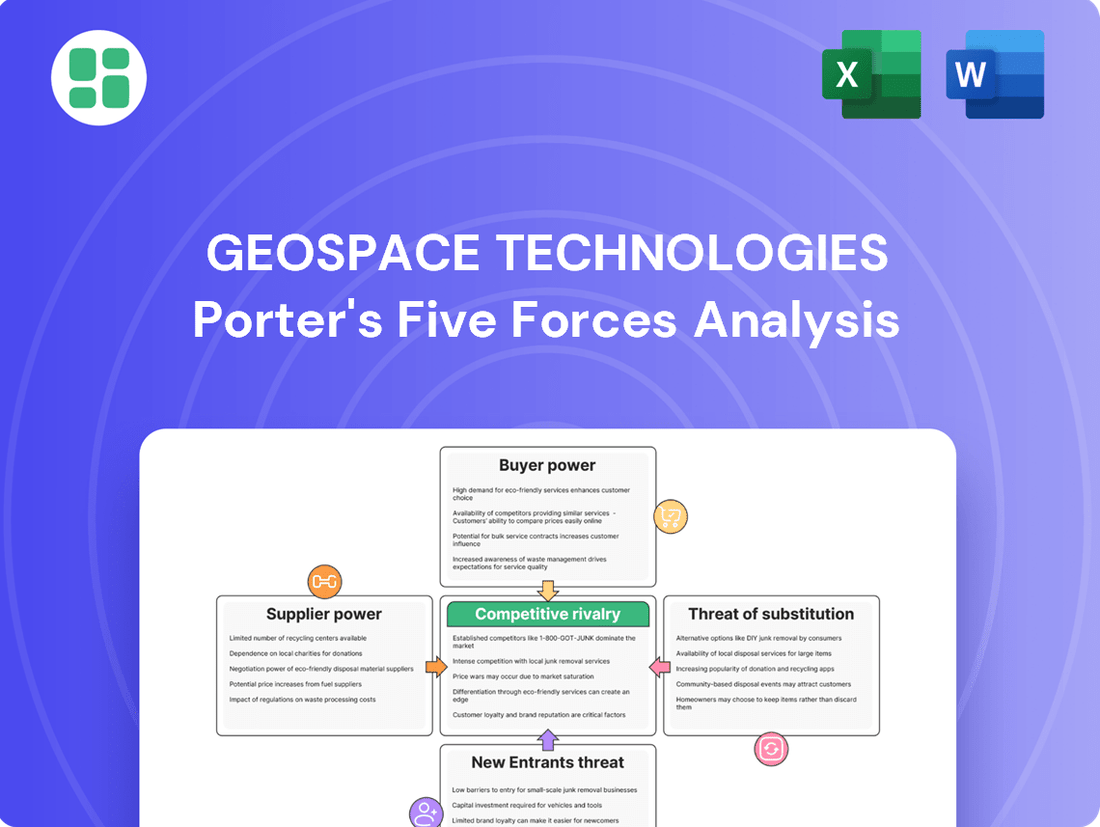

Geospace Technologies Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Geospace Technologies Bundle

Geospace Technologies operates in a market shaped by moderate bargaining power of buyers and suppliers, and a significant threat from substitutes in seismic data acquisition. The intensity of rivalry among existing competitors is also a key factor influencing profitability.

The complete report reveals the real forces shaping Geospace Technologies’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Geospace Technologies' dependence on specialized electronic components and raw materials for its seismic sensors and other electronics is a key factor in assessing supplier power. If these critical inputs are proprietary or come from only a handful of vendors, those suppliers gain significant leverage.

The limited availability of alternative sources for essential materials directly translates to increased supplier bargaining power. This means suppliers can more easily influence pricing and terms, potentially impacting Geospace Technologies' production costs and profitability.

The cost and complexity for Geospace Technologies to switch suppliers are a significant factor in determining supplier power. If changing suppliers requires substantial investment in retooling, re-certification of components, or even redesigning products, existing suppliers gain considerable leverage. This is especially true for highly integrated or specialized components critical to Geospace's defense and healthcare sectors.

The bargaining power of suppliers for Geospace Technologies is significantly influenced by how critical their specific inputs are to Geospace's final product quality and performance. If a supplier provides a highly specialized sensor component essential for the accuracy of seismic data acquisition or the reliability of Geospace's smart water solutions, that supplier gains considerable leverage. For example, in 2023, Geospace reported that its seismic data acquisition and processing segment, which relies heavily on specialized sensor technology, accounted for a substantial portion of its revenue, highlighting the importance of these critical components.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers can significantly impact Geospace Technologies. If suppliers begin producing the finished goods that Geospace currently offers, they could effectively become competitors. This scenario directly enhances their bargaining power by diminishing Geospace's reliance on their specialized components or services.

While this threat is generally lower for suppliers of highly specialized inputs, it becomes more pronounced if a supplier possesses the necessary technical expertise and established market channels. For instance, if a supplier of advanced seismic sensors also developed the capability to assemble and market complete seismic acquisition systems, Geospace would face direct competition from its own supply chain. This would force Geospace to potentially renegotiate terms or face losing market share to its former supplier.

Consider the broader industry landscape. In 2024, many technology-driven sectors are seeing increased vertical integration. Companies that previously supplied components are now exploring opportunities to capture more value by moving downstream. This trend, driven by a desire for greater control over the value chain and direct customer relationships, means Geospace must remain vigilant about its supplier relationships and potential competitive threats emerging from within its own supply base.

- Supplier Capability Assessment: Geospace should continuously assess the technical and market capabilities of its key suppliers to identify potential forward integration risks.

- Diversification of Supply: Maintaining relationships with multiple qualified suppliers for critical components can mitigate the impact of any single supplier attempting to integrate forward.

- Contractual Safeguards: Exploring contractual clauses that limit suppliers' ability to compete directly in Geospace's core markets can provide a layer of protection.

- Value Chain Analysis: Understanding where value is created in the seismic technology sector helps Geospace identify areas where supplier integration is most likely and most threatening.

Volume of Purchases by Geospace

The volume of Geospace's purchases significantly influences its bargaining power with suppliers. If Geospace represents a substantial portion of a supplier's revenue, it gains considerable leverage in negotiating prices and terms. For instance, if Geospace were to account for over 15% of a key component supplier's annual sales, that supplier would be more inclined to offer favorable pricing to retain Geospace's business.

Conversely, when Geospace's orders are a minor part of a supplier's overall business, its ability to influence pricing or secure preferential treatment is reduced. A supplier selling to thousands of clients, with Geospace making up less than 1% of their sales, would have less incentive to concede on price or terms.

- Geospace's purchase volume as a percentage of a supplier's total output is a key determinant of bargaining power.

- A higher percentage grants Geospace greater leverage in negotiations.

- Conversely, a low percentage diminishes Geospace's ability to influence supplier terms.

- For example, if Geospace is a significant client for a specialized seismic sensor manufacturer, it can negotiate better pricing compared to a supplier of generic office supplies.

The bargaining power of suppliers for Geospace Technologies is shaped by the criticality of their offerings and the availability of alternatives. When suppliers provide unique, proprietary components essential for Geospace's advanced seismic data acquisition systems, their leverage increases significantly. This is particularly true for specialized electronic components where few, if any, substitutes exist. For example, in 2023, Geospace's seismic segment, a core revenue driver, relied heavily on these sophisticated sensor technologies, underscoring supplier importance.

The cost and effort involved for Geospace to switch suppliers also bolster supplier power. If changing vendors requires substantial investment in retooling, component re-certification, or even product redesign, existing suppliers gain considerable leverage. This is especially relevant for highly integrated or specialized inputs critical to Geospace's performance in demanding sectors like defense and healthcare.

Geospace's purchase volume relative to a supplier's total sales is a critical factor. If Geospace constitutes a significant portion of a supplier's business, it gains greater negotiating power. For instance, if Geospace represents over 15% of a specialized component supplier's annual revenue, that supplier is incentivized to offer favorable pricing to retain the business. Conversely, if Geospace's orders are a small fraction of a supplier's overall sales, its ability to influence pricing or terms is diminished.

| Factor | Impact on Geospace Technologies | Example/Data Point (2023-2024) |

|---|---|---|

| Component Criticality & Uniqueness | High supplier power when components are proprietary and essential for product performance. | Seismic sensors are critical for data acquisition accuracy; limited alternatives. |

| Switching Costs | High costs to switch suppliers increase existing supplier leverage. | Retooling and re-certification for specialized electronics can be substantial. |

| Geospace's Purchase Volume | Greater power for Geospace when it represents a significant portion of a supplier's revenue. | If Geospace is >15% of a supplier's sales, it has more negotiation leverage. |

What is included in the product

This Porter's Five Forces analysis for Geospace Technologies dissects the competitive intensity within its industry, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the rivalry among existing competitors.

Instantly identify and address competitive threats with a dynamic Porter's Five Forces analysis, simplifying complex market pressures into actionable insights.

Customers Bargaining Power

Geospace Technologies has historically faced significant customer concentration, particularly within the oil and gas industry. This means a few large energy companies represented a substantial portion of their revenue.

This concentration grants these major clients considerable bargaining power. Losing even one of these key customers could have a material impact on Geospace's financial performance, as evidenced by past revenue fluctuations tied to specific project wins or losses.

However, Geospace is actively working to mitigate this by diversifying into markets like smart water, industrial applications, and defense. This strategic shift aims to broaden their customer base, thereby reducing reliance on any single sector or client and lessening the overall bargaining power of individual customers.

Customer switching costs play a crucial role in shaping their bargaining power. When customers face significant hurdles in moving to a competitor, their ability to demand lower prices or better terms from Geospace Technologies diminishes. For instance, if Geospace's seismic data acquisition and processing solutions require substantial investment in specialized hardware or software integration, this creates a barrier for customers looking to switch.

Geospace Technologies' OptoSeis® fiber optic sensing technology is a prime example. Implementing such advanced, integrated systems often entails considerable upfront costs and a learning curve for users. These high integration and operational setup expenses effectively raise the switching costs for clients, thereby strengthening Geospace's position by reducing the immediate threat of customer defection to alternative monitoring solutions.

Customers' price sensitivity is a crucial element in assessing bargaining power. In the oil and gas sector, where Geospace Technologies operates, this sensitivity can be quite high. For instance, during periods of low oil prices, such as those experienced in early 2020, exploration and production companies tend to reduce capital expenditures significantly, making them highly focused on cost. This directly impacts Geospace's ability to command premium pricing for its seismic data acquisition technologies.

However, in more diversified markets like smart water management, the dynamic shifts. Here, customers are often more focused on the long-term value proposition, such as reduced operational costs and improved efficiency. Geospace's solutions in this area, which can lead to substantial savings over time, may therefore face less immediate price pressure compared to the more volatile oil and gas market. This suggests a varying degree of price sensitivity depending on the end market.

Threat of Backward Integration by Customers

The threat of backward integration by customers poses a significant concern for Geospace Technologies. This means customers might decide to produce the specialized seismic equipment or sensors internally, rather than purchasing them. For highly complex and capital-intensive manufacturing, this is generally a low probability, but it's a factor that can increase customer leverage.

While building Geospace's sophisticated technology is a substantial undertaking, especially for those without extensive R&D and manufacturing expertise, larger, well-funded clients with strong engineering capabilities could potentially explore this avenue. This potential for self-sufficiency directly enhances their bargaining power.

- Customer Integration Threat: Customers could develop their own seismic equipment, reducing reliance on Geospace.

- Complexity Barrier: The high technical and capital demands of Geospace's products make this a challenging prospect for most customers.

- Potential for Leverage: Significant R&D capabilities in large clients could theoretically enable backward integration, increasing their bargaining power.

Availability of Substitute Products/Services for Customers

The ease with which customers can find comparable alternatives significantly influences their bargaining power. For Geospace Technologies, if clients can readily source seismic data acquisition solutions or industrial sensors from other providers that meet their needs, they gain leverage. This is particularly relevant in markets where technological advancements can be replicated or where established competitors offer similar functionalities.

Geospace's strategy to counter this involves differentiating its offerings through advanced technology and specialized services. By providing unique capabilities or superior performance, the company aims to reduce the perceived substitutability of its products. This focus on innovation is crucial for maintaining pricing power and customer loyalty in a competitive landscape.

- High Availability of Substitutes: Customers can easily switch to alternative seismic data acquisition or sensor providers if Geospace's offerings are not sufficiently differentiated.

- Customer Leverage: The presence of numerous comparable solutions empowers customers, allowing them to negotiate better prices or terms.

- Geospace's Mitigation Strategy: The company invests in advanced technology and unique features to reduce the appeal of substitutes and strengthen its market position.

Geospace Technologies faces significant customer bargaining power, particularly from its core oil and gas clients, due to historical customer concentration. This concentration means a few large energy companies represent a substantial portion of their revenue, giving them leverage to negotiate pricing and terms. For example, in 2023, the oil and gas sector remained a primary market, though the company actively sought diversification to mitigate this reliance.

High switching costs, driven by the integration of Geospace's advanced technologies like OptoSeis®, limit customer power. Implementing these systems involves considerable upfront investment and a learning curve, making it costly for clients to transition to competitors. This technological lock-in strengthens Geospace's position by reducing the immediate threat of customer defection.

Customer price sensitivity varies by market; it's high in the volatile oil and gas sector, impacting Geospace's pricing during downturns. Conversely, in markets like smart water, customers prioritize long-term value and efficiency, making them less sensitive to immediate price demands. This market differentiation affects the degree of customer bargaining power.

| Factor | Impact on Geospace | Mitigation Strategy |

|---|---|---|

| Customer Concentration | High bargaining power for major clients. | Diversification into new markets (e.g., smart water, defense). |

| Switching Costs | Low bargaining power due to integration complexity. | Developing advanced, integrated technologies (e.g., OptoSeis®). |

| Price Sensitivity | Varies by sector; high in oil & gas, lower in smart water. | Focusing on value proposition and long-term savings in diversified markets. |

| Backward Integration Threat | Potential leverage for large, capable clients. | Maintaining technological superiority and R&D investment. |

| Availability of Substitutes | Customer leverage if offerings are not differentiated. | Continuous innovation and unique product features. |

Full Version Awaits

Geospace Technologies Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. The comprehensive Porter's Five Forces analysis of Geospace Technologies meticulously details the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. This professionally crafted report is ready for your immediate use upon purchase.

Rivalry Among Competitors

Geospace Technologies faces a competitive environment populated by a mix of large, established companies and smaller, specialized firms. In the oil and gas exploration sector, giants like Schlumberger and Halliburton are significant players, offering a broad range of services and products that can overlap with Geospace's offerings. These larger competitors often possess greater financial resources and market reach.

Beyond these major players, companies like Sercel also represent direct competition, particularly in seismic data acquisition technology. The presence of numerous direct competitors across its various market segments means Geospace must continually innovate and differentiate its products and services to maintain its market position. For instance, in 2023, the global oilfield services market was valued at approximately $250 billion, indicating a substantial market with significant competitive pressures.

The growth rate within Geospace Technologies' core markets directly shapes the intensity of competitive rivalry. Historically, the oil and gas seismic sector has faced periods of subdued demand and price fluctuations, which often translates into heightened competition as companies vie for a limited pool of projects. This dynamic was evident in 2023, where the seismic acquisition market saw significant competition for projects, impacting pricing power for service providers.

However, the burgeoning Smart Water and Intelligent Industrial segments present a different competitive landscape. These emerging markets, characterized by higher growth potential, could potentially dilute the overall rivalry intensity for Geospace by offering new avenues for expansion and market share capture. For instance, the global smart water market is projected to grow at a CAGR of over 15% through 2028, indicating substantial opportunities that may temper aggressive competition compared to more mature industries.

Geospace Technologies' efforts to differentiate its offerings, such as its Mariner™ seismic acquisition system and OptoSeis® technology, directly influence competitive rivalry. By highlighting superior performance and reliability, particularly with products like its Hydroconn® connectors, Geospace aims to cultivate strong customer loyalty, thereby mitigating intense price-based competition.

Exit Barriers for Competitors

High exit barriers can significantly influence competitive rivalry within an industry. When it's difficult or costly for companies to leave the market, even those performing poorly may continue to operate, intensifying competition as they strive for survival. This is particularly true in capital-intensive sectors.

Geospace Technologies operates in the seismic equipment manufacturing industry, which is inherently capital-intensive. This means that companies have substantial investments in specialized assets, such as advanced manufacturing facilities and unique testing equipment. The specialized nature of these assets makes them difficult to repurpose or sell, creating a significant hurdle for companies looking to exit the market.

Furthermore, long-term contracts with clients and substantial employee severance costs can also contribute to high exit barriers. These commitments can lock companies into operations, even when profitability wanes. For instance, if a company has secured multi-year supply agreements for seismic sensors, terminating these contracts could incur substantial penalties, forcing them to remain operational.

- Specialized Assets: Geospace Technologies' reliance on highly specific seismic data acquisition and processing hardware, which has limited alternative uses.

- Long-Term Contracts: Existing agreements for equipment supply or service provision that obligate continued operation.

- Employee Severance Costs: Potential significant payouts for a specialized workforce if operations are ceased.

- Capital Investment: The substantial upfront investment in manufacturing plants and research and development for seismic technology acts as a deterrent to exiting.

Competitive Strategies and Intensity

Competitive rivalry within Geospace Technologies' markets is robust, extending beyond mere pricing to encompass innovation, technological prowess, and the quality of services offered. Companies actively vie for market share by developing advanced, next-generation products and securing significant contracts, such as the notable Petrobras deal, which underscores the importance of technological leadership and client relationships.

This intense competition is further fueled by the continuous drive to explore and penetrate new application areas for seismic technologies. Geospace’s strategic focus on expanding its offerings, for instance, into areas like environmental monitoring or industrial inspection, highlights the dynamic nature of its competitive landscape. The company’s ability to adapt and innovate is crucial for maintaining its edge.

- Innovation as a Differentiator: Geospace competes not just on price but on the sophistication and performance of its seismic data acquisition and processing solutions.

- Contract Wins as Milestones: Securing large-scale projects, like the Petrobras contract, demonstrates technological capability and market trust, intensifying rivalry among peers vying for similar opportunities.

- Market Expansion: The pursuit of new applications for existing and developing technologies signifies a strategic effort to outmaneuver competitors by broadening the addressable market.

- Technological Advancement: Continuous investment in R&D to create cutting-edge products is a primary battleground, as demonstrated by the industry's rapid evolution towards more efficient and higher-resolution seismic imaging.

Geospace Technologies operates in a highly competitive arena, facing pressure from both large, established players and nimble, specialized firms in the oil and gas sector. Companies like Schlumberger and Halliburton, with their vast resources and market presence, present a significant challenge, as do specialists such as Sercel in seismic technology.

The intensity of this rivalry is directly linked to market conditions; downturns in oil and gas exploration, like those experienced in 2023, often lead to more aggressive competition for fewer projects, impacting pricing. However, the growth in emerging areas like smart water, projected to expand at over 15% annually through 2028, offers potential relief from this intense rivalry by opening new avenues for growth.

Geospace actively combats this rivalry by focusing on technological differentiation, exemplified by its Mariner™ seismic acquisition system and OptoSeis® technology, aiming to build customer loyalty and reduce reliance on price-based competition.

The capital-intensive nature of seismic technology manufacturing creates high exit barriers, meaning companies tend to stay in the market even when struggling, which can further intensify competition. These barriers include substantial investments in specialized assets and the potential costs associated with long-term contracts and specialized workforces.

| Competitor Type | Key Characteristics | Impact on Geospace |

|---|---|---|

| Large Oilfield Service Companies | Greater financial resources, broader service offerings, established market reach | Intense competition for projects, potential price pressure |

| Specialized Seismic Technology Firms | Focused expertise, advanced product development (e.g., Sercel) | Direct competition on technological innovation and performance |

| Emerging Market Players | Operating in high-growth segments (e.g., Smart Water) | Potential for market share capture, potentially lower initial rivalry intensity |

SSubstitutes Threaten

The threat of substitutes for Geospace Technologies' offerings is significant, stemming from alternative technologies that can meet similar customer needs. For instance, in the oil and gas sector, exploration companies might increasingly rely on non-seismic methods or advanced data analytics, thereby diminishing the demand for traditional seismic data acquisition solutions. This shift presents a direct substitute for Geospace's core seismic sensing and data processing products.

Similarly, within the smart water market, Geospace's IoT-based solutions face substitution from alternative technologies. These could include different types of IoT platforms, or even a return to less technologically advanced, manual data collection and management processes if cost or complexity become prohibitive for certain users. The availability of these alternatives directly impacts the pricing power and market share potential for Geospace's smart water technologies.

Customers are always on the lookout for better value, meaning they'll switch to substitute products if those alternatives offer a more appealing price-performance ratio. If a simpler, less sophisticated solution can meet essential needs at a significantly lower cost, it presents a substantial challenge to Geospace Technologies.

Geospace's business model hinges on its ability to deliver advanced technology that provides superior performance, thereby justifying its premium pricing. For instance, while seismic data acquisition systems are complex, the emergence of more affordable, albeit less precise, alternatives in certain niche applications could entice price-sensitive clients.

Geospace Technologies faces a moderate threat from substitutes, largely influenced by customer willingness to adopt new technologies. For instance, in sectors like oil and gas exploration, where Geospace has significant presence, the shift to alternative seismic data acquisition methods or cloud-based processing solutions depends on the perceived cost savings and efficiency gains. While some advanced industrial applications might readily adopt new approaches, traditional sectors with substantial investments in existing infrastructure may be slower to transition.

Indirect Substitutes from Data Analytics

The threat of indirect substitutes, particularly from advancements in data analytics and artificial intelligence, is a significant consideration for Geospace Technologies. As analytical tools become more sophisticated, they can potentially derive valuable insights from existing data or alternative sources, thereby diminishing the reliance on specialized physical data acquisition methods. This could impact demand for Geospace's seismic sensors and related technologies if companies find more cost-effective or efficient ways to gather and interpret necessary information.

For instance, advancements in AI-powered seismic interpretation software could reduce the need for extensive field data collection in some exploration scenarios. Companies might leverage machine learning algorithms to analyze smaller datasets or even satellite imagery to infer subsurface conditions, thereby bypassing the need for some of Geospace's traditional offerings.

- AI-driven seismic interpretation: Emerging AI platforms are demonstrating capabilities in analyzing seismic data with increased speed and accuracy, potentially reducing the volume of raw data required.

- Alternative data sources: The increasing availability and affordability of data from sources like satellite imagery, drone-based sensors, and existing well logs offer alternative avenues for geological analysis.

- Cost-efficiency of analytics: While Geospace's hardware is critical, the ongoing operational costs associated with deploying and maintaining physical sensors can be high. Advanced analytics, if successful, could present a more economically attractive alternative for certain applications.

Regulatory or Environmental Shifts

Changes in regulations or environmental priorities can significantly influence the appeal and adoption of substitute technologies. For example, a heightened global commitment to combating climate change, as evidenced by the continued expansion of the Paris Agreement's signatories and the increasing urgency around decarbonization targets, could accelerate the shift away from fossil fuels.

This transition directly impacts industries reliant on traditional energy exploration. A stronger push for renewable energy sources, such as offshore wind and solar power, may lead to reduced long-term demand for seismic exploration services in the oil and gas sector. Consequently, investments that might have previously flowed into Geospace's core business could be diverted towards green technologies, acting as a substitute.

- Regulatory Impact: Stricter environmental regulations can increase the cost of traditional energy exploration, making alternatives more competitive.

- Environmental Priorities: A global focus on sustainability and reduced carbon emissions incentivizes the development and deployment of green technologies.

- Market Shift: For instance, the International Energy Agency reported in 2024 that renewable energy capacity additions reached record levels, signaling a substantial market shift.

- Substitution Effect: This trend could diminish the demand for Geospace's seismic data acquisition and processing services in the energy sector, as capital is reallocated to renewable infrastructure.

The threat of substitutes for Geospace Technologies is moderate but growing, particularly from advancements in data analytics and alternative data sources. For instance, AI-driven seismic interpretation tools can potentially reduce the need for extensive physical data acquisition, as demonstrated by the increasing accuracy of these platforms. Furthermore, shifts in global energy priorities, driven by climate change concerns and regulatory changes, are accelerating the move towards renewable energy, which may reduce long-term demand for traditional oil and gas exploration services that rely on Geospace's core technologies.

| Substitute Type | Description | Impact on Geospace | Example Data (2024) |

|---|---|---|---|

| Advanced Data Analytics & AI | AI algorithms analyzing existing or alternative data for insights. | Can reduce reliance on specialized physical sensors. | AI in seismic interpretation is projected to grow significantly, with market reports indicating substantial CAGR in the coming years. |

| Alternative Data Sources | Satellite imagery, drone sensors, well logs. | Offer complementary or alternative geological analysis. | Investment in Earth Observation data services, including satellite imagery, saw continued growth in 2024. |

| Shift to Renewables | Increased investment in solar, wind, and other green energy. | Decreases demand for oil and gas exploration services. | Global renewable energy capacity additions reached record levels in 2024, with significant capital reallocation from fossil fuels. |

Entrants Threaten

The substantial capital needed to develop and produce specialized equipment, such as seismic sensors and advanced electronics, presents a significant barrier for new companies entering the market. Geospace Technologies' established manufacturing infrastructure and research and development investments create a high entry cost.

Geospace Technologies' robust portfolio of proprietary technologies, including its OptoSeis fiber optic sensing solutions and Hydroconn connectors, presents a significant hurdle for potential new entrants. These patented innovations and deep engineering know-how are not easily replicated, requiring substantial research and development investment for competitors to match Geospace's product performance and market position.

Existing companies in the seismic technology sector, such as Geospace Technologies, often benefit from significant economies of scale. This means they can produce their specialized equipment at a lower cost per unit due to higher production volumes, which is a considerable hurdle for newcomers. For instance, in 2023, Geospace reported revenue of $158.4 million, indicating a substantial operational footprint that smaller entrants would find difficult to match immediately.

The experience curve also plays a crucial role, giving established players an advantage. Years of refining manufacturing processes, optimizing supply chains, and developing deep technical expertise translate into greater efficiency and potentially higher quality. This accumulated knowledge is not easily replicated by new market entrants, creating a steep learning curve and a cost disadvantage.

Access to Distribution Channels and Customer Relationships

Geospace Technologies benefits significantly from its deeply entrenched distribution channels and long-standing customer relationships, particularly within the oil and gas sector. These established ties act as a formidable barrier to entry for potential new competitors. For instance, securing contracts with major oil and gas exploration companies, government agencies, and large utility providers requires extensive vetting, proven reliability, and often, years of successful collaboration. This makes it incredibly difficult for newcomers to gain immediate traction and market access.

The time and capital investment needed to replicate Geospace's existing network are substantial. Building trust and proving technical capabilities to these critical clients is a lengthy process. In 2024, the energy sector continued to prioritize proven partners, with many large projects requiring established track records and extensive support infrastructure that new entrants would struggle to provide quickly.

- Established Distribution: Geospace's access to critical distribution networks for seismic data acquisition equipment and services is well-developed, making it hard for new firms to find reliable pathways to market.

- Customer Loyalty: Long-term contracts and strong relationships with key clients in the oil and gas industry, government, and utilities create significant switching costs for customers.

- Time and Investment Barriers: The considerable time and financial resources required to build comparable customer relationships and distribution networks present a high hurdle for new entrants.

- Proven Track Record: Geospace's history of reliable performance and service delivery fosters customer loyalty, a factor that new competitors must overcome through superior offerings or aggressive market penetration strategies.

Regulatory Hurdles and Certification

Geospace Technologies operates in sectors like defense, healthcare, and water utilities, all characterized by rigorous regulatory frameworks. These industries demand specific certifications and adherence to compliance standards, making it difficult for newcomers to enter the market. For instance, in the defense sector, obtaining necessary security clearances and product certifications can take years and involve substantial investment, acting as a significant deterrent to potential competitors.

The cost and complexity associated with meeting these stringent requirements present a substantial barrier. New entrants must invest heavily in product testing, quality assurance, and navigating bureaucratic approval processes. This financial and temporal commitment often outweighs the potential rewards for smaller or less established companies, thereby protecting Geospace Technologies from immediate competitive threats.

- Defense Sector Compliance: Companies must meet strict ITAR (International Traffic in Arms Regulations) and other national security standards, often requiring extensive background checks and facility audits.

- Healthcare Industry Standards: FDA (Food and Drug Administration) approvals for medical devices, for example, involve rigorous clinical trials and quality management systems, a lengthy and expensive undertaking.

- Water Utility Regulations: Ensuring products meet EPA (Environmental Protection Agency) standards for water quality and safety involves complex testing and validation protocols.

The threat of new entrants for Geospace Technologies is moderately low due to substantial barriers. High capital requirements for specialized equipment, proprietary technology, and established distribution networks make it difficult for newcomers to compete effectively. For example, in 2024, the energy sector's continued focus on proven reliability in seismic technology projects favors established players like Geospace, further solidifying these entry barriers.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Geospace Technologies is built upon a foundation of publicly available financial reports, industry-specific market research, and competitor disclosures. We also incorporate data from regulatory filings and relevant trade publications to capture a comprehensive view of the competitive landscape.