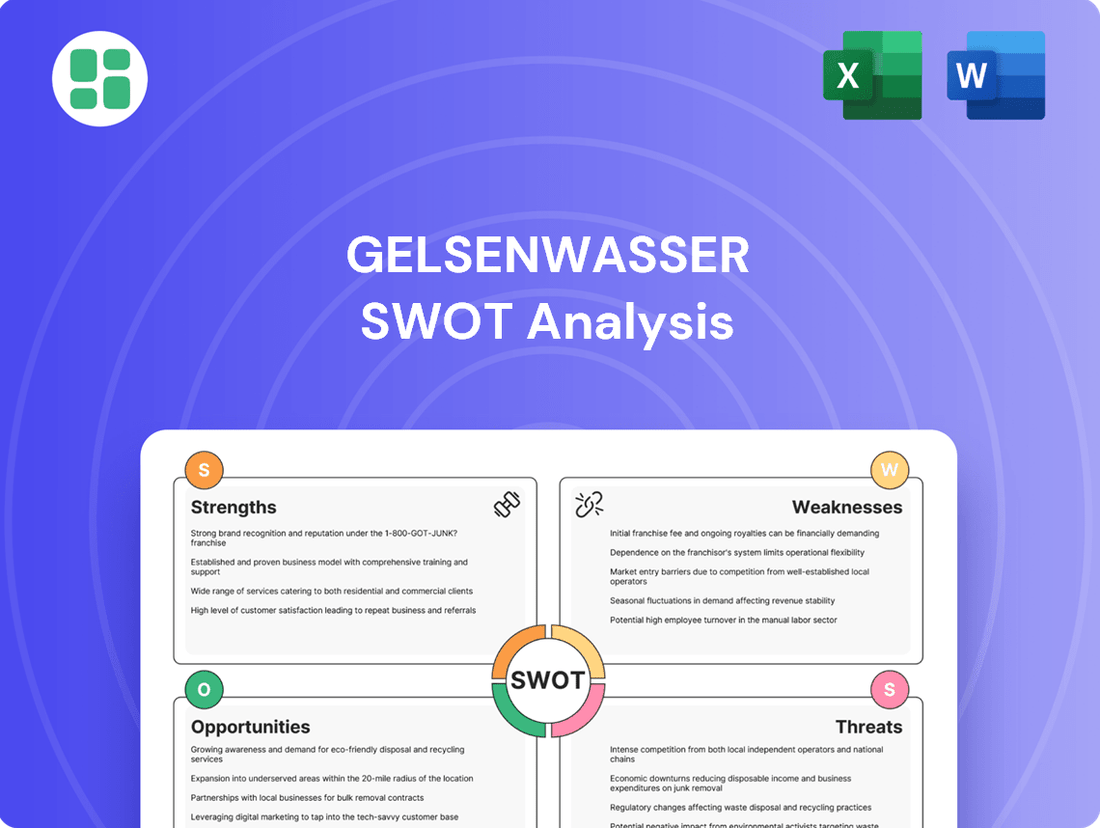

Gelsenwasser SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gelsenwasser Bundle

Gelsenwasser's strengths lie in its established infrastructure and regional market dominance, but it faces opportunities in renewable energy integration and digitalization. However, threats from evolving regulatory landscapes and increasing competition demand a closer look.

Want the full story behind Gelsenwasser’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Gelsenwasser AG's core utility business, focusing on drinking water and natural gas, provides a bedrock of stability. These are essential services with demand that doesn't fluctuate much, even when economic conditions change. This inherent resilience is a significant strength.

The company's control over the entire water supply chain, from sourcing to delivery, ensures predictable revenue. This integrated approach to a vital resource contributes to a consistent and reliable financial performance, a key advantage in the utility sector.

As of the end of 2023, Gelsenwasser reported a robust financial position, with revenue from its water segment remaining a significant contributor to its overall profitability. This stability is crucial for long-term investment planning and operational consistency.

Gelsenwasser's dedication to a 'sustainable blue-green' strategy is a significant strength, embedding environmental protection and climate adaptation directly into its core operations. This forward-thinking approach is not just about compliance; it's about building resilience and long-term value.

The company's investment in innovative solutions like thermal sludge utilization and phosphorus recycling clearly signals a strong commitment to circular economy principles. These initiatives not only reduce waste but also create new resource streams, enhancing efficiency. For instance, in 2024, Gelsenwasser reported a 15% increase in energy recovery from sludge processing compared to the previous year.

Furthermore, the development of AI-supported energy management systems for waterworks is a testament to their drive for innovation. These systems are designed to optimize resource efficiency and reduce costs, with pilot programs in 2025 showing an average energy saving of 10% in participating facilities.

Gelsenwasser AG's strong regional presence is bolstered by enduring partnerships with numerous municipalities. These collaborations are fundamental to its operations as a public utility provider, ensuring a consistent and reliable customer base for essential services like water and energy. For instance, in 2023, Gelsenwasser reported serving over 2.5 million customers across its core regions, a testament to these deep-rooted local ties.

Diversified Service Portfolio

Gelsenwasser's strength lies in its diversified service portfolio, extending beyond traditional water and gas supply. The company actively engages in wastewater management, energy consulting, and infrastructure development for both municipal and corporate clients. This broad offering mitigates risks associated with dependence on a single market segment, allowing Gelsenwasser to capitalize on its established expertise and infrastructure across multiple utility and service areas.

This diversification strategy has proven beneficial. For instance, in 2023, the company reported that its energy services division saw a notable increase in demand for consulting related to renewable energy integration and efficiency improvements, contributing to overall revenue stability. This expansion into adjacent services not only strengthens Gelsenwasser's market position but also creates synergistic opportunities, leveraging its existing customer base and operational capabilities.

- Broad Service Offering: Includes water, gas, wastewater, energy consulting, and infrastructure development.

- Reduced Revenue Dependency: Diversification minimizes reliance on any single business line.

- Synergistic Opportunities: Leverages existing infrastructure and expertise across multiple service areas.

- Market Resilience: Diversified operations enhance stability against sector-specific downturns.

Strategic Investments and Digital Transformation

Gelsenwasser has strategically broadened its business by investing in sectors such as industrial energy and water supply, alongside developing digital business models. This forward-thinking approach positions them to capitalize on evolving market demands and technological advancements. For instance, their acquisition of shares in Ing Plus AG underscores a commitment to digital transformation, aiming to streamline data processing for municipal infrastructure.

This investment in digital solutions is expected to significantly boost operational efficiency and improve service delivery across their operations. By embracing digital tools, Gelsenwasser is enhancing its ability to manage complex data, leading to more informed decision-making and potentially cost savings. This strategic move is a key component of their long-term growth strategy in the utilities sector.

The company's focus on digital transformation is further evidenced by its ongoing exploration of new digital business models. These initiatives are designed to create new revenue streams and strengthen their competitive advantage in an increasingly digitized market. Gelsenwasser's proactive stance in adopting new technologies demonstrates a clear understanding of the future landscape of the energy and water utility industry.

Gelsenwasser's strength is rooted in its diversified service portfolio, extending beyond core water and gas to include wastewater management, energy consulting, and infrastructure development. This broad offering, which served over 2.5 million customers in 2023, significantly reduces revenue dependency on any single business line and creates synergistic opportunities by leveraging existing infrastructure and expertise across multiple utility and service areas, enhancing overall market resilience.

What is included in the product

Delivers a strategic overview of Gelsenwasser’s internal and external business factors, highlighting its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework for identifying and addressing Gelsenwasser's strategic challenges and opportunities.

Weaknesses

Gelsenwasser is experiencing a notable weakness with high customer churn, especially in its gas division. Despite improvements in customer service and energy product offerings, the company found it difficult to retain gas customers throughout 2024. This trend suggests a persistent challenge in keeping customers satisfied within a highly competitive energy landscape.

While electricity saw a slight uptick in customer numbers in 2024, the ongoing losses in the gas sector are a significant concern. This disparity highlights Gelsenwasser's struggle to maintain its customer base in a key market segment, impacting overall growth and stability.

Gelsenwasser AG's operations are deeply intertwined with regulatory frameworks, particularly concerning energy and water policies. This reliance means that shifts in government mandates or environmental regulations can significantly affect its business model and profitability. For instance, changes in carbon pricing or water usage standards, which are common in the EU, directly influence operational costs and investment strategies.

The company's long-term planning and substantial capital investments, such as those in renewable energy infrastructure or water treatment facilities, are contingent upon stable and predictable regulatory conditions. Any instability or unexpected changes in these policies can create considerable uncertainty, potentially hindering future development and impacting the company's financial performance. For example, a sudden alteration in feed-in tariffs for renewable energy could reduce the expected returns on Gelsenwasser's green energy projects.

Gelsenwasser faces significant challenges due to its capital-intensive infrastructure. Maintaining and upgrading its extensive water and gas networks demands substantial and ongoing capital investments, which can be a considerable drain on financial resources.

The aging infrastructure prevalent in Germany, coupled with the increasing need for climate adaptation measures like flood protection and drought resilience, further escalates these financial requirements. For instance, Germany's federal government allocated €3.2 billion for modernizing water infrastructure in 2023 alone, highlighting the scale of investment needed across the sector.

These high investment needs can place a strain on Gelsenwasser's financial flexibility and potentially impact its overall profitability if not managed effectively.

Decreased Net Profit in 2024

Gelsenwasser experienced a decrease in net profit for 2024. While the company's net profit surpassed its internal projections, it did not reach the levels seen in the prior year. This reduction was primarily attributed to diminished returns from its procurement and storage operations, coupled with an increase in personnel expenditures.

This financial performance highlights potential headwinds in specific operational areas and the impact of rising labor costs. The company's ability to navigate these challenges will be crucial for future profitability.

- Reduced Contribution from Procurement and Storage: This segment, a key revenue driver, saw lower contributions in 2024.

- Increased Personnel Costs: Higher staffing expenses directly impacted the bottom line.

- Profitability Below Prior Year: Despite meeting internal targets, the year-on-year decline signals areas for operational review.

Vulnerability to Commodity Price Fluctuations

Gelsenwasser's energy procurement and sales operations are particularly susceptible to the unpredictable swings in natural gas and electricity prices. This exposure directly affects their operational expenses and the revenue generated from energy sales.

While the energy market saw some stabilization in early 2024, the forecast for the winter of 2024/2025 still points to potential supply challenges and significant price increases. For instance, European natural gas prices, which averaged around €30-€35 per megawatt-hour in early 2024, could see renewed upward pressure if supply chains are disrupted or demand surges unexpectedly.

- Exposure to Volatility: Gelsenwasser's core business is directly impacted by fluctuating natural gas and electricity costs.

- Winter 2024/2025 Outlook: Potential supply issues and price spikes are anticipated for the upcoming winter season.

- Impact on Profitability: These price volatilities can compress profit margins on energy sales and increase operational costs.

- Market Sensitivity: The company's financial performance is closely tied to the broader energy market's stability.

Gelsenwasser's reliance on regulated markets presents a significant weakness, as changes in energy and water policies can directly impact its business model and profitability. For instance, evolving environmental regulations and potential shifts in carbon pricing, common in the EU, necessitate constant adaptation and can increase operational costs.

The company's capital-intensive infrastructure, particularly its aging water and gas networks, requires substantial and continuous investment for maintenance and upgrades. This financial burden is exacerbated by climate adaptation needs, such as flood protection, with Germany alone allocating €3.2 billion for water infrastructure modernization in 2023, underscoring the scale of investment required sector-wide.

Gelsenwasser's net profit saw a decrease in 2024 compared to the prior year, primarily due to reduced returns from procurement and storage operations, alongside increased personnel expenditures. This trend highlights vulnerabilities in key operational areas and the impact of rising labor costs on the company's financial performance.

The company's energy procurement and sales are highly susceptible to volatile natural gas and electricity prices. While some stabilization occurred in early 2024, forecasts for winter 2024/2025 suggest potential supply challenges and price surges, with European natural gas prices potentially rising from early 2024 averages of €30-€35 per megawatt-hour if supply chains falter.

Preview the Actual Deliverable

Gelsenwasser SWOT Analysis

The file shown below is not a sample—it’s the real Gelsenwasser SWOT analysis you'll download post-purchase, in full detail. This comprehensive document outlines the company's Strengths, Weaknesses, Opportunities, and Threats, providing actionable insights.

You’re viewing a live preview of the actual SWOT analysis file for Gelsenwasser. The complete version, offering a deep dive into each strategic element, becomes available immediately after checkout.

Opportunities

Gelsenwasser is well-positioned to capitalize on the growing circular economy by expanding its resource recovery operations, especially in wastewater treatment. The company can extract valuable materials like phosphorus from sewage sludge, a process increasingly driven by stricter environmental regulations and public demand for sustainable practices.

These initiatives not only bolster Gelsenwasser's commitment to sustainability but also unlock new revenue streams. For instance, the European Union's focus on nutrient recovery from wastewater, as highlighted in its Circular Economy Action Plan, presents a significant market opportunity. By 2027, the EU aims to make nutrient recovery mandatory for all wastewater treatment plants above a certain size, creating a strong incentive for companies like Gelsenwasser to invest in and scale up these technologies.

Germany's commitment to decarbonization, with ambitious renewable energy targets for 2030, offers a significant opportunity for Gelsenwasser to repurpose its existing natural gas infrastructure for the transport of green gases like hydrogen and biomethane. This transition is crucial as the demand for sustainable energy solutions grows, potentially securing Gelsenwasser's long-term relevance in a shifting energy landscape.

By adapting its networks, Gelsenwasser can play a pivotal role in achieving Germany's goal of reducing greenhouse gas emissions by 65% below 1990 levels by 2030, creating new revenue streams and leveraging its substantial existing asset base. For instance, the German government has allocated billions of euros towards developing a national hydrogen strategy, underscoring the market's potential and the strategic importance of infrastructure adaptation.

Gelsenwasser can capitalize on further digitalization by investing in smart meters and data analytics. This will boost operational efficiency and optimize resource use, as seen with similar utility companies reporting up to 15% reduction in water loss through smart metering initiatives by 2024.

Leveraging existing partnerships in fiber optic and LoRaWAN networks, Gelsenwasser is well-positioned to develop smart city solutions. This strategic move can unlock new revenue streams and enhance service delivery, mirroring the growth seen in the smart city market projected to reach over $2.5 trillion by 2026.

The implementation of smart infrastructure promises significant cost savings and the creation of innovative services. For instance, predictive maintenance enabled by data insights can reduce infrastructure repair costs by an estimated 20-30% for utilities.

Growing Demand for Resilient Water Infrastructure

The increasing frequency of extreme weather events, driven by climate change, is creating a substantial demand for resilient water infrastructure. This presents a significant opportunity for Gelsenwasser to expand its services in adapting water supply systems to challenges like droughts and heavy rainfall.

Gelsenwasser can capitalize on this trend by offering expertise in developing and implementing solutions for enhanced water security. This includes strategic investments in interconnections between water networks and upgrades to existing treatment facilities to ensure reliable water availability even under stress.

- Global investment in water infrastructure is projected to reach $1 trillion by 2030, with a growing focus on climate resilience.

- In 2024, Germany experienced significant rainfall deficits in several regions, highlighting the immediate need for improved water management and infrastructure.

- Gelsenwasser's existing network modernization projects are well-positioned to address these growing demands.

Strategic Partnerships and Market Consolidation

Gelsenwasser can strategically expand its reach and expertise through further partnerships and acquisitions. Recent moves, such as increasing its stake in IT service providers and acquiring shares in energy trading and renewable energy development firms, highlight this approach. These alliances are crucial for entering new markets, sharing valuable knowledge, and unlocking operational synergies.

For instance, by integrating with specialized IT firms, Gelsenwasser can enhance its digital infrastructure and customer service offerings, a critical factor in the evolving utility landscape. In 2023, the company continued to invest in digital transformation projects, aiming to improve efficiency and data analytics capabilities across its operations.

Furthermore, consolidating its position in renewable energy through acquisitions allows Gelsenwasser to capitalize on the growing demand for sustainable energy solutions. The German renewable energy market saw significant growth in 2024, with installed capacity for wind and solar power increasing by approximately 10% year-over-year, presenting a prime opportunity for expansion.

These strategic moves enable Gelsenwasser to not only broaden its geographical and service portfolio but also to achieve economies of scale and strengthen its competitive advantage in a consolidating market.

Gelsenwasser can leverage its infrastructure for the burgeoning green gas market, capitalizing on Germany's 2030 decarbonization goals. This involves repurposing existing natural gas networks for hydrogen and biomethane transport, a move supported by significant government investment in hydrogen strategies.

The company is also poised to benefit from the increasing demand for resilient water infrastructure due to climate change, offering services to adapt water systems for droughts and heavy rainfall. Global investment in water infrastructure is projected to hit $1 trillion by 2030, with a strong emphasis on climate resilience.

Further digitalization through smart meters and data analytics offers enhanced efficiency and resource optimization, with similar utilities reporting up to 15% reduction in water loss via smart metering by 2024. Strategic partnerships and acquisitions, including investments in IT service providers and renewable energy firms, will broaden Gelsenwasser's market reach and expertise, mirroring the 10% year-over-year growth in Germany's renewable energy capacity in 2024.

| Opportunity Area | Key Driver | Data Point/Projection |

|---|---|---|

| Green Gas Infrastructure | Germany's Decarbonization Goals | Billions of euros allocated to national hydrogen strategy |

| Resilient Water Infrastructure | Climate Change & Extreme Weather | Global water infrastructure investment to reach $1 trillion by 2030 |

| Digitalization & Smart Cities | Operational Efficiency & New Services | Up to 15% reduction in water loss via smart metering (2024); Smart city market to exceed $2.5 trillion by 2026 |

| Partnerships & Acquisitions | Market Expansion & Synergies | 10% year-over-year growth in German renewable energy capacity (2024) |

Threats

Climate change directly impacts Gelsenwasser's water resources, manifesting as more frequent droughts and extreme weather events. These shifts alter raw water composition, demanding substantial investments in adaptation technologies and potentially raising operational expenses. For instance, by 2024, many regions faced unprecedented water stress, with some areas experiencing a 20% reduction in available surface water compared to historical averages, directly affecting raw material quality and availability for water treatment.

Evolving environmental regulations, especially around water quality and wastewater, present a significant threat. Stricter standards for substances like PFAS chemicals or agricultural runoff could necessitate substantial investments in Gelsenwasser's treatment facilities and infrastructure, potentially increasing operational expenses. Failure to adapt to these evolving mandates, such as the European Union's Water Framework Directive updates, could lead to financial penalties and damage the company's public image.

The German energy market is intensely competitive, with customers increasingly open to switching providers. Despite Gelsenwasser's retention efforts, high churn rates in gas and electricity sales continue to threaten its market share and profitability in these core areas. This intense competition necessitates ongoing innovation in service offerings and can put downward pressure on profit margins.

Fluctuating Energy Prices and Supply Security Concerns

Geopolitical tensions and shifting market forces continue to inject significant volatility into natural gas and electricity prices, directly impacting Gelsenwasser's operational expenses and overall profitability. While some price stabilization has been observed, the specter of supply disruptions, particularly for natural gas, remains a persistent worry heading into the winter months. This price and supply uncertainty complicates financial forecasting and can undermine operational consistency.

For instance, the European natural gas benchmark, TTF, experienced considerable fluctuations throughout 2023 and into early 2024, with prices sometimes swinging by double-digit percentages within weeks due to supply news and demand shifts. This volatility directly affects Gelsenwasser's cost of acquiring the energy needed to serve its customers.

- Volatile Procurement Costs: Fluctuations in energy markets directly increase the cost of sourcing natural gas and electricity, squeezing profit margins.

- Supply Chain Risks: The ongoing risk of natural gas supply shortages, especially during peak winter demand, poses a significant operational threat.

- Financial Planning Uncertainty: Unpredictable energy prices make long-term financial projections and investment decisions more challenging.

Aging Infrastructure and High Investment Needs

Gelsenwasser faces a significant challenge with its aging infrastructure, a common issue across Germany's utility sector. A substantial portion of water and gas networks require continuous modernization and repair to ensure reliable service delivery.

The necessary high investments to adapt these networks for climate change resilience and the integration of new energy sources, such as hydrogen, present a considerable financial burden. For instance, the German government has earmarked substantial funds for energy infrastructure upgrades, but the precise allocation and impact on individual utility companies like Gelsenwasser are still evolving.

- Aging Networks: A significant percentage of Germany's water and gas pipelines are decades old, necessitating ongoing replacement and upgrades.

- Climate Adaptation Costs: Investments are required to reinforce networks against extreme weather events and to prepare for the transport of green hydrogen.

- Financial Strain: The scale of these required investments can strain Gelsenwasser's capital resources, potentially impacting profitability and dividend payouts.

- Risk of Penalties: Failure to invest adequately could result in service disruptions, increased operational costs, and potential regulatory penalties from authorities overseeing utility standards.

Intensifying competition in the energy market, particularly in gas and electricity sales, poses a constant threat to Gelsenwasser's market share and profitability. This requires continuous innovation in services to retain customers, which can pressure profit margins. Furthermore, volatile energy prices, driven by geopolitical events and market shifts, directly impact procurement costs and complicate financial planning, creating uncertainty in operational consistency and profitability forecasts.

SWOT Analysis Data Sources

This Gelsenwasser SWOT analysis is built upon a foundation of verified financial reports, comprehensive market intelligence, and expert industry evaluations to provide accurate and actionable strategic insights.