Genworth Financial Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Genworth Financial Bundle

Genworth Financial navigates a landscape shaped by intense rivalry and the ever-present threat of substitutes, particularly in the evolving insurance sector. Understanding the power of buyers and the influence of suppliers is crucial for their strategic positioning.

The complete report reveals the real forces shaping Genworth Financial’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Genworth Financial, especially within its Long-Term Care and Mortgage Insurance divisions, depends on reinsurance to handle risk and maintain capital. The reinsurance market is experiencing a robust influx of capital, which generally leads to more favorable pricing for insurers like Genworth.

However, the casualty reinsurance sector, which can affect some of Genworth's operations, is still facing significant price hikes. These increases are largely driven by escalating litigation expenses and the phenomenon known as social inflation, which saw casualty reinsurance rates climb by over 10% in the first half of 2024.

Technology and data providers hold considerable bargaining power in the financial services sector, as Genworth relies heavily on their specialized software and data analytics for core operations like underwriting and customer engagement. The burgeoning FinTech market, projected to reach over $300 billion globally by 2025, with significant advancements in AI and data management, amplifies this power, particularly for niche solutions.

Genworth's CareScout segment, which links long-term care policyholders with healthcare providers, is heavily dependent on its network of service providers. The caliber and accessibility of these networks are paramount to its operations. As the demand for long-term care services continues to grow, established, high-quality care providers within these networks may see their bargaining power increase, potentially impacting service costs and Genworth's ability to secure access to these essential services.

Actuarial and Consulting Services

The bargaining power of suppliers in actuarial and consulting services for Genworth Financial is significant due to the highly specialized nature of the work. These firms possess critical expertise in areas like long-term care (LTC) product development, risk assessment, and navigating complex regulatory environments, making their insights indispensable.

The demand for specialized actuarial knowledge is particularly high in the insurance sector, especially for managing the intricacies of legacy LTC liabilities and pricing new products prudently. This demand, coupled with the limited supply of highly qualified professionals, allows these consulting firms to command substantial fees, thereby wielding considerable influence.

- Specialized Expertise: Actuarial and consulting firms offer unique skills essential for Genworth's product design and risk management.

- Regulatory Complexity: Navigating insurance regulations requires deep, specialized knowledge that few possess.

- High Demand for Niche Skills: The need for actuarial insights in managing liabilities and pricing products drives supplier power.

- Limited Supplier Pool: The scarcity of highly experienced professionals in this niche field strengthens their negotiating position.

Capital Markets and Investors

Genworth Financial, as a publicly traded entity, navigates the capital markets where investors act as significant, albeit unconventional, suppliers. The company's capacity to secure funding through debt or equity hinges on prevailing investor sentiment and overall market dynamics. In 2024, for instance, the financial services sector experienced fluctuating investor confidence, directly impacting the cost and availability of capital for companies like Genworth. A strong financial performance and positive outlook are key to strengthening Genworth's bargaining power when seeking investment.

The bargaining power of capital providers is a critical consideration for Genworth. These providers, including institutional investors and bondholders, can influence the terms and conditions under which capital is supplied. For example, if Genworth's credit rating were to be downgraded, or if the broader economic outlook deteriorated, investors might demand higher interest rates on debt or a greater equity stake, thereby increasing their bargaining power. Conversely, a robust financial position, as evidenced by strong earnings and a healthy balance sheet, allows Genworth to negotiate more favorable terms.

- Investor Sentiment: In 2024, the financial sector saw a cautious approach from investors, with a focus on companies demonstrating stable earnings and effective risk management, impacting Genworth's capital-raising ability.

- Market Conditions: Interest rate environments and overall economic stability play a crucial role; rising rates in 2024 generally increased the cost of debt for companies like Genworth.

- Financial Performance: Genworth's ability to maintain or improve its financial metrics, such as profitability and solvency ratios, directly influences its leverage in negotiations with capital providers.

- Credit Ratings: Agencies' assessments of Genworth's creditworthiness are pivotal; a stable or improving rating in 2024 would have provided a stronger negotiating position for securing capital.

Suppliers of specialized technology and data are crucial for Genworth's operations, particularly in areas like underwriting and risk assessment. The growing FinTech sector, expected to exceed $300 billion by 2025, empowers these providers, especially those offering AI and advanced data analytics, giving them significant leverage.

The bargaining power of reinsurance providers is a key factor for Genworth, especially in managing long-term care risks. While the overall reinsurance market saw increased capital in early 2024, leading to generally favorable pricing, the casualty reinsurance segment experienced rate hikes exceeding 10% due to litigation costs and social inflation.

Actuarial and consulting firms hold substantial power due to their indispensable, specialized knowledge in areas like LTC product development and regulatory compliance. The high demand for these niche skills, coupled with a limited supply of qualified professionals, allows them to command significant fees, influencing Genworth's operational costs.

Genworth's reliance on its network of service providers for its CareScout segment means these providers can wield considerable influence. As demand for long-term care services grows, established, high-quality providers may increase their bargaining power, potentially impacting service accessibility and costs for Genworth.

What is included in the product

This analysis of Genworth Financial's competitive landscape examines the intensity of rivalry, the bargaining power of buyers and suppliers, and the threats posed by new entrants and substitute products.

Effortlessly identify and mitigate competitive threats with a dynamic, customizable framework that highlights Genworth's strategic vulnerabilities.

Customers Bargaining Power

Mortgage lenders, Genworth's primary customers for mortgage insurance, possess significant bargaining power. They can choose from numerous private mortgage insurers (PMIs) and also consider alternatives like piggyback loans or government-backed options. This competitive landscape allows lenders to negotiate terms, pricing, and service quality, seeking the best value for their business.

Individual long-term care (LTC) policyholders at Genworth possess a moderate but evolving bargaining power. The complexity and cost associated with switching existing, traditional LTC policies limit their immediate leverage. However, the growing availability of alternative solutions, such as hybrid life and LTC policies and the option of self-funding, provides a growing counter-balance, especially for new purchasers.

Once a policy is active, policyholders' ability to negotiate terms is significantly reduced. Despite this, they remain acutely sensitive to premium adjustments, a factor insurers must consider. For instance, in 2023, Genworth reported that a substantial portion of its long-term care claims were filed by individuals who had held policies for many years, indicating a long-term commitment but also a potential for future dissatisfaction if premiums rise excessively.

Genworth's reliance on independent brokers and financial advisors means these intermediaries hold significant sway. They act as gatekeepers, channeling customer demand and influencing product selection. In 2024, the independent broker channel remained a cornerstone of life insurance and annuity distribution, with many advisors representing multiple carriers, including competitors to Genworth.

This multi-carrier access empowers brokers to negotiate favorable terms, from commission rates to product customization and service levels. If Genworth doesn't meet their expectations, these brokers can easily direct business to competitors, thereby increasing Genworth's customer bargaining power through their distribution network.

Large Institutional Clients (e.g., Employers offering Group LTC)

Large institutional clients, such as employers considering group Long-Term Care (LTC) insurance, wield considerable bargaining power. Their ability to commit substantial volumes of business allows them to negotiate favorable terms, including pricing and customized policy features tailored to their employee base. This can put pressure on Genworth's profit margins in this specific segment.

These large clients can also demand sophisticated administrative support and reporting capabilities, requiring Genworth to invest in specialized infrastructure. For instance, a major corporation might require seamless integration with their existing HR systems, influencing the operational costs and service level agreements for Genworth.

- Volume Commitment: Large employers can represent thousands of potential policyholders, giving them significant leverage.

- Customization Demands: Institutional clients often require tailored benefits and enrollment processes.

- Price Sensitivity: Bulk purchasing power enables these clients to seek competitive pricing structures.

- Administrative Requirements: Sophisticated reporting and integration needs can dictate service offerings.

Regulatory Bodies and Consumer Advocates

Regulatory bodies and consumer advocates, while not direct purchasers, wield substantial influence over customer power in the insurance sector. They achieve this by enforcing stringent disclosure rules, dictating standardized policy features, and establishing capital reserve requirements for insurers like Genworth. For instance, updates in federal legislation around 2024 have focused on bolstering consumer protections within the long-term care (LTC) insurance market, a move that inherently enhances the bargaining leverage of policyholders through increased transparency and equitable treatment.

These external forces indirectly empower customers by shaping the competitive landscape and demanding greater value.

- Increased Transparency: Regulatory mandates require clearer policy terms and conditions, making it easier for consumers to compare offerings and understand their rights.

- Standardized Features: The push for standardized policy elements reduces complexity and allows customers to more readily assess the value proposition of different insurance products.

- Consumer Protection Laws: Legislation aimed at protecting consumers, such as those enhancing disclosure in LTC insurance, directly strengthens the bargaining position of policyholders.

- Advocacy Group Influence: Consumer advocacy groups often lobby for lower prices and improved service, putting pressure on companies to offer more competitive terms.

Genworth's mortgage insurance customers, primarily lenders, hold significant bargaining power due to the availability of multiple PMI providers and alternative financing options like government-backed loans. This competition enables lenders to negotiate favorable terms, pricing, and service levels, directly impacting Genworth's market share and profitability in this segment. In 2024, the mortgage market continued to see intense competition among insurers, with lenders prioritizing cost-effectiveness and efficient processing from their chosen partners.

Individual long-term care policyholders have a more nuanced bargaining power, limited by the difficulty of switching existing policies but growing as hybrid products and self-funding gain traction. While policyholders cannot easily renegotiate terms once a policy is active, their sensitivity to premium increases remains a critical factor for Genworth. For instance, in 2023, Genworth's long-term care segment faced challenges with pricing adjustments, highlighting the delicate balance insurers must strike to retain customers while managing risk.

The bargaining power of Genworth's customers is influenced by the competitive landscape and regulatory environment. Lenders can switch providers, and policyholders are increasingly exploring alternatives, while regulators push for greater consumer protection. In 2024, Genworth's strategic focus included enhancing customer retention through improved service and product innovation to counter these pressures.

What You See Is What You Get

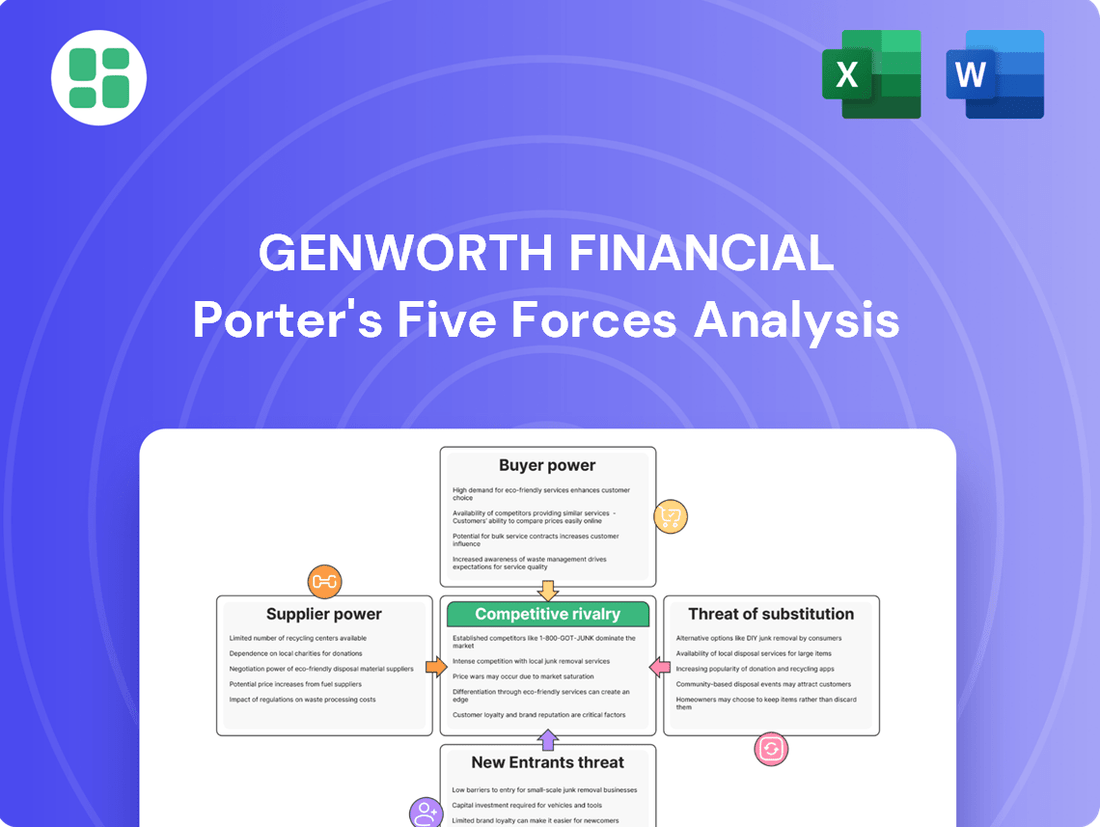

Genworth Financial Porter's Five Forces Analysis

This preview showcases the complete Genworth Financial Porter's Five Forces Analysis, offering a thorough examination of the competitive landscape within the insurance and retirement solutions industry. You're looking at the actual document; once your purchase is complete, you’ll gain instant access to this exact, professionally formatted file, ready for immediate use.

Rivalry Among Competitors

While the traditional long-term care (LTC) insurance market has fewer standalone providers, competition remains robust due to the increasing prevalence of hybrid life insurance and LTC products. Major players like Mutual of Omaha, Nationwide, New York Life, and Northwestern Mutual actively compete, offering a range of products designed to meet evolving consumer needs.

These established companies leverage their financial strength and brand recognition to attract customers. For instance, in 2023, the overall long-term care insurance market saw continued growth in hybrid product sales, with many insurers reporting strong uptake, indicating a dynamic competitive landscape where innovation in product design is key.

Genworth's mortgage insurance arm, Enact, faces a competitive field populated by key players such as NMI Holdings, Essent Group, and MGIC Investment. This rivalry intensifies as companies vie for market share through aggressive pricing strategies, streamlined service delivery, and the cultivation of strong relationships with lenders.

In 2024, the private mortgage insurance (PMI) market continues to be characterized by this intense competition. For instance, NMI Holdings reported a strong performance, with its net income reaching $135.6 million in the first quarter of 2024, demonstrating the potential for profitability even amidst robust competition.

The dynamics of this rivalry directly influence market share and profitability across the industry. Lenders often weigh factors like premium costs, the speed of underwriting, and the quality of customer support when selecting a PMI provider, making these areas critical battlegrounds for companies like Enact.

The financial services sector, including insurance, continues to experience significant merger and acquisition (M&A) activity. This trend, observed throughout 2024, means larger, more formidable competitors are emerging, potentially increasing competitive pressure on companies like Genworth. For instance, the broader insurance industry saw substantial deal flow, with many companies seeking scale and efficiency through consolidation.

Product Differentiation and Innovation

Competitive rivalry in the insurance sector, particularly for long-term care (LTC) solutions, is intensely fueled by product differentiation and ongoing innovation. Companies are actively developing novel hybrid products that blend traditional life insurance or annuities with LTC benefits, aiming to capture a broader market. Genworth, for instance, has been a pioneer in this space, notably with its CareScout platform, which enhances care coordination services, offering a tangible differentiator beyond basic policy features.

The ability to stand out through unique product attributes, adaptable payment structures, and exceptional customer support is paramount for gaining and maintaining a competitive edge. In 2024, the market saw a continued push towards integrated solutions that address not just the financial burden of care but also the logistical and support aspects. This strategic focus on value-added services is becoming as critical as the core insurance product itself.

- Product Innovation Focus: Development of hybrid LTC products combining life insurance or annuities with LTC benefits.

- Service Differentiation: Expansion of care coordination services, exemplified by Genworth's CareScout.

- Key Competitive Factors: Unique features, flexible payment options, and superior customer service are vital.

- Market Trend: Growing demand for integrated solutions addressing both financial and logistical aspects of long-term care.

Regulatory Environment and Compliance Costs

The insurance sector, including Genworth Financial, operates within a highly regulated framework, with federal and state laws constantly evolving. This complex environment necessitates significant investment in compliance, acting as a substantial barrier for smaller competitors and a key differentiator for established players.

Compliance costs can be substantial. For instance, in 2024, the National Association of Insurance Commissioners (NAIC) continued to refine solvency requirements and data reporting mandates, adding to the operational burden for insurers. These ongoing regulatory adjustments directly influence competitive dynamics, particularly in specialized areas like long-term care (LTC) insurance, where Genworth has historically faced challenges.

- Regulatory Burden: The insurance industry's inherent complexity means companies like Genworth must allocate considerable resources to navigate and adhere to a patchwork of state and federal regulations.

- Compliance as a Barrier: Heavy investment in compliance infrastructure and expertise can deter new entrants and favor larger, more established firms with greater financial capacity.

- Shifting Dynamics: Regulatory changes, such as proposed updates to capital requirements or consumer protection laws in 2024, can significantly alter the competitive landscape and impact profitability.

Competitive rivalry within Genworth's core insurance segments, particularly long-term care (LTC) and mortgage insurance, remains intense. In the LTC market, established players like Mutual of Omaha and Nationwide are key competitors, with hybrid product sales showing strong growth in 2023, indicating a dynamic landscape. Genworth's mortgage insurance subsidiary, Enact, faces robust competition from firms such as NMI Holdings and Essent Group, with NMI Holdings reporting $135.6 million in net income for Q1 2024, highlighting profitability potential amidst this rivalry.

Companies are differentiating through product innovation, such as hybrid LTC policies, and enhanced services like Genworth's CareScout. The mortgage insurance sector sees competition driven by pricing and lender relationships. Furthermore, ongoing merger and acquisition activity in the broader financial services sector in 2024 is creating larger competitors, potentially increasing pressure on Genworth.

| Competitor | Market Segment | Key Differentiator/Metric |

|---|---|---|

| Mutual of Omaha | Long-Term Care Insurance | Strong brand recognition, hybrid product offerings |

| Nationwide | Long-Term Care Insurance | Hybrid product innovation, financial strength |

| NMI Holdings | Mortgage Insurance | Profitability (Q1 2024 Net Income: $135.6M) |

| Essent Group | Mortgage Insurance | Focus on lender relationships, service delivery |

| New York Life | Long-Term Care Insurance | Established financial strength, diverse product portfolio |

SSubstitutes Threaten

Self-funding is a significant substitute for traditional long-term care insurance. Many individuals, especially those with substantial personal savings or investments, choose to cover potential future care expenses directly. This approach offers greater financial control and eliminates premium payments, appealing to a segment of the population comfortable with managing their own financial future.

In 2024, the trend of individuals utilizing personal assets for long-term care needs continues to grow. For instance, a considerable portion of Baby Boomers are actively planning to tap into their retirement accounts and home equity to fund potential care. This reliance on personal wealth bypasses the need for insurance products, directly impacting the demand for long-term care policies.

Hybrid life insurance and annuity products with long-term care (LTC) riders present a significant threat of substitution for traditional long-term care insurance. These hybrid offerings, which combine life insurance or annuity benefits with LTC coverage, are attractive because they address consumer concerns about the 'use-it-or-lose-it' nature of standalone LTC policies. In 2024, the market for these hybrid products continued to grow, with many major insurers actively promoting them as a more flexible and guaranteed way to plan for potential long-term care needs.

Government programs like Medicaid act as a significant substitute for private long-term care insurance, especially for individuals with limited financial resources. Medicaid steps in to cover long-term care expenses once a person's assets are depleted, effectively providing a safety net that reduces reliance on private solutions. In 2023, Medicaid spending on long-term services and supports reached approximately $175 billion, highlighting its substantial role in financing care.

Furthermore, several states are actively developing or have introduced their own public long-term care initiatives. For instance, California's proposed CalCare program aims to provide universal long-term care coverage, potentially diminishing the market for private long-term care insurance among its residents. These state-level efforts represent a growing trend that could further erode the demand for private insurance by offering alternative, publicly funded options.

Family Caregiving and Informal Support Networks

The threat of substitutes in the long-term care industry is significantly influenced by family caregiving and informal support networks. Many families opt for care provided by relatives or friends, often driven by emotional bonds and the perceived cost savings compared to professional services. However, this informal care model can strain caregivers and may not always be sufficient for complex or prolonged care needs.

In 2024, an estimated 53 million adults in the U.S. provided unpaid care to an adult or child, a number that underscores the prevalence of informal support. This informal care is a substantial substitute for formal long-term care services, offering a cost-free alternative for many families. The economic value of this unpaid care in 2023 was estimated at $483 billion, highlighting its significant financial impact.

- Prevalence of Informal Care: Millions of Americans rely on family and friends for caregiving, reducing demand for professional services.

- Cost Savings: Informal care is typically free for the recipient, making it a highly attractive substitute.

- Caregiver Burden: While cost-effective, informal care often places a significant physical, emotional, and financial burden on caregivers.

- Sustainability Challenges: Informal networks may struggle to provide consistent, specialized care over extended periods or for individuals with complex medical needs.

Alternative Mortgage Lending Structures

Lenders have several alternatives to traditional private mortgage insurance (PMI) that can mitigate borrower default risk. These include requiring larger down payments from consumers, which directly reduces the loan-to-value ratio. Another common strategy is the use of 'piggyback' second mortgages, where a portion of the down payment is financed through a separate loan, thereby avoiding the need for PMI on the primary mortgage.

Government-backed loan programs present a significant substitute for PMI. For instance, Federal Housing Administration (FHA) loans, and to some extent VA and USDA loans, allow for low-down-payment options and provide their own forms of risk mitigation for lenders. These government programs can be particularly attractive to borrowers with less upfront capital, effectively substituting the need for private mortgage insurance.

- Higher Down Payments: Reduces lender risk by lowering the loan-to-value (LTV) ratio.

- Piggyback Second Mortgages: A second mortgage covers part of the down payment, keeping the primary loan below the PMI threshold.

- Government-Backed Loans: FHA, VA, and USDA loans offer low-down-payment options with government risk coverage, acting as an alternative to PMI.

The threat of substitutes for Genworth Financial's long-term care insurance is substantial, encompassing various alternatives that reduce reliance on traditional policies. Self-funding, hybrid insurance products, government programs like Medicaid, and informal family caregiving all present significant substitution risks.

In 2024, the market continues to see a rise in individuals opting for personal asset utilization and hybrid insurance solutions. The economic value of informal caregiving, estimated at $483 billion in 2023, further highlights the prevalence of substitutes.

| Substitute Type | Description | 2023/2024 Relevance |

| Self-Funding | Using personal savings and investments for future care. | Growing trend, particularly among Baby Boomers. |

| Hybrid Products | Life insurance or annuities with LTC riders. | Increasingly popular due to flexibility and guaranteed benefits. |

| Government Programs | Medicaid and state-specific initiatives. | Medicaid spending on LTSS was ~$175 billion in 2023. |

| Informal Caregiving | Care provided by family and friends. | Estimated 53 million unpaid caregivers in the U.S. in 2024. |

Entrants Threaten

The insurance sector, particularly in areas like long-term care and mortgage insurance, demands substantial upfront capital. For instance, in 2024, many states require new insurers to hold minimum capital and surplus well into the tens of millions of dollars, a significant hurdle for emerging companies.

Furthermore, the regulatory landscape is intricate and varies by state and federal jurisdiction. Navigating licensing processes, adhering to solvency requirements, and complying with consumer protection laws present considerable challenges and costs, effectively acting as a barrier to entry for many potential competitors.

Established insurers like Genworth Financial have cultivated strong brand recognition and customer trust over many years, which are essential in the financial services sector. Newcomers find it difficult to gain this level of credibility, particularly in critical areas such as long-term care and mortgage protection, where consumers and lenders place a high premium on financial stability and dependability.

The threat of new entrants concerning distribution networks and market access for companies like Genworth is relatively low. Building robust relationships with brokers, lenders, and financial advisors is a time-intensive and capital-heavy endeavor. For instance, the mortgage origination industry, where Genworth has a significant presence, relies heavily on these established networks. New players would struggle to quickly gain the same level of trust and access that incumbents have cultivated over years, impacting their ability to reach a broad customer base efficiently.

Actuarial Expertise and Data Access

The long-term care insurance market demands intricate actuarial expertise and substantial historical data for accurate policy pricing and liability management. Newcomers would grapple with a significant learning curve and hurdles in acquiring the necessary data, hindering their ability to compete on price and risk assessment.

For instance, as of 2024, the complexity of accurately projecting long-term care costs, influenced by factors like healthcare inflation and changing consumer needs, presents a substantial barrier. Companies like Genworth have invested decades in building these sophisticated actuarial models and data repositories.

- Actuarial Sophistication: Developing the precise actuarial models required for long-term care insurance is a multi-year, data-intensive process.

- Data Acquisition Costs: Accessing and processing the vast datasets needed for reliable risk assessment and pricing can be prohibitively expensive for new entrants.

- Regulatory Hurdles: Navigating the complex regulatory landscape for long-term care insurance, which often mandates specific capital reserves and solvency standards, adds another layer of difficulty for new players.

- Competitive Pricing: Established players, with their refined data and actuarial insights, can often offer more competitive pricing, making it challenging for new entrants to gain market share.

Customer Acquisition Costs

Customer acquisition costs in the insurance industry are a significant barrier to entry. Genworth, like other established insurers, faces substantial expenses related to marketing campaigns, sales commissions paid to agents, and the rigorous underwriting processes required to assess risk. These costs can easily run into the hundreds or even thousands of dollars per new policyholder.

For a new entrant to compete effectively, they would need to commit a considerable amount of capital upfront to overcome the established players' advantages. These advantages include the benefits of economies of scale, where larger companies can spread their fixed costs over a wider customer base, and the loyalty and trust built with their existing customer relationships. Consider that in 2024, the average customer acquisition cost for life insurance in the US was estimated to be around $500, a figure that can be significantly higher for more complex products.

- High Marketing Expenses: Reaching potential customers through advertising, digital marketing, and agent networks requires substantial investment.

- Sales Commission Structures: Commission-based sales models mean a significant portion of initial revenue goes to agents, impacting profitability for new entrants.

- Underwriting and Onboarding Costs: The process of evaluating risk, processing applications, and setting up new policies adds to the initial cost per customer.

- Brand Recognition and Trust: New companies must spend heavily to build brand awareness and establish the trust that incumbent firms already possess.

The threat of new entrants for Genworth Financial is generally considered low due to significant barriers. High capital requirements, stringent regulatory compliance, and the need for deep actuarial expertise in specialized areas like long-term care insurance demand substantial upfront investment and specialized knowledge.

Furthermore, established brand recognition and extensive distribution networks, particularly in mortgage insurance, are difficult and costly for newcomers to replicate. For instance, in 2024, the average capital required to start a new insurance company in the US often exceeds $50 million, a substantial deterrent.

| Barrier Type | Description | Example (2024) |

| Capital Requirements | Minimum capital and surplus needed to operate. | Tens of millions of dollars for new insurers. |

| Regulatory Compliance | Licensing, solvency, and consumer protection laws. | Complex state-by-state navigation. |

| Actuarial Expertise | Data and modeling for pricing complex products. | Decades of data needed for long-term care. |

| Distribution Networks | Access to brokers, lenders, and advisors. | Years to build trust and relationships. |

Porter's Five Forces Analysis Data Sources

Our Genworth Financial Porter's Five Forces analysis leverages data from Genworth's annual reports and SEC filings, alongside industry-specific market research from sources like IBISWorld and S&P Capital IQ. This blend ensures a comprehensive understanding of competitive pressures and strategic positioning within the insurance sector.