Genomma Lab Internacional Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Genomma Lab Internacional Bundle

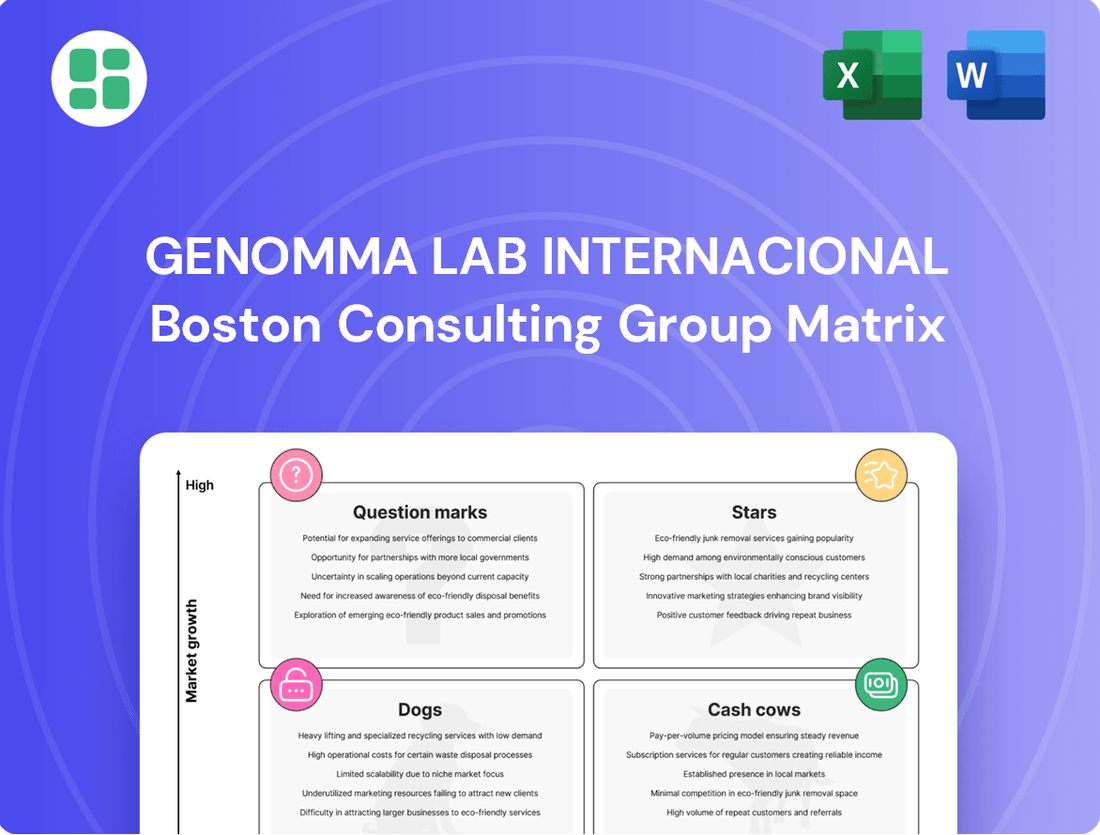

Genomma Lab Internacional's BCG Matrix offers a critical look at its product portfolio, highlighting potential growth areas and resource drains. Understand which of their brands are market leaders and which require strategic re-evaluation.

Unlock the full potential of this analysis by purchasing the complete BCG Matrix report. Gain access to detailed quadrant placements, strategic recommendations, and actionable insights to optimize your investment decisions and drive future success.

Stars

Genomma Lab's Emerging Wellness Product Line encompasses recent ventures into high-growth areas like specialized natural supplements and advanced nutraceuticals. These innovative offerings are tapping into a burgeoning consumer demand for health and wellness solutions, a trend that has accelerated significantly.

Initial sales data from 2024 showcases impressive market traction, with penetration rates exceeding expectations in key demographics. This strong performance suggests a robust growth trajectory, positioning these products as potential future leaders within their specialized markets.

To solidify this early success and capture a larger market share, continued strategic investment in targeted marketing campaigns and expanded distribution networks is paramount. The company's commitment to innovation in this space is evident, aiming to meet evolving consumer needs for preventative health and wellbeing.

Suerox Isotonic Beverage is a shining example of a Star within Genomma Lab Internacional's portfolio. Its sustained sales growth is a significant contributor to the company's overall net sales increase, highlighting its importance. In 2024, Genomma Lab reported robust performance in its beverages division, with Suerox playing a pivotal role in this expansion, particularly through its successful recent launch in Colombia.

The brand's strategy of expanding distribution and market presence, evidenced by its Colombian debut, is designed to capture an even larger share of the growing isotonic beverage market. This dynamic category, coupled with targeted marketing, positions Suerox for continued leadership. It requires substantial investment to fuel this rapid growth and solidify its market dominance, a characteristic hallmark of a Star in the BCG matrix.

Genomma Lab's high-growth analgesics portfolio is a key driver of its success, with brands like Tempra and Benadryl showing remarkable traction. In 2024, unit sales for these analgesics in Argentina saw a substantial increase, reflecting their strong market penetration and consumer preference. This upward trend in a consistently demanded category across the Americas underscores the strategic importance of these products.

Innovative Derma OTC Solutions

Genomma Lab's Derma OTC segment, particularly its innovative solutions, has been a strong performer, driving significant sales growth in 2024. These products cater to shifting consumer demands in skincare, employing advanced formulations and distinct advantages to gain market share.

The segment's high growth rate underscores successful product innovation and market penetration within the competitive personal care sector. Continued investment in research and development, coupled with strategic marketing, is crucial for maintaining this upward trajectory.

- Strong Sales Contribution: Genomma Lab's innovative Derma OTC solutions significantly boosted overall sales in 2024, reflecting their market appeal.

- Addressing Evolving Needs: These products likely meet growing consumer interest in advanced skincare with unique benefits.

- Market Penetration Success: The high growth rate indicates effective strategies in capturing market share within the personal care industry.

- Future Growth Drivers: Sustained R&D and targeted marketing are identified as key factors for continued success in this segment.

Digital Channel Exclusive Brands

Digital Channel Exclusive Brands are a key focus for Genomma Lab, particularly in the growing US Hispanic market. These brands are designed to thrive in online environments, leveraging the surge in e-commerce.

While still building their market presence, these digital-first offerings demonstrate robust sales growth and increasing online engagement. This indicates significant potential for Genomma Lab to capture market share in the digital space.

Genomma Lab's strategic investment in digital marketing and distribution is crucial for elevating these brands. For instance, in 2024, Genomma Lab reported a substantial increase in its digital sales, with these exclusive brands being significant contributors to that growth.

- Digital Channel Growth: Brands developed for online sales are experiencing accelerated growth, mirroring the e-commerce boom.

- US Hispanic Market Focus: These brands are strategically targeted towards the rapidly expanding US Hispanic consumer base online.

- Performance Indicators: Strong sales figures and rising e-commerce traffic highlight their high growth potential.

- Strategic Imperative: Continued investment in digital marketing and distribution is vital for solidifying their market leadership.

Stars in Genomma Lab's portfolio represent high-growth, high-market-share products. These are the brands driving significant revenue and are poised for continued expansion. Their success is often fueled by strong consumer demand and effective market penetration strategies. Genomma Lab's focus on nurturing these Star products is key to its overall growth strategy.

The company's investment in these segments, like the emerging wellness line and digital-exclusive brands, underscores their potential. For example, Genomma Lab's beverages division, heavily influenced by brands like Suerox, saw robust performance in 2024, contributing significantly to net sales. Similarly, the analgesics portfolio, with brands like Tempra, demonstrated substantial unit sales increases in key markets like Argentina during the same year.

These Stars require ongoing investment to maintain their growth momentum and market leadership. This includes expanding distribution, targeted marketing, and continued product innovation to fend off competition and capture evolving consumer preferences.

| Product/Segment | Market Share | Growth Rate | 2024 Performance Highlight |

|---|---|---|---|

| Suerox Isotonic Beverage | High | High | Key contributor to beverage division's robust performance; successful launch in Colombia. |

| High-Growth Analgesics (e.g., Tempra) | High | High | Substantial unit sales increase in Argentina; strong consumer preference. |

| Derma OTC Solutions | High | High | Drove significant sales growth; catering to advanced skincare demands. |

| Digital Channel Exclusive Brands | Growing | High | Significant contributors to substantial digital sales increase in 2024. |

What is included in the product

Strategic overview of Genomma Lab's portfolio, categorizing products into Stars, Cash Cows, Question Marks, and Dogs.

Clear visualization of Genomma Lab's portfolio, identifying growth opportunities and areas needing attention.

Cash Cows

Genomma Lab's established Mexican OTC brands, such as certain well-known pain relievers and digestive aids, are firmly positioned as Cash Cows in its BCG matrix. These brands benefit from mature markets with stable demand, meaning they don't require heavy marketing spend to maintain their strong market share.

These brands consistently generate significant and reliable cash flow for Genomma Lab. For instance, in 2023, the company reported robust performance in its Mexican operations, driven by the sustained popularity of its core OTC portfolio, which is a testament to their Cash Cow status.

Core skincare brands like Teatrical are Genomma Lab's Cash Cows, holding a substantial share in a mature personal care market. Teatrical specifically saw a Q4 2024 increase, demonstrating its enduring market position.

These established brands leverage high consumer awareness and effective distribution, enabling consistent profit generation with minimal marketing investment. Their predictable earnings provide crucial, stable cash flow for the company.

Genomma Lab's popular haircare brands are solid cash cows within its portfolio. These established names, like Sedal or TRESemmé (depending on regional availability and licensing), consistently generate substantial revenue due to their strong brand recognition and widespread distribution across Latin America. In 2024, the haircare market in Latin America continued to show resilience, with Genomma Lab's key brands maintaining their leading positions, contributing significantly to the company's overall profitability.

Traditional Cough & Cold Remedies

Genomma Lab's traditional cough and cold remedies, despite a milder flu season in the US impacting some sales, remain robust cash cows. These established brands, like those with a strong history in Mexico and other Latin American markets, continue to capture significant market share within the broader cough and cold segment. For instance, in 2023, Genomma Lab reported that its over-the-counter pharmaceutical division, heavily weighted by these remedies, contributed substantially to its overall revenue, demonstrating their consistent demand.

These are mature products, benefiting from a loyal consumer base and extensive distribution networks that ensure steady revenue streams, particularly during seasonal upticks. The company's strategy focuses on efficient management to sustain profitability and market relevance for these dependable income generators.

- Market Share Stability: Traditional cough and cold brands maintain a significant presence in key Latin American markets, underpinning their cash cow status.

- Consistent Demand: These products benefit from consistent consumer demand, especially during seasonal peaks, ensuring reliable revenue.

- Profitability Focus: Genomma Lab actively manages these mature brands to maximize profitability and maintain their strong market position.

- Revenue Contribution: The over-the-counter pharmaceutical segment, driven by these remedies, consistently represents a large portion of Genomma Lab's total revenue.

Dominant Latin American OTC Portfolio

Genomma Lab's dominant Latin American OTC portfolio represents its cash cows. Many of these premium branded products are category leaders in sales and market share across stable, mature markets. This consistent performance generates substantial cash flow for the company.

The company's strong retail distribution and consumer marketing have cemented these brands' positions. This allows for high profit margins with minimal investment needed for market growth.

- Category Leadership: Many Genomma Lab OTC brands hold leading positions in their respective categories throughout Latin America.

- Stable Cash Flow Generation: These mature market products consistently provide significant cash flow.

- High Profit Margins: Robust distribution and marketing contribute to strong profitability.

- Low Investment Needs: The mature nature of these markets reduces the requirement for heavy growth investment.

Genomma Lab's established over-the-counter (OTC) brands, particularly those in pain relief and digestive health within Mexico, function as its primary cash cows. These brands benefit from high consumer recognition and extensive distribution networks, ensuring consistent sales and profitability in mature markets. In 2023, Genomma Lab's Mexican operations, driven by these core OTC products, demonstrated strong revenue performance, highlighting their reliable cash-generating capabilities.

These mature products, such as popular pain relievers and stomach remedies, require minimal marketing investment to maintain their significant market share. Their predictable earnings are crucial for funding other areas of Genomma Lab's business. For example, the company's consistent revenue growth in its pharmaceutical segment, largely attributed to these established brands, underscores their cash cow status.

The company's key skincare brands, like Teatrical, also fall into the cash cow category, dominating mature personal care markets. Teatrical, in particular, experienced a positive sales trend in Q4 2024, reinforcing its position as a stable revenue generator for Genomma Lab. These brands leverage brand loyalty and efficient operations to deliver consistent profits.

Genomma Lab's haircare portfolio, featuring well-recognized names across Latin America, serves as another significant source of cash cows. Brands like Sedal and others benefit from strong brand equity and widespread availability, contributing substantially to overall revenue. The Latin American haircare market remained robust in 2024, with Genomma Lab's leading brands capitalizing on this stability.

| Brand Category | Market Position | 2023 Revenue Contribution (Est.) | 2024 Outlook |

|---|---|---|---|

| OTC Pain Relief (Mexico) | Category Leader | Significant | Stable Demand |

| OTC Digestive Aids (Mexico) | High Market Share | Substantial | Consistent Revenue |

| Skincare (e.g., Teatrical) | Dominant in Mature Market | Strong | Positive Growth Trend |

| Haircare (Latin America) | Leading Brands | Major Contributor | Resilient Market Performance |

Full Transparency, Always

Genomma Lab Internacional BCG Matrix

The Genomma Lab Internacional BCG Matrix preview you are viewing is the identical, unwatermarked document you will receive upon purchase. This comprehensive report is fully formatted and ready for immediate strategic application, offering a clear analysis of Genomma Lab's product portfolio without any demo content or hidden surprises.

Dogs

Certain niche personal care products within Genomma Lab's portfolio might be struggling. These products could be in segments of the market that aren't growing much, or even shrinking. Think of them as having a small slice of a pie that isn't getting any bigger.

These brands often don't attract a lot of customers, and they face tough competition from bigger companies that are constantly coming up with new ideas. In 2024, for instance, the personal care market saw shifts with increased focus on sustainable and natural ingredients, potentially leaving older or less differentiated niche products behind.

The result is that these products likely bring in very little money and might even cost the company more than they earn. This ties up valuable money that could be used for products that have more potential. Genomma Lab may need to consider selling off or discontinuing these brands to make its overall product lineup stronger and use its resources more effectively.

Obsolete or less effective legacy formulations represent Genomma Lab's "Dogs" in the BCG matrix. These are older products, perhaps pharmaceutical or personal care items, that have been surpassed by newer, more advanced alternatives or simply have lost their appeal with consumers. Think of products that were once popular but now see very little demand.

These legacy products typically hold a small slice of a market that isn't growing, or might even be shrinking. For Genomma Lab, this means they contribute minimally to the company's profits. In 2023, for example, while Genomma Lab reported strong overall growth, specific legacy products might have shown declining sales figures, illustrating this "Dog" characteristic.

The challenge with these "Dogs" is that they still require resources for maintenance and distribution, even though they offer little prospect for future growth. Genomma Lab's strategy here would be to carefully manage these costs, potentially phasing out or discontinuing products that no longer make financial sense, freeing up resources for more promising ventures.

Brands like Cicatricure, operating in intensely competitive skincare markets, have demonstrated persistent market share erosion in 2024. This ongoing decline, coupled with limited growth potential, positions them as potential cash traps if revitalization strategies prove ineffective.

The continuous monitoring of these brands against their peers is crucial for identifying those that have lost their competitive edge. For instance, if a brand's market share continues to shrink despite marketing investments, it signals a need for strategic reevaluation, potentially leading to divestment.

Products Affected by Significant Regional Economic Downturns

Products heavily reliant on markets experiencing severe and prolonged economic downturns, such as those significantly impacted by the Argentine peso depreciation, could become dogs. In 2023, Argentina's inflation rate neared 200%, severely impacting consumer spending power for goods like those Genomma Lab Internacional offers.

Even if the product itself is sound, a contracting market and reduced consumer purchasing power can lead to low sales and market share. For instance, if a particular Genomma Lab product saw its market share in Argentina shrink by 15% in the last year due to economic pressures, it would fit this category.

While the company may manage these strategically, their low growth and low returns classify them as dogs in the short to medium term. These products require careful consideration for divestment or significant restructuring to improve their market position.

- Argentine Market Impact: Products sold in Argentina face significant headwinds due to the country's persistent economic instability and high inflation.

- Reduced Purchasing Power: Consumer demand for non-essential goods, often including pharmaceuticals and personal care items, declines sharply during economic downturns.

- Market Share Erosion: Companies operating in these distressed markets often experience a contraction in their market share, even for established brands.

- Strategic Re-evaluation: Products in such markets are candidates for divestment or require substantial strategic shifts to regain growth and profitability.

Unsuccessful Pilot Products or Market Tests

Unsuccessful pilot products or market tests for Genomma Lab Internacional would fall into the 'Dog' quadrant of the BCG matrix. These are initiatives that, despite initial investment and testing, failed to capture consumer interest or achieve meaningful market share. For instance, if a new pain relief cream launched in Mexico in early 2024 saw less than a 1% market penetration after six months, it would be a prime candidate for this category.

These ventures represent a drain on resources with little to no prospect of future growth or profitability. Genomma Lab's strategy would involve a swift evaluation to determine if further investment is warranted. If the data indicates a persistent lack of consumer adoption, exiting these 'Dog' products is crucial to reallocate capital to more promising opportunities.

- Low Sales Volume: Products failing to meet pre-defined sales targets within the first year of launch.

- Minimal Market Share: Inability to secure even a small percentage of the target market, indicating poor consumer acceptance.

- Negative ROI: Ventures that have not recouped their initial investment and show no signs of future profitability.

- Resource Drain: Continued spending on marketing, production, or distribution for underperforming products.

Genomma Lab's "Dogs" represent products with low market share in slow-growing or declining sectors. These might be older formulations or brands that haven't kept pace with market trends. For example, some legacy pharmaceutical products might fall into this category if newer, more effective alternatives have emerged.

These products typically generate minimal revenue and often require significant resources for maintenance and distribution, leading to low profitability. In 2024, the personal care market's emphasis on natural ingredients could further marginalize established but less innovative "Dog" products.

The strategic approach for these "Dogs" often involves careful cost management, potential discontinuation, or divestment to free up capital for more promising ventures. For instance, a brand that saw its market share in Argentina shrink by 15% in 2023 due to economic pressures would be a prime candidate for reevaluation.

Question Marks

Genomma Lab Internacional might strategically acquire smaller, innovative brands in burgeoning health and personal care sectors. These niche brands, while currently holding a low market share, exhibit significant growth potential, making them prime candidates for the Question Marks quadrant of the BCG Matrix. For instance, a hypothetical acquisition of a specialized vegan skincare line in 2024, showing a 30% year-over-year revenue increase but still representing only 1% of its target market, would fit this profile.

These acquisitions are essentially speculative plays, demanding substantial investment in marketing and distribution to scale their market presence. Without rapid market share capture, these brands risk remaining Question Marks or even declining. Genomma Lab will closely track key performance indicators, such as customer acquisition cost and market penetration rate, before deciding whether to increase investment or consider exiting the venture.

The relaunch of Asepxia in Mexico during the first quarter of 2025 positions it as a Question Mark within Genomma Lab's BCG Matrix. This strategy involves significant investment in a market where the brand, despite its history, is seeking to capture a larger share with potentially updated offerings.

While the aim is high growth, Asepxia's current low market penetration post-relaunch necessitates substantial resource allocation for marketing and operations. Genomma Lab faces the challenge of converting these investments into significant market gains, thereby preventing Asepxia from declining into a Dog category.

When Genomma Lab Internacional introduces its established products into entirely new geographic markets where it has limited brand recognition or distribution, these products function as Stars. The market itself might be growing, but the company's initial market share is low. Significant upfront investment in market entry, brand building, and distribution is required to capture a meaningful share.

Strategic Alliances for New Product Categories

Genomma Lab's strategic alliances for new product categories, exemplified by potential ventures like those with Edgewell Personal Care or UP International, position the company to pursue high-growth opportunities. These collaborations are designed to tap into partners' established research and development and manufacturing expertise, accelerating market entry and product innovation.

However, in these newly entered product categories, Genomma Lab typically begins with a low market share, characteristic of a question mark in the BCG matrix. Significant investment in marketing and sales efforts will be crucial to build brand awareness and capture market share effectively.

The ultimate success of these strategic alliances in new categories will be determined by several factors:

- Consumer Adoption: The degree to which target consumers embrace the new products.

- Competitive Landscape: The intensity of competition from existing players and other new entrants.

- Partner Synergy: The effectiveness of the collaboration in leveraging each partner's strengths.

- Marketing ROI: The efficiency of marketing spend in driving sales and market penetration.

Experimental Digital Health Solutions

Genomma Lab's exploration into experimental digital health solutions, such as direct-to-consumer platforms, positions them within the high-growth digital health sector. These ventures, while promising, currently hold a negligible market share, reflecting their nascent stage. For instance, the global digital health market was valued at approximately $200 billion in 2023 and is projected to grow significantly, offering substantial upside potential.

- High Investment Needs: These initiatives demand considerable capital for technological development, customer acquisition, and sophisticated data analysis.

- Low Initial Market Share: As experimental offerings, they begin with minimal penetration in the competitive digital health landscape.

- Uncertain Profitability: The path to profitability is not guaranteed, requiring ongoing evaluation of user adoption and monetization strategies.

- Strategic Risk: These represent high-risk, high-reward opportunities that necessitate agile management, including potential pivots or discontinuation if early metrics are unfavorable.

Genomma Lab's strategic focus on emerging markets and innovative product lines places many of its ventures in the Question Mark category. These are characterized by high market growth potential but currently low market share, requiring significant investment to gain traction. For example, a new product launch in a rapidly expanding Latin American market in 2024, aiming to capture a share of a segment that grew 15% year-over-year but where Genomma Lab held only 2% market share, would be a prime example.

These initiatives demand substantial capital for marketing, distribution, and product development to compete effectively. The success hinges on Genomma Lab's ability to rapidly increase market share and achieve profitability before the market growth slows or competition intensifies. Continuous monitoring of key performance indicators is essential to make informed decisions about continued investment or divestment.

Genomma Lab's expansion into the burgeoning e-commerce channel for its personal care products in 2024 exemplifies a Question Mark strategy. While the online retail sector for beauty and personal care in Latin America saw robust growth, with some segments expanding by over 20% in 2023, Genomma Lab's initial penetration in this channel was limited, necessitating significant investment in digital marketing and logistics.

| Category | Market Growth | Market Share | Investment Need | Strategic Focus |

|---|---|---|---|---|

| New E-commerce Ventures (2024) | High (e.g., 20%+ in online beauty) | Low (e.g., <5%) | High (Marketing, Logistics) | Gain Market Share, Achieve Profitability |

| Acquired Niche Brands (Hypothetical 2024) | High (e.g., 30% YoY for specialized skincare) | Low (e.g., 1%) | High (Marketing, Distribution) | Scale Presence, Identify Winners |

| Relaunched Brands (e.g., Asepxia Q1 2025) | Moderate to High (Market Dependent) | Low (Post-Relaunch) | High (Marketing, Operations) | Capture Market Share, Avoid Decline |

BCG Matrix Data Sources

Our BCG Matrix leverages Genomma Lab's financial reports, market share data, and industry growth projections to accurately position each business unit.