. However, the company must also prioritize robust cybersecurity measures to protect sensitive data across its diverse operations, especially in defense and regulated sectors.

The global sensor market is projected to reach $44.8 billion by 2030, with AI-powered sensors driving innovation. Similarly, the global IoT market was projected to exceed $1.1 trillion in 2024, indicating substantial growth potential for Geospace's connected sensor offerings.

| Technology Area | Key Trend | Impact on Geospace | Market Data (2024/2025) |

|---|---|---|---|

| Seismic Imaging & Processing | AI/ML Integration, 4D Seismic | Improved exploration accuracy, optimized reservoir management | AI Market: >$200 billion (projected 2024) |

| Sensor Technology | Miniaturization, AI Integration | Expansion into industrial automation, defense, healthcare | Global Sensor Market: ~$22.7 billion (2023), projected $44.8 billion (2030) |

| Connectivity | IoT, 5G Rollout | Enhanced real-time data for smart water/industrial sensors | Global IoT Market: ~$1.1 trillion (projected 2024) |

| Cybersecurity | Advanced Threat Detection, Data Privacy Compliance | Ensuring data integrity, maintaining client trust, market access | Global Cybersecurity Market: >$200 billion (projected 2024) |

Legal factors

Stricter environmental regulations, particularly concerning seismic exploration and oil and gas operations, directly impact Geospace's Energy Solutions segment by increasing compliance costs and potentially affecting project viability. New Environmental Protection Agency (EPA) regulations, with key dates in May 2024 and May 2025, are set to enforce stringent control measures for emissions and associated gases, compelling industry players to adapt their technologies and operational practices.

Geospace Technologies must navigate a complex web of data privacy and security laws, which are constantly being updated. For instance, regulations like the General Data Protection Regulation (GDPR) in Europe and the Health Insurance Portability and Accountability Act (HIPAA) in the United States impose strict requirements on how sensitive information is handled. This is particularly relevant for Geospace as it expands into sectors like healthcare and smart water management, where personal and critical data are involved.

The secure handling, transmission, and storage of this data present a significant legal and operational hurdle. Failure to comply can result in substantial fines and reputational damage. For example, under GDPR, companies can face penalties of up to 4% of their annual global turnover or €20 million, whichever is higher. This underscores the critical need for robust data protection measures across all of Geospace's operations.

Intellectual property rights are crucial for Geospace Technologies, safeguarding its proprietary technologies and maintaining a competitive edge. The company actively protects its innovations through patents, which are vital for its market position. For instance, in 2023, Geospace reported significant investment in research and development, a portion of which is directly tied to securing and defending its intellectual property portfolio.

Litigation concerning patent infringement, whether as a plaintiff or defendant, poses a substantial risk. Such legal battles can be costly and time-consuming, potentially diverting resources from innovation and product development. Furthermore, a failure to secure new patents or to adequately protect existing ones could weaken Geospace's market exclusivity and impede its ability to introduce next-generation technologies.

International Trade Laws and Export Controls

Geospace Technologies navigates a complex web of international trade laws and export controls, impacting its global sales and operations. Regulations like the International Traffic in Arms Regulations (ITAR) and the Export Administration Regulations (EAR) are particularly relevant for its defense-related technologies. Adherence to these stringent rules is paramount to prevent significant penalties and ensure continued access to vital overseas markets.

Failure to comply can result in severe consequences, including hefty fines, debarment from future contracts, and damage to the company's reputation. For instance, violations of ITAR can lead to civil penalties up to $500,000 per violation and criminal penalties of up to $1 million and 10 years imprisonment. This underscores the critical need for robust compliance programs.

- ITAR and EAR Compliance: Geospace must meticulously follow regulations governing the export of defense articles and dual-use technologies.

- Market Access: Strict adherence to export controls is essential for maintaining access to lucrative international defense and commercial markets.

- Risk Mitigation: Non-compliance can lead to substantial financial penalties and operational disruptions, highlighting the importance of proactive management.

'Build America, Buy America' Act

The 'Build America, Buy America' Act significantly influences Geospace Technologies' opportunities in the U.S. market, particularly for its Smart Water solutions. This legislation mandates the use of American-made materials for federally funded infrastructure projects, creating a strong incentive for government entities to procure domestically sourced products. Geospace's Hydroconn® products are positioned to benefit directly from this preference, as compliance offers a distinct competitive edge in securing contracts related to water infrastructure development.

This legal framework presents a clear advantage for companies like Geospace that can demonstrate adherence to domestic sourcing requirements. For instance, the U.S. government's commitment to bolstering domestic manufacturing through such acts could translate into increased demand for Geospace's U.S.-manufactured components. The Infrastructure Investment and Jobs Act of 2021, which allocates substantial funds to infrastructure, further amplifies the impact of 'Build America, Buy America' by creating a larger pool of projects where domestic sourcing is a key consideration.

- Domestic Sourcing Mandate: The 'Build America, Buy America' Act requires U.S.-made materials for federally funded infrastructure, directly impacting Geospace's U.S. municipal contract potential.

- Competitive Advantage: Compliance with the act serves as a significant legal advantage, especially for products like Geospace's Hydroconn®, which meet domestic content criteria.

- Infrastructure Funding Alignment: Legislation like the Infrastructure Investment and Jobs Act, with its focus on domestic production, enhances the market opportunities for Geospace's compliant products.

- Market Access: Adherence to 'Build America, Buy America' can unlock greater access to U.S. government contracts for Geospace's Smart Water technologies.

Geospace Technologies must navigate evolving environmental regulations, particularly those impacting seismic exploration and oil/gas operations, which can increase compliance costs. For example, new EPA rules effective May 2024 and May 2025 mandate stricter emission controls, requiring adaptation in technologies and practices.

Environmental factors

Global climate change policies and the accelerating push for decarbonization are significantly shaping the long-term demand for seismic equipment within the oil and gas industry. As nations implement stricter emissions targets, the energy sector faces evolving operational landscapes, directly impacting Geospace Technologies' core market.

This environmental shift underscores the strategic importance of Geospace's diversification efforts into non-energy sectors. The company's focus on sustainable technologies, such as advanced solutions for smart water management, directly addresses growing environmental concerns and creates new revenue streams, aligning with the global decarbonization trend.

The increasing global emphasis on sustainability is significantly shaping manufacturing and supply chain operations for companies like Geospace Technologies. Consumers and investors alike are demanding environmentally responsible practices, influencing everything from raw material procurement to the final product's lifecycle. For instance, the global market for sustainable manufacturing is projected to reach substantial figures, with some estimates suggesting it could exceed $50 billion by 2027, driven by regulatory pressures and consumer preference.

Geospace's adoption of eco-friendly manufacturing processes and efforts to minimize its environmental footprint are becoming crucial for maintaining a positive brand image and satisfying stakeholder expectations. Companies that proactively integrate green technologies and sustainable sourcing strategies often see improved operational efficiency and reduced long-term costs. In 2024, many industrial sectors reported cost savings of 5-15% through waste reduction and energy efficiency initiatives alone, highlighting the tangible benefits of sustainability.

The environmental impact of seismic activities, especially in delicate regions, can result in tougher rules and increased public attention, influencing the practicality and expense of seismic surveys. For instance, concerns over underwater noise pollution from seismic airguns impacting marine life have led to moratoriums on offshore exploration in certain areas, such as parts of the Arctic. This directly affects companies like Geospace Technologies, which provides seismic data acquisition equipment.

Geospace Technologies may need to invest in or adapt to more eco-conscious seismic survey techniques and gear to address these environmental worries. This could involve exploring alternative energy sources for seismic sources or developing quieter, more efficient acquisition systems. The increasing focus on sustainability by major oil and gas companies, who are Geospace's primary customers, also pushes for greener solutions in the seismic sector.

Resource Scarcity and Raw Material Costs

Geospace Technologies faces significant headwinds from resource scarcity and fluctuating raw material costs. The price of essential materials like copper, crucial for their seismic data acquisition equipment, experienced notable volatility throughout 2024. For instance, copper prices saw significant upward pressure driven by increased global demand and supply chain disruptions, impacting Geospace's manufacturing expenses.

Furthermore, the cost of specialized materials such as Fluorinated Ethylene Propylene (FEP), used for insulation in their robust cable systems, is also subject to market dynamics. Rising demand for electronic components across various industries, coupled with geopolitical tensions affecting global trade routes, directly contributes to the instability in FEP pricing and availability, potentially squeezing Geospace's profit margins.

These challenges are exacerbated by:

- Supply Chain Vulnerabilities: Geopolitical events in 2024 continued to disrupt the flow of critical minerals and manufactured components, impacting lead times and increasing logistical costs for Geospace.

- Demand Surges: The accelerating global transition towards renewable energy and the expansion of digital infrastructure have simultaneously increased demand for materials like copper, creating a competitive sourcing environment.

- Inflationary Pressures: Broader inflationary trends in 2024 have also contributed to higher costs for a range of raw materials and energy, further complicating cost management for Geospace's production processes.

Focus on Energy Efficiency and Reduced Footprint

Geospace Technologies is seeing a significant push towards energy efficiency and a reduced environmental footprint, which directly influences their product development. This trend is accelerating innovation in their sensor and data acquisition systems, aiming to lower power consumption and minimize operational impact.

The company's commitment to developing more energy-efficient solutions aligns with broader global sustainability objectives. For instance, as of early 2025, many industrial sectors are setting ambitious targets for Scope 1 and Scope 2 emissions reductions, creating a market demand for technologies that support these goals. Geospace's ability to deliver on this front can offer a distinct competitive edge.

- Market Demand: Growing investor and regulatory pressure for sustainability is driving demand for energy-efficient industrial technologies.

- Competitive Advantage: Innovations in lower-power sensors and data acquisition systems can differentiate Geospace in a market increasingly focused on environmental performance.

- Operational Efficiency: Reduced energy consumption in Geospace's own operations and in the deployment of their technologies contributes to cost savings and a smaller carbon footprint.

The increasing global focus on sustainability is significantly impacting Geospace Technologies' operations and market demand. Stricter climate policies and the drive for decarbonization are reshaping the oil and gas industry, Geospace's primary market, pushing for more environmentally conscious solutions.

This environmental shift necessitates Geospace's diversification into non-energy sectors and the development of sustainable technologies, such as those for smart water management, to align with global decarbonization trends and create new revenue streams.

The company's manufacturing and supply chain practices are also under scrutiny, with growing demand for environmentally responsible sourcing and production. For example, the global market for sustainable manufacturing is projected to exceed $50 billion by 2027, driven by regulatory pressures and consumer preferences.

Geospace's proactive integration of eco-friendly processes and sustainable sourcing strategies are crucial for maintaining a positive brand image and meeting stakeholder expectations, potentially leading to improved operational efficiency and cost savings, with industrial sectors reporting 5-15% savings through waste reduction and energy efficiency initiatives in 2024.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Geospace Technologies is built on a robust foundation of publicly available data from government agencies, international organizations, and reputable industry publications. We meticulously gather information on political stability, economic indicators, technological advancements, environmental regulations, and socio-cultural trends to provide a comprehensive view.