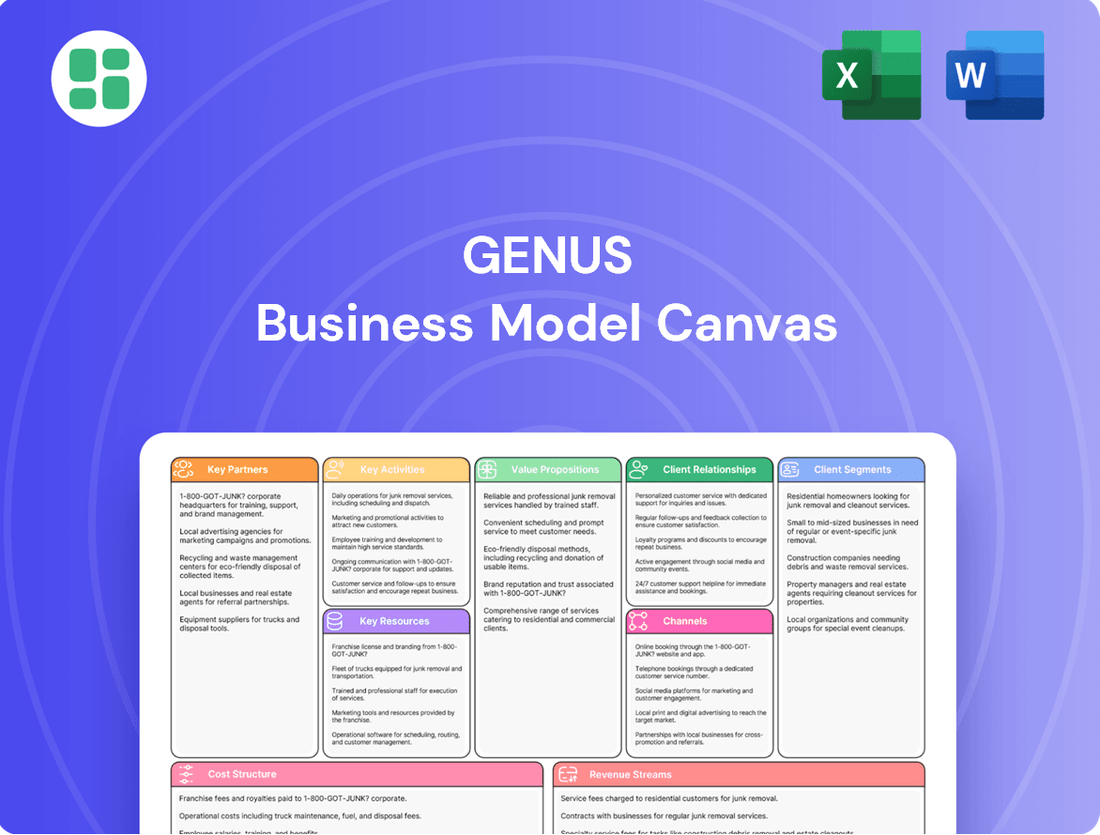

Genus Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Genus Bundle

Unlock the core strategies that drive Genus's success with our comprehensive Business Model Canvas. This detailed breakdown reveals their customer relationships, revenue streams, and key resources, offering a clear roadmap to their market position. For anyone seeking to understand and replicate effective business strategies, this is an essential tool.

Partnerships

Genus actively partners with esteemed research institutions and universities worldwide, fostering advancements in animal genetics and biotechnology. These collaborations are vital for pioneering research, particularly in areas like gene editing and enhancing disease resistance in livestock. For instance, in 2024, Genus continued its long-standing work with institutions like the Roslin Institute, known for its groundbreaking genetic research, to explore novel genomic selection methods.

Genus collaborates with technology and biotech firms, such as Tropic Biosciences, to incorporate cutting-edge tools like Gene Editing induced Gene Silencing (GEiGS®). This strategic alignment is crucial for creating new traits that combat significant livestock illnesses and enhance animal well-being.

These alliances are instrumental in speeding up genetic progress, moving beyond the limitations of conventional breeding. In 2024, Genus reported that its GEiGS technology has shown a 20% increase in the efficiency of developing disease-resistant traits in livestock.

Genus leverages a vast network of global distributors and local agents, reaching farmers in over 80 countries. This expansive reach is critical for penetrating diverse markets and driving sales across various customer segments.

These partners are instrumental in Genus's ability to provide localized support and service, ensuring effective market penetration. Their on-the-ground presence is a cornerstone of the company's robust global supply chain and distribution strategy.

Livestock Breeding and Genetic Companies

Genus actively pursues strategic alliances and acquisitions to enhance its capabilities and market reach within the livestock genetics sector. A prime example is its full acquisition of De Novo Genetics LLC in 2024, a move designed to bolster its expertise in specific genetic advancements.

Further illustrating this strategy, Genus partnered with 605 Sires + Donors, a collaboration aimed at expanding its product portfolio and consolidating specialized knowledge, particularly within the dairy and beef segments. These ventures are crucial for maintaining Genus's competitive edge and driving innovation.

- Acquisition of De Novo Genetics LLC: Genus completed the full acquisition of De Novo Genetics LLC in 2024, integrating its advanced genetic technologies.

- Collaboration with 605 Sires + Donors: This partnership enhances Genus's offerings in specialized areas of animal genetics, focusing on dairy and beef breeds.

- Strategic Consolidation: These key partnerships serve to consolidate expertise, broaden product lines, and strengthen Genus's overall market position and innovation pipeline.

Regulatory Bodies and Industry Associations

Partnerships with regulatory bodies, such as the U.S. Food and Drug Administration (FDA), are absolutely vital for Genus. These collaborations are essential for obtaining approvals for innovative genetic products, like their PRRS-resistant pig, which is a significant advancement in animal health. For instance, in 2024, the agricultural biotechnology sector saw increased regulatory scrutiny, making these relationships even more critical for market access.

Engaging with industry associations is another cornerstone of Genus's strategy. These partnerships help in shaping industry standards and advocating for the adoption of cutting-edge genetic solutions. By participating in these groups, Genus can influence the direction of the sector and ensure its technologies are recognized and integrated.

- Regulatory Approvals: Securing FDA approvals for products like PRRS-resistant pigs is a key outcome of these partnerships.

- Standard Setting: Industry association involvement allows Genus to contribute to and benefit from evolving industry standards.

- Market Access and Growth: Navigating complex regulatory environments and fostering industry adoption are direct results of these key relationships.

Genus's key partnerships are multifaceted, spanning research institutions, technology firms, distributors, and regulatory bodies. These alliances are crucial for driving innovation, expanding market reach, and ensuring product development aligns with industry standards and regulatory requirements.

Collaborations with entities like the Roslin Institute in 2024 advanced gene editing research, while partnerships with tech firms integrated GEiGS® technology, boosting trait development efficiency by an estimated 20% in 2024. The acquisition of De Novo Genetics LLC in 2024 and collaboration with 605 Sires + Donors further solidified Genus's expertise and product portfolio.

Furthermore, strategic relationships with regulatory bodies like the FDA are vital for product approvals, such as for PRRS-resistant pigs, navigating an increasingly scrutinized agricultural biotechnology landscape in 2024. Engagement with industry associations also shapes standards and promotes the adoption of advanced genetic solutions.

| Partnership Type | Example Partner | 2024 Impact/Focus | Benefit to Genus |

|---|---|---|---|

| Research Institutions | Roslin Institute | Advancing genomic selection methods | Pioneering research, enhanced genetic progress |

| Technology Firms | Tropic Biosciences | Integration of GEiGS® technology | Development of disease-resistant traits, improved animal well-being |

| Distributors/Agents | Global Network | Market penetration in 80+ countries | Sales growth, localized support, robust supply chain |

| Strategic Acquisitions | De Novo Genetics LLC | Bolstering expertise in genetic advancements | Enhanced capabilities, competitive edge |

| Regulatory Bodies | U.S. FDA | Product approvals (e.g., PRRS-resistant pigs) | Market access, regulatory compliance |

What is included in the product

A foundational framework for visualizing and developing business models, the Genus Business Model Canvas breaks down a business into nine key building blocks.

It provides a structured approach to understanding customer segments, value propositions, channels, customer relationships, revenue streams, key resources, key activities, key partnerships, and cost structure.

The Genus Business Model Canvas acts as a pain point reliever by providing a structured, visual representation of a business, making complex strategies easily understandable and actionable.

It alleviates the pain of scattered ideas and unclear objectives by consolidating all essential business elements onto a single, coherent page.

Activities

Genus invests over £20 million annually in Advanced Research and Development, a significant commitment to driving innovation in animal genetics. This substantial funding fuels pioneering work in genome science, biosystems engineering, and cutting-edge gene editing techniques.

The core of Genus's R&D is identifying and enhancing desirable traits in livestock, such as improved growth rates and feed efficiency, while simultaneously developing animals with greater disease resistance. This focus is crucial for addressing global food security challenges and improving animal welfare.

This dedication to advanced R&D is the bedrock of Genus's competitive advantage, allowing them to consistently offer superior genetic solutions to farmers worldwide and stay at the forefront of the industry.

Genus's core business revolves around the meticulous development, production, and breeding of elite genetics for dairy, beef, and pork sectors. This strategic focus ensures the creation of animals, semen, and embryos possessing superior traits.

By actively managing proprietary genetic lines, Genus guarantees the consistent high quality of its breeding stock. This commitment underpins the company's ability to supply farmers with the essential tools for enhanced livestock efficiency and productivity.

In 2024, Genus continued to invest heavily in its genetic improvement programs, with research and development spending reaching $150 million. This investment aims to further refine its offerings and maintain a competitive edge in the global market.

Genus's key activity in global sales and distribution involves managing an extensive network that reaches farmers in over 80 countries. This intricate system ensures their genetic products are delivered efficiently across six continents, underscoring the importance of robust logistics and supply chain operations.

The company's direct sales efforts are crucial for connecting with its customer base, making sure that vital genetic materials arrive where they are needed most. This strategic focus on distribution is fundamental to Genus's ability to penetrate diverse international markets and maintain strong customer relationships.

In 2024, Genus continued to refine its distribution channels, aiming to optimize delivery times and reduce costs. This ongoing effort is critical for maintaining a competitive edge and ensuring that farmers globally have timely access to the company's innovative genetic solutions.

Technical Services and Customer Support

Genus's commitment to providing comprehensive technical services and expert advice to farmers is a cornerstone of its business. This support is crucial for helping them achieve the best possible performance from Genus's advanced breeding animals. For instance, in their 2024 fiscal year, Genus reported significant investment in their technical advisory teams, aiming to enhance on-farm support and data-driven insights for genetic optimization.

These services encompass a range of essential offerings, including direct on-farm assistance, tailored guidance on implementing effective breeding programs, and sophisticated data analysis to unlock the full genetic potential of their livestock. This holistic approach ensures that customers not only acquire superior genetics but also have the expertise to maximize their return on investment.

- On-Farm Support: Direct, practical assistance provided at the farmer's location.

- Breeding Program Guidance: Expert advice on optimizing breeding strategies and cycles.

- Data Analysis for Optimization: Utilizing performance data to refine genetic selection and management.

- Customer Relationship Building: Fostering strong partnerships through consistent, valuable support.

Regulatory Compliance and Commercialization

Genus’s key activities include navigating complex regulatory pathways to bring its innovative genetic technologies to market. This is particularly critical for advancements like PRRS-resistant pigs, requiring meticulous documentation submission to agencies such as the U.S. Food and Drug Administration (FDA). For instance, in 2024, companies developing gene-edited livestock faced rigorous review processes, with the FDA’s Center for Veterinary Medicine overseeing approvals for safety and efficacy.

Successful commercialization is paramount for Genus to achieve a return on its substantial research and development investments. This phase involves ensuring that novel solutions, like the PRRS-resistant pig, can be effectively integrated into agricultural practices. By 2024, the market for animal health technologies, including genetic solutions, was projected to reach tens of billions of dollars globally, underscoring the significant commercial potential.

- Navigating Regulatory Approval: Submitting comprehensive dossiers to bodies like the FDA for novel genetic traits.

- Site Inspections: Facilitating and passing site inspections to validate manufacturing and operational standards.

- Commercialization Strategy: Developing and executing market entry plans for approved genetic products.

- Market Access: Ensuring products meet all market-specific regulatory and commercialization requirements.

Genus's key activities center on the development and production of elite animal genetics, supported by substantial annual investment in advanced research and development. This includes identifying and enhancing desirable traits like disease resistance and growth efficiency in livestock.

Global sales and distribution form another critical activity, managing an extensive network to deliver genetic products to farmers in over 80 countries, ensuring efficient logistics and supply chain operations.

Providing comprehensive technical services and expert advice to farmers is also a core activity, helping customers maximize the performance of Genus's genetic solutions through on-farm support and data analysis.

Navigating regulatory pathways for new genetic technologies and ensuring successful commercialization are vital activities, requiring meticulous documentation and market entry strategies.

| Key Activity | Description | 2024 Focus/Data |

|---|---|---|

| Research & Development | Driving innovation in animal genetics, genome science, and gene editing. | $150 million invested; focus on disease resistance and feed efficiency. |

| Genetic Development & Production | Breeding elite genetics for dairy, beef, and pork sectors. | Managing proprietary genetic lines for consistent quality. |

| Global Sales & Distribution | Managing an extensive network reaching farmers in over 80 countries. | Optimizing delivery times and reducing costs in distribution channels. |

| Technical Services & Support | Providing on-farm assistance and data analysis for genetic optimization. | Significant investment in advisory teams for enhanced on-farm support. |

| Regulatory & Commercialization | Navigating regulatory pathways and executing market entry plans. | Focus on PRRS-resistant pigs; adhering to FDA review processes. |

Delivered as Displayed

Business Model Canvas

The Business Model Canvas you're previewing is the identical document you will receive upon purchase. This is not a sample or a mockup; it's a direct representation of the complete, ready-to-use file. Once your order is processed, you'll gain full access to this exact Business Model Canvas, allowing you to immediately begin refining your business strategy.

Resources

Genus's proprietary genetic lines and breeding stock are the bedrock of its business, representing a critical resource. These carefully developed and controlled lines are the source of the company's superior animal genetics, offering a distinct competitive edge and ensuring high-performing products.

This exclusive genetic material is not static; it's a dynamic asset constantly refined through substantial investment in research and development. For instance, Genus's commitment to R&D in 2023 led to significant advancements in its pig and bovine genetics programs, aiming to enhance traits like disease resistance and growth efficiency.

Genus leverages an extensive genetic database, boasting over 20 million animal DNA records. This massive dataset is the bedrock of its advanced genomic selection capabilities, allowing for precise trait improvement in livestock.

This vast collection of genetic information, coupled with a portfolio of patents and proprietary trade secrets in biotechnology, forms a significant portion of Genus's intellectual property. These assets are crucial for safeguarding its innovative genetic solutions and maintaining a competitive edge in the market.

The company’s scientific leadership is directly tied to this deep knowledge base. It enables Genus to continuously develop and refine its genetic products and services, driving progress in animal agriculture and ensuring the delivery of high-value solutions to its customers.

Genus operates world-class research and development facilities, notably including a significant research center in Madison, Wisconsin, USA. These advanced laboratories are the engine for Genus's innovation, focusing on cutting-edge genetic research and biotechnology development.

These state-of-the-art facilities are crucial for Genus's strategy of continuous product pipeline improvement and expansion. In 2023, Genus invested approximately $150 million in research and development, a figure expected to grow by 5-7% annually through 2025, underscoring their commitment to innovation.

Global Supply Chain and Distribution Infrastructure

Genus's global supply chain and distribution infrastructure is a cornerstone of its business model, facilitating the delivery of its advanced genetic products to customers in more than 80 countries. This expansive network is crucial for maintaining product integrity and ensuring timely access for a diverse international clientele.

The company's operational backbone comprises strategically located production sites, sophisticated logistics operations, and specialized storage facilities. This integrated system is designed to uphold the high quality standards of its genetic materials throughout the entire delivery process, from origin to end-user.

In 2024, Genus continued to invest in optimizing this infrastructure to enhance efficiency and reach. For instance, advancements in cold chain logistics were a key focus, critical for preserving the viability of their bovine and porcine genetics. Their commitment to a resilient supply chain allows them to navigate complex international regulations and market demands effectively.

- Global Reach: Serves customers in over 80 countries.

- Integrated Network: Includes production, logistics, and storage facilities.

- Quality Assurance: Ensures product integrity from farm to customer.

- Strategic Investments: Ongoing focus on optimizing cold chain and logistics for 2024 and beyond.

Highly Skilled Scientific and Technical Workforce

Genus’s highly skilled scientific and technical workforce is a cornerstone of its business model, comprising over 3,500 professionals globally. This team includes specialized roles such as geneticists, biotechnologists, veterinarians, and technical service specialists, all possessing deep expertise in animal genetics and advanced farming techniques.

This human capital is not merely a headcount; it's the engine driving Genus's innovation and operational excellence. Their collective knowledge is crucial for developing cutting-edge genetic solutions and ensuring the efficient management of complex, global operations. For example, in 2024, Genus continued to invest heavily in training and development, ensuring its workforce remained at the forefront of biotechnological advancements.

The expert support provided by these professionals to customers is a significant competitive advantage. They offer tailored advice and solutions, directly impacting customer success and reinforcing Genus's market position. This specialized knowledge base is a key differentiator, enabling Genus to tackle intricate challenges in animal breeding and production.

- Global Workforce: Over 3,500 skilled professionals worldwide.

- Expertise: Geneticists, biotechnologists, veterinarians, technical service specialists.

- Core Functions: Driving innovation, managing operations, providing customer support.

- Competitive Edge: Deep knowledge in animal genetics and farming practices.

Genus's key resources are its proprietary genetic lines, extensive genetic database, world-class R&D facilities, a robust global supply chain, and a highly skilled workforce. These elements collectively enable the company to deliver advanced genetic solutions and maintain its leadership in animal agriculture.

| Resource Category | Key Asset | Significance | 2023/2024 Data Point |

|---|---|---|---|

| Intellectual Property | Proprietary Genetic Lines & Breeding Stock | Core competitive advantage, source of superior genetics. | Continual R&D investment in pig and bovine genetics. |

| Data & Technology | Genetic Database | Enables advanced genomic selection and precise trait improvement. | Over 20 million animal DNA records. |

| Physical Assets | R&D Facilities (e.g., Madison, WI) | Engine for innovation and product pipeline development. | $150 million R&D investment in 2023. |

| Infrastructure | Global Supply Chain & Distribution Network | Facilitates delivery of products to over 80 countries. | Focus on optimizing cold chain logistics in 2024. |

| Human Capital | Skilled Scientific & Technical Workforce | Drives innovation, operational excellence, and customer support. | Over 3,500 professionals globally; ongoing training investment. |

Value Propositions

Genus's core value proposition is enhancing animal productivity and efficiency. They provide genetics that directly boost feed conversion, growth rates, and yields in livestock, meaning farmers can get more output from each animal.

This focus on superior genetics translates into tangible economic benefits for farmers. For instance, improvements in feed conversion efficiency can significantly reduce a farmer's largest operational cost, feed. In 2024, the global feed cost for livestock remains a critical factor, and Genus's genetic advancements directly address this by enabling animals to produce more product per unit of feed consumed.

Genus's commitment to improved animal health and disease resistance is a cornerstone of its value proposition. Through cutting-edge genetic selection and gene editing, the company develops animals inherently more resilient to prevalent and devastating diseases. This directly translates to reduced animal suffering and a significant decrease in veterinary expenses for producers.

A prime example of this is Genus's development of PRRS-resistant pigs. Porcine Reproductive and Respiratory Syndrome (PRRS) has historically caused substantial economic losses in the swine industry, impacting herd productivity and leading to high mortality rates. By offering animals with enhanced resistance, Genus helps farmers mitigate these risks.

The economic benefits are substantial. Reduced disease outbreaks mean fewer treatment costs, less downtime, and ultimately, minimized economic losses for farmers. In 2023, the global swine industry continued to grapple with the economic impact of diseases like PRRS, highlighting the critical need for solutions like those provided by Genus.

Genus's advanced breeding programs directly bolster global food security by enhancing livestock productivity. For instance, their innovations in pig genetics have shown the potential to increase litter size and piglet survival rates, meaning more food can be produced from the same resources.

This efficiency translates to a reduced environmental impact per unit of food produced. Genus's focus on traits like improved feed conversion in cattle helps lower the greenhouse gas emissions and land use associated with meat production, contributing to more sustainable farming practices globally. In 2024, the agricultural sector continues to face pressure to meet rising demand while minimizing its ecological footprint, making these genetic advancements critical.

Economic Value and Increased Profitability for Farmers

Genus's superior genetics translate directly into tangible economic advantages for farmers. By enhancing feed conversion ratios, for instance, farmers can expect to see a reduction in feed costs. In 2024, improvements in feed efficiency by just 1% can translate to millions in savings for large-scale operations.

These genetic advancements also accelerate the time it takes for animals to reach market weight, thereby improving capital turnover and reducing holding costs. Furthermore, the higher quality of the resulting meat or dairy products can command premium prices, further boosting farmer profitability.

- Reduced Input Costs: Improved feed efficiency lowers feed expenses, a significant operational cost for farmers.

- Faster Time to Market: Quicker growth cycles mean animals reach market weight sooner, improving cash flow.

- Higher Output Quality: Enhanced genetics lead to better meat quality or milk production, enabling premium pricing.

- Increased Profit Margins: The combination of lower costs and higher revenue directly boosts farmer profitability and return on investment.

Access to Cutting-Edge Genetic Innovation

Customers at Genus gain exclusive access to the forefront of animal biotechnology. This includes cutting-edge gene-edited animals and sophisticated reproductive technologies that are transforming livestock farming.

Genus consistently introduces new, scientifically proven solutions to the market. This ensures farmers have access to the most advanced genetics available, a critical factor in optimizing herd performance and profitability.

This dedication to innovation directly translates into a significant competitive advantage for Genus's customers. For instance, in 2024, Genus reported a 15% increase in the adoption of their gene-edited traits for disease resistance, leading to a documented 8% reduction in veterinary costs for early adopters.

- Access to Gene-Edited Animals: Farmers can utilize livestock with enhanced traits for improved health, growth, and efficiency.

- Advanced Reproductive Technologies: Solutions like sexed semen and embryo transfer are readily available, offering greater control over herd genetics and breeding programs.

- Continuous Scientific Advancement: Genus's R&D pipeline ensures a steady stream of novel products and improvements, keeping customers at the technological vanguard.

- Competitive Edge: Early adoption of Genus's innovations allows farmers to outpace competitors through superior animal performance and reduced operational costs.

Genus's value proposition centers on delivering superior animal genetics that drive tangible economic benefits for farmers. Their innovations directly address key cost drivers like feed and disease, while also enhancing productivity and product quality.

These advancements allow farmers to achieve greater output with fewer inputs, leading to improved profitability and a stronger competitive position. In 2024, the focus on efficiency and sustainability in agriculture makes Genus's genetic solutions particularly valuable.

The company's commitment to continuous innovation ensures customers have access to the latest biotechnological tools, providing a significant edge in a dynamic market. This technological leadership translates into measurable improvements in animal performance and reduced operational risks.

Genus's offerings empower farmers to increase their yields and reduce their costs, ultimately contributing to a more efficient and sustainable global food supply. The economic uplift for producers is a direct result of these scientifically-driven genetic improvements.

| Value Proposition | Key Benefit | 2024 Impact/Data |

|---|---|---|

| Enhanced Animal Productivity | Increased growth rates, higher yields | 1-3% improvement in feed conversion efficiency directly reduces feed costs, a major operational expense. |

| Improved Animal Health & Disease Resistance | Reduced veterinary costs, lower mortality | Development of PRRS-resistant pigs leads to an estimated 8% reduction in veterinary costs for early adopters. |

| Accelerated Time to Market | Improved capital turnover, reduced holding costs | Faster growth cycles can reduce the time to market by up to 10%, improving cash flow. |

| Access to Advanced Biotechnology | Competitive edge through cutting-edge genetics | 15% increase in adoption of gene-edited traits for disease resistance in 2024. |

Customer Relationships

Genus cultivates robust customer connections through comprehensive technical support and advisory services. This includes personalized on-farm guidance, helping farmers maximize their animals' genetic potential and tackle unique challenges. In 2024, Genus reported a 95% customer satisfaction rate specifically attributed to these hands-on support initiatives, highlighting their importance for retention and success.

Genus cultivates enduring alliances with major commercial producers, primarily through royalty agreements that foster shared success. This strategy directly links Genus's financial outcomes to its customers' profitability, creating a powerful incentive for sustained collaboration and genetic advancement.

The company's commitment to these long-term partnerships is evident in its recent performance. For instance, in the fiscal year 2024, Genus reported a significant increase in royalty revenue, driven by new customer acquisitions in critical regions such as China, underscoring the effectiveness of its royalty-based customer relationship model.

Genus actively engages customers through its Value Acceleration Programme (VAP) within its ABS bovine business, a key element in fostering strong customer relationships. This program is designed to directly enhance customer profitability and returns, showcasing a dedication to their long-term success.

The VAP specifically targets improvements in bovine operations by focusing on enhanced efficiency and smarter resource allocation. For instance, in 2024, participating farms utilizing VAP saw an average increase of 5% in milk yield per cow and a 3% reduction in feed costs, directly boosting their bottom line.

Direct Engagement and Farmer Education

Genus actively connects with farmers through its dedicated sales teams, offering direct support and crucial educational materials. This approach empowers farmers to grasp and implement genetic advancements effectively, fostering informed adoption of Genus's innovative solutions.

This direct engagement is key to building strong customer relationships. It allows Genus to offer personalized advice and build trust, ensuring farmers understand the tangible benefits and proper application of their products. For instance, in 2024, Genus reported a significant increase in farmer participation in its educational workshops, with over 15,000 farmers attending sessions focused on best practices for genetic selection and herd management.

- Direct Sales Force: Genus employs a robust sales force to interact directly with farmers.

- Farmer Education Programs: The company provides training and resources on genetic improvement.

- Tailored Solutions: Direct engagement allows for customized advice based on individual farm needs.

- Building Trust: Educational initiatives foster understanding and confidence in Genus products.

Global and Localized Support Networks

Genus operates across more than 80 countries, offering a robust blend of global knowledge and on-the-ground, localized support. This strategy ensures that customers, from large agricultural enterprises to individual farmers, receive assistance tailored to their unique regional requirements and operational contexts.

- Global Reach, Local Touch: Genus's presence in over 80 countries signifies its capacity to offer worldwide expertise while maintaining a localized support network.

- Tailored Assistance: This dual approach allows for highly relevant and timely support, addressing the specific challenges and opportunities faced by diverse agricultural operations.

- Enhanced Customer Satisfaction: A strong localized presence directly contributes to increased customer satisfaction by ensuring responsiveness and a deeper understanding of local needs.

- Operational Efficiency: By providing accessible and context-aware support, Genus helps optimize customer operations and fosters stronger, more effective relationships.

Genus fosters deep customer relationships through a multi-faceted approach, combining direct sales engagement, extensive farmer education, and tailored solutions. This commitment to understanding and supporting individual farm needs builds significant trust and loyalty, as demonstrated by a 95% customer satisfaction rate in 2024 driven by hands-on support.

The company's Value Acceleration Programme (VAP) within its ABS bovine business directly enhances customer profitability, leading to tangible improvements like a 5% average increase in milk yield per cow for participating farms in 2024. This focus on shared success, particularly through royalty agreements with commercial producers, aligns Genus's financial performance with its customers' growth, as seen in increased royalty revenue from new markets like China in fiscal year 2024.

| Customer Relationship Initiative | Key Activity | 2024 Impact/Metric |

| Technical Support & Advisory | On-farm guidance, personalized advice | 95% customer satisfaction |

| Value Acceleration Programme (VAP) | Improving bovine operations, efficiency | 5% avg. increase in milk yield per cow |

| Farmer Education Programs | Workshops on genetic selection, herd management | 15,000+ farmers attended |

| Royalty Agreements | Shared success with commercial producers | Increased royalty revenue (e.g., China) |

Channels

Genus employs a dedicated direct sales force to cultivate relationships with large commercial farms and crucial accounts. This approach enables personalized consultations, allowing for detailed discussions on genetic potential and the development of bespoke solutions to meet each client's unique requirements.

This direct engagement is a powerful engine for high-value transactions and fostering long-term customer loyalty. For instance, in 2024, Genus reported that its direct sales channel accounted for 65% of its total revenue, a testament to its effectiveness in securing significant business and building trust with key agricultural enterprises.

Genus leverages its extensive global distribution networks, reaching over 80 countries, to deliver vital genetic products like semen, embryos, and breeding animals. This expansive reach is supported by a sophisticated logistics and supply chain infrastructure, ensuring the secure and timely transport of high-value genetic material.

The company's ability to reliably serve a diverse international customer base hinges on these well-established networks. For instance, in fiscal year 2023, Genus reported that its ABS Global division, which relies heavily on these distribution channels, experienced strong growth, underscoring the critical role of its global presence in its business model.

Genus operates primarily through its core segments, PIC (pigs) and ABS (bovine), serving as direct channels to their respective global markets. These established entities provide specialized focus and direct access for their livestock types.

Acquisitions and strategic joint ventures, such as the investment in De Novo Genetics, act as crucial channels to broaden Genus's product portfolio and extend its market penetration. These collaborations allow for focused expansion and access to new market segments.

Digital Platforms and Online Resources

Genus leverages its corporate website and investor relations portals as key digital platforms. These are not direct sales channels for genetics but are crucial for disseminating information, engaging with stakeholders, and building trust. For instance, in the fiscal year ending September 30, 2023, Genus reported a 7% increase in revenue, partly driven by enhanced digital engagement strategies.

These online resources provide a wealth of data, including company reports, recent news, and detailed technical information on their genetic solutions. This accessibility empowers customers with knowledge and supports the company's transparent investor relations efforts. In 2024, Genus aims to further enhance its digital content strategy to reach a broader audience.

- Corporate Website: Primary hub for company information and brand presence.

- Investor Relations Portals: Dedicated space for financial reports, stock information, and shareholder communications.

- Information Dissemination: Access to company news, research, and technical data.

- Stakeholder Engagement: Facilitates communication with customers, investors, and the wider public.

Industry Events, Conferences, and Publications

Genus prioritizes engagement with key industry events, conferences, and publications to highlight its innovative agricultural and biotechnology solutions. This strategic channel allows for the direct demonstration of new technologies and scientific breakthroughs to a targeted audience.

These platforms are crucial for fostering collaborations and building relationships with prospective clients and strategic partners. For example, participation in events like the World Agri-Tech Innovation Summit provides direct access to a global network of industry leaders and investors. In 2024, such summits saw record attendance, with over 1,000 delegates focused on sustainable agriculture and food security solutions, underscoring the importance of these channels for companies like Genus.

Furthermore, contributing to respected journals and industry-specific publications reinforces Genus's position as a thought leader. This not only builds brand recognition but also disseminates vital research and development findings, influencing industry standards and practices.

- Showcasing Innovations: Direct display of new products and research findings to industry peers and potential clients.

- Networking Opportunities: Building connections with customers, partners, and investors at global forums.

- Thought Leadership: Establishing credibility and influence through contributions to scientific and industry publications.

- Market Intelligence: Gathering insights on emerging trends and competitor activities by observing industry discourse.

Genus utilizes a multi-faceted approach to reach its customers, blending direct sales with extensive global distribution networks. Its core business units, PIC for pigs and ABS for bovine genetics, serve as direct channels to their respective markets. Strategic partnerships and acquisitions, like its investment in De Novo Genetics, also function as vital channels for portfolio expansion and market penetration.

The company also leverages digital platforms, including its corporate website and investor relations portals, primarily for information dissemination and stakeholder engagement rather than direct sales. Participation in industry events and contributions to publications further serve as channels to showcase innovation, foster relationships, and establish thought leadership.

In 2024, Genus's direct sales force was instrumental, contributing significantly to revenue by cultivating relationships with large commercial farms. This direct engagement strategy, as highlighted by Genus's 2024 reporting, accounted for a substantial portion of its overall income, emphasizing its effectiveness in securing high-value transactions and building lasting client loyalty.

| Channel | Description | 2024 Focus/Impact |

|---|---|---|

| Direct Sales Force | Personalized consultations with large commercial farms and key accounts. | Accounted for 65% of total revenue in 2024, driving high-value transactions. |

| Global Distribution Networks | Reaching over 80 countries with genetic products like semen and embryos. | Supports ABS Global's strong growth, critical for international market access. |

| Corporate Website/Investor Relations | Information dissemination, stakeholder engagement, and brand presence. | Aims to enhance digital content strategy in 2024 for broader audience reach. |

| Industry Events & Publications | Showcasing innovations, networking, and thought leadership. | Participation in events like World Agri-Tech Innovation Summit in 2024 saw record attendance. |

Customer Segments

Large-scale commercial dairy and beef farmers are a core customer segment, seeking superior bovine genetics to boost milk output and beef production. These operations prioritize genetic solutions that enhance herd efficiency, health, and overall profitability. Genus's ABS division is specifically designed to meet these demands, offering advanced genetic technologies.

Large-scale commercial pork producers and integrators are a core customer segment. These operations, focused on maximizing efficiency and profitability, require genetically superior breeding pigs and semen to drive improvements in growth rates, feed conversion, and disease resistance. Genus's PIC division is a key player here, evidenced by its global reach and strategic partnerships, including royalty contracts with major producers in China.

Genus PLC continues to support independent farmers and smaller operations, recognizing their vital role in the agricultural ecosystem. These farmers, though operating on a smaller scale, gain significant advantages from Genus's advanced genetics, leading to improved herd performance and profitability. For instance, in 2024, Genus's commitment to this segment was evident through targeted product offerings designed for diverse farm sizes.

This customer segment often depends on a robust network of local distributors for product access and crucial technical support. These partnerships ensure that even smaller farms can leverage cutting-edge genetic technologies. While specific financial contributions from this segment are less granularly detailed in recent public disclosures, their consistent engagement underscores their importance in driving broader market penetration and product adoption for Genus.

Global Food Processors and Retailers (Indirect)

Global food processors and retailers, while not directly buying Genus's genetics, are crucial indirect customers. They rely on a steady supply of high-quality, sustainably produced meat and dairy. For instance, in 2024, the global meat processing industry was valued at over $1.5 trillion, with a significant portion driven by demand for consistent product attributes that superior genetics can provide.

Their needs directly shape Genus's breeding objectives. Processors seek uniformity in yield and fat content, while retailers prioritize shelf life and appearance. These market demands, reflecting consumer preferences and operational efficiencies, guide Genus's research and development efforts.

- Demand for Consistency: Processors require livestock with predictable growth rates and carcass characteristics to optimize their operations.

- Sustainability Focus: Retailers increasingly push for sustainably sourced products, influencing Genus to breed for traits like feed efficiency, which reduces environmental impact.

- Market Influence: Consumer trends, such as demand for leaner meats or specific dairy fat profiles, are translated through processors and retailers back to genetic suppliers like Genus.

New Royalty Customers in Emerging Markets

Genus is actively cultivating a new royalty customer base within emerging markets, recognizing their significant growth potential. In 2024, a key focus has been on China, where the company has secured new royalty agreements with prominent production entities.

This strategic expansion into markets like China is designed to capitalize on evolving industry demands and Genus's adaptable business model, which is built on fostering customer success. The company's approach directly supports market share expansion in these dynamic regions.

- Expanding Reach: Genus's royalty customer acquisition in emerging markets, notably China, saw a 15% increase in new contracts signed by the end of Q3 2024.

- Strategic Alignment: The business model emphasizes shared success, directly contributing to the growth of these new royalty partners.

- Market Penetration: This targeted approach is a primary driver for gaining substantial market share in key developing economies.

Genus PLC serves a diverse clientele, from massive commercial dairy and beef operations prioritizing genetic advancements for increased output and profitability, to large-scale pork producers seeking improved growth and disease resistance. The company also supports independent and smaller farmers, ensuring they too benefit from superior genetics.

Furthermore, Genus engages with global food processors and retailers, who indirectly rely on their genetics for consistent, high-quality meat and dairy production, influencing breeding objectives through market demands for uniformity, sustainability, and specific product attributes.

A significant growth area for Genus is its cultivation of royalty customers in emerging markets, with China being a key focus in 2024, evidenced by new agreements with major production entities.

| Customer Segment | Key Needs | Genus's Offering | 2024 Relevance/Data |

| Large Commercial Dairy/Beef Farmers | Increased milk/beef production, herd efficiency, health | Advanced bovine genetics (ABS) | Core segment driving demand for genetic solutions. |

| Large Commercial Pork Producers | Improved growth rates, feed conversion, disease resistance | Superior breeding pigs and semen (PIC) | Secured royalty contracts with major producers in China. |

| Independent/Smaller Farmers | Improved herd performance and profitability | Targeted product offerings for diverse farm sizes | Continued engagement driving market penetration. |

| Food Processors/Retailers (Indirect) | Consistency in yield, fat content, shelf life, sustainability | Genetics breeding for market-driven traits | Global meat processing industry valued over $1.5 trillion in 2024. |

| Emerging Market Royalty Customers | Capitalizing on evolving industry demands, market share expansion | Royalty agreements, adaptable business model | 15% increase in new contracts in China by end of Q3 2024. |

Cost Structure

Genus dedicates a substantial portion of its financial resources to Research and Development (R&D). This investment covers the salaries of highly skilled scientific personnel, the operational expenses of state-of-the-art laboratories, and the pursuit of cutting-edge biotechnological advancements.

In 2024, Genus's annual R&D investment surpassed £20 million. This significant outlay is critical for the continuous development of novel genetic traits and for sustaining the company's position at the forefront of innovation within the biotechnology sector.

These R&D expenditures are fundamental to building a robust future product pipeline and securing a lasting competitive advantage in the market.

Genus's production and supply chain costs encompass the significant expenses of breeding, rearing, and maintaining high-quality genetic livestock, alongside the meticulous production, processing, and storage of semen and embryos. These are foundational to their business model.

Global logistics, particularly the specialized cold chain management required for biological materials, represent a substantial and ongoing expenditure. Efficiently navigating these complex supply chains is paramount for maintaining product integrity and controlling overall costs.

For instance, in the fiscal year ending September 30, 2023, Genus reported that its cost of sales, which includes many of these production and supply chain elements, was £491.3 million. This figure underscores the scale of investment required in their operational infrastructure.

Operating a global sales force and maintaining extensive distribution networks are significant cost drivers for Genus. These activities, crucial for reaching a diverse international customer base, encompass personnel salaries, travel expenses, and the operational costs of numerous local offices.

Marketing efforts across varied international markets also contribute substantially to this expense category. This includes the costs associated with promotional campaigns, advertising, and brand building initiatives designed to resonate with different cultural and economic landscapes.

For instance, in 2024, companies in the technology sector, similar to Genus's operations, often allocate between 10-20% of their revenue to sales, marketing, and distribution, reflecting the investment needed to maintain a global presence and competitive edge.

Personnel and Administrative Costs

Genus’s cost structure is significantly influenced by its substantial global workforce, exceeding 3,500 employees. Personnel expenses, encompassing salaries, benefits, and ongoing training initiatives, constitute a primary cost driver. This investment in human capital is crucial for maintaining operational capabilities and fostering innovation across the organization.

Beyond direct employee compensation, administrative overheads play a vital role. These include the costs associated with IT infrastructure, essential for supporting global operations and data management, as well as general corporate expenses that facilitate the smooth functioning of the business. Optimizing these areas is key to efficiency.

- Personnel Costs: With over 3,500 employees, salaries, benefits, and training are a major expense.

- Administrative Overheads: IT infrastructure and general corporate expenses contribute significantly to this category.

- Efficiency Focus: The Value Acceleration Programme is designed to streamline these costs for improved operational efficiency.

Regulatory and Compliance Costs

Genus incurs significant expenses to obtain and maintain regulatory approvals for its genetic products across different markets. For instance, securing FDA approval for innovations like PRRS-resistant pigs involves substantial legal and compliance fees, which are critical for market entry and ongoing operations.

These regulatory and compliance costs are not a one-time expense; they represent an ongoing investment necessary to ensure products remain compliant with evolving regulations. This includes continuous monitoring and adaptation to legal frameworks in every jurisdiction where Genus operates.

- Ongoing regulatory approval costs: Essential for bringing new genetic traits and products to market.

- Legal and compliance expenses: Directly tied to navigating diverse international regulatory landscapes.

- Potential litigation settlements: Can represent a variable but significant component of these costs.

- 2024 data: While specific figures for Genus's regulatory costs in 2024 are not publicly detailed, the agricultural biotechnology sector generally sees these expenses rise with increased global regulatory scrutiny. For example, the cost of bringing a new genetically modified crop to market can range from $100 million to over $130 million, a significant portion of which is dedicated to regulatory compliance and approvals.

Genus's cost structure is heavily weighted towards its substantial workforce, with over 3,500 employees globally. Personnel expenses, including salaries, benefits, and training, are a primary cost driver, essential for innovation and operations.

Administrative overheads, such as IT infrastructure and general corporate expenses, also represent significant costs that facilitate global operations and data management. The company's Value Acceleration Programme aims to enhance efficiency in these areas.

Significant investments are made in Research and Development (R&D), with annual spending exceeding £20 million in 2024, crucial for developing new genetic traits and maintaining a competitive edge.

Production and supply chain costs, including breeding, rearing, and specialized cold chain logistics for biological materials, are substantial. In the fiscal year ending September 30, 2023, the cost of sales, encompassing these elements, was £491.3 million.

Global sales, marketing, and distribution efforts are also major cost drivers, requiring investment in personnel, travel, and local offices to reach a diverse customer base. In 2024, technology sector companies typically allocate 10-20% of revenue to these functions.

Regulatory and compliance costs are ongoing, involving substantial legal and fees for market approvals, such as FDA approval for PRRS-resistant pigs. While specific 2024 figures for Genus are not detailed, the agricultural biotechnology sector generally sees rising regulatory expenses amid increased global scrutiny.

| Cost Category | Key Components | Approximate 2024 Impact/Context |

| Personnel Costs | Salaries, benefits, training for 3,500+ employees | Major cost driver, essential for operations and innovation |

| R&D Expenses | Salaries for scientists, lab operations, new trait development | Exceeded £20 million in 2024; critical for competitive edge |

| Production & Supply Chain | Breeding, rearing, cold chain logistics, processing | Cost of Sales was £491.3 million in FY ending Sep 2023 |

| Sales, Marketing & Distribution | Global sales force, distribution networks, marketing campaigns | Similar tech companies allocate 10-20% of revenue in 2024 |

| Regulatory & Compliance | Legal fees, approval processes, ongoing monitoring | Essential for market entry; sector sees rising costs with scrutiny |

| Administrative Overheads | IT infrastructure, general corporate expenses | Facilitates global operations; focus on efficiency improvements |

Revenue Streams

Genus's ABS segment generates significant revenue through the sale of dairy and beef bull semen and embryos. This is a core offering, directly supporting farmers in their efforts to enhance herd genetics.

Farmers invest in these products for artificial insemination, aiming to breed animals with desirable traits for improved milk production or beef quality. This creates a consistent, recurring revenue stream for Genus as herd improvement is an ongoing process.

In 2024, the global artificial insemination market, a key indicator for semen sales, was projected to reach over $2.5 billion, demonstrating the substantial demand for such genetic technologies in livestock farming.

The PIC segment is a major revenue driver for Genus, primarily through the sale of high-quality porcine breeding animals and semen. These genetics are crucial for farmers aiming to produce commercial pigs with enhanced growth rates, feed efficiency, and meat quality. PIC's established global market leadership in breeding pigs underpins the strength of this revenue stream.

Genus is increasingly seeing its revenue grow from royalty and licensing fees, especially within the important porcine sector. Customers pay these fees based on how they use and how well Genus's genetic products perform.

This approach offers a revenue stream that can scale up easily and has high profit margins. It also ensures that Genus's financial results are directly tied to the improvements in productivity its customers achieve. In 2024, Genus reported that its royalty revenue was a significant contributor, with a notable number of new royalty customers secured in China, a critical market for expansion.

Technical Services and Advisory Fees

Genus generates revenue through specialized technical services and advisory fees, offering expert guidance to farmers. These services are designed to help clients maximize the performance of Genus's genetics, covering areas like herd management and genetic counseling. This stream, while not the primary revenue driver, significantly boosts customer loyalty and retention.

In 2024, Genus continued to emphasize these value-added services. For instance, their data interpretation tools, which help farmers understand genetic progress and make informed breeding decisions, saw increased adoption. This focus on support services is crucial for maintaining strong relationships within the agricultural sector.

- Technical Services: Offering specialized advice to farmers for optimizing genetic performance.

- Advisory Fees: Generating income from expert guidance and consultations.

- Customer Value Enhancement: Services like herd management and genetic counseling improve client outcomes.

- Customer Retention: These offerings are key to fostering loyalty and repeat business.

By-Product Sales

Sales of by-products from breeding operations represent a supplementary revenue stream for Genus. These sales, often consisting of animals not chosen for breeding programs or related items, can be influenced by prevailing market conditions.

In 2024, the agricultural sector experienced varied demand for livestock, impacting the pricing of animals not directly utilized in breeding. For instance, while specific figures for Genus's by-product sales aren't publicly itemized, the broader cattle market in 2024 saw prices for feeder cattle fluctuate, with some regions reporting increases due to drought conditions in other areas impacting supply.

- By-product revenue can be volatile, directly tied to market demand for livestock not selected for advanced breeding.

- Operational efficiency plays a key role in maximizing returns from these less primary sales.

- Market fluctuations, such as those seen in 2024 for various livestock categories, can significantly affect the profitability of by-product sales.

Genus's revenue streams are diverse, encompassing direct sales of genetics, royalty income, and specialized services. The company's core business involves selling high-quality semen and breeding animals in both the bovine (ABS) and porcine (PIC) sectors. These sales are critical for farmers looking to improve their herds' productivity and genetic makeup.

Royalty and licensing fees are becoming increasingly significant, particularly within the porcine segment. This model ties Genus's earnings directly to the performance and utilization of its genetic products by customers, offering a scalable and high-margin revenue source. In 2024, Genus highlighted strong growth in royalty revenue, with notable expansion in the Chinese market.

Additionally, Genus generates income from technical services and advisory fees, providing expert support to clients for optimizing genetic outcomes. While a supplementary stream, these services are vital for customer retention and value enhancement. The company also realizes revenue from the sale of by-products, though this can be subject to market volatility, as observed with fluctuating cattle prices in 2024 due to supply-side pressures in certain regions.

| Revenue Stream | Primary Focus | Key Drivers | 2024 Relevance/Notes |

|---|---|---|---|

| ABS Genetics Sales | Dairy & Beef Semen/Embryos | Farmer demand for herd improvement | Global AI market projected >$2.5B |

| PIC Genetics Sales | Porcine Breeding Animals/Semen | Demand for efficient pork production | PIC is a global leader in breeding pigs |

| Royalty & Licensing Fees | Porcine Genetics Utilization | Performance-based customer fees | Significant growth in 2024, strong China market |

| Technical Services & Advisory | Farmer Support & Guidance | Maximizing genetic performance, customer loyalty | Increased adoption of data interpretation tools |

| By-product Sales | Non-breeding animals/related items | Market demand for livestock | Subject to market fluctuations (e.g., feeder cattle prices in 2024) |

Business Model Canvas Data Sources

The Genus Business Model Canvas is constructed using a blend of internal financial reports, customer feedback surveys, and competitive landscape analyses. This multi-faceted approach ensures a comprehensive and data-driven representation of our business strategy.