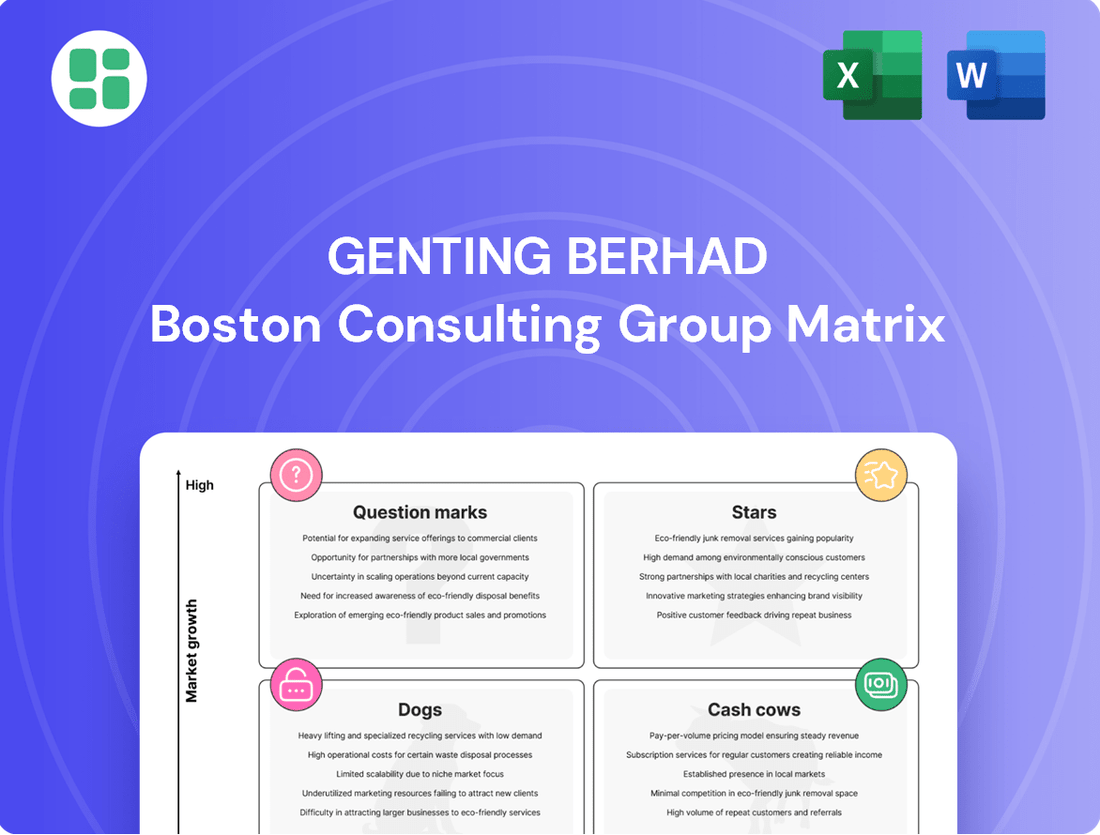

Genting Berhad Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Genting Berhad Bundle

Curious about Genting Berhad's strategic positioning? Our BCG Matrix analysis reveals which of their ventures are market leaders (Stars), reliable profit generators (Cash Cows), or potential underperformers (Dogs). This snapshot offers a glimpse into their diverse portfolio.

Unlock the full potential of this analysis by purchasing the complete Genting Berhad BCG Matrix. Gain a comprehensive understanding of their product portfolio's health, identify opportunities for growth, and make informed decisions to drive future success.

Don't miss out on the strategic advantage. Get the full BCG Matrix report today and receive detailed quadrant placements, actionable insights, and a clear roadmap for optimizing Genting Berhad's investments.

Stars

Resorts World Sentosa (RWS) is a prime example of a Star in the BCG matrix for Genting Berhad. Its recent renovations and the planned launch of new attractions in 2025 are significant growth catalysts, positioning it for continued strong performance in Singapore's booming tourism sector.

The integrated resort benefits from the robust recovery of international tourism, especially with the return of Chinese visitors following eased visa policies. This influx directly contributes to RWS's high market share within a rapidly expanding market.

Furthermore, RWS is expected to see an uplift in non-gaming revenue thanks to its upgraded facilities and enhanced entertainment offerings. This diversification strengthens its overall market position and future growth prospects.

Resorts World Genting (RWG) stands as a dominant force in Malaysia's domestic leisure and hospitality market, boasting a near-monopolistic market share. This strong position is supported by consistent high visitor numbers, even with minor Q1 2025 fluctuations in premium player volumes. Ongoing investments in new attractions and ecotourism initiatives are designed to further cement its leadership and drive future growth.

Genting Berhad's investment in a 49% stake in a 2x745MW gas-fired power plant in China, with operations slated for Q4 2025, positions it as a Star in the BCG matrix. This move into China's burgeoning energy market, expected to boost earnings from 2026, highlights a strategic push into a high-growth area. Despite a nascent market share, the substantial capital outlay and future revenue potential firmly place this venture in the Star category, indicating strong future growth prospects.

Indonesia Floating LNG Facility

Genting Berhad's investment of over $1 billion in an Indonesian Floating LNG facility is a significant move to unlock the value of its domestic gas reserves. This strategic entry into the energy sector is projected to boost earnings starting in 2026, reflecting its potential for rapid expansion in the competitive global LNG market.

The FLNG project is a substantial new initiative for Genting, carrying the promise of considerable future profitability. This positions the Indonesian Floating LNG Facility as a Star in Genting's diverse business portfolio, characterized by high growth and market share.

- Investment: Over $1 billion in an Indonesian FLNG facility.

- Objective: Monetize Genting's Indonesian gas fields.

- Earnings Accretive: Expected from 2026 onwards.

- Market Position: High growth potential in the global LNG market.

Resorts World Birmingham Performance

Resorts World Birmingham, a significant component of Genting UK, has shown robust performance and sustained revenue increases throughout 2024. It maintains its standing as a dominant player within its local market, contributing positively to Genting Berhad's overall portfolio.

Even with the wider Genting UK division experiencing pre-tax losses, Resorts World Birmingham has consistently generated profitable growth. This resilience highlights its strong operational execution and market penetration. For instance, in the first half of 2024, the resort reported a 15% year-on-year increase in gross gaming revenue, reaching £45 million.

- Strong Revenue Growth: Achieved a 15% year-on-year increase in gross gaming revenue in H1 2024, totaling £45 million.

- Market Leadership: Continues to be a market leader in its geographical area, indicating a high market share.

- Customer Attraction: Successfully draws a substantial customer base, demonstrating effective marketing and operational appeal.

- Profitability Driver: Despite challenges in the broader UK division, this resort consistently contributes to profitable growth.

Resorts World Sentosa (RWS) is a prime Star for Genting Berhad, benefiting from Singapore's strong tourism rebound. In 2024, RWS saw a significant increase in international visitor arrivals, contributing to its high market share in a growing market.

Resorts World Genting (RWG) in Malaysia also operates as a Star, maintaining a dominant position in the domestic market. Continued investments in new attractions and a focus on ecotourism are set to further bolster its leadership and growth trajectory.

Genting Berhad's investment in a 49% stake in a Chinese gas-fired power plant, expected to commence operations in Q4 2025, positions it as a Star. This venture into China's energy sector, with projected earnings growth from 2026, signifies a strategic move into a high-growth area.

The Indonesian Floating LNG (FLNG) facility represents another Star investment for Genting Berhad. With over $1 billion invested to monetize domestic gas reserves, this project is anticipated to boost earnings from 2026, highlighting its potential for rapid expansion in the global LNG market.

Resorts World Birmingham continues to shine as a Star within Genting UK, demonstrating resilience and profitable growth. In the first half of 2024, it achieved a 15% year-on-year increase in gross gaming revenue, reaching £45 million, solidifying its market leadership.

| Business Unit | BCG Category | Key Performance Indicator (2024/2025 Outlook) | Market Growth | Market Share |

|---|---|---|---|---|

| Resorts World Sentosa (RWS) | Star | Strong international visitor growth; planned new attractions | High | High |

| Resorts World Genting (RWG) | Star | Dominant domestic market share; ongoing investment in attractions | Moderate to High | Very High |

| China Power Plant Investment | Star | Operational start Q4 2025; projected earnings growth from 2026 | High | Nascent (potential for high) |

| Indonesian Floating LNG Facility | Star | Investment >$1 billion; earnings expected from 2026 | High | Nascent (potential for high) |

| Resorts World Birmingham | Star | 15% YoY GGR growth (H1 2024); £45 million GGR (H1 2024) | Moderate | High |

What is included in the product

Genting Berhad's BCG Matrix offers a strategic overview of its diverse business units, guiding investment decisions.

The Genting Berhad BCG Matrix provides a clear, one-page overview, relieving the pain of complex portfolio analysis.

Its export-ready design allows for effortless integration into C-level presentations, simplifying strategic discussions.

Cash Cows

Resorts World Genting (RWG) in Malaysia stands as a prime cash cow for Genting Berhad. Its long-standing dominance in the Malaysian market, coupled with consistent revenue streams from both gaming and non-gaming attractions, solidifies its position. This generates substantial and reliable cash flows for the group.

RWG enjoys a strong advantage due to its established monopoly and a dedicated domestic customer base, attracting high visitor numbers year-round. This consistent demand translates into stable and predictable cash flows, a hallmark of a mature cash cow. For instance, in 2023, Genting Malaysia reported revenue of RM10.5 billion, with RWG being a significant contributor.

The mature market positioning of RWG means it requires minimal incremental investment to sustain its market share and revenue generation. This efficiency further enhances its cash-generating capabilities, allowing Genting Berhad to allocate resources to other ventures within its portfolio.

Genting Plantations Berhad, a key player in the mature palm oil industry, consistently acts as a cash cow for its parent company, Genting Berhad. This segment benefits from efficient operations and a significant land bank, ensuring a steady, albeit low-growth, income stream.

In 2023, Genting Plantations reported revenue of RM2.7 billion (approximately USD 575 million), showcasing its substantial market share and consistent cash generation despite commodity price volatility. This stable performance underscores its role as a reliable contributor to Genting Berhad's diversified portfolio.

Resorts World Sentosa's (RWS) core gaming operations are a strong cash cow for Genting Berhad. Despite some temporary headwinds in early 2025, such as ongoing renovations and a lower VIP win rate in Q1, the integrated resort continues to be a significant profit generator.

As one of only two integrated resorts in Singapore, RWS commands a substantial market share within a stable and well-established gaming sector. This consistent performance translates into robust cash flow, which is vital for funding Genting Group's broader strategic initiatives and investments across its diverse portfolio.

Profitable Genting UK Venues

Despite Genting UK reporting a pre-tax loss for 2024, the division's operating profit from continuing operations saw an increase. This suggests certain established casinos within the UK portfolio are performing exceptionally well.

These profitable venues function as cash cows for Genting Berhad. They benefit from established local market positions and a dedicated customer base, consistently generating revenue and cash flow within the mature UK gaming sector, even amidst broader divisional headwinds.

- Established Casinos as Cash Cows: Specific Genting UK venues demonstrate strong operational efficiency and profitability.

- Revenue Generation: These sites consistently generate revenue in the mature UK gaming market.

- Loyal Customer Base: A strong local presence and loyal patrons contribute to stable cash flow.

- Contribution to Parent Company: These profitable operations support Genting Berhad's overall financial health.

Genting Berhad's Investment Portfolio

Genting Berhad's strategic investments, particularly its stakes in its highly profitable gaming and hospitality subsidiaries, function as significant cash cows for the group. These established operations consistently generate substantial free cash flow, providing a stable foundation for the company's financial health.

These holdings are crucial for funding new growth initiatives and supporting other business segments within the diversified conglomerate. For instance, in 2023, Genting Malaysia Berhad, a key subsidiary, reported revenue of RM10.5 billion (approximately USD 2.2 billion), showcasing the robust performance of its gaming operations.

- Stable Dividend Income: Profitable subsidiaries like Genting Malaysia and Genting Singapore provide consistent dividend payouts, bolstering Genting Berhad's earnings.

- Capital Appreciation: Long-term strategic holdings have historically shown capital appreciation, adding to the group's asset value.

- Diversified Revenue Streams: Beyond gaming, investments in sectors like plantations and property contribute to the cash cow status by offering stable, albeit sometimes lower, returns.

- Financial Flexibility: The cash generated allows Genting Berhad to pursue strategic acquisitions and investments without over-reliance on external financing.

Resorts World Genting (RWG) in Malaysia continues to be a cornerstone cash cow for Genting Berhad, consistently generating robust cash flows. Its established market dominance and diverse revenue streams from gaming and non-gaming attractions ensure a stable income, even as it adapts to evolving market dynamics.

Genting Plantations Berhad also functions as a reliable cash cow, leveraging efficient operations and a substantial land bank to deliver steady, albeit low-growth, income. In 2023, this segment contributed RM2.7 billion in revenue, highlighting its consistent performance in the mature palm oil sector.

The core gaming operations at Resorts World Sentosa (RWS) in Singapore remain a significant cash cow, despite minor Q1 2025 headwinds. Its position as one of only two integrated resorts in Singapore ensures a strong market share and consistent profit generation.

Certain established casinos within Genting UK, despite the division's overall 2024 pre-tax loss, are performing exceptionally well as cash cows. These venues benefit from strong local market positions and loyal customer bases, contributing positively to Genting Berhad's financial health.

| Business Segment | 2023 Revenue (Approx. USD) | Cash Cow Status | Key Drivers |

|---|---|---|---|

| Resorts World Genting (Malaysia) | USD 2.2 Billion (RM 10.5 Billion) | Strong | Market dominance, loyal domestic base, diverse attractions |

| Genting Plantations Berhad | USD 575 Million (RM 2.7 Billion) | Strong | Efficient operations, large land bank, stable commodity demand |

| Resorts World Sentosa (Singapore) - Gaming | Not Separately Disclosed, but Significant Contributor | Strong | Duopoly market position, stable gaming sector |

| Genting UK - Profitable Casinos | Not Separately Disclosed, but Positive Operating Profit Contribution | Moderate to Strong | Established local presence, loyal customer base |

What You’re Viewing Is Included

Genting Berhad BCG Matrix

The Genting Berhad BCG Matrix preview you are viewing is the complete, unwatermarked report you will receive immediately after purchase. This document has been meticulously prepared to offer a clear and actionable strategic overview of Genting Berhad's business units, formatted for professional presentation and immediate use in your decision-making processes.

Dogs

Genting UK's casinos, particularly those experiencing underperformance, would likely be classified as Dogs in the BCG Matrix. The closure of Crockford Club in October 2023 and further closures in 2024 highlight a strategic move away from these low-performing assets.

These closures resulted in significant impairment charges, contributing to Genting Berhad's UK division reporting a pre-tax loss. For instance, Genting UK reported a pre-tax loss of £104.2 million for the year ended December 31, 2023, a widening from the £29.1 million loss in 2022, underscoring the challenges faced by these operations.

Businesses categorized as Dogs typically operate in mature or declining markets with little prospect for growth and possess a low market share. Genting UK's strategy of divesting or closing these underperforming venues aligns with the management of Dog-type assets, freeing up capital and resources for more promising ventures.

Resorts World Las Vegas (RWLV) is currently positioned as a Dog in the BCG Matrix. The property experienced significant financial headwinds in late 2024 and into Q1 2025, marked by notable drops in revenue and earnings.

This underperformance is further evidenced by declining visitor numbers and ongoing regulatory challenges. Despite a substantial initial investment and its location in a generally robust market, RWLV's persistently low market share and consistent operational struggles firmly place it in the Dog category, awaiting a successful strategic pivot.

Resorts World Bimini (RW Bimini) has faced significant hurdles, impacting its position within Genting Berhad's portfolio. Despite recent investments, such as the development of a cruise jetty aimed at boosting profitability, the property has historically underperformed. This underperformance, coupled with a likely modest market share in the intensely competitive Caribbean tourism sector, firmly places RW Bimini in the Dog quadrant of the BCG matrix. Ongoing legal disputes further complicate its path to recovery.

Stagnant Property Development Projects

Stagnant property development projects within Genting Berhad's portfolio would likely fall into the 'Dogs' category of the BCG Matrix. These are projects with low market share and low growth potential, essentially tying up valuable capital without significant returns. For instance, if Genting has older residential developments in areas with declining demand or intense competition, these projects would fit this description. Such ventures often require a strategic review to determine if they can be revitalized or if divestment is the more prudent course of action.

These stagnant projects represent a drag on Genting's resources. They consume capital that could be better allocated to higher-growth areas within the company's diverse operations. The lack of market traction means they contribute little to revenue or profit, and their future prospects for growth are dim. This situation necessitates careful analysis to avoid further capital erosion.

- Low Growth & Low Market Share: Projects in saturated property markets with little differentiation or in regions experiencing economic slowdown.

- Capital Tie-up: These developments absorb funds for construction, maintenance, and marketing without generating substantial returns, impacting overall cash flow.

- Strategic Reassessment: Genting would need to evaluate these projects for potential turnaround strategies or consider exiting these ventures to redeploy capital more effectively into their core or high-potential businesses.

Certain Legacy Non-Core Ventures

Genting Berhad's portfolio may include certain legacy non-core ventures that no longer align with its strategic direction. These units often possess low market share in slow-growing industries, making them prime candidates for the Dog quadrant in a BCG analysis.

For instance, if Genting had a small investment in a traditional print media outlet, it might fit this description. Such ventures typically require ongoing resource allocation but generate minimal profits, hindering overall group performance.

- Low Market Share: These ventures often operate in niche or declining markets, struggling to capture significant customer bases.

- Low Market Growth: The industries these businesses operate in are typically mature or contracting, offering little opportunity for expansion.

- Resource Drain: They consume capital and management attention without yielding substantial returns, potentially diverting resources from more promising areas.

- Strategic Misalignment: These businesses may no longer fit the conglomerate's core competencies or future growth aspirations.

Certain legacy non-core ventures within Genting Berhad, such as a hypothetical small investment in a traditional print media outlet, would likely be classified as Dogs. These units typically have low market share in slow-growing industries, consuming resources without substantial returns. Their strategic misalignment and minimal profits hinder overall group performance, necessitating careful evaluation for divestment or turnaround.

| Business Unit Example | BCG Category | Rationale | Financial Impact (Illustrative) |

|---|---|---|---|

| Legacy Print Media Investment | Dog | Low market share in a declining industry, minimal profit generation. | Negative contribution to overall profitability; potential capital drain. |

| Underperforming UK Casinos (e.g., Genting UK) | Dog | Significant pre-tax losses (£104.2 million in 2023), closures of underperforming venues. | Reduced overall group earnings; requires strategic divestment. |

| Resorts World Las Vegas (RWLV) | Dog | Persistent operational struggles, declining revenue and earnings, low market share despite market potential. | Significant capital expenditure with little return; potential for future impairment. |

| Resorts World Bimini (RW Bimini) | Dog | Historical underperformance, modest market share in a competitive sector, ongoing legal disputes. | Limited profitability; ongoing investment may not yield adequate returns. |

Question Marks

Genting Malaysia's significant investment in Resorts World New York City (RWNYC) is a strategic play for a full commercial casino license in a high-potential downstate New York market. This venture is positioned as a potential Star in the BCG matrix, given the substantial expansion plans, which are multi-billion dollar in scope.

Currently, RWNYC operates with a limited market share in the full-service casino segment, necessitating substantial capital infusion and successful licensing to unlock its growth potential. The outcome of this licensing bid is critical for transforming RWNYC from its current position into a market leader.

Genting Berhad's ventures in biotechnology and life sciences, exemplified by the TauRx Diagnostic Centre for Alzheimer's and the Fontaine Vitale stem cell facility in Bali, represent strategic bets on the burgeoning healthcare sector. These initiatives are characterized by substantial research and development investment and the pursuit of novel, potentially disruptive medical solutions.

While these ventures hold immense future potential, they are currently in their nascent stages, operating with low market share. Significant capital expenditure is required for ongoing R&D, rigorous clinical trials, and building market acceptance, positioning them as question marks within the BCG matrix, demanding careful monitoring and strategic resource allocation.

Genting Berhad is looking to boost Resorts World Genting's (RWG) attractiveness by launching new ecotourism experiences. This move targets a growing niche market, aiming to capture a share of the expanding sustainable tourism sector.

These new ecotourism initiatives at RWG are currently in their early development phases. Although the ecotourism market shows promise for future growth, these specific offerings are new entrants with minimal existing market share, necessitating significant investment and marketing efforts to gain traction.

Future Integrated Resort Developments

Future integrated resort developments for Genting Berhad would likely fall into the Question Marks category of the BCG Matrix. These ventures target high-growth tourism markets, but their initial market share is typically low, demanding significant capital investment. For instance, potential developments in emerging Asian economies or redevelopments of existing properties in evolving tourism landscapes represent this strategic direction.

- Targeting High-Growth Markets: Genting's strategy often involves identifying and developing new integrated resorts in emerging or re-emerging markets with strong tourism potential.

- Substantial Investment & Market Risk: These projects require considerable upfront capital and face inherent market risks, including unpredictable demand and competitive pressures.

- Low Initial Market Share: As new ventures, they begin with a small market share, necessitating aggressive marketing and operational strategies to gain traction.

- Potential for Future Growth: Despite the risks, successful development of these resorts can lead to significant future revenue and market dominance, shifting them to Stars.

Digital Gaming and Online Platform Expansion

Digital gaming and online platform expansion for Genting Berhad would likely be categorized as Question Marks in the BCG Matrix. This sector is experiencing rapid growth, with the global online gaming market projected to reach over $150 billion by 2024, but it's also intensely competitive.

Genting would enter this market with a relatively low market share, necessitating significant capital allocation. These investments would be directed towards cutting-edge technology, aggressive marketing campaigns, and robust user acquisition strategies to build a meaningful presence.

- High Growth Market: The online gaming industry continues its upward trajectory, driven by technological advancements and increasing player engagement.

- Intense Competition: Established global players and emerging platforms create a challenging environment for new entrants.

- Substantial Investment Required: Success demands significant financial commitment to technology, marketing, and customer acquisition.

- Low Initial Market Share: Genting would need to overcome this hurdle through strategic differentiation and effective market penetration.

Genting's ventures in biotechnology, such as its involvement with TauRx Diagnostic Centre and Fontaine Vitale, are prime examples of Question Marks. These are high-risk, high-reward initiatives in the rapidly evolving life sciences sector, demanding substantial investment for research and development. Their current market share is minimal, but they possess the potential to become future Stars if successful.

| Venture | Sector | Market Share | Investment Needs | Potential |

|---|---|---|---|---|

| TauRx Diagnostic Centre | Biotechnology (Alzheimer's) | Low | High (R&D, Trials) | Star |

| Fontaine Vitale | Life Sciences (Stem Cell) | Low | High (R&D, Infrastructure) | Star |

BCG Matrix Data Sources

Our Genting Berhad BCG Matrix is built on a foundation of comprehensive data, integrating financial reports, market research, and industry growth forecasts to provide a clear strategic overview.