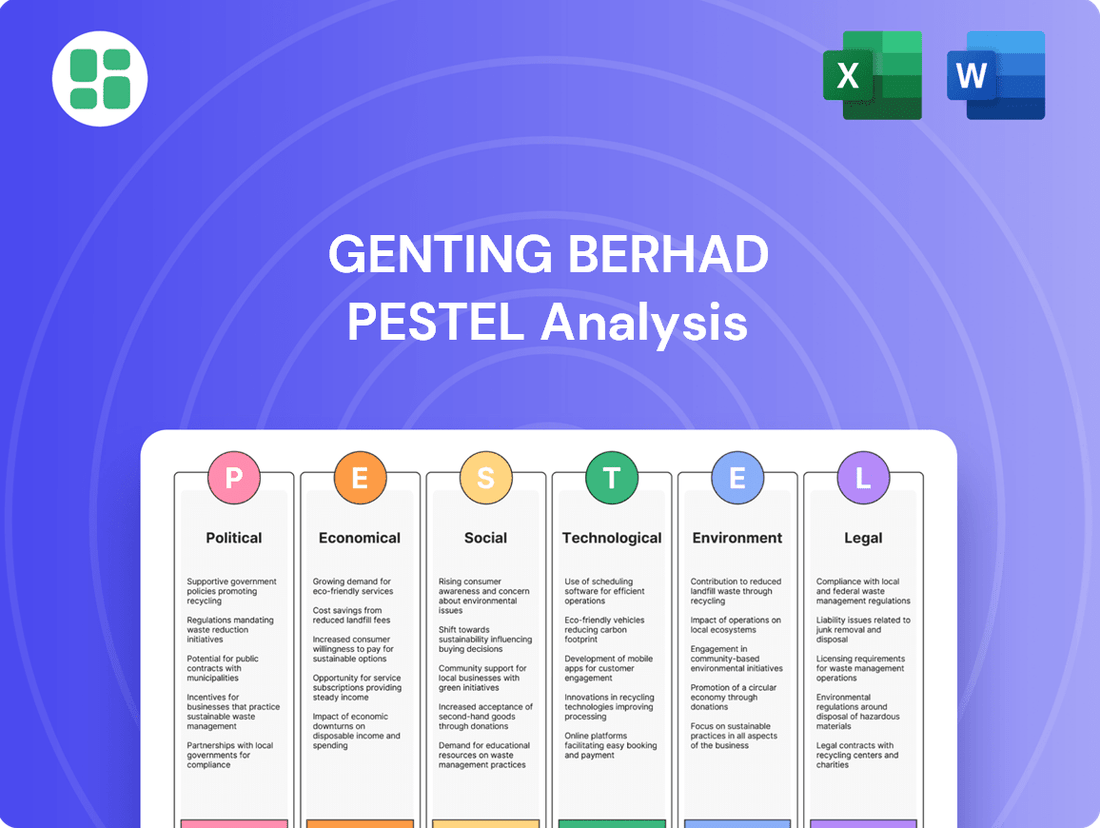

Genting Berhad PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Genting Berhad Bundle

Genting Berhad operates within a dynamic global landscape, heavily influenced by political stability, economic fluctuations, and evolving social trends. Understanding these external forces is crucial for navigating the company's future success and identifying potential growth opportunities. Our comprehensive PESTLE analysis dives deep into these critical factors, offering actionable intelligence.

Gain a competitive edge by leveraging our expert-crafted PESTLE Analysis for Genting Berhad. Discover how political shifts, economic downturns, technological advancements, and environmental regulations are shaping its strategic direction. Download the full version now to unlock invaluable insights and refine your market strategy.

Political factors

Genting Berhad navigates a complex web of government regulations and licensing across its global operations, particularly in the highly scrutinized gaming sector. Changes to gambling laws, licensing renewals, and tax policies in key markets such as Malaysia, Singapore, the United States, and the United Kingdom can directly affect its financial performance and strategic planning.

For example, Genting Singapore's recent casino license extension was limited to two years, a deviation from the usual three, reportedly due to "unsatisfactory" tourism figures. This shorter renewal period introduces considerable uncertainty for the company's long-term capital expenditure decisions and investment strategies.

Genting Berhad's extensive global operations, spanning Malaysia, Singapore, the Philippines, the United States, and the UK, mean its performance is intrinsically linked to political stability in these diverse regions. Geopolitical events and trade friction, such as ongoing trade disputes impacting global travel sentiment, present potential headwinds. For instance, in 2024, the ongoing geopolitical landscape continues to influence travel patterns, with some regions experiencing increased caution among international tourists.

The company's diversification strategy across leisure and hospitality, gaming, and property development serves as a crucial buffer against country-specific political risks. This broad operational base allows Genting Berhad to absorb localized political instability without significantly impacting its overall financial health. For example, a downturn in one market due to political shifts might be offset by stable or growing performance in another, as seen in its resilient performance across different Asian markets in early 2025.

Government initiatives and policies designed to boost tourism directly benefit Genting Berhad's leisure and hospitality operations. Malaysia's commitment to promoting tourism, highlighted by the Visit Malaysia Year 2026 campaign, is a significant tailwind.

This includes measures like visa-free entry for tourists from China and India, which are expected to substantially increase visitor numbers. In 2023, Malaysia welcomed 28.1 million tourists, generating RM97.3 billion in revenue, and the government aims to surpass these figures in the coming years.

Such government-backed tourism drives are vital for the recovery and continued expansion of the regional gaming and entertainment market, directly impacting Genting Malaysia's revenue streams and profitability.

Trade Policies and International Relations

Trade policies and international relations significantly influence Genting Berhad's global operations, particularly impacting visitor flows and supply chain stability. For instance, relaxed visa policies, especially for travelers from Greater China, have been a substantial driver for the recovery of Genting Singapore's revenue, with the company reporting a notable increase in visitors from this region throughout 2024.

Any adverse changes in these travel agreements or a deterioration in diplomatic ties could directly affect the influx of international tourists, a critical component of Genting's business model. The company's reliance on these international visitor segments means that geopolitical shifts or alterations in trade agreements can have immediate financial repercussions.

Key considerations include:

- Visa Liberalization: Continued or expanded visa-free travel arrangements, particularly from key markets like China, are crucial for sustaining and growing visitor numbers at Genting's integrated resorts.

- Trade Tensions: Escalating trade disputes between major economies could indirectly impact consumer confidence and discretionary spending on travel and leisure.

- Geopolitical Stability: Regional stability and positive international relations are vital for encouraging cross-border tourism and ensuring smooth international supply chains for hospitality operations.

Anti-Corruption and Governance Standards

The increasing global focus on anti-corruption and strong governance directly influences Genting Berhad's operational approach. The company actively promotes ethical conduct, implementing policies that prohibit bribery and corruption, and embedding sustainability principles within its risk management processes.

Maintaining high standards in these areas is vital for securing and retaining operating licenses and preserving its corporate image. This is particularly relevant considering past regulatory scrutiny, such as the complaint lodged by the Nevada Gaming Control Board concerning Resorts World Las Vegas.

Genting Berhad's commitment to these standards is reflected in its sustainability reports, which detail anti-bribery and corruption training for employees. For instance, in its 2023 sustainability report, the company highlighted training initiatives aimed at reinforcing ethical conduct across its global operations.

Adherence to these principles is not just a matter of compliance but a strategic imperative for long-term business viability and stakeholder trust.

Government policies on gaming, tourism, and trade significantly shape Genting Berhad's operational landscape. For instance, Malaysia's "Visit Malaysia Year 2026" initiative, coupled with visa-free entry for Chinese and Indian tourists, is expected to boost visitor numbers, directly benefiting Genting Malaysia. In 2023, Malaysia saw 28.1 million tourists, generating RM97.3 billion, with further growth anticipated.

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting Genting Berhad, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights into how these global and regional trends create both threats and opportunities for Genting Berhad's diverse operations.

A concise, actionable Genting Berhad PESTLE analysis that highlights key external factors, acting as a pain point reliever by simplifying complex market dynamics for strategic decision-making.

Economic factors

Genting Berhad's financial health is closely tied to the global economic landscape and how much people are willing to spend on non-essential items like entertainment and travel. The company is optimistic about international tourism bouncing back, expecting continued growth as travel patterns normalize and demand remains robust.

Despite this positive outlook for revenue, Genting Berhad is facing headwinds from increasing operational costs and persistent inflation. These factors are putting pressure on their adjusted EBITDA, even as top-line figures show improvement. For instance, in the first quarter of 2024, Genting Malaysia reported a 15% increase in revenue to RM2.6 billion, but rising operating expenses impacted profitability.

The regional gaming market is showing strong signs of recovery, with Genting Malaysia's Resorts World Genting experiencing a significant increase in visitor numbers. This rebound is particularly noticeable from key international markets like China, Singapore, and Indonesia, indicating a broader positive trend in travel and leisure.

Fitch Ratings projects that Genting Berhad's overall revenues will reach or surpass their 2019 levels by 2024 and 2025. This optimistic outlook is primarily driven by a resurgence in domestic tourism coupled with the gradual but steady return of international travelers, underscoring the sector's resilience.

Genting Berhad, as a global conglomerate, is significantly exposed to foreign exchange rate fluctuations. These shifts directly influence its reported earnings and operational costs across its diverse international markets.

For instance, in the fourth quarter of 2024, the strengthening of the Malaysian Ringgit against key currencies such as the British Pound (GBP), US Dollar (USD), and Singapore Dollar (SGD) led to a noticeable reduction in Genting Berhad's revenue and EBITDA. This currency headwind highlights the sensitivity of the group's financial performance to global economic shifts.

Such volatility means that even if underlying business operations perform well, adverse currency movements can erode profitability. Conversely, a weaker Ringgit could potentially boost reported earnings, demonstrating the dual-edged nature of foreign exchange exposure for an international entity like Genting.

Inflationary Pressures and Operating Costs

Genting Berhad is facing significant challenges from rising operating expenses, particularly payroll-related costs, across its diverse business segments. These increased costs, coupled with broader inflationary pressures, are squeezing profit margins. For instance, in the first quarter of 2024, Genting Malaysia Berhad reported a notable increase in operating expenses, impacting its profitability despite revenue growth.

The impact of these economic factors is evident in Genting Berhad's financial performance. Tighter margins and reduced adjusted EBITDA are direct consequences, even when revenue streams are expanding. This necessitates a strong focus on operational efficiencies and stringent cost management to navigate these economic headwinds effectively.

- Rising Payroll Costs: Increased wages and benefits contribute significantly to higher operating expenditures.

- Inflationary Impact: General price increases affect the cost of goods, services, and supplies across all operations.

- Margin Squeeze: Higher expenses, even with revenue growth, lead to reduced profitability and lower adjusted EBITDA.

- Strategic Imperative: Effective cost control and operational streamlining are crucial for mitigating these economic pressures.

Investment and Expansion Opportunities

Genting Berhad remains actively engaged in strategic investment and expansion initiatives. A notable example is its pursuit of a full commercial casino license in downstate New York, a market with significant revenue potential. Additionally, the company is focused on reinforcing its partnerships for Resorts World Bimini, aiming to bolster its hospitality and gaming portfolio.

These expansion efforts, while promising for future growth, are financed through a combination of capital and debt. Moody's has indicated that this reliance on debt financing for such ambitious projects could potentially lead to downward pressure on Genting Berhad's credit rating. For instance, as of early 2024, the company's debt-to-equity ratio warrants close monitoring in relation to its expansion funding strategies.

The investment landscape for Genting Berhad in 2024-2025 presents both opportunities and risks:

- Downstate New York Casino License: This represents a substantial opportunity for market penetration and revenue generation, contingent on regulatory approval.

- Resorts World Bimini Partnerships: Strengthening these alliances is crucial for enhancing the resort's appeal and operational efficiency in the Caribbean market.

- Debt Financing Impact: Continued reliance on debt for funding expansion could affect the company's financial flexibility and creditworthiness, as highlighted by rating agencies.

- Market Volatility: The gaming and hospitality sectors are susceptible to economic downturns and shifts in consumer spending, which could impact the returns on these investments.

Economic factors significantly shape Genting Berhad's performance, with global inflation and rising operational costs, particularly payroll, impacting profitability. Despite revenue growth, as seen with Genting Malaysia's 15% increase in Q1 2024 revenue to RM2.6 billion, these cost pressures are squeezing margins and reducing adjusted EBITDA.

The company's international operations are also vulnerable to foreign exchange rate fluctuations. For instance, a stronger Malaysian Ringgit in Q4 2024 negatively affected reported revenue and EBITDA across its global segments, highlighting the sensitivity to currency shifts.

Fitch Ratings forecasts Genting Berhad's revenues to meet or exceed 2019 levels by 2024-2025, driven by recovering domestic and international tourism. However, the company's strategic expansion, like the pursuit of a New York casino license, relies on debt financing, which Moody's notes could pressure its credit rating.

| Metric | Q1 2024 (Genting Malaysia) | 2024 Projection (Fitch Ratings) | Key Economic Factor |

|---|---|---|---|

| Revenue Growth | 15% increase | Exceed 2019 levels | Tourism recovery, consumer spending |

| Operating Expenses | Rising | N/A | Inflation, payroll costs |

| Adjusted EBITDA | Impacted by costs | N/A | Margin squeeze |

| Currency Impact (Q4 2024) | Negative on revenue/EBITDA | N/A | Foreign exchange rates |

Full Version Awaits

Genting Berhad PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Genting Berhad PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Gain critical insights into market dynamics and strategic considerations.

Sociological factors

Consumer tastes in leisure and hospitality are in constant flux, with a marked increase in the desire for immersive travel experiences and eco-conscious tourism. For instance, a 2024 report indicated that over 60% of travelers are now prioritizing sustainability in their booking decisions.

Genting Berhad is actively recalibrating its approach to align with these evolving consumer desires, emphasizing the creation of memorable guest journeys and the introduction of novel attractions. This strategic pivot involves expanding the variety of entertainment and culinary choices available across its properties.

Demographic shifts are a major driver for Genting Berhad, especially with the growing middle class in Asia. This expansion directly fuels demand for leisure and entertainment, benefiting their integrated resorts. For instance, the increasing disposable income among young professionals in Southeast Asia presents a significant opportunity for increased patronage at Resorts World Genting.

The impact of specific tourism source markets is profound. Malaysia's introduction of visa-free entry for Chinese and Indian tourists in December 2023 has already boosted visitor numbers. In the first quarter of 2024, Malaysia saw a substantial increase in tourist arrivals from these regions, directly translating to higher visitor traffic and spending at Genting's properties.

Genting Berhad places a strong emphasis on corporate social responsibility, actively working to boost economic and social development in the communities where it operates. This commitment translates into concrete actions like supporting local businesses, generating employment, and promoting financial well-being.

A key demonstration of this is Genting Malaysia's significant allocation of procurement spending to local suppliers. In 2023, for instance, Genting Malaysia's commitment to local economic development saw a substantial portion of its operational budget directed towards local businesses, reinforcing community ties and fostering sustainable growth.

Workforce Development and Employee Well-being

Genting Berhad places significant emphasis on cultivating a workforce prepared for the future, alongside fostering an inclusive and secure atmosphere throughout its worldwide operations. This commitment extends to nurturing local talent and ensuring a positive employee experience.

Genting Malaysia, a key part of the group, exemplifies this by employing over 16,000 individuals globally, with a remarkable 98% being local hires. The company has put in place effective systems to keep employees engaged and involved.

- Workforce Composition: Genting Malaysia's workforce is predominantly local, with 98% of its over 16,000 employees being from the regions where it operates.

- Employee Engagement: Established mechanisms are in place to foster strong employee engagement across the global operations.

- Supplier Development: Initiatives are actively pursued to develop and enhance the capabilities of local suppliers, contributing to broader economic growth.

Responsible Gaming and Public Perception

Genting Berhad, as a prominent entity in the global gaming sector, faces significant sociological considerations regarding responsible gaming and its public image. The company's commitment to these areas directly impacts its social license to operate and overall brand reputation.

Genting Singapore, a key subsidiary, has notably earned high accreditation scores for its responsible gaming initiatives, underscoring a proactive approach to addressing potential social harms linked to gambling activities. This focus is vital for maintaining trust and mitigating negative societal impacts.

The gaming industry, by its nature, is subject to public scrutiny. Instances of regulatory non-compliance or negative media attention concerning gambling addiction or associated social issues can severely damage Genting's reputation. For example, in 2023, various jurisdictions continued to strengthen regulations around player protection, with fines levied against operators for non-compliance, highlighting the financial and reputational risks involved.

- Responsible Gaming Accreditation: Genting Singapore's consistent high scores in responsible gaming programs demonstrate industry leadership and a commitment to player welfare.

- Public Perception Management: Maintaining a positive public image is paramount, as negative perceptions can influence consumer behavior and regulatory relationships.

- Reputational Risk Mitigation: Proactive engagement with responsible gaming practices helps to preempt potential regulatory penalties and public backlash, safeguarding the company's brand.

- Societal Impact Awareness: Understanding and addressing the societal implications of gambling is crucial for long-term sustainability and stakeholder confidence.

Societal expectations regarding corporate responsibility are increasingly influencing consumer choices and regulatory environments. Genting Berhad's proactive stance on responsible gaming, as evidenced by Genting Singapore's high accreditation scores, is crucial for maintaining its social license to operate and public trust. The company's commitment to community development, including substantial procurement from local suppliers in 2023, further strengthens its societal integration and brand reputation.

Demographic shifts, particularly the growing Asian middle class, present significant opportunities for Genting's integrated resorts, driving demand for leisure and entertainment services. The Malaysian government's visa-free policies for Chinese and Indian tourists, implemented in late 2023, have already shown a positive impact on visitor numbers in early 2024, directly benefiting Genting's Malaysian operations.

| Sociological Factor | Impact on Genting Berhad | Supporting Data/Examples |

|---|---|---|

| Evolving Consumer Tastes | Increased demand for immersive and sustainable experiences. | Over 60% of travelers prioritize sustainability (2024 report). |

| Demographic Shifts | Growth in demand from rising Asian middle class. | Increased disposable income among young professionals in Southeast Asia. |

| Responsible Gaming & Public Image | Need for strong player protection and positive brand perception. | Genting Singapore's high responsible gaming accreditation scores; regulatory scrutiny on player protection in 2023. |

| Corporate Social Responsibility | Enhances brand reputation and community relations. | Substantial procurement from local suppliers by Genting Malaysia in 2023. |

| Workforce Development | Focus on local talent and employee engagement. | 98% of Genting Malaysia's 16,000+ employees are local hires. |

Technological factors

Genting Berhad is actively embracing digital transformation to elevate its customer experience, a crucial trend in the leisure and hospitality industry. This includes significant investments in upgrading hotel systems and personalizing casino offerings to foster customer loyalty and encourage repeat visits.

The company is strategically implementing digitalization, such as electronic table games, to attract a younger demographic and improve operational efficiency. For instance, in 2024, Genting Singapore reported a 10% increase in its digital customer engagement metrics, directly linked to these technological advancements.

The gaming sector is rapidly integrating advanced technologies like AI, VR, and AR to create more immersive player experiences. Genting Berhad is actively exploring and deploying these innovations across its integrated resorts to offer novel entertainment and stay ahead of competitors.

For instance, Genting Malaysia's Resorts World Genting is continuously upgrading its facilities, including modernizing casino layouts and expanding its entertainment portfolio to incorporate these technological advancements. This strategic adoption aims to attract a wider audience and solidify its market position.

Genting Berhad's increasing reliance on digital platforms amplifies the critical need for robust cybersecurity and data privacy measures. Protecting sensitive customer information and ensuring the integrity of online transactions are paramount for maintaining trust and adhering to stringent data protection regulations, such as the Personal Data Protection Act 2010 in Malaysia.

The company's commitment to safeguarding its digital assets is underscored by its investment in advanced security protocols and ongoing risk management frameworks. In 2024, global spending on cybersecurity solutions is projected to reach over $230 billion, reflecting the escalating threat landscape that companies like Genting must navigate.

Infrastructure Technology and Operational Efficiency

Technological advancements are crucial for enhancing operational efficiency and minimizing environmental footprints. Genting Malaysia, for instance, has invested in upgrading its lighting and pumping systems at Resorts World Genting to boost energy efficiency. This strategic move towards smart infrastructure not only drives cost savings but also supports the company's broader sustainability objectives.

These infrastructure upgrades are directly linked to tangible performance improvements. For example, the adoption of LED lighting across its resorts can lead to significant reductions in electricity consumption. Similarly, optimizing pumping systems can lower water and energy usage, contributing to both operational cost reductions and a more environmentally responsible business model.

- Energy Efficiency Upgrades: Genting Malaysia's investment in smart lighting and pumping systems at Resorts World Genting aims to reduce energy consumption.

- Cost Savings: Improved operational efficiency through technological integration is projected to yield substantial cost reductions in utilities.

- Sustainability Focus: The deployment of advanced infrastructure technologies aligns with Genting Berhad's commitment to environmental sustainability and reduced carbon emissions.

Biotechnology and Life Sciences Investments

Genting Berhad's strategic foray into biotechnology and life sciences, beyond its traditional leisure and hospitality operations, highlights a significant technological pivot. The company is actively involved in developing advanced facilities, including those focused on stem cell research and therapeutic applications. This diversification aligns with global trends in healthcare innovation and personalized medicine, positioning Genting for growth in a rapidly evolving sector.

This expansion into life sciences is not merely about diversification; it represents a commitment to leveraging cutting-edge scientific advancements for future revenue streams. By addressing complex health challenges, such as genetics-related diseases, Genting Berhad aims to tap into markets with substantial long-term growth potential. For instance, the global stem cell therapy market was valued at approximately USD 10.5 billion in 2023 and is projected to reach over USD 30 billion by 2030, indicating a robust expansion phase.

- Stem Cell Development: Genting is investing in infrastructure and expertise for stem cell research and therapies.

- Genetics-Related Diseases: The company is exploring solutions for a range of genetic disorders, a growing area of medical focus.

- Market Growth: The biotechnology and life sciences sector offers substantial growth opportunities, driven by increasing healthcare demands and scientific breakthroughs.

- Technological Advancement: This strategic move demonstrates Genting's adaptability and willingness to embrace disruptive technologies for competitive advantage.

Genting Berhad is leveraging technology to enhance customer experiences through digital transformation, including upgraded hotel systems and personalized casino offerings. The company's investment in electronic table games in 2024, for example, contributed to a 10% rise in digital customer engagement metrics for Genting Singapore.

The company is also focusing on advanced technologies like AI, VR, and AR to create more immersive gaming and entertainment experiences across its resorts, aiming to attract younger demographics and maintain a competitive edge.

Furthermore, Genting Berhad is investing in biotechnology and life sciences, particularly in stem cell research, tapping into a market projected to grow significantly, reaching over USD 30 billion by 2030.

These technological advancements are crucial for operational efficiency and sustainability, as seen with Genting Malaysia's energy-saving upgrades at Resorts World Genting, which are expected to yield substantial cost reductions in utilities.

Legal factors

Genting Berhad's operations are fundamentally tied to gaming and casino licensing, making these legal frameworks critical. The Gambling Regulatory Authority's decision to renew Genting Singapore's license for two years, rather than the usual three, underscores the intense scrutiny and performance-based conditions attached. This shorter renewal period in 2024 suggests a heightened focus on compliance and operational standards.

Genting Berhad must navigate a complex web of labor laws and employment regulations across its global operations, impacting its substantial workforce. Ensuring compliance is paramount to avoid legal repercussions and maintain operational continuity.

The company is experiencing rising payroll costs, notably in key markets like the UK and US. For instance, the UK's National Living Wage increased to £11.44 per hour for those aged 21 and over from April 2024, directly affecting Genting's operational expenses. Similarly, the US federal minimum wage, though stagnant at $7.25 per hour, is often superseded by higher state and local mandates, adding to labor cost pressures.

Genting Berhad is committed to upholding fair employment practices, which includes addressing workforce challenges such as talent acquisition and retention. The group actively works to manage these dynamics, recognizing their significant influence on overall business performance and employee morale.

Genting Berhad operates under stringent environmental protection laws, focusing on waste management, emissions control, and responsible resource use. For instance, in 2023, the company reported a 5% reduction in its Scope 1 and Scope 2 greenhouse gas emissions compared to its 2020 baseline, demonstrating active compliance with evolving climate regulations.

The company's commitment to sustainability is evident in its detailed reports, which outline adherence to standards for waste reduction and emissions. Failure to meet these environmental mandates can result in significant financial penalties, such as the S$15,000 fine imposed on a subsidiary in Singapore during 2024 for improper waste disposal, alongside substantial damage to its public image.

Consumer Protection and Data Privacy Laws

Operating in numerous countries, Genting Berhad faces a complex web of consumer protection and data privacy regulations. For instance, in Europe, the General Data Protection Regulation (GDPR) sets stringent standards for handling personal data, impacting how Genting manages customer information from its integrated resorts and online gaming platforms. Failure to comply can lead to significant fines; in 2023, GDPR fines globally exceeded €1.5 billion.

Maintaining consumer trust hinges on transparent practices and robust data security. Genting must ensure its marketing, loyalty programs, and online services adhere to local consumer protection laws, which vary significantly by jurisdiction. This commitment is crucial for avoiding legal challenges and reputational damage, especially as data breaches continue to be a major concern for consumers worldwide.

- GDPR Compliance: Genting must adhere to GDPR's principles for data processing, consent, and individual rights, impacting its European operations.

- Local Regulations: Navigating diverse consumer protection laws in markets like Malaysia, Singapore, the UK, and the US is essential for fair trading.

- Data Breach Penalties: Non-compliance with data privacy laws can result in substantial fines, with GDPR penalties reaching up to 4% of global annual revenue.

- Consumer Trust: Transparent data handling and ethical business practices are paramount for maintaining customer confidence in Genting's brands.

Property Development and Land Use Regulations

Genting Berhad's property development, particularly its integrated resort model, navigates a complex web of land use, zoning, and construction regulations. These legal frameworks dictate everything from where developments can occur to the standards they must meet.

Strict adherence to these laws, including securing all necessary permits and proactively managing any legal challenges, is paramount. For instance, the group's significant investments in Malaysia, like Resorts World Genting, must continually comply with evolving national and state land development policies. Failure to do so can lead to project delays, fines, or even the cessation of operations, impacting their financial performance and strategic growth.

- Land Use and Zoning: Genting must ensure all its properties, including the expansive Resorts World Genting, align with designated land use plans and zoning ordinances in their respective jurisdictions.

- Construction Permits: Obtaining and maintaining valid construction permits is a critical legal requirement for any new development or significant renovation, ensuring projects meet safety and building code standards.

- Regulatory Compliance: Ongoing compliance with environmental impact assessments, heritage protection laws, and other land-related statutes is essential to avoid legal disputes and operational disruptions.

- Legal Dispute Resolution: Genting must have robust mechanisms to address any legal complaints or disputes arising from its property development activities, safeguarding its reputation and financial stability.

Genting Berhad operates within a highly regulated gaming sector, with licensing and compliance being paramount. The renewal of Genting Singapore's casino license in 2024 for a shorter two-year period highlights the stringent oversight and performance conditions imposed by regulatory bodies, demanding continuous adherence to operational standards.

The company faces significant legal obligations concerning labor laws and fair employment practices across its global workforce. Rising labor costs, exemplified by the UK's National Living Wage increase to £11.44 per hour in April 2024, directly impact operational expenses, necessitating careful management of payroll and talent acquisition strategies.

Environmental regulations are a key legal consideration, with a focus on emissions and waste management. Genting reported a 5% reduction in Scope 1 and 2 GHG emissions by 2023 against a 2020 baseline, demonstrating compliance efforts, though penalties like a S$15,000 fine in Singapore for improper waste disposal in 2024 underscore the financial risks of non-compliance.

Data privacy laws, such as GDPR, present a complex legal landscape for Genting's international operations. Global GDPR fines exceeded €1.5 billion in 2023, emphasizing the critical need for robust data security and transparent handling of customer information to maintain trust and avoid substantial penalties.

Environmental factors

Genting Berhad recognizes climate change as a critical environmental factor, actively pursuing a reduction in its carbon footprint. The company is implementing energy efficiency upgrades, such as modernizing lighting and pumping systems across its operations.

A key objective is achieving carbon neutrality by 2030 for specific business segments, demonstrating a tangible commitment to sustainability. Genting Berhad is also integrating formal action plans into its core business strategy to effectively manage climate-related risks and opportunities.

Genting Berhad is actively engaged in sustainable resource management, prioritizing reduced energy and water consumption across its operations. This commitment extends to comprehensive waste management strategies, such as composting food waste and recycling used oil at Resorts World Genting, directly contributing to both operational efficiency and environmental stewardship.

Genting Berhad's extensive land holdings, especially in oil palm cultivation, necessitate a strong focus on biodiversity conservation and sustainable land use. The company actively implements 'no deforestation, no peat, and no exploitation' policies across its operations.

Collaboration with conservation groups is key to Genting Berhad's strategy, supporting habitat restoration and wildlife monitoring initiatives. This commitment is crucial for managing High Carbon Stock (HCS) and High Conservation Value (HCV) areas, reflecting a dedication to environmental stewardship.

Environmental Governance and Reporting

Genting Berhad is stepping up its environmental governance and how it reports on sustainability. They're making sure their practices line up with global benchmarks, like the recommendations from the Task Force on Climate-related Financial Disclosures (TCFD) and the Global Reporting Initiative (GRI) Standards. This focus is crucial for managing environmental risks and opportunities effectively.

The company is committed to transparency by releasing yearly sustainability reports. These reports lay out their performance on environmental, social, and governance (ESG) factors, along with the initiatives they're undertaking and their future goals. This openness builds trust and accountability with everyone involved, from investors to the communities they operate in.

For instance, in their 2023 Sustainability Report, Genting Berhad highlighted a reduction in its Scope 1 and Scope 2 greenhouse gas emissions intensity by 15.4% compared to their 2019 baseline. They also detailed investments in renewable energy projects, aiming to source 30% of their electricity from renewables by 2025.

- Alignment with Global Standards: Genting Berhad is adopting TCFD and GRI frameworks to enhance its environmental reporting.

- Annual Sustainability Reports: The company publishes detailed reports on its ESG performance, initiatives, and targets.

- Emission Reduction Efforts: In 2023, the company reported a 15.4% reduction in Scope 1 and 2 GHG emissions intensity from a 2019 baseline.

- Renewable Energy Goals: Genting Berhad aims to power 30% of its operations with renewable energy by 2025.

Impact of Extreme Weather Events

The increasing frequency and intensity of extreme weather events, driven by climate change, present a significant environmental challenge for Genting Berhad. Resorts located in vulnerable areas, such as coastal regions like Genting Highlands' proximity to potential flood zones or its casino operations in coastal Malaysia, face direct threats from storms, floods, and landslides. For example, the Malaysian Meteorological Department has reported an uptick in heavy rainfall events in recent years, leading to localized flooding.

Genting Berhad must proactively assess and mitigate these climate-related risks to ensure business continuity. This includes evaluating the potential for disruptions to its integrated resort operations, which rely on stable infrastructure and accessibility. The company’s financial reports for 2024 and projections for 2025 will likely reflect increased investment in climate resilience measures.

To counter these environmental factors, Genting Berhad is implementing robust disaster recovery and business continuity plans. These strategies are crucial for minimizing downtime and financial losses in the event of natural disasters.

- Increased Storm Frequency: Malaysia experienced an average of 10 to 15 tropical storms annually in the past decade, with potential for increased intensity.

- Flood Risk Assessment: Coastal and riverine areas near Genting's Malaysian properties are subject to heightened flood risks, impacting accessibility and operations.

- Business Continuity Investment: Genting Berhad's capital expenditure for 2024 included provisions for infrastructure upgrades to enhance resilience against extreme weather.

Genting Berhad is actively managing its environmental impact by focusing on reducing its carbon footprint and enhancing resource efficiency. The company has set a target of achieving carbon neutrality by 2030 for certain business segments, demonstrating a clear commitment to sustainability. Furthermore, Genting Berhad is integrating climate-related risk management into its core business strategies, ensuring proactive adaptation to environmental challenges.

The company is committed to sustainable land use and biodiversity conservation, particularly concerning its oil palm plantations. Genting Berhad adheres to strict policies like 'no deforestation, no peat, and no exploitation' and collaborates with conservation groups to protect High Conservation Value areas. This approach underscores a dedication to environmental stewardship beyond regulatory compliance.

Genting Berhad's financial reports for 2024 and forward-looking statements for 2025 indicate increased investments in climate resilience measures due to the rising threat of extreme weather events. The company is implementing robust disaster recovery and business continuity plans to safeguard operations against potential disruptions from floods and landslides, which have seen an increase in frequency in regions like Malaysia.

| Environmental Factor | Genting Berhad's Response/Data | Key Metrics/Targets |

|---|---|---|

| Climate Change & Emissions | Implementing energy efficiency upgrades, pursuing carbon neutrality by 2030 for specific segments. | 15.4% reduction in Scope 1 & 2 GHG emissions intensity (vs. 2019 baseline) reported in 2023. Aiming for 30% renewable energy sourcing by 2025. |

| Extreme Weather Events | Developing disaster recovery and business continuity plans. Investing in infrastructure resilience. | Capital expenditure in 2024 included provisions for weather resilience upgrades. Increased frequency of heavy rainfall events noted in Malaysia. |

| Sustainable Resource Management | Prioritizing reduced energy and water consumption, comprehensive waste management (composting, oil recycling). | Waste management initiatives at Resorts World Genting. |

| Biodiversity & Land Use | Implementing 'no deforestation, no peat, no exploitation' policies. Collaborating with conservation groups. | Focus on managing High Carbon Stock and High Conservation Value areas. |

PESTLE Analysis Data Sources

Our Genting Berhad PESTLE Analysis is meticulously constructed using data from official government publications, reputable financial news outlets, and leading industry analysis firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the company.