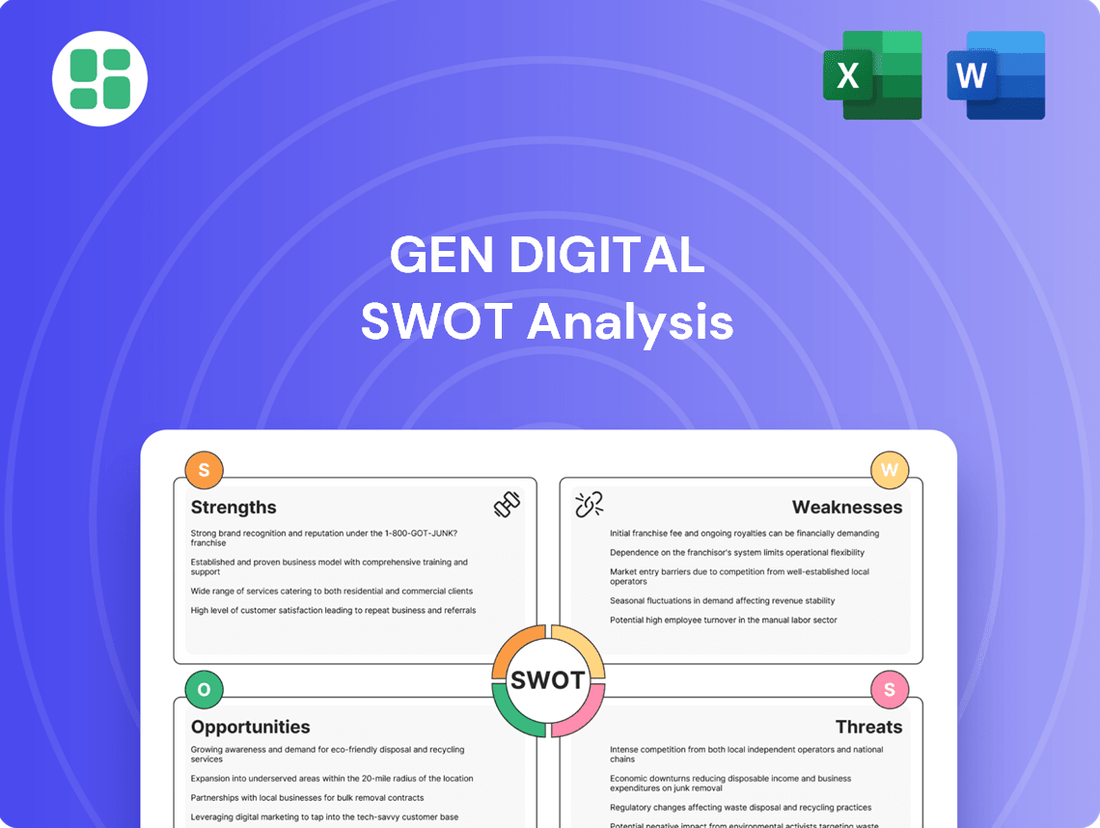

Gen Digital SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gen Digital Bundle

Gen Digital, a cybersecurity powerhouse, boasts strong brand recognition and a diverse product portfolio, but faces intense competition and evolving threats. Ready to dive deeper into their strategic advantages and potential vulnerabilities?

Strengths

Gen Digital commands a powerful market position through its diverse portfolio of trusted cybersecurity brands. Names like Norton, Avast, and LifeLock resonate deeply with consumers seeking digital protection, fostering significant brand loyalty and market recognition. This strong brand equity translates into a substantial competitive advantage.

Gen Digital has showcased impressive financial strength, achieving record revenue and profitability in fiscal year 2024, with this positive momentum continuing into the first quarter of fiscal year 2025. The company announced total revenues exceeding $3.8 billion for FY24 and reported $1.26 billion in Q1 FY25. This robust performance is underpinned by significant free cash flow generation, surpassing $2 billion, which fortifies the company's capacity for strategic initiatives and shareholder distributions.

Gen Digital boasts a vast and expanding global customer base, currently serving around 500 million users in over 150 countries. This reach includes a significant segment of over 65 million paid customers, highlighting the company's ability to convert users into paying subscribers.

The company's direct customer count hit a new high of 39.3 million in the first quarter of fiscal year 2025, a clear indicator of successful customer acquisition efforts. This growth is further bolstered by a record retention rate of 78%, showcasing strong customer loyalty and the generation of reliable recurring revenue.

Comprehensive and Expanding Product Portfolio

Gen Digital boasts a comprehensive and ever-growing product portfolio that spans critical areas of digital security. Their offerings cover a wide spectrum, including robust cybersecurity solutions, essential online privacy tools, and crucial identity protection services. This breadth ensures individuals and families are shielded against a multitude of digital threats.

The company's strategic expansion is evident in its recent acquisition of MoneyLion. This move significantly broadened Gen Digital's reach into financial wellness, effectively creating a more holistic 'Cyber Safety' portfolio. This integration allows them to address a wider range of evolving consumer needs, providing a more integrated approach to personal digital and financial well-being.

This diverse suite of products positions Gen Digital as a one-stop shop for digital protection. For instance, in fiscal year 2024, Gen Digital reported a revenue of $3.8 billion, demonstrating the market's demand for such comprehensive solutions. The company's ability to adapt and integrate new services, like those from MoneyLion, underscores its commitment to staying ahead in the dynamic cybersecurity landscape.

- Broad Protection: Offers cybersecurity, online privacy, and identity protection.

- Financial Wellness Integration: Expanded into financial wellness through the MoneyLion acquisition.

- Holistic Approach: Creates a comprehensive 'Cyber Safety' portfolio addressing diverse digital threats.

- Market Validation: Fiscal year 2024 revenue of $3.8 billion reflects strong market demand.

Successful Integration and Synergy Realization

Gen Digital has demonstrated a remarkable ability to integrate acquisitions, most notably with Avast. This strategic move has already yielded substantial financial benefits.

- Synergy Achievement: The company successfully realized nearly $300 million in annual cost synergies from the Avast integration within just 18 months.

- Profitability Boost: This disciplined execution directly contributed to Gen Digital's non-GAAP operating income exceeding $2.2 billion in fiscal year 2024, achieving an impressive 58% margin.

- Operational Efficiency: The effective merger has streamlined operations, leading to enhanced profitability and demonstrating strong post-acquisition management capabilities.

Gen Digital's strengths lie in its robust portfolio of well-recognized cybersecurity brands, including Norton and Avast, which foster strong customer loyalty. The company achieved significant financial success, reporting over $3.8 billion in revenue for fiscal year 2024 and $1.26 billion in Q1 FY25, supported by over $2 billion in free cash flow. Its expansive global reach, serving approximately 500 million users with a growing base of 39.3 million direct customers in Q1 FY25 and a strong 78% retention rate, solidifies its market standing.

The integration of MoneyLion has broadened Gen Digital's offerings into financial wellness, creating a more comprehensive 'Cyber Safety' portfolio. This strategic expansion, coupled with the successful integration of Avast which yielded nearly $300 million in cost synergies and contributed to a non-GAAP operating income exceeding $2.2 billion in FY24, highlights the company's adeptness at strategic execution and operational efficiency.

| Metric | FY24 (USD) | Q1 FY25 (USD) | Key Strength |

|---|---|---|---|

| Total Revenue | > $3.8 Billion | $1.26 Billion | Strong revenue growth and market demand |

| Free Cash Flow | > $2 Billion | N/A | Financial stability and investment capacity |

| Direct Customers | N/A | 39.3 Million | Growing customer acquisition |

| Customer Retention Rate | N/A | 78% | High customer loyalty and recurring revenue |

| Avast Synergies Realized | ~$300 Million (Annual) | N/A | Effective acquisition integration and cost savings |

What is included in the product

Analyzes Gen Digital’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Streamlines the complex Gen Digital landscape into actionable insights, alleviating the pain of strategic uncertainty.

Weaknesses

Gen Digital's commitment to innovation comes with significant research and development (R&D) expenditures. For the three months ending December 27, 2024, these costs rose from $77 million to $84 million, highlighting a substantial investment in future growth.

While crucial for staying competitive, these increasing R&D costs pose a potential weakness. If these investments don't translate into successful, market-ready products in a timely manner, they could put a strain on the company's finances and affect its profitability.

Gen Digital's acquisition of MoneyLion, a fintech firm, presents significant integration hurdles. Merging distinct operational systems and corporate cultures, especially in cybersecurity and financial services, demands meticulous planning and execution to ensure seamless transitions and avoid service disruptions.

The integration process also involves navigating the complexities of diverse regulatory landscapes inherent in both cybersecurity and financial technology sectors. This requires careful attention to compliance and risk management to uphold Gen Digital's reputation and operational integrity.

Furthermore, Gen Digital must address potential legal risks stemming from MoneyLion's historical operational practices. A thorough due diligence and remediation strategy is crucial to mitigate these liabilities and ensure a clean integration, safeguarding Gen Digital's financial health and market standing.

Gen Digital's reliance on its subscription-based revenue model, which accounts for nearly all its income, presents a significant weakness. This recurring revenue stream, while stable, hinges entirely on keeping existing customers and attracting new ones, a challenge in a competitive landscape. For instance, in fiscal year 2024, Gen Digital reported that a substantial majority of its revenue came from its subscription services.

Underperformance Compared to Market Benchmarks

Gen Digital has experienced underperformance relative to key market benchmarks. For instance, since its merger with Avast, the company's stock has lagged behind certain cybersecurity indices and the broader S&P 500. This divergence suggests that despite reported growth, market perception or strategic execution hasn't consistently translated into superior shareholder returns.

This underperformance can be concerning for investors. For example, looking at the period following the Avast merger, Gen Digital's stock may have shown a lower total return compared to the Nasdaq Cybersecurity Index. Such trends can impact investor confidence and the company's ability to attract capital for future growth initiatives.

- Lagging Stock Performance: Gen Digital's stock price has not kept pace with major cybersecurity indices and the S&P 500 since the Avast merger.

- Investor Sentiment Impact: This underperformance can dampen investor enthusiasm and make it harder to secure funding.

- Potential for Capital Attraction Issues: Sustained lagging stock performance could hinder the company's ability to attract investment capital.

Risk of Commoditization in Core Consumer Security

The core consumer cybersecurity market, especially for fundamental antivirus and device protection, faces a significant risk of commoditization. This trend directly impacts pricing power and makes it increasingly difficult for Gen Digital to achieve substantial growth in average revenue per user (ARPU). Competitors often offer basic security features at little to no cost, intensifying this challenge.

To counter this, Gen Digital must prioritize continuous innovation and the strategic bundling of premium, value-added services. This approach is crucial for differentiating its offerings beyond basic security functionalities. Without such a strategy, the company risks being perceived as just another provider of standard, easily substitutable security solutions.

- Commoditization Pressure: Basic antivirus and device security are increasingly seen as commodities, limiting pricing flexibility.

- ARPU Growth Challenge: Sustaining high ARPU becomes difficult when core offerings are easily replicated at lower costs.

- Differentiation Imperative: Gen Digital must innovate and bundle premium services to stand out from competitors offering free or low-cost basic solutions.

Gen Digital's significant investment in R&D, with costs rising to $84 million in the three months ending December 27, 2024, presents a risk if these expenditures do not yield timely, market-ready products, potentially straining finances.

The integration of MoneyLion introduces complexities, including merging disparate systems and cultures, navigating varied regulatory environments, and addressing potential legal risks from MoneyLion's past practices, all of which demand careful management to protect Gen Digital's reputation and financial standing.

The company's heavy reliance on a subscription-based revenue model, which constitutes almost all of its income, makes it vulnerable to challenges in customer acquisition and retention within a competitive market.

Gen Digital's stock performance has lagged behind key benchmarks like cybersecurity indices and the S&P 500 since the Avast merger, which could negatively impact investor confidence and the ability to attract future capital.

The commoditization of basic consumer cybersecurity services poses a threat to Gen Digital's pricing power and average revenue per user growth, necessitating a focus on innovation and premium service bundling to maintain differentiation.

Full Version Awaits

Gen Digital SWOT Analysis

The preview below is taken directly from the full Gen Digital SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of the company's strategic positioning. You'll gain access to detailed insights into their Strengths, Weaknesses, Opportunities, and Threats.

Opportunities

Gen Digital's acquisition of MoneyLion in 2024 significantly broadens its reach, boosting its total addressable market (TAM) to an estimated $50 billion. This move effectively nearly doubles the company's prior market opportunity.

This strategic expansion positions Gen Digital to tap into the rapidly expanding financial wellness sector. By integrating MoneyLion's platform, Gen can now offer a compelling blend of financial management tools alongside its established cybersecurity offerings, creating a unique value proposition.

The integration allows Gen to leverage its existing customer base and cybersecurity prowess to deliver comprehensive financial and cyber safety solutions. This diversification is expected to unlock new revenue streams and attract a broader range of customer segments seeking holistic digital protection and financial guidance.

The escalating sophistication of cyber threats, including AI-driven attacks and ransomware, fuels a robust demand for comprehensive cyber safety solutions. Gen Digital's focus on identity protection, online privacy, and device security directly addresses this growing market need.

Consumer awareness of digital risks is at an all-time high, creating a receptive audience for Gen Digital's integrated offerings. This heightened digital consciousness ensures a sustained market for the company's core products and services.

Gen Digital can significantly boost product innovation and customer experience by integrating artificial intelligence. This includes developing more sophisticated, personalized security features and enhancing its ability to detect emerging threats in real-time. For instance, the company's stated goal to become an 'AI-first company' signifies a strategic commitment to leveraging this technology across its portfolio.

The launch of AI-powered tools like Norton Genie, which assists with scam detection, demonstrates Gen Digital's proactive approach. Further embedding AI into its offerings can create more intelligent and adaptive cyber safety solutions. This differentiation is crucial in a market where cyber threats are constantly evolving, and users demand more proactive protection.

Significant Cross-Selling and Upselling Potential

Gen Digital's acquisition of MoneyLion significantly expands its reach, creating a powerful platform for cross-selling and upselling. With millions of existing customers across both entities, there's a prime opportunity to introduce a wider array of services. For instance, cybersecurity subscribers can now be offered MoneyLion's financial wellness tools, and vice versa, fostering deeper customer relationships.

This strategic integration aims to boost average revenue per user (ARPU) and enhance customer lifetime value. By leveraging the combined user base, Gen Digital can tailor offerings to meet diverse needs, from identity protection to financial management. This synergistic approach is projected to unlock substantial revenue growth by maximizing value from each customer relationship.

Key opportunities include:

- Expanding financial services: Offering MoneyLion's banking, investing, and credit-building tools to Gen Digital's cybersecurity customers.

- Enhancing security offerings: Introducing Gen Digital's identity theft protection and privacy solutions to MoneyLion's user base.

- Data-driven personalization: Utilizing combined customer data to create highly targeted and relevant product bundles.

- Increased customer retention: Providing a more comprehensive suite of services encourages users to consolidate their digital needs with Gen Digital.

Global Market Expansion and Geographic Diversification

Gen Digital's established footprint in over 150 countries, with substantial international revenue streams from regions like EMEA and APJ, presents a solid foundation for further global market expansion. This existing infrastructure allows for a more efficient rollout of new products and services into untapped territories.

There's a significant opportunity to penetrate emerging markets where digital adoption is accelerating, but cyber safety awareness and penetration rates may still be relatively low. By tailoring offerings to these specific market needs, Gen Digital can capture early market share and build brand loyalty.

Expanding its omni-channel strategy and forging new strategic partnerships internationally can significantly broaden the reach of its privacy and identity protection solutions. This includes leveraging local distribution channels and collaborating with regional technology providers to enhance customer accessibility and trust.

- Global Reach: Gen Digital already operates in over 150 countries, demonstrating its capacity for international operations.

- Emerging Market Potential: Significant growth opportunities exist in regions with rising digital adoption and lower cyber safety penetration.

- Partnership Strategy: New alliances can amplify the distribution and impact of privacy and identity protection services worldwide.

The acquisition of MoneyLion in 2024 significantly expanded Gen Digital's total addressable market to an estimated $50 billion, nearly doubling its prior opportunity by entering the financial wellness sector. This integration allows Gen Digital to offer a combined suite of cybersecurity and financial management tools, leveraging its existing customer base to drive new revenue streams and attract a broader audience seeking holistic digital protection and financial guidance.

Gen Digital's strategic focus on AI, exemplified by tools like Norton Genie for scam detection, presents a significant opportunity to enhance product innovation and customer experience. This commitment to becoming an 'AI-first company' aims to develop more sophisticated, personalized security features and improve real-time threat detection, differentiating its offerings in an evolving cyber threat landscape.

The company's established global presence in over 150 countries provides a strong foundation for further international expansion, particularly in emerging markets with accelerating digital adoption. By tailoring its privacy and identity protection solutions to these regions and forging new strategic partnerships, Gen Digital can broaden its reach and capture new customer segments.

Threats

Gen Digital faces a fiercely competitive cybersecurity market, contending with established giants like Palo Alto Networks and CrowdStrike, alongside nimble startups and even robust free security tools. This dynamic environment often forces price adjustments and necessitates a relentless pace of innovation to simply keep up, let alone gain an edge.

The cybersecurity sector is constantly reshaped by new entrants and disruptive business models, demanding that Gen Digital remain agile and consistently refine its strategies to highlight its unique value proposition. For instance, while Gen Digital reported $3.7 billion in revenue for fiscal year 2024, demonstrating its scale, the rapid evolution of threats means even significant revenue doesn't guarantee sustained market leadership without strategic adaptation.

The digital threat landscape is a moving target, with cybercriminals constantly developing more advanced methods. We're seeing a rise in AI-powered attacks, new strains of ransomware, and sophisticated social engineering designed to trick users. This means Gen Digital must innovate at a breakneck pace to keep its offerings effective and relevant.

For instance, the average cost of a data breach in 2024 reached $4.73 million, a significant increase from previous years, highlighting the escalating sophistication and cost of cyber threats. Gen Digital's ability to counter these evolving threats directly impacts its market position and customer retention.

Failure to adapt quickly to these emerging threats could lead to a decline in the effectiveness of Gen Digital's solutions. This erosion of effectiveness could damage customer trust and diminish the perceived value of its products, ultimately impacting revenue and market share.

Gen Digital faces increasing regulatory scrutiny, particularly as its operations span cybersecurity and financial services through its acquisition of MoneyLion. This dual focus means navigating a complex and constantly changing landscape of laws governing data privacy, consumer protection, and financial compliance across multiple regions. For instance, the General Data Protection Regulation (GDPR) in Europe and similar privacy laws globally impose stringent requirements on data handling, with potential fines for violations.

The evolving nature of these regulations presents a significant compliance burden and associated costs. Failure to adhere to these rules, such as those related to anti-money laundering (AML) or know-your-customer (KYC) in financial services, can lead to substantial financial penalties. In 2023, financial institutions globally paid billions in fines related to regulatory non-compliance, a trend that is expected to continue impacting companies like Gen Digital.

Macroeconomic Headwinds and Consumer Spending Volatility

Broader macroeconomic conditions present a significant threat to Gen Digital. Persistent inflation and rising interest rates, as seen throughout 2023 and into early 2024, can significantly curb consumer discretionary spending. This means individuals and families might cut back on services like cybersecurity and financial wellness tools, prioritizing more immediate needs. For instance, a prolonged economic downturn could lead to increased subscription cancellations, impacting Gen Digital's recurring revenue streams and customer retention efforts.

Consumer spending volatility directly affects Gen Digital's revenue growth. As economic uncertainty lingers, consumers may become more hesitant to commit to subscription-based digital protection services. This could lead to slower customer acquisition and higher churn rates, particularly for services perceived as non-essential during tighter financial periods. The company needs to monitor consumer confidence indexes and discretionary spending patterns closely.

Furthermore, currency fluctuations pose an additional risk, especially for a company with a global customer base. As of late 2023 and early 2024, many major currencies experienced notable shifts against the US dollar. Adverse movements can negatively impact the reported value of international revenues when translated back into the company's reporting currency, potentially dampening overall financial performance.

- Inflationary Pressures: Global inflation rates remained a concern through 2023, impacting consumer purchasing power.

- Interest Rate Hikes: Central banks continued to adjust interest rates in 2023 and early 2024, increasing borrowing costs for consumers and potentially reducing disposable income for non-essential services.

- Currency Volatility: The US Dollar saw fluctuations against major global currencies in 2023, affecting international revenue translation for companies like Gen Digital.

Reputational Risk from Data Breaches or Service Outages

Gen Digital's core business relies heavily on trust and security. A data breach impacting its own operations or customer data would be particularly damaging to its reputation, given its identity as a cybersecurity leader. Such an event could erode customer confidence, potentially leading to significant customer attrition and substantial financial repercussions from legal claims and lost business. For instance, a major breach could directly contradict the very value proposition Gen Digital offers its clients.

The threat of service outages also poses a significant reputational risk. In the digital security space, consistent availability is paramount. Prolonged downtime for critical services, such as antivirus protection or identity theft monitoring, could lead customers to question the reliability of Gen Digital's offerings. This could result in a loss of market share and a tarnished brand image, making it harder to attract new customers and retain existing ones. For example, a service interruption during a critical cyber threat event would be especially detrimental.

- Reputational Damage: A data breach could severely damage Gen Digital's standing as a trusted security provider.

- Customer Churn: Loss of confidence following a security incident or outage could lead to significant customer departures.

- Financial Impact: Legal liabilities and lost revenue from customer attrition can have a substantial negative financial impact.

- Brand Erosion: A high-profile failure in security or service availability can lead to long-term damage to the Gen Digital brand.

Gen Digital faces intense competition from both established players and emerging startups, forcing constant innovation and competitive pricing to maintain market share. The rapidly evolving threat landscape, including AI-powered attacks and sophisticated ransomware, necessitates continuous investment in R&D to ensure its solutions remain effective. For instance, the average cost of a data breach in 2024 reached $4.73 million, underscoring the escalating sophistication of threats Gen Digital must counter.

Navigating complex and evolving global regulations, particularly in data privacy and financial services, presents a significant compliance burden and potential for substantial fines. Macroeconomic pressures, such as inflation and interest rate hikes seen through 2023 and early 2024, can reduce consumer discretionary spending, impacting subscription revenue. Currency fluctuations also pose a risk to international revenue translation, as seen with US Dollar shifts in late 2023 and early 2024.

A critical threat to Gen Digital is the potential for reputational damage stemming from its own data breaches or service outages, which would directly undermine its core value proposition as a security provider. Such failures could lead to significant customer churn, legal liabilities, and long-term brand erosion. For example, a service interruption during a critical cyber event would be especially detrimental to customer trust.

SWOT Analysis Data Sources

This Gen Digital SWOT analysis is built upon a robust foundation of data, drawing from official financial filings, comprehensive market research reports, and expert industry analysis to provide accurate and actionable insights.