Generac Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Generac Bundle

Curious about Generac's product portfolio performance? This glimpse into their BCG Matrix highlights key areas of opportunity and challenge, but to truly unlock strategic growth, you need the full picture. Purchase the complete Generac BCG Matrix for a detailed quadrant breakdown, actionable insights, and a clear roadmap for optimizing your investments and product development.

Stars

Residential Home Standby Generators represent a strong Star in Generac's BCG Matrix, boasting an undisputed market leadership with over 70% share. This segment is experiencing robust growth, with residential product sales, including these generators, seeing a 15% increase in Q1 2025 and a 7% rise in Q2 2025. This upward trend is fueled by a growing frequency of power outages and a heightened consumer demand for dependable backup power solutions.

Generac's commitment to innovation further strengthens its Star position. The company is set to launch its next-generation home standby generator lineup in the latter half of 2025. This strategic move is designed to further cement its dominance in a market segment that continues to demonstrate significant expansion and potential.

Generac's portable generators are a strong performer, a "star" in their portfolio. This segment is seeing robust growth, with projections indicating a 5% compound annual growth rate through 2034. These units are a significant driver of Generac's overall residential sales, demonstrating their popularity and market penetration.

The company's strategic approach, focusing on innovative product designs and securing prominent placement with major retailers, is effectively boosting baseline demand for portable generators. This strategy is key to maintaining their leading position in a competitive market.

Generac's integrated home energy management solutions, such as its ecobee smart thermostats, are a significant growth area. With over 5 million connected devices, ecobee is a prime example of their strategic expansion.

These smart home offerings are crucial for Generac's expanding residential energy ecosystem. They are a key differentiator, driving a high-margin recurring revenue stream as more customers adopt these interconnected products.

This integration empowers homeowners with enhanced control over their energy consumption. It also significantly boosts the overall value proposition of Generac's comprehensive product portfolio.

High-Capacity C&I Generators for Data Centers

Generac is strategically targeting the booming data center market with its new high-capacity Commercial & Industrial (C&I) generators. These advanced units, with capacities reaching up to 3.25 megawatts, are specifically engineered to meet the escalating power demands of modern data facilities.

The global data center market is experiencing exponential growth, driven by cloud computing, AI, and Big Data. Projections indicate a substantial increase in power consumption, with some estimates suggesting data centers could account for a significant percentage of global electricity usage in the coming years. Generac's investment in these high-capacity generators positions them to capitalize on this trend.

- Market Growth: The data center infrastructure market was valued at over $200 billion in 2023 and is expected to grow at a CAGR of over 8% through 2030.

- Power Demand: A single hyperscale data center can consume as much power as a small city, highlighting the need for robust and scalable generator solutions.

- Generac's Offering: Models like the 3.25 MW generator are designed for enhanced efficiency and reliability, crucial for mission-critical data center operations.

- Future Integration: These generators are being developed with integration capabilities for renewable energy sources and microgrids, aligning with data center sustainability goals.

New Residential Energy Technology Solutions

Generac is making significant strides in residential energy technology, notably with its upcoming PWRmicro microinverter product line, slated for shipment in the latter half of 2025. This strategic push into innovative solutions reflects Generac's commitment to leading the energy transition and meeting the increasing consumer demand for clean, reliable power.

The company's investment in these advanced technologies positions it to capitalize on a rapidly expanding market. For instance, the global residential solar market was valued at approximately $75 billion in 2023 and is projected to grow substantially in the coming years, driven by policy support and falling costs.

- Residential Energy Technology Solutions: Generac is expanding its offerings with new products like the PWRmicro microinverter, expected to launch in H2 2025.

- Market Leadership Strategy: These innovations are central to Generac's ambition to be a leader in the evolving energy landscape, emphasizing clean and resilient power.

- Growth Potential: The focus on cutting-edge solutions in a high-demand sector indicates strong future growth prospects for Generac.

- Investment in Innovation: Generac's R&D spending in 2024 was directed towards developing these next-generation energy technologies.

Generac's residential home standby generators are a clear Star, holding over 70% market share and experiencing robust sales growth. This segment is further bolstered by upcoming product innovations, reinforcing Generac's market dominance. Similarly, portable generators are performing strongly as a Star, with a projected 5% CAGR through 2034, driven by strategic retail placement and design improvements.

Generac's integrated home energy management solutions, like ecobee, are also Stars, boasting over 5 million connected devices and providing a high-margin recurring revenue stream. These offerings enhance homeowner control and the overall value of Generac's ecosystem.

The company's high-capacity Commercial & Industrial (C&I) generators, designed for the booming data center market, represent another Star. With capacities up to 3.25 MW, these units are positioned to capture significant share in a sector projected for substantial power consumption growth. Furthermore, the upcoming PWRmicro microinverter line, shipping in H2 2025, targets the rapidly expanding residential solar market, solidifying Generac's commitment to clean energy innovation.

| Product Segment | BCG Classification | Key Growth Drivers | Market Share (Est.) | Recent Performance |

|---|---|---|---|---|

| Residential Home Standby Generators | Star | Increased power outage frequency, demand for backup power | >70% | 15% sales increase Q1 2025, 7% Q2 2025 |

| Portable Generators | Star | Innovative designs, prime retail placement | Strong | 5% CAGR projected through 2034 |

| Integrated Home Energy Management (ecobee) | Star | Expanding energy ecosystem, recurring revenue | >5 million connected devices | High-margin revenue stream |

| High-Capacity C&I Generators (Data Centers) | Star | Data center market growth, AI/Cloud computing | Emerging | Targeting 3.25 MW capacities |

| Residential Energy Technology (PWRmicro) | Star | Residential solar market growth, clean energy demand | Emerging | Shipments expected H2 2025 |

What is included in the product

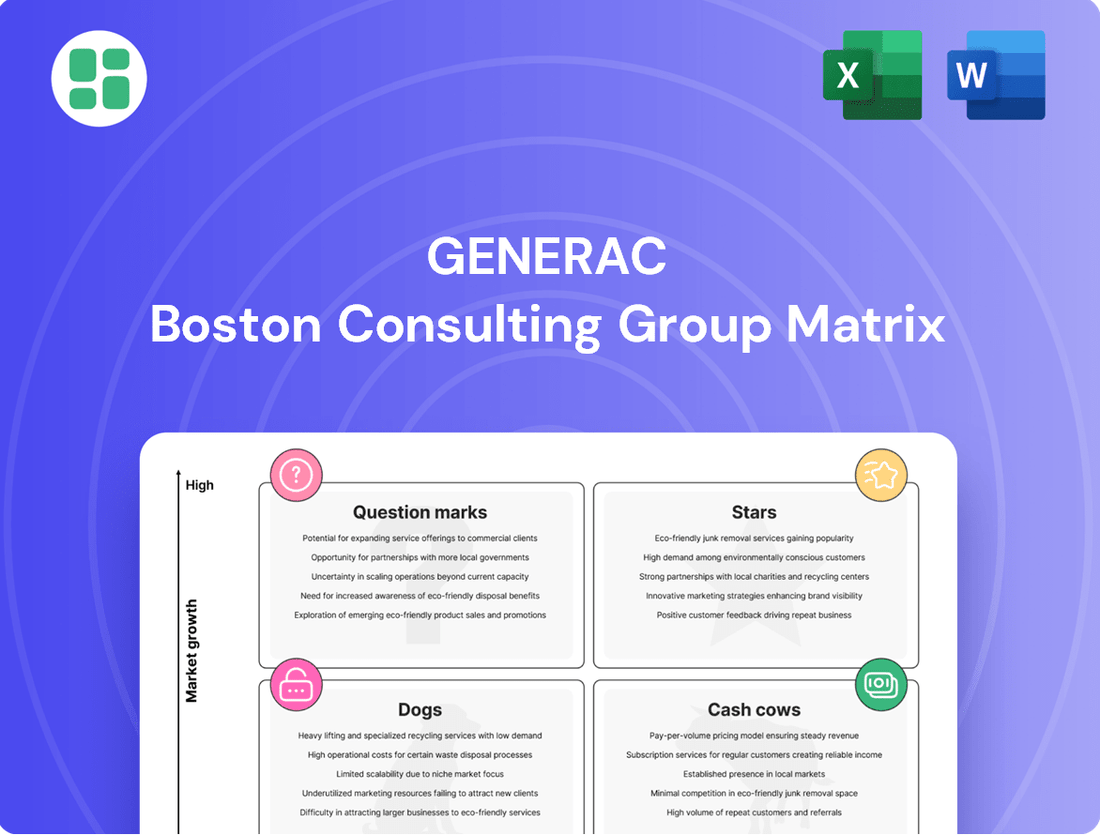

The Generac BCG Matrix analyzes its product portfolio by market share and growth rate, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

This framework guides strategic decisions on resource allocation, highlighting which Generac products to invest in, maintain, or divest.

Generac BCG Matrix provides a clear, visual overview of business unit performance, easing the pain of strategic resource allocation.

Cash Cows

Generac's established Commercial & Industrial (C&I) generators are a cornerstone of its business, representing a significant 32% of net sales in 2024. This segment consistently delivers a substantial and reliable revenue stream for the company.

Despite some mixed or flat growth observed in overall C&I product sales in early 2025, this segment continues to be a major contributor to Generac's financial health. The essential nature of these generators for businesses and infrastructure underpins a steady and predictable demand.

Generac's aftermarket service parts and accessories represent a strong Cash Cow. This segment capitalizes on the company's extensive installed base of generators, providing a consistent stream of high-margin revenue through ongoing maintenance, repairs, and upgrades. The long operational life of generator units naturally fuels demand for these essential components, creating a predictable revenue cycle.

The financial performance of this segment is robust, with Generac reporting aftermarket sales of $1.1 billion in 2023, a significant portion of its total revenue. This business line typically demands less marketing expenditure than new product introductions, contributing to its profitability. The company's focus on customer satisfaction and product reliability further solidifies its position in this lucrative market.

Generac's remote monitoring and subscription services, tied to its connected home standby and other generator units, represent a significant cash cow. These offerings generate a stable and expanding recurring revenue, bolstering profitability.

These services are crucial for customer retention and increasing product value by providing valuable insights and alerts post-purchase. In 2024, Generac reported strong adoption rates for its connected services, indicating a robust demand for enhanced product utility and peace of mind.

Legacy Industrial Power Generation Equipment

Legacy Industrial Power Generation Equipment represents Generac's established industrial generator offerings outside of high-growth sectors. These units cater to traditional industrial clients, ensuring reliable backup power and generating consistent revenue streams. Their enduring brand reputation and proven performance solidify their position as stable contributors to Generac's portfolio.

This segment benefits from a mature market where demand for dependable backup power remains steady. Generac's long-standing presence and quality in this area allow for predictable sales and profitability. The company's extensive service network further supports these legacy products, ensuring customer satisfaction and repeat business.

- Market Position: Dominant in established industrial sectors.

- Revenue Stream: Stable and predictable cash flow generation.

- Key Strengths: Proven reliability, strong brand recognition, extensive service network.

- Growth Potential: Moderate, driven by replacement cycles and infrastructure upgrades.

Small to Medium-Sized Commercial Standby Generators

Generac's small to medium-sized commercial standby generators are firmly established as cash cows within their product portfolio. These units cater to a wide array of businesses needing dependable backup power, a market segment that has seen consistent demand for years. In 2024, the demand for reliable power solutions for businesses, especially in light of increasing weather-related disruptions, continued to support strong sales in this category.

These generators represent a mature product line with well-defined market demand, enabling Generac to benefit from efficient production processes and stable revenue streams. This maturity allows for predictable cash flow generation, which is crucial for funding other areas of the business or for reinvestment.

- Market Dominance: Generac commands a significant share in the small to medium commercial generator market.

- Mature Product Lifecycle: These generators are in a stable phase, ensuring consistent sales.

- Consistent Revenue: They are a reliable source of income, contributing positively to Generac's cash flow.

- Operational Efficiency: Established production lines lead to cost-effective manufacturing.

Generac's aftermarket service parts and accessories are a prime example of a Cash Cow. This segment leverages Generac's extensive installed base, consistently generating high-margin revenue through maintenance and repairs. The long lifespan of generator units ensures sustained demand for these essential components, creating a predictable revenue cycle.

In 2023, aftermarket sales reached $1.1 billion, highlighting its significant contribution to overall revenue. This business line typically requires less marketing investment compared to new product launches, directly boosting its profitability. Generac's commitment to customer satisfaction further solidifies its strong position in this lucrative market.

| Product Segment | 2024 Net Sales (Approx.) | Key Characteristic | BCG Matrix Category |

|---|---|---|---|

| Commercial & Industrial (C&I) Generators | 32% of Net Sales | Established, reliable revenue stream | Cash Cow |

| Aftermarket Service Parts & Accessories | $1.1 Billion (2023) | High-margin, recurring revenue from installed base | Cash Cow |

| Remote Monitoring & Subscription Services | Strong Adoption Rates (2024) | Stable, expanding recurring revenue, customer retention | Cash Cow |

| Small to Medium Commercial Standby Generators | Consistent Demand (2024) | Mature product line, efficient production, stable cash flow | Cash Cow |

Preview = Final Product

Generac BCG Matrix

The Generac BCG Matrix document you are currently previewing is precisely the final, complete report you will receive upon purchase. This means no watermarks, no placeholder text, and no altered content – just the fully formatted, professionally analyzed strategic tool ready for immediate application.

Rest assured, the preview you see is the exact Generac BCG Matrix report that will be delivered to you after your purchase. It is a polished, ready-to-use document, meticulously prepared to provide clear strategic insights without any need for further editing or additions.

What you are viewing is the actual, unedited Generac BCG Matrix document that you will own after completing your purchase. This means you’ll gain immediate access to the complete, professionally designed analysis, perfectly formatted for your business strategy needs.

The Generac BCG Matrix file you are currently examining is the identical, final version you will download after your purchase. It’s a comprehensive, analysis-ready document, ensuring you receive the full strategic value without any surprises.

Dogs

Generac's national and independent rental equipment customer segment experienced a downturn in Q2 2025, with shipments remaining soft. This trend is expected to persist through the latter half of the year, signaling a challenging period for this business area.

This softness suggests this segment might be a 'dog' in Generac's BCG Matrix, characterized by low market share and low market growth. For instance, the rental equipment market can be cyclical, heavily influenced by construction and infrastructure spending, which may have seen a slowdown impacting Generac's shipments.

Older, less energy-efficient generator models are likely positioned as Dogs in Generac's BCG Matrix. As the market shifts towards more fuel-efficient engines and integrated smart home energy solutions, these older units may experience a decline in demand. For instance, Generac's commitment to advanced features in their 2024 and upcoming product lines means older models might have a shrinking market share and contribute less to overall company growth.

Within Generac's global operations, certain niche international markets might be experiencing stagnant demand, potentially due to intense competition or saturation. These segments, though small in overall contribution, could represent areas where Generac holds a low market share and sees minimal growth. For instance, if a particular region's economic development is slow, it could directly impact the adoption of Generac's products like standby generators.

These less dynamic international markets, characterized by flat or declining demand, could be prime candidates for a strategic reassessment. Generac might consider divesting these underperforming assets to reallocate resources towards more promising growth areas. This approach ensures capital is focused on segments with higher potential for market penetration and profitability, aligning with a strategy to optimize the company's portfolio.

Discontinued or Underperforming Acquired Product Lines

Generac's strategic acquisitions have aimed to bolster its presence in clean energy and smart home tech. However, some acquired product lines might not have met expectations, leading to their classification as Dogs in the BCG Matrix.

These underperforming assets, characterized by low market share and minimal growth, represent capital that could be better allocated. For example, if an acquired smart thermostat line, despite initial investment, only captured 1% of the market in 2024 and saw no significant growth, it would fit this category.

- Low Market Share: Acquired product lines that fail to gain significant market penetration, potentially holding less than 5% of their respective market segments.

- Stagnant or Declining Growth: These products exhibit minimal or negative year-over-year revenue growth, indicating a lack of market demand or competitive disadvantage.

- Capital Tie-up: Resources such as R&D, marketing, and inventory dedicated to these lines could be redirected to more promising ventures within Generac's portfolio.

- Integration Challenges: Difficulties in integrating acquired technologies or brands into Generac's existing ecosystem can contribute to their underperformance.

Basic, Low-Margin Portable Power Stations

Generac's basic, low-margin portable power stations likely fall into the Dogs quadrant of the BCG Matrix. These products, characterized by their undifferentiated features and intense price competition, struggle to capture substantial market share. In 2024, the portable power station market saw significant growth, with some estimates placing it at over $2 billion globally, but this segment is also highly fragmented with numerous players.

- Low Market Share: These basic models likely hold a small percentage of the overall portable power station market, especially when compared to more advanced, feature-rich competitors.

- Low Profit Margins: Competing solely on price in a saturated market means these units offer minimal profit per sale, impacting overall profitability.

- Stagnant Growth: The lack of unique selling propositions limits their ability to attract new customers or increase sales volume, leading to slow or no growth.

- Resource Drain: Continued investment in production and marketing for these low-performing products can divert resources from more promising areas of Generac's portfolio.

Generac's older, less energy-efficient generator models, along with certain niche international markets experiencing stagnant demand, can be categorized as Dogs in the BCG Matrix. These segments are characterized by low market share and minimal growth, often due to market saturation or economic slowdowns in specific regions. For instance, a particular international market might see less than 2% annual growth for standby generators, forcing Generac to re-evaluate its presence there.

Acquired product lines that haven't met initial expectations, such as a smart thermostat line that captured only 1% of its market in 2024, also fit the Dog profile. These underperforming assets tie up capital that could be better utilized in more promising growth areas. For example, if an acquired product line shows less than 3% revenue growth year-over-year, it signals a need for strategic reassessment.

Basic, low-margin portable power stations with undifferentiated features also fall into the Dog quadrant. Despite the overall portable power station market exceeding $2 billion globally in 2024, these basic models struggle with intense price competition, resulting in low market share and minimal profit margins. This necessitates a strategic focus on higher-margin, differentiated offerings.

These "Dog" segments, whether older product lines, underperforming acquisitions, or basic portable units, represent areas where Generac has low market share and experiences stagnant or declining growth. They often have low profit margins and can drain resources that could be reinvested in "Stars" or "Question Marks" with higher growth potential.

| Segment | BCG Category | Key Characteristics | 2024/2025 Outlook |

| Older Generator Models | Dog | Low market share, declining demand, less energy-efficient | Continued decline due to shift towards advanced features |

| Niche International Markets | Dog | Low market share, stagnant growth, intense competition | Potential for divestment or resource reallocation |

| Underperforming Acquired Lines (e.g., Smart Thermostat) | Dog | Low market penetration (e.g., <5%), minimal growth (e.g., <3% YoY) | Requires strategic review for integration or divestment |

| Basic Portable Power Stations | Dog | Low market share, low profit margins, undifferentiated features | Struggles against price competition in a growing but fragmented market |

Question Marks

Generac's PWRcell series, including the PWRcell 2 and the anticipated PWRcell 2 MAX, are positioned in a rapidly expanding residential energy storage market. This growth is fueled by increasing consumer interest in energy independence and resilience, a trend that saw the global residential energy storage market reach an estimated $25.6 billion in 2023, with projections suggesting continued strong growth through 2030.

Despite the favorable market conditions, Generac faces a competitive landscape where established players hold significant market share in the residential solar and storage inverter sector. While Generac's PWRcell offers advanced features, the company is actively working to solidify its position and capture a larger portion of this dynamic market, which is expected to see compound annual growth rates exceeding 15% in the coming years.

Generac's entry into the EV charger market in 2024 positions it as a new player in a sector experiencing explosive growth. While the market is expanding, Generac's current market share is likely minimal, reflecting its recent launch.

The company will need substantial investment to build brand recognition and secure a significant foothold against established competitors. This strategic positioning aligns with the characteristics of a "Question Mark" in the BCG matrix, demanding careful consideration of future investment to determine if it can become a "Star."

Generac is actively building its presence in grid services and microgrid solutions, recognizing these as crucial growth avenues for grid resilience and distributed energy. These innovative offerings are positioned for future expansion, though Generac's current market penetration in these nascent and intricate sectors is likely modest, requiring significant investment and ongoing development.

The company's commitment to these areas is underscored by its strategic investments, aiming to capture a larger share of the burgeoning microgrid market. For instance, the U.S. microgrid market alone was valued at approximately $4.5 billion in 2023 and is projected to grow substantially, indicating the significant potential Generac is targeting.

Advanced Smart Home Energy Management Platforms

Generac's advanced smart home energy management platforms are positioned as a potential star in its BCG matrix. These systems go beyond single devices like smart thermostats, aiming to create an integrated ecosystem for enhanced home energy control and efficiency. This represents a high-growth market where adoption is still in its early stages, and Generac is actively working to establish its competitive position.

The market for smart home energy management is experiencing significant growth, driven by consumer demand for cost savings and environmental consciousness. In 2024, the global smart home market was projected to reach over $150 billion, with energy management solutions being a key driver. Generac's investment in these platforms signifies a strategic move into a segment with substantial future potential, though it requires significant investment to capture market share.

- Market Growth: The smart home energy management sector is expected to grow at a CAGR of over 15% through 2028, indicating strong future demand.

- Generac's Strategy: The company is focusing on integrating solar, storage, and grid services through its platforms to offer a holistic energy solution.

- Competitive Landscape: Generac faces competition from established tech companies and other energy providers, necessitating innovation and strategic partnerships.

- Investment Focus: Continued R&D and marketing efforts are crucial for Generac to solidify its presence and gain traction in this developing market.

International Expansion into New Emerging Markets

Generac's international expansion into emerging markets positions it as a potential star in the BCG matrix. The company is experiencing growing demand for backup power solutions globally, and its international sales reflect this upward trend. This strategic push involves significant upfront investment to build market share in rapidly expanding power generation and energy technology sectors in these new territories.

- Growing International Sales: Generac's international segment sales have shown consistent growth, indicating successful market penetration.

- High-Growth Sectors: The focus on power generation and energy technology in emerging markets aligns with sectors experiencing rapid development and increased demand.

- Strategic Investment: Expansion requires substantial capital for market development, distribution networks, and product localization.

- Market Share Building: The objective is to establish a strong presence and capture significant market share in these nascent but promising markets.

Generac's ventures into the EV charger market and grid services represent classic "Question Marks" within the BCG matrix. These areas, while offering substantial future growth potential, currently demand significant investment due to nascent market positions and intense competition. The company is strategically allocating resources to build brand awareness and technological capabilities, aiming to convert these nascent opportunities into future stars.

The company's positioning in EV charging and grid services reflects a strategic bet on evolving energy infrastructure. While market penetration is currently low, the high growth trajectory of these sectors, projected to see significant expansion through 2030, makes them critical areas for Generac's long-term strategy. Success hinges on effectively navigating competitive landscapes and securing market share through innovation and investment.

Generac's investment in smart home energy management platforms and international expansion also falls into the Question Mark category. These segments exhibit strong growth potential, but require substantial capital for market development, product localization, and establishing distribution networks. The company's objective is to build a significant market presence in these high-potential, yet currently developing, areas.

These "Question Mark" initiatives are vital for Generac's diversification and future revenue streams. The company's commitment to these segments is evident in its ongoing research and development spending and strategic partnerships, aiming to capitalize on the projected growth in smart energy solutions and global energy technology adoption.

| Initiative | Market Status | Generac's Position | Investment Need | Potential |

|---|---|---|---|---|

| EV Chargers | Rapidly Growing | New Entrant, Low Share | High | Star |

| Grid Services/Microgrids | Emerging, Complex | Developing, Modest Penetration | High | Star |

| Smart Home Energy Management | High Growth, Early Stage | Building Presence | Significant | Star |

| International Expansion | Growing Demand | Increasing Sales, Building Share | Substantial | Star |

BCG Matrix Data Sources

Our Generac BCG Matrix is built on comprehensive market intelligence, integrating Generac's financial reports, industry growth data, and competitor analysis to provide strategic insights.