GE HealthCare Technologies Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GE HealthCare Technologies Bundle

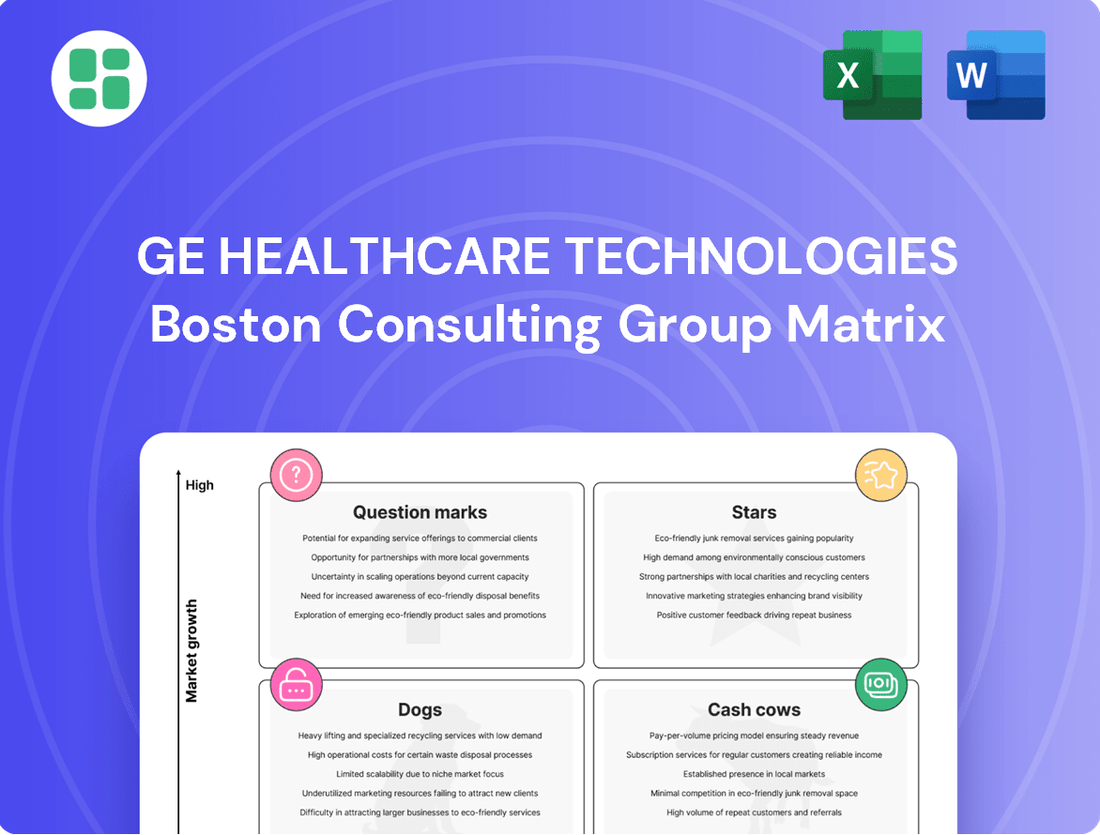

Curious about GE HealthCare Technologies' strategic positioning? Our BCG Matrix preview offers a glimpse into how their diverse product portfolio stacks up in the market. Understand which areas are driving growth and which might require a closer look.

Don't miss out on the full picture! Purchase the complete GE HealthCare Technologies BCG Matrix for an in-depth analysis of their Stars, Cash Cows, Dogs, and Question Marks. Gain actionable insights to optimize your investment and product strategies.

Stars

GE HealthCare Technologies' AI-enabled Diagnostic & Workflow Solutions are likely Stars in their BCG Matrix. The company is a frontrunner in AI for healthcare, frequently leading the FDA's approvals for AI-enabled devices. This strong innovation pipeline fuels growth in a booming market for intelligent healthcare solutions.

GE HealthCare's Pharmaceutical Diagnostics (PDx) segment is a standout performer, fueled by strong organic revenue growth. A prime example of this success is the novel radiopharmaceutical Flyrcado, a significant contributor to the segment's expansion.

Flyrcado, a pioneering PET MPI agent, directly taps into the burgeoning molecular imaging and theranostics markets. This high-growth area is central to the advancement of personalized medicine, and GE HealthCare's strategic investments are positioned to secure a dominant market share in these evolving diagnostic and therapeutic applications.

Advanced Visualization Solutions (AVS) stands out as a strong performer within GE HealthCare's portfolio, contributing significantly to revenue growth and demonstrating robust EBIT margins. In 2024, this segment has been a key driver, benefiting from the increasing demand for sophisticated diagnostic tools.

The segment's success is underpinned by its integration of cutting-edge imaging technologies and artificial intelligence, positioning it at the forefront of the rapidly expanding digital and AI-powered healthcare market. This strategic alignment is crucial for capturing future growth opportunities.

AVS plays a vital role in enhancing diagnostic accuracy and streamlining clinical workflows, making it a strategically important area for GE HealthCare. Its ability to improve patient care and operational efficiency solidifies its position as a valuable asset.

Omni Legend PET/CT Systems

The Omni Legend PET/CT system is a standout performer for GE HealthCare, recognized as its fastest-selling PET/CT solution. This success is underpinned by substantial order volumes and a direct contribution to revenue growth.

This advanced molecular imaging system caters to a growing market need, driven by ongoing technological advancements and critical clinical applications. The swift uptake of the Omni Legend underscores its strong market reception and GE HealthCare's prominent standing in the sophisticated field of molecular imaging.

- Fastest-selling PET/CT: The Omni Legend PET/CT system has achieved remarkable sales velocity, indicating strong market demand.

- Revenue Driver: Significant order numbers for the Omni Legend directly contribute to GE HealthCare's financial performance.

- Market Demand: The system addresses the escalating need for high-performance molecular imaging solutions.

- Market Position: Its rapid adoption highlights GE HealthCare's leadership in the advanced imaging sector.

New Digital X-ray Systems with Advanced Features

GE HealthCare Technologies is actively pushing the boundaries in its imaging segment, particularly with the introduction of new digital X-ray systems. These advanced systems are engineered for enhanced efficiency, making them ideal for environments with high patient volumes. This focus on innovation underscores GE HealthCare's strategy to solidify its market leadership and capitalize on growth opportunities within the dynamic X-ray sector.

The company’s commitment is evident in its continuous investment in technological advancements and operational improvements for its X-ray offerings. For instance, GE HealthCare's efforts in 2024 have seen the rollout of systems boasting features like AI-powered image enhancement and reduced radiation doses. These upgrades are crucial for attracting new customers and retaining existing ones in a competitive landscape where performance and patient safety are paramount.

- Innovation in Digital X-ray: GE HealthCare launched advanced digital X-ray systems in 2024, focusing on high-throughput efficiency.

- Market Leadership: These new products reinforce GE HealthCare's position in the evolving X-ray market.

- Technological Advancements: Features include AI enhancements and improved radiation dose management.

- Growth Capture: The company aims to leverage these innovations to drive growth and maintain its competitive edge.

GE HealthCare's Pharmaceutical Diagnostics (PDx) segment, particularly with products like Flyrcado, is a prime example of a Star. This segment is experiencing robust organic growth, driven by its presence in the high-growth molecular imaging and theranostics markets. The company's strategic investments in this area are designed to capture significant market share as personalized medicine advances.

The Omni Legend PET/CT system is also a Star, being GE HealthCare's fastest-selling PET/CT solution. Its strong order volumes directly contribute to revenue growth, reflecting high market demand for advanced molecular imaging. This system's rapid adoption underscores GE HealthCare's leadership in this sophisticated field.

| Product/Segment | BCG Category | Key Growth Drivers | 2024 Performance Indicators |

| Pharmaceutical Diagnostics (PDx) | Star | Molecular imaging, theranostics, personalized medicine | Strong organic revenue growth, Flyrcado success |

| Omni Legend PET/CT | Star | Technological advancements, clinical applications | Fastest-selling PET/CT, substantial order volumes |

What is included in the product

GE HealthCare Technologies' BCG Matrix offers strategic insights into its product portfolio, categorizing units as Stars, Cash Cows, Question Marks, or Dogs.

This analysis guides investment decisions, highlighting which business units to nurture, maintain, or divest for optimal growth and profitability.

A clear BCG Matrix visually identifies GE HealthCare's business units, easing the pain of resource allocation by highlighting Stars and Cash Cows for investment and management.

Cash Cows

GE HealthCare Technologies' core medical imaging equipment, including CT and MRI scanners, represent significant cash cows. The company commands a substantial global market share in these established modalities, leveraging a large installed base to generate consistent and robust cash flow. Despite moderate market growth, their leadership position ensures ongoing profitability and market dominance.

GE HealthCare's ultrasound systems are a clear Cash Cow, holding over 30% of the market share. This segment consistently delivers robust cash flow, a testament to its strong market leadership and broad product offering.

Despite a healthy market growth rate, GE HealthCare's high penetration and established brand in ultrasound ensure it remains a dependable engine for revenue and profit. Continued investment in innovation further bolsters its cash-generating power.

GE HealthCare's Medical Equipment Services and Maintenance division is a prime example of a cash cow. This segment leverages the company's vast installed base of medical devices, generating a consistent and reliable stream of recurring revenue through essential support and upkeep. This predictable income is crucial for the company's financial stability.

The services segment is vital for healthcare providers, ensuring their critical equipment remains operational and performs optimally. This reliability translates into significant profitability for GE HealthCare, as evidenced by its consistent contribution to the company's bottom line. For instance, GE HealthCare reported over $18 billion in revenue for its Services segment in 2023, highlighting its substantial and dependable nature.

Iodinated Contrast Media (Pharmaceutical Diagnostics)

GE HealthCare's iodinated contrast media stands out as a Cash Cow within its portfolio. These agents are fundamental for a vast array of medical imaging, ensuring their consistent and substantial demand. The market for these essential diagnostic tools is robust, with projections indicating a doubling of global demand. This steady revenue stream underpins GE HealthCare's financial stability.

- Product Line: Iodinated Contrast Media (Pharmaceutical Diagnostics)

- Market Position: Established, high-volume product with widespread adoption in medical imaging.

- Financial Contribution: Generates consistent and significant revenue streams due to essential usage and stable market.

- Growth Outlook: Global demand is projected to double, reinforcing its Cash Cow status.

Established Patient Monitoring Solutions

GE HealthCare's established patient monitoring solutions, including core bedside monitors, ECG, and blood pressure devices, represent a significant Cash Cow. These mature product lines benefit from a substantial installed base, ensuring consistent demand and reliable cash flow.

The company's strong market position in this segment translates into predictable revenue streams, requiring minimal incremental investment for promotional activities. In 2023, GE HealthCare reported that its Patient & Monitoring Solutions segment generated approximately $4.9 billion in revenue, underscoring the segment's maturity and cash-generating capabilities.

- Mature Market Presence: GE HealthCare holds a dominant position in established patient monitoring, including critical devices like bedside monitors and ECG machines.

- Reliable Cash Flow: A large installed base and consistent demand provide a steady and predictable stream of revenue with limited need for aggressive marketing.

- Segment Contribution: The Patient & Monitoring Solutions segment is a cornerstone of GE HealthCare's financial performance, contributing significantly to overall revenue.

GE HealthCare's established medical imaging equipment, like CT and MRI scanners, are prime cash cows. Their significant global market share and large installed base generate consistent, robust cash flow, even with moderate market growth. This leadership ensures ongoing profitability.

Ultrasound systems are another clear cash cow, with GE HealthCare holding over 30% market share. This segment consistently delivers strong cash flow due to market leadership and a broad product offering, with continued innovation enhancing its cash-generating power.

The Medical Equipment Services and Maintenance division acts as a vital cash cow, leveraging GE HealthCare's extensive installed base for recurring revenue through essential support. This predictable income stream is crucial for financial stability, with the Services segment generating over $18 billion in revenue in 2023.

GE HealthCare's patient monitoring solutions, including bedside monitors and ECG devices, are also cash cows. These mature product lines benefit from a substantial installed base, ensuring consistent demand and reliable cash flow, with the Patient & Monitoring Solutions segment contributing approximately $4.9 billion in revenue in 2023.

| Product Segment | Market Position | Cash Flow Generation | 2023 Revenue Contribution (Approx.) |

| Medical Imaging (CT/MRI) | Market Leader | Robust & Consistent | N/A (Segmented within Imaging) |

| Ultrasound Systems | 30%+ Market Share | Strong & Dependable | N/A (Segmented within Imaging) |

| Medical Equipment Services | Extensive Installed Base | Recurring & Predictable | $18 Billion+ |

| Patient Monitoring Solutions | Dominant | Steady & Reliable | $4.9 Billion |

Full Transparency, Always

GE HealthCare Technologies BCG Matrix

The GE HealthCare Technologies BCG Matrix preview you are viewing is the exact, fully formatted document you will receive immediately after your purchase. This means no watermarks or demo content, just a professional, analysis-ready report designed for strategic decision-making.

Dogs

The Life Support Solutions sub-segment, a component of GE HealthCare's Patient Care Solutions, has shown a concerning trend. Revenue has remained flat, and more critically, segment EBIT has seen a significant drop in recent quarters. This suggests the segment is facing considerable headwinds.

This underperformance points to a difficult market environment or intense competition that is impacting GE HealthCare's ability to grow or maintain profitability in this area. For instance, in Q1 2024, the Patient Care Solutions segment saw a revenue increase of 1%, but specific sub-segment performance within it, like Life Support Solutions, may be lagging behind.

Given this sustained underperformance, Life Support Solutions could be a prime candidate for strategic re-evaluation, potentially leading to divestiture or a substantial restructuring effort to improve its financial standing.

Older, less differentiated X-ray systems, particularly those facing tariff impacts and heightened competition, likely fall into the Dogs category for GE HealthCare. These products are in a low-growth market and may have a declining market share, making them less attractive investments.

The broader Imaging segment, which includes X-ray technology, experienced margin pressure in 2023, partly due to tariffs and slower growth in markets like China. This environment would disproportionately affect less advanced or differentiated X-ray offerings, pushing them towards the Dogs quadrant.

In the realm of commoditized, low-end patient care solutions, GE HealthCare likely finds itself with offerings that are price-sensitive and face significant competition. These segments, characterized by minimal product differentiation, often struggle with low market share and limited growth potential. For instance, basic diagnostic imaging consumables or routine patient monitoring devices might fall into this category.

These types of products typically yield lower profit margins, demanding considerable operational effort to maintain their market position. GE HealthCare's investment in these areas might be strategic to maintain a broad portfolio or serve specific customer needs, but they are unlikely to be growth drivers. In 2024, the medical device industry saw continued pressure on pricing for established, non-innovative products, reinforcing the challenges in these low-end segments.

Phased-Out or Non-Strategic Legacy Products

GE HealthCare, like many established technology firms, likely manages a portfolio that includes phased-out or non-strategic legacy products. These are older generations of medical equipment that may no longer be the focus of new sales efforts or substantial research and development investment. While they can still provide a stream of service revenue, their market share and growth potential are typically in decline.

These legacy offerings often represent products whose technology has been surpassed by newer innovations or whose market demand has waned. They fit the profile of 'dogs' in the Boston Consulting Group (BCG) matrix, characterized by low market share and low market growth. For instance, GE HealthCare's 2023 annual report indicated a strategic shift towards investing in high-growth areas like molecular imaging and diagnostic cardiology, suggesting a de-emphasis on older product lines.

- Low Market Growth: Legacy products operate in mature or declining markets, experiencing minimal to negative growth.

- Low Market Share: These products typically hold a small share of their respective markets due to competition from newer technologies.

- Minimal R&D Investment: Companies often reduce or cease significant R&D for products nearing the end of their lifecycle.

- Service Revenue Focus: While not growth drivers, some legacy products continue to generate revenue through maintenance and service contracts.

Underperforming Regional Sub-Segments (e.g., specific challenges in China)

Within GE HealthCare Technologies' portfolio, certain regional sub-segments can be classified as dogs, particularly those facing significant headwinds in the China market. Despite the company's overall positive trajectory, these areas grapple with intense local competition, a slower uptake of advanced technologies, and evolving regulatory landscapes. For instance, in 2024, China's medical device market faced increased pressure from domestic manufacturers offering lower-cost alternatives, impacting the market share of established international players in specific product categories.

These underperforming segments might include older product lines or those less aligned with China's current healthcare priorities, leading to diminished growth prospects. While GE HealthCare is actively adapting its strategy, some localized offerings may continue to struggle to gain substantial traction. For example, reports from early 2024 indicated that certain diagnostic imaging equipment, while still functional, faced challenges competing with newer, locally developed systems in terms of price and specific feature sets tailored to local clinical workflows.

- China's medical device market saw a significant rise in domestic player market share in 2023-2024, impacting foreign competitors.

- Regulatory shifts in China have sometimes favored local innovation, creating challenges for established international product lines.

- Slower adoption rates for certain advanced technologies in specific Chinese provinces can hinder growth for relevant GE HealthCare offerings.

- Older generation diagnostic equipment lines may be particularly vulnerable to competition from newer, locally produced alternatives in the Chinese market.

Products classified as Dogs within GE HealthCare's portfolio are typically characterized by low market share in low-growth markets. These might include older, less differentiated medical equipment lines or specific sub-segments facing intense competition and pricing pressures, such as certain diagnostic imaging consumables. For example, the company's strategic focus on high-growth areas like molecular imaging in 2023 suggests a de-emphasis on legacy product lines, which would naturally fall into the Dogs category.

These offerings often require significant operational effort for minimal returns, with limited potential for future growth or innovation. In 2024, the medical device industry continued to see pricing challenges for established, non-innovative products, underscoring the difficulties faced by these segments. The Life Support Solutions sub-segment, which saw flat revenue and a drop in EBIT in recent quarters, could also house products fitting the Dog profile due to market headwinds.

GE HealthCare's portfolio likely includes legacy products whose technology has been surpassed, leading to declining market demand and share. These products, while potentially still generating service revenue, are not growth drivers. The company's 2023 annual report highlighted investments in areas like diagnostic cardiology, indicating a strategic shift away from older technologies that would be considered Dogs.

| Category | Characteristics | Examples within GE HealthCare (Potential) | Market Outlook | Strategic Implication |

| Dogs | Low Market Share, Low Market Growth | Older X-ray systems, commoditized patient care solutions, certain legacy medical equipment | Mature, declining, or highly competitive markets | Divestiture, restructuring, or minimal investment |

Question Marks

GE HealthCare is heavily investing in cloud-first AI applications like CareIntellect for Oncology. This innovative platform uses generative AI to consolidate patient data, aiming to improve cancer care pathways.

These AI-driven clinical software solutions are positioned in a new, but rapidly expanding market. The potential for AI to transform healthcare is immense, with the global AI in healthcare market projected to reach $187.95 billion by 2030, growing at a CAGR of 37.3% from 2023.

Despite their promise, these applications are in their early adoption phases. Significant capital expenditure is necessary to build market share and unlock their full capabilities, placing them in a category that demands substantial resources for future growth.

GE HealthCare is strategically deploying AI-enabled portable ultrasound devices in underserved regions through key partnerships. This move capitalizes on the burgeoning demand for accessible and affordable diagnostic tools in these markets, which represent a significant growth opportunity.

While the market for these advanced diagnostics in emerging areas is expanding rapidly, GE HealthCare's current penetration and market share in these specific segments are relatively modest. This necessitates substantial investment to build brand presence and secure a leading position.

GE HealthCare is introducing cutting-edge AI tools designed to streamline cardiology processes, exemplified by the enhanced CASE system for stress testing. This strategic move targets the rapidly expanding market for advanced cardiac diagnostics, a sector experiencing significant growth due to the demand for improved efficiency and accuracy.

These AI-driven cardiology solutions represent a newer segment within GE HealthCare's portfolio, necessitating considerable investment to establish a strong market presence. The company's commitment to innovation in this high-growth area positions these offerings as potential stars in its product lineup, though they are still in the early stages of market penetration.

AI-based 3D Reconstruction in Interventional Suite (CleaRecon DL)

GE HealthCare's CleaRecon DL, an AI-based 3D reconstruction solution for interventional suites, signifies a strategic move into a specialized, high-growth segment of medical imaging technology. This innovative product aims to enhance visualization and precision during complex interventional procedures, a critical need in modern healthcare.

The interventional imaging market, particularly for AI-enhanced solutions, is experiencing robust growth. Analysts project the global medical imaging market to reach over $50 billion by 2025, with AI-driven applications showing particularly strong upward trends. CleaRecon DL is positioned to capitalize on this expansion, though its success hinges on widespread adoption and integration into clinical workflows.

- Market Entry: CleaRecon DL enters the specialized interventional suite market, a niche with significant potential for advanced imaging solutions.

- AI Integration: The AI-based 3D reconstruction technology offers enhanced visualization, a key differentiator in demanding clinical environments.

- Growth Potential: While in early commercialization, the product targets a segment of the medical imaging market projected for substantial growth, driven by technological advancements and clinical demand.

- Adoption Curve: Market penetration will depend on demonstrating clear clinical benefits and ease of integration, typical for new technologies in this sector.

Advanced Digital Solutions for Biopharmaceutical Manufacturing and Cell & Gene Therapy

GE HealthCare is actively investing in advanced digital solutions for biopharmaceutical manufacturing and the rapidly expanding cell and gene therapy sectors. These areas represent significant growth opportunities within the life sciences industry, with the global cell and gene therapy market projected to reach substantial figures in the coming years.

While GE HealthCare aims to be a leader, it faces competition from established and specialized digital solution providers in these niche, high-growth markets. The company's current offerings in this space are positioned as having substantial future potential, reflecting ongoing development and market penetration efforts.

- High Growth Potential: The cell and gene therapy market is experiencing exponential growth, with projections indicating a market size exceeding $30 billion by 2027, driven by advancements in personalized medicine.

- Digital Transformation Focus: GE HealthCare's digital solutions aim to streamline complex biopharmaceutical manufacturing processes, enhancing efficiency and quality control for both traditional biologics and novel cell/gene therapies.

- Competitive Landscape: The company is navigating a competitive environment where specialized software and platform providers already hold significant market share, necessitating strong innovation and strategic partnerships.

- Future Investment: Continued investment in these digital capabilities is crucial for GE HealthCare to capture a meaningful share of these high-margin, future-oriented markets.

GE HealthCare's AI-driven clinical software, like CareIntellect for Oncology, targets the burgeoning AI in healthcare market, projected to reach $187.95 billion by 2030. These solutions, while innovative, are in early adoption phases, requiring significant investment for market penetration and growth.

AI-enabled portable ultrasound devices are being deployed in underserved regions, tapping into growing demand for accessible diagnostics. However, GE HealthCare's current market share in these specific segments is modest, necessitating substantial investment to build brand presence.

Advanced AI tools for cardiology, such as the enhanced CASE system, are entering a high-growth sector. These offerings represent potential stars but require considerable investment for market establishment.

CleaRecon DL, an AI-based 3D reconstruction solution, targets the specialized interventional imaging market, a segment within the over $50 billion medical imaging market (projected for 2025) showing strong AI-driven growth. Its success depends on clinical benefit demonstration and workflow integration.

Digital solutions for biopharmaceutical manufacturing and cell/gene therapy are areas of significant investment for GE HealthCare. The cell and gene therapy market alone is expected to exceed $30 billion by 2027, but GE faces competition from established niche providers.

| Product/Solution Area | Market Growth Driver | GE HealthCare's Position | Investment Need | BCG Category |

|---|---|---|---|---|

| AI Clinical Software (e.g., CareIntellect) | AI in Healthcare Market Growth ($187.95B by 2030) | Early Adoption, High Potential | High | Question Mark |

| AI Portable Ultrasound | Demand in Underserved Regions | Modest Market Share | High | Question Mark |

| AI Cardiology Solutions (e.g., CASE) | Advanced Cardiac Diagnostics Growth | Early Market Penetration | High | Question Mark |

| CleaRecon DL (AI Interventional Imaging) | Medical Imaging Market Growth, AI Integration | Early Commercialization | High | Question Mark |

| Digital Solutions for Biopharma/Cell & Gene Therapy | Cell & Gene Therapy Market Growth ($30B+ by 2027) | Navigating Competitive Landscape | High | Question Mark |

BCG Matrix Data Sources

Our GE HealthCare Technologies BCG Matrix leverages comprehensive data from GE's annual reports, market research on healthcare technology growth, and internal product sales figures to accurately position each business unit.