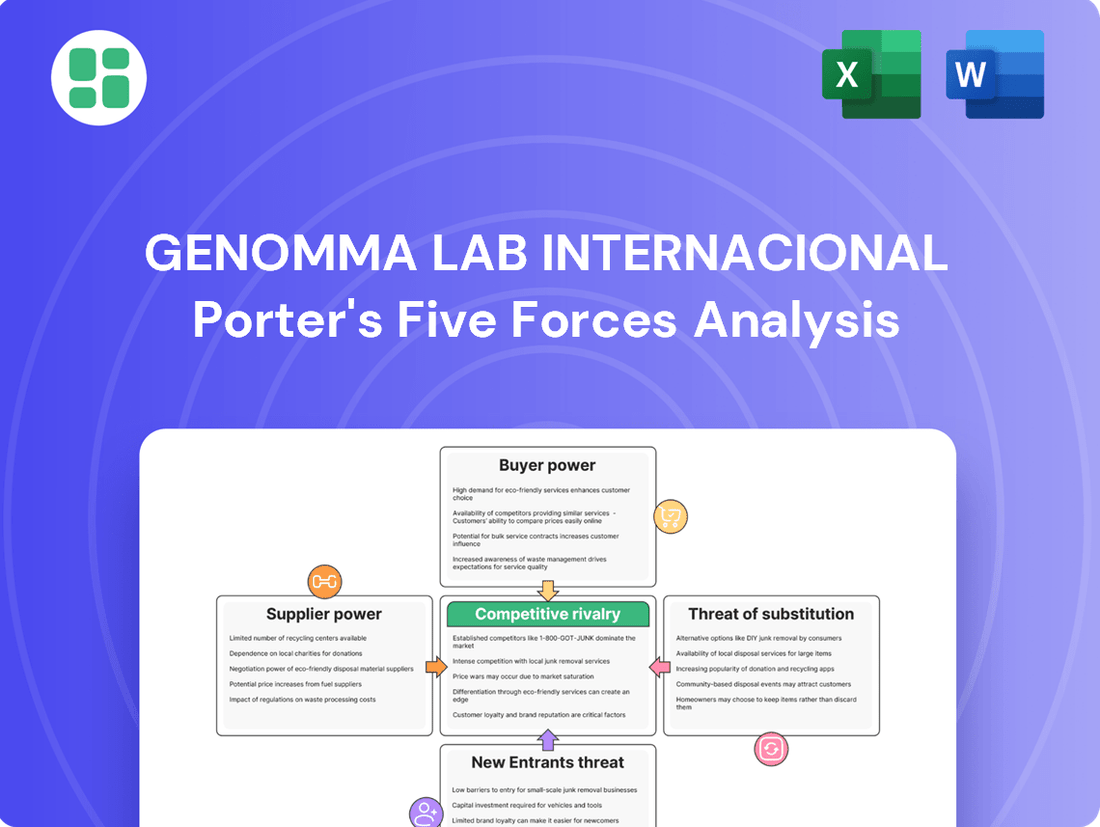

Genomma Lab Internacional Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Genomma Lab Internacional Bundle

Genomma Lab Internacional navigates a complex competitive landscape, with significant forces like buyer bargaining power and the threat of new entrants shaping its market. Understanding the intensity of these pressures is crucial for any strategic player in the consumer healthcare sector.

The complete report reveals the real forces shaping Genomma Lab Internacional’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Genomma Lab Internacional's reliance on a limited number of suppliers for critical raw materials and active pharmaceutical ingredients (APIs) significantly influences its bargaining power. If the market for these essential inputs is concentrated, with only a few dominant players, these suppliers can exert considerable leverage. This concentration could lead to higher procurement costs for Genomma Lab, impacting its profitability.

For instance, if key APIs are sourced from a handful of global manufacturers, those suppliers are in a strong position to dictate terms and prices. In 2024, the pharmaceutical supply chain continued to face volatility, with some specialized API producers experiencing increased demand and tighter capacity. This environment generally favors suppliers, potentially increasing Genomma Lab's input expenses if it lacks alternative sourcing options.

Genomma Lab faces significant switching costs when changing suppliers for critical inputs. These can include the expense and time required for requalifying ingredients to meet stringent quality standards, retooling manufacturing processes to accommodate new materials, and obtaining necessary regulatory approvals for alternative sources. For instance, in 2024, the pharmaceutical and personal care sectors often see these requalification processes take upwards of six months and cost tens of thousands of dollars per ingredient.

While Genomma Lab's vertically integrated model may reduce reliance on external suppliers for some components, crucial raw materials and specialized packaging often remain sourced externally. These external dependencies mean that suppliers of these key inputs can exert considerable bargaining power, especially if they are few in number or possess unique capabilities that are difficult for Genomma Lab to replicate internally or source elsewhere.

The uniqueness of inputs significantly impacts supplier bargaining power for Genomma Lab. If suppliers provide proprietary ingredients or highly differentiated components crucial for Genomma Lab's branded products, their leverage grows. This is especially true for specialized pharmaceutical compounds or unique personal care formulations where alternatives may be scarce or inferior.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into Genomma Lab's core business, such as manufacturing or distributing OTC pharmaceuticals and personal care products, represents a significant concern. If key suppliers were to make this move, they could directly compete with Genomma Lab, potentially leveraging their existing supply chain and expertise. This would transform them from mere providers of raw materials or components into formidable rivals.

A credible threat of forward integration by suppliers would inherently increase Genomma Lab's dependence on these entities. As suppliers gain the capability and inclination to enter Genomma Lab's market space, their bargaining power naturally escalates. For instance, if a major supplier of active pharmaceutical ingredients (APIs) decided to launch its own branded generic line, it could disrupt Genomma Lab's sourcing and pricing strategies.

- Supplier Capability: Assess if suppliers possess the necessary manufacturing infrastructure, regulatory expertise, and market access to effectively produce and distribute finished OTC products.

- Market Attractiveness: Evaluate if the profit margins and growth potential within Genomma Lab's product categories are sufficiently attractive to incentivize suppliers to pursue forward integration.

- Competitive Landscape: Analyze the existing competitive intensity within Genomma Lab's markets; a less saturated market might encourage supplier entry.

- Potential Impact on Genomma Lab: Consider how supplier entry could affect Genomma Lab's market share, pricing power, and overall profitability.

Importance of Genomma Lab to Suppliers

Genomma Lab Internacional's significance as a customer heavily influences its bargaining power with suppliers. If Genomma Lab constitutes a large percentage of a supplier's total sales, that supplier is likely to be more accommodating with pricing and terms to retain this valuable business. Conversely, if Genomma Lab is a minor client for a supplier, the supplier holds more leverage, potentially leading to less favorable conditions for Genomma Lab.

For instance, in 2023, Genomma Lab's cost of goods sold was approximately MXN 10.2 billion. The proportion of this spending relative to the total revenue of its key raw material or packaging suppliers would determine how much sway Genomma Lab has in negotiations. A supplier heavily reliant on Genomma Lab's orders would be more susceptible to price pressures or demands for customized service.

- Supplier Dependence: The degree to which key suppliers depend on Genomma Lab for their revenue directly impacts Genomma Lab's bargaining power.

- Volume of Purchases: Large-scale procurement by Genomma Lab can command better pricing and terms from suppliers.

- Alternative Suppliers: The availability of multiple alternative suppliers for critical inputs weakens the individual supplier's bargaining position.

- Supplier Concentration: If a particular input is sourced from a few dominant suppliers, their collective bargaining power increases.

Genomma Lab's bargaining power with suppliers is influenced by the concentration of the supplier market and the uniqueness of inputs. If few suppliers offer critical raw materials, like specialized APIs, their leverage increases. For example, in 2024, supply chain disruptions for certain pharmaceutical ingredients often favored suppliers, potentially raising Genomma Lab's costs if alternatives were limited.

High switching costs, involving lengthy requalification processes and regulatory hurdles, further bolster supplier power. These processes, often taking over six months and costing tens of thousands of dollars per ingredient in 2024, make it difficult for Genomma Lab to easily change suppliers for essential components.

The threat of suppliers integrating forward into Genomma Lab's market also strengthens their position. If suppliers, such as API manufacturers, were to launch their own branded products, they could become direct competitors, increasing Genomma Lab's dependence and reducing its negotiation leverage.

Genomma Lab's own purchasing volume significantly impacts its bargaining power. If Genomma Lab represents a substantial portion of a supplier's revenue, the supplier is more likely to offer favorable terms to retain the business. In 2023, Genomma Lab's cost of goods sold was approximately MXN 10.2 billion, indicating its potential influence with suppliers heavily reliant on its orders.

What is included in the product

This analysis dissects the competitive forces impacting Genomma Lab Internacional, evaluating the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the pharmaceutical and personal care sectors.

Instantly identify and address competitive threats with a clear, actionable breakdown of Genomma Lab Internacional's industry landscape.

Customers Bargaining Power

Consumers often demonstrate price sensitivity for over-the-counter (OTC) drugs and personal care items, especially when numerous brands and generic options are available. For instance, in 2024, the global OTC drug market saw increased price competition, with consumers actively comparing prices across different pharmacies and online platforms.

Large retailers and pharmacy chains wield considerable bargaining power due to their significant purchasing volumes. These key distribution channels can leverage their market presence to negotiate lower prices or more favorable payment terms from manufacturers like Genomma Lab, impacting the company's profit margins.

The availability of numerous substitute over-the-counter (OTC) drugs and personal care items significantly amplifies customer bargaining power. Consumers can readily switch to generic versions or products from major competitors like Bayer or Johnson & Johnson, limiting Genomma Lab's ability to dictate prices.

Customers today are highly informed, with easy access to product efficacy data, ingredient lists, and price comparisons online. This heightened awareness, fueled by digital platforms and health campaigns, significantly strengthens their ability to negotiate and seek better value.

Switching Costs for Customers

For many of Genomma Lab's over-the-counter (OTC) and personal care products, the switching costs for customers are notably low. This means consumers can easily try different brands without facing significant financial penalties or functional inconveniences, which inherently increases their bargaining power. For instance, a customer deciding between two similar pain relievers or skincare products can switch brands with minimal effort or cost, making brand loyalty less entrenched.

This low switching cost environment is a key factor in Genomma Lab's competitive landscape. In 2024, the global personal care market, where Genomma Lab is a significant player, continued to see intense competition driven by product innovation and aggressive marketing. Companies like Genomma Lab must therefore focus on product differentiation and value propositions to retain customers, as the ease of switching empowers consumers to seek out the best offerings.

- Low Switching Costs: Customers can easily move between Genomma Lab's products and competitors' offerings in categories like personal care and OTC medications.

- Consumer Choice: The lack of significant barriers to switching enhances customer power, allowing them to readily explore alternatives based on price, quality, or brand appeal.

- Market Dynamics: In 2024, the competitive nature of the personal care and OTC markets meant that low switching costs contributed to a dynamic environment where customer preferences could shift rapidly.

Volume of Purchases by Distribution Channels

The bargaining power of customers is significantly influenced by the volume of purchases made through various distribution channels. Major retail chains, supermarkets, and large online pharmacies represent substantial buyers for Genomma Lab Internacional. Their considerable purchasing volumes grant them leverage to negotiate favorable terms.

These large-scale buyers can exert considerable pressure on Genomma Lab for price reductions, enhanced promotional support, and extended payment terms. This is a direct consequence of their market presence and the significant revenue they represent as distribution partners.

- High Volume Buyers: Key retail chains and online platforms purchase substantial quantities of Genomma Lab products.

- Negotiating Leverage: This scale allows them to demand discounts and favorable payment conditions.

- Promotional Demands: Buyers often require promotional support to ensure product visibility and sales.

- Distribution Importance: Genomma Lab relies on these channels, increasing their bargaining power.

Customers' bargaining power is amplified by the vast array of readily available substitutes in the over-the-counter and personal care sectors. This ease of substitution, coupled with low switching costs, allows consumers to readily compare prices and product benefits, forcing companies like Genomma Lab to compete on value and innovation. In 2024, the global personal care market, a key area for Genomma Lab, experienced significant growth with numerous new product launches, further empowering consumer choice.

| Factor | Impact on Genomma Lab | 2024 Market Insight |

|---|---|---|

| Price Sensitivity | High | Consumers actively sought discounts in OTC and personal care. |

| Availability of Substitutes | High | Generic options and competitor brands offered easy alternatives. |

| Low Switching Costs | Significant | Customers could easily try new brands without penalty. |

| Informed Consumers | High | Online research empowered price and efficacy comparisons. |

Same Document Delivered

Genomma Lab Internacional Porter's Five Forces Analysis

This preview displays the comprehensive Genomma Lab Internacional Porter's Five Forces Analysis, detailing the competitive landscape and strategic positioning of the company. The document you see here is the exact, fully formatted analysis you will receive immediately after purchase, offering actionable insights without any placeholders or surprises. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact file, ready for immediate use.

Rivalry Among Competitors

Genomma Lab Internacional operates in a highly competitive landscape, characterized by a large number of global, regional, and local players in the over-the-counter (OTC) pharmaceutical and personal care sectors. This fragmentation fuels intense rivalry among existing firms.

The diversity of these competitors, ranging from multinational corporations with vast resources to smaller, niche brands, further intensifies the competitive rivalry. For instance, in 2024, the global OTC pharmaceutical market was valued at approximately $147.5 billion, showcasing the scale and breadth of participants.

The overall growth rate for the Over-the-Counter (OTC) pharmaceutical market is robust, with projections indicating a Compound Annual Growth Rate (CAGR) between 5.7% and 8.55% from 2025 through 2034. Similarly, the personal care market is expected to expand at a CAGR of 3.51% to 6.69% between 2025 and 2032.

While these figures suggest a generally expanding industry, it's crucial to note that slower growth within specific product categories or geographic regions can significantly intensify competitive rivalry. Companies then face greater pressure to capture market share from rivals.

Genomma Lab Internacional actively cultivates strong brand identities, a key strategy to dampen competitive rivalry. This focus on differentiation aims to foster consumer loyalty, making customers less susceptible to switching based on price alone. For instance, in 2023, the company reported significant growth in its over-the-counter (OTC) pharmaceutical and personal care segments, areas where brand perception plays a crucial role.

However, the intensity of rivalry can escalate in product categories where differentiation is less pronounced. In such instances, price becomes a more significant factor, intensifying competition among players. This dynamic is particularly relevant in certain consumer health and beauty markets where Genomma Lab operates, requiring continuous innovation and marketing investment to maintain its competitive edge.

Exit Barriers

Genomma Lab Internacional faces significant exit barriers in the highly competitive pharmaceutical and personal care markets. The specialized nature of manufacturing facilities and established distribution networks represent substantial sunk costs, making it financially challenging for companies to simply walk away. For instance, pharmaceutical production requires highly regulated and expensive equipment, which has limited alternative uses.

These high fixed costs and specialized assets mean that even when profitability dips, firms may continue operating to recoup some of their investment, thereby intensifying ongoing rivalry. This can lead to prolonged periods of price competition or market saturation as players fight to maintain market share. In 2024, the pharmaceutical industry globally continued to see high R&D expenditures, further cementing the need for long-term commitment.

- Specialized Assets: Manufacturing plants and R&D facilities are often industry-specific, limiting resale value or alternative applications.

- High Fixed Costs: Significant investments in production, marketing, and distribution create a substantial financial hurdle for exiting.

- Emotional Attachments: Long-standing brands and company histories can foster a reluctance to exit, even in the face of declining performance.

Advertising and Marketing Intensity

The pharmaceutical and personal care industries, particularly over-the-counter (OTC) products, are known for their high advertising and marketing intensity. Companies like Genomma Lab invest heavily to build brand recognition and foster consumer confidence in a crowded marketplace. This intense focus on marketing creates significant barriers for new entrants and fuels fierce rivalry among established players.

In 2024, Genomma Lab reported substantial marketing and advertising expenses as a key driver of its sales growth. For instance, their consolidated advertising and sales promotion expenses represented a significant portion of their revenue, reflecting the industry's competitive landscape. This high level of spending is essential for capturing and retaining market share.

- High Marketing Spend: Pharmaceutical and personal care sectors, especially OTC, exhibit substantial advertising investment.

- Brand Building: Significant marketing efforts are directed towards establishing brand awareness and consumer trust.

- Competitive Pressure: Intense competition exists for consumer attention and loyalty, driving up marketing costs.

- Genomma Lab's Investment: Genomma Lab's 2024 financial reports highlight considerable expenditure on advertising and sales promotion to maintain market position.

Competitive rivalry within Genomma Lab Internacional's operating sectors is notably high due to a fragmented market with numerous global, regional, and local competitors. This intensity is further amplified by the diverse range of players, from large multinational corporations to specialized niche brands, all vying for market share. The robust growth projected for both the OTC pharmaceutical and personal care markets, with CAGRs in the mid-single to high-single digits through 2034, attracts and sustains this competitive pressure.

Genomma Lab's strategy of building strong brand identities is crucial for mitigating this rivalry, aiming to foster customer loyalty beyond price sensitivity. However, in product categories with less distinct differentiation, price competition can become a more dominant factor, demanding continuous innovation and marketing investment. The substantial exit barriers, including specialized assets and high fixed costs in manufacturing and distribution, also encourage existing players to remain active even in challenging conditions, perpetuating intense competition.

| Factor | Description | Impact on Genomma Lab | 2024 Data Point |

| Number of Competitors | Large number of global, regional, and local players | Intensifies rivalry, pressure on market share | N/A (Qualitative assessment) |

| Competitor Diversity | Multinationals to niche brands | Varied competitive strategies and resource levels | N/A (Qualitative assessment) |

| Industry Growth Rate | OTC Pharma: 5.7%-8.55% (2025-2034) Personal Care: 3.51%-6.69% (2025-2032) |

Attracts new entrants and sustains rivalry | N/A (Projected data) |

| Brand Differentiation | Genomma Lab's focus on brand building | Mitigates price-based competition | Significant marketing/advertising spend in 2024 |

| Exit Barriers | Specialized assets, high fixed costs | Companies may continue operating, increasing rivalry | Continued high R&D expenditures in pharma (2024) |

SSubstitutes Threaten

The availability of generic or private label alternatives for many over-the-counter medications and personal care products presents a substantial threat. These substitutes often provide comparable effectiveness at a considerably lower cost, directly appealing to budget-conscious consumers. For instance, in the competitive consumer health market, private label brands can capture significant market share by undercutting established brands, as seen in the growing penetration of store-brand pain relievers and skincare products, which can erode Genomma Lab's pricing power and customer loyalty.

Consumers are increasingly exploring non-pharmaceutical options like home remedies, lifestyle adjustments, and natural or herbal products to manage their health and wellness. This shift presents a significant threat of substitution for Genomma Lab Internacional, as these alternatives can directly address needs typically met by the company's products.

The growing consumer preference for natural and organic ingredients in personal care and the rising popularity of herbal remedies within over-the-counter (OTC) markets further amplify this substitution pressure. For instance, the global market for natural and organic personal care products was projected to reach over $25 billion by 2025, indicating a substantial and growing segment of consumers willing to opt for alternatives.

The threat of prescription drugs for conditions typically managed by over-the-counter (OTC) medications, and vice-versa, presents a nuanced challenge. While Rx-to-OTC switches, like the 2020 FDA approval of alicaforsen for Crohn's disease, can broaden the OTC market, the continued availability of prescription-strength alternatives for common ailments remains a significant substitute threat for companies like Genomma Lab Internacional.

Consumer Perception of Effectiveness and Convenience

Consumer perception heavily influences the threat of substitutes for Genomma Lab's products. If consumers believe alternative over-the-counter medications or personal care items are just as effective, safer, or more convenient, they are more likely to switch.

For instance, in 2024, the global market for over-the-counter (OTC) drugs continued to see strong growth, with consumers increasingly seeking readily available and trusted solutions. This trend can empower consumers to consider substitutes if Genomma Lab's offerings are perceived as lagging in efficacy or ease of use.

Consider the following points regarding consumer perception:

- Perceived Efficacy: If consumers view generic brands or private-label products as delivering comparable results to Genomma Lab's established brands, the threat of substitution rises significantly.

- Safety and Trust: Consumer confidence in the safety profiles of substitute products, especially those recommended by healthcare professionals or backed by strong clinical data, can erode loyalty to Genomma Lab.

- Convenience and Accessibility: The ease with which consumers can purchase and use substitute products, whether through wider distribution channels or simpler application methods, directly impacts the threat.

Technological Advancements in Healthcare

Technological advancements are increasingly presenting viable substitutes for traditional over-the-counter (OTC) healthcare solutions, a significant threat for companies like Genomma Lab. Digital health platforms, for instance, offer remote consultations and health monitoring, potentially reducing the need for self-medication with OTC products. By mid-2024, the global digital health market was valued at over $200 billion, demonstrating substantial consumer adoption of these alternatives.

Personalized medicine and advanced diagnostic tools also emerge as strong substitutes. These innovations allow for more targeted treatments and early detection, which could diminish the market for generalized OTC remedies. For example, advancements in at-home genetic testing kits, which saw a significant surge in interest throughout 2023 and into 2024, empower consumers with health insights that might steer them away from conventional OTC purchases.

- Digital health platforms offer remote consultations, reducing reliance on traditional pharmacies and OTC products.

- Personalized medicine tailors treatments, potentially displacing broad-spectrum OTC remedies.

- Advanced diagnostic tools enable proactive health management, lessening the need for reactive OTC solutions.

- The global digital health market's growth, exceeding $200 billion by mid-2024, underscores the increasing consumer acceptance of these technological substitutes.

The threat of substitutes for Genomma Lab's products is significant, driven by readily available and often cheaper alternatives in both the over-the-counter (OTC) and personal care sectors. Private label brands, for instance, continue to gain traction by offering comparable quality at lower price points, directly impacting Genomma Lab's market share and pricing flexibility. The global market for private label products is projected to see continued growth, with some reports indicating it could reach over $1.5 trillion by 2027, highlighting the persistent challenge from these lower-cost options.

Consumer shifts towards natural, herbal, and lifestyle-based health solutions also present a growing substitution threat. As consumers increasingly seek holistic wellness approaches, they may opt for these alternatives over traditional OTC medications. The global market for natural and organic personal care products, already substantial, demonstrates this trend, with projections suggesting continued expansion well into the future.

Technological advancements, particularly in digital health and personalized medicine, are further diversifying the substitute landscape. Telehealth platforms and advanced diagnostic tools offer consumers new ways to manage their health, potentially reducing the need for conventional OTC products. The digital health market's robust growth, exceeding $200 billion by mid-2024, underscores the increasing consumer adoption of these tech-driven alternatives.

| Substitute Type | Key Characteristics | Impact on Genomma Lab | Market Trend Example (2024/2025 Projection) |

| Private Label/Generic Brands | Lower price, comparable efficacy | Erodes pricing power, market share | Continued strong penetration in OTC categories |

| Natural/Herbal/Lifestyle Remedies | Holistic wellness focus, perceived safety | Shifts consumer preference away from traditional OTCs | Growing demand in wellness and personal care segments |

| Digital Health/Telehealth | Convenience, remote access, personalized insights | Reduces reliance on physical OTC products | Rapid expansion of digital health platforms |

Entrants Threaten

The pharmaceutical and personal care sectors, especially for over-the-counter (OTC) products like those Genomma Lab Internacional offers, are heavily regulated. New companies face significant hurdles with stringent approval processes for new products, adherence to Good Manufacturing Practices (GMP), and complex labeling requirements.

These extensive compliance obligations translate into substantial upfront costs and ongoing expenses. For instance, obtaining regulatory approval for a new drug or cosmetic product can take years and cost millions of dollars, creating a formidable barrier to entry for smaller or less capitalized competitors.

In 2024, the global pharmaceutical market, valued at over $1.5 trillion, continues to see increased regulatory scrutiny worldwide, adding to the financial and operational burden for any new player looking to gain market share.

Genomma Lab, operating in highly competitive sectors like Over-the-Counter (OTC) pharmaceuticals and personal care, faces significant barriers to entry due to the substantial capital required for research and development. Launching a new product necessitates considerable investment in scientific innovation and clinical trials, often running into millions of dollars. For instance, bringing a new pharmaceutical product to market can cost upwards of $2.6 billion, a figure that deters many potential new players.

Establishing state-of-the-art manufacturing facilities is another major hurdle. These facilities must meet stringent regulatory standards, requiring significant upfront investment in equipment, infrastructure, and quality control systems. Companies like Genomma Lab invest heavily in these operational aspects to ensure product quality and compliance, creating a high capital threshold for newcomers.

Furthermore, building brand awareness and capturing market share in these saturated markets demands extensive and costly marketing campaigns. Companies must allocate considerable budgets to advertising, promotions, and distribution networks to compete effectively. In 2024, the global advertising spend for consumer health products alone was projected to be tens of billions of dollars, highlighting the financial commitment needed to make an impact.

Genomma Lab Internacional benefits from substantial brand loyalty within its key markets, making it challenging for new entrants to capture consumer attention and market share. This loyalty is cultivated through consistent marketing and product quality, creating a significant hurdle for newcomers attempting to gain a foothold.

The established distribution channels are a formidable barrier. Genomma Lab's extensive network across major retail chains, pharmacies, and online platforms means new products often struggle to secure prominent shelf space or even access to consumers. For instance, in 2024, securing placement in top-tier retail chains in Latin America often involves significant slotting fees and existing supplier relationships that new entrants lack.

Economies of Scale in Production and Distribution

Existing large-scale manufacturers and distributors, including Genomma Lab, benefit from significant cost advantages due to their established operations. These economies of scale in production allow for lower per-unit manufacturing costs, as fixed costs are spread over a larger output. For instance, in 2023, Genomma Lab's efficient supply chain and high production volumes contributed to its competitive pricing strategy.

Genomma Lab's vertically integrated model further solidifies its cost leadership. By controlling various stages of production and distribution, the company minimizes reliance on third-party suppliers and logistics providers, thereby reducing overall expenses. This integration, coupled with their substantial market share, creates a formidable barrier for newcomers aiming to match their cost efficiency.

- Economies of Scale: Genomma Lab leverages its large production volumes to achieve lower per-unit manufacturing costs, a key advantage over smaller potential entrants.

- Distribution Network: An extensive and efficient distribution network allows Genomma Lab to reach a wider customer base at a lower cost per unit delivered.

- Vertical Integration: Control over raw materials, manufacturing, and distribution channels provides Genomma Lab with cost savings and operational efficiencies.

- Market Share: A significant market share enables Genomma Lab to negotiate better terms with suppliers and distributors, further reducing costs.

Access to Raw Materials and Specialized Knowledge

Newcomers to Genomma Lab Internacional's markets, particularly in pharmaceuticals and personal care, face significant hurdles in securing consistent access to high-quality raw materials and specialized active ingredients. The industry relies on a complex supply chain where established players often have preferential agreements, making it difficult for new entrants to negotiate favorable terms or even secure sufficient quantities. For example, the sourcing of certain patented active pharmaceutical ingredients (APIs) can be tightly controlled by a limited number of global manufacturers.

Furthermore, acquiring the requisite scientific expertise for product development and regulatory compliance is a substantial barrier. This includes not only R&D capabilities but also the specialized knowledge needed for navigating stringent pharmaceutical regulations and effective marketing strategies in a highly competitive consumer landscape. Genomma Lab itself has invested heavily in building its scientific and marketing teams, a significant upfront cost for any potential competitor.

- Raw Material Sourcing: New entrants may struggle to secure contracts with key suppliers of specialized ingredients, potentially facing higher costs or limited availability compared to established firms with long-standing relationships.

- Scientific Expertise: The need for specialized knowledge in pharmaceutical formulation, clinical trials, and regulatory affairs requires significant investment in talent and infrastructure, which can be prohibitive for new companies.

- Marketing and Distribution: Building brand recognition and establishing effective distribution channels in the personal care and pharmaceutical sectors demands considerable marketing spend and strategic partnerships, areas where Genomma Lab has a proven track record.

The threat of new entrants for Genomma Lab Internacional is moderate to low, primarily due to high capital requirements for R&D and manufacturing, coupled with significant regulatory hurdles. Established brand loyalty and extensive distribution networks further deter new players. In 2024, the global pharmaceutical market's over $1.5 trillion valuation, alongside stringent global regulatory scrutiny, underscores these entry barriers, making it costly and time-consuming for newcomers to compete effectively.

Securing access to specialized raw materials and possessing deep scientific expertise are also considerable challenges. Genomma Lab's vertical integration and economies of scale, achieved through high production volumes and efficient supply chains, provide cost advantages. For instance, in 2023, Genomma Lab's operational efficiencies contributed to its competitive pricing, a difficult benchmark for new entrants to meet.

| Barrier Type | Description | Impact on New Entrants | Genomma Lab's Advantage |

|---|---|---|---|

| Capital Requirements | High costs for R&D, clinical trials, and manufacturing facilities. | Prohibitive for many potential competitors. | Established infrastructure and financial resources. |

| Regulatory Compliance | Stringent approval processes, GMP, and labeling requirements. | Time-consuming and expensive to navigate. | Expertise in compliance and existing approvals. |

| Brand Loyalty & Marketing | Need for substantial investment in advertising and promotions. | Difficult to capture consumer attention and market share. | Strong brand recognition and established marketing campaigns. |

| Distribution Networks | Access to retail chains, pharmacies, and online platforms. | Challenging to secure shelf space and reach customers. | Extensive and efficient distribution channels. |

Porter's Five Forces Analysis Data Sources

Our Genomma Lab Internacional Porter's Five Forces analysis is built upon a foundation of robust data, including official company filings, reputable market research reports, and industry-specific publications.

We leverage insights from financial databases, competitor disclosures, and economic indicators to provide a comprehensive understanding of the competitive landscape.