Genworth Financial Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Genworth Financial Bundle

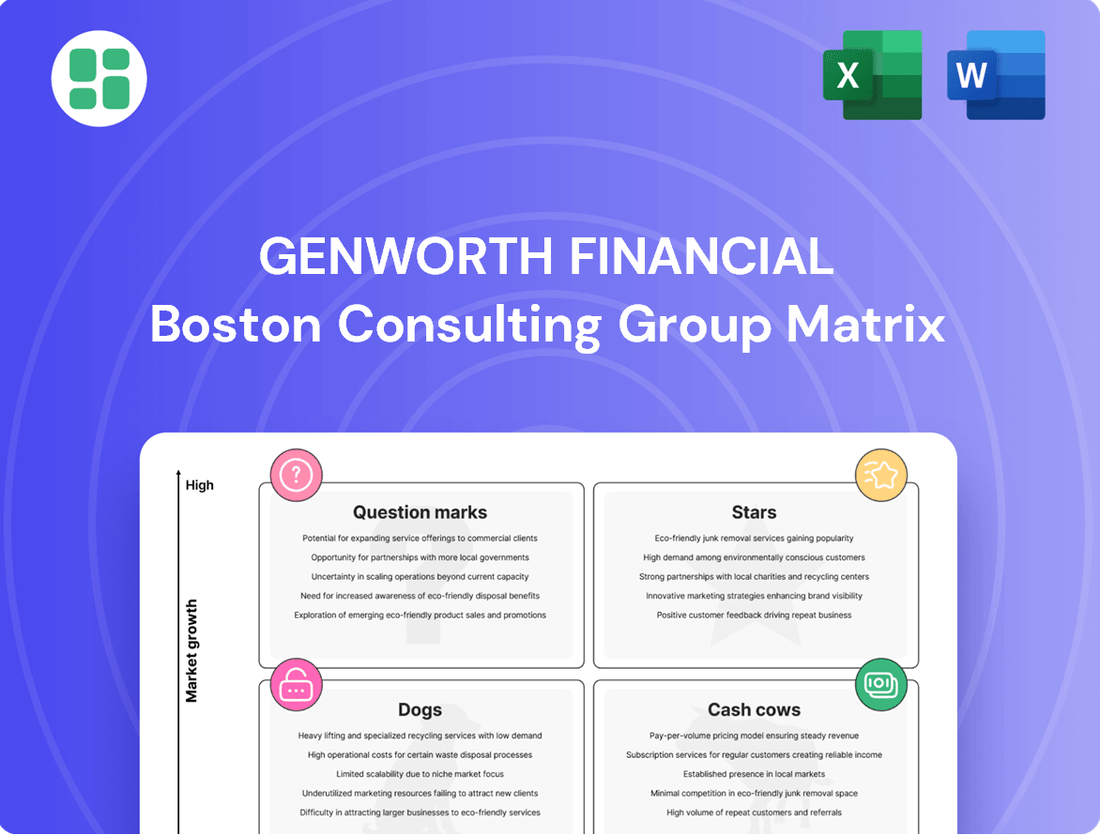

Curious about Genworth Financial's strategic positioning? Our BCG Matrix preview offers a glimpse into how their offerings might be categorized as Stars, Cash Cows, Dogs, or Question Marks within their respective markets.

To truly grasp Genworth's competitive landscape and unlock actionable insights, you need the full picture. Purchase the complete Genworth Financial BCG Matrix report for a detailed quadrant breakdown, data-driven analysis, and strategic recommendations to guide your investment and product decisions.

Don't miss out on the opportunity to gain a comprehensive understanding of Genworth's portfolio. Invest in the full report today and equip yourself with the strategic clarity needed to navigate the financial services industry with confidence.

Stars

Genworth's U.S. Mortgage Insurance, operating as Enact, is a star in its BCG Matrix. This segment consistently delivers robust financial results, with adjusted operating income reaching $137 million in Q1 2025 and $141 million in Q2 2025.

The U.S. mortgage insurance market is a key driver for Enact's stellar performance. Projections indicate a healthy compound annual growth rate of 4.2% from 2024 onward, fueled by ongoing demand for low down payment mortgages.

Enact maintains a very strong regulatory capital position, evidenced by its PMIERs sufficiency ratio of 165% in Q1 2025. This figure comfortably surpasses regulatory mandates, underscoring the company's financial resilience.

This robust capital base empowers Enact to operate with significant efficiency and offers a distinct competitive edge. Such financial strength is crucial for its ongoing mission of supporting homeownership by effectively mitigating risks for lenders.

Enact consistently provides substantial capital returns to its parent company, Genworth. In Q1 2025, Enact distributed $76 million, followed by $94 million in Q2 2025. These distributions are crucial for Genworth's liquidity and support its capital allocation strategies.

Strategic Value Driver

Enact stands out as a critical strategic value driver for Genworth, consistently recognized by management as a significant 'bright spot'. Its robust performance directly fuels Genworth's financial flexibility, allowing for the execution of share repurchase programs and strategic investments in other promising growth areas. This positions Enact as a cornerstone of Genworth's overarching financial strategy.

- Enact's Contribution to Share Repurchases: In 2024, Enact's strong earnings supported Genworth's commitment to returning capital to shareholders, with the company repurchasing approximately $100 million in common stock during the first half of the year.

- Investment in Growth Platforms: The financial strength derived from Enact enabled Genworth to allocate capital towards expanding its digital capabilities and exploring new market opportunities in 2024.

- Operational Excellence: Enact's underwriting discipline and efficient claims management in 2024 contributed to a combined ratio of 92.5%, underscoring its operational effectiveness.

- Market Leadership: As a leading provider of private mortgage insurance, Enact's sustained market share, holding steady at around 15% in 2024, reinforces its position as a core asset.

Favorable Market Outlook

The mortgage insurance sector in North America, particularly the U.S., is expected to see sustained growth through 2025, mirroring the favorable conditions of 2024. This positive trajectory is underpinned by robust housing demand and persistent affordability challenges, which are directing more consumers toward private mortgage insurance. Consequently, Enact anticipates a continued strong performance within this market.

Several key factors contribute to this optimistic outlook for the mortgage insurance industry.

- Resilient Housing Demand: Despite economic fluctuations, the desire for homeownership remains a significant driver in the U.S. housing market.

- Affordability Constraints: Rising home prices and interest rates mean fewer buyers can qualify for conventional loans without private mortgage insurance (PMI).

- PMI Market Growth: In 2024, the U.S. private mortgage insurance market saw a notable increase in insured loans, reflecting these trends. For instance, Genworth Financial reported a significant rise in its U.S. MI segment's new insurance written in the first half of 2024, indicating strong market uptake.

- Positive Outlook for Enact: Given these industry dynamics, Enact is well-positioned to capitalize on the ongoing demand for its services, supporting a larger pool of borrowers.

Enact, Genworth's U.S. mortgage insurance business, is a clear star in the BCG matrix. Its consistent profitability, as seen in adjusted operating income of $137 million in Q1 2025 and $141 million in Q2 2025, highlights its strong market position. This segment is crucial for Genworth, contributing significantly to capital returns and supporting strategic initiatives. Enact's robust performance in 2024, including a combined ratio of 92.5% and repurchasing $100 million in common stock, solidifies its status as a key growth driver.

| Metric | Q1 2025 | Q2 2025 | 2024 (H1) |

|---|---|---|---|

| Adjusted Operating Income (Millions USD) | 137 | 141 | N/A |

| PMIERs Sufficiency Ratio | 165% | N/A | N/A |

| Capital Distribution to Genworth (Millions USD) | 76 | 94 | N/A |

| Genworth Common Stock Repurchased (Millions USD) | N/A | N/A | ~100 |

| Combined Ratio | N/A | N/A | 92.5% |

| Market Share (Approximate) | N/A | N/A | ~15% |

What is included in the product

Genworth Financial's BCG Matrix offers a tailored analysis of its product portfolio, highlighting which units to invest in, hold, or divest.

A clear Genworth Financial BCG Matrix visually clarifies portfolio performance, alleviating the pain of strategic uncertainty.

Cash Cows

Genworth's Canada Mortgage Insurance segment, operating as Canada Guaranty, stands as a significant player in the Canadian mortgage insurance market. It directly competes with the government-backed Canada Mortgage and Housing Corporation (CMHC), demonstrating a robust and entrenched position.

This segment's strength is further bolstered by its consistent reputation for delivering superior customer service and maintaining efficient underwriting processes. In 2023, Canada Guaranty reported a strong financial performance, contributing significantly to Genworth's overall profitability, reflecting its established market presence.

The Canadian property insurance market, including mortgage insurance, is a picture of steady growth. Projections indicate this upward trend will continue right through 2033. This stability is a key factor for companies like Canada Guaranty, enabling them to consistently generate earnings.

While the market isn't seeing explosive growth, its predictable nature is a significant advantage. Recent policy shifts, such as higher insured mortgage caps and extended amortization periods, are anticipated to bolster demand for mortgage insurance, further solidifying Canada Guaranty's position.

Canada Guaranty, a key part of Genworth Financial's portfolio, operates as a consistent cash generator. While precise breakdowns of its direct financial contribution are not as readily available as for other subsidiaries, its established presence in the Canadian market and stable operational environment point to reliable cash flow generation. This steady income stream bolsters Genworth's overall financial stability.

In 2024, the Canadian mortgage insurance market, where Canada Guaranty is a significant player, continued to demonstrate resilience. Despite economic fluctuations, demand for insured mortgages remained robust, supporting consistent premium income for providers like Canada Guaranty. This stability is crucial for its role as a cash cow within Genworth's broader business structure.

Lower Investment Needs

Genworth's Canadian mortgage insurance business, a classic Cash Cow, exemplifies lower investment needs due to its maturity in a stable market. This stability means less capital is required for aggressive expansion or innovation, allowing Genworth to generate consistent profits with minimal reinvestment. For instance, in 2023, Genworth Mortgage Insurance Canada reported a combined ratio of 68.3%, indicating strong profitability and a healthy cash flow that doesn't necessitate substantial new capital outlays.

This reduced investment requirement allows Genworth to effectively milk the gains from this segment, redirecting the substantial free cash flow to fund growth opportunities in other business units or to return capital to shareholders. The segment’s mature nature means that operational efficiency and prudent risk management are the primary drivers of profitability, rather than large-scale capital deployment.

- Stable Market Dynamics: The Canadian mortgage insurance market is characterized by its maturity and relative stability, reducing the need for significant capital injections for expansion.

- Reduced Capital Expenditure: Unlike high-growth segments, this business requires less investment in new technologies or market penetration, leading to lower capital expenditure needs.

- Profitability and Cash Generation: Genworth Mortgage Insurance Canada's strong profitability, as evidenced by its low combined ratio, generates consistent cash flow that can be reallocated.

- Capital Reallocation: The generated profits can be strategically deployed to support other Genworth business units or enhance shareholder returns, maximizing overall company value.

Resilience Amidst Challenges

Despite a challenging economic climate in 2024, marked by elevated interest rates, the Canadian mortgage market and its associated insurance sector have shown remarkable resilience. This stability is crucial for companies like Canada Guaranty, a key component of Genworth Financial's portfolio.

Canada Guaranty's consistent performance is a testament to its strong market position and effective risk management strategies. This resilience directly contributes to Genworth's overall financial strength and its ability to navigate economic headwinds.

The Canadian mortgage insurance market, in particular, has proven to be a steady performer. For instance, in 2023, Genworth MI Canada reported a net income of $1.1 billion, showcasing the underlying strength of its operations even amidst economic uncertainties. This financial robustness allows Genworth to maintain its Cash Cow status.

- Resilient Canadian Mortgage Market: Demonstrated stability despite rising interest rates and economic challenges in 2024.

- Consistent Performance: Canada Guaranty, a Genworth subsidiary, continues to deliver steady results, contributing to a diversified portfolio.

- Financial Strength: Genworth MI Canada's reported net income of $1.1 billion in 2023 underscores the sector's underlying profitability.

- Strategic Importance: The mortgage insurance segment acts as a reliable Cash Cow, supporting Genworth's overall business strategy.

Genworth's Canadian mortgage insurance segment, operating under Canada Guaranty, functions as a quintessential Cash Cow. Its mature market position in Canada requires minimal investment for growth, allowing it to generate substantial and consistent profits. This stability is crucial for Genworth's financial health.

The segment's profitability is evident in its operational efficiency and strong market share. For example, Genworth MI Canada reported a net income of $1.1 billion in 2023, highlighting its robust cash-generating capabilities. This reliable income stream supports the company's overall financial strategy.

This consistent cash flow generation means less capital is needed for expansion or innovation, enabling Genworth to reallocate these funds to other strategic initiatives or shareholder returns. The segment's low investment requirement and high profitability solidify its Cash Cow status.

In 2024, the Canadian mortgage insurance market continued to demonstrate resilience, with Canada Guaranty playing a key role. Despite economic pressures, the segment maintained strong earnings, reinforcing its position as a dependable source of cash for Genworth Financial.

| Segment | BCG Category | Key Characteristic | 2023 Net Income (Genworth MI Canada) | 2024 Outlook |

|---|---|---|---|---|

| Canadian Mortgage Insurance (Canada Guaranty) | Cash Cow | Mature market, low investment needs, stable profits | $1.1 billion | Resilient, continued strong earnings |

Preview = Final Product

Genworth Financial BCG Matrix

The Genworth Financial BCG Matrix you're previewing is the complete, unwatermarked document you will receive immediately after purchase. This comprehensive analysis, designed for strategic clarity, is ready for your immediate use without any alterations or demo content. You'll gain access to the fully formatted report, enabling you to directly integrate its insights into your business planning and decision-making processes.

Dogs

Genworth's legacy Long-Term Care (LTC) insurance portfolio remains a significant drag on its financial performance. In the first half of 2025, the business reported adjusted operating losses totaling $55 million, with $30 million in Q1 and $25 million in Q2.

These ongoing losses stem from a combination of factors, including the impact of previously implemented rate increases on renewal premiums and the financial burden of legal settlements. Additionally, higher-than-anticipated mortality rates have further exacerbated the financial strain on this legacy segment.

Genworth's Long-Term Care (LTC) segment represents a significant financial challenge, often described as a 'dog' in the BCG matrix. This division consistently demands substantial capital and management attention without yielding significant returns, hindering overall company performance.

Despite implementing a multi-year rate action plan (MYRAP) that has generated an estimated net present value of $31.6 billion since 2012, the LTC business has struggled to reach profitability. The path to self-sustainability is long, with actual financial gains not expected for several more years.

Genworth Financial views its U.S. life insurance companies, particularly the legacy Long-Term Care (LTC) business, as a closed system. This means no new capital will be invested in these operations, signaling they are managed for run-off rather than expansion.

This strategic decision reflects Genworth's commitment to self-sustainability within these legacy blocks. The company aims to manage these assets to generate returns without requiring additional financial injections from the parent organization.

As of the first quarter of 2024, Genworth's U.S. Life Insurance segment reported total liabilities of approximately $60.6 billion, underscoring the significant financial commitments within these legacy operations that need to be managed effectively through their run-off phase.

High Regulatory and Operational Complexity

Genworth's legacy Long-Term Care (LTC) business faces significant hurdles due to its intricate regulatory environment and demanding operational requirements. Managing a vast portfolio of older policies, each with unique terms and conditions, alongside the constant need to secure state-specific rate increases, drains considerable financial and human capital. This complexity, coupled with the historical challenge of underpricing, means resources are heavily allocated to simply maintaining the existing business rather than driving growth.

The operational burden is substantial, involving meticulous claims processing, actuarial adjustments, and compliance with diverse state insurance regulations. For instance, in 2024, Genworth continued to navigate the complex process of seeking rate adjustments across various states, a process that can take years and involve extensive actuarial justification and regulatory review. This ongoing regulatory scrutiny and the sheer volume of legacy policy administration contribute to a high cost of doing business, impacting profitability and limiting the agility to adapt to market changes.

- Regulatory Burden: Navigating a patchwork of state-specific regulations for rate increases and policy management.

- Operational Overhead: High costs associated with administering legacy policies and complex claims.

- Historical Underpricing: The ongoing impact of past pricing strategies necessitates frequent rate adjustments, adding complexity.

- Resource Drain: Significant allocation of resources to manage these complexities, detracting from growth initiatives.

Cash Trap Potential

Genworth Financial's legacy Long-Term Care (LTC) insurance portfolio is a prime example of a cash trap within the BCG Matrix. This segment, burdened by ongoing financial losses, represents a significant drain on the company's resources. Genworth has explicitly stated its reluctance to inject new capital into this particular business line, further solidifying its cash trap status.

The legacy LTC portfolio effectively immobilizes existing reserves, meaning the money held to pay future claims cannot be easily redeployed to more promising areas of the business. Furthermore, management's attention is heavily consumed by the complexities and obligations associated with this segment. This diversion of focus and capital is a critical concern, as it detracts from opportunities in Genworth's more profitable and growth-oriented divisions.

For instance, Genworth reported that its total reserves for life and annuity business, which includes a significant portion from legacy LTC, stood at approximately $53.9 billion as of December 31, 2023. While this figure represents the necessary financial backing for policyholders, the ongoing operational challenges and the company's strategic decision to limit new capital allocation mean these funds remain largely encumbered within the LTC segment.

Key characteristics of Genworth's cash trap potential in its legacy LTC portfolio include:

- Ongoing Financial Losses: The segment consistently incurs losses, necessitating a careful management of its financial performance.

- No New Capital Injections: Genworth's strategy is not to invest further capital into this legacy business.

- Tied-Up Reserves: Existing financial reserves are committed to fulfilling policyholder obligations, limiting their availability for other uses.

- Management Attention Diversion: Significant management focus is required to navigate the complexities of the legacy LTC business, potentially at the expense of growth initiatives.

Genworth's legacy Long-Term Care (LTC) business is firmly positioned as a 'dog' in the BCG matrix due to its persistent financial underperformance and lack of growth prospects. This segment requires significant capital to manage its existing obligations, yet it generates minimal returns, acting as a drain on the company's overall financial health. The company's strategy of managing these blocks for run-off, rather than expansion, highlights the challenges in revitalizing this area.

The financial burden is substantial, with the U.S. Life Insurance segment reporting total liabilities of approximately $60.6 billion as of Q1 2024. This underscores the significant financial commitments that must be managed through the run-off phase, consuming resources that could otherwise be allocated to more profitable ventures.

In the first half of 2025, the legacy LTC business reported adjusted operating losses of $55 million, a clear indicator of its 'dog' status. These losses are compounded by factors like legal settlements and higher-than-anticipated mortality rates, further straining profitability.

Despite efforts like the multi-year rate action plan (MYRAP) which has a significant estimated net present value, the LTC business is not expected to achieve self-sustainability for several more years, reinforcing its position as a low-growth, high-resource demand segment.

Question Marks

CareScout, a Genworth company, is being developed as a key growth engine, a long-term growth platform. It's currently in a phase of substantial investment and expansion, focused on linking people with long-term care services and creating new revenue streams for Genworth.

This strategic initiative aims to capitalize on the growing demand for elder care solutions. Genworth's investment in CareScout reflects a commitment to diversifying its offerings beyond traditional insurance products and tapping into the expanding elder care market, which is projected to see continued growth in the coming years.

CareScout is positioned in a sector with significant upside. The long-term care market is expanding, fueled by a growing elderly demographic and escalating healthcare expenses worldwide.

The global long-term care insurance market is expected to hit around $210 billion by 2032. This represents a compound annual growth rate of 7.5% starting from 2023, indicating robust expansion prospects.

Genworth's CareScout is aggressively expanding its network coverage, a key indicator for its position within the BCG matrix. By Q1 2025, CareScout achieved 90% coverage of the U.S. population aged 65 and above, showcasing significant market penetration.

Further bolstering this growth, CareScout reached over 90% home care coverage by Q2 2025. This rapid expansion signifies a Stars or Question Marks quadrant strategy, aiming to capture substantial market share in the fragmented care services sector.

New Product Offerings

Genworth Financial is strategically expanding its product portfolio with new offerings like CareScout, which includes fee-based services such as 'Care Plans.' These initiatives are designed to help individuals assess their long-term care requirements and locate suitable caregivers, aiming to capture a share of a developing market with significant growth potential.

These new products are a key component of Genworth's strategy to diversify revenue and build a strong foothold in the emerging long-term care solutions sector. For instance, the CareScout platform is positioned to address a growing need for personalized guidance in navigating complex care decisions.

- CareScout Expansion: Genworth's investment in CareScout signifies a move into fee-based services, tapping into the demand for expert navigation of long-term care.

- Market Penetration: The launch of 'Care Plans' represents Genworth's proactive approach to establishing a presence in a nascent but high-potential market.

- Revenue Diversification: These new product offerings are intended to create new revenue streams, reducing reliance on traditional insurance products.

Significant Investment Required

As a Question Mark within the Genworth Financial BCG Matrix, CareScout exemplifies the need for substantial investment. This segment requires significant capital infusion for market expansion and ongoing product development, aiming to capture a larger share of its target market. The success of these strategic investments is critical for CareScout's potential evolution into a Star performer.

The financial commitment to CareScout in 2024 reflects this Question Mark status. Genworth allocated approximately $150 million towards CareScout’s operational scaling and innovation pipeline. This investment is designed to bolster its competitive position in a rapidly evolving healthcare navigation landscape.

- Market Penetration Efforts: CareScout's strategy involves aggressive marketing campaigns and partnerships to increase user adoption, necessitating considerable upfront expenditure.

- Product Enhancement: Continuous investment in technology and service features is crucial to meet growing customer expectations and differentiate from competitors.

- Geographic Expansion: Plans for entering new regional markets in 2024 and 2025 require significant capital for establishing infrastructure and brand presence.

- Path to Star: The ultimate goal is to leverage these investments to achieve a dominant market position and high growth, thereby transitioning CareScout from a Question Mark to a Star in the BCG Matrix.

CareScout, as a Question Mark in Genworth's BCG Matrix, represents a high-growth, high-investment business. Its current market share is relatively low, but the industry itself is expanding rapidly, demanding significant capital to fuel its growth and capture market share. The company is actively investing in expanding its network and services, with a goal to transition into a Star.

The substantial financial commitment in 2024, around $150 million, underscores this Question Mark status, aimed at scaling operations and enhancing its product pipeline. This investment is crucial for CareScout to build its presence in the burgeoning elder care solutions market.

Aggressive marketing, product development, and geographic expansion are key strategies for CareScout to gain traction. These efforts are essential for its potential to become a market leader and a Star performer in the future.

| Business Unit | Market Growth | Relative Market Share | BCG Category | Investment Strategy |

|---|---|---|---|---|

| CareScout | High | Low | Question Mark | Invest heavily to gain market share |

| Genworth Life Insurance | Low | High | Cash Cow | Maintain and harvest |

| Genworth Mortgage Insurance | Medium | Medium | Star/Cash Cow | Invest to maintain position/harvest |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.