Gentrack Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gentrack Group Bundle

Gentrack Group, a leader in utility billing and customer management software, boasts strong market positioning and a robust product suite. However, understanding the nuances of its competitive landscape and potential technological disruptions is key to unlocking its full growth potential.

Want the full story behind Gentrack's strengths in recurring revenue, its opportunities in digital transformation, and the potential threats from evolving market demands? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Gentrack Group's strength lies in its deep specialization within the utilities (energy and water) and airport industries. This focus allows them to create highly specific and robust software for billing, customer management, and operational needs, which generalist software providers often cannot match. For instance, their utility billing solutions are designed to handle the complex regulatory and pricing structures unique to these sectors.

Gentrack Group benefits from a strong and expanding recurring revenue stream, a key strength that underpins its financial stability and predictability. This consistent income is largely fueled by successful renewals and strategic upsells within its established customer base, a clear indicator of high customer satisfaction and effective retention strategies.

The company's deliberate transition to a Software-as-a-Service (SaaS) model, particularly with its g2.0 platform, significantly bolsters this recurring revenue profile. This shift is crucial for ensuring a more resilient and predictable income flow, insulating the business from market volatility.

Gentrack's g2.0 platform, a cloud-native solution built on AWS and integrated with Salesforce CRM, is a core technological advantage. This architecture enables utilities to rapidly deploy new offerings, lower operational expenses, and improve customer interactions. For example, its composable nature allows for faster adaptation to evolving market demands, a crucial factor in the rapidly digitizing energy sector.

Proven Track Record and Transformation Success

Gentrack Group's strengths are significantly bolstered by its proven track record and remarkable transformation success. With over 35 years in the industry, the company has become a trusted partner for more than 60 energy and water utilities worldwide. This extensive experience translates into a deep understanding of the sector's unique challenges and requirements.

A key differentiator for Gentrack is its impressive 100% transformation success rate. This statistic is crucial for utility providers who often face significant risks and complexities when upgrading their core systems. Such a high success rate instills immense confidence, assuring clients that Gentrack can deliver on its promises for critical system overhauls.

- Over 35 years of industry experience

- Trusted by more than 60 energy and water companies

- 100% transformation success rate

- Proven ability to manage complex utility system upgrades

Commitment to Innovation and Sustainability

Gentrack Group demonstrates a strong commitment to innovation, evident in its significant investments in research and development. Their focus areas include AI-driven insights, automation technologies, and specialized solutions for distributed energy resources, such as optimizing battery storage and managing electric vehicle charging infrastructure.

This strategic direction directly supports the global push towards decarbonization. Gentrack's technology is designed to enhance operational efficiency and provide customer-centric solutions that facilitate the adoption of sustainable energy practices, positioning them as a crucial partner in the transition to a greener utility sector.

- AI and Automation Focus: Gentrack is enhancing its platforms with artificial intelligence and automation to improve utility operations.

- Distributed Energy Resources (DER) Solutions: The company is developing capabilities for battery optimization and electric vehicle integration.

- Decarbonization Enabler: Gentrack's innovations align with global sustainability goals, supporting the energy transition.

- Operational Efficiency Gains: Their technology aims to streamline processes and reduce costs for utility clients.

Gentrack Group's deep specialization in the utilities and airport sectors is a significant strength, allowing for highly tailored software solutions that generalist providers can't match. Their utility billing systems, for example, are adept at handling the intricate regulatory and pricing frameworks inherent to these industries.

A robust and growing recurring revenue stream, driven by high customer satisfaction and effective retention strategies, provides considerable financial stability. This is further amplified by their successful transition to a SaaS model, particularly with the cloud-native g2.0 platform built on AWS and integrated with Salesforce CRM.

Gentrack's 35-year track record, serving over 60 energy and water utilities globally with a 100% transformation success rate, builds immense client confidence. Their commitment to innovation, including AI and automation for DER management, positions them as a key partner in the global decarbonization effort.

| Metric | Value | Year |

|---|---|---|

| Industry Experience | Over 35 years | 2024 |

| Global Utility Clients | 60+ | 2024 |

| Transformation Success Rate | 100% | 2024 |

| Recurring Revenue Focus | SaaS Model (g2.0) | 2024-2025 |

| Innovation Investment | AI & Automation, DER Solutions | 2024-2025 |

What is included in the product

This SWOT analysis offers a comprehensive understanding of Gentrack Group's internal strengths and weaknesses, alongside external market opportunities and threats.

Uncovers key competitive advantages and potential market threats for strategic advantage.

Weaknesses

Gentrack is experiencing heightened competition, notably from Kraken, which has secured consecutive contracts in Gentrack's key Australia and New Zealand markets. This escalating rivalry, often involving aggressive pricing, directly threatens Gentrack's market position and expansion plans.

The departure of significant clients such as Red Energy and Meridian to competitors underscores the critical need for Gentrack to bolster its competitive advantages and customer retention strategies.

Gentrack's journey with its advanced g2.0 platform has faced a notable hurdle: attracting major Tier 1 utility clients. This challenge stems partly from a market perception that Gentrack's primary customer base consists of Tier 2 and 3 utilities, potentially hindering its expansion into the most profitable market segments.

Securing a significant new Tier 1 customer is a critical objective for Gentrack, representing a substantial obstacle to unlocking higher growth potential. For instance, as of their 2023 annual report, while they secured several new contracts, the acquisition of a Tier 1 utility for the g2.0 platform remained a key strategic focus, indicating this weakness persists.

Gentrack's commitment to research and development, alongside expanded sales and marketing initiatives, has presented a near-term challenge to its profitability. While these investments are vital for future growth and software enhancements, they have directly contributed to a modest rise in operating profits despite substantial revenue increases. This strategic allocation of resources, aimed at developing next-generation software and broadening market reach, naturally creates a drag on current financial performance, impacting EBITDA margins.

Lumpy Non-Recurring Revenue

Gentrack Group's revenue stream exhibits a degree of lumpiness due to its reliance on non-recurring project work. This means that income from these projects can fluctuate significantly from one reporting period to the next, making consistent financial performance harder to achieve.

While these projects are crucial for securing future recurring revenue, their inherent variability complicates financial forecasting. For instance, the company's FY23 results showed a notable increase in revenue driven by project completions, highlighting this unevenness.

- Inconsistent Project Income: A significant portion of Gentrack's revenue originates from one-off project implementations, which are not predictable on a regular basis.

- Forecasting Challenges: The uneven nature of this project-based income makes it difficult to accurately predict total revenue and cash flow from one half-year to the next.

- Investor Uncertainty: This variability can introduce uncertainty for investors trying to assess the company's financial stability and growth trajectory.

- Impact on Financial Planning: The lumpy revenue pattern necessitates robust financial planning to manage cash flow effectively and mitigate the impact of unpredictable income streams.

Share Price Volatility from Contract News

Gentrack Group's share price has shown a notable sensitivity to news surrounding contract wins and losses. For instance, the company experienced a significant drop in its stock value following announcements in early 2024 where it did not secure certain key tenders. This reaction highlights how investor sentiment can be heavily swayed by the outcomes of individual project bids.

This volatility implies that the market is closely watching each contract announcement, making the stock prone to sharp fluctuations based on short-term news. For example, a loss of a major tender could lead to a rapid sell-off, while a significant win could trigger a rapid ascent. This makes it challenging for investors to maintain a stable outlook.

- Share Price Sensitivity: Gentrack's stock price has reacted negatively to news of lost tenders, as seen in early 2024.

- Investor Confidence Impact: Market perception and investor confidence appear to be directly tied to the success or failure of securing new contracts.

- Short-Term Fluctuations: The company's share price is susceptible to considerable movement driven by the continuous flow of contract-related news.

Gentrack faces intense competition, particularly from Kraken, which has recently secured contracts in Australia and New Zealand, directly impacting Gentrack's market share and growth ambitions.

The company's struggle to attract major Tier 1 utility clients for its g2.0 platform, partly due to a perception of focusing on smaller utilities, limits its access to the most lucrative market segments.

Gentrack's financial performance is also affected by the lumpiness of its revenue, driven by reliance on non-recurring project work, which complicates consistent financial reporting and forecasting.

Furthermore, Gentrack's share price exhibits high sensitivity to contract win/loss announcements, leading to significant short-term volatility and potential investor uncertainty, as evidenced by market reactions in early 2024.

| Weakness | Description | Impact |

|---|---|---|

| Heightened Competition | Kraken winning contracts in AU/NZ | Threatens market position and expansion |

| Tier 1 Client Acquisition | Difficulty attracting major utilities for g2.0 | Limits access to profitable market segments |

| Revenue Lumpiness | Reliance on non-recurring project work | Complicates forecasting and consistent performance |

| Share Price Volatility | Sensitivity to contract news | Creates investor uncertainty and short-term fluctuations |

What You See Is What You Get

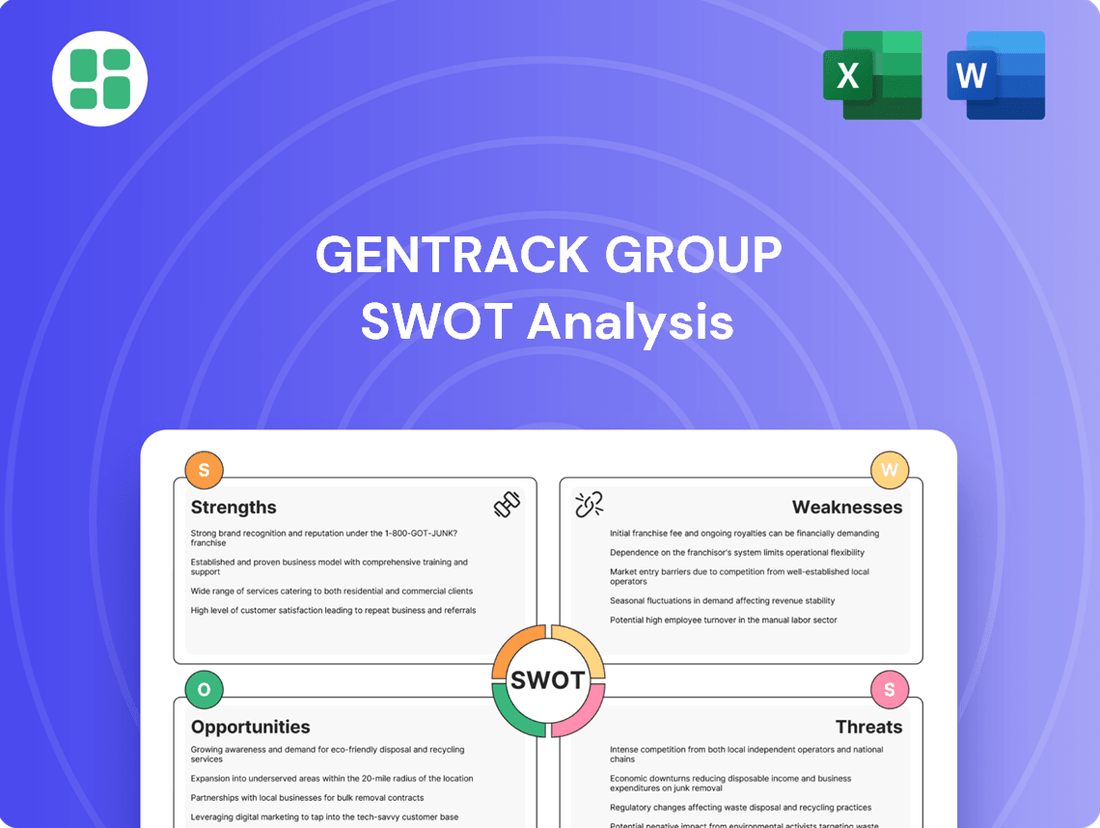

Gentrack Group SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering a comprehensive look at Gentrack Group's Strengths, Weaknesses, Opportunities, and Threats.

Opportunities

The global drive towards decarbonization is a massive catalyst for upgrading energy and water infrastructure. This trend, fueled by government policies and consumer demand for sustainability, opens up substantial new markets for companies like Gentrack. Utilities are at the forefront of this energy transition, needing advanced digital systems to meet net-zero targets.

Gentrack's software is perfectly positioned to support utilities in this modernization effort. For example, the International Energy Agency (IEA) reported in 2024 that investments in clean energy technologies are projected to reach $2 trillion globally by 2025, with a significant portion directed towards grid modernization and smart meter rollouts, areas where Gentrack excels.

A significant portion of the global utilities sector continues to operate on aging ERP systems from broad providers such as SAP and Oracle. This reliance on legacy technology presents a considerable market opening for specialized, cloud-native platforms like Gentrack's g2.0.

The utilities industry is currently in a substantial upgrade cycle, creating a prime opportunity for Gentrack to replace these older, less efficient systems. For instance, reports from 2024 indicated that over 60% of utility companies were actively planning or executing digital transformation initiatives, with ERP modernization being a key focus.

Gentrack is strategically targeting expansion into new international markets, with a particular focus on South East Asia, the Middle East, and Europe. This geographic diversification is a key opportunity, aiming to tap into burgeoning customer bases beyond its established Australia and New Zealand markets. The company has already secured early successes in regions such as Saudi Arabia and the Philippines, demonstrating the viability of this growth strategy.

Successful penetration into these high-growth international territories presents a significant avenue for boosting Gentrack's future revenue streams. By reducing its reliance on its core markets, Gentrack can achieve greater stability and unlock substantial new revenue potential. For instance, the energy and water utility sectors in many of these targeted regions are undergoing significant digital transformation, creating a strong demand for Gentrack's solutions.

Leveraging Strategic Partnerships for Innovation

Gentrack's strategic alliances with major players like Salesforce and AWS are crucial for driving innovation and expanding its service capabilities. These collaborations are not just about technology integration; they represent a commitment to staying at the forefront of industry advancements.

A prime example of this strategy is Gentrack's investment in Amber Electric. This move directly supports the development and global licensing of advanced energy optimization solutions tailored for household batteries and EV chargers. By focusing on these smart devices, Gentrack is positioning itself to capitalize on the rapidly expanding distributed energy management sector.

- Innovation through Collaboration: Partnerships with Salesforce and AWS provide access to cutting-edge technologies and market insights.

- Investment in Future Solutions: The Amber Electric investment fuels the development of smart energy optimization for household batteries and EV chargers.

- Market Leadership in Distributed Energy: These alliances enable Gentrack to offer leading solutions in the high-growth distributed energy management market.

Growing Demand for Data, AI, and Automation

The increasing complexity of energy grids and customer interactions is fueling a significant demand for advanced data solutions, AI-driven insights, and automation across the utility and airport sectors. Gentrack's strategic focus and ongoing investments in these critical areas, such as dynamic pricing models and sophisticated battery optimization technologies, are positioning the company to effectively leverage this growing market trend. These enhanced capabilities directly translate into improved operational efficiencies, more engaging customer experiences, and robust support for the integration of novel energy propositions, aligning with industry shifts towards smarter, more automated systems.

Gentrack's commitment to innovation in data and AI is particularly relevant given the projected growth in the smart grid market. For instance, the global smart grid market was valued at approximately USD 25.4 billion in 2023 and is expected to reach USD 70.5 billion by 2030, growing at a compound annual growth rate (CAGR) of 15.7% during this period. This expansion underscores the substantial opportunity for companies like Gentrack that offer solutions enabling efficient data management and intelligent automation for utilities.

The company's investments are geared towards addressing key industry challenges:

- Enhanced Grid Management: AI and automation are crucial for managing the intermittency of renewable energy sources and optimizing grid stability.

- Customer Engagement: Data analytics and personalized offerings, powered by AI, improve customer satisfaction and retention in competitive markets.

- Operational Efficiency: Automation of processes, from billing to network management, reduces costs and minimizes human error.

- New Revenue Streams: Dynamic pricing and battery optimization enable utilities to create new value propositions and manage demand more effectively.

The global push for decarbonization and grid modernization presents a significant opportunity for Gentrack. Utilities are actively upgrading legacy systems, with over 60% planning digital transformations in 2024. Gentrack's specialized, cloud-native solutions are well-positioned to capture this market, especially as investments in clean energy technologies are projected to hit $2 trillion globally by 2025.

Expansion into new international markets, particularly South East Asia, the Middle East, and Europe, offers substantial revenue growth potential. Gentrack's strategic alliances with tech giants like Salesforce and AWS, alongside investments in areas like smart energy optimization for household batteries and EV chargers, further solidify its competitive edge in the burgeoning distributed energy sector.

| Opportunity Area | Key Drivers | Gentrack's Position | Market Data (2024-2025) |

| Decarbonization & Grid Modernization | Net-zero targets, renewable energy integration | Provider of essential digital infrastructure | Global clean energy investment: ~$2 trillion by 2025 |

| Legacy System Replacement | Aging ERPs in utilities | Specialized, cloud-native alternative (g2.0) | >60% of utilities planning digital transformation (2024) |

| International Market Expansion | Growth in emerging economies | Targeting SE Asia, Middle East, Europe | Strong early successes in Saudi Arabia, Philippines |

| Distributed Energy Management | Rise of EVs, home batteries, smart devices | Investment in Amber Electric, smart solutions | Smart grid market growth: 15.7% CAGR (2023-2030) |

Threats

The utility software market is experiencing a surge in competition, with nimble companies like Kraken presenting a significant challenge to established players like Gentrack. Kraken's market approach, characterized by aggressive pricing strategies, has proven effective in securing new contracts and even poaching existing Gentrack clients.

This heightened competition directly impacts Gentrack's market position and financial performance. Kraken's success in winning bids, even from Gentrack's established customer base, underscores the intensity of the rivalry. This trend could lead to downward pressure on Gentrack's profit margins and impede its growth prospects in key markets.

Gentrack's reliance on software solutions places it at risk of technological obsolescence, even with its g2.0 innovation. The fast-paced tech world demands continuous adaptation, and falling behind on advancements like advanced AI or novel cloud infrastructure could cede a crucial advantage to rivals.

This threat underscores the necessity for sustained, significant investment in research and development to maintain Gentrack's competitive edge in the evolving digital landscape.

Economic downturns present a significant threat, potentially curbing IT investment by Gentrack's core utility and airport clients. For instance, a general slowdown in infrastructure projects, a common feature of economic contractions, could directly shrink Gentrack's sales opportunities and delay its project pipeline.

Furthermore, shifts in regulatory landscapes pose a substantial risk. Unfavorable policy changes in key operating regions could necessitate increased compliance expenditures, alter existing business models, or even trigger financial distress among customers, as historically observed in the UK's energy sector, impacting Gentrack's revenue streams.

Failure to Secure Major New Contracts

Gentrack's ambitious growth hinges on securing substantial new contracts, a critical factor for achieving its targets. The company has recently experienced setbacks in competitive tenders, particularly for larger client acquisitions. This trend suggests a tangible risk that a continued inability to win significant new business could directly hinder its revenue expansion plans.

The market for utility billing system transformations is highly competitive and demands proven reliability from vendors. Losing out on key tenders, especially those involving major utility providers, underscores the challenge Gentrack faces in demonstrating this required confidence. This threat directly impacts its ability to scale and meet its projected financial performance for the 2024-2025 period.

- Reliance on New Wins: Gentrack's growth strategy is heavily dependent on successfully acquiring new, large-scale customer contracts.

- Recent Tender Losses: The company has recently faced instances where it did not secure significant new business opportunities, impacting its pipeline.

- Market Demand for Proven Solutions: Clients in the utility sector require vendors with a strong track record of reliability for critical billing system upgrades.

- Impact on Revenue Projections: A sustained failure to win major contracts could impede Gentrack's ability to achieve its projected revenue growth for the 2024-2025 fiscal years.

High Valuation and Market Expectations

Gentrack's share price has seen considerable growth, resulting in a high market valuation. This elevated valuation suggests investors anticipate sustained strong performance and perfect execution from the company. For instance, as of early 2024, Gentrack's market capitalization reflected significant optimism about its future earnings potential, with its price-to-earnings ratio often trading at a premium compared to industry peers.

This stretched valuation places considerable pressure on Gentrack. Any deviation from its ambitious medium-term targets, such as losing a significant contract or experiencing slower growth than projected, could trigger a sharp decline in its share price. Investors are closely monitoring the company's ability to consistently meet these high expectations, making flawless operational delivery crucial.

- Elevated Investor Expectations: Gentrack's market valuation implies a demand for continuous high growth.

- Sensitivity to Missteps: Contract losses or slower growth could lead to significant share price drops.

- Pressure to Deliver: The company must consistently achieve its ambitious medium-term financial targets.

Intensified competition, exemplified by Kraken's aggressive market strategies and pricing, directly challenges Gentrack's market share and profitability. Furthermore, Gentrack faces the persistent threat of technological obsolescence, necessitating ongoing R&D investment to maintain its competitive edge against emerging innovations.

Economic downturns could significantly reduce IT spending by Gentrack's utility and airport clients, impacting its sales pipeline and project execution. Shifting regulatory landscapes also pose a risk, potentially increasing compliance costs or disrupting customer operations.

Gentrack's growth trajectory is heavily reliant on securing new, substantial contracts, and recent losses in competitive tenders highlight a tangible risk to its revenue expansion plans for the 2024-2025 period. The market's demand for proven reliability in utility billing system transformations means that continued tender setbacks could hinder Gentrack's ability to scale and meet financial projections.

Gentrack's elevated market valuation, often trading at a premium in early 2024, creates significant pressure to deliver sustained high performance. Any shortfall in achieving ambitious medium-term targets, such as losing a major contract, could trigger a sharp decline in its share price, making consistent operational success critical.

SWOT Analysis Data Sources

This analysis is built upon a foundation of reliable data, incorporating Gentrack's official financial statements, comprehensive market research reports, and expert commentary from industry analysts to ensure a robust and accurate assessment.