Gen Digital Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gen Digital Bundle

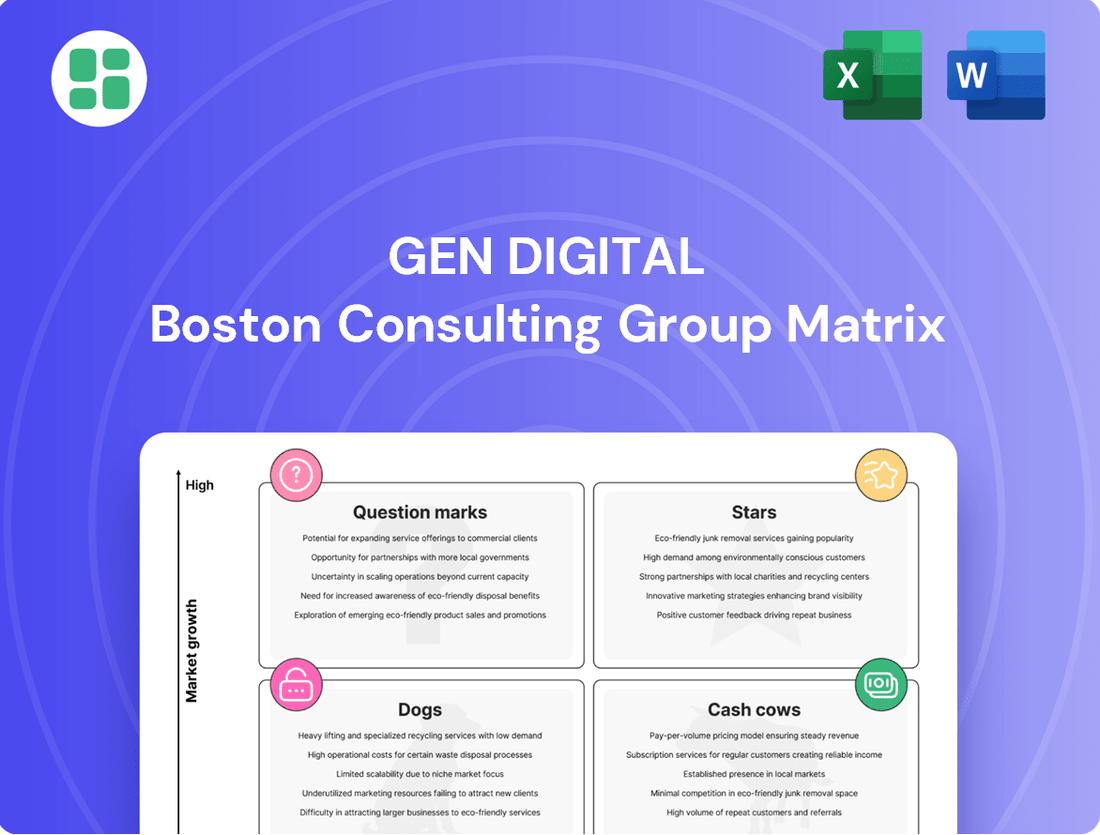

Curious about Gen Digital's product portfolio? Our BCG Matrix preview offers a glimpse into their market positions, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. To truly unlock strategic advantages and make informed decisions about resource allocation, dive deeper with the full report.

Gain a comprehensive understanding of Gen Digital's competitive landscape by purchasing the complete BCG Matrix. This detailed analysis provides actionable insights into each product's performance, empowering you to optimize your investment strategies and drive future growth.

Stars

Gen Digital's AI-Powered Advanced Threat Protection, featuring products like Norton Genie for scam detection and Norton Neo, an AI-native browser, are strategically positioned as question marks within the BCG matrix. These innovations directly combat the escalating sophistication of cyber threats, including AI-driven attacks and personalized scams, a critical concern in 2024. Gen's commitment to AI for proactive defense taps into a high-growth market, leveraging their substantial existing customer base to potentially capture significant market share.

Unified cross-platform security suites, such as Avast One and Norton 360 Deluxe, are crucial for today's digitally integrated lives, offering comprehensive protection across various devices and operating systems. This trend is driven by consumers' increasing reliance on multiple platforms, making a single, robust solution for antivirus, VPN, identity protection, and privacy tools highly desirable. These bundled offerings are effective in boosting customer loyalty and encouraging the adoption of additional services, tapping into a significant market segment prioritizing simplified digital security.

Gen Digital's enhanced identity theft protection and restoration services, particularly through its LifeLock brand, are positioned as a strong growth driver. With identity theft incidents on the rise, expected to continue escalating through 2025, consumers are actively seeking robust solutions. These services, encompassing credit monitoring and fraud restoration, are seeing a significant uptick in adoption as awareness of digital risks grows.

Privacy-Focused VPN Solutions

The Virtual Private Network (VPN) market is booming, fueled by growing worries about data privacy and online surveillance. Gen Digital's Norton Ultra VPN and Avast SecureLine VPN are poised to benefit significantly from this trend.

These VPN solutions directly address consumer demand for secure browsing and robust data encryption, positioning them as strong contenders in a high-growth sector. For instance, the global VPN market was projected to reach approximately $75 billion by 2025, indicating substantial expansion opportunities.

- Market Growth: The VPN market is expanding rapidly due to privacy concerns and remote work trends.

- Gen Digital's Position: Norton Ultra VPN and Avast SecureLine VPN are key offerings in this growing market.

- Consumer Demand: Emphasis on secure browsing and data encryption aligns with current user needs.

- Market Value: The global VPN market was anticipated to approach $75 billion by 2025, highlighting significant potential.

Financial Cybersecurity Tools (Gen Digital Financial)

Gen Digital's strategic acquisition of MoneyLion, now operating as Gen Digital Financial, marks a significant expansion into the burgeoning financial fraud prevention sector. This integration bolsters Gen's offerings with advanced financial cybersecurity tools, a critical response to the escalating threats posed by sophisticated financial theft, including mobile banking fraud and cryptocurrency scams.

Gen Digital Financial is now well-positioned to capitalize on the increasing demand for robust security solutions in digital finance. The company is leveraging its established customer trust to enter a high-growth market segment, aiming to protect users from evolving financial crimes.

- Market Growth: The global cybersecurity market, with a significant portion dedicated to financial services, is projected to reach $345.8 billion by 2026, up from $200.5 billion in 2021, indicating substantial growth potential for Gen Digital Financial.

- Fraud Trends: In 2023, financial institutions reported a 42% increase in reported fraud attempts, highlighting the urgent need for advanced cybersecurity tools like those now offered by Gen Digital Financial.

- Customer Trust: Gen Digital's existing strong brand reputation is a key asset in the financial sector, where trust is paramount for adopting new security services.

Gen Digital's Norton AntiTrack and Avast AntiTrack products, designed to combat online tracking and enhance user privacy, represent a significant opportunity. As concerns over digital privacy intensify, these tools are becoming increasingly vital for consumers seeking to safeguard their online activities. The market for privacy-enhancing technologies is experiencing robust growth, driven by a heightened awareness of data collection practices.

These privacy solutions are well-positioned to capture market share by offering tangible benefits like anonymous browsing and protection against targeted advertising. With an increasing number of users actively seeking ways to shield their digital footprints, Gen Digital's offerings in this space are poised for expansion. The demand for such tools is expected to remain strong as online tracking methods become more sophisticated.

What is included in the product

This Gen Digital BCG Matrix overview provides strategic insights for Stars, Cash Cows, Question Marks, and Dogs, detailing which units to invest in, hold, or divest.

A clear Gen Digital BCG Matrix visually clarifies portfolio strengths and weaknesses, easing strategic decision-making.

Cash Cows

Norton and Avast's core antivirus and malware protection services are the bedrock of Gen Digital's revenue. These established brands hold substantial market share in the consumer cybersecurity space, a market that's mature yet remarkably stable.

The consistent cash flow generated by these offerings stems from their widespread adoption and the recurring revenue from subscription models. This stability means they require less aggressive promotional spending compared to newer, emerging products within Gen Digital's portfolio. For instance, in fiscal year 2023, NortonLifeLock, a key component of Gen Digital, reported revenue of $2.8 billion, with a significant portion attributable to its core protection services.

Traditional device security suites, such as Norton 360 and Avast Premium Security, represent Gen Digital's cash cows. These comprehensive packages, offering antivirus, firewall, and VPN services, are mature offerings with a substantial and loyal customer base.

Despite operating in less dynamic markets, these products consistently command high market share and generate significant profits. For instance, Gen Digital reported that its subscription revenue, largely driven by these established security suites, remained robust throughout 2023 and into early 2024, underscoring their stability.

This predictable and substantial revenue stream is crucial. It provides the financial backbone for Gen Digital to allocate resources towards research and development in newer, high-growth areas, ensuring the company's future innovation and market expansion.

Gen Digital's commitment to customer retention is a cornerstone of its cash cow strategy, evidenced by a record 78% retention rate in Q1 2025. This high retention, coupled with increased cross-sell and upsell initiatives, demonstrates a clear focus on extracting maximum value from its existing customer base, especially within the Norton segment.

The company's ability to maintain and grow its relationship with its 39.3 million direct customers ensures a steady and profitable stream of revenue. This sustained engagement is characteristic of a mature product or service that generates more cash than it consumes, a hallmark of a cash cow.

Global Direct-to-Consumer Subscription Model

Gen Digital's direct-to-consumer subscription model is a significant cash cow, generating consistent and predictable revenue streams. This model, encompassing brands like Norton and LifeLock, benefits from high profit margins and a loyal customer base.

In fiscal year 2024, Gen Digital reported a substantial increase in its subscription revenue, underscoring the strength of this business segment. The recurring nature of these subscriptions provides a stable financial foundation, allowing for strategic investments and shareholder returns.

- Stable Recurring Revenue: The subscription base for Norton, Avast, and LifeLock offers predictable income.

- High Profit Margins: Software and service subscriptions typically yield strong profitability.

- Free Cash Flow Generation: This model is the primary driver of Gen Digital's robust free cash flow.

- Financial Flexibility: Cash generated supports debt repayment, R&D, and capital returns to investors.

Established ReputationDefender Services

ReputationDefender, within Gen Digital's portfolio, likely functions as a cash cow. It targets a specialized market focused on online reputation and privacy, a segment where its established presence allows for a significant market share. This means it generates predictable revenue without needing substantial investment in expanding into new, high-growth markets.

The consistent income from ReputationDefender is a valuable contributor to Gen Digital's overall financial health. For instance, the digital privacy market, which includes reputation management, has seen steady growth. In 2024, the global online reputation management market was estimated to be worth billions, with projections indicating continued expansion, underscoring the stable revenue potential for established players like ReputationDefender.

- Niche Market Dominance: ReputationDefender leverages its specialized services to secure a strong position in the online reputation management sector.

- Consistent Revenue Generation: The service provides a steady stream of income, benefiting from a loyal customer base and recurring subscription models.

- Low Investment Needs: As an established offering, it requires minimal new investment to maintain its market share and profitability.

- Contribution to Profitability: Its stable earnings bolster Gen Digital's overall financial performance, supporting investments in other business units.

Gen Digital's established cybersecurity offerings, particularly the core antivirus and malware protection services under brands like Norton and Avast, are prime examples of cash cows. These mature products operate in a stable, albeit less dynamic, market, consistently generating significant revenue through their substantial customer base and recurring subscription models. This predictable income stream, exemplified by NortonLifeLock's $2.8 billion revenue in fiscal year 2023, provides the financial stability needed to fund innovation in other areas of the company.

The direct-to-consumer subscription model, a significant cash cow for Gen Digital, drives consistent and predictable revenue, bolstered by high profit margins and a loyal customer base. This segment, which includes brands like Norton and LifeLock, saw a substantial increase in subscription revenue in fiscal year 2024, reinforcing its role as a stable financial foundation. The company's focus on customer retention, achieving a record 78% in Q1 2025, further solidifies the cash cow status of these offerings by maximizing value from existing relationships.

ReputationDefender, a specialized service within Gen Digital's portfolio, also functions as a cash cow by dominating a niche market focused on online reputation and privacy. Its established presence allows for significant market share and predictable revenue without requiring substantial investment in new market expansion. The digital privacy market, in which ReputationDefender operates, is projected for continued expansion, ensuring a steady income stream that contributes positively to Gen Digital's overall financial health and profitability.

| Gen Digital Business Unit | BCG Matrix Category | Key Characteristics | Fiscal Year 2024 Data/Insights |

|---|---|---|---|

| Norton & Avast Core Protection | Cash Cow | Mature, high market share, stable recurring revenue, low investment needs | Subscription revenue remained robust; significant portion of NortonLifeLock's $2.8B FY23 revenue |

| LifeLock Identity Protection | Cash Cow | Strong customer retention (78% in Q1 2025), loyal customer base, direct-to-consumer model | 39.3 million direct customers; increased cross-sell/upsell initiatives |

| ReputationDefender | Cash Cow | Niche market dominance, specialized services, consistent revenue generation | Operates in a growing digital privacy market, estimated billions in 2024 |

What You’re Viewing Is Included

Gen Digital BCG Matrix

The Gen Digital BCG Matrix preview you are seeing is the exact, fully formatted document you will receive upon purchase. This means no watermarks, no demo content, and no hidden surprises – just the comprehensive strategic analysis ready for immediate application.

Rest assured, the BCG Matrix report you are currently viewing is the final, unedited version that will be delivered to you after your purchase. This ensures you get a professionally crafted strategic tool, directly applicable to your business planning and decision-making processes.

What you see is precisely the Gen Digital BCG Matrix file that will be yours once the purchase is complete. This means you'll receive a ready-to-use, professionally designed document, instantly downloadable for immediate integration into your strategic initiatives.

Dogs

Older, standalone antivirus software, often found in free or basic versions from brands like Avast and AVG, can be viewed as legacy products within the Gen Digital portfolio. While these still retain a user base, their position in the premium antivirus market is weakening.

The free versions frequently rely on data collection or persistent upselling tactics, which can lead to user distrust. These offerings contribute very little in terms of direct revenue and are unlikely to receive substantial investment for future expansion, placing them in the question mark category of the BCG matrix.

Older versions of PC optimization tools, such as certain iterations of CCleaner, could be classified as Dogs in Gen Digital's BCG Matrix. The market for standalone PC cleaning utilities is generally considered mature, with operating systems increasingly incorporating built-in optimization features, diminishing the demand for third-party solutions.

These products likely exhibit low market growth and a potentially shrinking market share, especially when contrasted with Gen Digital's more robust cybersecurity offerings which are experiencing higher demand. For instance, while specific market share data for older CCleaner versions isn't readily available, the broader utility software market has seen shifts as OS capabilities evolve.

Single-feature, non-bundled utilities, like standalone file shredders or basic password managers, once common, are now facing a shift in the cybersecurity market. The trend clearly favors comprehensive, integrated solutions that offer a wider range of protection. For instance, in 2024, the global cybersecurity market saw significant growth in endpoint security suites, which bundle multiple functionalities, rather than individual tools.

These isolated utilities, if they aren't part of a larger, value-added offering, likely hold a smaller market share and face limited growth prospects. This is because consumers and businesses increasingly prefer consolidated platforms that provide a more robust and convenient security posture. Data from late 2023 indicated that over 70% of consumers surveyed preferred bundled security solutions over single-feature applications for their digital protection needs.

Products with Declining Market Relevance

Products in the Dogs quadrant of the BCG Matrix, like those addressing increasingly mitigated cybersecurity threats, often experience declining market relevance. These offerings might have been crucial in the past, but advancements in operating systems and widespread adoption of security best practices have reduced their necessity. Consequently, demand for these products is typically low, and growth prospects are minimal.

For instance, software focused on combating specific, now-outdated malware strains or providing basic firewall functionalities that are now integrated into modern operating systems could fall into this category. Investing further in such products is unlikely to generate significant returns. In 2024, companies are increasingly scrutinizing their portfolios for underperforming assets, with a focus on divesting or providing only essential maintenance for these "dog" products.

- Diminished Threat Landscape: Cybersecurity solutions targeting threats that are no longer prevalent or have been effectively neutralized by OS patches and user education.

- Low Growth & Demand: These products face stagnant or declining sales due to reduced market need and competition from integrated, built-in security features.

- Poor Investment Returns: Further R&D or marketing efforts are unlikely to yield a positive return on investment, making them candidates for divestment.

- Portfolio Optimization: Companies are actively identifying and managing these products to free up resources for more promising ventures.

Geographical Markets with Low Penetration and High Competition

Certain niche geographical markets present a challenge for Gen Digital, characterized by intense competition and a slow uptake of consumer cybersecurity solutions. In these areas, Gen Digital has found it difficult to secure a substantial market share. For instance, while global cybersecurity spending is projected to reach $372 billion in 2024 according to Gartner, growth in some emerging markets for consumer solutions remains sluggish, potentially below 5% annually.

Investing heavily in these low-penetration, high-competition regions could yield minimal returns, making them a prime candidate for the question mark category in the BCG matrix. Such markets might necessitate disproportionately high marketing and sales expenditures to achieve even modest gains. For example, a report by Statista indicated that in certain Eastern European countries, consumer cybersecurity adoption rates were still in the 30-40% range in 2023, while competition from local and international players was fierce.

- Low Market Share: Gen Digital may hold less than 10% market share in these specific geographical segments.

- High Competitive Intensity: The presence of numerous established and emerging cybersecurity providers intensifies competition.

- Slow Consumer Adoption: Consumer awareness and willingness to invest in cybersecurity solutions are notably underdeveloped.

- High Investment Risk: The cost of market entry and expansion may outweigh the potential for revenue generation.

Products classified as Dogs within Gen Digital's portfolio represent offerings with low market share and low growth potential. These are often older technologies or solutions that face diminishing demand due to market shifts or the availability of superior, integrated alternatives. For example, standalone PC cleanup utilities, like some older versions of CCleaner, fit this description as operating systems now offer more robust built-in features.

These products typically generate minimal revenue and are unlikely to receive significant investment for future development. Companies like Gen Digital often manage these assets through minimal support or consider divestment to reallocate resources to more promising areas. In 2024, the focus for such products is on maintaining existing user bases rather than expanding market reach.

The cybersecurity market, in particular, sees certain legacy antivirus solutions or single-feature security tools fall into the Dog category. As the threat landscape evolves and users opt for comprehensive suites, these isolated offerings struggle to maintain relevance. For instance, data from late 2023 indicated that over 70% of consumers preferred bundled security solutions, highlighting the declining appeal of single-feature applications.

These products often face declining market relevance due to the mitigation of specific, once-prevalent threats or the integration of basic security functionalities into modern operating systems. Consequently, demand is low, and growth prospects are minimal, making further investment unlikely to yield positive returns.

| Product Category | Market Share | Market Growth | Strategic Implication | Example |

| Legacy Antivirus | Low | Low/Declining | Minimal investment, potential divestment | Older, standalone antivirus software from less prominent brands |

| Standalone Utilities | Low | Low/Declining | Focus on maintenance, consider bundling or phasing out | Older versions of PC optimization or cleaning software |

| Niche Security Tools | Low | Low/Declining | Evaluate for integration or sunsetting | Single-feature password managers or file shredders without broader suite integration |

Question Marks

As AI-driven deepfakes and synthetic identities become more sophisticated, Gen Digital's solutions specifically targeting these emerging threats represent a potential "Question Mark" in the BCG matrix. The market for specialized consumer solutions is still developing, meaning Gen's current market share might be low, despite the high-growth nature of these threats.

Significant investment in research and development, alongside consumer education, will be crucial for Gen Digital to establish leadership in this nascent market. The company needs to innovate rapidly and build awareness to convert these emerging threat solutions into Stars.

Gen Digital is exploring advanced privacy tools like digital footprint management, which go beyond traditional VPNs. These services aim to give users more control over their online presence by identifying and removing personal data from the web. While consumer interest in privacy is rising, adoption of these newer, more complex solutions remains relatively low.

The market for comprehensive digital footprint management is still developing, with Gen Digital investing in this nascent space. Although the company is active, it has not yet established a dominant market share in these sophisticated privacy solutions. Strategic investments will be crucial for Gen Digital to capitalize on the projected growth in demand for advanced online privacy management.

Gen Digital's smart home and IoT security solutions are positioned in a high-growth market, driven by the increasing number of connected devices. This segment is expected to see significant expansion, with the global IoT security market projected to reach $57.3 billion by 2027, growing at a CAGR of 27.7% from 2022.

Despite the market's potential, Gen Digital's current market share in this relatively new and fragmented consumer segment may be low. The company faces competition from specialized players who have already established a foothold.

These offerings require substantial investment for research and development to create robust security solutions. Gen Digital must also invest in marketing and brand building to gain traction against established competitors in this evolving landscape.

Personalized Scam Prevention through AI Integration

Gen Digital is exploring AI-powered solutions to combat increasingly sophisticated, hyper-personalized scams, particularly those that exploit data from past breaches. This strategic area, akin to a Question Mark in the BCG matrix, holds significant potential but is still in its early stages of development and market acceptance.

The effectiveness of these advanced prevention tools hinges on Gen Digital's ability to meticulously analyze vast amounts of personal data and continuously refine its AI models. Building consumer trust in these personalized security measures is paramount for achieving significant market penetration and dominance in this evolving threat landscape.

- Growing Threat: Reports indicate a significant rise in AI-generated phishing and scam attempts, with some estimates suggesting over 90% of cyberattacks now involve social engineering elements.

- Data Dependency: The efficacy of personalized scam prevention relies heavily on access to and sophisticated analysis of user data, raising privacy concerns that need careful management.

- Market Uncertainty: While the demand for enhanced security is high, consumer willingness to adopt AI tools that process their personal information for scam prevention is still being gauged.

- Investment Required: Significant ongoing investment in AI research, data infrastructure, and cybersecurity talent is necessary to stay ahead of rapidly evolving scamming techniques.

Integration of Cybersecurity with Financial Wellness (Gen Digital Financial expansion)

Gen Digital's strategic integration of acquired financial wellness capabilities, such as those from MoneyLion, alongside its core cybersecurity offerings presents a classic BCG Matrix Question Mark. The market for financial fraud prevention is substantial, with projections indicating continued growth. For instance, the global fraud detection and prevention market was valued at approximately $30.2 billion in 2023 and is expected to reach over $100 billion by 2030, demonstrating significant potential.

The success of this expansion hinges on Gen Digital's ability to effectively cross-sell these complementary services to its existing cybersecurity customer base. This requires not only a robust technological integration but also a compelling value proposition that resonates with consumers seeking holistic digital safety and financial health. Achieving a high market share within this expanded offering will demand strategic marketing campaigns and potentially new product development to bridge the gap between cybersecurity and financial wellness.

- Market Opportunity: The financial fraud prevention market is experiencing robust growth, with a projected compound annual growth rate (CAGR) of around 15% through 2030.

- Integration Challenge: Merging distinct service offerings like cybersecurity and financial wellness into a unified, appealing product requires significant strategic and operational effort.

- Cross-Selling Potential: Gen Digital can leverage its existing customer relationships to introduce financial wellness solutions, but effective segmentation and tailored messaging are crucial.

- Investment Requirement: Achieving market leadership in this integrated space will likely necessitate substantial investment in technology, marketing, and customer education.

Gen Digital's ventures into AI-driven deepfake and synthetic identity protection, alongside advanced digital footprint management, represent significant question marks. These areas target high-growth threats but currently have low market penetration for Gen Digital, requiring substantial R&D and consumer education to mature into stars.

The company's smart home and IoT security solutions also fall into this category. While the IoT security market is expanding rapidly, Gen Digital faces competition and needs to invest heavily in innovation and branding to capture a larger share.

Similarly, AI-powered personalized scam prevention and the integration of financial wellness services present opportunities with high growth potential but unproven market dominance for Gen Digital, necessitating strategic investments and careful customer acquisition.

| Area of Focus | Market Growth Potential | Gen Digital's Current Position | Strategic Imperative |

|---|---|---|---|

| AI-driven Deepfake & Synthetic Identity Protection | High (Emerging Threats) | Low Market Share | R&D, Consumer Education |

| Digital Footprint Management | High (Growing Privacy Concerns) | Low Market Share | Innovation, Brand Building |

| Smart Home & IoT Security | High (CAGR 27.7% by 2027) | Low Market Share | Investment in R&D, Marketing |

| AI-Powered Personalized Scam Prevention | High (Evolving Threats) | Nascent Stage | AI Refinement, Trust Building |

| Integrated Financial Wellness & Fraud Prevention | High (CAGR ~15% through 2030) | Developing | Cross-selling, Tech Integration |

BCG Matrix Data Sources

Our Gen Digital BCG Matrix is built on a foundation of robust data, encompassing financial disclosures, market research reports, and competitive analysis to provide strategic clarity.