Genworth Financial PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Genworth Financial Bundle

Navigate the complex external environment shaping Genworth Financial's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors impacting its operations and strategic decisions. Gain a critical edge in your market analysis and investment strategies. Download the full version now for actionable intelligence.

Political factors

Government housing policies significantly shape the mortgage insurance landscape, directly affecting companies like Genworth. For instance, adjustments to mortgage interest deductions or the introduction of new first-time homebuyer programs can either boost or slow down housing demand, impacting Genworth's core U.S. and Canada Mortgage Insurance businesses. These policy shifts are crucial for understanding market dynamics.

Regulatory oversight from bodies such as the Federal Housing Finance Agency (FHFA) also plays a vital role. The FHFA's decisions on eligibility requirements and risk exposure for mortgage insurers can directly influence Genworth's operational capacity and financial health. For example, during 2024, discussions around potential changes to Fannie Mae and Freddie Mac's loan limits could indirectly affect the volume of mortgages requiring private mortgage insurance.

The long-term care (LTC) insurance sector navigates a complex web of state and federal regulations, with continuous dialogue focused on managing escalating costs and bolstering consumer safeguards. States are actively exploring and implementing new models, such as Washington's state-funded LTC program, which could reshape the competitive landscape for private insurers like Genworth.

The National Association of Insurance Commissioners (NAIC) remains instrumental in fostering standardized regulatory approaches and robust rate review mechanisms for LTC insurance products, aiming for greater consistency across jurisdictions.

Genworth's international trade and geopolitical stance significantly impact its operations, especially its Canadian mortgage insurance. For instance, shifts in trade agreements or tariffs between Canada and other nations could indirectly affect economic stability, influencing housing markets and mortgage demand. Geopolitical tensions can also dampen investor confidence, potentially impacting Genworth's global investment portfolios and overall financial health.

The company's exposure to international legal and political landscapes was highlighted by a notable legal case in the UK, underscoring the direct financial and reputational risks associated with navigating diverse regulatory and political environments. Such international legal outcomes can have ripple effects on operational strategies and risk management frameworks across Genworth's global footprint.

Consumer Protection Laws

Evolving consumer protection laws, especially within financial services and insurance, directly impact Genworth. These regulations, focusing on disclosure, sales tactics, and claims, can necessitate higher compliance expenditures or adjustments to product portfolios. For instance, the U.S. Consumer Financial Protection Bureau (CFPB) continues to refine rules affecting financial products, with ongoing scrutiny of lending and insurance practices.

Stricter consumer safeguards can translate into increased operational costs for Genworth as they adapt to new disclosure requirements or sales conduct standards. This is particularly true for complex products like long-term care insurance, where clarity and fairness are paramount. In 2024, discussions around enhancing consumer protections in the insurance sector, especially concerning retirement income products, are expected to continue, potentially influencing how companies like Genworth structure their offerings and client interactions.

- Increased Compliance Burden: New regulations may require Genworth to invest more in compliance staff, training, and technology to meet evolving standards.

- Product Development Impact: Consumer protection laws can shape product design, potentially leading to simpler, more transparent offerings or the phasing out of certain complex products.

- Reputational Risk Mitigation: Adherence to robust consumer protection frameworks helps Genworth build trust and avoid negative publicity associated with regulatory violations.

Fiscal and Monetary Policy

Government fiscal policies, such as changes in taxation or spending, and central bank monetary policies, like adjustments to interest rates, directly influence the economic landscape. For Genworth Financial, these policies are critical as they shape consumer behavior and market conditions. For instance, the Federal Reserve's monetary policy decisions, including its benchmark interest rate, directly affect mortgage demand and the cost of capital for financial institutions.

Higher interest rates, a common tool to combat inflation, can dampen demand for mortgages, which in turn impacts Genworth's mortgage insurance volumes. Conversely, periods of low interest rates can stimulate housing markets. As of early 2024, the Federal Reserve has maintained a relatively high interest rate environment, aiming to control inflation, which presents a headwind for mortgage origination volumes.

- Interest Rate Impact: The Federal Reserve's federal funds rate, hovering around 5.25%-5.50% in early 2024, directly influences mortgage rates, potentially reducing affordability and demand for Genworth's mortgage insurance.

- Fiscal Stimulus/Austerity: Government spending initiatives or tax policies can boost consumer confidence and disposable income, indirectly benefiting the financial services sector by increasing loan demand.

- Policy Uncertainty: Shifts in fiscal or monetary policy can create volatility in financial markets, impacting investment portfolio returns and the overall risk appetite of consumers and businesses.

Government housing policies, such as those influencing first-time homebuyers or mortgage interest deductions, directly impact Genworth's core mortgage insurance business. Regulatory actions by bodies like the FHFA, especially concerning loan limits for Fannie Mae and Freddie Mac, can influence the volume of mortgages requiring private mortgage insurance. Furthermore, evolving consumer protection laws, exemplified by the CFPB's ongoing scrutiny of financial products, necessitate increased compliance efforts and can shape Genworth's product development and sales practices.

The long-term care insurance sector faces significant regulatory attention, with states exploring new models like Washington's state-funded program, potentially altering the competitive landscape for private insurers. The NAIC continues to promote standardized regulations and rate reviews for LTC products, aiming for greater consistency across jurisdictions. These regulatory shifts require Genworth to adapt its strategies to ensure compliance and maintain market competitiveness.

Geopolitical factors and international trade agreements can indirectly affect Genworth's operations, particularly its Canadian mortgage insurance business, by influencing economic stability and housing market demand. Geopolitical tensions may also impact the company's global investment portfolios. Legal challenges in international markets, such as a past case in the UK, highlight the direct financial and reputational risks associated with diverse political and regulatory environments.

Fiscal and monetary policies significantly shape the economic environment for Genworth. For instance, the Federal Reserve's monetary policy, including its benchmark interest rate which stood at 5.25%-5.50% in early 2024, directly affects mortgage demand and borrowing costs. Higher rates can dampen mortgage origination volumes, impacting Genworth's business, while government spending or tax policies can influence consumer confidence and loan demand.

| Factor | Impact on Genworth | Data/Trend (2024/2025) |

| Housing Policy | Influences mortgage demand and insurance volumes. | Ongoing discussions on housing affordability initiatives. |

| Regulatory Oversight (FHFA) | Affects eligibility requirements and risk exposure for mortgage insurers. | Potential adjustments to Fannie Mae/Freddie Mac loan limits under consideration. |

| Consumer Protection Laws (CFPB) | Drives compliance costs and product design. | Continued focus on transparency in financial products and sales practices. |

| State LTC Regulations | Reshapes competitive landscape for long-term care insurance. | Emergence of new state-level LTC funding models. |

| Monetary Policy (Federal Reserve) | Impacts interest rates, mortgage demand, and capital costs. | Federal Funds Rate maintained at 5.25%-5.50% in early 2024, affecting mortgage affordability. |

What is included in the product

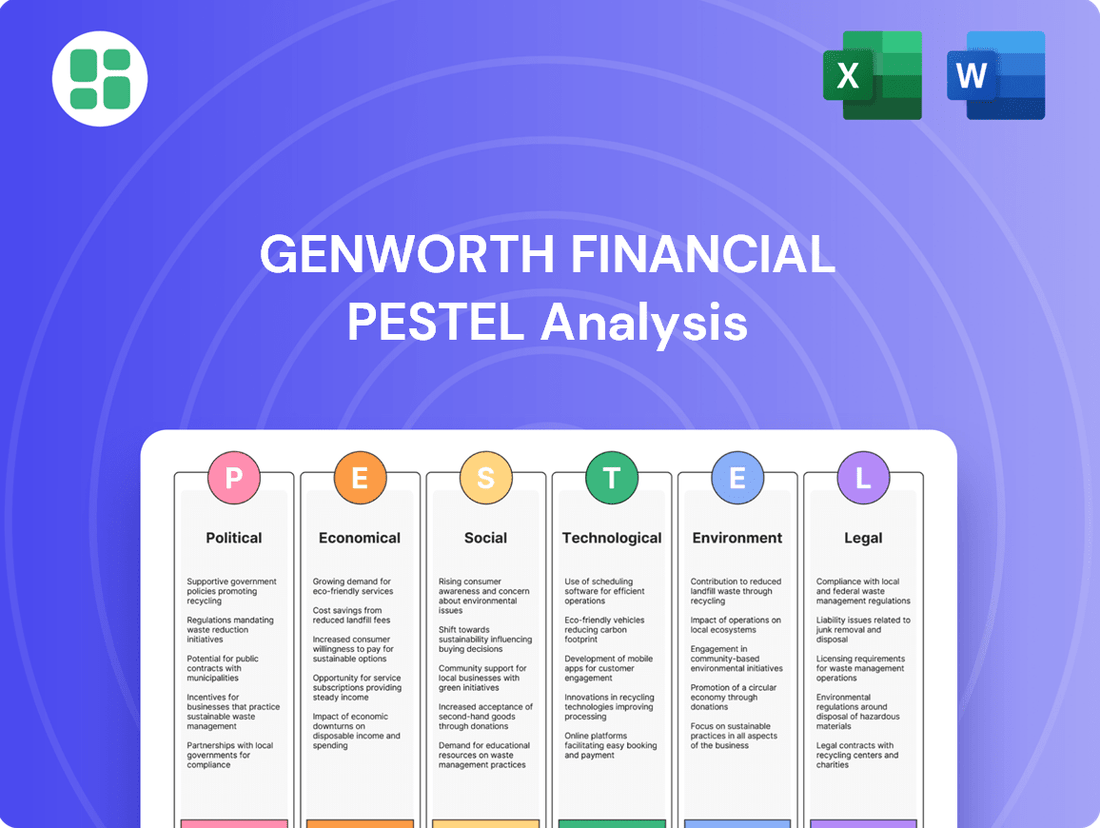

This PESTLE analysis examines the external macro-environmental factors impacting Genworth Financial across Political, Economic, Social, Technological, Environmental, and Legal dimensions, providing a comprehensive view of its operating landscape.

It offers actionable insights for strategic decision-making by identifying potential threats and opportunities derived from current market and regulatory trends relevant to Genworth Financial's sector.

A clear, actionable summary of Genworth Financial's PESTLE factors, empowering leadership to proactively address external challenges and capitalize on opportunities.

Economic factors

Interest rate fluctuations significantly impact Genworth's business. For instance, the Federal Reserve's monetary policy decisions in 2024 and projections for 2025, which have seen rates remain elevated compared to previous years, directly affect housing affordability. This can lead to fewer mortgage originations, consequently reducing the demand for Genworth's mortgage insurance products.

Furthermore, Genworth's investment portfolios, crucial for backing long-term liabilities like those in its long-term care segment, are sensitive to interest rate environments. Higher rates can boost investment income, but a rapid increase can also lead to unrealized losses on existing bond holdings. The average 30-year fixed mortgage rate hovered around 6.8% in early 2024, a notable increase from prior years, illustrating the direct impact on the housing market.

The U.S. housing market's resilience is a key factor for Genworth. Through Q1 2025, median home prices saw a year-over-year increase of approximately 5.5%, indicating continued demand. This appreciation supports the value of insured mortgages, positively impacting Genworth's risk profile.

Inventory levels also play a crucial role. As of early 2025, the U.S. housing inventory remained tight, with roughly 3.2 months of supply, below the 6 months typically considered balanced. This scarcity can lead to higher home prices but potentially lower transaction volumes, influencing new mortgage insurance originations.

In Canada, housing market dynamics are similarly important. While some regions experienced cooling in late 2024, the overall market has shown signs of stabilization heading into 2025, with average home prices seeing modest gains. This stability supports Genworth's Canadian mortgage insurance operations.

Inflation is a major concern for Genworth's long-term care business, as it directly drives up the cost of providing care. Think about it: the price of a home health aide or a room in an assisted living facility can increase year after year. For Genworth, this means the amount they might have to pay out on a long-term care claim is also going up.

In 2024, inflation continued to put pressure on various sectors, and healthcare services are no exception. While specific long-term care cost inflation figures for Genworth aren't publicly detailed, broader healthcare cost inflation in the US hovered around 4-5% annually in recent periods, impacting the actuarial models insurers rely on. This persistent rise in care expenses forces Genworth to regularly review and adjust its premium rates to ensure its policies remain financially viable and can cover future claims.

Economic Growth and Employment Rates

Robust economic growth and stable employment rates are foundational for the insurance sector, directly impacting consumer spending power and financial security. As of early 2024, the US economy demonstrated resilience, with GDP growth projected to continue, albeit at a more moderate pace. This generally translates to a healthier financial environment for individuals, making them more likely to invest in insurance products.

Employment figures are a key indicator. For instance, the US unemployment rate remained historically low through late 2023 and into early 2024, hovering around 3.7%. This high level of employment means more people have consistent income, boosting consumer confidence and disposable income. Consequently, demand for various insurance lines, including long-term care and life insurance, tends to rise.

The link between economic health and insurance performance is clear. Strong employment reduces the likelihood of mortgage defaults, which is a critical factor for mortgage insurers like Genworth. A stable job market also supports higher consumer confidence, potentially driving demand for discretionary financial products.

- US GDP Growth: Projected to remain positive in 2024, supporting consumer spending.

- Unemployment Rate: Consistently low around 3.7% in late 2023/early 2024, indicating strong labor market health.

- Consumer Confidence: Higher employment generally correlates with increased confidence, boosting demand for insurance.

- Mortgage Delinquencies: Expected to remain low in a strong employment environment, benefiting mortgage insurers.

Investment Market Performance

Genworth Financial's substantial investment portfolios, crucial for backing insurance liabilities, are directly influenced by market performance. The equity and fixed-income markets are key drivers of its investment income and overall profitability. For instance, during 2024, the S&P 500 saw significant gains, and while bond yields fluctuated, a generally stable interest rate environment supported fixed-income returns, benefiting companies like Genworth.

The company's financial health is intrinsically linked to these market dynamics. Volatility or downturns in financial markets can present considerable risks, negatively impacting Genworth's earnings and capital position. For example, a sharp decline in equity markets, such as a hypothetical 10% drop in the S&P 500, would directly reduce the value of Genworth's equity holdings, potentially affecting its solvency ratios and profitability metrics.

- Equity Market Performance: The S&P 500, a benchmark for U.S. equities, experienced an approximate 20% increase year-to-date by mid-2024, contributing positively to Genworth's investment income.

- Fixed-Income Market Conditions: Treasury yields saw moderate fluctuations in 2024, with the 10-year Treasury yield hovering around 4.2% by July 2024, providing a relatively stable income stream for Genworth's bond portfolio.

- Impact on Profitability: Strong market performance in 2024 is expected to bolster Genworth's net investment income, a critical component of its overall earnings.

- Risk of Downturns: A significant market correction, potentially triggered by unexpected economic events, could lead to substantial unrealized losses in Genworth's investment portfolio, impacting its financial stability.

The economic outlook for 2024 and 2025 presents a mixed but generally stable environment for Genworth Financial. While inflation remains a consideration, particularly for long-term care costs, robust employment figures and positive GDP growth in the U.S. support consumer spending and financial security. This economic backdrop is favorable for Genworth's core businesses, including mortgage insurance and long-term care, as it generally translates to lower delinquency rates and sustained demand for insurance products.

| Economic Indicator | Period | Value | Impact on Genworth |

|---|---|---|---|

| US GDP Growth | 2024 Projection | Positive, moderate pace | Supports consumer spending and demand for insurance |

| US Unemployment Rate | Late 2023 / Early 2024 | ~3.7% | Indicates strong labor market, boosting consumer confidence and disposable income |

| Healthcare Cost Inflation (General) | Recent Periods | ~4-5% annually | Increases long-term care claim costs, necessitating premium adjustments |

| 30-Year Fixed Mortgage Rate | Early 2024 | ~6.8% | Affects housing affordability and mortgage origination volumes |

Preview Before You Purchase

Genworth Financial PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Genworth Financial PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain a detailed understanding of the external forces shaping Genworth's strategic landscape.

Sociological factors

The global population is aging rapidly, with the U.S. seeing a significant rise in those over 65. By 2030, all Baby Boomers will be 65 or older, meaning 1 in 5 Americans will be retirement age. This demographic shift, coupled with increasing life expectancy, directly fuels demand for long-term care services and, by extension, long-term care insurance.

Genworth's core long-term care business is intrinsically linked to these demographic trends. As people live longer, the need for extended care solutions grows, presenting both opportunities and challenges for companies like Genworth.

The traditional model of family caregiving is undergoing a significant transformation. With more women participating in the workforce and families increasingly spread out geographically, the pool of available family caregivers is shrinking. This reality means fewer individuals are able to dedicate the extensive time required for long-term care, consequently driving a greater demand for professional caregiving services.

This evolving landscape directly impacts the market for long-term care insurance. As reliance on professional services grows, individuals and families are more actively seeking financial solutions to cover these escalating costs. Genworth's offerings are well-positioned to address this rising need, with industry data from 2024 indicating continued growth in the demand for such insurance products as a crucial component of financial planning.

Growing public understanding of the substantial financial burden of long-term care is directly impacting the demand for related insurance products. As more people recognize the potential costs of aging, they are increasingly seeking ways to safeguard their savings and secure quality care, creating a fertile ground for products like Genworth's offerings.

Personal experiences and targeted educational initiatives are significantly boosting this awareness. For instance, reports from organizations like AARP in 2024 highlighted that the median annual cost for a private nursing home room was over $100,000, a figure that underscores the financial risks many individuals face without adequate planning.

This heightened consumer consciousness is a critical factor driving interest in solutions like Genworth's CareScout platform, which aims to simplify the process of finding and understanding long-term care options and associated costs, thereby empowering individuals to make more informed decisions about their future.

Homeownership Aspirations and Affordability

Societal aspirations for homeownership continue to be a powerful driver, yet significant affordability hurdles are emerging. As of early 2024, median home prices in the U.S. have seen continued increases, making the initial purchase price a substantial barrier for many. Coupled with this, rising interest rates on mortgages and escalating property insurance premiums, particularly in disaster-prone areas, further strain household budgets.

These combined affordability challenges directly impact the demand for new mortgages, which in turn affects the need for mortgage insurance. Genworth's core business is intrinsically linked to the health of the housing market and the ability of individuals to secure financing.

- Homeownership Demand: Despite challenges, the desire for homeownership remains a long-term societal goal for a majority of Americans.

- Affordability Metrics: In Q1 2024, the median home price nationally hovered around $400,000, with mortgage rates fluctuating in the 6-7% range, significantly impacting monthly payments.

- Insurance Costs: Property insurance premiums have seen double-digit percentage increases year-over-year in many regions, adding to the overall cost of homeownership.

- Mortgage Insurance Relevance: These affordability pressures increase the likelihood of borrowers needing Private Mortgage Insurance (PMI), a key revenue stream for companies like Genworth.

Health and Wellness Trends

Societal shifts towards preventative health and a strong desire for individuals to remain in their homes as they age are significantly shaping the long-term care market. This trend is evident in the growing demand for home and community-based care solutions over traditional institutional settings.

Genworth's CareScout platform directly addresses these evolving preferences. By connecting users with a wider array of care providers and developing personalized care plans, CareScout is enhancing its support for aging in place, reflecting a broader commitment to meeting these health and wellness trends.

- Growing Demand for Home Care: The U.S. home healthcare market was valued at approximately $145 billion in 2023 and is projected to grow, indicating a clear preference for in-home care services.

- Focus on Preventative Health: Increased consumer interest in wellness and preventative measures is leading to a greater demand for services that support healthy aging and reduce the need for intensive medical intervention.

- CareScout's Network Expansion: Genworth's platform actively works to broaden its network of providers specializing in home and community-based care, aligning its services with these dominant health and wellness trends.

Societal expectations regarding retirement planning are evolving, with a growing emphasis on financial independence and self-sufficiency in later life. This shift is driven by increased awareness of the limitations of traditional pension plans and social security benefits, prompting individuals to seek more robust savings strategies.

The demand for long-term care insurance, a core product for Genworth, is directly influenced by these changing societal attitudes towards retirement security. As individuals take more personal responsibility for their future, they are more inclined to invest in solutions that protect their assets and ensure access to quality care.

Genworth's business is also shaped by evolving attitudes towards health and wellness, with a pronounced trend towards preventative care and aging in place. This societal preference for maintaining independence at home is driving demand for home-based care services and related financial products.

| Societal Factor | Trend Description | Impact on Genworth | Supporting Data (2024-2025) |

|---|---|---|---|

| Retirement Planning Attitudes | Increased emphasis on self-funded retirement and financial independence. | Drives demand for long-term care insurance and wealth management solutions. | AARP survey data from early 2024 indicated that 70% of adults aged 50+ are concerned about having enough savings for retirement. |

| Aging in Place Preference | Strong societal preference for remaining at home rather than moving to institutional care. | Boosts demand for home care services and financial products supporting in-home care. | The U.S. home healthcare market was projected to reach over $160 billion by the end of 2024, reflecting this growing trend. |

| Family Caregiving Dynamics | Shrinking availability of informal family caregivers due to workforce participation and geographic dispersion. | Increases reliance on professional care services, thus elevating the need for long-term care insurance. | Studies in 2024 show that the average age of family caregivers is rising, and many juggle caregiving with full-time employment. |

Technological factors

The insurance sector is rapidly digitizing, with automation becoming standard in underwriting, claims, and customer interactions. Genworth can capitalize on this trend to streamline operations, cut expenses, and elevate customer satisfaction across its mortgage and long-term care offerings. For instance, by mid-2024, many insurers reported using AI for fraud detection, leading to an average reduction in fraudulent claims by 15%.

Advanced data analytics and predictive modeling are becoming indispensable for Genworth, particularly in managing risk for its mortgage and long-term care insurance segments. These capabilities allow for more precise risk assessment, accurate pricing strategies, and robust fraud detection mechanisms.

By leveraging vast datasets, Genworth can continuously refine its underwriting models, leading to more personalized product offerings and a better understanding of emerging risks. This data-driven approach is key to improving pricing accuracy and ultimately enhancing profitability.

For instance, in 2024, the insurance industry saw a significant uptick in the adoption of AI-powered analytics for risk assessment, with some reports indicating a potential 15-20% improvement in underwriting accuracy for insurers employing these advanced techniques.

Genworth's reliance on digital platforms means cybersecurity is a top priority. In 2023, the financial services sector saw a 22% increase in reported data breaches, highlighting the constant threat. Protecting sensitive customer data from cyberattacks and ensuring compliance with regulations like GDPR and CCPA is crucial for maintaining customer trust and avoiding substantial fines, which can run into millions of dollars for non-compliance.

Online Distribution Channels and Customer Engagement Platforms

The insurance industry is rapidly shifting towards online distribution channels and digital customer engagement platforms. This transformation is fundamentally altering how companies like Genworth connect with and serve their customers. For instance, in 2024, a significant portion of insurance purchases, estimated to be over 60%, were initiated or completed online, highlighting the growing importance of a robust digital presence.

Genworth can capitalize on this trend by enhancing its user-friendly online portals and mobile applications. Implementing AI-powered chatbots for policy inquiries and customer support can further streamline interactions and improve efficiency. These digital tools are crucial for expanding reach and fostering deeper customer engagement. By 2025, it's projected that AI chatbots will handle over 70% of initial customer service inquiries in the financial services sector.

- Digital Dominance: Online channels are increasingly the primary avenue for insurance sales and customer service interactions.

- AI Integration: AI-powered chatbots are becoming essential for efficient customer support, handling a growing volume of inquiries.

- Embedded Insurance: This emerging trend, where insurance is offered at the point of sale for other products, represents a new digital distribution frontier.

- Customer Experience: User-friendly digital platforms are key to improving customer satisfaction and loyalty in the insurance market.

Telehealth and Remote Care Technologies

The increasing adoption of telehealth and remote monitoring technologies is reshaping long-term care. These advancements allow for more efficient and potentially less expensive care delivered in the home, which could alter how Genworth Financial manages its long-term care insurance products and claims.

For instance, remote patient monitoring devices can track vital signs and activity levels, providing early alerts for potential health issues. This proactive approach could reduce hospitalizations and the need for more intensive, costly care settings. In 2024, the global telehealth market was valued at approximately $128.2 billion and is projected to grow significantly, indicating a strong trend towards remote healthcare solutions.

- Efficiency Gains: Telehealth can streamline consultations and follow-ups, reducing travel time and costs for both patients and providers.

- Cost Reduction: Home-based care enabled by remote monitoring is often more affordable than traditional facility-based care.

- Data-Driven Claims: Real-time data from remote monitoring can offer clearer insights into policyholder needs and care utilization, potentially improving claims accuracy and management for Genworth.

- Service Evolution: Genworth may need to adapt its covered services and reimbursement models to accommodate these evolving care delivery technologies.

Technological advancements are fundamentally reshaping the insurance landscape, driving efficiency and customer engagement. Genworth's strategic integration of AI and advanced analytics is crucial for refining underwriting, pricing, and fraud detection, with industry-wide accuracy improvements in underwriting reaching up to 20% by mid-2024. The company's digital-first approach, evidenced by over 60% of insurance purchases initiated online in 2024, necessitates robust cybersecurity measures, especially given a 22% rise in financial sector data breaches in 2023.

The burgeoning telehealth sector, valued at approximately $128.2 billion in 2024, presents opportunities for Genworth to innovate in long-term care insurance by supporting home-based care models, potentially reducing costs and improving policyholder outcomes. The increasing reliance on digital platforms and AI chatbots, which are projected to handle over 70% of initial customer service inquiries by 2025, underscores the need for seamless digital experiences and data security.

| Technology Area | Impact on Genworth | Key Data/Trend (2024-2025) |

|---|---|---|

| AI & Automation | Streamlined underwriting, claims processing, fraud detection, enhanced customer service. | 15% average reduction in fraudulent claims via AI detection (mid-2024); 70%+ of initial customer service inquiries handled by AI chatbots by 2025. |

| Data Analytics & Predictive Modeling | Precise risk assessment, accurate pricing, personalized product offerings, improved underwriting accuracy. | Potential 15-20% improvement in underwriting accuracy with AI analytics (2024). |

| Digital Platforms & Online Channels | Expanded customer reach, improved customer engagement, efficient sales and service delivery. | Over 60% of insurance purchases initiated or completed online (2024). |

| Cybersecurity | Protection of sensitive customer data, regulatory compliance, maintenance of customer trust. | 22% increase in reported data breaches in the financial services sector (2023). |

| Telehealth & Remote Monitoring | Innovation in long-term care offerings, potential for cost reduction, data-driven claims management. | Global telehealth market valued at ~$128.2 billion (2024), with significant growth projected. |

Legal factors

Genworth's U.S. mortgage insurance arm, Enact, operates under strict Private Mortgage Insurer Eligibility Requirements (PMIERs) mandated by Fannie Mae and Freddie Mac. These regulations ensure that Enact maintains sufficient capital and operational integrity to act as a counterparty for mortgages these entities acquire. For instance, as of the first quarter of 2024, Enact reported a strong risk-to-capital ratio, demonstrating its compliance with these solvency standards.

Maintaining compliance with evolving PMIERs is paramount for Enact's continued access to the secondary mortgage market, a critical distribution channel. Any shifts in these capital or operational benchmarks could necessitate adjustments to Enact's business strategy and financial management, potentially impacting its market share and profitability. The recent regulatory landscape has seen a focus on enhanced liquidity and risk management practices for mortgage insurers.

Genworth's long-term care insurance business faces significant legal and regulatory scrutiny, particularly concerning rate approvals. State insurance departments must approve premium increases, a process that can be lengthy and contentious, impacting Genworth's ability to adjust pricing to reflect rising claims costs. For instance, in 2023, Genworth continued to engage with various states on rate filings, with some approvals pending or subject to negotiation, directly affecting its revenue projections for this segment.

The company has also been a target of class-action lawsuits stemming from allegations of inadequate disclosure regarding substantial, multi-year rate hikes planned for its long-term care policies. These legal challenges can result in significant financial settlements and reputational damage, adding another layer of complexity to managing its long-term care portfolio. Successfully navigating these legal battles and regulatory landscapes is paramount for ensuring the financial health and continued viability of Genworth's long-term care offerings.

Consumer protection regulations are a significant legal factor for Genworth Financial. These rules dictate how insurance products, especially intricate ones like long-term care policies, can be marketed, sold, and managed. For instance, in 2024, regulatory bodies continued to emphasize clear and upfront communication of policy details, benefits, and any restrictions to prevent consumer confusion and potential mis-selling.

Failure to adhere to these consumer protection laws can lead to severe consequences. Genworth, like other insurers, faces potential fines, costly litigation, and damage to its brand reputation. In 2023, the U.S. Department of Justice recovered over $3 billion in settlements related to consumer protection violations across various industries, highlighting the financial risks involved.

Antitrust and Competition Laws

Genworth Financial, operating in highly regulated insurance sectors, must navigate a complex landscape of antitrust and competition laws. These regulations are designed to prevent monopolistic practices and ensure a level playing field for all market participants, a critical consideration given Genworth's significant presence in mortgage and long-term care insurance.

Any strategic moves, such as mergers, acquisitions, or even substantial shifts in market share, will inevitably attract scrutiny from regulatory bodies. For instance, the U.S. Department of Justice and the Federal Trade Commission actively monitor industries for potential anti-competitive behavior. In 2024, continued focus on market concentration in financial services means Genworth must be particularly diligent in demonstrating that its actions foster, rather than hinder, fair competition.

- Regulatory Oversight: Genworth's operations are subject to antitrust reviews, particularly concerning market share and potential impacts on consumer choice.

- Merger & Acquisition Scrutiny: Proposed deals involving Genworth would undergo rigorous antitrust analysis to ensure they do not create undue market power.

- Compliance Burden: Adherence to these laws necessitates ongoing legal counsel and internal compliance programs to avoid penalties and maintain market access.

- Market Dynamics: The evolving competitive landscape in insurance requires Genworth to constantly assess its strategies against prevailing antitrust standards.

Data Privacy and Security Laws

Genworth Financial, like all financial institutions, operates under a complex web of data privacy and security laws. The sheer volume of sensitive personal and financial information they manage—from policyholder details to investment data—makes compliance absolutely critical. For instance, the General Data Protection Regulation (GDPR), if Genworth has any operations or data subjects in the European Union, imposes stringent requirements on data handling, consent, and breach notification. In the United States, various state-level acts, such as the California Consumer Privacy Act (CCPA) and its successor, the California Privacy Rights Act (CPRA), grant consumers significant control over their personal information.

Failure to adhere to these regulations can have severe repercussions. Beyond substantial financial penalties, which can amount to millions of dollars or a percentage of global revenue, a data breach or privacy violation can irrevocably damage customer trust. For example, in 2023, the U.S. Federal Trade Commission (FTC) continued to enforce data security standards, with significant fines levied against companies for inadequate protection of consumer data. Genworth's commitment to robust cybersecurity measures and transparent data handling practices is therefore paramount to maintaining its reputation and operational integrity.

- GDPR Fines: Up to €20 million or 4% of annual global turnover, whichever is higher.

- CCPA/CPRA Penalties: Up to $7,500 per intentional violation and $2,500 per unintentional violation.

- Customer Trust Impact: A data breach can lead to significant customer attrition and brand damage.

- Increased Regulatory Scrutiny: Regulators globally are enhancing enforcement of data protection laws.

Genworth’s U.S. mortgage insurance subsidiary, Enact, must adhere to specific eligibility requirements set by Fannie Mae and Freddie Mac, known as PMIERs. These rules ensure Enact maintains adequate capital and operational soundness. For instance, as of Q1 2024, Enact reported a robust risk-to-capital ratio, demonstrating ongoing compliance with these solvency standards, crucial for its participation in the secondary mortgage market.

The company's long-term care (LTC) business faces stringent state-level regulations regarding premium rate approvals. These processes can be protracted, affecting Genworth's ability to adjust pricing to match escalating claims costs. In 2023, Genworth was actively engaged in rate filing negotiations with various states, with some approvals still pending, directly influencing revenue forecasts for its LTC segment.

Genworth operates under consumer protection laws that govern the marketing and sale of its products, particularly complex policies like long-term care. Regulators in 2024 continued to emphasize transparent communication of policy terms and benefits. Non-compliance can result in significant penalties, as highlighted by the U.S. Department of Justice's recovery of over $3 billion in settlements for consumer protection violations in 2023.

Antitrust and competition laws are also critical, requiring Genworth to ensure its market activities do not stifle fair competition. In 2024, regulatory bodies like the DOJ and FTC continued to scrutinize market concentration in financial services, demanding diligence from companies like Genworth to demonstrate their strategies support, rather than impede, healthy market dynamics.

Environmental factors

Climate change is amplifying the risk profile for properties due to a rise in extreme weather events. Hurricanes, floods, and wildfires are becoming more frequent and intense, directly impacting property values and increasing the likelihood of damage. For instance, the U.S. experienced 28 separate billion-dollar weather and climate disasters in 2023 alone, according to NOAA.

This heightened physical risk poses a significant challenge for Genworth's mortgage insurance operations. As Genworth insures loans on properties susceptible to these climate-related events, the potential for increased claims payouts and the need for more sophisticated risk modeling become paramount. The economic impact of these disasters, as seen in the cumulative $1.775 trillion in damages from billion-dollar disasters since 1980, underscores the growing importance of climate adaptation in financial underwriting.

Genworth, like many financial institutions, is experiencing significant pressure from investors, regulators, and consumers to embed Environmental, Social, and Governance (ESG) principles into its investment strategies and daily operations. This trend is reshaping how companies are evaluated and funded.

The demand for sustainable and responsible investing is accelerating. For instance, global sustainable investment assets reached an estimated $37.8 trillion in early 2024, reflecting a strong market appetite for ESG-aligned companies. Genworth must actively demonstrate its commitment to these factors to attract and retain capital, ensuring its long-term viability and stakeholder trust.

Transparency in ESG reporting is becoming a critical differentiator. Investors are increasingly scrutinizing companies' environmental impact, social responsibility, and governance structures. Genworth's ability to clearly communicate its ESG performance and initiatives will be key to maintaining its reputation and competitive edge in the evolving financial landscape.

Genworth must integrate natural disaster preparedness into its risk management, especially with the rising frequency of such events. This involves scrutinizing its portfolio for concentrations in disaster-prone areas.

For instance, the increasing severity of hurricanes and wildfires in 2024 and projected into 2025 necessitates a thorough review of property insurance exposure. Genworth might need to adjust underwriting standards or pricing in regions facing heightened climate-related risks to maintain financial stability.

Resource Scarcity and Operational Footprint

While Genworth's core business isn't directly resource-intensive like manufacturing, concerns around resource scarcity, particularly water and energy, can subtly impact operational costs and public perception. As a large financial services company, Genworth is increasingly scrutinized for its environmental footprint, including energy consumption in its offices and data centers, and waste management practices. These factors align with growing investor and consumer demand for corporate sustainability. For instance, in 2023, many large corporations reported increased energy costs due to global supply chain disruptions, a trend that could continue into 2024 and 2025, potentially affecting Genworth's operating expenses if energy efficiency measures are not robust.

Genworth's commitment to sustainability extends to managing its operational impact. This includes efforts to reduce energy usage and minimize waste across its facilities. While specific figures for Genworth's 2024 or 2025 environmental footprint are not yet widely published, the broader industry trend points towards greater transparency and reporting on these metrics. For example, many companies are setting targets for carbon neutrality and waste reduction.

- Energy Consumption: Financial institutions are focusing on energy-efficient building designs and data center cooling technologies to lower their environmental impact and operational costs.

- Waste Management: Initiatives like paperless offices and enhanced recycling programs are becoming standard practice to reduce waste generation.

- Supply Chain Scrutiny: Even indirect resource use within the supply chain is gaining attention, prompting companies to assess the environmental practices of their vendors.

- Reputational Impact: Demonstrating environmental responsibility is crucial for maintaining a positive public image and attracting environmentally conscious investors and customers.

Regulatory Focus on Climate-Related Financial Risk

Insurance regulators are intensifying their scrutiny of climate-related financial risks, directly impacting entities like Genworth. This heightened focus means insurers must proactively assess how climate events could affect their financial stability, potentially leading to stricter reporting and capital requirements.

For Genworth, this translates into a need to embed climate risk analysis deeply into its financial planning and reporting processes. The expectation is for more robust disclosures, stress testing scenarios specifically designed around climate impacts, and possibly capital adjustments to account for climate-related exposures. For instance, the National Association of Insurance Commissioners (NAIC) in the US has been actively developing frameworks for climate risk disclosure and supervision, with discussions ongoing throughout 2024 and into 2025 regarding implementation details.

- Increased Disclosure Demands: Regulators are pushing for standardized disclosures of climate-related risks, similar to those being adopted in Europe under frameworks like the Task Force on Climate-related Financial Disclosures (TCFD).

- Climate Stress Testing: Insurers may face mandatory stress tests to evaluate their resilience against various climate change scenarios, such as extreme weather events or gradual shifts in climate patterns.

- Capital Adequacy Adjustments: Capital requirements could be revised to reflect an insurer's specific climate risk profile, potentially increasing capital needs for those with higher exposures.

- Supervisory Expectations: Financial oversight bodies are setting clear expectations for how insurers should govern and manage climate-related risks, requiring clear strategies and robust governance structures.

Genworth's operations are increasingly influenced by evolving environmental regulations and the growing demand for sustainable business practices. The company must navigate these changes to maintain compliance and investor confidence.

The increasing frequency and severity of extreme weather events, such as those experienced in 2023 with 28 billion-dollar disasters in the U.S., directly impact Genworth's mortgage insurance portfolio. This necessitates robust risk management strategies to account for potential property damage and increased claims.

Investor pressure for Environmental, Social, and Governance (ESG) integration is significant, with global sustainable investment assets reaching an estimated $37.8 trillion by early 2024. Genworth's ability to demonstrate its commitment to sustainability is crucial for attracting capital and maintaining its competitive edge.

Regulators are intensifying their focus on climate-related financial risks, prompting insurers like Genworth to enhance climate risk analysis and disclosure. Frameworks for climate risk supervision are actively being developed, with ongoing discussions in 2024 and 2025 regarding implementation.

| Environmental Factor | Impact on Genworth | Relevant Data/Trend |

|---|---|---|

| Climate Change & Extreme Weather | Increased risk of property damage, higher insurance claims, need for sophisticated risk modeling. | 28 U.S. billion-dollar weather/climate disasters in 2023. |

| ESG Integration & Sustainable Investing | Pressure to adopt ESG principles, attract capital, maintain stakeholder trust. | Global sustainable investment assets estimated at $37.8 trillion (early 2024). |

| Regulatory Scrutiny on Climate Risk | Need for enhanced climate risk analysis, disclosure, and potential capital adjustments. | NAIC developing frameworks for climate risk disclosure and supervision (ongoing 2024-2025). |

| Operational Environmental Footprint | Focus on energy efficiency, waste reduction, and supply chain sustainability. | Industry trend towards greater transparency in reporting operational environmental metrics. |

PESTLE Analysis Data Sources

Our Genworth Financial PESTLE Analysis is meticulously constructed using data from reputable financial institutions like the IMF and World Bank, alongside reports from leading market research firms and government regulatory bodies. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors influencing Genworth's operations.