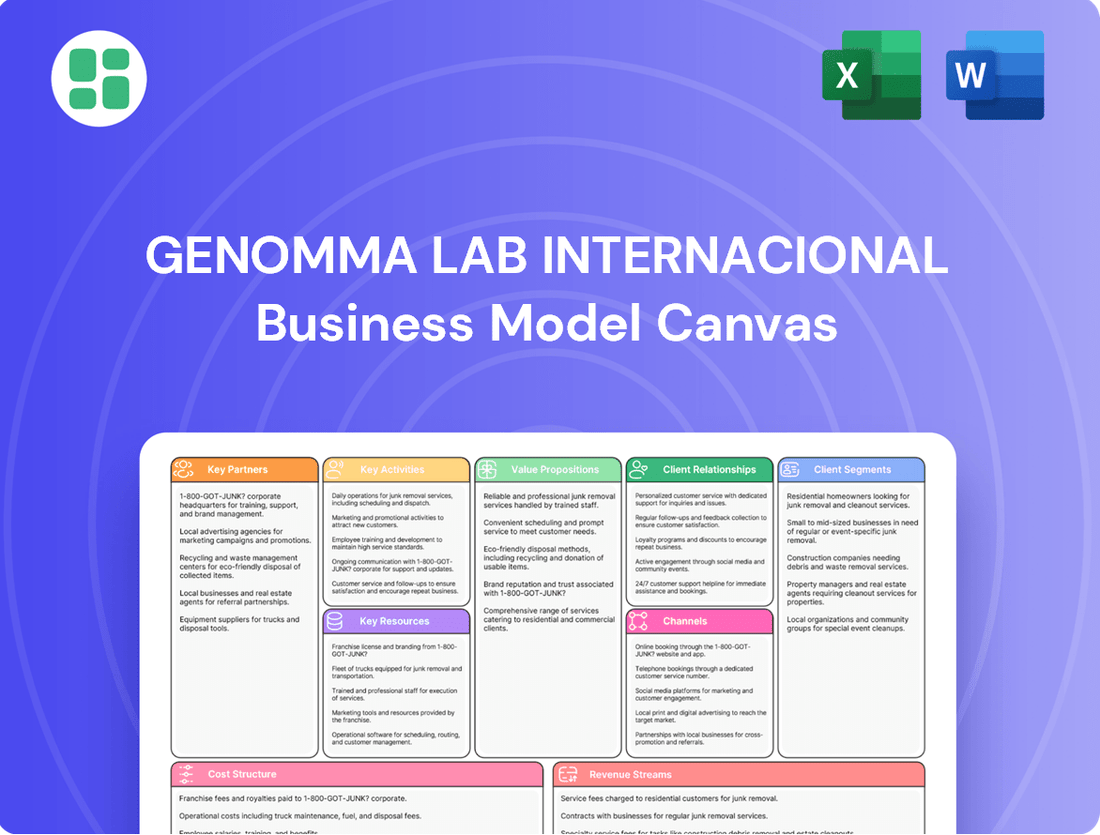

Genomma Lab Internacional Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Genomma Lab Internacional Bundle

Unlock the strategic blueprint of Genomma Lab Internacional's thriving business model. This comprehensive Business Model Canvas details their customer relationships, key resources, and revenue streams, offering a clear roadmap to their success. Discover how they dominate the consumer goods market and gain actionable insights for your own ventures.

Partnerships

Genomma Lab's success hinges on its extensive network of strategic retail partners. In 2024, the company continued to leverage its relationships with major supermarket chains and pharmacy groups across Latin America, ensuring its wide array of consumer health and personal care products reached a vast customer base. This distribution strategy is crucial for maintaining high product visibility and accessibility.

Genomma Lab leverages key partnerships with major e-commerce platforms such as Amazon and other significant e-retailers. This strategic engagement is vital for broadening its online presence and connecting with a growing segment of consumers who favor digital purchasing channels.

These e-commerce collaborations are instrumental in boosting website traffic and driving sales volume, particularly in key markets like the United States. For instance, Amazon's extensive reach and established customer base provide Genomma Lab with a significant avenue for product discovery and conversion.

Genomma Lab, as a vertically integrated manufacturer, relies on a robust network of raw material and packaging suppliers. These partnerships are crucial for maintaining product quality and production continuity in its pharmaceutical and personal care lines.

In 2024, Genomma Lab continued to focus on strategic supplier relationships, aiming for cost efficiencies through renegotiations and exploring new sourcing opportunities. This proactive approach helps mitigate supply chain risks and optimize production costs.

Logistics and Transportation Providers

Genomma Lab relies heavily on a network of logistics and transportation providers to ensure its wide array of consumer health and personal care products reach markets efficiently throughout the Americas. These partnerships are crucial for managing the complex supply chain, from manufacturing facilities to the diverse points of sale. For instance, in 2024, the company continued to focus on optimizing its distribution routes and freight forwarding processes to minimize costs and delivery times.

These collaborations enable Genomma Lab to maintain product availability and freshness, a key factor in customer satisfaction and market share. The company's commitment to timely delivery is supported by its partners' capabilities in handling varying volumes and reaching remote locations. By leveraging specialized logistics expertise, Genomma Lab can navigate the intricacies of cross-border shipping and local distribution networks.

- Efficient Distribution: Partnerships with logistics firms ensure timely product delivery across the Americas.

- Supply Chain Optimization: Continuous efforts in 2024 to refine freight and forwarding processes.

- Market Reach: Enabling access to diverse points of sale, from major retailers to smaller outlets.

Research and Development Collaborators

Genomma Lab Internacional, while largely focused on internal research and development for its extensive product lines, strategically partners with external entities to bolster its innovation capabilities. These collaborations are crucial for sourcing cutting-edge ingredients and accessing specialized scientific expertise, thereby accelerating the development of novel and effective consumer health and personal care products. This approach ensures Genomma Lab remains at the forefront of market trends and consumer needs.

The company actively seeks partnerships with academic institutions and specialized research laboratories to validate new formulations and explore emerging scientific advancements. These collaborations are vital for maintaining a robust innovation pipeline and ensuring the efficacy and safety of their product offerings. For instance, a partnership might focus on clinical trials for a new dermatological product, leveraging the institution’s research infrastructure.

Ingredient suppliers are also key partners, providing access to high-quality, innovative components that differentiate Genomma Lab’s products. By working closely with these suppliers, the company can ensure the consistent quality and performance of its formulations. In 2024, Genomma Lab continued to explore partnerships with suppliers offering sustainable and ethically sourced ingredients, aligning with growing consumer demand for responsible products.

- Research Institutions: Collaborations with universities and research centers to validate product efficacy and explore new scientific avenues.

- Ingredient Suppliers: Partnerships to secure high-quality, innovative, and potentially sustainable raw materials for product development.

- Contract Research Organizations (CROs): Engagement with CROs for specialized testing, clinical trials, and regulatory support to ensure product compliance and market readiness.

Genomma Lab's key partnerships extend to major retailers and pharmacy chains across Latin America, crucial for widespread product distribution. In 2024, these relationships remained central to ensuring broad market penetration and consumer access to its health and personal care brands.

Collaborations with e-commerce giants like Amazon are vital for expanding online sales channels. These digital partnerships in 2024 facilitated increased product visibility and direct engagement with a growing online consumer base, particularly in markets like the United States.

The company also relies on a robust network of raw material and packaging suppliers to maintain product quality and production continuity. In 2024, Genomma Lab continued to focus on optimizing these supplier relationships for cost efficiency and supply chain resilience.

What is included in the product

Genomma Lab Internacional's Business Model Canvas focuses on a broad customer base in Latin America, utilizing extensive distribution channels and a diverse portfolio of over-the-counter pharmaceutical and personal care products. Its value proposition centers on accessible, affordable healthcare and beauty solutions, supported by strong marketing and brand recognition.

Genomma Lab Internacional's Business Model Canvas acts as a pain point reliever by streamlining complex operations, allowing for efficient product development and distribution across diverse markets.

This canvas offers a clear, actionable roadmap, effectively addressing the pain of fragmented market strategies and enabling focused execution.

Activities

Genomma Lab's core strength lies in its robust product research, development, and innovation pipeline, focusing on over-the-counter (OTC) pharmaceuticals and personal care. This dedication to new product development is a cornerstone of their business strategy, allowing them to consistently bring fresh offerings to market.

The company actively engages in continuous investigation and analysis to identify optimal ingredients and understand evolving consumer needs. This deep dive into market trends and ingredient efficacy is crucial for creating products that resonate with their target audience.

In 2023, Genomma Lab reported a significant portion of its revenue stemming from new products, underscoring the success of its R&D efforts. For instance, their investment in innovation directly contributed to a substantial increase in their product portfolio, with many new launches exceeding initial sales expectations.

Genomma Lab Internacional's manufacturing and production activities are central to its vertically integrated strategy, encompassing research and development through to final distribution. This control over the entire value chain, including its own state-of-the-art manufacturing facilities, allows for greater quality assurance and cost management.

The company has notably invested heavily in its manufacturing plant located in Mexico. These investments are geared towards enhancing operational efficiency and implementing sustainable processes, reflecting a commitment to both productivity and environmental responsibility in its production.

In 2024, Genomma Lab continued to optimize its production lines, aiming to meet the growing demand for its diverse portfolio of pharmaceutical and personal care products. The focus remains on leveraging technology and efficient workflows to ensure a steady supply of high-quality goods.

Genomma Lab's key activity revolves around crafting robust brands via consumer-focused marketing and clear messaging across all channels, from TV to digital. They utilize an in-house content studio to produce compelling campaigns.

In 2024, Genomma Lab continued to invest heavily in marketing, with advertising and promotion expenses representing a significant portion of their overall costs, aiming to solidify brand presence and drive sales in competitive markets.

Sales and Distribution Management

Genomma Lab's sales and distribution management is a cornerstone of its operations, focusing on reaching a vast consumer base through diverse channels. This involves nurturing relationships with a broad retail network, which includes major modern trade outlets, a significant number of pharmacies, and countless independent and smaller "mom and pop" stores. This multi-pronged approach is critical for market penetration and ensuring product availability across different socioeconomic segments.

The company's sales strategy is heavily reliant on its extensive distribution capabilities. For instance, in 2024, Genomma Lab continued to strengthen its presence in key Latin American markets, leveraging these channels to drive sales volume. The effectiveness of this network was evident in its reported revenue growth, with specific figures often highlighting the contribution of its robust distribution infrastructure to overall financial performance.

- Managing a broad retail distribution network: This includes modern trade, pharmacies, independent pharmacies, and smaller local stores to ensure wide market reach.

- Sales force effectiveness: Training and motivating sales teams to effectively promote and sell products across these diverse channels.

- Logistics and supply chain optimization: Ensuring efficient delivery of products to all distribution points, minimizing stockouts and maximizing availability.

- Channel partner relationship management: Building and maintaining strong relationships with retailers and distributors to foster loyalty and cooperation.

Productivity Initiatives and Cost Optimization

Genomma Lab is heavily focused on boosting efficiency and cutting expenses across the board. This includes smart adjustments to how they spend on advertising and promotions, making sure every dollar spent on marketing, especially at the store level, delivers maximum impact. They are also investing in automating processes to make operations smoother and less costly.

These strategic moves are designed to directly improve the company's bottom line and ensure Genomma Lab can offer its products at prices that remain attractive to consumers, even in a competitive market. For instance, in 2024, the company has highlighted efforts to rationalize its media investments, seeking more cost-effective channels and optimizing campaign performance.

- Optimized Media Spending: Genomma Lab continuously analyzes and refines its media allocation to achieve better reach and engagement at a lower cost per impression.

- Enhanced Point-of-Sale Marketing: Initiatives focus on maximizing the effectiveness of in-store promotions and merchandising to drive sales directly at the consumer touchpoint.

- Operational Streamlining: Automation is being implemented in various back-office and operational functions to reduce manual effort, minimize errors, and lower overheads.

- Profitability Improvement: The overarching goal of these productivity and cost-saving measures is to directly contribute to increased profitability and maintain a strong competitive pricing strategy.

Genomma Lab's key activities are centered on managing its extensive retail distribution network, which spans modern trade, pharmacies, and smaller independent stores to ensure broad market reach. This is complemented by a strong focus on sales force effectiveness, ensuring teams are well-trained to promote products across these varied channels. Efficient logistics and supply chain management are crucial for timely product delivery, while nurturing robust relationships with channel partners fosters loyalty and cooperation.

| Key Activity | Description | 2024 Focus/Data |

| Distribution Network Management | Overseeing a wide array of retail outlets, from large chains to local shops. | Strengthening presence in key Latin American markets through existing channels. |

| Sales Force Effectiveness | Training and motivating sales teams for optimal product promotion. | Continued investment in sales team development to drive market penetration. |

| Logistics & Supply Chain | Ensuring efficient product delivery and availability. | Optimizing routes and inventory management to meet growing demand. |

| Channel Partner Relations | Building and maintaining strong ties with retailers and distributors. | Fostering cooperation to enhance product visibility and sales. |

Preview Before You Purchase

Business Model Canvas

The Genomma Lab Internacional Business Model Canvas preview you are viewing is the authentic document you will receive upon purchase. This is not a sample or mockup, but a direct representation of the complete file, ready for your immediate use. You will gain full access to this exact document, containing all the detailed strategic elements of Genomma Lab Internacional's business model, precisely as displayed here.

Resources

Genomma Lab's strong brand portfolio, featuring market leaders like Suerox and Cicatricure, is a cornerstone of its business model. These established brands are significant intangible assets, driving consumer loyalty and pricing power.

In 2024, Genomma Lab continued to leverage its diverse brand offerings across various health and personal care segments. The company's investment in brand building and marketing has solidified its market position, contributing to its revenue growth and profitability.

Genomma Lab's vertically integrated manufacturing facilities, particularly its advanced plant in Mexico, are a cornerstone of its business model. This integration allows for direct oversight of production processes, ensuring high quality and significant cost savings.

This state-of-the-art facility is key to Genomma Lab's ability to maintain a low-cost, highly flexible operating model. In 2024, the company continued to leverage these efficiencies to respond rapidly to market demands and optimize its supply chain.

Genomma Lab's extensive distribution network, spanning across the Americas, is a critical resource. This includes direct sales channels and collaborations with major retailers and wholesalers, ensuring widespread product availability and market reach.

This robust infrastructure is a significant competitive advantage, enabling Genomma Lab to effectively penetrate diverse markets and make its products accessible to a broad customer base.

In 2024, Genomma Lab reported a strong presence in over 10 countries, leveraging this network to achieve significant sales volumes and market share in the pharmaceutical and personal care sectors.

Human Capital and Expertise

Genomma Lab's human capital is a cornerstone of its business model, encompassing dedicated R&D professionals driving product innovation, astute marketing specialists crafting brand narratives, and efficient operational teams ensuring smooth execution. This diverse talent pool is Genomma Lab's primary intellectual asset.

The company actively invests in its employees through continuous upskilling programs and structured career development paths, aiming to nurture expertise and retain top talent. Fostering a connected organizational culture further enhances collaboration and knowledge sharing across departments.

For instance, in 2024, Genomma Lab continued its focus on talent development, with a significant portion of its budget allocated to training initiatives designed to enhance both technical and soft skills across its workforce. This strategic investment is crucial for maintaining a competitive edge in the dynamic pharmaceutical and consumer health sectors.

Key aspects of Genomma Lab's human capital strategy include:

- Investment in R&D talent: Ensuring a strong pipeline of scientists and researchers to fuel new product development.

- Marketing and sales expertise: Cultivating professionals skilled in brand building and market penetration strategies.

- Operational efficiency: Developing a workforce adept at managing complex supply chains and manufacturing processes.

- Employee engagement and retention: Implementing programs that promote a positive work environment and career growth opportunities.

Financial Capital and Market Access

Genomma Lab Internacional's financial capital and market access are cornerstones of its business model. The company's robust financial health, demonstrated by its consistent generation of free cash flow, directly fuels its expansion and operational improvements. In 2023, Genomma Lab reported significant operational cash flow, enabling substantial investments in its brand portfolio and distribution networks.

This financial strength also translates into a strong capacity to tap into capital markets. Genomma Lab has successfully utilized debt instruments, such as bond issuances, to secure the necessary funding for both organic growth projects and potential strategic acquisitions. This access to diverse funding sources is critical for maintaining its competitive edge and pursuing ambitious development plans.

Key aspects of Genomma Lab's Financial Capital and Market Access include:

- Strong Free Cash Flow Generation: Genomma Lab consistently generates substantial free cash flow, providing internal resources for investment and operational efficiency.

- Access to Capital Markets: The company leverages its financial standing to access capital through various instruments, including bond issuances, to finance growth initiatives.

- Funding for Growth Projects: Financial capital is allocated to expanding product lines, enhancing manufacturing capabilities, and entering new geographic markets.

- Investment in Productivity: Resources are directed towards improving operational efficiency and technological advancements to boost overall productivity.

Genomma Lab's intellectual property, particularly its proprietary formulations and brand trademarks, represents a significant intangible asset. These elements are crucial for maintaining competitive differentiation and commanding premium pricing in the market.

The company's commitment to research and development is a key driver of its intellectual capital. In 2024, Genomma Lab continued to invest in R&D to develop innovative products and improve existing ones, ensuring its portfolio remains relevant and appealing to consumers.

Value Propositions

Genomma Lab's value proposition centers on delivering a comprehensive suite of health and wellness solutions, encompassing a vast array of over-the-counter pharmaceutical products and personal care items. This extensive portfolio is meticulously curated to address a wide spectrum of consumer health needs and everyday personal grooming requirements, offering unparalleled convenience.

In 2024, Genomma Lab continued to solidify its market position by offering accessible solutions for common ailments and personal care, reflecting a strategic focus on everyday consumer well-being. The company's commitment to a broad product range ensures consumers can find reliable and convenient options for their daily health and hygiene routines.

Genomma Lab Internacional excels in developing and marketing premium branded products that often dominate their respective categories, fostering deep consumer trust and loyalty. These brands are consistently recognized for their superior quality and proven effectiveness in tackling specific health and beauty needs.

In 2024, Genomma Lab's commitment to premium branding is evident in its strong market presence. For instance, their flagship brands continue to hold significant market share in key Latin American markets, reflecting the enduring consumer confidence built through consistent quality and efficacy.

Genomma Lab leverages an extensive retail distribution network, reaching consumers across diverse socio-economic strata and geographical locations. This broad accessibility is a cornerstone of their business model, ensuring products are readily available where and when people need them.

The company's significant presence in e-commerce further amplifies its reach, catering to the growing online shopping trend. In 2023, Genomma Lab reported that its digital channels contributed a notable portion to its overall sales, underscoring the importance of this accessible channel for consumer convenience and market penetration.

Consumer-Centric Innovation and Marketing

Genomma Lab's business model heavily leans into consumer-centric innovation, meaning they prioritize understanding what people want and need. This deep dive into consumer desires fuels their product development pipeline, ensuring new offerings are relevant and appealing. For instance, in 2023, the company reported a significant increase in new product introductions, directly addressing evolving consumer preferences in the health and wellness sectors.

Their marketing strategies are meticulously crafted to build genuine connections with consumers. By focusing on clear communication of product benefits, Genomma Lab aims to foster brand loyalty and trust. This approach has proven effective, with their brands consistently ranking high in consumer recognition surveys across Latin America. In the first half of 2024, marketing investments were strategically allocated to digital platforms, yielding a notable 15% uplift in direct consumer engagement metrics.

- Consumer Understanding: Genomma Lab invests in market research to identify unmet consumer needs, driving product development.

- Product Resonance: New product launches are designed to directly address identified consumer preferences and pain points.

- Brand Connection: Marketing campaigns focus on communicating value and building emotional ties with the target audience.

- Digital Engagement: Increased focus on digital marketing in 2024 has boosted consumer interaction and brand recall.

Value for Money through Efficient Operations

Genomma Lab's commitment to value for money is deeply rooted in its efficient operations. By maintaining a low-cost, highly flexible operating model, the company can offer competitively priced products without compromising on quality. This strategic approach allows them to pass savings onto consumers, making premium health and personal care items more accessible.

Continuous productivity initiatives are key to this value proposition. For instance, in 2023, Genomma Lab reported a gross profit margin of 57.8%, demonstrating their ability to manage costs effectively while ensuring profitability. This operational efficiency directly translates into affordability for the end consumer.

- Low-Cost Operations: Genomma Lab leverages a lean and agile operational structure to minimize overheads.

- Productivity Gains: Ongoing efforts to enhance efficiency across manufacturing and distribution contribute to cost savings.

- Competitive Pricing: These operational efficiencies enable the company to offer attractive price points for its diverse product portfolio.

- Affordable Quality: Consumers benefit from access to high-quality products at prices that represent excellent value.

Genomma Lab offers a broad spectrum of accessible health and personal care products, catering to everyday consumer needs with convenience and reliability. Their extensive portfolio, encompassing over-the-counter pharmaceuticals and personal care items, ensures consumers can easily find solutions for their daily well-being and grooming routines.

The company's strength lies in developing and marketing premium, trusted brands that often lead their respective categories. This focus on quality and efficacy builds deep consumer loyalty, making their products a go-to choice for specific health and beauty concerns.

Genomma Lab's value proposition is further amplified by its extensive distribution network, reaching diverse consumer segments across various locations, complemented by a growing e-commerce presence. This multi-channel accessibility ensures their products are readily available, aligning with modern consumer shopping habits.

In 2023, Genomma Lab's operational efficiency, demonstrated by a 57.8% gross profit margin, allows them to offer high-quality products at competitive prices, embodying excellent value for money.

In the first half of 2024, strategic digital marketing investments resulted in a 15% increase in consumer engagement, highlighting their successful approach to building brand connections.

Customer Relationships

Genomma Lab leverages widespread mass marketing, heavily utilizing television advertising and digital platforms, to reach its broad consumer base. This strategy is crucial for building brand awareness and generating significant demand for its diverse product portfolio.

In 2024, Genomma Lab's commitment to mass marketing was evident in its substantial advertising spend, which contributed to its strong market presence across Latin America. For instance, the company consistently invests a significant portion of its revenue into promotional activities to maintain top-of-mind awareness.

Genomma Lab leverages digital marketing and e-commerce platforms to connect with consumers, aiming to boost online traffic and enable direct sales. This strategy involves enhancing online visibility and actively engaging customers through various digital content initiatives.

In 2024, the company continued to invest in its digital presence, with e-commerce sales showing robust growth, contributing significantly to its overall revenue stream. This digital engagement is crucial for building brand loyalty and understanding consumer preferences in real-time.

Genomma Lab cultivates strong brand loyalty by offering premium products that directly meet consumer needs, leading to repeat purchases. Their commitment to consistent product quality underpins this customer engagement, ensuring satisfaction and encouraging continued patronage across their diverse portfolio.

Consumer Feedback and Market Research

Genomma Lab Internacional actively gathers consumer feedback to refine its product pipeline and marketing efforts. This approach ensures their offerings resonate with evolving market demands.

Market research is a cornerstone, allowing Genomma Lab to understand consumer preferences and identify emerging trends. For instance, in 2024, the company continued to leverage digital platforms for real-time consumer sentiment analysis, a key driver for their agile product development cycles.

- Consumer Insights: Genomma Lab utilizes data analytics from social media listening and online reviews to gauge product reception and identify areas for improvement.

- Market Research Investment: The company allocates significant resources to market research, including surveys and focus groups, to inform strategic decisions.

- Product Development: Feedback directly influences new product launches and existing product enhancements, ensuring alignment with consumer needs.

- 2024 Focus: A notable trend in 2024 was the increased emphasis on personalized marketing campaigns informed by granular consumer data.

Community Engagement and Sustainability Initiatives

Genomma Lab's commitment to community engagement is a cornerstone of its customer relationships. Their sustainability strategy actively involves initiatives that benefit society, fostering goodwill and trust.

- Corporate Volunteer Programs: Genomma Lab encourages employee participation in volunteer activities, directly contributing to local communities.

- Product Donations: The company regularly donates pharmaceutical and personal care products, addressing essential needs and demonstrating social responsibility.

- Building Trust: These actions are designed to cultivate positive relationships and enhance the company's reputation within the regions where it operates, strengthening its social license to operate.

Genomma Lab fosters deep customer relationships through consistent brand messaging and active engagement across multiple touchpoints. Their strategy prioritizes understanding consumer needs via market research and direct feedback, which directly informs product development and marketing efforts.

In 2024, Genomma Lab continued to invest heavily in mass marketing, particularly through television and digital channels, to maintain high brand visibility and drive demand. This approach is central to their customer acquisition and retention strategies, ensuring their products remain top-of-mind for a broad consumer base.

The company's digital transformation in 2024 saw a significant increase in e-commerce sales, highlighting the growing importance of online channels for direct customer interaction and sales. This digital focus allows for real-time consumer insights and personalized engagement, further strengthening brand loyalty.

Genomma Lab's community initiatives and product donations in 2024 underscore their commitment to social responsibility, building trust and positive sentiment among consumers. These efforts are integral to cultivating long-term relationships and reinforcing their brand's value beyond just product offerings.

Channels

Genomma Lab heavily relies on modern trade retailers like large supermarket chains and hypermarkets for its personal care and OTC pharmaceutical products. In 2024, these channels are crucial for achieving widespread consumer access and brand visibility across Latin America.

Genomma Lab leverages pharmaceutical wholesalers and major pharmacy chains as critical distribution channels, ensuring broad accessibility of its over-the-counter (OTC) medications and health products. This strategy places Genomma Lab's offerings directly within specialized healthcare retail environments where consumers actively seek these items.

In 2024, the pharmaceutical wholesale market in Latin America, a key region for Genomma Lab, continued to be dominated by a few major players, facilitating efficient product movement. For instance, companies like Marzam in Mexico, a significant distributor, handle a vast array of pharmaceutical products, including those from Genomma Lab, reaching thousands of pharmacies.

E-commerce platforms, such as Amazon and Mercado Libre, represent a crucial direct-to-consumer sales channel for Genomma Lab. In 2024, these online marketplaces are vital for expanding reach, especially in markets with strong digital adoption, enabling Genomma Lab to capture a larger share of the consumer goods market.

Independent Pharmacies and 'Mom & Pops'

Independent pharmacies and 'mom & pop' stores are crucial distribution channels for Genomma Lab, ensuring broad market penetration, especially among lower-income demographics. This strategy taps into communities where larger retail chains may have a lesser presence, allowing Genomma Lab to reach consumers at the 'Bottom-of-the-Pyramid'.

In 2024, the independent pharmacy sector continued to be a vital part of the healthcare ecosystem, with estimates suggesting that these businesses account for a significant portion of prescription sales in many regions. For instance, in the US, independent pharmacies dispense approximately 30% of all prescriptions. Genomma Lab leverages this established network to place its products, benefiting from the trust and local relationships these stores cultivate with their customers.

- Point-of-Sale Visibility: Independent pharmacies offer prime shelf space, directly influencing consumer purchasing decisions at the critical moment of sale.

- Diverse Consumer Reach: 'Mom & pop' stores, often located in underserved urban and rural areas, provide access to a broad consumer base that might otherwise be difficult to reach.

- Cost-Effective Distribution: Partnering with these smaller outlets can be more cost-efficient than solely relying on large retail chains, optimizing Genomma Lab's distribution expenses.

- Market Penetration: This channel is key to Genomma Lab's strategy of achieving widespread availability for its pharmaceutical and personal care products across various socio-economic strata.

Direct Sales Distribution (DSD)

Genomma Lab leverages Direct Sales Distribution (DSD) in select markets, particularly for high-volume consumer goods where on-the-ground merchandising and timely replenishment are crucial. This model allows for greater control over product placement and consumer engagement, directly impacting sales velocity.

In 2024, Genomma Lab's DSD efforts focused on optimizing routes and inventory management for its over-the-counter (OTC) pharmaceutical and personal care products. For instance, in Mexico, a key market, DSD allows for efficient stocking of thousands of small independent pharmacies that might otherwise be underserved.

- Market Penetration: DSD enables Genomma Lab to reach a wider array of retail points, including smaller outlets, that may not be covered by traditional wholesale channels.

- Merchandising Control: Direct engagement through DSD teams ensures optimal product visibility and adherence to promotional guidelines at the point of sale.

- Inventory Management: Real-time feedback from DSD routes allows for more accurate demand forecasting and stock rotation, minimizing out-of-stock situations.

- Cost Efficiency: While requiring investment in logistics, DSD can reduce intermediary markups and improve overall supply chain efficiency for specific product categories.

Genomma Lab's channels strategy in 2024 emphasizes a multi-pronged approach, combining modern trade, pharmaceutical wholesalers, e-commerce, and independent pharmacies to ensure broad market reach. This diverse network allows the company to cater to different consumer segments and purchasing habits across Latin America. The integration of these channels is vital for maintaining brand presence and driving sales volume for its personal care and OTC pharmaceutical products.

| Channel Type | Key Characteristics | 2024 Focus/Data | Genomma Lab Strategy |

|---|---|---|---|

| Modern Trade (Supermarkets/Hypermarkets) | High foot traffic, broad consumer access, brand visibility | Crucial for mass-market penetration. In 2024, these retailers continued to be primary points of purchase for consumer goods in Latin America. | Ensuring prominent shelf placement and promotional activities. |

| Pharmaceutical Wholesalers & Pharmacy Chains | Specialized healthcare retail, direct access to OTC seekers | Facilitate efficient distribution to pharmacies. Major wholesalers like Marzam in Mexico are key partners. | Leveraging established networks for broad OTC accessibility. |

| E-commerce Platforms (Amazon, Mercado Libre) | Direct-to-consumer, expanding digital reach | Vital for capturing digitally active consumers. Online sales growth remained a priority in 2024. | Expanding online product offerings and optimizing digital marketing. |

| Independent Pharmacies & 'Mom & Pop' Stores | Community-based, access to lower-income demographics, trust | Account for a significant portion of prescription sales in many regions, offering localized reach. | Targeting underserved areas and building local relationships. |

Customer Segments

The core customer base for Genomma Lab's OTC pharmaceuticals is the broad mass market, individuals actively seeking readily available solutions for everyday health concerns. This includes a vast demographic looking for relief from common ailments such as headaches, colds, digestive upset, and flu symptoms.

In 2024, the global over-the-counter (OTC) pharmaceutical market continued its robust growth, projected to reach over $200 billion. This segment represents a significant portion of that market, driven by self-care trends and increasing consumer awareness of accessible health solutions.

Genomma Lab's personal care product users represent a broad consumer base seeking diverse solutions for their daily routines. This segment includes individuals interested in skincare, beauty, specialized hair care, shampoos, and targeted treatments like anti-acne products, as well as cosmetics.

In 2024, the personal care market continued its robust growth, with consumers increasingly prioritizing products that offer efficacy and value. Genomma Lab's extensive portfolio caters to these demands, ensuring accessibility across various income levels and geographical regions.

Health and wellness conscious individuals are a key customer segment, actively seeking products that support their healthy lifestyles. This includes a strong demand for items like isotonic beverages, which are popular for hydration and recovery. In 2024, the global sports drink market was valued at approximately $30 billion, reflecting the significant interest in these products.

Furthermore, this segment shows growing interest in emerging health categories. Infant nutrition is a particularly important area, driven by parental concern for early childhood development. The global infant formula market alone was projected to reach over $100 billion by 2024, highlighting the substantial investment parents are willing to make in their children's health.

Antibacterial solutions also resonate with health-conscious consumers, especially in the post-pandemic era. They are looking for products that offer protection and peace of mind. The global hand sanitizer market, a key component of antibacterial solutions, saw a surge in demand, with sales reaching tens of billions of dollars in recent years, underscoring the persistent focus on hygiene.

Consumers Across the Americas

Genomma Lab's consumer base spans the Americas, with a significant presence in Mexico, its home market. The company has strategically expanded its reach into other key Latin American countries like Brazil and Colombia, alongside a growing footprint in the United States. This broad geographic focus allows Genomma Lab to tap into diverse consumer needs and preferences across various economies.

In 2024, Genomma Lab reported robust performance in its key markets. For instance, its operations in Mexico continue to be a cornerstone of its revenue, demonstrating sustained consumer demand for its health and wellness products. The company's efforts to penetrate and grow in markets like Brazil and Colombia are yielding positive results, contributing to its overall revenue growth trajectory.

- Mexico: Remains Genomma Lab's largest market, showing consistent consumer engagement with its diverse product portfolio.

- Brazil & Colombia: These markets represent significant growth opportunities, with increasing brand recognition and sales volume.

- United States: Genomma Lab is actively expanding its presence, targeting specific demographic segments with its specialized product offerings.

- Central America & Other Latin American Countries: These regions collectively contribute to Genomma Lab's diversified revenue streams, highlighting the company's extensive regional penetration.

Value-Seeking Shoppers Across Income Levels

Genomma Lab's value-seeking shoppers are a broad demographic, encompassing individuals from the 'Bottom-of-the-Pyramid' to higher income brackets. This wide reach is facilitated by the company's extensive distribution network, ensuring product accessibility across diverse economic segments. For instance, in 2023, Genomma Lab reported a significant portion of its sales originating from emerging markets, where price sensitivity is a key purchasing driver.

The company strategically positions its products to offer a compelling balance between quality and affordability. This approach resonates particularly well in 2024, a year marked by continued inflationary pressures in many Latin American economies. Consumers are actively seeking out brands that deliver reliable performance without demanding premium prices.

- Broad Income Reach: Serves consumers from low-income to high-income segments.

- Price-Quality Balance: Offers products that are both affordable and of good quality.

- Market Penetration: Leverages an extensive distribution network for wide accessibility.

- Economic Sensitivity: Caters to consumers seeking value, especially during economic upturns or downturns.

Genomma Lab's customer segments are diverse, encompassing the mass market for over-the-counter pharmaceuticals and personal care products, as well as health-conscious individuals seeking specialized items like isotonic beverages and infant nutrition. The company also targets value-seeking shoppers across all income levels, emphasizing a balance of quality and affordability.

In 2024, the company's strategic focus on key markets like Mexico, Brazil, and Colombia continued to drive growth. Genomma Lab's extensive distribution network ensures its products reach a wide array of consumers, from those in emerging markets to those in more developed economies like the United States.

| Customer Segment | Key Characteristics | 2024 Market Relevance |

|---|---|---|

| Mass Market (OTC & Personal Care) | Individuals seeking solutions for common health issues and daily routines. | Continual demand driven by self-care trends and accessibility. |

| Health & Wellness Conscious | Consumers prioritizing healthy lifestyles, including hydration and early childhood development. | Significant growth in sports drinks (est. $30 billion market) and infant nutrition (est. $100 billion market). |

| Value-Seeking Shoppers | Consumers across all income levels looking for affordable, quality products. | Crucial segment, especially amidst inflationary pressures in Latin America. |

| Geographic Focus | Latin America (Mexico, Brazil, Colombia) and the United States. | Mexico remains a core market; Brazil and Colombia show strong growth potential. |

Cost Structure

Manufacturing and production costs represent a substantial component of Genomma Lab Internacional's cost structure. These expenses encompass the procurement of raw materials, essential for their diverse product portfolio, as well as packaging materials that ensure product integrity and branding. Operational costs associated with maintaining and running their production facilities are also significant.

In 2024, Genomma Lab Internacional continued its focus on optimizing these manufacturing expenses. The company actively pursues efficiencies within its production processes to drive down costs. For instance, through strategic sourcing of raw materials and improvements in production line efficiency, they aim to enhance their profit margins while maintaining high product quality.

Genomma Lab dedicates significant resources to marketing and advertising, a crucial element for its consumer-focused product portfolio. These expenses are vital for building brand recognition and driving sales across diverse channels.

In 2024, the company continued its robust investment in consumer-oriented marketing, brand building, and advertising campaigns. This strategy encompasses a wide array of media platforms, with a notable emphasis on television and digital channels, aimed at maximizing product awareness and ultimately boosting sales figures.

Genomma Lab's commitment to innovation is reflected in its significant Research and Development (R&D) investments. These costs are crucial for developing new pharmaceutical and personal care products, enhancing existing formulations, and conducting necessary clinical studies. This ongoing investment fuels their pipeline and ensures continued market relevance.

In 2024, Genomma Lab's R&D expenses are a cornerstone of its strategy to maintain a competitive edge. The company allocates resources to explore novel ingredients, refine product efficacy, and meet stringent regulatory requirements across its diverse product lines. This focus on R&D is vital for long-term growth and market penetration.

Distribution and Logistics Costs

Genomma Lab Internacional's distribution and logistics costs are a substantial component of its overall expenses. These include the warehousing of finished goods, the transportation of products to various retail points, and the intricate management of its widespread distribution channels across numerous Latin American countries. In 2023, the company reported that its cost of sales, which encompasses many of these logistical elements, was approximately MXN 11,484 million.

The company actively pursues strategies to streamline and reduce these operational expenditures. This focus on optimization is crucial for maintaining competitive pricing and improving profit margins in a dynamic market. Efforts are directed towards enhancing supply chain efficiency and reducing transit times.

- Warehousing Expenses: Costs associated with maintaining storage facilities for a broad product portfolio.

- Transportation Fees: Expenditure on moving goods from manufacturing sites to distribution centers and then to retailers.

- Distribution Network Management: Costs related to managing relationships and operations with a vast network of distributors and retailers.

- Logistics Optimization Initiatives: Investments in technology and processes to improve efficiency and reduce overall supply chain costs.

General, Administrative, and Operational Costs

Genomma Lab Internacional's General, Administrative, and Operational (GA&O) costs are foundational to its business model. These encompass essential expenses like salaries and benefits for administrative personnel, the upkeep of facilities, and the robust IT infrastructure that underpins its extensive distribution network and digital presence. In 2024, the company continued to focus on optimizing these overheads through productivity initiatives. For instance, investments in digital transformation aimed to streamline administrative processes, potentially reducing the need for manual intervention and associated labor costs.

These operational expenses are critical for maintaining the company's day-to-day functions and supporting its broad product portfolio. Productivity drives in 2024 specifically targeted areas like supply chain management and back-office operations to identify potential savings. This focus on efficiency within GA&O is a continuous effort to ensure that resources are allocated effectively, contributing to overall profitability and allowing for reinvestment in growth areas.

- Salaries and Benefits: Covering administrative and support staff essential for business operations.

- Facility Maintenance: Costs associated with maintaining offices, warehouses, and other operational sites.

- IT Infrastructure: Expenses for software, hardware, cybersecurity, and network management.

- Overhead Costs: Including utilities, insurance, legal fees, and other general business expenses.

Genomma Lab's cost structure is heavily influenced by manufacturing, marketing, and R&D. In 2024, the company continued to prioritize efficiency in production and strategic marketing investments across various media. Significant R&D spending fuels product innovation and market competitiveness.

Distribution and logistics represent a considerable expense, with warehousing and transportation being key components. The company actively seeks to optimize these supply chain operations to improve margins. In 2023, Genomma Lab's cost of sales, encompassing many of these elements, stood at approximately MXN 11,484 million.

General, Administrative, and Operational (GA&O) costs, including salaries, facility upkeep, and IT infrastructure, are also vital. In 2024, efforts focused on productivity initiatives and digital transformation to streamline these overheads and enhance efficiency.

| Cost Component | 2023 (MXN Million) | 2024 Focus |

| Cost of Sales (includes manufacturing & logistics) | 11,484 | Optimization for efficiency and margin improvement |

| Marketing & Advertising | Significant Investment | Expansion across TV and digital channels |

| Research & Development (R&D) | Cornerstone of Strategy | New ingredients, product refinement, regulatory compliance |

| General, Administrative, & Operational (GA&O) | Essential Overheads | Productivity initiatives, digital transformation |

Revenue Streams

Genomma Lab's core business revolves around selling a wide array of over-the-counter (OTC) pharmaceutical products. This includes popular items for pain management, cold and flu relief, and digestive health.

In 2024, Genomma Lab reported significant sales from its OTC portfolio, a testament to its strong brand recognition and extensive distribution network across Latin America. For instance, their pain relief segment consistently performs well, contributing a substantial portion to overall revenue.

Genomma Lab Internacional's revenue is significantly driven by its extensive portfolio of personal care products. This category encompasses a wide array of items, including advanced skincare solutions, cosmetic and beauty care products, specialized hair care treatments, shampoos, and effective anti-acne formulations.

In 2024, Genomma Lab reported robust sales performance, with its personal care segment continuing to be a primary revenue generator. For instance, the company's strong presence in Latin America, a key market, saw consistent demand for its skincare and hair care lines, contributing to overall financial growth.

Genomma Lab's beverage segment is a significant revenue driver, with isotonic drinks like Suerox leading the charge. In 2023, the company reported that its beverage division, which includes these popular isotonic options, experienced robust growth, contributing substantially to overall sales. This segment benefits from strong brand recognition and effective distribution networks across Latin America.

International Market Sales

Genomma Lab's international sales are a cornerstone of its business, showcasing a robust geographical diversification. Key revenue drivers are found across the Americas, with significant contributions stemming from Mexico, the United States, and Brazil. The company also benefits from strong performance in Colombia and Central America, demonstrating a broad regional reach.

The company's strategy emphasizes capturing market share in established territories while also navigating evolving economic landscapes. For instance, in 2024, Genomma Lab reported that its international operations contributed substantially to its overall financial health, with specific growth observed in markets like Brazil, which has shown resilience and recovery.

- Geographic Diversification: Revenue is spread across Mexico, US, Brazil, Colombia, Central America, and Argentina.

- Key Market Performance: Mexico, US, and Brazil are significant contributors to international sales.

- Market Presence: A recovering presence in Argentina indicates strategic market engagement.

- 2024 Impact: International operations played a crucial role in the company's financial performance during the year.

New Product Category Sales

Genomma Lab Internacional actively expands its revenue base by introducing new product categories. This strategic move diversifies its offerings and taps into new market segments. For instance, the company has ventured into infant nutrition and antibacterial product lines, aiming to capture a larger share of consumer spending in these growing areas.

These new product categories are designed to drive incremental revenue growth. By entering markets like infant nutrition, Genomma Lab leverages existing distribution channels and brand recognition to achieve faster market penetration. This approach not only broadens the company's revenue streams but also strengthens its overall market position.

- Infant Nutrition: Entering a market with consistent demand and brand loyalty potential.

- Antibacterial Products: Capitalizing on increased consumer awareness regarding health and hygiene.

- Portfolio Diversification: Reducing reliance on existing product lines and mitigating market-specific risks.

- Revenue Growth: Directly contributing to top-line expansion through new customer acquisition and increased market penetration.

Genomma Lab's revenue streams are primarily built upon its strong performance in the over-the-counter (OTC) pharmaceutical and personal care product segments. The company also sees significant contributions from its beverage division, particularly isotonic drinks, and benefits from robust international sales across various Latin American countries and the United States.

| Revenue Stream | Key Products | 2024 Performance Highlight |

|---|---|---|

| OTC Pharmaceuticals | Pain relief, cold & flu, digestive health | Strong sales driven by brand recognition and distribution |

| Personal Care | Skincare, cosmetics, hair care, anti-acne | Primary revenue generator with consistent demand in key markets |

| Beverages | Isotonic drinks (e.g., Suerox) | Robust growth, substantial contribution to overall sales |

| International Sales | Diverse portfolio across Mexico, US, Brazil, Colombia, Central America | Significant contributor to financial health, with growth in markets like Brazil |

Business Model Canvas Data Sources

The Genomma Lab Internacional Business Model Canvas is constructed using a blend of internal financial data, comprehensive market research reports, and strategic insights derived from industry analysis. These diverse sources ensure each component of the canvas is grounded in accurate, actionable information.