Geospace Technologies Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Geospace Technologies Bundle

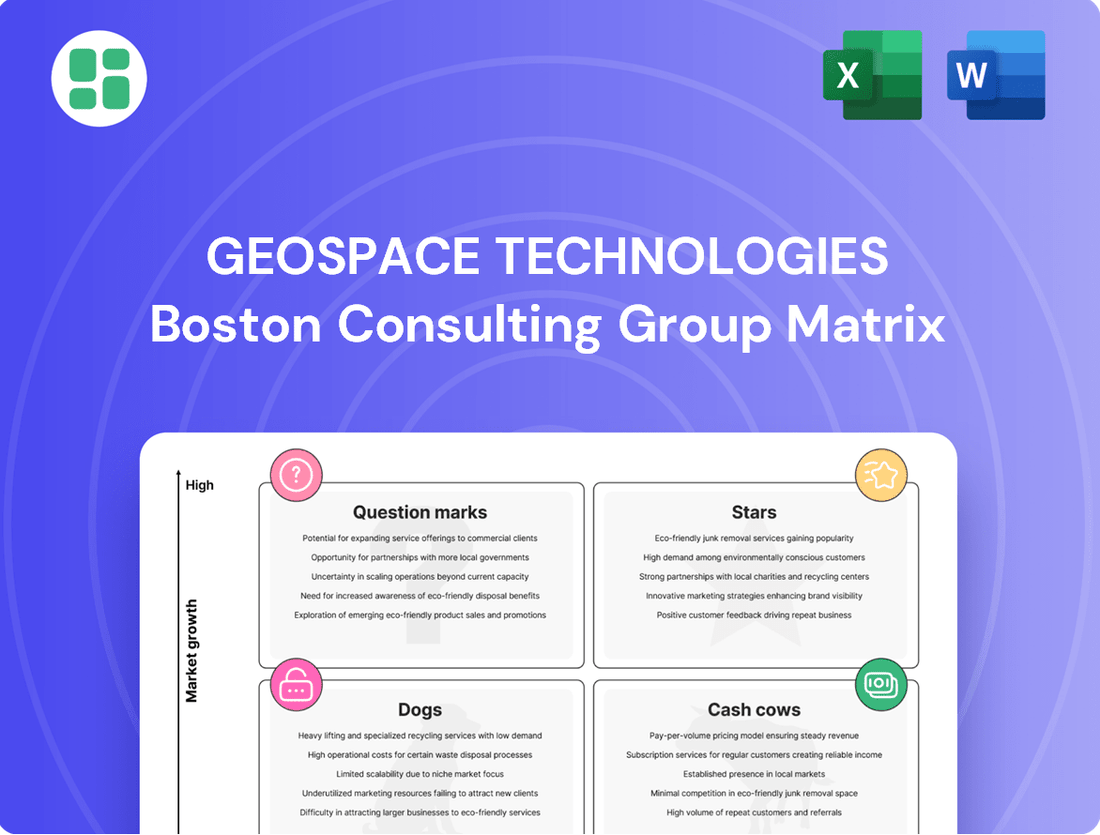

Curious about Geospace Technologies' strategic positioning? This BCG Matrix preview offers a glimpse into their product portfolio, highlighting potential Stars, Cash Cows, and areas needing attention. To truly unlock actionable strategies and understand their market dominance, dive into the complete BCG Matrix.

Gain a competitive edge by purchasing the full Geospace Technologies BCG Matrix. It provides a detailed quadrant-by-quadrant analysis, revealing crucial insights into market share and growth potential, empowering you to make informed investment and resource allocation decisions.

Don't miss out on the complete picture! The full Geospace Technologies BCG Matrix is your essential tool for navigating the complexities of their product landscape and formulating a winning strategy. Purchase now for immediate access to data-driven clarity.

Stars

The Smart Water segment, featuring products like Hydroconn® universal connectors and Aquana, experienced remarkable revenue surges. Specifically, it saw a 47.7% revenue increase in the second quarter of 2025 and an impressive 72% jump in the first quarter of 2025.

This robust growth trajectory within an expanding market firmly establishes the Smart Water segment as a critical engine for Geospace Technologies' future revenue generation.

By the first half of 2025, this segment commanded over 50% of the company's total revenue, underscoring its growing market dominance and strong potential for continued leadership.

Hydroconn® Universal Connectors are a clear Star in Geospace Technologies' portfolio. With over 27 million units sold domestically, this product line commands a significant market share in the smart water connectivity space.

The impressive revenue performance of Hydroconn®, coupled with its adherence to the 'Build America, Buy America' Act, positions it favorably for securing lucrative U.S. municipal contracts. This strong market position and regulatory compliance underscore its status as a leading product.

The Aquana brand, featuring IoT-enabled valves, is a key driver in Geospace Technologies' Smart Water segment. This segment has seen record performance, fueled by growing global demand for water conservation and infrastructure upgrades. Aquana's alignment with these trends positions it as a strong contender in a high-growth market.

AquaLink™ IoT Solution

AquaLink™ IoT Solution, launched in June 2025, is Geospace Technologies' foray into commercial smart water monitoring. This innovative product is poised to disrupt the market, targeting a significant expansion of Geospace's footprint in the burgeoning IoT and smart water management sectors.

The company anticipates AquaLink™ will drive substantial growth, leveraging its advanced sensing capabilities to address the increasing global demand for efficient water resource management. This strategic move underscores Geospace's commitment to innovation in high-growth technology markets.

- Market Entry: June 2025

- Product Focus: Commercial smart water monitoring

- Strategic Goal: Capture market share in IoT and smart water management

- Innovation Driver: Advanced sensing and IoT technologies

Strategic Diversification Focus

Geospace Technologies' strategic pivot, underscored by its May 2025 rebranding, signals a clear intent to cultivate high-growth, high-margin technology sectors beyond its legacy oil and gas operations.

This strategic diversification aims to leverage advanced sensing and IoT capabilities across new markets, with a stated ambition to reach over $200 million in annual revenue, evenly split across its various segments.

- Market Expansion: Targeting new industries with existing sensing technology.

- Revenue Goal: Aiming for $200 million+ in annual revenue from diversified segments.

- Investment Focus: Actively channeling resources into these emerging areas to secure market leadership.

The Smart Water segment, particularly Hydroconn® Universal Connectors and Aquana, are clear Stars for Geospace Technologies. These products are driving significant revenue growth, with the segment contributing over 50% of total revenue in the first half of 2025. Their success is rooted in strong market demand, technological innovation, and strategic alignment with growth trends in water conservation and infrastructure.

| Product | Market Position | Growth Driver | Strategic Importance |

|---|---|---|---|

| Hydroconn® Universal Connectors | Dominant in smart water connectivity; over 27 million units sold domestically. | High revenue growth; favorable for securing U.S. municipal contracts due to 'Build America, Buy America' Act compliance. | Key revenue generator; solidifies market leadership. |

| Aquana (IoT-enabled valves) | Key driver in high-growth smart water market. | Fueled by global demand for water conservation and infrastructure upgrades. | Expands IoT footprint in smart water management. |

| AquaLink™ IoT Solution | New entrant in commercial smart water monitoring (launched June 2025). | Targets expansion in burgeoning IoT and smart water management sectors with advanced sensing. | Poised to disrupt market; significant future growth potential. |

What is included in the product

Geospace Technologies' BCG Matrix provides a strategic overview of its product portfolio, categorizing them as Stars, Cash Cows, Question Marks, and Dogs.

This analysis helps identify areas for investment, divestment, or maintenance based on market share and growth potential.

The Geospace Technologies BCG Matrix provides a clear, one-page overview, alleviating the pain of complex strategic analysis by instantly categorizing business units.

Cash Cows

Geospace Technologies' OptoSeis® Permanent Reservoir Monitoring (PRM) Systems are a clear cash cow. The significant multi-year contract secured with Petrobras in June 2025 for their fiber optic PRM system provides substantial and predictable long-term revenue. This technology is crucial for optimizing oil production, cementing Geospace's leadership in a high-value, specialized segment of the energy industry.

Despite potential volatility in the broader oil and gas market, the consistent demand for essential reservoir monitoring, coupled with Geospace's established dominance in this advanced technology, ensures its role as a reliable revenue generator. This segment benefits from recurring revenue streams due to the continuous need for monitoring and optimization, making it a stable performer for the company.

Geospace Technologies' established seismic data acquisition equipment historically formed the backbone of its operations, primarily serving the oil and gas industry. Despite market fluctuations, these well-regarded instruments continue to be a significant revenue generator, reflecting Geospace's enduring market position.

In fiscal year 2024, Geospace reported that its Energy Solutions segment, which heavily features seismic equipment, generated $67.1 million in revenue. This segment, while experiencing some volatility, demonstrates the continued demand for their specialized acquisition technology.

Geospace's OBX nodal products, especially those in the rental fleet, have historically been a reliable source of income, despite varying demand. These assets, representing a substantial capital outlay, continue to bring in cash through rental agreements and sporadic sales, even with recent dips in usage.

The consistent rental revenue, even at lower utilization rates, highlights the inherent cash-generating ability of this segment for Geospace. This steady income stream, a hallmark of a Cash Cow, is bolstered by the company's established market position and existing client relationships.

Traditional Seismic Sensors and Marine Products

Geospace Technologies' traditional seismic sensors and marine products form the bedrock of its Energy Solutions segment, consistently generating significant cash flow. These mature offerings benefit from a well-established market presence and existing infrastructure, reducing the need for substantial marketing expenditures. While subject to the cyclical nature of oil and gas exploration, their consistent demand, especially in 2024 with renewed investment in energy security, allows for healthy profit margins.

These products are considered Cash Cows because they require minimal investment to maintain their market share. For instance, Geospace Technologies reported that its Energy Products segment, which includes these seismic sensors, saw revenue growth in fiscal year 2023, indicating sustained demand. The company's ability to leverage its brand reputation further solidifies their Cash Cow status.

- Established Market Position: Geospace Technologies has a long-standing reputation for reliability in seismic sensing technology.

- Low Investment Needs: Mature products like these require less capital for research and development or aggressive marketing compared to newer offerings.

- Consistent Cash Generation: Despite market fluctuations, these products provide a stable and predictable revenue stream for the company.

- Profitability: The established infrastructure and customer base allow for high profit margins, especially during periods of stable energy demand, as seen in the ongoing energy transition efforts in 2024.

Intellectual Property and Manufacturing Expertise

Geospace Technologies' intellectual property and manufacturing expertise in advanced sensing and ruggedized products form a significant Cash Cow. Their deep engineering talent and established production processes allow for the efficient creation of high-quality equipment, ensuring strong profit margins in their core markets. This operational prowess, coupled with their proprietary technology, generates consistent revenue and underpins the company's overall financial health.

This segment benefits from Geospace's substantial investment in research and development, leading to a portfolio of patents and specialized manufacturing techniques. For instance, in fiscal year 2023, Geospace reported $73.6 million in revenue from its Seismic segment, which heavily relies on these core competencies. The ability to produce durable, high-performance sensors at competitive costs allows them to maintain a leading position and generate reliable cash flow.

- Strong Engineering Base: Geospace leverages its extensive engineering talent to develop and refine its sensing technologies.

- Robust Manufacturing: The company's manufacturing capabilities are optimized for producing ruggedized, high-quality equipment.

- High Margins: Efficient production and valuable intellectual property contribute to strong profit margins in established markets.

- Consistent Cash Flow: This segment acts as a reliable source of income, supporting other business areas.

Geospace Technologies' OptoSeis® Permanent Reservoir Monitoring (PRM) Systems represent a significant cash cow, bolstered by a substantial multi-year contract with Petrobras secured in June 2025. This fiber optic PRM technology is vital for optimizing oil production, reinforcing Geospace's leadership in a high-value, specialized energy sector. The predictable, long-term revenue from such contracts ensures a stable financial contribution.

Geospace's established seismic data acquisition equipment, a historical revenue driver, continues to perform well. In fiscal year 2024, the Energy Solutions segment, which includes this equipment, generated $67.1 million in revenue. These well-regarded instruments benefit from Geospace's enduring market position, providing a consistent income stream despite market fluctuations.

The company's OBX nodal products, particularly those utilized in rental fleets, have historically been a reliable income source. Even with varying demand, these assets generate cash through rental agreements and occasional sales, underscoring their cash cow status. This consistent rental revenue, a hallmark of cash cows, is supported by Geospace's established market presence and client relationships.

| Product/Segment | BCG Category | FY 2024 Revenue (Millions USD) | Key Cash Cow Attributes | Supporting Data |

|---|---|---|---|---|

| OptoSeis® PRM Systems | Cash Cow | N/A (Contractual) | Predictable long-term revenue, market leadership, essential technology | Petrobras contract (June 2025) |

| Seismic Data Acquisition Equipment | Cash Cow | $67.1 (Energy Solutions Segment) | Established market position, consistent demand, reliable revenue | Enduring market presence |

| OBX Nodal Products (Rental Fleet) | Cash Cow | N/A (Segmented) | Consistent rental income, asset utilization, existing client base | Steady income stream even with lower utilization |

What You See Is What You Get

Geospace Technologies BCG Matrix

The Geospace Technologies BCG Matrix preview you're examining is the identical, fully formatted report you'll receive upon purchase. This means no watermarks or demo content, just a professional, analysis-ready document designed for immediate strategic application.

What you see here is the exact Geospace Technologies BCG Matrix file you'll download after completing your purchase. It's a professionally crafted report, ready for immediate use in your business planning and strategic decision-making.

Rest assured, the Geospace Technologies BCG Matrix document you are previewing is the final, complete version you will receive. It's been meticulously prepared by industry experts, ensuring it's ready for immediate editing, presentation, or integration into your business strategy.

Dogs

Geospace Technologies' imaging products within the Intelligent Industrial segment are currently struggling, showing decreased revenue. This decline is attributed to a general softening in demand for these specific offerings.

These imaging products are situated in a market characterized by low growth, and Geospace's share within this market appears to be shrinking. This combination suggests a challenging environment for these products.

Given the low growth and declining market share, continued substantial investment in these underperforming imaging products would likely be an inefficient use of capital. They represent a prime candidate for strategic review, potentially leading to divestiture or a significant reduction in operational focus to free up resources for more promising ventures.

Geospace Technologies' Intelligent Industrial segment experienced a revenue dip in fiscal year 2024, primarily due to the conclusion of a significant government contract. This highlights a potential vulnerability in the segment, suggesting a reliance on large, non-recurring projects rather than a consistent stream of business.

This reliance on one-off contracts means that without a steady pipeline of new, comparable projects, the products associated with these agreements may struggle to generate ongoing revenue, potentially leading to cash flow challenges.

While Geospace Technologies' Energy Solutions segment saw revenue declines in Q2 2025, partly due to lower utilization of its OBX rental fleet, specific outdated seismic equipment presents a classic case of a Dogs category asset. These underperforming assets, characterized by consistently low demand and minimal operational use, tie up valuable capital without yielding adequate returns.

For instance, if older seismic vibrators or specialized sensors are rarely deployed, they become a significant drain. This underutilization, potentially falling below 20% for certain units, indicates a lack of market competitiveness or obsolescence, making them prime candidates for divestment or strategic phase-out to free up capital for more promising ventures.

Declining Legacy Oil & Gas Hardware

Geospace Technologies' rebrand in May 2025 signals a strategic pivot away from its historical identity as primarily an oil-and-gas hardware supplier. This move suggests that certain legacy, commoditized oil and gas hardware products, facing increased competition and diminishing market demand, are now categorized as low-growth, low-market-share offerings within the BCG Matrix. These products may represent a drain on company resources without substantial contributions to future growth.

- Legacy Products: Undifferentiated oil and gas hardware.

- Market Position: Low market share.

- Growth Prospects: Low growth.

- Strategic Implication: Potential resource drain.

Products Affected by Tariff Concerns

Geospace Technologies' Intelligent Industrial segment has faced headwinds, particularly impacting its EXILE products. Trade tariffs introduced in recent years have created significant challenges, leading to a decline in revenue for this segment. These external pressures can quickly make products less profitable or even uncompetitive in the global market.

The EXILE product line, once a strong performer, now finds itself in a precarious position within the BCG Matrix, likely categorized as a Dog. This is due to the combined effect of declining market demand influenced by trade disputes and the company's existing market share. For instance, in fiscal year 2023, the Intelligent Industrial segment saw its revenue decrease, partly attributable to these tariff-related issues.

- Tariff Impact: Trade tariffs have directly affected the cost and competitiveness of EXILE products, contributing to revenue erosion in the Intelligent Industrial segment.

- Market Position: The EXILE products are now considered low-growth and low-market-share due to these external economic factors.

- Cash Trap Risk: If these tariff-related market conditions persist or worsen, and mitigation strategies are not effective, EXILE products could become cash traps for Geospace Technologies.

- Segment Performance: The Intelligent Industrial segment's overall revenue decline in recent periods underscores the negative impact of these product-specific challenges.

Geospace Technologies' legacy seismic equipment and certain undifferentiated oil and gas hardware products are prime examples of "Dogs" in their BCG Matrix. These assets are characterized by low market share and operate in low-growth markets, often experiencing declining demand and profitability.

For instance, older seismic vibrator units that see infrequent deployment, potentially below 20% utilization, tie up capital without generating significant returns. Similarly, commoditized oil and gas hardware facing increased competition and diminishing demand, such as those impacted by trade tariffs on EXILE products, fall into this category.

These "Dog" assets represent a potential drain on company resources, consuming capital and management attention without contributing meaningfully to future growth. Strategic decisions often involve divesting or phasing out these underperforming products to reallocate capital towards more promising ventures.

| Product Category | Market Growth | Market Share | Revenue Trend (FY2024/Q2 2025) | BCG Classification |

|---|---|---|---|---|

| Legacy Seismic Equipment | Low | Low | Declining (low utilization) | Dog |

| Undifferentiated Oil & Gas Hardware | Low | Low | Declining (competition/tariffs) | Dog |

| EXILE Products (Intelligent Industrial) | Low | Low | Decreasing (tariff impact) | Dog |

Question Marks

Geospace Technologies' new industrial sensor products are positioned within the Question Marks quadrant of the BCG Matrix. While the broader Intelligent Industrial segment experienced revenue declines, there's a notable increase in demand for these specific sensor products. This suggests they are tapping into high-growth industrial IoT markets.

Despite the growing demand, Geospace's market share in these nascent sensor technology niches is still developing, placing them in the Question Marks category. Significant investment in research and development, coupled with targeted promotion and market penetration strategies, will be crucial for these products to potentially evolve into Stars.

The Aquanaut™ Deepwater Wireless Node, a recent innovation from Geospace Technologies, is positioned as a Question Mark in the BCG Matrix. This advanced, wireless seismic acquisition node is designed for extended deepwater operations, a segment with significant growth potential, particularly in offshore seismic and the 4D imaging market, which is projected to expand substantially through 2024 and beyond.

While the technology is cutting-edge, its market penetration and overall share within the deepwater seismic acquisition sector are still in their nascent stages. Geospace Technologies is investing heavily in this product, recognizing the high-growth trajectory of the offshore seismic market, but its current revenue contribution and market dominance are yet to be firmly established through secured contracts or widespread adoption.

The Pioneer™ ultralight land node represents a new entrant in Geospace Technologies' portfolio, positioned as a potential star in the BCG matrix. Its recent launch targets a growing demand for cost-effective, high-performance seismic equipment, a segment that could see significant expansion. While its market position is still developing, early adoption and market penetration will be crucial for its future success.

Healthcare Technology Applications

Geospace Technologies' foray into healthcare technology represents a strategic diversification, aiming to tap into a sector known for its robust growth potential. While specific revenue contributions from this segment are not yet prominently featured in recent financial disclosures, the company's investment in this area signals a long-term vision for expansion beyond its traditional markets.

The healthcare technology market is dynamic, with advancements constantly reshaping patient care and diagnostics. Geospace's current position within this market is likely in its early stages, meaning its market share and the commercial success of its specific product applications are still developing. This makes it a potential area for future growth, but one that necessitates continued investment and strategic refinement.

To assess the viability of these healthcare ventures as future Stars in Geospace's BCG Matrix, several factors are critical:

- Market Growth: The global digital health market was projected to reach over $660 billion by 2025, indicating substantial opportunity.

- Geospace's Investment: Continued R&D and strategic partnerships are essential for developing competitive healthcare technology solutions.

- Market Penetration: Success hinges on establishing a strong market presence and demonstrating clear value propositions for its healthcare products.

Future Acquisitions for Growth

Geospace Technologies' management has clearly articulated a strategy focused on growth through acquisitions, specifically targeting opportunities that immediately boost revenue. These potential acquisitions are not products themselves but represent strategic moves into high-growth markets where the company aims to rapidly increase its market share.

The success of these acquisition plans hinges on identifying the right targets and effectively integrating them, which involves significant capital investment and careful management. For instance, in fiscal year 2023, Geospace reported revenue of $177.3 million, and the company's stated goal is to ensure any new acquisitions are immediately accretive to this topline figure.

- Strategic Investments: Acquisitions are viewed as investments in high-growth sectors.

- Market Share Expansion: The primary goal is to quickly gain market share in new or existing segments.

- Capital Allocation: These initiatives require substantial capital, impacting cash flow and financial flexibility.

- Integration Risk: The success of acquisitions depends heavily on effective post-acquisition integration and operational synergy realization.

Geospace Technologies' new industrial sensor products, including the Aquanaut™ Deepwater Wireless Node and Pioneer™ ultralight land node, are currently positioned as Question Marks. These products target high-growth markets like industrial IoT and offshore seismic, but Geospace's market share is still developing. Significant investment in R&D and market penetration is needed for them to become Stars.

The company's strategic acquisitions also fall into the Question Mark category, aiming to rapidly increase market share in high-growth sectors. For fiscal year 2023, Geospace reported $177.3 million in revenue, with a focus on acquisitions that are immediately accretive to this figure.

The healthcare technology segment represents another area of diversification for Geospace, with the global digital health market projected to exceed $660 billion by 2025. Geospace's current market share and commercial success in this sector are still in their early stages, requiring continued investment.

| Product/Segment | BCG Category | Market Growth Potential | Geospace's Market Share | Key Strategy |

|---|---|---|---|---|

| Industrial Sensors (New) | Question Mark | High (Industrial IoT) | Developing | R&D, Market Penetration |

| Aquanaut™ Deepwater Wireless Node | Question Mark | High (Offshore Seismic) | Nascent | Investment, Market Adoption |

| Pioneer™ Ultralight Land Node | Question Mark | Growing (Cost-effective Seismic) | Developing | Early Adoption, Market Penetration |

| Healthcare Technology | Question Mark | Very High (Digital Health) | Early Stages | R&D, Strategic Partnerships |

| Acquisitions | Question Mark | High (Targeted Sectors) | Rapid Expansion Goal | Revenue Accretion, Market Share Growth |

BCG Matrix Data Sources

Our BCG Matrix leverages a robust data foundation, integrating financial disclosures, market research reports, and competitive intelligence to provide a comprehensive strategic overview.