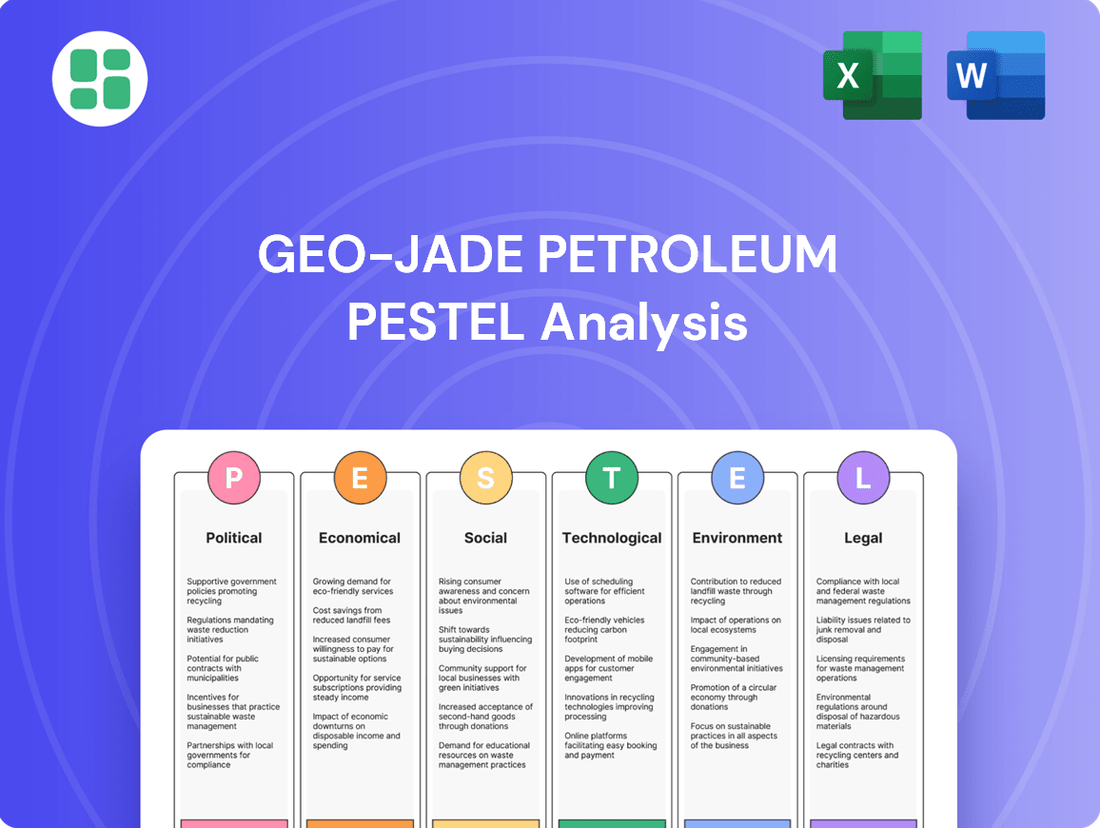

Geo-Jade Petroleum PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Geo-Jade Petroleum Bundle

Navigate the complex external forces shaping Geo-Jade Petroleum's future with our comprehensive PESTLE analysis. Understand how political stability, economic shifts, and technological advancements are creating both challenges and opportunities for the company. Equip yourself with actionable intelligence to refine your investment strategy and gain a competitive edge. Download the full PESTLE analysis now for immediate access to these critical insights.

Political factors

Geo-Jade Petroleum's extensive oil and gas operations in Central Asia are intrinsically linked to the region's geopolitical stability. Fluctuations in political landscapes directly impact asset security and operational continuity, influencing the company's investment climate. For instance, ongoing border disputes or shifts in regional power dynamics can create significant operational hurdles and increase the company's risk exposure.

China's energy security policies are a critical factor for Geo-Jade Petroleum. The nation's strategy focuses heavily on increasing domestic oil and gas production, aiming to reduce reliance on imports. For instance, China's crude oil output reached approximately 4.2 million barrels per day in early 2024, showcasing its commitment to bolstering internal supply.

These policies also involve diversifying import sources, ensuring a stable flow of energy from various regions. This diversification strategy, coupled with efforts to expand strategic reserves, aims to create a resilient energy system capable of weathering global supply disruptions. Such initiatives present opportunities for companies like Geo-Jade that can support China's production goals or contribute to its diversified import network.

However, the emphasis on self-reliance and strategic control within China's energy sector can also introduce challenges. Increased state intervention or heightened competition from state-owned enterprises might impact market access and operational flexibility for foreign players. China's long-term energy security plan is designed to ensure stability even in extreme geopolitical or economic scenarios.

Government oil and gas policies and regulations are paramount for Geo-Jade Petroleum. The specific licensing terms, royalty structures, and taxation regimes implemented in Central Asian countries like Uzbekistan and China directly influence the company's financial performance and operational expenses. For example, shifts in production sharing agreements or local content mandates can significantly alter profitability.

In 2024, for instance, several Central Asian nations continued to refine their upstream regulations to attract foreign investment while ensuring national benefit. Uzbekistan, a key operational area for Geo-Jade, has been actively reviewing its fiscal terms to align with global energy market dynamics. Changes in these areas can directly impact Geo-Jade's cost of production and the ultimate revenue it retains from its operations, making regulatory foresight essential for strategic planning.

International Sanctions and Trade Relations

International sanctions, particularly those impacting oil-producing nations or involving major trading partners like China, present a significant political factor for Geo-Jade Petroleum. The imposition or relaxation of these sanctions directly influences Geo-Jade's operational capacity, market access, and its ability to procure essential equipment and funding. For instance, the ongoing geopolitical tensions and evolving trade policies, including those between the US and China, can create volatility in global oil prices. This uncertainty directly affects the investment climate and the overall risk profile for companies with international footprints like Geo-Jade.

The impact of these geopolitical dynamics is substantial. For example, in 2023, global oil prices experienced fluctuations driven by supply concerns stemming from geopolitical events in Eastern Europe and the Middle East. These price swings, often exacerbated by trade disputes, can significantly alter Geo-Jade's revenue streams and profitability projections. Furthermore, sanctions can restrict access to critical technologies and financial markets, potentially hindering exploration and production activities.

- Sanctions Impact: Restrictions on technology transfer and financing due to sanctions can impede Geo-Jade's access to advanced drilling equipment and capital.

- Trade Disputes: Broader trade disputes involving China, a key market, can lead to tariffs or other trade barriers affecting the cost of imported goods and the competitiveness of exported products.

- Price Volatility: Geopolitical tensions in major oil-producing regions in 2023 contributed to Brent crude oil prices averaging around $82 per barrel, creating an unpredictable revenue environment.

- Investment Climate: Uncertain trade relations and sanctions regimes can deter foreign investment in the energy sector, impacting Geo-Jade's ability to attract partnerships and capital.

Bilateral Relations and Investment Treaties

The strength of bilateral relations between China and Central Asian nations significantly impacts Geo-Jade Petroleum's cross-border ventures. Strong diplomatic ties foster a more predictable and supportive environment for investments, crucial for maintaining operational stability in regions like Kazakhstan and Uzbekistan. China's increasing reliance on Central Asian energy resources, evidenced by the China-Central Asia Gas Pipeline network, underscores the strategic importance of these relationships for energy security.

Investment protection treaties are vital for companies like Geo-Jade. These agreements offer legal safeguards and clear dispute resolution processes, mitigating political and expropriation risks. For instance, China has numerous bilateral investment treaties (BITs) with Central Asian countries, providing a framework for fair treatment and protection of Chinese investments. In 2023, China's outward foreign direct investment (OFDI) reached $137.4 billion, with a significant portion directed towards energy and infrastructure in regions with established investment treaties.

China's evolving energy strategy, with its emphasis on diversification and self-reliance, further elevates the importance of stable relationships with resource-rich Central Asian neighbors. This strategic alignment encourages long-term partnerships and joint development projects, benefiting companies like Geo-Jade. The Belt and Road Initiative (BRI) has also played a role in strengthening these economic and political connections.

Key aspects of these bilateral relations include:

- Strategic Energy Partnerships: China's commitment to securing energy supplies from Central Asia, with significant pipeline infrastructure investments.

- Investment Treaties: The presence of bilateral investment treaties providing legal recourse and protection for foreign investors like Geo-Jade.

- Political Stability: The importance of stable political environments in Central Asian countries for sustained operational success.

- Economic Cooperation: Growing trade volumes and joint economic projects between China and Central Asian nations, fostering mutual economic benefits.

Government policies in Central Asia directly shape Geo-Jade's operational landscape. For example, Uzbekistan's 2024 energy strategy aims to attract further foreign investment in upstream projects, potentially offering favorable fiscal terms. These national policies, alongside regional stability, are crucial for Geo-Jade's asset security and investment decisions.

China's drive for energy self-sufficiency influences Geo-Jade's market opportunities. While China's crude oil production hovered around 4.2 million barrels per day in early 2024, its import diversification strategy creates openings for suppliers. However, increased state intervention in China's energy sector could present challenges for foreign entities.

International sanctions create significant risks for Geo-Jade. Geopolitical tensions in 2023 contributed to oil price volatility, with Brent crude averaging around $82 per barrel. Sanctions can restrict access to technology and financing, potentially hindering Geo-Jade's exploration and production activities.

| Political Factor | Impact on Geo-Jade Petroleum | Supporting Data (2023-2024) |

| Central Asian Energy Policies | Influences investment attractiveness and operational terms. | Uzbekistan reviewing fiscal terms for upstream projects in 2024. |

| China's Energy Security Strategy | Creates market opportunities and potential competition. | China's crude oil output ~4.2 mb/d (early 2024); focus on import diversification. |

| International Sanctions & Geopolitics | Affects market access, financing, and price volatility. | Brent crude average ~$82/barrel in 2023 due to geopolitical events. |

What is included in the product

This Geo-Jade Petroleum PESTLE analysis examines the impact of Political, Economic, Social, Technological, Environmental, and Legal factors on the company's operations and strategic planning.

It provides actionable insights into emerging trends and potential challenges within the oil and gas sector, specifically for Geo-Jade Petroleum.

A Geo-Jade Petroleum PESTLE Analysis provides a clear, summarized version of external factors, relieving the pain point of navigating complex market dynamics during strategic planning.

Economic factors

Geo-Jade Petroleum's profitability is directly tied to the often-unpredictable swings in global oil and gas prices. When prices are low, the company's revenue and profits take a hit, making it harder to fund new exploration and production ventures. Conversely, higher prices generally lead to increased earnings.

The oil market in 2024 has presented a mixed picture. While OPEC+ has maintained some control over supply, demand has been variable. Brent crude prices have shown a degree of stability this year, but projections for 2025 suggest potential downward pressure as inventories are expected to build.

The economic trajectory of China and Central Asia significantly shapes energy consumption patterns. China's economic performance, particularly its industrial output, is a key driver for petroleum demand. Despite ongoing government efforts to stimulate the economy, China's electricity consumption, a strong indicator of industrial activity, is anticipated to grow by a more measured 5% in 2025, a slight deceleration from previous years.

A slowdown in China's GDP growth, even with stimulus measures, could directly impact Geo-Jade Petroleum by dampening the demand for its products. Similarly, the economic health of Central Asian nations, many of which are significant energy producers or transit countries, influences regional market dynamics and potential partnerships for Geo-Jade.

The availability and cost of capital are crucial for Geo-Jade Petroleum's growth, directly impacting its ability to fund exploration and boost reserves. Global economic health, interest rate fluctuations, and overall investor sentiment towards the oil and gas industry significantly influence this investment climate.

Despite prevailing economic uncertainties, the oil and gas sector is anticipating a strong 2025, driven by increased capital discipline and strategic investments in innovative technologies. For instance, the International Energy Agency (IEA) projected in late 2024 that global oil and gas investment would rise by approximately 10% in 2025, reaching around $600 billion, signaling a more favorable environment for companies like Geo-Jade.

Inflationary Pressures and Operational Costs

Rising inflation directly impacts Geo-Jade Petroleum by escalating expenses for essential resources like drilling equipment, raw materials, and skilled labor. This surge in operational costs can significantly affect the profitability and feasibility of exploration and production (E&P) projects, which are inherently capital-intensive.

Managing these cost pressures is paramount for Geo-Jade to sustain its financial health. For instance, if the cost of specialized drilling fluids increases by 15% due to inflation, it directly eats into project margins.

The International Monetary Fund (IMF) projects a return to price growth in China for 2025, underscoring the importance for Geo-Jade to closely monitor and adapt to evolving inflationary trends. This suggests a potential need for proactive cost management strategies and contract renegotiations.

- Increased Material Costs: A 10% rise in steel prices, a key component for pipelines and rigs, directly inflates Geo-Jade's capital expenditure.

- Labor Wage Inflation: A projected 5% annual increase in wages for specialized petroleum engineers adds to ongoing operational overhead.

- Equipment Procurement Expenses: Higher global demand for oilfield equipment could lead to a 7% price increase for new drilling rigs in 2025.

- Impact on Project Viability: A sustained inflation rate above 3% could render marginal oil field development projects economically unfeasible.

Currency Exchange Rate Fluctuations

Geo-Jade Petroleum's operations span Central Asia and China, making it susceptible to currency exchange rate fluctuations. Changes between the Chinese Yuan (CNY) and currencies like the Kazakhstani Tenge (KZT) or Uzbekistani Som (UZS) can significantly alter the reported value of its revenues, expenses, and assets. For instance, if the CNY strengthens against a Central Asian currency where Geo-Jade has substantial costs, those costs would effectively increase when translated back into CNY. Conversely, a weaker CNY could boost the reported value of revenues earned in Central Asian markets.

China's policymakers are committed to maintaining the renminbi exchange rate's "basic stability," a key factor for companies like Geo-Jade. This policy aims to reduce volatility and provide a more predictable operating environment. However, global economic pressures and trade dynamics can still lead to shifts. For example, in late 2023 and early 2024, the CNY experienced some weakening against the US dollar, which could have implications for companies with significant international transactions.

- Impact on Revenue: A stronger CNY relative to Central Asian currencies can decrease the reported value of revenues earned in those regions.

- Impact on Costs: Conversely, a weaker CNY can increase the cost of imported equipment or services sourced from countries with stronger currencies.

- Asset Valuation: Fluctuations affect the CNY-denominated value of Geo-Jade's assets located in Central Asia.

- Policy Influence: China's managed approach to the CNY exchange rate aims to mitigate extreme volatility, but does not eliminate all risk.

Global economic growth directly impacts Geo-Jade Petroleum's demand for oil and gas. A robust global economy typically translates to higher energy consumption, benefiting the company. Conversely, economic downturns can lead to reduced demand and lower prices.

The International Monetary Fund (IMF) projected global growth to be around 3.2% in 2024 and anticipates a similar rate for 2025, indicating a generally supportive, albeit not booming, economic environment for energy demand.

China's economic performance is a critical factor, as it is a major consumer of energy. While China's GDP growth is expected to moderate to around 4.6% in 2025, according to various forecasts, this still represents significant demand. Central Asian economies, where Geo-Jade also operates, are influenced by commodity prices and regional stability.

| Economic Indicator | 2024 (Est.) | 2025 (Proj.) | Impact on Geo-Jade |

|---|---|---|---|

| Global GDP Growth | 3.2% | 3.2% | Supports energy demand |

| China GDP Growth | 5.0% | 4.6% | Continued significant demand |

| Brent Crude Oil Price | $80-85/barrel | $75-80/barrel | Moderate revenue impact |

Preview the Actual Deliverable

Geo-Jade Petroleum PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Geo-Jade Petroleum delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain valuable insights into the external forces shaping Geo-Jade Petroleum's operations and strategic decisions.

Sociological factors

Public perception of fossil fuel companies like Geo-Jade Petroleum is significantly shaped by growing global awareness of climate change and Environmental, Social, and Governance (ESG) issues. This heightened awareness translates into tangible pressure from investors, consumers, and regulators who demand more sustainable practices and transparent ESG reporting.

The financial landscape is increasingly prioritizing ESG. For instance, as of early 2025, a significant portion of major institutional investors, estimated to be over 70%, have integrated ESG factors into their investment decisions. This trend is further amplified by evolving regulations, with many jurisdictions implementing mandatory ESG disclosure requirements starting in 2025, directly impacting how companies like Geo-Jade must present their environmental and social impact.

Geo-Jade Petroleum's social license to operate hinges on robust community relations, particularly addressing environmental concerns and ensuring local economic benefits. For instance, in 2024, many oil and gas companies reported increased investment in community development programs, with some allocating over 1% of pre-tax profits to social initiatives, aiming to mitigate potential opposition and ensure operational continuity.

The availability of a skilled workforce, especially in specialized exploration and production within the oil and gas sector, is a critical sociological consideration for Geo-Jade Petroleum. Demographic shifts, educational attainment levels, and intense competition for talent across Central Asia and China directly influence the company's ability to attract and retain the necessary expertise, impacting operational efficiency.

The ongoing digital transformation within the oil and gas industry presents a significant hurdle due to a persistent shortage of digitally skilled labor. For instance, a 2024 report indicated that over 60% of oil and gas companies struggle to find candidates with the specific digital competencies required for advanced analytics and automation, a challenge Geo-Jade will likely face in its operational regions.

Health and Safety Standards

Geo-Jade Petroleum places a high priority on maintaining robust health and safety standards for its workforce, encompassing both employees and contractors. The company recognizes that even a single incident can trigger substantial human suffering, financial losses, and damage to its reputation. Consequently, strict adherence to safety protocols and a persistent focus on fostering a strong safety culture are fundamental to its operations.

In 2024, the oil and gas industry continued to see advancements in safety technology. For instance, the adoption of Artificial Intelligence (AI) and the Internet of Things (IoT) is increasingly being used to monitor conditions, predict potential hazards, and automate dangerous tasks, thereby reducing the risk of human error in complex operations.

- Employee Safety: Geo-Jade's commitment to employee well-being is reflected in its investment in safety training and equipment, aiming to minimize workplace accidents.

- Contractor Management: Ensuring that all contractors meet the company's rigorous safety benchmarks is a key aspect of risk mitigation.

- Technological Integration: The company is exploring and implementing AI and IoT solutions to enhance real-time monitoring and predictive safety analytics in its field operations.

- Regulatory Compliance: Meeting and exceeding industry-specific health and safety regulations is a non-negotiable operational requirement.

Energy Consumption Patterns and Lifestyle Shifts

Societal shifts toward sustainability are significantly impacting energy consumption. In China, for instance, the rapid adoption of electric vehicles (EVs) is already altering gasoline demand patterns. This trend is projected to continue, influencing long-term demand for traditional petroleum products.

Lifestyle changes are a key driver here. As more consumers embrace eco-friendly practices, the preference for alternative energy sources grows. This can lead to a decrease in the consumption of fossil fuels for transportation and other uses.

- EV Market Growth: China's NEV (New Energy Vehicle) sales reached approximately 9.5 million units in 2023, a substantial increase from previous years, directly impacting gasoline consumption.

- Consumer Preferences: Surveys indicate a growing consumer willingness to switch to EVs, driven by environmental concerns and government incentives, which will further shape energy demand.

- Policy Influence: Government targets for EV adoption and emissions reduction are accelerating these lifestyle shifts, creating a more pronounced impact on the petroleum industry.

Public sentiment towards fossil fuel companies is increasingly influenced by climate change awareness and ESG considerations, leading to pressure for sustainable practices and transparent reporting from investors, consumers, and regulators.

The financial sector's focus on ESG is substantial; by early 2025, over 70% of major institutional investors incorporated ESG factors into their decisions, with many jurisdictions implementing mandatory ESG disclosures from 2025 onward.

Geo-Jade Petroleum's operational continuity relies on strong community relations, addressing environmental concerns and ensuring local economic benefits, with many oil and gas firms in 2024 investing over 1% of pre-tax profits in social initiatives.

The availability of a skilled workforce, particularly in specialized oil and gas roles, is a crucial sociological factor, with demographic shifts and educational attainment levels impacting talent acquisition in regions like Central Asia and China.

| Sociological Factor | Impact on Geo-Jade Petroleum | Supporting Data/Trend (2024-2025) |

|---|---|---|

| Public Perception & ESG | Demand for sustainable practices, investor scrutiny | >70% of institutional investors integrating ESG (early 2025); Mandatory ESG disclosures from 2025 |

| Community Relations | Social license to operate, risk mitigation | Oil & gas companies investing >1% pre-tax profits in social initiatives (2024) |

| Skilled Workforce Availability | Operational efficiency, talent retention | Demographic shifts and competition for specialized digital skills impacting hiring |

| Societal Shift to Sustainability | Changing energy consumption patterns | China's NEV sales ~9.5 million units (2023), accelerating EV adoption |

Technological factors

Continuous innovation in drilling, seismic imaging, and reservoir management is crucial for Geo-Jade Petroleum. These advancements directly impact their ability to boost production and efficiently grow reserves. For instance, sophisticated seismic imaging techniques can provide clearer subsurface data, leading to more precise well placement and reduced exploration risk.

Technologies like Enhanced Oil Recovery (EOR) are particularly vital for Geo-Jade, especially in maximizing extraction from their existing, mature fields. Methods such as thermal, gas, and chemical injection are key to unlocking additional hydrocarbons that conventional methods leave behind. The global EOR market is expected to see significant expansion, with projections indicating substantial growth fueled by these very technological leaps.

Geo-Jade Petroleum can significantly enhance its operations by embracing digitalization and artificial intelligence. The oil and gas sector is increasingly adopting technologies like AI, machine learning, and the Internet of Things to streamline processes. These advancements are crucial for predictive maintenance, optimizing drilling, analyzing reservoirs, and real-time monitoring, all contributing to improved efficiency and cost reduction.

The global AI in oil and gas market is projected for substantial growth, expected to reach USD 25.24 billion by 2034. This indicates a strong industry trend towards leveraging AI for competitive advantage. By integrating these digital tools, Geo-Jade can expect to see tangible benefits in operational performance and safety protocols.

The increasing global focus on climate change is driving significant advancements and investment in Carbon Capture, Utilization, and Storage (CCUS) technologies. These innovations are becoming critical for industries aiming to decarbonize their operations.

For Geo-Jade Petroleum, integrating CCUS with Enhanced Oil Recovery (CO2-EOR) presents a dual benefit: reducing operational carbon footprints while potentially boosting oil production. This synergy aligns with growing sustainability mandates and could unlock new revenue opportunities or provide a vital compliance mechanism in a carbon-conscious market.

The CCUS market is projected for substantial growth, with estimates suggesting it could reach over $100 billion by 2030, indicating a strong economic incentive for adoption. Companies exploring CCUS integration, like Geo-Jade, are positioning themselves for future market demands and regulatory landscapes.

Cybersecurity and Data Security

As Geo-Jade Petroleum navigates an increasingly digital landscape, the company faces significant cybersecurity and data security challenges. The oil and gas sector, by its nature, relies heavily on operational technology systems that are becoming more interconnected, creating a larger attack surface for cyber threats. Protecting these critical systems and the vast amounts of sensitive data generated is paramount. For instance, a report by IBM in 2024 indicated that the average cost of a data breach in the energy sector reached $4.73 million, highlighting the severe financial implications of security failures.

Ensuring robust cybersecurity measures is not just about financial protection; it's crucial for maintaining operational continuity. A successful cyberattack could disrupt production, damage infrastructure, or even lead to environmental incidents, as seen in various industrial control system breaches globally. The industry is keenly aware of this, with cybersecurity consistently ranking as a top priority for oil and gas firms heading into 2025. Companies are investing heavily in advanced threat detection, incident response capabilities, and employee training to mitigate these risks.

- Increased Digitalization: The integration of IoT devices and advanced analytics in oil and gas operations expands the potential vulnerabilities to cyberattacks.

- Operational Continuity: Protecting operational technology (OT) systems from cyber threats is vital to prevent disruptions in exploration, production, and distribution.

- Data Integrity and Financial Risk: Safeguarding sensitive company data and financial information from breaches is essential to avoid significant financial losses and reputational damage.

- Industry Trend: Cybersecurity remains a critical focus for the oil and gas industry in 2025, with ongoing investment in advanced security solutions and protocols.

Automation and Robotics

Automation and robotics are significantly reshaping the oil and gas industry, directly impacting companies like Geo-Jade Petroleum. The integration of these technologies promises enhanced operational efficiency and a reduction in human error, particularly crucial in high-risk environments. For instance, robotic solutions are increasingly utilized for critical tasks such as offshore inspections and the optimization of drilling processes through artificial intelligence.

The market for drilling robots alone is projected for substantial growth, with expectations to double by 2032. This trend underscores the industry's commitment to adopting advanced technologies to streamline operations, improve safety protocols, and ultimately boost productivity. Such advancements are vital for maintaining a competitive edge in the dynamic energy sector.

- Efficiency Gains: Automation and robotics streamline drilling, inspection, and maintenance, leading to faster operations and reduced downtime.

- Safety Enhancement: Robots are deployed in hazardous environments, minimizing human exposure to risks and improving overall workplace safety.

- Market Growth: The drilling robot market is anticipated to double by 2032, indicating a strong industry-wide adoption trend.

- AI Integration: Artificial intelligence is being used to optimize drilling parameters, further increasing efficiency and resource utilization.

Technological advancements in digitalization, AI, and automation are transforming Geo-Jade Petroleum's operational landscape. The oil and gas sector is rapidly adopting AI, with the global market projected to reach USD 25.24 billion by 2034, promising enhanced efficiency and cost reduction through predictive maintenance and optimized drilling.

The integration of robotics, particularly in drilling, is expected to see significant growth, with the market projected to double by 2032. This trend highlights a strong industry commitment to improving safety and productivity in hazardous environments, directly benefiting companies like Geo-Jade.

Furthermore, the increasing focus on sustainability is driving innovation in Carbon Capture, Utilization, and Storage (CCUS) technologies, a market anticipated to exceed $100 billion by 2030. Geo-Jade can leverage CO2-EOR to reduce its carbon footprint while potentially boosting production, aligning with evolving environmental regulations and market demands.

However, this increased digitalization also brings heightened cybersecurity risks. The energy sector's average data breach cost reached $4.73 million in 2024, underscoring the critical need for robust protection of operational technology and sensitive data to ensure business continuity and financial stability.

Legal factors

Geo-Jade Petroleum faces a complex web of environmental regulations, particularly concerning emissions, waste disposal, water consumption, and land impact across its operational areas in China and Central Asia. Failure to adhere to these increasingly strict national and international environmental standards can lead to significant financial penalties, costly legal battles, and severe damage to the company's public image.

The evolving landscape of sustainability reporting presents another significant legal challenge. Mandatory disclosures, such as those mandated by the EU's Corporate Sustainability Reporting Directive (CSRD) and forthcoming SEC climate disclosure rules, require companies like Geo-Jade to provide transparent data on their environmental performance, adding a layer of compliance and potential scrutiny.

Legal frameworks for oil and gas exploration and production, encompassing licensing, concession agreements, and production sharing contracts (PSCs), are critical for Geo-Jade Petroleum. Resource ownership laws dictate the fundamental rights and responsibilities associated with extracting hydrocarbons.

In 2024, many nations are reviewing or implementing new regulations aimed at increasing state revenue from oil and gas. For instance, some countries are exploring higher royalty rates or adjusting profit-sharing mechanisms within existing PSCs to capture a larger share of production value, directly affecting Geo-Jade's operational economics.

Local content requirements, a growing trend in 2024 and projected to intensify through 2025, mandate the use of local labor, goods, and services. These regulations can increase operational costs and complexity for Geo-Jade by requiring adjustments to supply chains and workforce management.

Tax laws and royalty rates are crucial for Geo-Jade Petroleum. For instance, in 2024, many oil-producing nations are reviewing their fiscal terms. Some countries are considering reducing royalty rates to attract foreign investment, which could positively impact Geo-Jade's profitability.

Changes in these regimes directly influence the economic feasibility of Geo-Jade's exploration and production projects. A shift in tax policy, such as an increase in corporate income tax, could significantly reduce the net profit margin on existing and future ventures.

For example, if a host country were to increase its royalty rate from 15% to 20% on oil production, this would directly reduce Geo-Jade's revenue per barrel, potentially making marginal fields uneconomical. Conversely, a reduction in royalty rates, perhaps to 12%, could unlock new investment opportunities.

Labor Laws and Worker Safety Regulations

Geo-Jade Petroleum must strictly comply with labor laws governing employment conditions, wages, worker rights, and occupational health and safety. Failure to adhere to these mandates, which are legally binding, can result in significant penalties and reputational damage. For instance, in 2024, China's Ministry of Human Resources and Social Security continued to emphasize strict enforcement of labor contract laws and workplace safety standards across all industries, including the energy sector.

Maintaining a safe and fair working environment is paramount to preventing legal liabilities and fostering positive industrial relations. This includes implementing robust safety protocols and ensuring fair compensation, aligning with international best practices and national regulations. The International Labour Organization (ILO) reported in late 2024 that compliance with occupational safety and health regulations remains a key focus for global energy companies to mitigate risks and protect their workforce.

- Compliance with China's Labor Contract Law: Ensuring all employment agreements meet statutory requirements for terms, conditions, and termination.

- Adherence to Occupational Safety and Health Standards: Implementing and monitoring safety protocols, particularly in hazardous environments like oil extraction and refining.

- Worker Rights Protection: Upholding rights related to fair wages, reasonable working hours, and freedom of association.

- Regulatory Enforcement Trends: Staying updated on governmental crackdowns and penalties for non-compliance, as seen in increased inspections in the petroleum sector throughout 2024.

Anti-Corruption and Transparency Laws

Operating in diverse global markets, Geo-Jade Petroleum is subject to a complex web of anti-corruption and transparency laws. Compliance with international statutes like the U.S. Foreign Corrupt Practices Act (FCPA) and the UK Bribery Act is paramount, alongside adherence to local transparency regulations in each operating jurisdiction. These laws are designed to prevent bribery and promote honest dealings, impacting how the company conducts its business and manages its relationships with government entities and local partners.

The company's commitment to ethical conduct and the implementation of rigorous compliance programs are critical for mitigating significant legal and reputational risks. A strong compliance framework helps prevent violations that could lead to hefty fines, sanctions, and severe damage to investor confidence. For instance, in 2023, companies globally faced billions in penalties for FCPA violations, underscoring the financial and operational consequences of non-compliance.

- FCPA and UK Bribery Act: Strict adherence to these extraterritorial laws is mandatory for companies operating internationally.

- Local Transparency Regulations: Compliance with country-specific rules on disclosure and anti-bribery is essential.

- Risk Mitigation: Robust compliance programs are key to avoiding legal penalties and maintaining market integrity.

- Investor Confidence: Demonstrating a commitment to transparency and ethical practices builds trust with stakeholders.

Geo-Jade Petroleum must navigate evolving tax regimes and royalty structures. In 2024, some oil-producing nations considered adjusting fiscal terms, potentially impacting profit margins. For example, a hypothetical increase in royalty rates from 15% to 20% could significantly reduce revenue per barrel, while a decrease to 12% might unlock new investment opportunities.

Environmental factors

The intensifying global commitment to climate action, marked by ambitious national emissions targets and international accords like the Paris Agreement, directly shapes the operational landscape and future prospects of fossil fuel enterprises. Geo-Jade Petroleum is under increasing pressure to curtail its carbon emissions and transition towards a less carbon-intensive energy model.

To maintain the critical 1.5°C warming limit, global greenhouse gas emissions need to reach their peak by 2025. This urgency compels companies like Geo-Jade to accelerate their adaptation strategies and investments in cleaner energy solutions.

Geo-Jade Petroleum's operations, particularly in Central Asia, face significant challenges due to water scarcity. These oil and gas activities are water-intensive, demanding careful management to ensure sustainability. For instance, the Aral Sea basin, a region where Geo-Jade has interests, has experienced severe water depletion, highlighting the critical need for responsible water sourcing and usage.

Implementing advanced water management strategies, such as recycling produced water and optimizing freshwater consumption, is crucial for Geo-Jade. This approach not only reduces environmental impact but also secures operational continuity in water-stressed areas. By adopting these practices, the company can better navigate the growing global concern over water resource availability, which is projected to intensify in the coming years.

Geo-Jade's exploration and production operations, particularly those in ecologically sensitive regions, carry inherent risks to biodiversity and natural habitats. The company is therefore obligated to conduct thorough environmental impact assessments and implement effective mitigation strategies to safeguard ecosystems and uphold its commitments to biodiversity conservation.

The ongoing expansion of oil and gas activities, with a notable focus on offshore ventures, presents a significant threat to marine biodiversity. For instance, the International Union for Conservation of Nature (IUCN) reported in 2024 that over 42,100 species are threatened with extinction, a figure exacerbated by habitat destruction linked to industrial activities.

Waste Management and Pollution Control

Oil and gas extraction inherently generates diverse waste streams, including drilling muds, produced water, and various hazardous materials. Geo-Jade Petroleum faces significant environmental risks from potential spills or leaks during its operations. Effective waste management and robust pollution control are therefore critical to prevent environmental contamination and ensure regulatory compliance.

In 2024, the global oil and gas industry continued to face scrutiny over its environmental footprint. For instance, the International Energy Agency (IEA) reported that while efforts are being made to reduce emissions, the sector still accounts for a substantial portion of industrial waste. Companies like Geo-Jade must invest in advanced technologies for treating produced water, which can contain high levels of salinity and hydrocarbons, before discharge or reinjection. Furthermore, the proper disposal of drilling fluids, which can contain chemicals and fine rock particles, is paramount. Failure to manage these effectively can lead to soil and water contamination, impacting local ecosystems and potentially incurring significant remediation costs.

To mitigate these risks, Geo-Jade Petroleum is expected to implement comprehensive environmental management systems. Key aspects include:

- Stringent waste segregation and treatment processes for drilling muds and produced water.

- Robust spill prevention and response plans, including regular equipment inspections and containment measures.

- Investment in pollution control technologies to minimize air emissions and prevent water contamination.

- Adherence to evolving environmental regulations, which increasingly focus on circular economy principles for waste reduction and recycling.

Energy Transition and Decarbonization Pressures

The global push for decarbonization is a major environmental challenge for companies like Geo-Jade Petroleum, which primarily deals with hydrocarbons. This trend is intensifying, with many nations setting ambitious net-zero targets. For instance, the International Energy Agency (IEA) reported in 2024 that global clean energy investment is projected to reach $2 trillion in 2024, a significant increase from previous years, highlighting the shift in focus.

This transition puts pressure on traditional oil and gas firms to adapt. Geo-Jade may face growing expectations to either diversify its portfolio into renewable energy sources or invest in technologies that minimize the environmental impact of its current operations. Such investments could include carbon capture, utilization, and storage (CCUS) technologies, which are becoming increasingly crucial for reducing emissions in the oil and gas sector.

- Global Energy Transition: The worldwide shift towards cleaner energy sources is accelerating, driven by climate change concerns and government policies.

- Decarbonization Targets: Many countries have committed to ambitious emissions reduction goals, impacting the demand for fossil fuels.

- Investment in Renewables: Clean energy investments are surging, with projections indicating continued growth through 2025 and beyond.

- Technological Innovation: Companies are pressured to adopt technologies like CCUS to mitigate the environmental footprint of hydrocarbon extraction and production.

Environmental regulations are tightening globally, pushing companies like Geo-Jade Petroleum towards more sustainable practices. The increasing focus on water scarcity, particularly in regions like Central Asia, necessitates advanced water management techniques to ensure operational continuity and minimize ecological impact. Furthermore, the urgent need to address climate change and achieve net-zero targets is driving a significant shift in energy investments towards renewables, creating pressure for oil and gas companies to adapt or invest in emission-reduction technologies.

| Environmental Factor | Impact on Geo-Jade Petroleum | Key Data/Trend |

|---|---|---|

| Climate Change & Decarbonization | Pressure to reduce carbon footprint and transition to cleaner energy. | Global clean energy investment projected to reach $2 trillion in 2024. (IEA) |

| Water Scarcity | Need for efficient water management in operations. | Aral Sea basin, a region of interest for Geo-Jade, faces severe water depletion. |

| Biodiversity & Habitat Protection | Risk to ecosystems from exploration and production activities. | Over 42,100 species threatened with extinction globally as of 2024. (IUCN) |

| Waste Management & Pollution | Requirement for robust waste treatment and spill prevention. | Oil and gas sector still accounts for substantial industrial waste. (IEA, 2024) |

PESTLE Analysis Data Sources

Our Geo-Jade Petroleum PESTLE Analysis is grounded in comprehensive data from international energy organizations, national petroleum agencies, and leading financial news outlets. We incorporate regulatory updates, economic forecasts, and technological advancements from reputable industry research firms and government databases.