Genus Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Genus Bundle

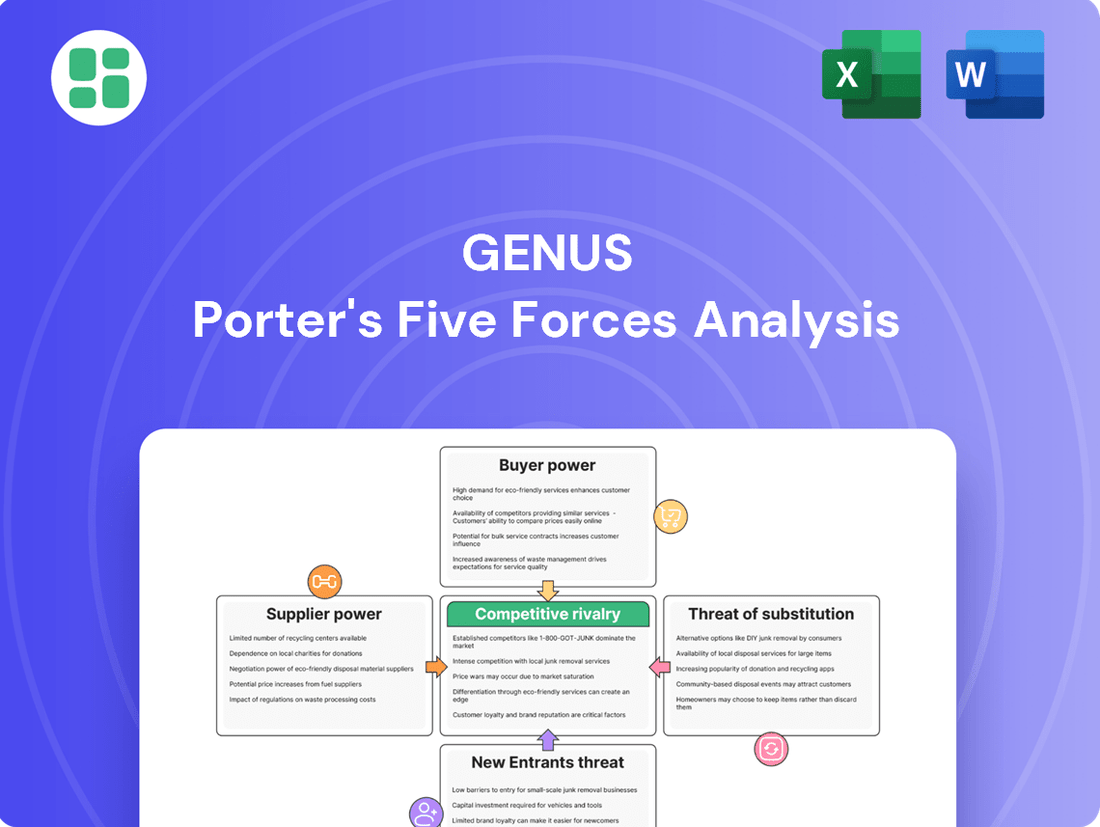

Porter's Five Forces Analysis offers a powerful lens to understand the competitive landscape Genus operates within. By dissecting the power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry, we gain crucial insights into Genus's market position.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Genus’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Genus PLC's reliance on highly specialized genetic material and cutting-edge biotechnology presents a potential area of supplier bargaining power. Suppliers of proprietary gene-editing tools or unique foundational breeding stock can wield significant influence if their offerings are scarce or difficult to replicate.

The substantial investment and lengthy development cycles required for Genus to internally develop such advanced genetic solutions further bolster the bargaining power of these specialized suppliers. For instance, the development of a new elite breeding line can take years and millions in research and development, making switching suppliers costly and time-consuming.

The development and application of advanced animal genetics, a core area for Genus, heavily rely on specialized scientific expertise. This includes deep knowledge in genomics, cutting-edge biotechnology, and advanced veterinary science.

A constrained global supply of these highly skilled researchers and scientists inherently grants them considerable leverage. This situation can translate into increased labor costs and intense competition for securing their services, directly impacting Genus's operational expenses and strategic hiring.

This limited talent pool presents a significant challenge for Genus's innovation pipeline and expansion plans. The company may face substantial human capital expenses to attract and retain the necessary scientific minds, potentially slowing growth or increasing the cost of R&D.

Genus's proprietary research partnerships, particularly with leading universities and research institutions, significantly influence supplier power. These collaborations are vital for novel genetic discoveries, which are the bedrock of Genus's future product pipeline. For instance, in 2024, Genus announced a multi-year research agreement with a prominent agricultural university focused on developing enhanced crop resilience, securing access to cutting-edge genetic data.

When these partners hold critical intellectual property, their bargaining power escalates. This can translate into more demanding licensing agreements or a larger share of future profits for Genus's innovations. The long-term commitment inherent in these R&D partnerships further solidifies the supplier's entrenched position, making it difficult for Genus to switch partners without substantial disruption.

Regulatory compliance and biosecurity inputs

Suppliers providing biological materials and specialized equipment for Genus must navigate a complex web of global and local regulations concerning animal health and biosecurity. These stringent compliance demands significantly narrow the pool of qualified suppliers. For instance, in 2024, the World Organisation for Animal Health (WOAH) continued to emphasize harmonized biosecurity protocols, impacting the availability and cost of compliant inputs.

This regulatory hurdle effectively concentrates supply, making Genus more reliant on a limited number of suppliers who can meet these rigorous standards. This dependency inherently boosts the bargaining power of these compliant suppliers, especially when considering the critical need for disease resistance in livestock genetics, a core focus for Genus.

- Regulatory Hurdles: Suppliers must meet evolving animal health and biosecurity standards, limiting the number of viable partners.

- Supplier Concentration: Fewer compliant suppliers mean increased reliance and thus greater supplier leverage.

- Disease Resistance Focus: Genus's emphasis on disease resistance necessitates specialized inputs from suppliers who can meet high biosecurity mandates.

Dependence on specific animal health products

Genus's reliance on specialized animal health products, such as vaccines and unique feed additives, highlights a potential area of supplier bargaining power. These inputs are crucial for ensuring the health and optimal performance of the animals carrying Genus's genetic traits, directly impacting the value proposition offered to Genus's customers.

Suppliers of patented or highly specialized animal health solutions could leverage their unique offerings. For instance, if a particular vaccine is critical for disease prevention in a high-value breeding stock, and only one or a few suppliers provide it, those suppliers gain significant leverage. This dependence means Genus might face pressure on pricing or supply availability for these essential components, impacting its operational costs and the overall productivity of its genetic programs.

- Dependence on Critical Inputs: Genus's genetic business is indirectly reliant on the availability and efficacy of animal health products.

- Supplier Leverage: Suppliers of patented or niche animal health products can exert influence due to their essential role in maximizing animal performance.

- Impact on Value Chain: Disruptions or cost increases in animal health inputs can affect the profitability and competitive positioning of Genus's genetic offerings.

The bargaining power of suppliers for Genus PLC is amplified by the specialized nature of its genetic materials and biotechnology needs. Suppliers of proprietary gene-editing tools or unique foundational breeding stock hold significant leverage, especially when their offerings are scarce or difficult to replicate. This is further compounded by the lengthy development cycles and substantial R&D investments Genus makes, making supplier switching a costly and time-consuming endeavor.

The global scarcity of highly skilled researchers in genomics and biotechnology also grants them considerable leverage, directly impacting Genus's operational expenses through increased labor costs and intense competition for talent. Furthermore, Genus's reliance on strategic research partnerships, particularly with universities holding critical intellectual property, strengthens the bargaining power of these partners, potentially leading to more demanding licensing agreements.

Regulatory hurdles, such as evolving animal health and biosecurity standards, significantly narrow the pool of qualified suppliers, concentrating supply and increasing Genus's dependence on a limited number of compliant partners. This dependence, especially concerning disease resistance which is a core focus for Genus, boosts the bargaining power of these compliant suppliers.

Suppliers of patented or highly specialized animal health products, like vaccines or unique feed additives crucial for optimal animal performance, can also exert significant influence. This dependence on essential inputs means Genus may face pricing or supply availability pressures, impacting its operational costs and the overall productivity of its genetic programs.

| Factor | Impact on Genus | Example (2024 Data/Trends) |

|---|---|---|

| Specialized Genetic Materials | High Supplier Bargaining Power | Scarcity of proprietary gene-editing tools or foundational breeding stock. |

| Scientific Expertise | Increased Labor Costs & Competition | Limited global pool of specialized researchers in genomics and biotechnology. |

| Research Partnerships | Demanding Licensing Agreements | University collaborations holding critical intellectual property for novel genetic discoveries. |

| Regulatory Compliance | Supplier Concentration | Stringent biosecurity protocols (e.g., WOAH emphasis in 2024) limiting qualified suppliers. |

| Animal Health Products | Potential Price/Supply Pressure | Dependence on patented vaccines or feed additives for optimal animal performance. |

What is included in the product

This analysis dissects the competitive landscape for Genus by examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each force, enabling targeted strategic adjustments.

Customers Bargaining Power

Large commercial farming operations, such as major dairy, beef, and pork producers, represent a significant customer segment for Genus. These entities often buy genetics in substantial quantities, which inherently grants them considerable bargaining power.

Their sheer scale of operation allows them to negotiate for better pricing and more favorable contract terms. This concentrated purchasing power means they can exert pressure on Genus's pricing strategies, potentially impacting profitability.

In commodity markets, especially in livestock farming for meat and dairy, producers operate on thin margins. This means they are extremely sensitive to any costs that go into their operations, including the quality of animal genetics they use.

This heightened price sensitivity directly amplifies the bargaining power of customers. Farmers are actively looking for the most economical ways to improve their herds, making them more likely to switch suppliers or negotiate harder on prices for genetic materials.

For instance, in 2024, the global dairy market saw fluctuating milk prices, with average farmgate prices in the US hovering around $18.50 per hundredweight, influenced by feed costs and global demand. This economic pressure means dairy farmers scrutinize every input, including the cost of high-quality semen or embryos, making them potent negotiators for genetic services.

The availability of alternative genetic suppliers significantly impacts Genus's bargaining power with its customers. While Genus holds a strong global position, the animal genetics sector is competitive, featuring other established players offering comparable products and services.

Customers are not locked into a single provider and can readily switch if they find better value, superior performance, or more attentive service from competitors. This ability to choose limits Genus's capacity to dictate terms or raise prices unilaterally.

For instance, in 2023, the global animal genetics market was valued at approximately $3.8 billion, with several companies vying for market share, underscoring the competitive landscape that customers navigate.

Performance-based purchasing decisions

Customers increasingly scrutinize genetic products for demonstrable results like enhanced feed conversion, better disease resistance, higher milk yields, or improved meat quality. For instance, in 2024, the global animal genetics market saw continued demand for traits directly impacting profitability, with advancements in genomic selection contributing to an estimated 5-10% improvement in key performance indicators for livestock in leading agricultural nations.

If Genus's genetic offerings fail to consistently provide superior economic advantages or effectively tackle specific agricultural hurdles, clients gain significant power. This leverage allows them to negotiate for better terms or explore competing genetic providers, directly impacting Genus's pricing flexibility and market share.

- Performance Metrics: Customers prioritize tangible outcomes such as improved feed conversion ratios (FCR), disease resistance levels, and increased yield (milk, meat, eggs).

- Economic Benefit: The ability of genetics to translate into quantifiable cost savings or revenue increases for the farmer is a key decision driver.

- Alternative Sourcing: The availability of comparable or superior genetic solutions from other suppliers strengthens the customer's bargaining position.

- Market Trends: In 2024, precision agriculture technologies further enabled farmers to track and verify genetic performance, amplifying the impact of these tangible outcomes on purchasing decisions.

Integration and in-house breeding programs

The bargaining power of customers can be impacted by the integration and in-house breeding programs of large farming conglomerates. These entities might develop their own genetic resources, lessening their dependence on external suppliers like Genus. For instance, a major agricultural producer could invest in advanced breeding technology, aiming to create proprietary genetic lines.

This development directly challenges Genus's market position. When customers can source genetics internally or through partnerships, their leverage against Genus increases. This is particularly relevant as the agricultural sector sees consolidation and a drive for vertical integration. In 2024, the global animal genetics market is highly competitive, with innovation in breeding technologies being a key differentiator.

- Customer Integration: Large agribusinesses are increasingly integrating their operations, including genetic development.

- Reduced Reliance: In-house breeding programs can significantly decrease a customer's need for external genetic providers.

- Alternative Sourcing: Strategic alliances among farming groups can create alternative sources for genetics, amplifying customer bargaining power.

Customers possess significant bargaining power when they purchase genetics in large volumes, as seen with major commercial farming operations. Their ability to negotiate favorable pricing and contract terms is amplified by their scale and sensitivity to input costs, especially in price-volatile commodity markets.

The availability of numerous alternative genetic suppliers in a competitive market also empowers customers, as they can readily switch providers if they find better value or performance. Furthermore, customers increasingly demand demonstrable economic benefits and superior performance metrics from genetic products, which limits Genus's ability to dictate terms.

Large agricultural conglomerates developing in-house breeding programs can reduce their reliance on external suppliers like Genus, thereby increasing their bargaining leverage. This trend towards vertical integration and proprietary genetic lines directly challenges Genus's market position and pricing flexibility.

| Customer Power Factor | Impact on Genus | 2024 Data/Trend |

|---|---|---|

| Purchasing Volume & Scale | High leverage for price and term negotiation | Major dairy/beef producers buy in bulk, influencing pricing. |

| Price Sensitivity | Pressure on Genus's margins due to thin farmer profit margins | US farmgate milk prices around $18.50/cwt in 2024, sensitive to feed costs. |

| Availability of Alternatives | Limits Genus's ability to unilaterally raise prices | Global animal genetics market valued at ~$3.8 billion in 2023, with multiple competitors. |

| Demand for Performance Metrics | Requires Genus to prove tangible economic benefits | Genomic selection contributing to 5-10% KPI improvement in livestock in 2024. |

| In-house Breeding Programs | Reduces customer dependence on Genus | Increasing consolidation and vertical integration in agriculture. |

Same Document Delivered

Genus Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces analysis, offering a thorough examination of competitive forces within an industry. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase. It is ready for immediate application to your strategic planning needs, providing actionable insights without any placeholders or surprises.

Rivalry Among Competitors

The animal genetics market is dominated by a handful of global leaders, such as Genus, creating a highly competitive landscape. These major players vie intensely for market share by focusing on superior genetics, cutting-edge technology, and expansive global distribution. For instance, Genus reported a 12% increase in revenue for the fiscal year ending June 30, 2023, reaching £583.7 million, demonstrating its strong market position and competitive success.

Developing and maintaining elite genetic lines, especially in sectors like advanced agriculture or biotechnology, demands significant and ongoing investment in research and development. This includes cutting-edge genomics, sophisticated breeding programs, and advanced biotechnological processes. For instance, companies in the advanced seed sector might spend upwards of 10-15% of their revenue on R&D annually, a figure that can be even higher for novel biotech developments.

These substantial fixed costs create a powerful incentive for companies to maximize sales volumes. The need to achieve economies of scale to recoup these investments intensifies competition, as rivals aggressively pursue market share. This dynamic often leads to consolidation and a focus on efficiency, as companies strive to spread their high R&D and operational costs over a larger customer base, making it challenging for smaller players to compete effectively.

In the animal genetics sector, competition is fierce and centers on demonstrating superior animal performance. This includes traits like disease resistance, such as the development of PRRS-resistant pigs, and enhanced growth rates and feed efficiency. Companies are locked in a continuous cycle of innovation to prove their genetic lines are better.

This intense rivalry demands significant investment in research and development. For instance, companies like Genus plc, a leader in animal genetics, reported a 3% increase in revenue for the fiscal year ending June 30, 2024, reaching £585.1 million, underscoring the financial commitment required to stay ahead in this innovation-driven market.

Geographic expansion and market penetration

Competitors are aggressively expanding into lucrative livestock-producing regions, intensifying rivalry. For instance, major players are investing heavily in emerging markets in Southeast Asia and Latin America, areas showing significant growth potential in animal protein consumption.

This geographic push means companies frequently encounter each other in the same local and regional markets, forcing direct competition on price, product offerings, and distribution networks. The global livestock sector saw a notable increase in cross-border investments and market entries throughout 2024.

- Increased Competition: Competitors are actively expanding into key livestock-producing regions, leading to more direct clashes in local and regional markets.

- Market Penetration Tactics: Companies are employing strategic acquisitions and partnerships to gain faster market access and solidify their competitive standing.

- Global Expansion Trends: Emerging markets in Asia and Latin America are particular hotspots for this expansion, driven by rising demand for animal protein.

- 2024 Market Dynamics: The year 2024 witnessed a significant rise in cross-border investments and new market entries within the global livestock industry.

Industry consolidation and strategic alliances

The animal genetics sector has seen significant consolidation, with larger companies actively acquiring smaller, specialized businesses. This strategy allows them to expand their genetic offerings and incorporate novel technologies. For instance, in 2023, Zoetis acquired Bioatla, a biopharmaceutical company, to bolster its biologics pipeline, signaling a move towards integrated solutions.

- Industry Consolidation: Major players are absorbing smaller, specialized firms to enhance genetic portfolios and technological access.

- Increased Market Concentration: This trend leads to a few dominant entities, intensifying direct competition among them.

- Strategic Alliances: Companies are forming partnerships to share research and development costs, access new markets, and jointly develop innovative genetic solutions.

- Impact on Rivalry: The heightened concentration and collaborative efforts among large players create a more intense competitive landscape.

Competitive rivalry in the animal genetics market is characterized by intense competition among a few dominant global players. These companies, including Genus plc, actively invest in research and development to enhance genetic traits like disease resistance and growth efficiency. Genus plc reported a 3% increase in revenue for the fiscal year ending June 30, 2024, reaching £585.1 million, highlighting the financial commitment necessary to maintain a competitive edge.

Companies are aggressively pursuing market share by expanding into high-growth regions, particularly in Southeast Asia and Latin America, where demand for animal protein is rising. This global expansion leads to direct competition in local markets, forcing players to compete on price, product innovation, and distribution strength. The year 2024 saw a notable uptick in cross-border investments and new market entries across the global livestock sector.

Industry consolidation is a significant trend, with larger firms acquiring smaller, specialized companies to broaden their genetic offerings and integrate new technologies. This strategy, exemplified by Zoetis's acquisition of Bioatla in 2023, concentrates market power and intensifies rivalry among the remaining major entities. Strategic alliances are also becoming more common as companies seek to share R&D costs and access new markets.

| Company | FY Ending | Revenue (Millions) | Revenue Growth (%) |

|---|---|---|---|

| Genus plc | June 30, 2023 | £583.7 | 12% |

| Genus plc | June 30, 2024 | £585.1 | 3% |

SSubstitutes Threaten

Farmers might choose traditional breeding methods over Genus's advanced genetics. These conventional practices, while less efficient, offer a lower-cost alternative, especially appealing to smaller operations or those with tighter budgets. For instance, in 2024, the global agricultural sector continued to see a significant portion of production relying on established, non-GMO techniques, demonstrating the persistent presence of these substitutes.

The increasing consumer preference for plant-based, lab-grown, and insect-based proteins presents a significant threat of substitution for traditional livestock. This macro trend directly impacts the demand for animal genetics, as it shrinks the addressable market for Genus's core offerings.

For instance, the global plant-based meat market was valued at approximately $5.6 billion in 2023 and is projected to reach over $17 billion by 2030, indicating a substantial shift in consumer protein choices. This growing adoption of alternative proteins indirectly reduces the need for the livestock genetics that Genus provides.

Farmers are increasingly exploring alternatives to solely relying on genetic advancements for animal productivity. For instance, in 2024, the global animal health market was projected to reach over $60 billion, indicating significant investment in areas like improved nutrition and veterinary services. This focus on non-genetic interventions can serve as a substitute for certain genetic improvements.

Optimizing animal nutrition, for example, can lead to better growth rates and disease resistance, potentially lessening the demand for specific genetic traits. Similarly, advancements in biosecurity measures and preventative veterinary care can mitigate losses from disease, reducing the reliance on genetic solutions for herd health. These alternative strategies offer farmers ways to enhance their operations without solely depending on genetic improvements, thereby acting as a threat of substitutes.

Lower-cost, less genetically optimized animals

In certain markets, especially those facing economic strain or with less sophisticated farming setups, producers might favor less expensive animals that haven't undergone extensive genetic refinement. The immediate financial advantage of using these lower-cost, less optimized animals can sometimes overshadow the long-term benefits of Genus's superior genetics. For instance, in regions where the average farm income is significantly lower, the upfront cost difference becomes a primary decision driver.

This presents a challenge for Genus PLC, as the value proposition of their premium genetics might not resonate as strongly when immediate affordability is the paramount concern. Farmers in these areas may prioritize basic survival and immediate cost reduction over the potential for higher yields or improved animal health offered by advanced genetics. This can lead to a segmentation of the market where Genus's offerings are more prevalent in developed agricultural economies.

- Market Segmentation: The threat of substitutes is more pronounced in markets with lower per capita income and less developed agricultural support systems.

- Cost Sensitivity: Farmers in these regions often operate on thinner margins, making the initial purchase price of breeding stock a critical factor in their decision-making process.

- Perceived Value: The long-term benefits of genetically superior animals, such as faster growth rates or disease resistance, may be perceived as less critical than immediate cost savings in certain economic environments.

- Competitive Landscape: This dynamic allows lower-cost, less genetically optimized animal providers to capture market share, particularly in price-sensitive segments of the global livestock industry.

On-farm breeding and semen collection

While not widespread for top-tier genetics, some larger agricultural operations and breeding cooperatives may develop their own on-farm breeding programs and semen collection capabilities. This internal capacity directly substitutes for acquiring genetic material from external providers like Genus. For instance, in 2024, a significant portion of cattle semen sales in the US still comes from specialized AI companies, but the trend towards greater producer self-sufficiency in certain aspects of breeding is noticeable.

This internal capability can reduce reliance on external suppliers for genetic material.

- Reduced Dependence: Farms with in-house capabilities lessen their need to purchase semen, impacting supplier revenue.

- Cost Savings Potential: For large operations, developing internal programs can potentially be more cost-effective than continuous external purchases.

- Control Over Genetics: On-farm collection allows for greater control over breeding stock selection and program management.

The threat of substitutes for Genus PLC's genetic products comes from alternative farming methods, changing consumer preferences towards novel proteins, and non-genetic improvements in animal productivity. Farmers can opt for traditional breeding, which is less costly, or focus on nutrition and veterinary care to boost animal performance. The rise of plant-based and lab-grown foods also directly impacts the demand for livestock genetics, as seen in the plant-based meat market's substantial growth.

Furthermore, some larger farms are developing in-house breeding programs, reducing their reliance on external genetic suppliers like Genus. This move towards self-sufficiency, particularly noticeable in certain aspects of cattle AI in the US as of 2024, can directly substitute for purchasing external genetic material.

| Substitute Category | Example | Impact on Genus | 2024 Data/Trend |

|---|---|---|---|

| Traditional Breeding | Non-GMO techniques | Lower cost alternative for farmers | Significant portion of global agricultural production still uses non-GMO methods. |

| Alternative Proteins | Plant-based meat | Reduces demand for livestock genetics | Global plant-based meat market valued at ~$5.6 billion in 2023, projected to exceed $17 billion by 2030. |

| Non-Genetic Improvements | Animal nutrition, veterinary care | Lessens reliance on genetic solutions | Global animal health market projected over $60 billion in 2024, indicating investment in these areas. |

| In-house Breeding Programs | On-farm semen collection | Reduces need for external genetic suppliers | Growing trend towards producer self-sufficiency in certain breeding aspects observed in 2024. |

Entrants Threaten

The animal genetics sector demands significant upfront investment in sophisticated research and development facilities, cutting-edge biotechnology equipment, and sustained R&D efforts to cultivate competitive genetic lines. For instance, companies like Genus plc invest heavily in their breeding programs and genomic research, with capital expenditures often running into tens of millions of dollars annually. This substantial financial barrier effectively discourages many aspiring entrants.

Genus's extensive intellectual property and patents create a formidable barrier to entry. Established players hold vast portfolios of patents, proprietary genetic lines, and trade secrets, making it difficult for newcomers to develop unique genetic material without costly infringement issues or licensing fees. For instance, the global biotechnology market, which heavily relies on intellectual property, was valued at approximately $1.3 trillion in 2023 and is projected to grow significantly, highlighting the immense value and protection afforded by patents in such innovation-driven sectors.

Stringent regulatory hurdles and approvals present a significant barrier to entry in the animal genetics sector. Navigating complex and evolving regulations across different jurisdictions, covering genetic modification, animal welfare, and product safety, demands substantial expertise and resources. For instance, obtaining approvals for new genetic technologies can take years and involve extensive testing, making it a costly endeavor for newcomers.

Brand reputation and established customer relationships

Genus has cultivated a robust global brand reputation, forged over decades through consistent performance and deep connections with farmers and breeding companies. This long-standing trust is a significant barrier for newcomers. For instance, in 2024, Genus's commitment to innovation and quality was recognized through various industry awards, further solidifying its market standing.

New entrants face a considerable challenge in replicating Genus's established customer loyalty. Farmers often prioritize genetics they know and trust, making it difficult for unproven alternatives to gain market acceptance quickly. This reliance on proven performance means new players need substantial time and resources to build credibility.

- Brand Loyalty: Decades of reliable performance have fostered deep trust with Genus's customer base.

- Established Relationships: Long-standing partnerships with farmers and breeding companies create a high switching cost.

- Perceived Risk: Farmers are hesitant to adopt new genetics without a proven track record, favoring established suppliers.

- Market Inertia: The agricultural sector often exhibits a preference for continuity, making it slow to embrace novel entrants.

Need for specialized scientific and commercial expertise

Success in the animal genetics sector hinges on a complex blend of scientific acumen and market savvy. Companies must possess deep knowledge in genomics, animal husbandry, and the intricacies of global agricultural supply chains. This specialized expertise is not easily acquired, presenting a considerable hurdle for newcomers aiming to enter the market.

The development of this talent pool is a protracted and resource-intensive process. Potential entrants face the challenge of either attracting highly skilled professionals or investing heavily in internal training and research and development. For instance, major players in the animal genetics industry often have decades-long histories of building their scientific teams and proprietary knowledge bases, creating a significant competitive moat.

- High R&D Investment: Companies like Genus PLC reported significant R&D expenditure in 2023, underscoring the capital required to maintain a competitive edge in scientific advancement.

- Talent Acquisition Costs: The demand for specialized geneticists and animal scientists drives up recruitment costs, making it harder for smaller firms to compete for top talent.

- Intellectual Property: Existing companies hold patents and proprietary data, which are difficult and expensive for new entrants to replicate or circumvent.

The threat of new entrants in animal genetics is considerably low due to high capital requirements for research and development, as well as the need for specialized talent. Established players like Genus plc have significant investments in proprietary technology and global distribution networks, creating substantial barriers.

Intellectual property, including patents and exclusive genetic lines, further deters new companies, as circumventing or acquiring these assets is costly and time-consuming. Regulatory compliance and the need for extensive testing and approvals also add layers of difficulty for potential market entrants.

Brand reputation and established customer loyalty, built over years of consistent performance, make it challenging for newcomers to gain market share. Farmers often prefer proven genetics, creating inertia that favors incumbents and increases the perceived risk for new entrants.

| Barrier to Entry | Description | Example/Data Point |

|---|---|---|

| Capital Requirements | Significant investment needed for R&D, facilities, and technology. | Genus plc's annual capital expenditures in breeding programs and genomic research are in the tens of millions of dollars. |

| Intellectual Property | Patents, proprietary genetic lines, and trade secrets. | The global biotechnology market, heavily reliant on IP, was valued at $1.3 trillion in 2023. |

| Regulatory Hurdles | Navigating complex and evolving regulations across jurisdictions. | Approvals for new genetic technologies can take years and involve extensive testing. |

| Brand Reputation & Loyalty | Established trust and long-standing relationships with customers. | Genus's market standing is solidified by decades of consistent performance and industry recognition in 2024. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, drawing from company annual reports, industry-specific market research, and government economic indicators to provide a comprehensive view of competitive pressures.