GE HealthCare Technologies PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GE HealthCare Technologies Bundle

Navigate the complex external forces impacting GE HealthCare Technologies with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are shaping the healthcare landscape. Gain a crucial competitive edge by leveraging these insights for strategic planning and informed decision-making. Download the full PESTLE analysis now to unlock actionable intelligence and secure your market position.

Political factors

Government healthcare policies are a major driver for companies like GE HealthCare. For instance, the US government's Medicare reimbursement rates for medical imaging directly affect sales volumes and pricing power for GE HealthCare's diagnostic equipment. In 2024, ongoing discussions around Medicare payment adjustments for certain imaging procedures highlight the sensitivity of GE HealthCare's revenue to these policy decisions.

Shifts towards value-based care models, where providers are reimbursed based on patient outcomes rather than the volume of services, also reshape the market. GE HealthCare's investment in integrated solutions and data analytics, aimed at improving patient care efficiency, is a direct response to this trend, anticipating that such offerings will be favored under new reimbursement frameworks being implemented globally through 2025.

Global trade policies, including tariffs and trade agreements, significantly influence GE HealthCare's supply chain and the cost of its products. For instance, the U.S. imposed tariffs on goods from China, impacting companies like GE HealthCare. This has driven the company to actively pursue local-for-local manufacturing strategies and diversify its sourcing to cushion these financial blows.

GE HealthCare's operations are significantly influenced by political stability in its key markets. Geopolitical uncertainties, such as those experienced in China, can create disruptions. For instance, in 2023, China's continued zero-COVID policies and evolving regulatory landscape presented challenges for foreign healthcare companies, impacting market access and supply chain reliability for GE HealthCare.

Government Funding for Research and Innovation

Government funding plays a crucial role in driving innovation within the healthcare sector, directly impacting companies like GE HealthCare. Increased public investment in research and development, particularly in cutting-edge areas, can significantly boost opportunities for GE HealthCare by creating a more receptive market for their advanced technologies.

For instance, national governments are channeling substantial resources into digital health initiatives and artificial intelligence in healthcare. In 2024, the US National Institutes of Health (NIH) allocated over $45 billion for research, with a growing portion dedicated to AI and data science applications. Similarly, European Union initiatives like Horizon Europe are earmarking significant funds for digital and health research through 2027. This financial backing accelerates the adoption of GE HealthCare’s diagnostic imaging, patient monitoring, and digital solutions.

Furthermore, these government investments often foster a collaborative environment, encouraging public-private partnerships. Such collaborations can lead to:

- Accelerated development cycles for new medical technologies.

- Increased market access for innovative products through pilot programs and government procurement.

- Enhanced research capabilities through shared infrastructure and data.

- Support for clinical trials and validation of GE HealthCare's offerings.

Public Health Initiatives and Priorities

National public health initiatives significantly influence the market for GE HealthCare's diverse product portfolio. When governments prioritize disease prevention and early detection, it directly boosts demand for sophisticated diagnostic imaging equipment and related technologies. For example, the U.S. National Prevention Strategy, which emphasizes wellness and prevention, encourages the adoption of technologies that can identify health issues at their earliest stages.

GE HealthCare actively adapts its product development and marketing strategies to align with these evolving public health agendas. A concerted effort by governments to expand access to healthcare services, particularly in underserved areas, creates opportunities for GE HealthCare's portable and cost-effective medical devices. The company's focus on areas like oncology and cardiology aligns with global health priorities aimed at reducing mortality from these leading causes of death.

- Increased demand for diagnostic imaging: Public health campaigns focusing on early cancer detection, such as mammography screening programs, directly drive sales of GE HealthCare's advanced MRI and CT scanners.

- Focus on preventative care technologies: Initiatives promoting chronic disease management, like diabetes and cardiovascular health, fuel the market for GE HealthCare's monitoring and diagnostic solutions.

- Government investment in healthcare infrastructure: In 2024, many nations are increasing healthcare spending to bolster public health systems, creating a favorable environment for capital equipment purchases by hospitals and clinics.

- Alignment with global health goals: GE HealthCare's commitment to addressing key public health challenges, such as maternal and infant health, positions it to benefit from international health funding and programs.

Government healthcare policies, including reimbursement rates and the push towards value-based care, directly influence GE HealthCare's revenue streams and product strategy. For instance, ongoing adjustments to Medicare payment rates for imaging procedures in 2024 highlight this sensitivity. Furthermore, national public health initiatives focusing on disease prevention and early detection, such as those promoting cancer screening, significantly boost demand for GE HealthCare's advanced diagnostic equipment.

Government funding for research and development, particularly in digital health and AI, is a key enabler for GE HealthCare's innovation pipeline. In 2024, substantial allocations by entities like the U.S. NIH, exceeding $45 billion for research with a growing AI component, and EU initiatives like Horizon Europe, are creating a more receptive market for advanced healthcare technologies.

Political stability and evolving trade policies also play a critical role, impacting GE HealthCare's global supply chains and market access. Geopolitical uncertainties, as seen with China's regulatory landscape in 2023, can create operational challenges, prompting strategies like diversified sourcing and local manufacturing.

| Factor | Impact on GE HealthCare | 2024/2025 Data/Trend |

|---|---|---|

| Reimbursement Policies | Affects sales volume and pricing of diagnostic equipment. | Ongoing Medicare payment rate discussions for imaging in the US. |

| Value-Based Care | Drives demand for integrated solutions and data analytics. | Global shift towards outcome-based reimbursement frameworks. |

| Government R&D Funding | Accelerates adoption of new technologies like AI in healthcare. | US NIH research funding over $45B in 2024, with increased AI focus. |

| Public Health Initiatives | Increases demand for preventative care and diagnostic tools. | Focus on early cancer detection and chronic disease management globally. |

| Trade Policies & Stability | Influences supply chain costs and market access. | Continued efforts to diversify sourcing due to geopolitical factors. |

What is included in the product

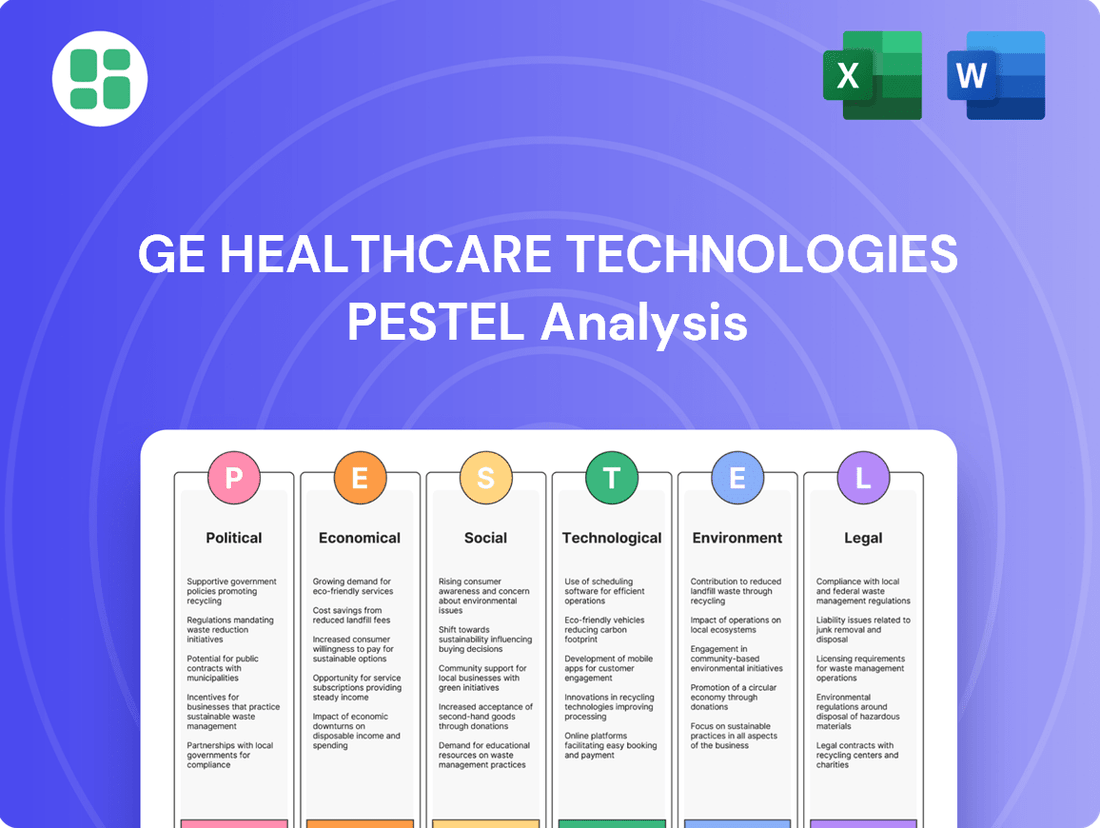

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting GE HealthCare Technologies, providing a comprehensive understanding of the external landscape.

It offers actionable insights for strategic decision-making by identifying potential threats and opportunities arising from these macro-environmental forces.

A concise GE HealthCare Technologies PESTLE analysis that highlights key external factors, acting as a pain point reliever by providing clarity on market dynamics and potential challenges for strategic planning.

Economic factors

Global economic growth is a significant driver for healthcare spending, directly impacting GE HealthCare's market opportunities. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight slowdown from 2023, but still indicative of continued demand. A healthy economic environment typically translates into higher government budgets for public health initiatives and increased disposable income for individuals to spend on private healthcare, both of which benefit companies like GE HealthCare that provide advanced medical technologies and services.

Conversely, economic slowdowns or recessions can create headwinds. During periods of reduced economic activity, governments may face fiscal constraints, leading to tighter healthcare budgets and potentially delaying or scaling back investments in new medical equipment and infrastructure. Similarly, individuals might postpone elective procedures or reduce spending on healthcare services, impacting the demand for GE HealthCare's product and service portfolio. The IMF's forecast for 2025 suggests a modest pickup to 3.5%, offering a potentially more favorable environment for increased healthcare investment.

Healthcare systems worldwide are grappling with significant budget constraints, pushing for cost containment measures across the board. This trend directly impacts companies like GE HealthCare, as providers seek more economical solutions. For instance, in 2024, many national health services are reviewing their capital expenditure, prioritizing investments that demonstrate clear cost savings and efficiency gains.

GE HealthCare's strategy must therefore focus on delivering value through innovation that addresses these cost pressures. Developing and promoting cost-effective alternatives, such as refurbished medical equipment, becomes crucial. These programs not only extend the life of existing assets but also offer substantial savings compared to new purchases, helping healthcare providers manage their budgets more effectively while still accessing quality technology.

Inflationary pressures significantly impact GE HealthCare's operational costs. For instance, rising prices for semiconductors and other critical components in medical devices, a trend observed throughout 2023 and continuing into 2024, directly increase manufacturing expenses. Managing these higher input costs is paramount for profitability, necessitating careful adjustments to pricing strategies and robust supply chain negotiations.

The company actively monitors inflation rates to refine its financial projections and adapt its business operations. As of early 2024, global inflation, while showing signs of moderation in some regions, still presents a challenge for industries reliant on global supply chains, including healthcare technology. GE HealthCare's ability to navigate these cost increases through efficiency gains and strategic sourcing will be a key determinant of its financial performance.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations present a significant challenge for GE HealthCare Technologies, given its extensive global operations. When the company converts revenues and profits earned in foreign currencies back into its reporting currency, the US dollar, unfavorable movements can reduce the reported financial figures. For instance, if the US dollar strengthens against other major currencies, foreign earnings will translate into fewer dollars, impacting top-line growth and profitability.

These shifts also influence GE HealthCare's competitive positioning in international markets. A stronger dollar can make its products and services more expensive for customers in countries with weaker currencies, potentially dampening demand and market share. Conversely, a weaker dollar could boost the affordability of its offerings abroad, but might also increase the cost of imported components or raw materials.

- Impact on Reported Earnings: GE HealthCare's 2024 financial reporting will reflect the impact of currency translations. For example, if the Euro weakened by 5% against the dollar in a given quarter, revenue generated in Europe would be reported at a lower dollar amount.

- Competitive Pricing: Fluctuations directly affect the price competitiveness of GE HealthCare's medical equipment and services in key markets like Europe and Asia. A 10% depreciation of the Japanese Yen against the USD could make GE's advanced imaging systems less attractive to Japanese hospitals if prices aren't adjusted.

- Hedging Strategies: The company likely employs hedging strategies, such as forward contracts, to mitigate some of this currency risk. However, the effectiveness of these strategies can vary, and significant unexpected currency volatility can still pose a threat.

- 2025 Outlook: Analysts are closely monitoring the projected strength of the US dollar in 2025, as it will be a critical factor in GE HealthCare's ability to achieve its revenue and profit targets in international segments.

Access to Capital and Investment

The ease and cost of obtaining capital significantly impact healthcare organizations' capacity to invest in advanced medical technologies, directly influencing GE HealthCare's sales pipeline. For instance, rising interest rates in 2024 could make financing larger equipment purchases more challenging for hospitals. Market confidence, reflected in credit markets and investor sentiment towards the healthcare sector, also plays a crucial role in capital availability.

GE HealthCare's revenue streams are sensitive to the financial health and borrowing capacity of its client base. Hospitals facing tighter credit conditions or decreased investor confidence may postpone or scale back capital equipment orders. This dynamic was evident in late 2023 and early 2024 as some healthcare systems navigated increased operational costs and a less certain economic outlook, potentially delaying technology upgrades.

- Capital Costs: In 2024, benchmark interest rates for corporate debt have seen fluctuations, impacting the cost of capital for healthcare providers looking to finance major equipment acquisitions.

- Investment Decisions: A hospital's ability to secure favorable loan terms or issue bonds directly correlates with its willingness to invest in new imaging systems or surgical robots from GE HealthCare.

- Market Sentiment: Investor confidence in the healthcare sector's long-term growth prospects, influenced by regulatory changes and reimbursement policies, can affect the availability and pricing of capital for providers.

- GE HealthCare's Exposure: The company's sales performance is thus linked to the broader economic environment and its effect on the financial capacity of its global customer base.

Global economic growth directly influences healthcare spending, impacting GE HealthCare's market. The IMF projected global growth at 3.2% for 2024, with an expected rise to 3.5% in 2025, signaling continued demand for advanced medical technologies. Economic slowdowns, however, can lead to tighter healthcare budgets and delayed investments by providers.

Inflationary pressures, particularly for components like semiconductors, increased GE HealthCare's manufacturing costs in 2023 and 2024. While inflation showed signs of moderation in some areas by early 2024, it remained a challenge for global supply chains. Managing these rising input costs is crucial for the company's profitability.

Currency fluctuations impact GE HealthCare's reported earnings and competitive pricing. A strengthening US dollar, for instance, reduces the dollar value of foreign earnings and can make products more expensive internationally. The company likely uses hedging strategies to mitigate this risk, but significant volatility can still pose a threat.

The cost and availability of capital are critical for healthcare providers' investment decisions. Rising interest rates in 2024 made financing larger equipment purchases more challenging. GE HealthCare's sales are thus linked to its clients' financial health and borrowing capacity, influenced by market confidence and credit conditions.

| Economic Factor | 2024 Projection/Observation | Impact on GE HealthCare |

|---|---|---|

| Global Economic Growth | IMF projected 3.2% in 2024, forecast to reach 3.5% in 2025 | Drives healthcare spending; slowdowns can reduce demand and budgets |

| Inflation | Continued pressure on components (e.g., semiconductors) observed in 2023-2024 | Increases manufacturing costs, impacting profitability; necessitates pricing adjustments |

| Currency Exchange Rates | Fluctuations impact reported earnings and international competitiveness | Stronger USD can reduce foreign earnings; affects pricing in global markets |

| Capital Availability & Cost | Rising interest rates in 2024 affecting financing for providers | Influences hospitals' ability to purchase new equipment; impacts sales pipeline |

Preview Before You Purchase

GE HealthCare Technologies PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of GE HealthCare Technologies delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides a strategic overview for informed decision-making.

Sociological factors

The world's population is getting older, with projections indicating that by 2050, one in six people globally will be aged 65 or over, a significant increase from one in eleven in 2019. This demographic shift, coupled with a rise in chronic diseases like cardiovascular conditions and diabetes, directly fuels demand for GE HealthCare's advanced diagnostic imaging, patient monitoring systems, and therapeutic equipment. For instance, the global market for chronic disease management is expected to reach hundreds of billions of dollars in the coming years, presenting a substantial growth avenue.

A significant surge in global health consciousness is driving demand for early detection and preventative healthcare solutions. This trend directly benefits GE HealthCare, as their advanced imaging and diagnostic technologies are crucial for identifying potential health issues before they become serious.

For instance, the global preventative healthcare market was valued at approximately $32.9 billion in 2023 and is projected to grow substantially. GE HealthCare's investments in AI-powered diagnostic tools, like those assisting in early cancer detection, align perfectly with this societal shift, positioning them to capitalize on the increasing patient and provider focus on proactive well-being.

Patients now demand healthcare that feels more personal, accessible, and integrated into their daily lives. This includes a strong preference for remote monitoring options and treatments specifically designed for their individual needs. For instance, a 2024 survey indicated that over 60% of consumers are interested in telehealth services for routine check-ups and managing chronic conditions.

GE HealthCare is actively addressing these evolving patient expectations by investing in digital health platforms and artificial intelligence. These advancements aim to facilitate precision care, allowing for more targeted treatments and a smoother, more connected patient experience from diagnosis through recovery. The company's commitment to AI in diagnostics, for example, saw significant investment in R&D throughout 2024, focusing on improving diagnostic accuracy and speed.

Healthcare Workforce Shortages and Burnout

The global healthcare sector grapples with significant workforce shortages and rising clinician burnout, a trend exacerbated by the lingering effects of the pandemic. For instance, a 2024 report indicated a projected shortfall of over 10 million healthcare professionals worldwide by 2030, with nurses and physicians being particularly affected. This scarcity directly fuels demand for technological solutions that can boost operational efficiency and support clinical decision-making.

GE HealthCare is strategically positioned to address these societal pressures. Their portfolio of AI-enabled diagnostic imaging equipment and digital health platforms is designed to automate routine tasks, optimize patient flow, and provide clinicians with advanced analytical tools. This focus aims to reduce the administrative burden on healthcare providers, allowing them to dedicate more time to direct patient care and mitigating burnout.

- Healthcare Professional Shortage: The World Health Organization projects a global deficit of 10 million healthcare workers by 2030, impacting service delivery.

- Clinician Burnout: High workloads and stress contribute to burnout, affecting patient care quality and staff retention.

- Demand for Efficiency: Societal need for improved healthcare access and quality drives demand for technologies that enhance workflow automation and decision support.

- GE HealthCare's Response: The company's AI and digital solutions are developed to address these critical issues by improving operational efficiency and clinical effectiveness.

Health Equity and Access to Care

Societal emphasis on health equity and expanding access to quality healthcare for underserved communities creates both hurdles and avenues for GE HealthCare. The company's mission to facilitate earlier and more rapid diagnosis and treatment for a greater number of patients worldwide directly supports these broader societal objectives.

This focus translates into tangible market opportunities. For instance, in 2024, global healthcare spending was projected to reach over $10 trillion, with a significant portion driven by efforts to improve access in emerging markets and for marginalized groups.

GE HealthCare's strategic alignment with these trends is evident through initiatives like:

- Expanding access to diagnostic imaging in rural areas.

- Developing affordable and portable medical technologies.

- Partnering with governments and NGOs to enhance healthcare infrastructure in underserved regions.

By addressing these societal needs, GE HealthCare not only contributes to improved health outcomes but also strengthens its market position and brand reputation.

The increasing global focus on preventative care and early disease detection, with the preventative healthcare market valued at approximately $32.9 billion in 2023 and projected for substantial growth, directly benefits GE HealthCare's advanced diagnostic technologies. Furthermore, evolving patient expectations for personalized and accessible healthcare, evidenced by over 60% of consumers in a 2024 survey expressing interest in telehealth, drives demand for GE HealthCare's digital health platforms and AI-driven solutions. The company's commitment to AI in diagnostics, with significant R&D investment in 2024, aligns with these patient-centric trends.

Societal shifts towards health equity and broader access to quality healthcare, supported by over $10 trillion in global healthcare spending projected for 2024, present significant opportunities for GE HealthCare. Their initiatives to expand access to diagnostics in underserved areas and develop affordable technologies directly address these societal goals, enhancing their market position.

The persistent global healthcare professional shortage, with a projected deficit of 10 million workers by 2030 according to the WHO, and rising clinician burnout, create a strong demand for efficiency-boosting technologies. GE HealthCare's AI and digital solutions are designed to automate tasks and support clinical decision-making, mitigating these critical workforce challenges.

| Sociological Factor | Description | Impact on GE HealthCare | Relevant Data/Trend |

|---|---|---|---|

| Aging Population & Chronic Diseases | Growing elderly population and rise in chronic conditions. | Increased demand for diagnostic imaging and monitoring systems. | By 2050, 1 in 6 people globally will be aged 65+, up from 1 in 11 in 2019. |

| Health Consciousness & Prevention | Increased awareness and demand for early detection and wellness. | Drives adoption of advanced diagnostic and AI-powered tools. | Preventative healthcare market valued at ~$32.9 billion in 2023. |

| Patient Expectations | Demand for personalized, accessible, and integrated healthcare. | Boosts need for digital health platforms and remote monitoring. | >60% of consumers interested in telehealth for routine check-ups (2024 survey). |

| Healthcare Workforce Challenges | Shortages and burnout among healthcare professionals. | Increases demand for automation and decision support technologies. | Projected global deficit of 10 million healthcare workers by 2030 (WHO). |

| Health Equity & Access | Societal push for equitable healthcare access. | Creates opportunities for affordable, portable, and accessible technologies. | Global healthcare spending projected to exceed $10 trillion in 2024. |

Technological factors

GE HealthCare is significantly leveraging advancements in AI, machine learning, and data analytics to revolutionize medical diagnostics and patient care. The company's investment in these technologies is evident in its development of AI-powered imaging solutions and predictive analytics platforms, aiming to improve diagnostic accuracy and operational efficiency.

For instance, GE HealthCare's Edison AI platform is designed to integrate seamlessly into existing workflows, offering clinicians insights that can lead to earlier disease detection and more personalized treatment plans. This focus on data-driven insights is crucial for navigating the increasingly complex healthcare landscape.

GE HealthCare's business is deeply intertwined with the continuous innovation in medical imaging, such as advancements in CT, MR, and PET systems. The company's commitment to staying ahead in these areas is paramount for its competitive positioning and ability to deliver state-of-the-art solutions to healthcare providers.

The development of novel pharmaceutical diagnostics and therapies also forms a critical pillar of GE HealthCare's strategy. By embracing these breakthroughs, the company aims to provide comprehensive diagnostic and treatment pathways, enhancing patient care and driving market leadership.

For instance, GE HealthCare's Edison AI platform is increasingly integrating advanced imaging capabilities, aiming to improve diagnostic accuracy and workflow efficiency. In 2023, the company reported that its Imaging segment revenue grew by 5% year-over-year, reflecting the market demand for its advanced technologies.

The healthcare industry is undergoing a significant digital transformation, with telemedicine and remote patient monitoring becoming central to its evolution. This shift is driven by the need for more accessible and efficient care delivery. For instance, the global telemedicine market was projected to reach over $175 billion by 2024, highlighting its rapid expansion.

GE HealthCare is actively participating in this transformation by developing innovative solutions. These include platforms that facilitate virtual collaboration among healthcare professionals, enabling seamless communication and consultation. Furthermore, their advancements in remote scanning capabilities are empowering healthcare providers to extend their reach and offer diagnostic services without requiring patients to be physically present, supporting more flexible care models.

Cybersecurity Threats to Medical Devices and Data

The growing interconnectedness of medical devices, from MRI machines to wearable sensors, creates significant cybersecurity vulnerabilities. This trend, amplified by the massive volume of sensitive patient data being generated and shared, presents a critical challenge for companies like GE HealthCare.

GE HealthCare must maintain a proactive stance, dedicating substantial resources to advanced cybersecurity defenses. Protecting patient privacy and ensuring the uninterrupted, safe functioning of its increasingly digital healthcare solutions are paramount. For instance, the healthcare sector experienced a 42% increase in data breaches in 2023 compared to the previous year, with ransomware attacks targeting medical devices becoming more sophisticated.

- Increased Connectivity: Over 70% of medical devices are expected to be connected to healthcare networks by 2025, expanding the attack surface.

- Data Volume: The amount of healthcare data is projected to grow by 36% annually, making data protection a monumental task.

- Ransomware Impact: In 2024, ransomware attacks on healthcare providers led to an average downtime of 25 days, costing millions in lost revenue and recovery.

- Regulatory Scrutiny: Stricter data privacy regulations, like HIPAA and GDPR, impose significant penalties for breaches, underscoring the need for robust security.

Rapid Pace of Innovation and Product Obsolescence

The medical technology landscape is characterized by an accelerating pace of innovation, meaning GE HealthCare's products can become outdated quickly. For instance, advancements in AI-powered diagnostics and minimally invasive robotic surgery are rapidly reshaping patient care pathways. This necessitates a continuous investment in research and development to stay ahead.

GE HealthCare's ability to adapt to emerging technologies is paramount for maintaining its competitive edge. The company's commitment to R&D is crucial, as evidenced by its significant investments in areas like digital health solutions and advanced imaging technologies. In 2023, GE HealthCare reported R&D expenses of approximately $1.6 billion, underscoring its focus on future product development.

- AI Integration: The rapid integration of artificial intelligence into medical imaging and data analysis requires constant adaptation.

- Digital Health Platforms: The growing demand for integrated digital health platforms necessitates ongoing development and upgrades.

- Robotics and Automation: Advancements in surgical robotics and automation in healthcare settings demand continuous innovation in GE HealthCare's product lines.

- Cybersecurity: As digital solutions become more prevalent, ensuring robust cybersecurity for medical devices and platforms is a critical, evolving technological factor.

GE HealthCare is heavily invested in leveraging artificial intelligence, machine learning, and advanced data analytics to transform medical diagnostics and patient care. The company's Edison AI platform, for instance, is designed to enhance diagnostic accuracy and operational efficiency by providing clinicians with actionable insights for earlier disease detection. This focus on digital transformation is critical as the global telemedicine market was projected to exceed $175 billion by 2024, underscoring the shift towards accessible and efficient care delivery.

The rapid pace of technological innovation, particularly in AI-powered diagnostics and robotic surgery, necessitates continuous investment in research and development for GE HealthCare. In 2023, the company's R&D expenses were approximately $1.6 billion, reflecting its commitment to staying competitive. Furthermore, the increasing connectivity of medical devices, with over 70% expected to be connected by 2025, expands the attack surface, making robust cybersecurity a paramount concern, especially given the 42% rise in healthcare data breaches reported in 2023.

| Technological Factor | Description | Impact on GE HealthCare | 2023/2024 Data Point |

|---|---|---|---|

| AI & Machine Learning | Advancements in AI and ML for diagnostics and patient care. | Enhances diagnostic accuracy, operational efficiency, and personalized treatment. | Edison AI platform integration. |

| Digital Health & Telemedicine | Growth of remote patient monitoring and virtual collaboration. | Expands access to care, necessitates development of integrated platforms. | Global telemedicine market projected >$175B by 2024. |

| Cybersecurity | Increasing vulnerability of connected medical devices and patient data. | Requires significant investment in advanced defenses to protect patient privacy and ensure system integrity. | 42% increase in healthcare data breaches in 2023. |

| R&D and Innovation Pace | Accelerating pace of medical technology advancements. | Demands continuous investment in R&D to maintain competitive edge and product relevance. | GE HealthCare R&D expenses approx. $1.6B in 2023. |

Legal factors

Securing and maintaining approvals from regulatory bodies like the U.S. Food and Drug Administration (FDA) is absolutely critical for GE HealthCare's medical devices and diagnostic products. This rigorous approval process directly influences when products can be launched and how easily they can reach the market.

GE HealthCare has demonstrated a consistent ability to gain FDA authorizations, particularly for its advanced AI-enabled devices. For instance, in 2023, the company received FDA clearance for its Edison AI platform, showcasing its commitment to innovation within regulatory frameworks.

GE HealthCare operates under stringent global data privacy regulations like HIPAA in the United States and GDPR in Europe, which dictate how patient health information can be collected, stored, and utilized. Compliance is paramount to avoid significant legal penalties and maintain the critical trust of patients and healthcare providers.

Failure to adhere to these complex rules can result in substantial fines; for instance, GDPR violations can lead to penalties of up to 4% of annual global turnover or €20 million, whichever is higher. GE HealthCare's digital health platforms and data management strategies must be meticulously designed to meet these evolving legal requirements.

GE HealthCare Technologies relies heavily on robust intellectual property rights and patent protection to maintain its competitive edge in the healthcare technology sector. The company actively secures patents for its groundbreaking medical devices, diagnostic tools, and software solutions, ensuring its innovations are shielded from unauthorized use and imitation. As of early 2024, GE HealthCare continues to invest significantly in research and development, a portion of which directly fuels its extensive patent portfolio, aiming to prevent infringement and leverage its technological advancements in the global market.

Product Liability and Safety Regulations

GE HealthCare faces significant legal scrutiny regarding product liability and safety. Compliance with regulations like the U.S. Food and Drug Administration's (FDA) Quality System Regulation is paramount. Failure to meet these standards can lead to costly recalls and litigation, impacting financial performance. For instance, in 2023, the medical device industry saw a notable increase in product liability claims, underscoring the importance of robust safety protocols.

Maintaining rigorous quality control is essential to mitigate risks. GE HealthCare's commitment to patient safety directly influences its legal standing and operational stability. The company's proactive approach to regulatory adherence aims to prevent adverse events that could result in substantial financial penalties and damage to its brand reputation.

- Regulatory Compliance: Adherence to FDA, EMA, and other global health authority regulations is non-negotiable.

- Product Recalls: The cost of a product recall can range from millions to billions of dollars, including investigation, remediation, and lost sales.

- Litigation Costs: Lawsuits related to product defects can incur significant legal fees, settlements, and damages.

- Patient Safety Focus: Prioritizing patient safety through stringent testing and quality assurance minimizes liability exposure.

Anti-trust and Competition Laws

GE HealthCare Technologies operates within a global regulatory landscape where anti-trust and competition laws are paramount. These regulations, enforced by bodies like the U.S. Federal Trade Commission (FTC) and the European Commission, aim to prevent market dominance and foster fair competition. For GE HealthCare, this means any proposed mergers or acquisitions are scrutinized to ensure they do not unduly stifle competition in the medical technology sector. For instance, in 2024, regulatory bodies continued to closely monitor consolidation trends within the healthcare industry, impacting strategic growth avenues for major players.

Compliance with these laws directly shapes GE HealthCare's market strategies, influencing how it approaches product launches, pricing, and distribution. The company must demonstrate that its business practices do not create monopolies or engage in anti-competitive behavior, such as predatory pricing or exclusive dealing arrangements. Failure to comply can result in significant fines and operational restrictions, as seen in past cases where large healthcare companies faced penalties for anti-competitive conduct.

Key considerations for GE HealthCare include:

- Merger and Acquisition Scrutiny: Ensuring proposed deals, such as the acquisition of smaller innovative firms, receive regulatory approval by demonstrating no adverse impact on market competition.

- Pricing and Market Practices: Adhering to regulations that prevent price fixing, bid rigging, and other collusive activities that could harm consumers or other businesses.

- Intellectual Property Licensing: Managing patents and licenses in a way that promotes innovation rather than restricts market access for competitors.

- Global Regulatory Alignment: Navigating differing anti-trust frameworks across major markets like the US, EU, and Asia, which can influence international business operations and expansion plans.

GE HealthCare Technologies must navigate a complex web of global regulations, including those from the FDA and EMA, which dictate product approval and market access. In 2024, the company continued to focus on securing clearances for its advanced imaging and diagnostic tools, with regulatory hurdles significantly impacting product launch timelines and market penetration strategies.

Compliance with data privacy laws like GDPR and HIPAA is critical, as breaches can result in substantial fines, potentially up to 4% of global annual turnover as per GDPR. GE HealthCare's investment in secure digital health platforms is therefore paramount to avoid legal repercussions and maintain customer trust.

The company's robust intellectual property strategy, including patent protection for innovations, is vital for maintaining its competitive edge. As of early 2024, significant R&D investment continues to bolster this patent portfolio, safeguarding its technological advancements against infringement.

Furthermore, anti-trust regulations require careful management of mergers and acquisitions to prevent stifling market competition, with regulatory bodies closely monitoring industry consolidation trends throughout 2024.

Environmental factors

Global demand for sustainable and eco-friendly products is a significant environmental factor influencing GE HealthCare. Consumers and healthcare providers increasingly prioritize environmentally conscious choices, pushing companies to adopt greener practices.

GE HealthCare is actively integrating sustainability into its operations, evident in its focus on energy-efficient product design and waste reduction initiatives. For instance, the company aims to reduce its greenhouse gas emissions by 50% by 2030 compared to a 2019 baseline, a commitment that resonates with environmentally aware stakeholders.

Environmental regulations around medical waste are tightening globally, impacting companies like GE HealthCare. These rules govern everything from how old equipment is handled to the disposal of single-use consumables, pushing for more sustainable practices.

GE HealthCare actively addresses these by investing in recycling and refurbishment programs. For instance, their efforts in 2023 focused on extending the life cycle of imaging equipment, diverting significant tonnage from landfills and ensuring adherence to evolving environmental standards across various operating regions.

The energy demands of manufacturing medical equipment and powering healthcare facilities present a significant environmental challenge. GE HealthCare acknowledges this, with its operations contributing to greenhouse gas emissions.

In pursuit of its net-zero ambitions, GE HealthCare is actively working to enhance energy efficiency across its manufacturing sites and within the design of its medical devices. For instance, by the end of 2023, the company reported a 15.6% reduction in Scope 1 and 2 greenhouse gas emissions compared to its 2019 baseline, demonstrating progress in its environmental stewardship.

Supply Chain Resilience and Climate-Related Disruptions

Climate change poses a significant threat to GE HealthCare's global supply chain. Extreme weather events, such as floods and hurricanes, can halt manufacturing operations and disrupt transportation networks, directly impacting the delivery of critical medical equipment and components. For instance, in 2024, several key semiconductor manufacturing hubs experienced disruptions due to severe weather, affecting the availability of electronic components essential for medical devices.

GE HealthCare is actively working to enhance its supply chain resilience to counter these environmental risks. This includes diversifying its supplier base, increasing inventory levels for critical components, and exploring alternative logistics routes. The company recognizes that a robust supply chain is paramount to ensuring uninterrupted product availability for healthcare providers worldwide.

The financial implications of supply chain disruptions can be substantial. In 2024, the healthcare sector, in general, faced increased costs associated with logistics and raw material procurement due to climate-related events. GE HealthCare's proactive measures aim to mitigate these financial impacts by minimizing downtime and preventing stockouts.

Key strategies GE HealthCare is employing include:

- Diversification of suppliers: Reducing reliance on single-source suppliers, particularly those located in regions prone to climate-related disruptions.

- Strategic inventory management: Holding higher levels of critical raw materials and finished goods to buffer against short-term supply interruptions.

- Enhanced logistics planning: Developing contingency plans for transportation and distribution, including the use of alternative modes of transport and routes.

- Investment in advanced analytics: Utilizing data to better predict and respond to potential supply chain disruptions caused by environmental factors.

Corporate Social Responsibility (CSR) and Environmental Stewardship

GE HealthCare's dedication to corporate social responsibility and environmental stewardship is a growing factor influencing its brand image and relationships with various stakeholders. The company's focus on minimizing its environmental impact and promoting planetary health resonates with both investors and the general public. For instance, in 2023, GE HealthCare reported a 15% reduction in its Scope 1 and 2 greenhouse gas emissions compared to its 2019 baseline, demonstrating tangible progress in its environmental goals.

This commitment is not merely about compliance but is integral to meeting evolving expectations. Investors are increasingly scrutinizing companies' environmental, social, and governance (ESG) performance, with a significant portion of institutional capital now directed towards sustainable investments. GE HealthCare's proactive approach in this area aims to secure its long-term social license to operate and attract capital.

Furthermore, the company's environmental initiatives directly support its business objectives by fostering innovation and efficiency. Efforts to reduce waste and optimize resource utilization can lead to cost savings and enhance operational resilience. As of early 2024, GE HealthCare has set targets to achieve carbon neutrality in its operations by 2030, a move that signals a clear strategic direction in its environmental stewardship.

- Commitment to Sustainability: GE HealthCare actively pursues initiatives to reduce its environmental footprint, aligning with global sustainability trends.

- Stakeholder Expectations: Growing investor and public demand for strong ESG performance necessitates robust corporate social responsibility efforts.

- Brand Reputation: Demonstrable environmental stewardship enhances GE HealthCare's brand reputation, fostering trust and loyalty.

- Operational Efficiency: Environmental initiatives often translate into operational efficiencies and cost savings, contributing to financial performance.

GE HealthCare's environmental strategy is increasingly shaped by global sustainability demands and regulatory pressures. The company is actively working to reduce its environmental impact, with a goal to achieve carbon neutrality in its operations by 2030. This commitment is reflected in its 2023 performance, where it reported a 15.6% reduction in Scope 1 and 2 greenhouse gas emissions against a 2019 baseline.

Supply chain resilience is a key focus due to climate change impacts, with GE HealthCare diversifying suppliers and managing inventory strategically to mitigate disruptions. For instance, in 2024, the company continued to invest in advanced analytics to better predict and respond to environmental risks affecting its global operations and product delivery.

| Environmental Factor | GE HealthCare's Response/Data (2023/2024 Focus) | Impact on Business |

|---|---|---|

| Sustainability Demand | Commitment to carbon neutrality by 2030; 15.6% reduction in Scope 1 & 2 GHG emissions (vs. 2019 baseline) by end of 2023. | Enhances brand reputation, attracts ESG-focused investment. |

| Climate Change & Supply Chain | Diversifying suppliers, strategic inventory management, investing in advanced analytics for disruption prediction. | Mitigates financial losses from weather events; ensures product availability. |

| Environmental Regulations | Investing in recycling and refurbishment programs for medical equipment; adherence to global waste disposal standards. | Ensures compliance, reduces landfill waste, supports circular economy principles. |

PESTLE Analysis Data Sources

Our GE HealthCare Technologies PESTLE analysis is grounded in comprehensive data from leading financial institutions like the IMF and World Bank, alongside reports from industry-specific market research firms and government health policy updates. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors impacting the healthcare sector.