Geo-Jade Petroleum Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Geo-Jade Petroleum Bundle

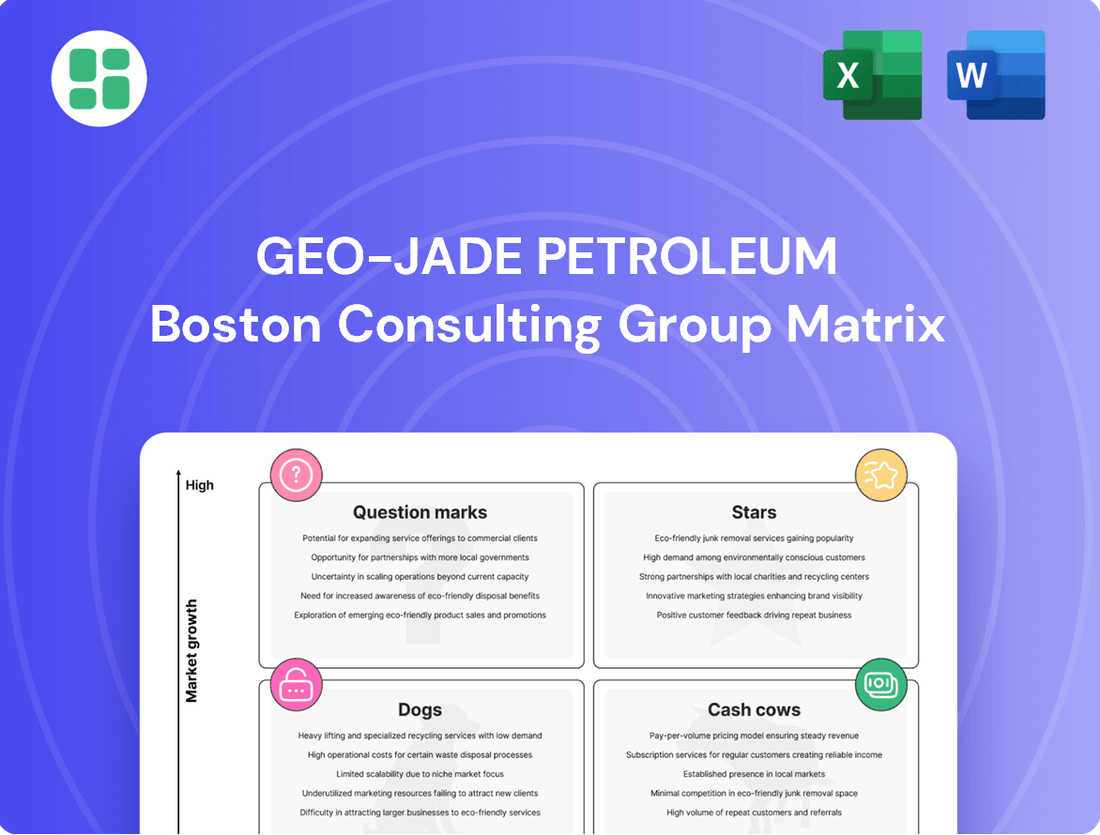

Curious about Geo-Jade Petroleum's product portfolio? Our BCG Matrix preview offers a glimpse into their market position, highlighting potential Stars, Cash Cows, Dogs, or Question Marks. Don't settle for just a peek; unlock the full strategic advantage.

Purchase the complete Geo-Jade Petroleum BCG Matrix to gain a comprehensive understanding of each product's performance and potential. This detailed report provides actionable insights and data-driven recommendations, empowering you to make informed investment and strategic decisions for future growth.

Stars

The Iraq South Basra Integrated Project is a significant undertaking for Geo-Jade Petroleum, focusing on boosting oil production at the Al-Tubba field from 20,000 barrels per day (kb/d) to 100 kb/d. This ambitious expansion, coupled with the development of a large refinery, signals a substantial strategic investment aimed at capturing a leading role in Iraq's burgeoning energy sector.

With a multi-billion dollar capital allocation, this project targets a high-growth market and is positioned to become a major future revenue generator for Geo-Jade. The scale of investment highlights its potential to significantly impact the company's overall market standing and financial performance.

The Huwaiza field in Iraq represents a significant growth opportunity for Geo-Jade Petroleum. Initial production is slated for 10,000 barrels per day (bpd) by 2026, with a broader development aiming for 40,000 bpd within three years. This aggressive expansion plan highlights its status as a high-growth asset.

The planned restart of production at the Naft Khana oil field in Iraq by the first half of 2026, targeting an initial output of 15,000 barrels per day (bpd), positions it as a significant growth opportunity for Geo-Jade Petroleum. This field benefits from existing proven reserves and a documented production history, providing a solid base for swift expansion.

Geo-Jade's strategic investment in Naft Khana, with its potential for substantial output increases beyond the initial 15,000 bpd target, underscores its classification as a Star within the BCG Matrix. The company's ongoing drilling of exploratory and appraisal wells at the site further solidifies its high-growth, high-potential profile, indicating a strong future outlook for this asset.

Strategic Acquisitions in Iraq

Geo-Jade Petroleum's strategic acquisitions in Iraq, specifically their successful bids in 2024 for the Zurbatiya and Jabel Sanam blocks, underscore a forward-thinking approach to securing promising exploration assets. These moves are pivotal for expanding their reserve base and boosting future production in a market showing considerable growth potential. Securing these rights in competitive tender processes signals Geo-Jade's clear intent to cultivate future 'star' assets.

These acquisitions are more than just land grabs; they represent calculated investments into Iraq's evolving energy landscape. The potential for significant reserve discoveries within these blocks positions Geo-Jade to capitalize on future production and market demand. The company's ability to win these exploration rights in 2024 amidst competition highlights their strategic acumen and financial capacity.

- Zurbatiya Block Acquisition: Geo-Jade secured exploration rights in 2024, targeting significant hydrocarbon potential.

- Jabel Sanam Block Acquisition: Another key 2024 acquisition, aimed at expanding the company's future production capacity.

- Strategic Market Entry: These blocks represent entry into a growing Iraqi energy market with substantial upside.

- Future Star Assets: The acquisitions are designed to develop high-potential assets that can become future revenue drivers.

Pre-Caspian Basin Exploration (Balykshy)

The Balykshy project, situated in the pre-salt layers of the Caspian Sea, is a key exploration initiative for Geo-Jade Petroleum. It's characterized by its substantial potential, with projections suggesting an investment return that could be more than twenty times the initial outlay. This high-growth, high-reward profile positions it as a potential Star in the BCG matrix, contingent on successful exploration and development.

This project embodies Geo-Jade's strategy to pursue transformative discoveries in frontier regions. The Caspian Sea is known for its vast hydrocarbon potential, making Balykshy a significant undertaking. If exploration yields positive results, it could significantly boost Geo-Jade's market share and revenue streams, aligning perfectly with Star characteristics.

- Project Status: Pre-salt exploration phase.

- Geographic Location: Caspian Sea.

- Investment Potential: Projected return exceeding 20x.

- Strategic Alignment: High-growth, high-market-share aspiration for Geo-Jade.

Geo-Jade Petroleum's Iraqi ventures, including the South Basra Integrated Project and the Huwaiza field, are prime examples of Star assets. These projects are characterized by high growth potential and are poised to capture significant market share in Iraq's expanding energy sector.

The Naft Khana oil field, with its planned restart and expansion, along with the strategic 2024 acquisitions of the Zurbatiya and Jabel Sanam blocks, further solidify Geo-Jade's portfolio of Stars. These acquisitions represent calculated moves to secure high-potential exploration assets that are expected to drive future production and revenue.

The Balykshy project in the Caspian Sea, with its substantial projected returns, also fits the Star profile. Successful exploration and development here could significantly enhance Geo-Jade's market position and financial performance, aligning with its strategy for high-growth, high-reward opportunities.

| Asset | Location | Current Status/Target | Growth Potential | Market Share Aspiration |

|---|---|---|---|---|

| South Basra Integrated Project | Iraq | Boost production to 100 kb/d; refinery development | High | Leading role in Iraq |

| Huwaiza Field | Iraq | Initial 10,000 bpd by 2026, expanding to 40,000 bpd | High | Significant contributor |

| Naft Khana Field | Iraq | Restart by H1 2026, targeting 15,000 bpd initially | High | Substantial output increase |

| Zurbatiya Block | Iraq | Exploration rights acquired in 2024 | High (exploration potential) | Future production driver |

| Jabel Sanam Block | Iraq | Acquired in 2024 | High (exploration potential) | Future production expansion |

| Balykshy Project | Caspian Sea | Pre-salt exploration | Very High (20x+ projected return) | Transformative discoveries |

What is included in the product

This BCG Matrix analysis for Geo-Jade Petroleum outlines strategic recommendations for each business unit.

It highlights which segments to invest in, hold, or divest based on market growth and share.

The Geo-Jade Petroleum BCG Matrix offers a clear, one-page overview, relieving the pain of complex portfolio analysis.

Cash Cows

Geo-Jade's Maten Petroleum producing fields in Kazakhstan, encompassing the Matin, Eastern Kokarna, and Kara-Arna oil fields, are mature but stable assets. These fields are integral to an upstream project in the Pre-Caspian region, a vital area for oil production.

The Maten fields contribute significantly to Geo-Jade's cash flow, reflecting a strong market presence in a well-established sector. In 2024, Kazakhstan's oil production was projected to reach approximately 1.7 million barrels per day, underscoring the strategic importance of these mature fields within this context.

The KoZhaN JSC assets in Kazakhstan, specifically the Morskoye, Karatal, and Dauletally fields, are established oil producers. These fields benefit from existing production infrastructure and utilize the Caspian Pipeline Consortium (CPC) for exports, indicating stable operational cash flow.

As mature assets, they likely represent consistent cash cows for Geo-Jade Petroleum. Their established nature means that while growth may be limited, the profit margins are typically robust, requiring minimal additional investment to maintain production levels.

Geo-Jade Petroleum's existing Central Asian production base, especially fields exporting via the CPC pipeline to Novorossiysk, represents a robust and consistent revenue generator. This established infrastructure taps into a region with enduring energy needs, ensuring predictable cash flows for the company.

These assets are prime examples of cash cows within Geo-Jade's portfolio. They benefit from significant economies of scale and streamlined operational efficiencies. For instance, in 2024, Geo-Jade reported that its Central Asian operations contributed a substantial portion of its total production, with exports through the CPC pipeline remaining a key logistical and revenue channel.

Stable Revenue from Core Operations

Geo-Jade Petroleum's core oil and gas operations are its cash cows. Despite a slight dip in sales for 2024, the company generated CNY 2,547.56 million in revenue. This robust revenue stream, coupled with a positive net income, highlights the consistent cash generation from its established production assets.

These mature assets continue to provide significant financial returns, solidifying their cash cow status. The company's resilience in maintaining substantial revenue, even amidst market volatility, underscores the dependable nature of its primary business activities.

- Stable Revenue Generation: Geo-Jade Petroleum reported CNY 2,547.56 million in revenue for 2024, demonstrating the strength of its core oil and gas production.

- Consistent Cash Flow: Positive net income from these operations indicates a steady and reliable source of cash for the company.

- Resilience in Market Fluctuations: The ability to maintain significant revenue despite market shifts confirms the mature and dependable nature of its assets.

Integrated Upstream Operations Efficiency

Geo-Jade Petroleum's integrated upstream operations in the Pre-Caspian region are a prime example of a Cash Cow. This established infrastructure, encompassing production, storage, and transportation, allows for exceptional operational efficiency. This integrated value chain is key to maintaining robust profit margins from their mature fields.

The company's ability to minimize costs and maximize cash flow from these assets is a direct result of this streamlined approach. For instance, in 2024, Geo-Jade reported that its upstream segment consistently delivered strong performance, contributing significantly to overall profitability. This operational synergy allows them to effectively leverage their existing infrastructure.

- Established Integrated Value Chain: Geo-Jade's Pre-Caspian operations benefit from a fully integrated system from extraction to delivery, enhancing cost control.

- Sustained High Profit Margins: Mature fields within this integrated system continue to generate substantial profits due to optimized cost structures.

- Maximized Cash Flow: The efficiency of their operations translates directly into consistent and high cash flow generation, a hallmark of a Cash Cow.

- Competitive Advantage: This integrated model provides a significant competitive edge, allowing Geo-Jade to effectively monetize its mature asset base.

Geo-Jade Petroleum's established oil fields in Kazakhstan, such as Maten and KoZhaN JSC assets, are prime examples of Cash Cows. These mature fields benefit from existing infrastructure and consistent demand, ensuring stable revenue generation. In 2024, Geo-Jade reported CNY 2,547.56 million in revenue, with these operations forming the backbone of its financial performance, demonstrating their reliable cash-generating capabilities.

These assets require minimal new investment to maintain production, leading to high profit margins and predictable cash flows. The company's resilience in generating substantial revenue, even amidst market fluctuations, highlights the dependable nature of its core oil and gas production activities.

| Asset Category | Key Fields | Region | 2024 Revenue Contribution (Indicative) | BCG Status |

| Cash Cows | Maten, Eastern Kokarna, Kara-Arna | Pre-Caspian, Kazakhstan | Significant Portion of Total | Cash Cow |

| Cash Cows | Morskoye, Karatal, Dauletally | Kazakhstan | Consistent Cash Flow Generator | Cash Cow |

Preview = Final Product

Geo-Jade Petroleum BCG Matrix

The Geo-Jade Petroleum BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after purchase. This comprehensive report, meticulously crafted for strategic insights, contains no watermarks or demo content, ensuring you get a professional, ready-to-use analysis of Geo-Jade Petroleum's business units.

Dogs

Geo-Jade Petroleum's small production assets in Albania are categorized as Dogs in the BCG Matrix. These operations are not expected to contribute meaningfully to the company's overall revenue or growth trajectory.

These Albanian assets likely hold a small market share within a mature or slow-growing oil and gas segment. In 2024, Albania's oil production averaged around 16,000 barrels per day, a figure that has remained relatively stable but offers limited expansion potential.

Consequently, these assets may consume resources without generating substantial returns, positioning them as potential candidates for divestment or requiring only minimal capital allocation to maintain operations.

Underperforming legacy fields, while not explicitly detailed in recent Geo-Jade Petroleum reports, represent existing oil and gas assets with diminishing output and escalating operational expenses. These fields, if not slated for revitalization through new investment or enhanced recovery techniques, typically exhibit a low market share within slow-growing segments.

Such assets often hover around the break-even point or become cash drains, negatively impacting overall profitability and necessitating stringent oversight. For instance, in 2024, many mature oil fields globally experienced a production decline of over 5% year-on-year, coupled with a 10% increase in lifting costs, making them prime candidates for this category if not strategically managed.

Geo-Jade Petroleum's diversified portfolio extends to petrochemical project investment, engineering technology development, and property management. If these ventures consistently underperform, generating low returns on capital and offering no strategic advantage to the core oil and gas operations, they would be classified as Dogs within the BCG matrix. These segments often struggle with limited market share in highly competitive ancillary industries.

Exploration Blocks with Limited Potential

Exploration blocks that have historically delivered disappointing results or currently exhibit limited commercial viability are categorized as Dogs within the BCG Matrix. These assets represent a drain on capital, as funds are expended on exploration and appraisal activities without the commensurate discovery of significant reserves or the initiation of production.

Continuing to hold these underperforming blocks ties up valuable capital that could be more effectively deployed in projects with higher potential for returns. For instance, if a company has invested $50 million in exploration over five years in a particular block with no commercially viable discoveries, that capital could have been used for development of proven reserves elsewhere.

- Disappointing Results: Past exploration campaigns in these blocks have failed to identify commercially viable hydrocarbon deposits.

- Limited Commercial Viability: Current geological assessments and market conditions suggest a low probability of profitable extraction.

- Capital Consumption: Significant expenditure on exploration and appraisal activities has not translated into substantial reserves or production.

- Opportunity Cost: Capital tied up in these Dog assets could be reallocated to more promising ventures, potentially yielding higher returns.

Assets Requiring Costly Turnaround

If Geo-Jade Petroleum's existing producing assets encounter substantial technical issues or necessitate exceptionally costly maintenance to sustain output, they could be classified as dogs. This scenario typically results in diminished profitability and a shrinking market share because the expense of restoring these assets surpasses their potential future earnings.

These underperforming assets would then be strong contenders for a strategy of minimal capital infusion or outright divestment. For instance, if a specific offshore platform requires an estimated $150 million for essential upgrades to meet regulatory standards and maintain production levels, but its projected remaining revenue is only $100 million, it would clearly fall into this category.

- Low Profitability: Assets with high operational costs relative to their revenue generation are prime candidates for the dog quadrant.

- Market Share Decline: A significant drop in production or an inability to compete effectively due to technical limitations can lead to a loss of market share.

- Divestment or Minimal Investment: The strategic response often involves either selling off these assets or investing only enough to manage their decline, rather than attempting a full turnaround.

- Example Scenario: An aging onshore field, producing 500 barrels of oil per day with an average lifting cost of $40/barrel, but with current market prices hovering around $45/barrel, leaving little margin for unexpected repairs or capital expenditures, would be a strong candidate for a dog classification.

Geo-Jade Petroleum's Albanian assets, characterized by low production and limited growth prospects, are firmly placed in the Dogs category of the BCG Matrix. These operations, contributing minimally to overall revenue, face a market with little expansion potential, as evidenced by Albania's stable but modest daily oil production of around 16,000 barrels in 2024.

These assets likely represent a low market share in a mature segment, consuming resources without substantial returns, suggesting a potential divestment or minimal capital allocation strategy. Underperforming legacy fields globally experienced a production decline of over 5% year-on-year in 2024, with lifting costs rising by 10%, highlighting the challenges faced by such assets.

Exploration blocks with a history of disappointing results or low commercial viability also fall into the Dogs category, tying up capital that could be better utilized elsewhere. For example, if $50 million is invested over five years in an exploration block without commercial discoveries, that capital could yield higher returns in more promising ventures.

Assets with high operational costs relative to revenue, like an aging field with a narrow profit margin in 2024, are prime candidates for the Dog quadrant, often leading to divestment or minimal investment strategies.

| Asset Category | Market Growth | Market Share | Cash Flow | Strategic Recommendation |

| Albanian Production Assets | Low | Low | Negative to Neutral | Divest or Minimal Investment |

| Underperforming Legacy Fields | Low | Low | Negative | Divest or Minimal Investment |

| Unsuccessful Exploration Blocks | N/A (No Production) | N/A (No Production) | Negative | Divest or Write-off |

| Technically Challenged Producing Assets | Low | Declining | Low/Negative | Divest or Minimal Investment |

Question Marks

The 2024 agreement with QazaqGas to explore the Pridorozhnoe gas field in Kazakhstan positions this venture as a significant question mark for Geo-Jade Petroleum within a BCG matrix. While Central Asia's gas market is experiencing robust growth, Geo-Jade's presence in this particular new field is currently zero, reflecting its status as a potential future star but with no established market share.

This exploration necessitates considerable upfront capital expenditure, typical of a question mark, with an uncertain outlook on returns. However, the strategic location within a high-growth region offers substantial potential for future expansion and market penetration if exploration proves successful.

The Sozak gas field in Kazakhstan holds an estimated 2.189 billion cubic meters of geological reserves, a significant portion of which contains helium. This helium content positions Sozak as a potential player in the increasingly valuable helium market. However, the viability of its extraction and market entry remains a key question mark.

The commercial extraction of helium from Sozak is not yet a certainty, presenting a strategic challenge. While global helium demand is robust, driven by industries like healthcare and advanced manufacturing, the specific economics and technical feasibility of extracting helium from Sozak are still being evaluated. This uncertainty places the Sozak field's helium reserves in the question mark category of the BCG matrix, requiring further investment and strategic planning to determine if it can become a star performer.

Geo-Jade Petroleum's acquisition of exploration rights in Iraq's Jabal Sanam and Zurbatiya blocks in 2024 places these ventures squarely in the question mark category of the BCG matrix. These represent significant opportunities within Iraq's growing energy landscape, a market poised for expansion.

While the potential for high growth exists, Geo-Jade's current market share in these specific Iraqi exploration areas is minimal, reflecting their early-stage status. This necessitates substantial investment in drilling and appraisal activities to confirm reserve potential and initiate production, with the ultimate success still undetermined.

Petrochemical and Fertilizer Plants (South Basra Integrated Project)

The South Basra Integrated Project, encompassing a planned 620 kilotons per year petrochemical plant and a 520 kilotons per year fertilizer plant, represents a significant diversification for Geo-Jade Petroleum into downstream value-added products. These sectors are generally considered high-growth, offering potential for increased profitability beyond traditional upstream oil and gas operations.

However, Geo-Jade's current market share in these specific petrochemical and fertilizer segments is minimal, placing these new ventures in a question mark position within the BCG matrix. The substantial capital expenditure required for construction and ongoing operations presents a considerable risk, making their future performance uncertain.

- Project Scope: Establishment of a 620 kt/year petrochemical plant and a 520 kt/year fertilizer plant.

- Market Position: Low current market share in these downstream industries.

- Investment: Significant capital investment required for construction and operation.

- Growth Potential: High-growth potential in value-added petrochemical and fertilizer products.

New Energy Product Technology R&D and Sales

Geo-Jade Petroleum's involvement in new energy product technology research and development, production, and sales places it within a dynamic, high-growth sector. While the energy transition market is rapidly expanding, Geo-Jade's current market share in this specific segment is likely very low, characteristic of a question mark in the BCG matrix. Significant R&D investment and market development are critical to establishing viability and future growth potential.

These new energy ventures demand substantial capital outlay for research and development, aiming to innovate and bring new technologies to market. The success of these initiatives hinges on the ability to navigate an evolving landscape, identify promising niche markets, and effectively scale production. Without a strong existing market presence, these efforts are essentially bets on future market leadership.

- High R&D Investment: Companies in this space often spend upwards of 10-15% of revenue on R&D to stay competitive. For example, in 2024, the global renewable energy market is projected to see significant investment, with R&D playing a crucial role in unlocking new efficiencies and product categories.

- Market Development Challenges: Establishing a foothold requires not only technological advancement but also building brand recognition and distribution channels in a market with established players and emerging competitors.

- Potential for Growth or Decline: The outcome for Geo-Jade's new energy segment depends on its ability to gain traction. Successful innovation could propel it into a star, while failure to gain market share or technological obsolescence could relegate it to a dog.

- 2024 Market Context: The global clean energy sector continued its robust growth in 2024, with investments in areas like advanced battery technology and green hydrogen seeing substantial increases, presenting both opportunities and intense competition for new entrants.

Geo-Jade Petroleum's ventures in Kazakhstan's Pridorozhnoe gas field and the Sozak gas field, particularly its helium potential, represent significant question marks. These projects require substantial upfront capital with uncertain returns, although they are situated in high-growth regions offering future expansion possibilities.

Similarly, the Iraqi exploration blocks, Jabal Sanam and Zurbatiya, and the South Basra integrated project for petrochemicals and fertilizers, are also question marks due to minimal current market share and high investment needs, despite strong growth potential in their respective markets.

The company's foray into new energy product technology research and development is a classic question mark, demanding considerable R&D investment and market development to establish viability in a rapidly evolving, competitive sector.

| Venture | Market Position | Investment Needs | Growth Potential | Uncertainty Factor |

|---|---|---|---|---|

| Pridorozhnoe Gas Field (Kazakhstan) | Zero current market share | High upfront capital expenditure | High (Central Asia gas market growth) | Exploration success and profitability |

| Sozak Gas Field (Kazakhstan) | Low current market share (helium) | Significant investment for extraction | High (Valuable helium market) | Commercial viability of helium extraction |

| Jabal Sanam & Zurbatiya Blocks (Iraq) | Minimal current market share | Substantial drilling and appraisal investment | High (Iraq's growing energy landscape) | Confirming reserve potential and production |

| South Basra Integrated Project (Iraq) | Minimal current market share | Significant capital for construction/operation | High (Petrochemicals & fertilizers) | Future performance and profitability |

| New Energy Product Technology | Very low current market share | Substantial R&D investment | High (Energy transition market) | Gaining traction and scaling production |

BCG Matrix Data Sources

Our Geo-Jade Petroleum BCG Matrix is built on a foundation of robust data, incorporating financial disclosures, industry research, and market trend analysis to provide strategic clarity.