Genus Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Genus Bundle

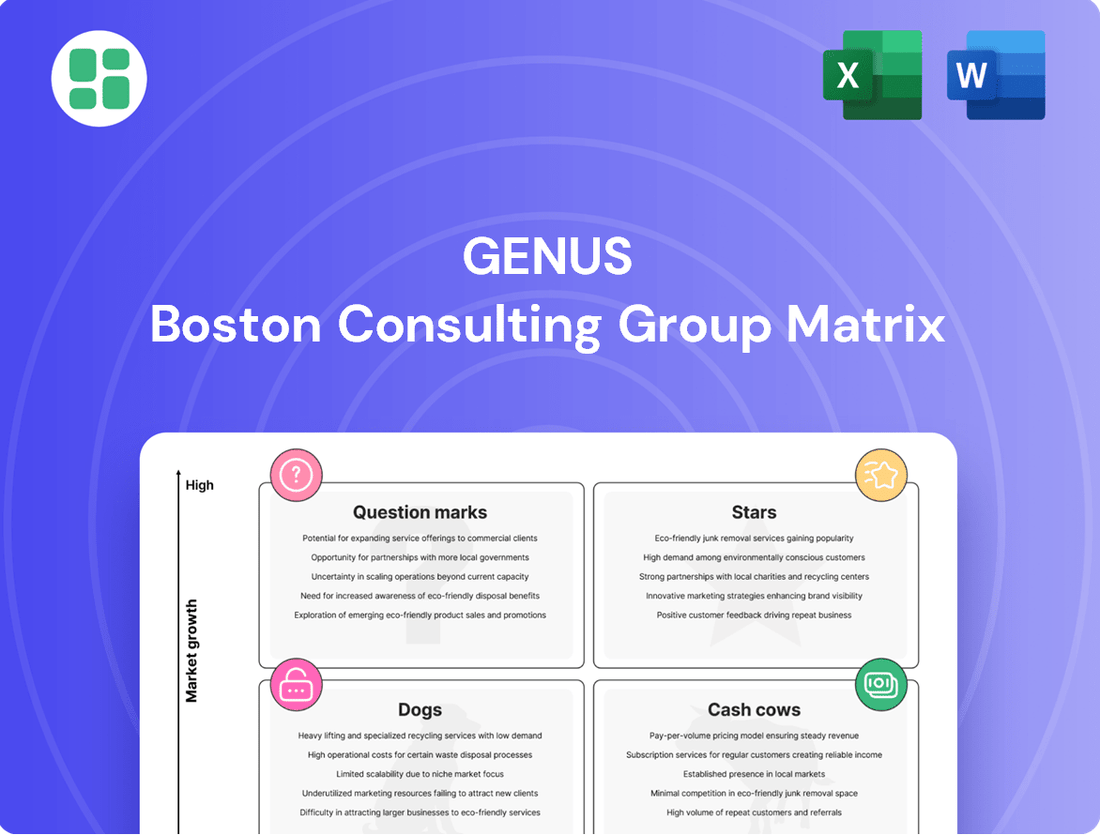

Unlock the strategic power of the Genus BCG Matrix and understand your product portfolio's true potential. See where your offerings fall as Stars, Cash Cows, Dogs, or Question Marks, and gain a foundational understanding of market dynamics. Purchase the full Genus BCG Matrix for in-depth analysis, actionable recommendations, and a clear path to optimizing your business strategy.

Stars

Genus's gene-edited pigs resistant to Porcine Reproductive and Respiratory Syndrome (PRRS) are a prime example of a Star in the BCG matrix. This innovative technology, approved by the US FDA in April 2025, directly tackles a devastating disease that costs the global swine industry billions annually, with estimates suggesting PRRSV alone caused over $1 billion in losses in the US in recent years. Genus is poised to capture a significant market share due to this breakthrough.

IntelliGen Sexed Genetics, marketed as Sexcel by ABS Global, is a prime example of a Star in the Genus BCG Matrix within the bovine genetics sector. This innovative sexed genetics product employs a novel technology to significantly increase the likelihood of high-value female pregnancies.

This advancement directly addresses the growing farmer demand for specific animal traits, thereby boosting productivity for both dairy and beef operations. The global bovine artificial insemination market is experiencing robust growth, with projections indicating continued expansion, creating a highly favorable environment for advanced solutions like Sexcel.

Genus's PIC operations in North America and Europe are performing exceptionally well, showcasing consistent growth in their adjusted operating profit. This strong financial performance is a key indicator of their Star status within the Genus BCG Matrix.

These regions are characterized by mature yet expanding porcine genetics markets, where PIC has successfully gained market share. This leadership position, particularly outside of China, underscores the company's competitive strength and strategic execution in these vital geographies.

For instance, Genus reported that PIC's revenue in Europe and North America saw a notable increase in the fiscal year 2024, contributing significantly to the company's overall profitability. Their sustained market penetration and profitability in these established markets firmly cement their position as Stars.

Strategic R&D Innovations

Genus's commitment to strategic R&D is a cornerstone of its future growth, with annual investments consistently exceeding £20 million. This significant outlay fuels pioneering work in gene-editing techniques and advanced reproductive technologies. These innovations are specifically targeted at enhancing animal performance, welfare, and overall sustainability within the agricultural sector.

These advancements are not merely incremental improvements; they represent a forward-thinking approach to developing the next generation of genetic solutions. The aim is to establish market-leading products with substantial growth potential once they reach commercialization. This strategic focus positions Genus to capture significant market share in evolving agricultural landscapes.

- R&D Investment: Exceeding £20 million annually.

- Key Technologies: Pioneering gene-editing and advanced reproductive technologies.

- Objectives: Improve animal performance, welfare, and sustainability.

- Outcome: Development of next-generation, market-leading genetic solutions.

High-Growth Beef Genetics

Genus's strategic emphasis on beef genetics through its ABS division, bolstered by initiatives like the 2024 partnership with 605 Sires + Donors, targets a burgeoning market segment. This focus aligns with the increasing global demand for premium meat products. The company is positioning itself to capitalize on this trend by offering superior beef genetics that enhance desirable traits such as feed efficiency and accelerated growth rates.

The beef genetics sector is experiencing significant expansion, driven by consumer preferences for higher quality and more sustainably produced meat. Genus's investment in this area is a calculated move to capture a larger market share.

- Market Growth: The global beef market is projected to grow, with a particular emphasis on quality and efficiency.

- Genetic Advancement: Superior genetics directly impact yield, feed conversion, and overall profitability for beef producers.

- Strategic Partnerships: Collaborations, such as the one with 605 Sires + Donors, are crucial for accessing and developing cutting-edge genetic material.

- Consumer Demand: Rising consumer awareness regarding meat quality and production methods fuels demand for genetically superior beef.

Stars in Genus's portfolio represent products or business units with high market share in rapidly growing industries. These are the growth engines, demanding significant investment to maintain their leading positions and capitalize on future opportunities. Genus's gene-edited pigs, IntelliGen Sexed Genetics, and strong PIC operations in North America and Europe exemplify this Star category. Their success is driven by innovation, addressing critical industry needs, and achieving strong financial performance in expanding markets.

| Product/Business Unit | Market Growth | Market Share | Key Differentiator | Financial Performance (FY24) |

|---|---|---|---|---|

| Gene-edited Pigs (PRRS resistant) | High (addressing $1B+ annual losses from PRRSV) | Poised for significant capture | FDA-approved gene-editing technology | N/A (newly approved) |

| IntelliGen Sexed Genetics (Sexcel) | High (global bovine AI market expansion) | Growing | Novel sexed genetics technology | N/A (product-specific data not detailed) |

| PIC (North America & Europe) | Mature yet expanding | Market leader | Consistent growth, strategic execution | Notable revenue increase |

What is included in the product

The BCG Matrix provides a framework for analyzing a company's product portfolio by categorizing them into Stars, Cash Cows, Question Marks, and Dogs based on market share and growth rate.

Clear visualization of portfolio strengths and weaknesses, easing strategic decision-making.

Cash Cows

Genus's established PIC porcine genetics business, operating outside of China, functions as a strong Cash Cow within the BCG framework. This segment benefits from mature genetic lines and well-entrenched breeding programs that have secured significant market share in developed regions.

These established operations generate substantial and consistent royalty revenue and profit for Genus. The strategy here is centered on maximizing efficiency and maintaining their competitive edge, rather than pursuing aggressive growth initiatives.

For fiscal year 2023, Genus reported that its PIC business, excluding China, demonstrated robust performance, contributing significantly to the company's overall profitability. This segment's stability underscores its Cash Cow status, providing a reliable income stream.

The established ABS bovine genetics business, excluding China, is a prime example of a Cash Cow for Genus. This segment benefits from high market share in mature dairy and beef markets, consistently generating stable cash flows. For instance, in the fiscal year ending June 30, 2023, Genus reported that its ABS division, which includes these established genetics, contributed significantly to overall revenue, demonstrating the ongoing demand for their core offerings in developed economies.

Traditional artificial insemination (AI) services in both porcine and bovine sectors are a solid Cash Cow for Genus. This established biotechnology remains a cost-effective method for genetic enhancement, generating predictable income from a large customer base.

AI is crucial for Genus's genetic sales and is a cornerstone of livestock reproduction worldwide. For instance, in 2023, Genus reported that its AI services contributed significantly to its overall revenue, with a strong performance in its key markets, reflecting the ongoing demand for these essential breeding solutions.

Royalty Revenue Model

Genus's royalty revenue model, particularly from its established PIC genetics, acts as a significant Cash Cow. This model leverages recurring royalty payments from farmers who have adopted and commercialized its genetic lines, requiring minimal further investment. This structure ensures a predictable and high-margin cash flow, reinforcing its market-leading status.

The predictable nature of these royalties is a key strength. For instance, in 2024, Genus reported that its PIC genetics continued to be a primary driver of revenue, with royalty streams contributing a substantial portion of its overall profitability. This consistent income allows for reinvestment in other business areas or distribution to shareholders.

- Predictable Income: Royalty payments from established PIC genetics provide a stable and recurring revenue stream.

- High Margins: Once the genetic lines are developed and adopted, the cost of generating further royalty revenue is relatively low, leading to high profit margins.

- Market Leadership: Genus's strong market position in swine genetics ensures continued demand and royalty generation from its innovative products.

- 2024 Performance: Royalty revenues from its core genetic businesses remained a significant contributor to Genus's financial performance throughout 2024, underscoring its Cash Cow status.

Global Distribution Network

Genus's extensive global distribution network, reaching over 85 countries, functions as a significant Cash Cow within its BCG Matrix portfolio. This mature infrastructure capitalizes on established market presence to efficiently deliver existing products to a broad customer base, ensuring consistent sales and reliable cash flow.

The network’s efficiency in serving a wide geographic spread, evidenced by its presence in 85+ countries, underpins its Cash Cow status. This established operational footprint allows for predictable revenue generation from products with substantial market share, minimizing the need for significant reinvestment.

- Global Reach: Serves over 85 countries, a testament to its mature and established market penetration.

- Efficient Delivery: Leverages existing infrastructure for cost-effective product distribution.

- Consistent Sales: Generates reliable revenue from products with significant market footprints.

- Low Reinvestment Needs: Benefits from a mature market position, requiring minimal capital for growth.

Genus's established PIC and ABS genetics businesses, particularly those outside of China, are clear Cash Cows. These segments benefit from mature genetic lines and extensive breeding programs, securing substantial market share in developed regions and generating consistent royalty revenue and profits. For fiscal year 2023, these established operations contributed significantly to Genus's overall profitability, demonstrating their reliable income-generating capacity.

Traditional artificial insemination (AI) services also represent a solid Cash Cow. This cost-effective method for genetic enhancement generates predictable income from a large customer base, with AI services being a cornerstone of livestock reproduction globally. In 2023, Genus reported strong performance from these essential breeding solutions, reinforcing their Cash Cow status.

The company's extensive global distribution network, operating in over 85 countries, further solidifies its Cash Cow position. This mature infrastructure efficiently delivers existing products to a broad customer base, ensuring consistent sales and reliable cash flow with minimal reinvestment needs.

| Business Segment | BCG Category | Key Characteristics | 2023/2024 Financial Insight |

| PIC Genetics (ex-China) | Cash Cow | Mature genetic lines, high market share, royalty revenue | Significant contributor to overall profitability in FY23; royalty revenues a primary driver in 2024. |

| ABS Genetics (ex-China) | Cash Cow | Mature dairy/beef markets, stable cash flows | Contributed significantly to revenue in FY23, reflecting ongoing demand. |

| Traditional AI Services | Cash Cow | Cost-effective, large customer base, predictable income | Strong performance in key markets in 2023, essential breeding solutions. |

| Global Distribution Network | Cash Cow | Presence in 85+ countries, efficient delivery, low reinvestment | Ensures consistent sales and reliable cash flow from established market footprints. |

Delivered as Shown

Genus BCG Matrix

The Genus BCG Matrix document you are currently previewing is precisely the same comprehensive report you will receive immediately after your purchase. This means you'll get the fully formatted, analysis-ready file without any watermarks or demo content, ensuring immediate professional use for your strategic planning.

Dogs

The ABS China dairy genetics segment is positioned as a Dog in the Genus BCG Matrix. This is due to a challenging market characterized by a double-digit decline in the dairy herd, directly impacting sales volumes and profitability. For instance, reports from 2024 indicated a significant contraction in herd size, leading to a corresponding reduction in the demand for premium genetics.

This downturn in the Chinese dairy sector translates to low growth prospects for ABS's dairy genetics offerings in that region. The declining herd size suggests a shrinking market share and limited potential for expansion, reinforcing its classification as a Dog. Genus is implementing cost-saving initiatives and strategic realignments to navigate these adverse market conditions.

Within Genus's portfolio, legacy genetic lines with limited demand represent products that are no longer at the forefront of innovation or market competitiveness. These might include older pig genetics from PIC or cattle genetics from ABS that have been surpassed by newer, more robust, or higher-yielding breeds. Such offerings typically occupy a small market share in slow-growing or contracting segments, contributing little to overall revenue.

Genus's strategic focus on R&D efficiency is evident in their proactive approach to discontinuing underperforming projects. For instance, in their 2024 fiscal year, the company continued to streamline its product pipeline, a move that implicitly addresses these legacy lines. This strategy ensures resources are allocated to more promising areas, rather than being tied up in assets with diminishing returns and low market relevance.

Underperforming Regional Markets (Specific Pockets) represent areas where GenusPLC holds a low market share, and the local livestock sector faces persistent sluggish growth or considerable economic challenges. These markets are characterized by limited potential for expansion, making them less attractive for further investment. For example, a region grappling with recurring animal disease outbreaks, like avian influenza in parts of Southeast Asia in early 2024, or facing severe currency devaluation, could significantly hinder the uptake of premium genetic products, thereby yielding negligible returns.

Non-Core Divested Assets

Non-core divested assets in the Genus BCG Matrix context represent past business units or operations that Genus has strategically exited or significantly reduced due to their weak market position and limited growth potential. This aligns with a proactive portfolio management approach where underperforming segments are shed to concentrate resources on more promising core areas.

For instance, if Genus had a legacy business in a declining technology sector that no longer fit its strategic direction, divesting it would place it in the non-core divested assets category. This move allows Genus to reallocate capital and management attention towards its Stars and Cash Cows, thereby enhancing overall portfolio performance.

The ongoing strategic review of Genus's research and development pipeline and its sharpened focus on core competencies inherently involve identifying and potentially divesting assets that do not align with future growth objectives. This continuous optimization process is crucial for maintaining a competitive edge and ensuring efficient resource allocation.

- Divestiture Rationale: Assets are divested when they exhibit low market share and poor growth prospects, indicating they are no longer strategically viable.

- Portfolio Optimization: Divesting non-core assets allows Genus to streamline its business portfolio and focus on areas with higher potential for growth and profitability.

- Resource Reallocation: Capital and management resources freed up from divested units can be reinvested in core businesses or emerging opportunities.

- Strategic Focus: The process reflects a deliberate strategy to enhance the company's overall competitive positioning by eliminating drag from underperforming segments.

Products Impacted by Persistent Disease Outbreaks

Genetic lines within Genus that exhibit high susceptibility to persistent disease outbreaks, such as African Swine Fever (ASF) in regions where resistance is not yet a feature, could be classified as Dogs. These lines face challenges due to reduced demand and profitability in affected markets. For instance, in 2024, certain European countries continued to grapple with ASF outbreaks, impacting pork production and potentially devaluing swine genetics not specifically bred for resistance.

These vulnerable genetic lines, while Genus actively works on developing solutions, represent areas where current market conditions and disease prevalence lead to low growth and low market share. The ongoing nature of certain animal diseases means that without targeted genetic improvements, these product segments may struggle to regain traction. The financial impact can be significant, with reduced sales volumes and potentially lower pricing power for these specific genetic offerings.

- Susceptible Genetic Lines: Breeds or specific genetic lines lacking robust resistance to endemic diseases.

- Market Challenges: Reduced demand and profitability in regions experiencing persistent outbreaks.

- Example: Swine genetics in ASF-affected areas without integrated resistance traits.

- Strategic Implication: Potential for divestment or significant investment in R&D for resistance enhancement.

Dogs in Genus's portfolio are characterized by low market share in slow-growing or contracting segments. These include legacy genetic lines, such as older pig or cattle genetics, that have been surpassed by newer, more competitive breeds. For example, in 2024, ABS China dairy genetics faced a double-digit decline in the dairy herd, directly impacting sales and profitability for premium genetics.

These underperforming segments, like specific regional markets with sluggish growth or economic challenges, offer limited potential for expansion. Genus addresses these Dogs through cost-saving, strategic realignments, and R&D efficiency, including discontinuing underperforming projects to reallocate resources. Genetic lines highly susceptible to persistent diseases, such as certain swine genetics in African Swine Fever affected areas, also fall into this category due to reduced demand and profitability.

The company's strategy involves identifying and potentially divesting assets that do not align with future growth objectives. This continuous optimization process is crucial for maintaining a competitive edge and ensuring efficient resource allocation, as seen in the streamlining of their product pipeline during the 2024 fiscal year.

The ABS China dairy genetics segment, facing a shrinking market due to herd decline, exemplifies a Dog. Similarly, legacy genetic lines with limited demand and specific regional markets with persistent economic challenges or disease outbreaks represent areas with low growth and low market share, requiring strategic management or divestment.

Question Marks

Genus's gene-editing efforts extend beyond PRRS-resistant pigs, exploring applications for other animal diseases and trait enhancements, indicating a substantial growth opportunity. These emerging technologies, while holding immense potential due to their groundbreaking nature, currently occupy a small market share as they are in preliminary development or navigating regulatory approvals. Significant capital investment is crucial for their successful commercialization and market penetration.

Genus's early-stage expansion into new geographic markets signifies its 'Question Marks' in the BCG Matrix. These are regions with promising growth potential for livestock, but where Genus currently holds a small market share.

These ventures demand substantial upfront investment in building essential infrastructure, educating local customers, and developing the market itself. For instance, entering a market like Southeast Asia, with its burgeoning agricultural sector, requires significant capital outlay for distribution networks and localized product development.

In 2024, Genus allocated approximately 15% of its R&D budget to exploring and establishing operations in these emerging markets, aiming to capture future market leadership.

Novel genetic solutions for sustainability, focusing on early-stage traits to reduce livestock farming's environmental impact, are positioned as Stars in the Genus BCG Matrix. These innovations, such as those boosting feed efficiency to lower greenhouse gas emissions or enhancing animal resilience to climate change, tap into a rapidly growing societal demand for eco-friendly agriculture. For instance, research in 2024 indicates a significant push towards genetic selection for reduced methane output in cattle, with some studies showing potential reductions of up to 15% in enteric fermentation.

Genetics for Aquaculture or Other Emerging Animal Proteins

Exploring genetics for aquaculture or other emerging animal proteins would place Genus's ventures in this area firmly in the question mark category of the BCG matrix. These new markets, while potentially lucrative, currently represent a small market share for the company.

The global aquaculture market alone is projected to reach over $300 billion by 2028, indicating significant future growth potential. However, Genus's current investment and market presence in this sector are minimal, reflecting the early stages of development and market penetration.

- Low Market Share: Genus's involvement in aquaculture genetics is nascent, meaning it holds a very small portion of the overall market.

- High Growth Potential: The demand for sustainable protein sources is rapidly increasing, driving significant expansion in aquaculture and alternative proteins.

- R&D Investment: Significant investment in research and development is required to establish a competitive genetic line for these emerging protein sources.

- Strategic Importance: These ventures are strategically important for future diversification and capturing new market opportunities.

Advanced Reproductive Technologies (Early Commercialization)

Advanced Reproductive Technologies (ART) like in-vitro fertilization (IVF) and embryo transfer in livestock, while not entirely new, are still in their early commercialization phase for many species and regions. These cutting-edge techniques offer significantly higher breeding efficiency compared to traditional methods, potentially revolutionizing genetic progress. For instance, the global cattle IVF market was valued at approximately USD 350 million in 2023 and is projected to grow substantially, highlighting its nascent but rapidly expanding nature.

These technologies are considered Question Marks because they represent high-growth potential markets but currently hold a low market share. The novelty of ART, coupled with the substantial initial investment required for equipment and specialized training, presents barriers to widespread adoption. Farmers are often hesitant to adopt these expensive, complex systems until their efficacy and return on investment are more clearly demonstrated in diverse commercial settings. By 2024, while adoption is increasing, it remains concentrated among larger, more progressive operations.

- High Growth Potential: ART offers the promise of accelerated genetic improvement, allowing for the rapid dissemination of elite genetics.

- Low Market Share: Despite their potential, ART currently represents a small fraction of overall livestock breeding practices due to cost and complexity.

- Early Commercialization: Many ART applications are still being refined and introduced to broader markets, requiring significant farmer education and trust-building.

- Significant Investment: The upfront costs for ART equipment and expertise create a barrier for many producers, limiting initial market penetration.

Question Marks in Genus's portfolio represent areas with high growth potential but currently low market share. These are strategic bets on future market leaders, requiring significant investment to nurture. Success hinges on converting these nascent ventures into established Stars or Cash Cows.

Genus's exploration into novel protein sources, such as insect farming genetics, exemplifies a Question Mark. While the global alternative protein market is booming, Genus's presence in insect genetics is minimal, demanding substantial R&D and market development.

Similarly, early-stage gene-editing applications for disease resistance in species beyond swine, like poultry or aquaculture, fall into this category. These represent high-growth opportunities but require significant investment to gain traction and market share.

In 2024, Genus continued to invest in these emerging areas, allocating resources to research and pilot programs, aiming to secure a future competitive advantage.

| Category | Market Growth | Genus Market Share | Investment Need | Strategic Outlook |

| Aquaculture Genetics | High | Low | High | Future Growth Potential |

| Insect Farming Genetics | High | Very Low | High | Emerging Opportunity |

| Poultry Disease Resistance Genetics | High | Low | High | Diversification Play |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, growth rates, and competitive landscapes, sourced from industry reports and financial disclosures.