Gentrack Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gentrack Group Bundle

Curious about Gentrack Group's product portfolio performance? This glimpse into their BCG Matrix reveals potential Stars and Cash Cows, but are there hidden Dogs or emerging Question Marks? Unlock the full strategic picture and actionable insights by purchasing the complete BCG Matrix report.

Stars

Gentrack's g2.0 platform is a cloud-native solution built with industry leaders like Salesforce and AWS. It's specifically designed to help utilities modernize their operations, a crucial step as the energy and water sectors push towards net-zero emissions and smart grid technologies. This platform is a key part of Gentrack's strategy, aiming to capture growth in a market ripe for digital transformation.

Veovo, Gentrack's airport division, is a star performer, experiencing robust growth. In the first half of fiscal year 2025, its revenue saw a substantial increase, reflecting its strong market position. Veovo operates in 23 countries, serving over 140 airports, making it a key enabler of airport digitization and modernization worldwide.

Gentrack's strategic pivot to cloud-based Software-as-a-Service (SaaS) offerings is a significant factor in its growth trajectory. This shift capitalizes on the burgeoning utility billing software market, which is experiencing robust expansion driven by increasing cloud service adoption across enterprises.

By embracing SaaS, Gentrack delivers agile, scalable, and cost-effective solutions, directly addressing the market's demand for modern, flexible platforms. This move positions Gentrack favorably within a landscape where cloud computing is becoming increasingly standard for businesses seeking operational efficiency and enhanced service delivery.

Solutions for Energy Transition and Net Zero

Gentrack's commitment to modernizing energy and water utilities is a key driver for the global energy transition. Their solutions are designed to help these critical sectors embrace greener practices and manage the complexities of distributed energy resources, directly contributing to net-zero goals. This focus places Gentrack in a rapidly expanding market driven by environmental urgency.

The demand for smart grid technology and efficient resource management is soaring. In 2024, the global smart grid market was valued at approximately $35 billion and is projected to reach over $100 billion by 2030, showcasing the immense potential for companies like Gentrack. Their platforms are instrumental in enabling this shift.

- Accelerating Net Zero: Gentrack's software empowers utilities to integrate renewable energy sources and manage decentralized energy production, crucial for achieving net-zero emissions targets.

- Market Growth: The global market for utility customer information systems (CIS) and meter data management (MDM) is expanding, with projections indicating continued strong growth through 2025 and beyond, driven by digital transformation initiatives.

- Efficiency Gains: By streamlining operations and improving data accuracy, Gentrack's solutions help utilities reduce waste and optimize resource allocation, contributing to both economic and environmental sustainability.

- Regulatory Tailwinds: Increasingly stringent environmental regulations worldwide are creating a favorable market for technologies that support the energy transition, benefiting Gentrack's strategic positioning.

Strategic Partnerships and New Market Entry

Gentrack's strategic partnerships, like the one with Amber Electric for smart energy services, are key drivers for its growth. These collaborations enable the company to offer more comprehensive solutions, tapping into emerging customer demands for integrated energy management. For instance, in FY24, Gentrack secured significant new customer wins in markets such as Saudi Arabia and the Philippines, demonstrating successful new market entry.

These strategic moves are designed to extend Gentrack's global footprint and solidify its position in high-growth territories. By entering new regions and forming alliances, Gentrack can bundle its offerings to cater to the evolving needs of customers in dynamic market landscapes. The company has explicitly stated its intention to pursue further wins in these new territories throughout FY25, signaling continued aggressive expansion.

- Partnership with Amber Electric: Facilitates the expansion of smart energy services.

- New Market Wins in FY24: Secured key customers in Saudi Arabia and the Philippines.

- Strategic Objective: Extend reach and offer bundled solutions in dynamic markets.

- FY25 Outlook: Targeting further customer acquisition in new territories.

Gentrack's Veovo platform is a clear star, showcasing exceptional growth and market leadership in airport operations technology. Its robust expansion, evidenced by significant revenue increases in the first half of fiscal year 2025, highlights its strong market position. Operating across 23 countries and serving over 140 airports, Veovo is a critical player in the global airport digitization trend.

Gentrack's g2.0 platform, designed for utility modernization, is also a star performer. This cloud-native solution is crucial for utilities navigating the transition to net-zero emissions and smart grid technologies. The increasing adoption of cloud services in the utility sector, a market experiencing robust expansion, directly benefits Gentrack's SaaS offerings.

The company's strategic focus on cloud-based SaaS solutions is a key differentiator. This approach allows Gentrack to provide agile, scalable, and cost-effective platforms, meeting the evolving demands of the utility sector. The global smart grid market, valued at approximately $35 billion in 2024 and projected for substantial growth, underscores the significant opportunity for Gentrack's solutions.

Gentrack's commitment to facilitating the energy transition and its strategic partnerships, such as with Amber Electric, further solidify its star status. New market wins in FY24, including Saudi Arabia and the Philippines, demonstrate successful expansion strategies. The company is actively targeting further growth in these new territories throughout FY25.

| Business Unit | BCG Category | Key Growth Drivers | Market Position | FY25 Outlook |

|---|---|---|---|---|

| Veovo (Airport Division) | Star | Airport digitization, robust demand for operational efficiency | Market leader, strong revenue growth in H1 FY25 | Continued expansion, significant new customer wins anticipated |

| g2.0 (Utility Division) | Star | Utility modernization, net-zero transition, smart grid adoption | Key enabler of digital transformation in utilities | Capitalizing on growing SaaS market, strategic partnerships |

What is included in the product

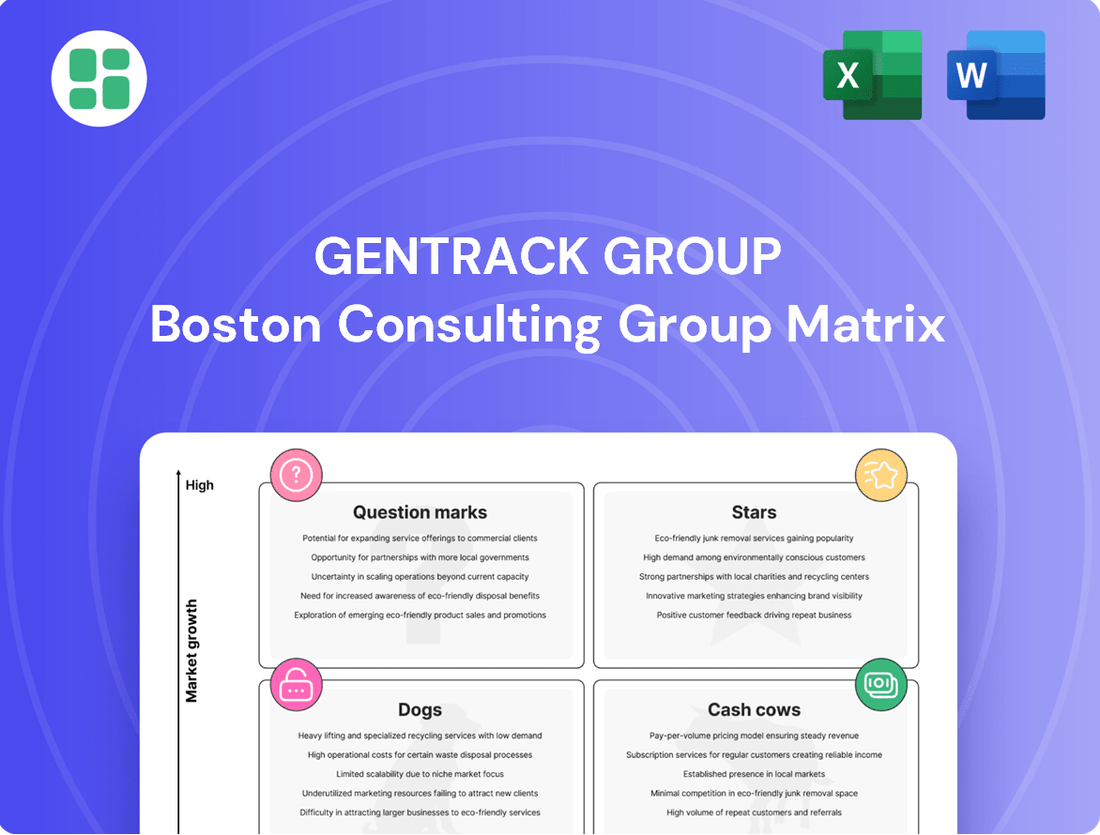

This BCG Matrix overview for Gentrack Group highlights strategic recommendations for each business unit, indicating which to invest in, hold, or divest based on market share and growth.

Visualize Gentrack's portfolio with a BCG Matrix, clarifying Stars, Cash Cows, Question Marks, and Dogs to strategically allocate resources and alleviate portfolio management pain.

Cash Cows

Gentrack's established utility billing and CRM systems in mature markets such as Australasia and the UK are clear cash cows. These solutions, honed over 35 years, serve more than 60 energy and water companies, providing a consistent and substantial stream of recurring revenue.

The utility software market sees growth, but Gentrack's core billing and CRM segment, especially for large, established utilities, functions as a dependable cash generator. High customer switching costs and Gentrack's deep integration into existing operations solidify this position.

Gentrack Group benefits from a robust recurring revenue base, primarily from its established utility and airport clients. This predictable income stream is a bedrock of financial stability, a fact underscored by its significant increase in H1 FY25.

This consistent revenue, less vulnerable to market volatility, demands less intensive sales and marketing expenditure than new customer acquisition. Consequently, it functions as a dependable generator of cash flow for the company.

Gentrack Group's legacy system maintenance and support acts as a quintessential cash cow. This segment focuses on providing ongoing upkeep for its established software installations, even for older versions, which consistently generates revenue. For the fiscal year 2023, Gentrack reported revenue from its Utilities segment, which includes these legacy services, contributing significantly to overall financial stability.

Specialized Solutions for Regulatory Compliance

Gentrack's specialized solutions for regulatory compliance are a significant asset, addressing the critical and often non-negotiable needs of utility companies. These offerings ensure clients remain aligned with evolving regulatory landscapes, a crucial factor for their financial health and brand reputation.

The Australian market exemplifies the stickiness of these services. By helping utilities navigate complex compliance, Gentrack secures a stable revenue stream. This stability is a hallmark of a cash cow, as the essential nature of regulatory adherence makes these solutions indispensable.

- Critical Need: Utilities must adhere to stringent regulations, making compliance solutions essential, not optional.

- Brand Protection: Ensuring compliance safeguards client financial performance and brand image.

- Stable Revenue: The non-negotiable nature of these services creates a predictable and reliable income stream for Gentrack.

- Market Example: Success in markets like Australia highlights the demand and value of these specialized offerings.

Hardware Sales via Veovo (Non-Recurring, but Stable)

Veovo's hardware sales, while non-recurring, represent a stable revenue stream for Gentrack Group. These sales, sourced from a supplier network, are often linked to airport operational system upgrades and new installations. For instance, in the fiscal year 2023, Gentrack reported that its airport solutions, including hardware components, contributed significantly to its revenue, with a notable portion stemming from these project-based hardware procurements.

The airport sector, though mature, continues to invest in modernization and efficiency, ensuring a consistent demand for Veovo's hardware. This predictable, albeit non-recurring, cash flow from hardware complements Gentrack's core software services, bolstering the financial stability of the Veovo offering.

- Veovo's hardware sales are non-recurring but stable.

- These sales are tied to airport operational system projects and upgrades.

- The airport sector's ongoing investment provides predictable demand.

- Hardware revenue complements core software services, stabilizing cash flow.

Gentrack's established utility billing and CRM systems are prime examples of cash cows. These mature offerings, particularly in markets like Australasia and the UK, generate consistent and substantial recurring revenue, a testament to their long-standing presence and deep integration.

The predictable income from these core services, bolstered by high customer switching costs, allows Gentrack to operate with less intensive sales and marketing spend compared to newer ventures. This efficiency directly translates into strong cash flow generation for the group.

For H1 FY25, Gentrack reported a significant increase in revenue, underscoring the dependable nature of its established software segments which function as the company's cash cows.

The legacy system maintenance and support also contributes to this cash cow status, providing ongoing revenue from existing installations. In FY23, the Utilities segment, encompassing these services, was a major contributor to Gentrack's financial stability.

| Segment | Description | Revenue Contribution (Illustrative) | Cash Flow Impact |

|---|---|---|---|

| Utility Billing & CRM | Mature, established software in key markets | Significant recurring revenue | Strong, consistent cash generation |

| Legacy System Maintenance | Ongoing support for existing installations | Reliable revenue stream | Drives predictable cash flow |

Delivered as Shown

Gentrack Group BCG Matrix

The Gentrack Group BCG Matrix you are currently previewing is the identical, fully formatted report you will receive immediately after purchase. This means no watermarks, no placeholder text, and no altered content; what you see is precisely what you'll download, ready for immediate strategic application.

Rest assured, the BCG Matrix analysis for Gentrack Group that you're examining is the definitive version you'll obtain upon completing your purchase. This comprehensive report, meticulously crafted for strategic insight, will be delivered to you in its entirety, ensuring you have the complete analytical tool without any compromises.

What you see here is the actual, unadulterated Gentrack Group BCG Matrix document that will be yours after purchase. This preview accurately represents the final, professionally designed file, which will be instantly available for download and use in your business planning and decision-making processes.

Dogs

Underperforming legacy software modules within Gentrack's portfolio, such as older versions of their utility billing or customer management systems, represent the Dogs in the BCG Matrix. These components are characterized by low market share and declining demand as clients migrate to newer, cloud-based solutions or competitor offerings. For instance, if a significant portion of Gentrack's revenue historically came from on-premise installations of a decade-old billing system that now sees minimal new client acquisition and declining upgrade cycles, it would fit this category.

Gentrack Group's Divested or Phased-Out Products would encompass any offerings with diminishing market relevance or profitability. While specific divestments aren't publicly detailed, such products typically represent strategic decisions to reallocate resources towards more promising areas. These might include older software versions or services with declining customer adoption rates, freeing up capital for innovation.

Gentrack Group may identify certain smaller geographical markets, such as specific regions within Southeast Asia or parts of Eastern Europe, where initial entry efforts have not translated into substantial market share. These markets, characterized by low growth prospects and intense local competition, might demand significant resources for sales and marketing with limited return on investment.

The company's strategic focus, as evidenced by recent investor updates highlighting expansion in North America and Australia, suggests a reallocation of resources away from less promising territories. For instance, while Gentrack reported a 15% revenue growth in its core markets for the fiscal year ending September 30, 2024, some of its smaller, less penetrated markets likely contributed minimally to this overall performance.

Unsuccessful Pilot Projects or Niche Offerings

Unsuccessful pilot projects or highly specialized niche offerings that failed to gain traction are classified as Dogs in the BCG Matrix. These ventures often represent significant investments of time and capital with minimal market penetration and growth. For instance, a utility software pilot that only secured a handful of small clients by the end of 2024, despite substantial R&D spending, would fall into this category.

These initiatives, while potentially innovative, did not resonate broadly enough to achieve scalability or a meaningful market share. They can become drains on resources, consuming cash without generating the expected returns. Gentrack's focus on digital transformation means that some early-stage, highly specific solutions might not have achieved the necessary market adoption to move beyond this Dog classification.

- Low Market Share: Pilot projects that did not scale typically end up with a negligible percentage of the total addressable market.

- Stagnant Growth: These offerings exhibit little to no revenue growth, indicating a lack of customer demand or competitive advantage.

- Resource Drain: Continued investment in unsuccessful niche products can divert funds and attention from more promising business areas.

- Negative ROI: The cost of development and support often outweighs any revenue generated, leading to a poor return on investment.

Products Affected by Customer Churn (Limited Impact)

Gentrack's Veovo airport division typically boasts very low customer churn, and its utility customer retention is also robust. However, any specific instances where a particular product or customer segment faces loss due to intense competition or a mismatch in product suitability can be categorized as 'Dogs' within the BCG matrix. These represent areas with limited growth potential and low market share that require careful management.

The recent loss of an Australian customer, though not a significant financial blow, serves as an indicator. This event, related to a platform replacement program, points to potential vulnerabilities in specific product applications or customer segments. Such occurrences, even if minor in immediate financial impact, highlight the need for vigilance in maintaining competitive positioning and product relevance.

- Low Churn Areas: Veovo airport division and utility customer base demonstrate strong retention.

- 'Dog' Characteristics: Specific product applications or customer segments experiencing churn due to competition or poor fit.

- Illustrative Event: Loss of an Australian customer for platform replacement, highlighting potential weaknesses.

- Strategic Implication: Even minor customer losses signal areas needing attention to maintain market competitiveness.

Gentrack's older, less adopted software modules and unsuccessful niche projects are classified as Dogs in the BCG Matrix. These segments exhibit low market share and stagnant growth, often requiring significant resources without generating substantial returns. For instance, a legacy billing system with declining client acquisition or a pilot project that secured minimal clients by late 2024 exemplifies these underperforming assets.

These 'Dogs' represent areas where Gentrack has limited competitive advantage and low growth prospects. The company's strategic focus on expanding in markets like North America and Australia implies a reallocation of resources away from these less promising territories, aiming to improve overall portfolio performance and profitability.

While Gentrack maintains strong customer retention in core areas like its Veovo airport division, any specific product or customer segment experiencing churn due to competition or poor product fit would fall into the 'Dog' category. The loss of an Australian customer in 2024, though minor, highlights potential vulnerabilities in specific product applications that require careful management.

Question Marks

The initial deployments of Gentrack's g2.0 platform in new, high-growth territories or with complex new customers represent question marks. While the platform itself is a Star, its successful penetration and market share gain in these nascent deployments are still unproven. These require significant investment in implementation and support to convert into high-market-share Stars.

Gentrack's investment in Amber Electric, an Australian tech firm specializing in real-time electricity pricing and renewable energy solutions, positions it as a Question Mark within the BCG Matrix. This strategic move is designed to integrate Gentrack's established billing systems with Amber's advanced automation software.

The primary objective is to tap into the burgeoning smart energy services sector, a market experiencing significant expansion. For instance, the global smart grid market size was valued at approximately USD 27.6 billion in 2023 and is projected to grow substantially in the coming years, indicating strong potential for this venture.

Despite the high growth prospects, Gentrack's initial 10% ownership stake in Amber Electric means its current market share within this specific bundled offering is relatively small. This necessitates continued investment and strategic development to effectively scale the partnership and capitalize on the market opportunity.

Gentrack's focus on integrating advanced analytics, AI, and machine learning into utility billing and operations is a smart move, tapping into a market poised for significant expansion. This shift towards data-driven solutions is a major trend in the utility sector.

While Gentrack is actively building these capabilities, their current market share in these specialized, cutting-edge AI/ML solutions may be modest when measured against dedicated AI vendors. The utility sector is increasingly prioritizing these advanced tools.

Capturing a larger slice of this dynamic market will require substantial investment from Gentrack to truly differentiate its offerings. For instance, the global AI in utilities market was projected to reach over $6 billion by 2024, highlighting the immense opportunity.

Solutions for Distributed Energy Resource Management (DERM)

As utilities navigate the complex path to net-zero emissions, the need for advanced Distributed Energy Resource Management (DERM) systems is escalating. Gentrack's DERM solutions are positioned to address this growing demand, playing a vital role in managing the increasing integration of renewables and other distributed assets. However, despite their critical importance, these offerings may currently represent a smaller portion of the overall market, indicating early-stage adoption. Significant investment in research and development, coupled with strategic market penetration efforts, will be essential for these solutions to mature into market leaders.

- Growing Market Demand: The global DER management systems market was valued at approximately USD 1.5 billion in 2023 and is projected to reach over USD 6.5 billion by 2030, exhibiting a compound annual growth rate (CAGR) of around 23%.

- Gentrack's Position: While Gentrack is a recognized player in the utility software space, its specific market share in DERM solutions, as of early 2024, is likely in the nascent stages, reflecting a focus on building out capabilities and securing initial client wins.

- Investment and Evolution: To capitalize on this expansion, Gentrack's ongoing investment in R&D for its DERM platform is paramount. This focus is intended to enhance functionality, ensure scalability, and drive broader market adoption, transforming these critical offerings into future market stars.

Targeting New Utility Customer Wins in Untapped Regions

Gentrack's strategic focus on acquiring new utility customers in untapped regions, moving beyond its established markets like New Zealand, Australia, and the UK, clearly positions this initiative within the 'Question Mark' category of the BCG matrix. These emerging territories present substantial growth opportunities, but Gentrack's current market penetration is minimal, necessitating significant investment and tailored strategies for success.

The success of these expansion efforts hinges on Gentrack's ability to effectively adapt its offerings to local market needs, differentiate itself from existing competitors, and execute robust sales and marketing campaigns. For instance, entering a new market often requires understanding local regulatory frameworks and consumer preferences, which can be a complex undertaking. In 2023, Gentrack announced its intention to explore opportunities in North America, a region with a large utility customer base but also significant competition, highlighting the 'Question Mark' nature of this venture.

Key considerations for this 'Question Mark' strategy include:

- Market Research: Thorough analysis of regulatory environments, competitive landscapes, and customer demands in new territories.

- Product Localization: Adapting software solutions to meet specific regional requirements and compliance standards.

- Sales and Marketing Investment: Allocating resources for building brand awareness and establishing sales channels in unfamiliar markets.

- Partnership Development: Collaborating with local entities to navigate market entry and accelerate adoption.

Gentrack's investments in emerging technologies and new market entries are classic Question Marks. These ventures, like the integration with Amber Electric or the expansion into new geographical territories, require substantial capital to gain market share. While the potential for high growth exists, their current market penetration is low, making their future success uncertain.

The success of these Question Mark initiatives is crucial for Gentrack's future growth. For instance, the global smart grid market, which Amber Electric operates within, was valued at approximately USD 27.6 billion in 2023 and is expected to see significant expansion. Gentrack's strategic focus on advanced analytics and AI in utilities also taps into a market projected to exceed $6 billion by 2024.

These ventures represent opportunities where Gentrack is investing heavily to build capabilities and establish a foothold. The company's expansion into North America in 2023, for example, highlights the significant investment needed to navigate competitive landscapes and adapt offerings to local demands.

Ultimately, Gentrack must convert these Question Marks into Stars through sustained investment, strategic market penetration, and successful product development. This transformation is key to capturing market leadership in high-growth sectors.

| Initiative | Market Opportunity | Gentrack's Current Position | Investment Focus |

|---|---|---|---|

| Amber Electric Integration | Smart energy services (Global market ~USD 27.6B in 2023) | Small initial market share (10% stake) | Scaling partnership, advanced automation |

| AI/ML in Utilities | AI in Utilities market (>USD 6B by 2024) | Modest market share vs. dedicated AI vendors | Enhancing functionality, differentiation |

| DERM Solutions | DER Management Systems (~USD 1.5B in 2023, growing to >USD 6.5B by 2030) | Nascent stages, early client wins | R&D, scalability, market adoption |

| New Geographic Markets (e.g., North America) | Untapped regions with substantial growth potential | Minimal current penetration | Market research, localization, sales investment |

BCG Matrix Data Sources

Our Gentrack Group BCG Matrix leverages comprehensive data including financial statements, market share analysis, and industry growth forecasts to accurately position each business unit.