Gelsenwasser Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gelsenwasser Bundle

Gelsenwasser operates in a market shaped by significant buyer power and the constant threat of substitutes, impacting its pricing and customer loyalty. Understanding these forces is crucial for any player in the German energy sector.

The complete report reveals the real forces shaping Gelsenwasser’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Suppliers of raw water to Gelsenwasser operate under a stringent regulatory and environmental framework. These constraints, often embedded in long-term concessions and public agreements, significantly curtail their ability to dictate terms. For instance, adherence to the EU Water Framework Directive and national water quality standards necessitates substantial investment and operational diligence from these suppliers, limiting their flexibility.

Gelsenwasser's water treatment and distribution processes are heavily reliant on energy, positioning energy suppliers as a significant force in its operations. While the wholesale price of natural gas, a key energy input, experienced a decrease of approximately 5% in April 2025 compared to the previous year, these costs remain a substantial component of Gelsenwasser's overall expenditure.

The company's profitability is directly susceptible to volatility in wholesale energy markets. Even with the recent price moderation, any upward swings in energy costs can compress Gelsenwasser's margins, necessitating careful management of its energy procurement strategies.

Suppliers of highly specialized equipment for water treatment and gas network infrastructure, along with providers of advanced digital solutions, can exert moderate bargaining power. This is often due to the unique, proprietary nature of their technology and the deep, specialized expertise they bring to the table. For instance, a provider of a novel membrane filtration system for water purification might command higher prices if few alternatives exist with comparable efficiency.

The switching costs associated with these critical components can be substantial. Integrating new, specialized systems into existing infrastructure, such as upgrading gas distribution control systems or water treatment plants, typically involves significant capital expenditure and can disrupt ongoing operations during the transition period. This inertia makes it challenging for Gelsenwasser to readily change suppliers for these essential technologies.

Gelsenwasser's ongoing commitment to modernizing and expanding its infrastructure, including investments in smart metering and advanced leak detection systems, naturally increases its reliance on these specialized technology providers. For example, in 2024, Gelsenwasser continued to invest in digitalizing its operations, with a notable portion of its capital expenditure allocated to IT and network management solutions, underscoring the dependence on key tech suppliers.

Infrastructure Materials and Construction Services

Gelsenwasser's reliance on a vast network of pipes and gas lines means a consistent need for construction materials and specialized civil engineering services. The bargaining power of these suppliers is influenced by factors like market demand, the availability of specific materials, and the pool of qualified contractors. For instance, in 2024, the global construction materials market saw price fluctuations due to supply chain disruptions, potentially increasing supplier leverage.

Large infrastructure projects, crucial for Gelsenwasser's maintenance and expansion efforts, are particularly sensitive to the pricing and reliability of these essential inputs. Suppliers with specialized expertise or unique material offerings can command higher prices, impacting Gelsenwasser's operational costs.

- Supplier Concentration: The number of qualified civil engineering firms and material providers in Gelsenwasser's operating regions directly impacts their bargaining power. A more concentrated supplier market generally favors suppliers.

- Material Availability and Substitutability: The availability of specific pipe materials (e.g., ductile iron, steel, plastic) and the ease with which they can be substituted influences supplier leverage. Shortages of key components can significantly strengthen supplier positions.

- Cost of Switching: The costs associated with Gelsenwasser switching from one supplier to another, including logistical changes and potential project delays, can empower existing suppliers.

Skilled Labor and Human Capital

The utility sector, including companies like Gelsenwasser, relies heavily on a specialized workforce. This includes engineers for infrastructure, technicians for maintenance, and experts in water treatment and energy systems. The demand for these skilled professionals is high, and their availability can be a challenge.

In 2024, the competition for skilled labor in technical fields remains intense. For instance, reports indicate a growing shortage of qualified engineers across various industries, a trend that directly impacts utilities. This scarcity means that employees with in-demand skills possess considerable bargaining power.

Gelsenwasser, like other utilities, must focus on retaining its valuable human capital. This involves offering competitive salaries and benefits, as well as investing in continuous training and development programs to keep its workforce up-to-date with evolving technologies and regulations. Failure to do so could lead to increased labor costs and operational disruptions.

- High Demand for Specialized Skills: Engineers, technicians, and water treatment specialists are crucial for utility operations.

- Talent Shortages Impact Bargaining Power: Demographic shifts and competition for talent in 2024 empower skilled utility workers.

- Investment in Human Capital is Key: Gelsenwasser needs to prioritize training and competitive compensation to secure its workforce.

Suppliers of raw water to Gelsenwasser face significant limitations on their bargaining power due to strict regulatory and environmental frameworks, including EU directives. These regulations necessitate substantial investments and operational diligence, curtailing their ability to dictate terms. The company's reliance on specialized technology providers for water treatment and digital solutions also grants these suppliers moderate leverage, particularly when their offerings are unique and switching costs are high. For instance, Gelsenwasser's 2024 investments in digitalization underscored its dependence on key tech suppliers.

The bargaining power of suppliers for construction materials and civil engineering services is influenced by market demand, material availability, and contractor pools. In 2024, supply chain disruptions in the construction materials market led to price fluctuations, potentially increasing supplier leverage for essential inputs like pipes and specialized components. Furthermore, the intense competition for skilled labor in 2024, particularly for engineers and technicians, significantly empowers utility workers, necessitating competitive compensation and training from companies like Gelsenwasser to retain talent.

What is included in the product

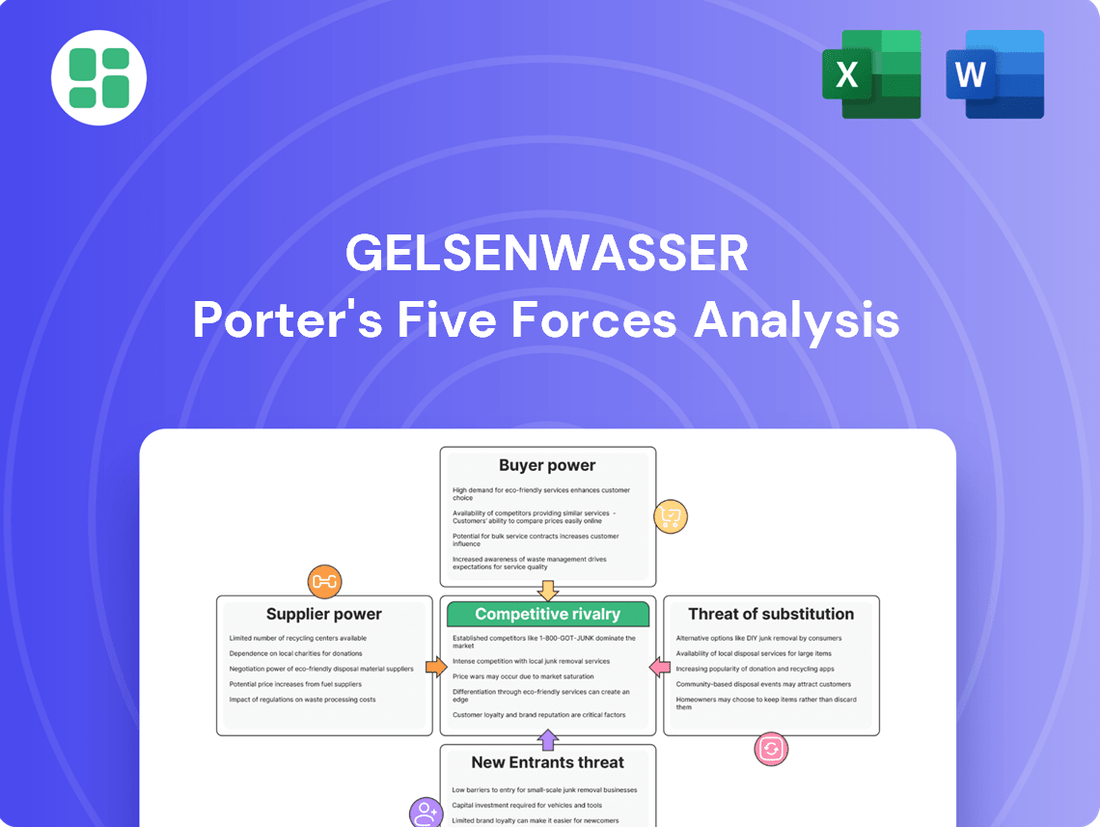

Analyzes the competitive intensity and profitability of the German water and energy utility market for Gelsenwasser, examining buyer and supplier power, threat of new entrants and substitutes, and existing rivalry.

Instantly assess competitive pressures with a visual breakdown of Gelsenwasser's Porter's Five Forces, simplifying complex market dynamics for strategic clarity.

Customers Bargaining Power

For essential services like drinking water and natural gas, customers, encompassing households and numerous businesses, possess limited bargaining power. This stems from the fundamental necessity of these utilities and the scarcity of viable direct alternatives to piped supply. The inability to simply forgo these services renders customers highly reliant on their local provider, a dynamic that underpins Gelsenwasser's consistent revenue streams in these areas.

Municipal and industrial clients, by their sheer size and the volume of services they procure, wield significant bargaining power over Gelsenwasser. For instance, large industrial users might negotiate for more favorable pricing or specialized service terms, directly impacting Gelsenwasser's revenue streams. These entities can also leverage their influence within local governance, potentially impacting regulatory frameworks or future contract awards.

Switching costs for core utilities like water and gas are exceptionally high, effectively locking customers into their current providers. For instance, in Germany, the extensive and integrated nature of water and gas networks means that a residential customer cannot simply choose a different supplier for their piped water or natural gas without significant infrastructure changes, which are practically impossible for individuals. This inherent immobility reinforces Gelsenwasser's market position by limiting customer churn.

Price Sensitivity in Competitive Segments

While core utility services like water provision often exhibit low price elasticity, Gelsenwasser's ventures into electricity and gas sales, alongside energy consulting, encounter a more discerning customer base. These segments are characterized by a greater willingness to explore alternatives based on price, a trend clearly visible in the competitive energy market.

Data from 2024 highlights this price sensitivity, with customer churn rates exceeding 10% in Gelsenwasser's electricity and gas sales divisions. This significant turnover underscores that customers are actively seeking better deals and are not hesitant to switch providers when more attractive offers are available. Consequently, Gelsenwasser must maintain competitive pricing strategies and elevate customer service to retain its market share in these more dynamic areas.

- Price Sensitivity: Gelsenwasser's electricity and gas sales face higher price sensitivity compared to core water services.

- Customer Churn: In 2024, customer churn rates in Gelsenwasser's electricity and gas sales surpassed 10%.

- Competitive Response: The company must offer competitive pricing and superior customer service to mitigate customer switching in these segments.

Influence of Regulatory Bodies

The bargaining power of customers for Gelsenwasser is indirectly shaped by regulatory bodies in Germany. These entities, such as the Federal Network Agency (Bundesnetzagentur) for energy and water, ensure that utility pricing remains fair and that service quality meets established standards. This regulatory oversight serves to protect consumers, thereby limiting the extent to which Gelsenwasser could otherwise leverage its position to impose unfavorable terms.

For instance, in 2024, German energy regulators continued to monitor wholesale energy prices and their pass-through to consumers, aiming to prevent excessive increases. Similarly, water quality standards are strictly enforced, with penalties for non-compliance, which indirectly strengthens the consumer's position by ensuring a baseline level of service and safety.

- Regulatory Oversight: German regulators protect consumer interests by controlling utility pricing and service standards.

- Fair Pricing: Oversight aims to prevent Gelsenwasser from charging excessively high prices for water and energy.

- Service Quality: Regulations ensure a reliable and safe supply, bolstering the consumer's position.

- Mitigated Power: While individual customers have limited direct power, regulatory intervention offers a collective safeguard.

While Gelsenwasser's core water services see customers with low bargaining power due to necessity, their electricity and gas sales face significant price sensitivity. In 2024, this was evident with customer churn rates exceeding 10% in these segments, indicating a strong customer inclination to switch for better deals. This necessitates competitive pricing and enhanced service to retain customers in these more dynamic markets.

| Segment | 2024 Churn Rate | Key Driver |

| Water Services | Negligible | High switching costs, essential service |

| Electricity & Gas Sales | >10% | Price sensitivity, availability of alternatives |

What You See Is What You Get

Gelsenwasser Porter's Five Forces Analysis

This preview showcases the complete Gelsenwasser Porter's Five Forces Analysis, offering a detailed examination of competitive forces within its industry. The document you see here is the exact, professionally formatted analysis you will receive instantly upon purchase, ensuring no surprises or placeholder content. You can confidently acquire this ready-to-use strategic tool, which meticulously breaks down Gelsenwasser's competitive landscape.

Rivalry Among Competitors

The German utility sector, where Gelsenwasser operates, is notably fragmented, featuring a blend of large national companies and many smaller municipal utilities, known as Stadtwerke. These Stadtwerke often hold regional monopolies for essential services like water and gas distribution, which inherently reduces direct competitive clashes within their specific service territories.

Despite this localized market structure, the entire German utility landscape is subject to stringent regulations. These regulations dictate operational boundaries and service quality benchmarks, indirectly shaping the competitive environment by setting a common playing field for all participants. For instance, in 2023, the Federal Network Agency (Bundesnetzagentur) continued to oversee pricing and infrastructure development across the energy and water sectors, reinforcing a stable, albeit regulated, competitive dynamic.

Competitive rivalry is particularly intense in the energy procurement and sales sectors, encompassing electricity and gas supply, as well as supplementary services like energy consulting and wastewater management. This heightened competition stems from customers having a broader range of choices in these areas.

Gelsenwasser contends with numerous regional and national energy providers, a dynamic reflected in significant customer switching rates. For instance, in Germany, the electricity market saw around 10.7 million customers switch providers in 2023, indicating a highly competitive landscape.

To thrive, Gelsenwasser must differentiate itself through superior service quality, competitive pricing strategies, and the development of innovative, customer-centric offerings to retain and attract its customer base.

The utility sector, including water and gas provision, is inherently capital-intensive. Companies like Gelsenwasser must invest heavily in building and maintaining vast networks of pipes, treatment plants, and distribution infrastructure. These substantial upfront and ongoing costs act as significant barriers, making it difficult for new players to enter the market.

For instance, in 2024, the German energy and water sector continued to see significant investment. While specific Gelsenwasser figures for this aspect are proprietary, the broader industry trend shows billions of euros being allocated annually to grid modernization and expansion, underscoring the high fixed cost environment. This intensity of investment naturally fuels rivalry among established companies, as they strive to achieve economies of scale and optimize the utilization of their expensive assets.

Decarbonization and Digitalization Pressures

The German energy sector's push towards decarbonization and digitalization significantly intensifies competitive rivalry among utilities. Companies are actively competing to develop and offer green energy solutions, integrate diverse renewable sources, and harness digital tools to boost operational efficiency and enhance customer interaction. This dynamic environment forces players to innovate rapidly to secure market share and meet evolving consumer demands for sustainable services.

Gelsenwasser's strategic direction, particularly its commitment to the 'Nachhaltig blau-grün' (sustainable blue-green) strategy and its engagement in circular economy projects, directly addresses these competitive pressures. By focusing on sustainability and resource efficiency, Gelsenwasser aims to differentiate itself and capture value in a market increasingly shaped by environmental and technological advancements.

- Renewable Energy Growth: Germany's renewable energy share in gross electricity consumption reached approximately 55% in the first half of 2024, up from 52% in the same period of 2023, highlighting the intense competition in this segment.

- Digitalization Investments: Major German utilities are investing billions of euros in grid modernization and digital infrastructure, with companies like E.ON and RWE channeling significant capital towards smart grid technologies and data analytics to improve service delivery and customer engagement.

- Circular Economy Initiatives: Companies are increasingly exploring circular economy models, such as waste-to-energy and water recycling, to create new revenue streams and reduce environmental impact, fostering a competitive race for sustainable resource management.

Strategic Partnerships and Acquisitions

Competitive rivalry is also evident in strategic partnerships and acquisitions, as companies aim to broaden their service offerings, market presence, or technological expertise. Gelsenwasser has actively pursued such strategies, including acquiring stakes in other utility firms, showcasing a competitive approach to consolidation and growth in a dynamic market. These actions are designed to solidify its market standing and diversify its business operations.

These strategic moves are crucial for staying competitive. For instance, in 2024, the German energy sector saw significant M&A activity, with companies like E.ON and RWE actively divesting or acquiring assets to optimize their portfolios. Gelsenwasser’s participation in similar consolidation efforts, even on a smaller scale, reflects this broader industry trend.

- Strategic Alliances: Companies form partnerships to share resources, technology, and market access, thereby reducing individual risk and increasing competitive strength.

- Mergers & Acquisitions (M&A): Gelsenwasser's engagement in acquiring stakes in complementary businesses directly enhances its competitive edge by expanding its operational scope and service capabilities.

- Market Consolidation: The utility sector, including water and energy, is experiencing consolidation. Gelsenwasser’s strategic acquisitions are a direct response to this trend, aiming to achieve economies of scale and greater market influence.

- Portfolio Diversification: Acquisitions allow companies like Gelsenwasser to diversify their revenue streams and reduce reliance on single markets or services, making them more resilient to economic fluctuations.

Competitive rivalry within Gelsenwasser's operating environment, particularly in energy supply and supplementary services, is quite robust. This is driven by customer choice and the sector's push towards sustainability and digitalization, forcing companies to innovate and offer competitive pricing. Gelsenwasser faces numerous regional and national competitors, evidenced by significant customer switching rates in the German energy market, with approximately 10.7 million electricity customers changing providers in 2023.

The intensity of competition is further fueled by strategic partnerships and acquisitions as firms seek to expand their reach and capabilities. Gelsenwasser's participation in these consolidation efforts, such as acquiring stakes in other utility firms, directly addresses this dynamic, aiming to bolster its market position and diversify its operations in a sector experiencing significant M&A activity throughout 2024.

| Metric | 2023 Data | 2024 Trend (H1) | Implication for Rivalry |

|---|---|---|---|

| Customer Switching (Electricity) | ~10.7 million customers | Continued high | Indicates intense competition for customer acquisition and retention. |

| Renewable Energy Share (Gross Electricity Consumption) | 52% | ~55% | Heightened competition in offering green energy solutions. |

| Digitalization Investments (Industry-wide) | Billions of Euros | Continued high investment | Competition to leverage digital tools for efficiency and customer engagement. |

SSubstitutes Threaten

The threat of substitutes for Gelsenwasser's core business of providing piped drinking water is exceptionally low. Bottled water, while a substitute for occasional use, is neither practical nor cost-effective for the vast volumes required for household or industrial purposes. In 2024, the average German household consumed approximately 122 liters of water per day, a quantity impractical to meet with bottled alternatives.

Similarly, private wells, though a potential substitute, are geographically limited and often face stringent quality regulations and environmental concerns, making them an unreliable and localized option. The inherent convenience, established infrastructure, and cost efficiency of a public water supply system like Gelsenwasser's remain largely unparalleled for widespread, consistent access.

The most substantial threat of substitution for natural gas stems from the rapid growth of renewable energy sources and district heating systems. Germany's commitment to decarbonization, evident in its expanding solar and wind power capacity and increasing use of heat pumps, directly challenges natural gas in both heating and power generation sectors.

Government policies and significant investments are actively fueling this shift away from natural gas. For instance, in 2023, renewable energies accounted for approximately 52% of Germany's gross electricity consumption, a notable increase that directly impacts natural gas demand.

The increasing focus on energy efficiency, spurred by technological innovation and a growing environmental consciousness, presents a significant threat of substitutes for Gelsenwasser. For instance, advancements in building insulation and smart home technologies are actively reducing the need for heating, which often relies on natural gas, a key product for Gelsenwasser's energy segment. This trend directly impacts demand for their core services.

Conservation efforts, though not direct replacements, function as a powerful substitute by diminishing the overall volume of energy and water consumed. In 2023, for example, Germany saw a notable decrease in household energy consumption per capita due to increased awareness and adoption of energy-saving practices. This long-term reduction in demand poses a persistent challenge to Gelsenwasser's growth prospects.

Decentralized Energy Solutions

The increasing adoption of decentralized energy solutions presents a significant threat of substitutes for traditional utility providers like Gelsenwasser. Rooftop solar photovoltaic systems, for instance, allow households and businesses to generate their own electricity, thereby reducing their dependence on grid-supplied power and, by extension, natural gas-fired power plants which are often part of the broader energy mix. This shift directly impacts the demand for gas distribution services, especially as consumers seek greater energy independence and cost savings.

Germany's energy landscape is a prime example of this trend. In 2024 alone, Germany saw a substantial deployment of 16.2 GW of solar capacity. This rapid expansion in renewable, decentralized generation highlights a growing consumer preference for alternative energy sources, which can erode the market share of conventional gas suppliers.

- Reduced Reliance on Grid: Decentralized generation, like rooftop solar, lessens consumer dependence on utility-provided electricity.

- Impact on Gas Demand: This trend indirectly affects natural gas consumption, particularly in power generation.

- Consumer Behavior Shift: Growing consumer interest in energy independence and cost-efficiency drives the adoption of substitutes.

- German Solar Growth: Germany's 16.2 GW solar deployment in 2024 underscores the accelerating shift towards decentralized energy.

Hydrogen as a Future Alternative

The rise of green hydrogen presents a significant threat of substitution for Gelsenwasser's core natural gas business. As Germany pushes its energy transition, green hydrogen is emerging as a viable clean energy alternative, particularly for industrial processes and heating. This transition could reduce demand for natural gas over the long term.

While Gelsenwasser's existing infrastructure for gas distribution might offer a pathway to adapt to a hydrogen economy, the shift itself represents a fundamental change from its current operations. The German government has ambitious hydrogen targets, aiming for 10 gigawatts of domestic electrolysis capacity by 2030, which underscores the potential scale of this substitution.

- Green Hydrogen as a Substitute: Green hydrogen, produced using renewable electricity, offers a decarbonized alternative to natural gas.

- Industrial and Heating Applications: Industries requiring high-temperature heat and residential heating are key areas where hydrogen can substitute natural gas.

- Infrastructure Adaptation: Gelsenwasser's gas grids may require significant upgrades or repurposing to safely transport and distribute hydrogen.

- Market Uncertainty: The pace of hydrogen adoption and the regulatory framework surrounding it remain key factors influencing the threat of substitution.

The threat of substitutes for Gelsenwasser's water provision is minimal, with bottled water and private wells offering limited practical alternatives for consistent, large-scale use. However, for its natural gas segment, the landscape is shifting significantly.

Renewable energy sources, particularly solar and wind, are rapidly displacing natural gas in electricity generation and heating. This is amplified by government policies and increasing consumer demand for energy efficiency and independence, as seen in Germany's substantial solar capacity growth in 2024.

Furthermore, the emergence of green hydrogen as a clean energy alternative, especially for industrial heat and residential heating, poses a long-term threat. Germany's ambitious hydrogen targets highlight the potential for this substitute to reshape the energy market, requiring Gelsenwasser to consider infrastructure adaptations.

| Substitute Category | Description | Impact on Gelsenwasser (Natural Gas) | Key Data Point (2023/2024) |

|---|---|---|---|

| Renewable Energy | Solar, Wind, District Heating | Reduces demand for gas in power generation and heating. | Renewables accounted for ~52% of Germany's gross electricity consumption in 2023. |

| Energy Efficiency | Insulation, Smart Home Tech | Decreases overall energy consumption, including heating needs. | Notable decrease in household energy consumption per capita in Germany (2023). |

| Decentralized Solutions | Rooftop Solar PV | Erodes demand for grid-supplied power and associated gas use. | Germany deployed 16.2 GW of solar capacity in 2024. |

| Green Hydrogen | Clean Hydrogen Production | Potential long-term replacement for natural gas in industry and heating. | Germany aims for 10 GW electrolysis capacity by 2030. |

Entrants Threaten

The water and gas utility sectors, where Gelsenwasser operates, demand enormous upfront capital for essential infrastructure like pipelines, treatment facilities, and storage. For instance, in 2024, the U.S. Bureau of Economic Analysis reported that infrastructure spending by utilities reached over $150 billion, highlighting the scale of investment needed. This massive financial commitment acts as a significant deterrent, making it exceptionally difficult for new companies to enter and compete effectively.

The German utility sector presents significant barriers to entry due to its rigorous regulatory landscape. Aspiring new entrants face complex licensing procedures, demanding environmental permits, and stringent quality standards, all of which are time-consuming and expensive to navigate. For instance, obtaining the necessary permits for a new energy generation facility can take years and involve substantial legal and consulting fees.

Gelsenwasser, like other established utilities, enjoys substantial economies of scale. This means their massive customer base and extensive infrastructure allow them to spread fixed costs, such as pipeline maintenance and treatment facilities, over a larger volume. For instance, in 2023, Gelsenwasser reported total revenues of €1.7 billion, a testament to their operational scale. This scale makes it incredibly difficult for new entrants to match their per-unit cost efficiency, a critical factor in the price-sensitive utility market.

Furthermore, network effects play a crucial role. The more customers connected to Gelsenwasser's existing water and energy grids, the more valuable that network becomes. Newcomers would face immense upfront investment to build parallel infrastructure, a barrier that is often prohibitive. In 2024, the capital expenditure for new utility infrastructure projects can run into hundreds of millions of euros, making it a daunting prospect for any potential competitor seeking to enter Gelsenwasser's established service territories.

Access to Raw Resources and Infrastructure

New companies entering the water and gas utility sector face significant hurdles in securing essential raw resources and infrastructure. Gelsenwasser's established network for water extraction and treatment, coupled with its integration into national gas transmission systems, provides a substantial barrier. For instance, the cost of developing new water abstraction and purification facilities, alongside the complex process of gaining access to and integrating with existing gas pipelines, represents a formidable capital investment that deters many potential entrants.

The economic viability of building entirely new infrastructure for water and gas distribution is often prohibitive. New entrants would need to replicate Gelsenwasser's extensive network of pipes, treatment plants, and pumping stations, a process that requires billions in upfront capital. In 2024, the average cost for laying a kilometer of water pipeline can range from €50,000 to €150,000, depending on terrain and depth, making a nationwide rollout an immense undertaking.

- High Capital Costs: Building new water treatment plants and gas distribution networks requires massive upfront investment, often in the billions of euros.

- Infrastructure Integration Challenges: Gaining access to and connecting with existing national gas transmission infrastructure is complex and subject to regulatory approval.

- Resource Scarcity and Rights: Securing long-term rights to reliable raw water sources can be difficult and is often already allocated to established players like Gelsenwasser.

- Economies of Scale: Existing utilities benefit from economies of scale in operations and maintenance that new entrants struggle to match initially.

Municipal Ownership and Public Service Mandate

Many German utilities, including Gelsenwasser, have municipal or public ownership, which inherently prioritizes regional supply security and long-term stability over aggressive profit-seeking. This public service mandate can create a less attractive environment for purely profit-driven new entrants aiming to disrupt established essential services.

For instance, in 2024, many municipal utilities in Germany reported stable, albeit modest, profit margins, with a significant portion of their investments directed towards grid modernization and renewable energy integration, reflecting their public service obligations. This focus on essential infrastructure and sustainability, rather than maximizing short-term shareholder returns, presents a barrier for new, commercially-oriented competitors.

- Municipal Ownership: Gelsenwasser's structure, like many German utilities, involves significant municipal stakes, influencing strategic priorities towards public welfare.

- Public Service Mandate: This mandate often dictates investment in infrastructure and service reliability, potentially at the expense of higher profit margins sought by private competitors.

- Competitive Landscape: The emphasis on long-term stability and regional supply security makes it challenging for new, purely profit-maximization-focused entrants to gain a foothold in essential services.

- Investment Focus: In 2024, German municipal utilities continued to invest heavily in grid upgrades and sustainable energy, reinforcing their commitment to public service over aggressive market capture.

The threat of new entrants for Gelsenwasser is low due to the immense capital required to build new utility infrastructure, estimated at billions of euros for a comprehensive network. Additionally, stringent regulatory hurdles, including complex licensing and environmental permits, create significant barriers. Established economies of scale, where Gelsenwasser's large customer base lowers per-unit costs, further deter newcomers. In 2024, the average cost to lay a kilometer of water pipeline alone can reach €150,000, underscoring the prohibitive initial investment.

| Barrier Type | Description | Estimated Cost/Impact (2024) |

|---|---|---|

| Capital Requirements | Building new water and gas infrastructure | Billions of Euros |

| Regulatory Hurdles | Licensing, permits, quality standards | Years of process, significant legal/consulting fees |

| Economies of Scale | Lower per-unit costs for established players | Gelsenwasser's €1.7 billion revenue (2023) indicates significant scale advantage |

| Infrastructure Access | Connecting to existing national gas grids | Complex, subject to regulatory approval, high integration costs |

Porter's Five Forces Analysis Data Sources

Our Gelsenwasser Porter's Five Forces analysis is built upon a foundation of robust data, including Gelsenwasser's annual reports, industry-specific market research from firms like Statista and IBISWorld, and relevant regulatory filings. This blend ensures a comprehensive understanding of the competitive landscape.