Gelsenwasser Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gelsenwasser Bundle

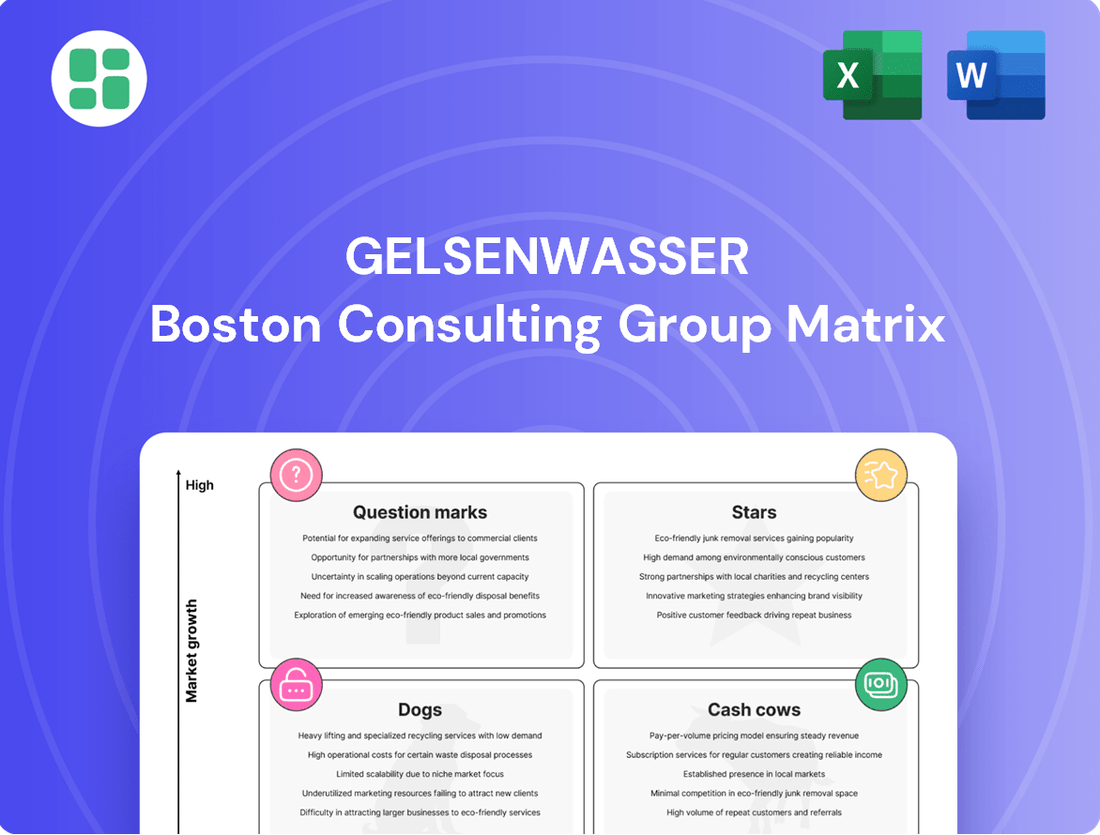

Curious about Gelsenwasser's strategic positioning? Understanding their BCG Matrix reveals which business units are driving growth (Stars), generating consistent revenue (Cash Cows), struggling in the market (Dogs), or require further investment (Question Marks). Don't miss out on the complete picture.

Dive deeper into Gelsenwasser's strategic landscape with the full BCG Matrix. Gain a clear, actionable understanding of their product portfolio's performance and unlock insights for smarter resource allocation and future growth. Purchase the full report for a comprehensive breakdown.

Stars

Gelsenwasser is strategically investing in digital infrastructure services, recognizing its high-growth potential. This is clearly demonstrated by their May 2024 acquisition of a 20% stake in Ing Plus AG, a move that signals a strong commitment to this sector. This expansion into digital solutions for communal infrastructure is driven by the growing demand for smart city technologies and efficient utility management.

The company's focus on automatic data processing and geoinformatics highlights a forward-looking approach. These technologies are crucial for optimizing urban planning and resource management, positioning Gelsenwasser to capitalize on future market trends. The digital infrastructure services segment is therefore a key area for Gelsenwasser's continued development and market presence.

Gelsenwasser is actively expanding its electric vehicle charging infrastructure within municipalities. This strategic move goes beyond serving its internal needs, opening up public access to charging points. The company is positioning itself to capitalize on the burgeoning e-mobility sector, a market projected for significant expansion driven by environmental mandates and a rise in electric vehicle ownership.

The global electric vehicle market is on a strong upward trajectory. For instance, by the end of 2023, over 30 million electric vehicles were estimated to be on the roads worldwide, a substantial increase from previous years. This growth fuels the demand for accessible and widespread charging solutions, making Gelsenwasser's investment in this area particularly timely.

Gelsenwasser is actively engaging in novel collaborations for infrastructure projects, exemplified by its 49% investment in the wastewater sattwerk in Hamminkeln. This initiative cleverly merges energy and wastewater management, tapping into a rapidly expanding sector focused on sustainable city growth.

This strategic approach to municipal partnerships enables Gelsenwasser to establish a foothold and expand its presence in developing infrastructure markets. For instance, in 2023, investments in municipal infrastructure across Germany saw significant growth, with renewable energy integration in water systems becoming a key trend, reflecting the potential of such ventures.

Advanced Energy Consulting and Smart Grid Solutions

While traditional energy consulting might be a mature market, Gelsenwasser's strategic move into advanced energy solutions, exemplified by its 7.5% stake in Trianel GmbH acquired in late 2023, points to a significant growth opportunity. This investment signals a clear intention to capitalize on the increasing demand for decentralization and decarbonization strategies.

This focus positions Gelsenwasser to capture market share in high-growth segments such as smart grid development and specialized consulting for complex industrial and municipal clients. The market for these sophisticated energy solutions is experiencing rapid expansion as global energy systems undergo transformation. For instance, the global smart grid market was valued at approximately USD 25 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 15% through 2030, driven by the need for greater efficiency and renewable energy integration.

- Smart Grid Development: Offering expertise in the design, implementation, and management of intelligent electricity networks.

- Decarbonization Consulting: Assisting clients in reducing their carbon footprint through innovative energy strategies and technologies.

- Decentralization Solutions: Providing services for distributed energy resources and microgrid development.

- Specialized Industrial/Municipal Services: Tailored energy consulting for large-scale energy consumers and public utilities.

Strategic Renewable Energy Project Development

Gelsenwasser's strategic focus on renewable energy, especially wind and solar, aligns with its blue-green sustainability goals. While not yet dominant revenue generators, these investments are crucial for future growth. The company is actively pursuing partnerships, such as its collaboration with Trianel, to bolster its presence in the burgeoning green energy market.

The company's commitment to renewable energy development positions it to capitalize on the accelerating global shift towards sustainable power sources. This strategic direction is vital for long-term competitiveness and market relevance in the evolving energy landscape.

- Market Growth: The global renewable energy market is projected to reach over $2.5 trillion by 2030, indicating significant expansion opportunities.

- Investment Focus: Gelsenwasser's investments are concentrated in wind and solar, sectors that have seen substantial technological advancements and cost reductions in recent years.

- Partnership Strategy: Collaborations, like the one with Trianel, are key to sharing expertise and resources, accelerating project development and market penetration.

- Sustainability Drive: The blue-green strategy underscores a commitment to environmental responsibility, which is increasingly valued by consumers and investors alike.

Gelsenwasser's strategic investments in digital infrastructure, EV charging, and novel municipal partnerships position its offerings as potential Stars in the BCG matrix. These areas exhibit high market growth and require significant investment, mirroring the characteristics of Stars. For example, their 20% stake in Ing Plus AG in May 2024 highlights their commitment to the high-growth digital infrastructure sector.

The company's expansion into EV charging infrastructure is directly tapping into a rapidly expanding global market, with over 30 million EVs on roads by the end of 2023. Similarly, the wastewater sattwerk in Hamminkeln, a 49% investment, merges energy and wastewater management, a sector seeing increased investment in sustainable city growth, as evidenced by German municipal infrastructure investments in 2023.

Gelsenwasser's engagement in advanced energy solutions, including a 7.5% stake in Trianel GmbH acquired in late 2023, targets the growing demand for decentralization and decarbonization. The smart grid market alone was valued at approximately USD 25 billion in 2023 and is projected for substantial growth, further solidifying these ventures as potential Stars.

The company's focus on renewable energy, particularly wind and solar, is another key Star. With the global renewable energy market projected to exceed $2.5 trillion by 2030, Gelsenwasser's strategic partnerships and investments in these sectors are well-positioned for high growth and market penetration.

| Business Area | Market Attractiveness | Gelsenwasser's Position | BCG Category |

|---|---|---|---|

| Digital Infrastructure | High Growth | Significant Investment (Ing Plus AG stake) | Star |

| EV Charging Infrastructure | High Growth (30M+ EVs globally by end 2023) | Active Expansion | Star |

| Wastewater & Energy Integration | Growing Sector (Increased municipal investment) | Strategic Partnership (Hamminkeln) | Star |

| Advanced Energy Solutions (Smart Grid, Decarbonization) | High Growth (Smart Grid market ~$25B in 2023) | Strategic Investment (Trianel GmbH stake) | Star |

| Renewable Energy (Wind & Solar) | Very High Growth (Projected >$2.5T by 2030) | Partnership Strategy, Investment Focus | Star |

What is included in the product

The Gelsenwasser BCG Matrix analyzes business units based on market growth and share, guiding investment decisions.

Gelsenwasser's BCG Matrix offers a clear, one-page overview, simplifying complex portfolio analysis for decisive action.

Cash Cows

Gelsenwasser's drinking water supply operations are a prime example of a cash cow. The company holds a significant market share in established regions like the Ruhrgebiet, Münsterland, and Ostwestfalen, ensuring a steady stream of revenue. This essential service benefits from stable, albeit low, market growth.

In 2023, Gelsenwasser reported that its water division generated revenues of €742.6 million, highlighting the consistent financial performance of this core business. The company's ongoing investments in infrastructure and quality assurance further solidify its dominant position and ability to maintain profitability.

Natural gas distribution continues to be Gelsenwasser's primary revenue generator, solidifying its position as a cash cow. The company benefits from a substantial market share within its existing distribution infrastructure, ensuring a consistent and mature income stream.

Despite a reported dip in trading activities during 2024, the fundamental natural gas distribution segment remains a robust contributor to Gelsenwasser's financial performance.

Wastewater management services are a cornerstone of Gelsenwasser's portfolio, acting as a reliable cash cow. This essential utility generates consistent revenue streams due to its non-discretionary nature and the stable demand in its mature, regulated market.

In 2024, Gelsenwasser's wastewater segment benefits from existing, well-maintained infrastructure. The focus here is on operational efficiency and adherence to stringent environmental regulations, rather than expansion, which solidifies its role as a generator of predictable cash flow for the company.

Operation of Existing Energy Networks

Gelsenwasser’s operation and maintenance of its extensive gas and electricity distribution networks is a prime example of a Cash Cow. This segment benefits from a high market share in its operational areas, providing a stable and predictable revenue stream. The regulated nature of these assets allows for consistent earnings through established network fees, serving a large and essential customer base.

These networks are critical infrastructure, and Gelsenwasser consistently invests in their upkeep and modernization. For instance, in 2023, the company reported significant capital expenditures focused on maintaining and upgrading its distribution infrastructure to ensure reliability and efficiency, a hallmark of a mature, cash-generating business.

- Stable Revenue Generation: The regulated nature of network fees ensures predictable income.

- High Market Share: Dominance in its service territories supports consistent demand.

- Essential Service Provision: The fundamental need for gas and electricity guarantees ongoing customer engagement.

- Continuous Investment: Ongoing capital allocation maintains asset quality and operational efficiency, securing future cash flows.

Chemiepark Bitterfeld-Wolfen Management

Gelsenwasser's management of Chemiepark Bitterfeld-Wolfen positions this venture as a significant cash cow within its portfolio. This specialized service caters to industrial park clients, suggesting a stable revenue base underpinned by long-term agreements and a dominant position in its niche market.

The company's involvement in managing industrial sites like Chemiepark Bitterfeld-Wolfen exemplifies a strategy focused on established, low-growth markets where it holds a substantial share. This typically translates to consistent, predictable cash flows, crucial for funding other business areas.

- Gelsenwasser's management of industrial parks like Chemiepark Bitterfeld-Wolfen acts as a cash cow.

- This niche service likely benefits from long-term contracts and a high market share within its specialized segment.

- The operation contributes to diversified revenue streams through reliable, consistent returns.

- In 2023, the German chemical industry, a key sector for such parks, reported a turnover of approximately €227 billion, highlighting the scale of the market Gelsenwasser operates within.

Gelsenwasser's drinking water and wastewater operations are stable cash cows, benefiting from significant market share in established German regions and the essential nature of these services. These segments generate consistent revenue streams due to their regulated markets and ongoing demand, with investments focused on maintaining infrastructure and operational efficiency. In 2023, the water division alone brought in €742.6 million in revenue, underscoring its reliable contribution.

The company's natural gas distribution and the operation of its gas and electricity distribution networks also function as strong cash cows. These segments leverage high market shares and the regulated nature of network fees, ensuring predictable income. Continuous investment in maintaining and modernizing these critical infrastructure assets further solidifies their role as consistent cash generators.

| Business Segment | BCG Category | Key Characteristics | 2023/2024 Data Point |

| Drinking Water Supply | Cash Cow | High market share, stable, low growth, essential service | €742.6 million revenue (Water Division) |

| Wastewater Management | Cash Cow | Non-discretionary, stable demand, mature market, operational efficiency focus | Focus on infrastructure upkeep and regulatory compliance |

| Natural Gas Distribution | Cash Cow | Substantial market share, mature income stream, core revenue generator | Remains robust despite some trading dips in 2024 |

| Network Operation (Gas & Electricity) | Cash Cow | High market share, regulated fees, essential infrastructure, continuous investment | Significant capital expenditures in 2023 for infrastructure upgrades |

| Industrial Park Management (e.g., Chemiepark Bitterfeld-Wolfen) | Cash Cow | Niche market, long-term agreements, stable revenue base | Operates within a large market, e.g., German chemical industry turnover ~€227 billion in 2023 |

Full Transparency, Always

Gelsenwasser BCG Matrix

The BCG Matrix preview you are viewing is the identical, fully unlocked document you will receive upon purchase. This comprehensive analysis of Gelsenwasser's business units, meticulously crafted to guide strategic decisions, will be delivered to you without any watermarks or demo limitations. You can confidently expect the same high-quality, actionable insights that are ready for immediate integration into your business planning or presentations.

Dogs

Gelsenwasser's legacy infrastructure, built for bygone industrial needs, now faces the challenge of being underutilized. These assets, though still functional, demand considerable upkeep expenses that far outweigh their current contribution to revenue or operational efficiency. For instance, a significant portion of older water pipe networks, designed for much higher industrial consumption, now serves fewer customers and businesses, leading to a lower return on investment for ongoing maintenance.

These underperforming legacy components can be categorized as Dogs within the BCG Matrix. They represent a drain on financial resources, tying up capital that could be better deployed in growth-oriented areas or more modern, efficient infrastructure. In 2024, reports indicated that maintenance costs for some of Gelsenwasser's older water treatment facilities, which are no longer operating at full capacity due to shifts in demand, represented a disproportionately high percentage of their operational budget.

Non-core, Unprofitable Ancillary Services within Gelsenwasser's BCG Matrix would encompass any niche consulting offerings that stray from their strategic pillars of climate resilience and digitalization. These could include minor, low-demand services that haven't demonstrated significant market uptake or profitability, potentially draining resources without contributing to the company's financial health.

For instance, if Gelsenwasser offered a highly specialized, outdated water quality testing methodology that garnered minimal client interest, it would fit this category. In 2024, such services might represent less than 0.5% of overall revenue, failing to meet even minimal profitability thresholds, as indicated by a negative contribution margin.

Gelsenwasser's 2024 financial report highlighted a significant drop in revenues specifically from gas trading, separate from its essential distribution services. This segment, often characterized by speculative market plays, saw its contribution diminish.

If this trend persists, with the trading activities consistently underperforming and offering little to no profit due to evolving market dynamics or reduced demand for speculative ventures, it risks being classified as a 'Dog' within the BCG matrix. Such a classification implies an area requiring resources but yielding minimal returns, with bleak prospects for future expansion.

Outdated Internal IT Systems

Outdated internal IT systems, despite digitalization efforts, can become a significant drag on resources. These systems, often costly to maintain and lacking scalability, can hinder operational efficiency without offering a clear strategic advantage. For instance, a 2024 survey by Gartner indicated that over 60% of IT leaders reported challenges with legacy systems impacting their digital transformation initiatives.

These legacy systems represent sunk costs, offering low returns on continued investment and impeding the agility needed for more responsive business operations. Without a clear strategic benefit, they are prime candidates for divestment or replacement. Consider that companies spend, on average, 70-80% of their IT budget just maintaining existing systems, leaving less for innovation, according to industry reports from 2024.

- High Maintenance Costs: Legacy systems often require specialized, expensive support and frequent patching.

- Lack of Scalability: They struggle to adapt to growing data volumes or increased user demand.

- Operational Inefficiencies: Outdated technology can slow down processes and create bottlenecks.

- Limited Strategic Value: These systems may not support new business models or competitive advantages.

Underperforming Small-Scale Pilot Projects

Small-scale pilot projects, especially those exploring novel or nascent markets, that haven't proven their worth, ability to grow, or a clear route to making money, can be classified as Dogs.

These ventures often demand ongoing funding without showing any real market traction or potential for future expansion, turning them into resource drains.

For instance, a hypothetical renewable energy pilot in 2024 that consumed $500,000 in its initial phase but only secured a single, non-replicable contract, demonstrating poor scalability, would likely fit this category.

- Lack of Market Adoption: Projects failing to gain traction with target customers.

- Unproven Scalability: Inability to demonstrate a viable path for growth and wider implementation.

- Resource Drain: Continued investment without clear returns or future profitability.

Gelsenwasser's "Dogs" represent business units or assets with low market share and low growth potential, demanding significant resources without generating substantial returns. These often include legacy infrastructure and underperforming ancillary services. For example, in 2024, older water pipe networks, designed for higher industrial use, now serve fewer customers, leading to inefficient maintenance spending.

These segments are characterized by high operational costs relative to their revenue contribution. In 2024, maintenance for some of Gelsenwasser's older, underutilized water treatment facilities consumed a disproportionately large share of the operational budget, highlighting their "Dog" status.

Such units tie up capital that could be reinvested in more promising areas, such as digitalization or climate resilience initiatives. The company's 2024 financial review noted that gas trading, a speculative venture, saw diminishing returns, potentially indicating a shift towards "Dog" classification if performance doesn't improve.

The strategic approach for "Dogs" typically involves minimizing investment, divesting, or phasing out operations to reallocate resources effectively. This focus aims to improve overall portfolio efficiency and financial health by shedding these low-performing segments.

Question Marks

Gelsenwasser is strategically positioning itself in the burgeoning hydrogen infrastructure market. A key initiative involves a significant collaboration with Thyssengas to develop a hydrogen pipeline network, signaling a commitment to this future-oriented sector. This move aligns with broader decarbonization efforts, making it a high-growth area.

While the hydrogen market presents substantial future potential, Gelsenwasser's current market share within this developing sector is minimal. This reflects the early stage of the industry and the significant investments needed to establish a leading position.

Realizing the full potential of hydrogen infrastructure requires substantial capital outlay. Gelsenwasser's investment in this area is crucial for building capacity and aiming for market leadership in the coming years.

The advanced smart metering and data analytics for water segment is a promising area, with the global smart water meter market projected to reach $7.5 billion by 2027, growing at a CAGR of 13.5%. Gelsenwasser's investment in this technology is crucial for future efficiency and new service development, though current market penetration and monetization are still developing.

Gelsenwasser is actively deploying digital water meters, a key component in building sophisticated data analytics capabilities for water management. This initiative positions the company to leverage real-time data for operational improvements and potentially new customer-facing services.

The early stages of market penetration and the full realization of revenue from these advanced data services present a challenge. Significant investment is needed to expand market share and demonstrate the profitability of these innovative solutions.

Gelsenwasser is actively developing cold local heating networks, exemplified by its project in Schermbeck serving 49 buildings. This innovative approach taps into the burgeoning market for sustainable energy solutions, a sector experiencing significant growth due to the global energy transition.

While Gelsenwasser's current footprint in these niche, geographically concentrated systems is likely modest, the potential is substantial. The market for decentralized, low-temperature heating solutions is expanding rapidly, driven by the need for efficient and environmentally friendly energy distribution.

Significant further investment will be crucial for Gelsenwasser to scale these cold local heating network projects. Achieving broader market penetration requires not only technological advancement but also strategic capital allocation to expand infrastructure and reach a wider customer base.

Phosphorus Recycling and Circular Economy Initiatives

Gelsenwasser is actively investing in circular economy initiatives, with a particular focus on phosphorus recycling from sewage sludge. This strategic move positions the company within an emerging, high-growth sector. The demand for such processes is being fueled by increasingly stringent environmental regulations and the growing scarcity of essential resources like phosphorus, which is critical for agriculture and industry.

These phosphorus recycling efforts, while representing a smaller segment of Gelsenwasser's current operations, hold significant long-term potential. The global phosphorus market is projected to see substantial growth, with estimates suggesting a market size of over $100 billion by 2030, driven by these very factors. For Gelsenwasser, this translates into an opportunity to capture market share in a sector with strong tailwinds.

- Phosphorus Recycling Investment: Gelsenwasser is committing capital to develop and scale its phosphorus recycling capabilities from sewage sludge.

- Market Growth Drivers: Environmental regulations and resource scarcity are creating a robust demand for phosphorus recovery solutions.

- Emerging Sector Potential: This initiative taps into a high-growth area with significant long-term revenue and market share expansion opportunities for the company.

- Current Market Position: While promising, these circular economy initiatives currently constitute a minor portion of Gelsenwasser's overall business portfolio.

Expansion into New or Underserved Municipal Infrastructure Markets

Gelsenwasser's strategic move to acquire a 50% stake in Wasserservice Westfalen Weser GmbH in March 2024 is a clear indicator of its ambition to penetrate new or underserved municipal infrastructure markets. This partnership is designed to extend services to more than 100 municipalities, a significant expansion that taps into areas where integrated utility solutions are increasingly in demand.

These emerging markets represent a high-growth opportunity for Gelsenwasser. As municipalities across Germany continue to seek more comprehensive and efficient utility management, Gelsenwasser is positioning itself to meet this need. However, it's important to note that while the potential is substantial, Gelsenwasser's market penetration and established presence within these specific new territories are still in the early stages of development.

- Market Expansion: Acquisition of 50% of Wasserservice Westfalen Weser GmbH in March 2024.

- Target Reach: Aims to provide services to over 100 municipalities.

- Growth Potential: Underserved municipal markets seek integrated utility solutions.

- Market Share: Gelsenwasser's share in these new territories is still developing.

Question Marks represent business areas with low market share in high-growth industries. Gelsenwasser's investment in hydrogen infrastructure and phosphorus recycling falls into this category. These sectors are poised for significant expansion due to decarbonization trends and resource scarcity, respectively.

While Gelsenwasser is making strategic moves, its current market penetration in these nascent fields is minimal. Substantial capital investment is necessary to build capacity and achieve market leadership in these emerging opportunities.

The company's expansion into new municipal markets through its Wasserservice Westfalen Weser GmbH acquisition also signifies a Question Mark. This move targets high-growth potential, but Gelsenwasser's established presence in these new territories is still in its early development stages.

| Business Area | Market Growth | Current Market Share | Strategic Focus |

|---|---|---|---|

| Hydrogen Infrastructure | High | Low | Pipeline Development, Decarbonization |

| Phosphorus Recycling | High | Low | Circular Economy, Resource Scarcity |

| New Municipal Markets | High | Low | Service Expansion, Integrated Solutions |

BCG Matrix Data Sources

Our Gelsenwasser BCG Matrix is informed by a robust blend of internal financial reports, comprehensive market research, and official industry statistics to provide a clear strategic overview.