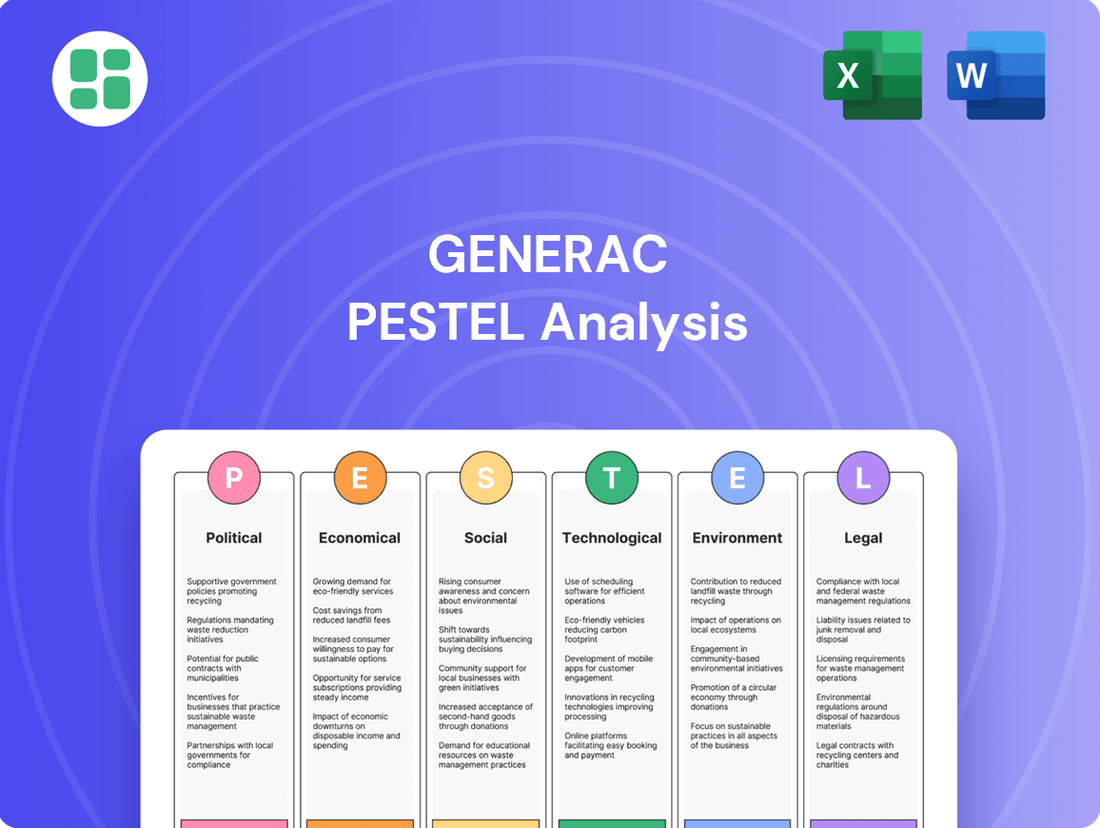

Generac PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Generac Bundle

Uncover the critical Political, Economic, Social, Technological, Environmental, and Legal factors shaping Generac's trajectory. This comprehensive PESTLE analysis provides actionable intelligence, empowering you to anticipate market shifts and capitalize on opportunities. Download the full version now and gain a strategic advantage.

Political factors

Governments are actively promoting energy resilience through incentives. For instance, the U.S. Inflation Reduction Act of 2022 offers significant tax credits for home energy storage systems, a key area for Generac. These policies encourage adoption of backup power, directly boosting demand for Generac's products by making them more affordable.

National and regional policies are increasingly pushing for grid modernization, creating a fertile ground for companies like Generac. These initiatives often focus on making the energy grid more resilient, efficient, and capable of integrating distributed energy resources. For instance, the U.S. Department of Energy's Grid Deployment Office is overseeing significant investments in grid modernization projects, aiming to enhance reliability and incorporate renewable energy sources. This trend directly benefits Generac as it offers solutions like energy storage systems and smart home energy management devices that are crucial for a decentralized and smarter grid.

Fluctuations in international trade policies, including tariffs, directly influence Generac's operational costs. For instance, the U.S. imposed tariffs on steel and aluminum in 2018, which could have affected manufacturing expenses for generators, though specific impacts on Generac's 2024-2025 financials are proprietary. These policies can ripple through the supply chain, impacting component pricing and availability.

Geopolitical tensions and trade disputes present ongoing challenges. For example, ongoing trade friction between major economic blocs can disrupt market access for Generac's products or necessitate adjustments to pricing strategies in key regions. Navigating these complex international relations is crucial for maintaining global sales growth and profitability.

Regulatory Support for Distributed Generation

Policies that encourage distributed generation, like net metering and streamlined interconnection for solar and storage, directly fuel the demand for Generac's products. These regulations empower homes and businesses to produce and store their own electricity, creating a more robust market for Generac's integrated energy solutions.

For instance, in 2024, several U.S. states continued to refine their net metering policies, with some expanding access and others adjusting compensation rates. The Solar Energy Industries Association (SEIA) reported that by the end of 2023, solar capacity continued to grow, with residential solar installations seeing a significant uptick, partly driven by these supportive policies.

- Net Metering Expansion: States like California and Massachusetts have maintained or enhanced net metering programs, making it more financially attractive for homeowners to install solar and Generac's battery storage.

- Interconnection Simplification: Efforts to simplify the process for connecting distributed energy resources (DERs) to the grid, such as updated interconnection standards in states like New York, reduce barriers for Generac's customers.

- Investment Tax Credits (ITC): The continuation and potential enhancements of federal tax credits, like the ITC for solar and storage, provide direct financial incentives that increase the affordability and adoption of Generac's systems.

- Grid Modernization Initiatives: Investments in grid modernization, often supported by state and federal programs, can create opportunities for distributed generation to participate in grid services, further enhancing the value proposition of Generac's offerings.

Political Stability in Key Markets

Political stability in Generac's key markets, particularly North America and Europe, is paramount for sustained demand and operational continuity. For instance, the U.S. presidential election cycle in 2024 and its potential policy shifts regarding infrastructure spending and energy regulations could influence demand for Generac's backup power solutions.

Unstable political landscapes can introduce significant economic headwinds. Currency volatility, as seen with fluctuations in the Euro against the U.S. dollar in late 2023 and early 2024, directly impacts Generac's international sales figures and profitability. Moreover, geopolitical tensions can disrupt supply chains and distribution networks, as experienced with earlier global shipping challenges.

- North American Market Stability: The U.S. market, representing a substantial portion of Generac's revenue, benefits from a relatively stable political framework, although upcoming elections in 2024 introduce a degree of uncertainty regarding potential regulatory changes.

- European Market Dynamics: European political stability, while generally strong, faces regional variations. For example, ongoing discussions around energy independence and climate policies in the EU could create both opportunities and challenges for Generac's product adoption.

- Impact of Trade Policies: Changes in international trade agreements and tariffs, which can be influenced by political decisions, directly affect the cost of imported components and the competitiveness of Generac's exported products.

Government incentives, such as the U.S. Inflation Reduction Act of 2022, significantly boost demand for Generac's energy storage solutions through tax credits, making backup power more accessible. Continued policy support for grid modernization and distributed energy resources, like net metering and simplified interconnection, further enhances the market for Generac's integrated systems. Political stability in key markets like North America and Europe is crucial, though upcoming elections in 2024 introduce potential policy shifts that could impact demand.

| Policy Area | Impact on Generac | 2024/2025 Relevance |

|---|---|---|

| Energy Resilience Incentives | Increased adoption of backup power solutions | IRA tax credits continue to drive home energy storage sales. |

| Grid Modernization Initiatives | Demand for smart grid-compatible products | DOE investments support decentralized energy infrastructure. |

| Distributed Generation Policies | Growth in solar and storage integration | Net metering and interconnection rules influence residential market growth. |

| Trade and Tariffs | Potential impact on manufacturing costs | Geopolitical tensions can affect component pricing and market access. |

What is included in the product

This Generac PESTLE Analysis systematically examines the influence of Political, Economic, Social, Technological, Environmental, and Legal forces on the company's strategic landscape.

It provides actionable insights for identifying potential risks and capitalizing on emerging opportunities within Generac's operating environment.

Provides a clear, actionable framework that helps Generac identify and address external challenges, thereby reducing uncertainty and mitigating potential business disruptions.

Economic factors

Consumer spending is a significant driver for Generac. In the first quarter of 2024, U.S. retail sales saw a healthy increase, reflecting continued consumer confidence and a willingness to spend on discretionary items, which bodes well for Generac's residential product demand.

Economic growth directly correlates with increased investment in infrastructure and business expansion, boosting demand for Generac's commercial power solutions. As of early 2024, GDP growth projections indicate a stable economic environment, supporting capital expenditures by businesses.

When the economy is robust, consumers often have more disposable income, making them more inclined to invest in home improvements and backup power solutions like Generac generators. This trend was evident in 2023, where consumer spending contributed positively to overall economic output.

Rising interest rates significantly impact Generac by increasing the cost of capital for its operations and potentially reducing consumer demand for its products. For instance, the Federal Reserve's aggressive rate hikes throughout 2022 and 2023, with the federal funds rate reaching a range of 5.25% to 5.50% by July 2023, made borrowing more expensive for both Generac and its customers, potentially slowing sales of larger investments like whole-home generators.

Conversely, periods of lower interest rates can act as a catalyst for Generac's business. When borrowing costs are low, consumers are more likely to finance significant purchases such as standby generators or integrated home energy solutions. This was evident in the historically low interest rate environment of 2020-2021, which supported consumer spending on durable goods, including home improvement and backup power solutions.

Fluctuations in electricity prices and concerns over grid reliability, often driven by extreme weather or aging infrastructure, can significantly increase demand for backup power and energy independence solutions. For instance, in early 2024, wholesale electricity prices in some regions saw considerable volatility, with prices spiking during peak demand periods, making the appeal of self-generation and storage solutions even stronger for consumers and businesses alike.

Higher utility costs directly translate to increased attractiveness for energy storage and self-generation technologies. As of Q1 2024, average residential electricity rates in the U.S. continued their upward trend, reaching approximately $0.17 per kilowatt-hour, according to the U.S. Energy Information Administration (EIA). This makes the return on investment for solar and battery storage systems more compelling.

Supply Chain Costs and Inflation

Inflationary pressures significantly impact Generac's cost of goods sold. For instance, in early 2024, the Producer Price Index (PPI) for manufactured goods saw notable increases, directly affecting the cost of raw materials like steel and aluminum, essential for Generac's generator and energy storage products. This also extends to key components and the rising cost of logistics, including shipping and trucking, which can compress profit margins if not effectively passed on to consumers or managed through operational efficiencies.

Managing supply chain resilience and costs remains a critical challenge for Generac amidst ongoing global economic uncertainties. Disruptions, whether from geopolitical events or natural disasters, can lead to shortages and further price volatility. For example, the semiconductor shortage experienced through 2023 and into 2024 continued to affect the availability and cost of electronic components used in Generac's advanced control systems, highlighting the need for robust supplier relationships and diversified sourcing strategies.

- Rising Material Costs: Steel prices, a key input for Generac, experienced a significant surge in late 2023 and early 2024, impacting manufacturing expenses.

- Logistics Expenses: Freight rates, particularly for ocean shipping, remained elevated in early 2024 compared to pre-pandemic levels, increasing transportation costs.

- Component Availability: Continued challenges in securing certain electronic components, like microcontrollers, in 2024 added to production lead times and costs.

- Inflationary Impact on Margins: Generac's ability to absorb or pass on these increased costs directly influences its gross profit margins.

Competitive Landscape and Pricing Pressure

The energy technology and backup power sectors are seeing a surge in new entrants, intensifying competition and creating significant pricing pressure for established players like Generac. This influx of competitors, ranging from traditional appliance manufacturers expanding into power solutions to specialized energy tech startups, means Generac needs to constantly reassess its pricing strategies to remain competitive without sacrificing margins. For instance, the residential standby generator market, a core area for Generac, has witnessed increased activity from companies like Kohler and Briggs & Stratton, alongside emerging players offering integrated solar and battery storage solutions.

To navigate this dynamic environment and maintain its market share and profitability, Generac must prioritize continuous innovation and product differentiation. This involves not only enhancing the core functionality of its backup power systems but also integrating smart technology, improving energy efficiency, and offering comprehensive energy management solutions that go beyond simple power generation. The company's focus on expanding its clean energy offerings, such as its PWRcell battery storage systems, directly addresses this need for differentiation in a market increasingly focused on sustainable and integrated energy solutions.

Key competitive factors impacting Generac include:

- Increased Market Entry: The growing demand for reliable backup power, driven by grid instability and a desire for energy independence, attracts new competitors.

- Price Sensitivity: As more options become available, consumers and businesses may become more price-sensitive, forcing manufacturers to compete on cost.

- Technological Advancements: Competitors are rapidly introducing new technologies, such as advanced battery storage and smart grid integration, requiring Generac to invest heavily in R&D.

- Service and Support Networks: A strong dealer and service network is crucial for customer satisfaction and retention, becoming a key differentiator in a crowded market.

Economic factors significantly influence Generac's performance, with consumer spending and GDP growth acting as key demand drivers for both residential and commercial products. For example, Q1 2024 U.S. retail sales showed robust growth, indicating strong consumer confidence. However, rising interest rates, exemplified by the Federal Reserve's rate reaching 5.25%-5.50% by July 2023, increase borrowing costs for Generac and its customers, potentially dampening sales of higher-ticket items like standby generators.

Inflationary pressures, as seen in the early 2024 increase in the Producer Price Index for manufactured goods, directly impact Generac's cost of goods sold, affecting raw material and component expenses. Supply chain disruptions, such as the ongoing semiconductor shortage into 2024, further exacerbate cost and availability challenges.

Utility cost trends also play a vital role; rising residential electricity rates, approximately $0.17 per kilowatt-hour in early 2024, enhance the appeal of Generac's energy storage and self-generation solutions. Conversely, volatility in wholesale electricity prices in early 2024 incentivizes backup power adoption.

| Economic Indicator | Generac Impact | Data Point/Trend (2023-2024) |

|---|---|---|

| Consumer Spending | Drives residential product demand | U.S. retail sales increased in Q1 2024 |

| GDP Growth | Boosts commercial power solutions demand | Stable GDP growth projections in early 2024 |

| Interest Rates | Increases borrowing costs, potentially reduces demand | Federal Funds Rate at 5.25%-5.50% (as of July 2023) |

| Inflation (PPI) | Raises cost of goods sold | PPI for manufactured goods increased in early 2024 |

| Electricity Prices | Increases demand for backup/storage solutions | Residential rates ~ $0.17/kWh (early 2024); wholesale price volatility |

Full Version Awaits

Generac PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Generac PESTLE analysis breaks down the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides a thorough understanding of the external forces shaping Generac's business landscape.

Sociological factors

The increasing frequency and severity of power outages, often linked to extreme weather events like hurricanes and heatwaves, are significantly boosting public awareness of the need for reliable backup power. For instance, the U.S. experienced an average of 1,370 power outages per million customer-hours in 2023, a notable increase from previous years, highlighting a growing societal vulnerability.

This heightened societal concern directly fuels demand for solutions like Generac's generators and energy storage systems. Consumers and businesses are actively seeking ways to maintain essential services and comfort during these disruptions, translating directly into increased sales for companies providing these critical backup power technologies.

A growing societal desire for energy independence is a significant driver for companies like Generac. This trend sees consumers and businesses actively seeking ways to reduce their reliance on traditional utility grids, often driven by concerns about grid reliability and rising energy costs.

This shift is directly reflected in market demand. For instance, the home standby generator market, a core area for Generac, saw robust growth, with sales increasing significantly in 2023 and projections indicating continued expansion through 2024 as homeowners prioritize backup power solutions.

Societal trends show a significant uptick in smart home technology adoption, with projections indicating the global smart home market could reach over $200 billion by 2025. This growing consumer demand for integrated energy management and automated control directly impacts how people interact with their homes and energy systems. Generac's strategic move into smart home devices and monitoring systems aligns perfectly with this societal preference for connected living, offering consumers enhanced convenience and energy efficiency.

Demographic Shifts and Homeownership Trends

Demographic shifts are significantly reshaping the demand for home standby solutions. As the population ages, there's a growing emphasis on comfort, security, and reliable power for medical equipment, driving interest in Generac's offerings. For instance, the U.S. Census Bureau reported that in 2023, individuals aged 65 and over constituted approximately 17.3% of the total population, a figure projected to rise.

Simultaneously, younger generations, often more environmentally conscious, are increasingly valuing sustainable and resilient living. This trend can translate into demand for energy-efficient backup power solutions that can integrate with renewable energy sources. The National Association of Realtors noted in late 2024 that a significant portion of millennial homebuyers prioritize energy efficiency and smart home technology.

Homeownership rates are a direct indicator of the potential market size for Generac's residential products. In the second quarter of 2024, the U.S. homeownership rate stood at around 66.2%, according to the U.S. Census Bureau, indicating a substantial base of potential customers for home standby generators. Fluctuations in these rates, influenced by economic conditions and housing affordability, directly impact market penetration opportunities.

- Aging Population: Approximately 17.3% of the US population was 65+ in 2023, a demographic segment prioritizing reliable home power.

- Younger Generations: Increased demand for sustainable and resilient home solutions, including integrated backup power.

- Homeownership Rate: The US homeownership rate was around 66.2% in Q2 2024, representing a broad market for residential backup power.

- Market Influence: Demographic trends and homeownership levels directly correlate with the addressable market for Generac's residential product line.

Environmental Consciousness and Sustainability

Societal values are increasingly prioritizing environmental consciousness, directly impacting consumer purchasing decisions. This shift is evident in the growing demand for energy-efficient products and solutions that actively reduce carbon footprints.

Generac is responding to this trend by focusing on developing more sustainable and integrated energy offerings. For instance, by the end of 2024, the company aims to have a significant portion of its new product lines incorporate enhanced energy efficiency features, aligning with consumer preferences for eco-friendly options.

Key areas of focus include:

- Development of smart home energy management systems that optimize power usage and reduce waste.

- Integration of renewable energy sources like solar power with backup generation capabilities.

- Investment in research and development for cleaner fuel technologies and more efficient engine designs.

- Transparency in reporting environmental impact and sustainability initiatives to build consumer trust.

Societal awareness of power grid vulnerabilities is a significant driver for Generac, amplified by increasing power outages. In 2023, the U.S. saw an average of 1,370 power outages per million customer-hours, a stark increase that heightens demand for reliable backup power solutions.

This growing concern directly translates into market opportunities for Generac, as both consumers and businesses seek energy independence and resilience against disruptions. The emphasis on smart home technology adoption, projected to exceed $200 billion globally by 2025, also aligns with Generac's offerings in integrated energy management.

Demographic shifts, such as an aging population prioritizing comfort and security, and younger generations valuing sustainability, further shape demand. The U.S. homeownership rate, around 66.2% in Q2 2024, provides a substantial addressable market for Generac's residential products.

Technological factors

Rapid advancements in battery chemistry, including improvements in lithium-ion performance and the exploration of solid-state batteries, are significantly increasing energy density and lifespan. This progress directly enhances the viability and appeal of Generac's energy storage systems, making them more competitive and efficient for both residential and commercial applications.

The cost of battery storage continues its downward trend, with projections indicating further reductions in the coming years. For instance, by 2025, the global average cost for lithium-ion battery packs is expected to be around $100 per kilowatt-hour, a substantial decrease from previous years, directly boosting the economic attractiveness of Generac's solutions.

The increasing integration of smart grid technologies and the Internet of Things (IoT) is fundamentally reshaping energy management. This evolution allows for enhanced connectivity and intelligence, paving the way for more efficient and responsive energy systems.

Generac is strategically positioned to capitalize on these trends, with its smart home devices and monitoring systems actively leveraging IoT advancements. These products offer consumers real-time data, remote control capabilities, and optimized energy usage, directly benefiting from the growing smart grid infrastructure.

For instance, by 2025, the global smart grid market is projected to reach over $100 billion, highlighting the significant investment and adoption of these technologies. Generac's ability to connect its products to this expanding network provides a substantial competitive advantage.

Generac is leveraging artificial intelligence and predictive analytics to revolutionize energy management. These technologies are key to enabling predictive maintenance, optimizing how energy is dispatched, and making power grids more resilient. For instance, by analyzing vast datasets, AI can forecast potential equipment failures before they occur, reducing downtime and maintenance costs.

By integrating AI and machine learning into its product ecosystem, Generac can offer more intelligent and efficient power solutions. This translates to enhanced reliability and performance for consumers and businesses alike. In 2024, the global AI market in the energy sector was projected to reach over $10 billion, highlighting the significant investment and growth in this area, a trend Generac is actively participating in.

Renewable Energy System Integration

Technological advancements in solar, wind, and other renewable energy sources are accelerating, with increasing emphasis on seamless integration. This trend directly fuels demand for sophisticated hybrid energy systems that combine traditional power generation with renewables and storage. Generac is strategically positioned to capitalize on this market evolution.

Generac's core competency lies in its ability to integrate its robust generator solutions with emerging battery storage technologies and renewable energy inputs. This integration capability is crucial for creating reliable and efficient hybrid power systems. For instance, the company's PWRcell energy storage system is designed to work harmoniously with solar inverters and grid-tied applications, enabling homeowners and businesses to manage diverse energy sources effectively.

The market for distributed energy resources (DERs), which includes renewables and storage, is experiencing significant growth. By 2025, the global residential energy storage market is projected to reach over $30 billion, with hybrid systems forming a substantial portion. Generac's focus on these integrated solutions allows it to capture a larger share of this expanding segment.

- Technological progress in solar and wind power continues to advance, making these sources more efficient and cost-effective.

- The demand for hybrid energy systems, combining renewables with traditional generation and storage, is on the rise.

- Generac's PWRcell system exemplifies its strategy to integrate generators with battery storage and renewable inputs.

- The global residential energy storage market is expected to exceed $30 billion by 2025, highlighting the significant opportunity for integrated solutions.

Manufacturing Automation and Efficiency

Generac is increasingly leveraging advancements in manufacturing automation and robotics to streamline its production lines. These technological upgrades are crucial for enhancing operational efficiency and maintaining cost competitiveness. For instance, the adoption of collaborative robots (cobots) in assembly processes allows for greater precision and faster throughput, directly impacting the cost of goods sold.

These improvements in manufacturing processes are not just about speed; they also significantly bolster product quality. By integrating advanced materials and precision automation, Generac can reduce defects and ensure greater consistency across its product range. This focus on quality is vital for building brand loyalty and meeting the high expectations of its diverse customer base.

Generac's strategic investments in these cutting-edge manufacturing technologies are designed to fortify its market position. The company's commitment to innovation in production processes directly supports its ability to accelerate the development and launch of new products, ensuring it remains at the forefront of the power generation industry. For example, by Q2 2024, Generac reported a 7% increase in production capacity at key facilities due to these automation initiatives.

- Enhanced Production Efficiency: Automation and robotics lead to quicker assembly times and reduced labor costs per unit.

- Improved Product Quality: Precision in automated processes minimizes errors and enhances the reliability of Generac's products.

- Strengthened Competitive Edge: Lower production costs and higher quality output allow Generac to offer more competitive pricing and superior products.

- Accelerated Innovation: Streamlined manufacturing processes facilitate faster prototyping and scaling of new product designs.

The rapid evolution of battery technology, particularly in lithium-ion and the emerging solid-state sector, is enhancing energy density and lifespan. This directly benefits Generac's energy storage solutions, making them more competitive and efficient for various applications.

The decreasing cost of battery storage, with projections for lithium-ion packs to approach $100 per kWh by 2025, significantly improves the economic viability of Generac's offerings.

Generac is actively integrating smart grid and IoT technologies into its product ecosystem, enabling more intelligent and responsive energy management. The global smart grid market is expected to surpass $100 billion by 2025, underscoring the significant opportunity for Generac's connected products.

Artificial intelligence and predictive analytics are being leveraged by Generac to optimize energy dispatch and enhance grid resilience, with the AI market in energy projected to exceed $10 billion in 2024.

Generac's strategic focus on integrating its generators with battery storage and renewable energy inputs, such as its PWRcell system, positions it well within the growing distributed energy resources market, which is projected to see the residential energy storage sector reach over $30 billion by 2025.

| Technological Factor | Impact on Generac | Supporting Data/Projections |

| Battery Technology Advancements | Improved energy density and lifespan for storage solutions | Lithium-ion battery pack costs projected near $100/kWh by 2025 |

| Smart Grid & IoT Integration | Enhanced energy management and connectivity | Global smart grid market to exceed $100 billion by 2025 |

| Artificial Intelligence & Predictive Analytics | Optimized energy dispatch, predictive maintenance | AI in energy market projected over $10 billion in 2024 |

| Renewable Energy Integration | Growth in hybrid energy systems | Residential energy storage market to exceed $30 billion by 2025 |

Legal factors

Generac must navigate a complex web of product safety regulations and certification standards across its global markets. For instance, in North America, compliance with Underwriters Laboratories (UL) standards, like UL 2200 for Stationary Engine Generator Assemblies, is essential for market entry. Similarly, Canadian markets require CSA certification, while European sales necessitate CE marking, demonstrating adherence to directives like the Low Voltage Directive.

Environmental regulations, particularly those concerning emissions and noise pollution, significantly shape Generac's operational landscape. The U.S. Environmental Protection Agency (EPA) and the California Air Resources Board (CARB) set stringent standards for generator emissions, directly influencing product development and the technologies Generac must incorporate. For instance, CARB's emission standards for off-road engines are among the strictest globally, requiring continuous innovation in engine design and exhaust after-treatment systems to ensure compliance for products sold in California.

Generac's increasing focus on smart home technology and connected devices, such as their PWRview monitoring system, necessitates strict adherence to evolving data privacy regulations. Laws like the California Consumer Privacy Act (CCPA) and the European Union's General Data Protection Regulation (GDPR) dictate how customer data must be collected, stored, and protected. Failure to comply can result in significant fines; for instance, GDPR penalties can reach up to 4% of global annual revenue or €20 million, whichever is higher.

Robust cybersecurity measures are not just good practice but a legal requirement for companies like Generac handling sensitive customer information. Protecting their connected product ecosystem from cyber threats is crucial to prevent data breaches, which can lead to substantial financial losses and severe damage to brand reputation. In 2023, the average cost of a data breach in the United States was reported to be $4.45 million, a figure that underscores the financial imperative of strong cybersecurity protocols.

Intellectual Property Rights and Patents

Protecting Generac's innovations through patents, trademarks, and copyrights is crucial for its market position. This legal framework shields its product designs and brand identity from unauthorized use, a key element in its competitive strategy. In 2023, Generac reported spending $219 million on research and development, underscoring its commitment to innovation that requires robust intellectual property protection.

The company must also navigate the potential for costly legal disputes arising from intellectual property infringement. A proactive and strong legal defense strategy is therefore essential to safeguard its technological advancements and market share. Generac's ability to enforce its IP rights directly impacts its ability to recoup its significant R&D investments and maintain its technological leadership.

- Patent Protection: Generac actively patents new generator technologies and control systems to prevent competitors from replicating its designs.

- Trademark Safeguarding: The Generac brand name and logo are protected trademarks, ensuring brand recognition and preventing counterfeiting.

- Copyright Enforcement: Software and technical documentation developed by Generac are protected by copyright, preventing unauthorized distribution.

- Litigation Costs: The company must budget for potential legal expenses associated with defending its intellectual property against infringement claims.

Building Codes and Installation Regulations

Generac's operations are significantly shaped by a complex web of legal mandates, including local and national building codes, stringent electrical safety standards, and specific zoning regulations. These laws dictate everything from where a generator or energy storage system can be physically located to the precise methods of installation, directly impacting product design and deployment strategies.

Adherence to these varied legal frameworks is paramount for Generac and its extensive dealer network. Non-compliance can lead to significant legal repercussions, including fines, installation delays, and potential product recalls, underscoring the critical need for robust compliance protocols. For instance, in 2024, the International Code Council (ICC) continued to update its model codes, which many jurisdictions adopt, influencing requirements for backup power systems in new construction and renovations.

- Building Codes: National and local building codes, such as those referenced by the ICC, often mandate backup power requirements for critical facilities and increasingly for residential applications in disaster-prone areas.

- Electrical Codes: Compliance with the National Electrical Code (NEC) is essential for safe and legal generator and energy storage system installations, covering wiring, grounding, and interconnection standards.

- Zoning Regulations: Local zoning laws can impose restrictions on generator placement, noise levels, and the visual impact of energy storage systems, requiring careful site assessment and permitting.

- Permitting and Inspections: Generac dealers must navigate diverse local permitting processes and pass inspections to ensure installations meet all legal specifications, a process that can vary widely by municipality.

Generac's product development and market access are heavily influenced by product safety and certification standards across its global operations. Compliance with standards like UL 2200 in North America and CE marking in Europe are critical for market entry, ensuring products meet safety directives. For example, in 2024, ongoing updates to these standards necessitate continuous product adaptation to maintain market access.

The company must also adhere to increasingly strict environmental regulations concerning emissions and noise pollution, particularly from agencies like the EPA and CARB. These regulations directly impact engine technology and exhaust systems, with California's stringent standards often setting a benchmark for innovation in 2024.

Generac's expansion into smart home and connected technologies requires strict compliance with data privacy laws such as CCPA and GDPR, underscoring the legal imperative to protect customer information. Non-compliance can result in substantial financial penalties, reinforcing the importance of robust data security measures.

Environmental factors

The escalating frequency and severity of extreme weather events, a direct consequence of climate change, are significant drivers for Generac's core business. These events, such as hurricanes, wildfires, and severe storms, consistently lead to widespread power outages, amplifying the need for reliable backup power solutions.

Generac's product portfolio, ranging from home standby generators to commercial power systems, directly addresses this growing demand. For instance, the company saw a notable increase in demand following major weather events in 2023, underscoring the direct link between climate-related disruptions and sales. In 2024, projections indicate continued volatility in weather patterns, suggesting sustained market opportunities for Generac.

The increasing global focus on reducing carbon emissions and enhancing air quality directly influences the design and efficiency standards for power generation technology. This trend is particularly relevant for companies like Generac, which are being pushed to innovate cleaner, more fuel-efficient generator models.

Generac is responding by investing in and expanding its portfolio of renewable energy and energy storage solutions to meet these evolving environmental demands. For instance, by 2024, many regions are implementing stricter emissions standards for portable generators, requiring manufacturers to adopt advanced combustion technologies and exhaust after-treatment systems.

Generac faces growing concerns over resource scarcity, particularly for metals and rare earth elements critical to its generator components. This scarcity directly impacts supply chain stability and cost management, pushing the company to explore more resilient sourcing strategies. For instance, the global demand for copper, essential for electrical windings, saw prices fluctuate significantly through 2024, impacting manufacturing costs.

Consequently, there's mounting pressure on Generac to enhance its commitment to sustainable sourcing and circular economy principles. This includes investigating the feasibility of incorporating a higher percentage of recycled materials into its products and improving the overall lifecycle environmental footprint. By 2025, many manufacturing sectors are targeting a 15-20% increase in the use of recycled content in their finished goods, a benchmark Generac will likely need to consider.

Waste Management and Product End-of-Life

Environmental regulations and growing consumer awareness are increasingly holding companies accountable for managing their products after use, focusing on recycling and responsible disposal. Generac must integrate sustainable practices throughout its product lifecycles, from initial manufacturing to final end-of-life management.

This includes designing for disassembly and exploring take-back programs. For instance, the European Union's Waste Electrical and Electronic Equipment (WEEE) directive sets stringent recycling targets, and similar initiatives are expanding globally, impacting manufacturers like Generac. In 2024, global e-waste generation was projected to reach 61.3 million metric tons, underscoring the scale of this challenge and the increasing regulatory pressure.

- Regulatory Compliance: Adhering to evolving waste management laws, such as extended producer responsibility (EPR) schemes, is crucial for market access and avoiding penalties.

- Circular Economy Integration: Implementing strategies for product repair, refurbishment, and material recovery can reduce environmental impact and create new revenue streams.

- Supply Chain Transparency: Ensuring that suppliers also adopt responsible waste management practices is vital for a holistic approach to product stewardship.

- Consumer Perception: Demonstrating commitment to sustainability in product disposal can enhance brand reputation and appeal to environmentally conscious customers.

Renewable Energy Adoption and Grid Decarbonization

The global transition to renewable energy sources, like solar and wind, is accelerating, aiming to decarbonize electrical grids. This shift is projected to significantly impact the demand for traditional fossil fuel generators.

However, this transition also fuels substantial growth opportunities for companies like Generac. The intermittent nature of renewables necessitates robust energy storage solutions and advanced grid services, areas where Generac's hybrid power systems and energy management technologies are well-positioned to capitalize. By 2024, the global renewable energy market was valued at over $1.5 trillion, with significant investments in grid modernization and storage technologies.

- Increased Demand for Energy Storage: As renewable penetration grows, the need for battery storage to ensure grid stability and reliability intensifies.

- Hybrid Solutions: Generac's expertise in integrating various power sources, including renewables and traditional generators, creates demand for their hybrid offerings.

- Grid Services: The evolving grid requires flexible resources for load balancing and frequency regulation, creating new service revenue streams for companies like Generac.

- Decarbonization Targets: Government mandates and corporate sustainability goals are driving investment in low-carbon energy infrastructure, benefiting companies aligned with these objectives.

The increasing frequency of extreme weather events, such as hurricanes and severe storms, directly boosts demand for Generac's backup power solutions, as seen in sales upticks following major weather disruptions in 2023 and anticipated continued market opportunities in 2024.

Stricter environmental regulations are pushing Generac towards cleaner, more fuel-efficient generator designs, prompting investment in renewable energy and storage solutions to meet evolving standards, with many regions implementing stricter emissions rules for portable generators by 2024.

Resource scarcity, particularly for critical metals like copper, impacts Generac's supply chain and costs, necessitating resilient sourcing strategies and a greater focus on recycled materials, with a projected 15-20% increase in recycled content use across manufacturing sectors by 2025.

Growing pressure for responsible end-of-life product management, driven by global e-waste concerns (projected at 61.3 million metric tons in 2024) and regulations like the EU's WEEE directive, requires Generac to integrate sustainable practices, including designing for disassembly and exploring take-back programs.

| Environmental Factor | Impact on Generac | 2023-2025 Data/Trend |

| Extreme Weather Events | Increased demand for backup power | Sales growth post-weather events (2023); sustained opportunities (2024) |

| Emissions Regulations | Need for cleaner, efficient products; investment in renewables | Stricter portable generator emissions (2024); global renewable market >$1.5T (2024) |

| Resource Scarcity | Supply chain volatility, cost increases | Copper price fluctuations (2024); target 15-20% recycled content (by 2025) |

| Waste Management & E-waste | Focus on product lifecycle, recycling | 61.3M metric tons global e-waste (2024); WEEE directive impact |

PESTLE Analysis Data Sources

Our Generac PESTLE Analysis is meticulously crafted using data from leading market research firms, government regulatory bodies, and reputable economic forecasting agencies. This comprehensive approach ensures that our insights into political, economic, social, technological, legal, and environmental factors influencing Generac are grounded in verifiable, current information.