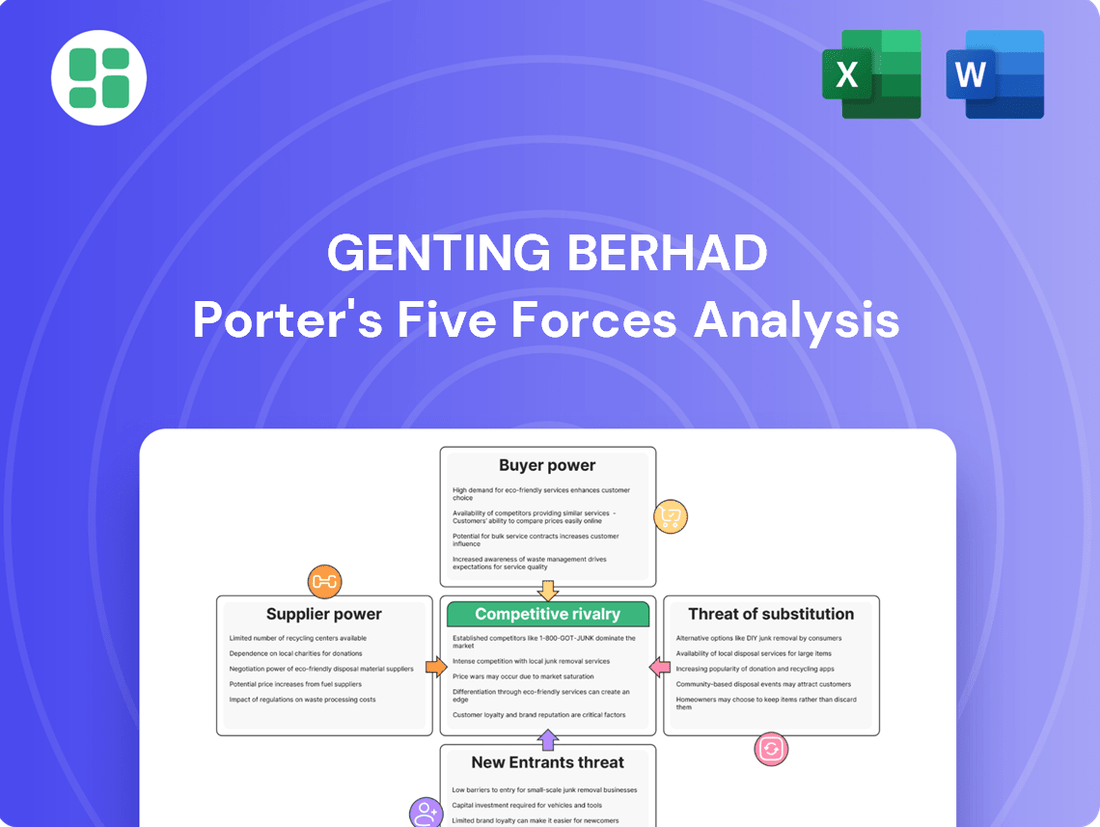

Genting Berhad Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Genting Berhad Bundle

Genting Berhad operates in highly competitive sectors, facing intense rivalry from established players and emerging disruptors. Understanding the bargaining power of its buyers and suppliers is crucial for its profitability.

The threat of substitute products and the potential for new entrants to challenge its market share significantly shape Genting Berhad's strategic landscape. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Genting Berhad’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Genting Berhad's reliance on specialized gaming equipment providers presents a significant factor in its supplier bargaining power. These manufacturers often possess unique, proprietary technology essential for modern casino operations, limiting the pool of viable alternatives.

The competitive landscape for cutting-edge gaming machines and integrated systems is frequently characterized by a few dominant players, granting them considerable leverage. For instance, companies specializing in advanced slot machine software or sophisticated surveillance systems may command higher prices due to their technological edge and limited competition.

The substantial costs and technical complexities associated with switching core gaming hardware or software vendors create a strong incentive for Genting Berhad to maintain existing relationships, further empowering these specialized suppliers.

Genting Berhad relies on major construction and infrastructure contractors for its ambitious integrated resorts, hotels, and theme parks. The bargaining power of these suppliers can be substantial, especially when projects demand highly specialized skills or when the pool of qualified contractors in a specific region is small. This can directly impact Genting's project schedules and overall expenditure.

Energy and utility providers hold moderate bargaining power over Genting Berhad. While Genting has its own power generation capabilities, it still relies on external suppliers for certain energy needs and specific utility services across its diverse operations. This dependence, especially in regions with limited energy providers or strong regulatory control, allows these suppliers to exert some influence.

High-Caliber Talent and Entertainment

Genting Berhad, operating in the competitive leisure and hospitality sector, faces significant bargaining power from high-caliber talent and entertainment providers. The demand for unique skills and established reputations in the global entertainment industry allows these individuals and their representatives to command premium compensation and favorable contract terms. This can directly impact Genting's operational costs and profitability.

The ability to attract and retain top-tier performers, celebrity chefs, and highly skilled hospitality staff is paramount for delivering a superior customer experience. However, these sought-after professionals often have multiple opportunities, increasing their leverage. For instance, in 2024, the average salary for a Michelin-starred chef in major global entertainment hubs saw an increase of approximately 8-12% year-over-year, reflecting this talent scarcity and bargaining power.

- Talent Scarcity: Specialized skills in entertainment and hospitality are in high demand, limiting the pool of qualified candidates.

- Reputation and Brand Value: Celebrities and renowned chefs lend significant brand appeal, increasing their negotiating strength.

- Industry Standards: Global entertainment industry benchmarks for talent compensation and working conditions set a high bar for negotiation.

- Agency Representation: Professional agents and management firms can collectively bargain for better terms on behalf of their clients.

Land and Raw Material Owners/Producers

For Genting Berhad's property development and oil palm ventures, the bargaining power of land and raw material owners is a significant factor. Access to prime land for development, particularly in high-demand urban or tourism-centric areas, allows landowners to command premium prices. Similarly, producers of specialized raw materials, such as high-grade timber for construction or specific biotechnological inputs for plantations, can leverage their unique offerings to influence costs and supply availability.

In 2024, the global demand for prime real estate, especially in Asia Pacific where Genting Berhad has substantial operations, continued to drive up land acquisition costs. For instance, land prices in key Malaysian cities saw an average increase of 5-8% year-on-year, directly impacting development budgets. For its oil palm plantations, the cost of fertilizers and specialized seeds, crucial for yield optimization, also saw fluctuations. In early 2024, the price of key fertilizers increased by approximately 10% due to supply chain disruptions and increased global agricultural demand, affecting plantation operational expenses.

- Landowners in strategic locations can significantly influence property development costs for Genting Berhad.

- Producers of specialized raw materials for construction or biotechnology hold sway over acquisition expenses and supply chain reliability.

- In 2024, land prices in key Asian Pacific markets saw an average increase of 5-8%, impacting Genting Berhad's development outlays.

- The cost of essential agricultural inputs like fertilizers rose by around 10% in early 2024, affecting Genting Berhad's plantation operational costs.

Genting Berhad faces significant bargaining power from specialized gaming equipment suppliers due to proprietary technology and limited competition, which can drive up costs for essential hardware and software. Similarly, the company's reliance on major construction firms for its large-scale integrated resorts means these contractors can leverage their specialized skills and regional scarcity to influence project timelines and budgets. Furthermore, the high demand for top-tier entertainment talent and hospitality professionals, evidenced by an estimated 8-12% salary increase for Michelin-starred chefs in 2024, grants these individuals considerable leverage, impacting Genting's operational expenses.

| Supplier Category | Factors Influencing Bargaining Power | Impact on Genting Berhad | 2024 Data Point |

|---|---|---|---|

| Gaming Equipment Providers | Proprietary technology, limited competition | Higher equipment costs, potential supply constraints | N/A (specific data not publicly available for 2024) |

| Construction & Infrastructure | Specialized skills, regional contractor availability | Project cost escalation, schedule delays | N/A (specific data not publicly available for 2024) |

| Entertainment Talent | Talent scarcity, reputation, industry standards | Increased talent acquisition and retention costs | 8-12% salary increase for Michelin-starred chefs |

What is included in the product

Tailored exclusively for Genting Berhad, this analysis dissects the intensity of rivalry, bargaining power of buyers and suppliers, threat of new entrants, and the impact of substitutes on its diverse leisure and hospitality operations.

Effortlessly identify and address the core competitive pressures impacting Genting Berhad's profitability with a focused analysis of each Porter's Five Forces component.

Customers Bargaining Power

Individual leisure and gaming customers, from casual visitors to serious gamblers, wield considerable bargaining power. This is largely because the global market offers a vast array of competing entertainment and travel destinations. For instance, in 2024, the global tourism market is projected to continue its robust recovery, offering consumers more choices than ever before.

Customers can readily shift their spending to rival resorts, online gaming sites, or entirely different leisure pursuits. This ease of switching means that price competitiveness and the overall customer experience are paramount for businesses like Genting Berhad. A 2023 report indicated that customer loyalty in the hospitality sector is increasingly tied to personalized offers and value for money, underscoring this point.

Corporate and group event organizers wield considerable bargaining power with Genting Berhad due to the substantial revenue these bookings represent. Their ability to commit to large-scale events, conferences, and group stays allows them to negotiate preferential pricing, customized packages, and exclusive services. This directly impacts Genting's revenue streams and profit margins within its hospitality and entertainment divisions.

For instance, in 2024, major conventions and corporate retreats booked at Genting's integrated resorts can involve thousands of attendees, translating into significant spending on accommodation, dining, and entertainment. This volume empowers organizers to demand competitive rates, potentially influencing Genting's pricing strategies and service offerings to secure these high-value contracts.

The proliferation of online travel agencies (OTAs) and booking platforms significantly amplifies customer bargaining power within the hospitality sector. These digital marketplaces enhance price transparency, allowing consumers to effortlessly compare rates across numerous providers, including Genting Berhad's properties. This ease of comparison puts direct pressure on room pricing and necessitates competitive strategies to attract and retain guests.

While OTAs offer valuable market reach, they also introduce a layer of intermediation that impacts Genting's pricing autonomy. Commission fees charged by these platforms can erode profit margins, and the constant visibility of competitor pricing online compels Genting to remain highly competitive. For instance, in 2024, the average commission rate for major OTAs remained a significant consideration for hotel operators globally, impacting net revenue per available room.

Diversified Customer Base Across Segments

Genting Berhad's diverse operations, spanning gaming, hospitality, power generation, and plantations, create a varied customer base. This diversification means that the bargaining power of customers isn't uniform across all its business segments. For instance, individual tourists in its resort operations might have relatively low individual bargaining power, but collectively, they can influence pricing and service standards.

Conversely, in its power generation segment, which operates under long-term power purchase agreements, the influence of its corporate or government utility customers is often dictated by the terms of these contracts and the concentration of the energy market. As of 2024, Genting Malaysia, a key subsidiary, reported revenue from its integrated resorts, highlighting the significant customer volume in its leisure and gaming operations, where customer loyalty programs and competitive offerings play a role in managing customer power.

- Varied Customer Influence: Individual consumers in leisure segments have less power than large B2B clients in specialized sectors.

- Contractual Power: In segments like power, customer bargaining power is often defined by existing long-term contracts.

- Market Concentration Impact: The number of alternative suppliers or buyers in a specific market segment significantly shapes customer leverage.

- Segment-Specific Strategies: Genting employs different strategies to manage customer power across its diverse business portfolio.

Demand Elasticity for Discretionary Spending

Genting Berhad's revenue is heavily reliant on discretionary spending, particularly in sectors like gaming, hospitality, and entertainment. This inherent characteristic means customers possess considerable bargaining power, especially when economic conditions tighten. During periods of reduced disposable income, consumers become more price-sensitive, actively seeking out better value or opting for less expensive leisure activities, thereby amplifying customer leverage over Genting.

The demand elasticity for Genting's offerings is a critical factor. For instance, in 2024, global consumer spending on leisure and entertainment faced headwinds due to persistent inflation and higher interest rates. This environment typically leads consumers to scrutinize non-essential expenditures more closely. Genting's ability to maintain pricing power is directly challenged when customers can easily substitute its premium experiences for more affordable alternatives.

- High Sensitivity to Economic Cycles: Genting's customer base is significantly exposed to fluctuations in disposable income, making demand for its services elastic.

- Availability of Substitutes: Consumers have a wide array of entertainment and leisure options, allowing them to switch away from Genting's offerings if prices increase or value perception declines.

- Price Sensitivity in Downturns: During economic slowdowns, customers prioritize value, increasing their bargaining power by demanding lower prices or enhanced benefits.

The bargaining power of customers for Genting Berhad is substantial, driven by the wide availability of alternative leisure and gaming options globally. This means customers can easily switch providers, forcing Genting to remain competitive on price and experience. For instance, in 2024, the global tourism market continued its strong recovery, presenting consumers with an unprecedented number of choices.

Corporate clients and group organizers hold significant sway due to the large revenue they generate, enabling them to negotiate favorable terms. These large-scale bookings, such as major conventions in 2024 involving thousands of attendees at Genting's resorts, grant organizers considerable leverage in demanding competitive rates and customized packages.

The digital landscape, with numerous online travel agencies and booking platforms, further enhances customer power by increasing price transparency and facilitating easy comparisons. While these platforms offer reach, they also mean Genting must contend with commission fees and constant online price visibility, a factor in 2024 where average OTA commissions remained a key consideration for global hotel operators.

| Customer Segment | Bargaining Power Drivers | Impact on Genting Berhad | 2024 Context/Data Example |

|---|---|---|---|

| Individual Leisure/Gaming Customers | Abundance of global alternatives, ease of switching | Pressure on pricing, need for superior customer experience | Robust global tourism recovery increased consumer choice. |

| Corporate/Group Event Organizers | Large booking volumes, potential for high revenue | Ability to negotiate preferential pricing and packages | Conventions with thousands of attendees translate to significant revenue potential for negotiation. |

| Online Travel Agencies (OTAs) Users | Enhanced price transparency, easy comparison | Reduced pricing autonomy, pressure to remain competitive | Average OTA commissions in 2024 impacted net revenue per available room for operators. |

Preview the Actual Deliverable

Genting Berhad Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details Genting Berhad's competitive landscape through Porter's Five Forces, analyzing the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products. This comprehensive analysis provides actionable insights into the strategic positioning and future outlook of Genting Berhad within the global leisure and hospitality industry.

Rivalry Among Competitors

Genting Berhad operates in a highly competitive landscape, facing significant rivalry from established global integrated resort operators like Las Vegas Sands, Marina Bay Sands, and Wynn Resorts. These competitors vie for the same affluent customer base, particularly high-value tourists and gamblers, across key international markets.

The intensity of this rivalry is amplified by the considerable fixed costs associated with developing and maintaining integrated resorts. For instance, the construction of a single luxury resort can easily run into billions of dollars, creating a high barrier to entry but also necessitating aggressive strategies to capture market share and achieve profitability.

Genting Berhad faces significant competitive rivalry from numerous regional casino and entertainment venues across its operating regions. In Malaysia, for instance, Genting Highlands competes with other integrated resorts and smaller gaming establishments. Similarly, in Singapore, Marina Bay Sands and Resorts World Sentosa are direct competitors, alongside potential new entrants or expansions from existing players.

These local competitors often leverage their understanding of regional preferences and can offer more customized experiences or aggressive pricing strategies. For example, while Genting Malaysia's revenue was RM2.4 billion in 2023, smaller, localized operators might focus on specific demographics with tailored promotions, intensifying the battle for market share.

The intensity of this rivalry is further amplified by the fact that many regional venues are not solely reliant on gaming revenue. They often integrate hotels, dining, retail, and MICE (Meetings, Incentives, Conferences, and Exhibitions) facilities, creating a holistic entertainment offering. This broad appeal means Genting must constantly innovate and differentiate its services to maintain its competitive edge against a diverse set of players in each market.

The competitive rivalry in the online gaming and digital entertainment sector is intense, posing a substantial indirect threat to Genting Berhad's traditional casino operations. The sheer volume of online gaming platforms, sports betting sites, and diverse digital entertainment options available means consumers have numerous alternatives for leisure spending.

These digital substitutes offer unparalleled convenience and accessibility, allowing users to engage from anywhere at any time. This ease of access can directly divert customers who might otherwise choose to visit physical casinos and resorts, impacting foot traffic and revenue. For instance, the global online gambling market was valued at approximately USD 64.5 billion in 2023 and is projected to grow significantly, highlighting the scale of this competitive landscape.

Diversification Across Non-Gaming Sectors

Genting Berhad's competitive rivalry isn't confined to its prominent leisure and hospitality operations. The company's diversification into sectors like power generation and oil palm plantations means it contends with distinct sets of competitors in each arena. For instance, in power generation, Genting competes with established utility providers, facing pressures on pricing and operational efficiency.

Similarly, its oil palm plantation business operates within a competitive agricultural landscape, where it rivals other large-scale agribusinesses. This broad diversification introduces varied competitive dynamics, requiring Genting to navigate different market structures and strategic challenges across its portfolio.

For example, Genting Power's projects in the UK, such as the Point of Ayr facility, operate within a deregulated energy market where competition from other independent power producers and national grid operators is a constant factor. In 2024, the UK's energy market continued to see significant investment in renewable sources, intensifying competition for all players, including Genting.

In its plantation segment, the global palm oil market, while dominated by a few large players, also features numerous smaller producers. Genting Plantations, as of its latest reporting, manages a substantial land bank, but its profitability is directly influenced by global commodity prices and the production efficiencies of its peers.

- Diversified Competition: Genting's rivalry spans leisure, power generation, and plantations, each with unique competitive landscapes.

- Power Sector Dynamics: In power generation, Genting competes with other utility providers in markets like the UK, facing pricing and efficiency pressures.

- Agribusiness Rivalry: The oil palm plantation segment contends with other large agricultural companies, influenced by global commodity prices and operational efficiency.

- Market Presence: Genting's diversified operations mean it must manage competitive pressures across multiple, distinct industry sectors.

Marketing, Innovation, and Customer Experience Focus

The leisure and hospitality sector, where Genting Berhad operates, is characterized by intense competition driven by a relentless focus on marketing, innovation, and customer experience. Companies constantly vie for consumer attention and loyalty by introducing novel attractions, integrating cutting-edge technology, and developing robust loyalty programs. This dynamic environment necessitates significant investments in marketing campaigns and product development, directly impacting operational costs and profitability.

Competitors are not shy about spending to stand out. For instance, in 2024, major integrated resort developers continued to allocate substantial budgets towards marketing and experiential upgrades. This includes everything from enhanced digital engagement platforms to the development of new themed zones and entertainment offerings. The goal is to create a unique value proposition that draws and retains customers in a crowded marketplace.

- Marketing Spend: Leading casino and resort operators often dedicate 5-10% of their revenue to marketing and advertising, a figure that can surge during new property launches or major promotional events in 2024.

- Innovation Investment: Significant capital is channeled into research and development for new gaming technologies, immersive entertainment experiences, and personalized customer service solutions.

- Customer Experience: Investments in staff training, service quality enhancements, and loyalty program benefits are crucial differentiators, aiming to foster repeat business and positive word-of-mouth.

- Competitive Response: Any innovation or successful marketing campaign by one player often triggers a swift, similar response from rivals, escalating the overall intensity of rivalry.

Genting Berhad faces intense rivalry from global integrated resort operators like Las Vegas Sands and Wynn Resorts, all competing for high-value customers. This competition is fueled by the massive fixed costs of resort development, with new properties costing billions, pushing operators to aggressively seek market share.

Regional competitors, often with a better grasp of local preferences, employ tailored promotions and pricing. For example, while Genting Malaysia reported RM2.4 billion in revenue for 2023, smaller players can chip away at market share with localized strategies.

The intensity of rivalry in leisure is driven by continuous investment in marketing and innovation, with major players in 2024 allocating substantial budgets to new attractions and digital platforms to differentiate themselves.

This competitive pressure extends to Genting's other sectors, like power generation, where it contends with utility providers in deregulated markets such as the UK, and its oil palm plantations, which face competition from other agribusinesses influenced by global commodity prices.

| Competitor Type | Key Focus Areas | Example Competitors | Impact on Genting |

|---|---|---|---|

| Global Integrated Resorts | High-roller market, luxury amenities, entertainment | Las Vegas Sands, Wynn Resorts | Direct competition for premium customers, requires constant innovation |

| Regional Casinos/Resorts | Local market understanding, tailored promotions | Marina Bay Sands (Singapore), local Malaysian operators | Threatens market share through localized strategies |

| Online Gaming Platforms | Convenience, accessibility, diverse offerings | Various online casino and sports betting sites | Diverts customers from physical casinos, impacting foot traffic |

| Power Generation Utilities | Pricing, operational efficiency, market share | National Grid, other independent power producers (UK) | Pressure on pricing and efficiency in the energy sector |

| Agribusinesses | Production efficiency, commodity prices | Other large-scale palm oil producers | Influences profitability in the plantation segment |

SSubstitutes Threaten

The most potent substitute threatening Genting Berhad's core casino business is the burgeoning online gaming and mobile entertainment sector. These digital platforms offer unparalleled convenience and accessibility, allowing players to engage with a vast selection of games from virtually any location, directly competing with the traditional casino experience.

This shift is underscored by significant market growth; for instance, the global online gambling market was valued at approximately $64.04 billion in 2022 and is projected to reach $157.92 billion by 2030, demonstrating a compound annual growth rate of over 12%. Such expansion directly siphons potential customers away from physical resorts, as players increasingly opt for the ease and variety offered by their mobile devices.

Consumers have a wide range of vacation and leisure options beyond integrated resorts, such as cruises, eco-tourism, cultural tours, and even at-home entertainment. This broad availability of alternatives directly challenges Genting's primary hospitality and theme park operations. For instance, the global cruise industry saw a significant rebound in 2023, with major lines reporting strong booking trends, indicating a robust alternative for leisure spending.

The increasing sophistication of home entertainment systems, coupled with the widespread availability of streaming services, presents a significant threat of substitutes for companies like Genting Berhad. Consumers now have access to a vast library of movies, TV shows, and interactive games directly in their living rooms, often at a lower cost than traditional entertainment venues. This trend was amplified in 2024, with global streaming revenue projected to reach over $100 billion, demonstrating the strong consumer preference for convenient, at-home entertainment options.

Other Forms of Gambling and Betting

Beyond traditional casino games, other forms of gambling and betting represent a significant threat of substitutes for Genting Berhad. These include national lotteries, which offer a low-cost entry point with the allure of massive payouts, and the rapidly expanding online and physical sports betting markets. The global sports betting market alone was valued at over USD 60 billion in 2023 and is projected to grow substantially, offering a different kind of engagement and thrill for consumers.

Furthermore, even seemingly unrelated activities like stock market speculation can be viewed as substitutes, as they also involve risk-taking and the potential for financial gain. These alternatives provide diverse risk-reward profiles and varying levels of accessibility, drawing in different customer segments who might otherwise patronize casinos.

- National Lotteries: Offer high payout potential at a low buy-in cost, appealing to a broad demographic.

- Sports Betting: A rapidly growing market, valued at over USD 60 billion in 2023, providing interactive entertainment.

- Online Gambling: Platforms offer convenience and a wide array of games, including poker and slots, directly competing with physical casinos.

- Stock Market Speculation: Represents an alternative avenue for risk-taking and wealth accumulation for some consumers.

Shift in Consumer Preferences Towards Wellness/Experiential Travel

The rising popularity of wellness and experiential travel presents a significant threat of substitutes for Genting Berhad's traditional resort offerings. Consumers are increasingly prioritizing unique experiences, personal well-being, and nature-based activities over conventional gaming and theme park attractions.

This shift is evident in the robust growth of the global wellness tourism market, which was valued at approximately $700 billion in 2023 and is projected to reach over $1 trillion by 2027. Travelers are seeking more enriching and health-focused vacations, potentially diverting demand from casinos and amusement parks.

- Wellness Tourism Growth: The global wellness tourism market is expanding rapidly, indicating a strong consumer preference for health-oriented travel experiences.

- Experiential Travel Demand: There's a clear trend towards seeking unique and memorable travel opportunities, which can be fulfilled by alternatives to traditional resort entertainment.

- Nature-Based Activities: An increasing number of travelers are opting for outdoor adventures and nature immersion, offering a substitute for indoor, man-made attractions.

- Shifting Consumer Priorities: Consumers are re-evaluating their travel choices, placing greater emphasis on personal enrichment and well-being over pure entertainment.

The threat of substitutes for Genting Berhad is multifaceted, extending beyond direct competitors to encompass a broad range of leisure and entertainment activities. Online gaming platforms, with their convenience and accessibility, continue to draw a significant share of the gambling market, a trend amplified by the global online gambling market's projected growth to $157.92 billion by 2030. Similarly, the burgeoning wellness tourism sector, valued at around $700 billion in 2023, offers an alternative focus for discretionary spending, diverting consumers seeking health-oriented experiences. Even home entertainment, bolstered by over $100 billion in global streaming revenue projected for 2024, presents a compelling substitute for traditional resort-based leisure.

| Substitute Category | Key Offerings | Market Data/Trend | Impact on Genting |

|---|---|---|---|

| Online Gaming | Casino games, poker, slots | Global online gambling market projected to reach $157.92B by 2030 (CAGR >12%) | Direct competition for casino revenue, convenience advantage |

| Alternative Leisure | Cruises, eco-tourism, cultural tours | Cruise industry saw strong booking trends in 2023 | Diversion of vacation spending from integrated resorts |

| Home Entertainment | Streaming services, home gaming | Global streaming revenue projected over $100B in 2024 | Reduced demand for out-of-home entertainment experiences |

| Other Gambling | National lotteries, sports betting | Global sports betting market valued over $60B in 2023 | Captures segments seeking different risk-reward profiles |

| Wellness & Experiential Travel | Spa retreats, nature tours, cultural immersion | Wellness tourism market valued at ~$700B in 2023 | Shifts consumer focus from gaming to personal enrichment |

Entrants Threaten

The threat of new companies entering the integrated resort and casino market, where Genting Berhad operates, is quite low. This is mainly because setting up these massive entertainment hubs requires an enormous amount of money. We're talking about billions of dollars needed to construct everything from luxurious hotels and bustling casinos to exciting theme parks and extensive retail areas.

For instance, the development cost for a new integrated resort can easily exceed $3 billion, creating a substantial financial hurdle. This high capital requirement acts as a significant barrier, discouraging potential new players from even attempting to enter the market and compete with established giants like Genting Berhad.

The casino industry, including for major players like Genting Berhad, faces significant barriers to entry due to strict government regulations and licensing requirements. For instance, in many jurisdictions, obtaining a new casino license is an exceptionally complex and time-consuming process, often involving extensive background checks, substantial capital investment proof, and adherence to rigorous operational standards.

These hurdles are not merely bureaucratic; they are designed to ensure stability and prevent illicit activities within the gaming sector. In 2024, the ongoing evolution of gaming regulations in key markets, such as the expansion of online gambling and the introduction of new responsible gaming measures, continues to add layers of complexity that deter nascent competitors from entering the market.

The sheer cost and the protracted timeline associated with securing the necessary permits mean that only well-capitalized and well-connected entities can realistically consider entering. This regulatory environment effectively acts as a formidable gatekeeper, protecting established operators like Genting from a flood of new competition.

Genting Berhad's decades of operation have cultivated strong brand recognition and deep customer loyalty across its diverse segments, from integrated resorts to plantations. This is a significant barrier for potential new entrants, who would face immense challenges in replicating Genting's established reputation and attracting a comparable customer base without substantial, long-term investment in marketing and brand building.

Access to Strategic Locations and Infrastructure

The threat of new entrants in the integrated resort industry, particularly concerning access to strategic locations and infrastructure, is significantly influenced by the scarcity of prime real estate. Genting Berhad, for instance, benefits from its established presence in highly sought-after destinations like the Genting Highlands in Malaysia and Resorts World Sentosa in Singapore. These locations offer unparalleled connectivity and high tourism appeal, making them difficult for newcomers to replicate.

New players face substantial hurdles in acquiring suitable land for integrated resorts. The cost of acquiring prime land in desirable tourism hubs can be astronomical, often running into hundreds of millions, if not billions, of dollars. For example, the development of Resorts World Sentosa involved significant land acquisition and infrastructure investment, a barrier that deters many potential entrants.

- Scarcity of Prime Locations: Key tourism hubs with excellent infrastructure and accessibility are limited and often already developed by established operators like Genting Berhad.

- High Land Acquisition Costs: Acquiring suitable land in these strategic locations is extremely expensive, presenting a significant capital barrier for new entrants.

- Infrastructure Development Challenges: New entrants must invest heavily in developing or upgrading infrastructure, including transportation links and utilities, which is both costly and time-consuming.

Economies of Scale and Operational Expertise

Existing players like Genting Berhad leverage significant economies of scale in their integrated resort operations. For instance, in 2023, Genting Malaysia's revenue reached RM9.77 billion (approximately USD 2.07 billion), showcasing the substantial financial muscle needed to operate at this level. New entrants would struggle to achieve similar cost efficiencies in procurement, marketing, and overall operational overhead, making it challenging to compete on price or service quality.

The operational complexity across Genting's diverse portfolio, including gaming, hospitality, and theme parks, presents a substantial barrier. Developing the necessary expertise in managing such multifaceted businesses requires years of experience and significant investment in talent and infrastructure. This steep learning curve for newcomers means they are unlikely to quickly match the efficiency and effectiveness of established operators.

- Economies of Scale: Genting's large-scale operations in 2023, with RM9.77 billion in revenue for Genting Malaysia, offer cost advantages in purchasing and marketing that new entrants cannot easily replicate.

- Operational Expertise: The intricate management of integrated resorts, encompassing gaming, leisure, and hospitality, demands specialized knowledge and experience, creating a high entry barrier.

- Capital Intensity: Building and operating world-class integrated resorts requires immense capital investment, estimated in the billions of dollars, which is a significant hurdle for potential new entrants.

The threat of new entrants for Genting Berhad is generally low, primarily due to the substantial capital investment required to establish integrated resorts. For instance, developing a new resort can easily cost over $3 billion, a significant financial barrier. Additionally, stringent government regulations and complex licensing processes in the casino industry further deter potential newcomers, as seen in the intricate requirements for obtaining gaming permits in various jurisdictions in 2024.

| Barrier Type | Description | Example/Data Point |

|---|---|---|

| Capital Requirements | Extremely high upfront investment for integrated resort development. | Development costs often exceed $3 billion. |

| Regulatory Hurdles | Complex and time-consuming licensing and compliance. | 2024 gaming regulations continue to evolve, adding complexity. |

| Brand Loyalty & Reputation | Established operators benefit from decades of brand building. | Genting's strong recognition across gaming and hospitality. |

| Location & Infrastructure | Scarcity of prime real estate and high acquisition costs. | Prime locations like Genting Highlands and Resorts World Sentosa are difficult to replicate. |

| Economies of Scale | Existing players achieve cost efficiencies through large-scale operations. | Genting Malaysia's RM9.77 billion revenue in 2023 indicates significant scale advantages. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Genting Berhad is built upon a foundation of comprehensive data, including Genting's annual reports, investor presentations, and financial statements. We also leverage industry-specific market research reports from reputable firms and news from financial publications to capture competitive dynamics.